Noticias del mercado

-

23:57

Schedule for today, Friday, Jul 08’2016:

(time / country / index / period / previous value / forecast)

01:30 Japan Labor Cash Earnings, YoY May 0.3%

05:00 Japan Eco Watchers Survey: Current June 43.0 42.9

05:00 Japan Eco Watchers Survey: Outlook June 47.3

05:45 Switzerland Unemployment Rate (non s.a.) June 3.3% 3.3%

06:00 Germany Current Account May 28.8

06:00 Germany Trade Balance (non s.a.), bln May 25.6

06:45 France Industrial Production, m/m May 1.2% -0.5%

08:30 United Kingdom Total Trade Balance May -3.294

12:30 Canada Unemployment rate June 6.9% 7%

12:30 Canada Employment June 13.8 5

12:30 U.S. Average workweek June 34.4 34.4

12:30 U.S. Average hourly earnings June 0.2% 0.2%

12:30 U.S. Unemployment Rate June 4.7% 4.8%

12:30 U.S. Nonfarm Payrolls June 38 175

19:00 U.S. Consumer Credit May 13.42 16

-

22:07

Major US stock indexes finished trading without any dynamics

Major stock indexes in Wall Street closed mixed on the eve of the publication of data on the number of jobs in non-farm payrolls on Friday.

In addition, as shown by data provided by Automatic Data Processing (ADP), employment growth in the US private sector accelerated in June, and were higher than forecasts of experts. According to the report, in June the number of employees increased by 172 thousand. People in comparison to the revised downward index for May at the level of 168 thousand. (Originally reported growth of 173 thousand.). Analysts had expected the number of people employed will increase by 159 thousand.

At the same time, the number of Americans who applied for unemployment benefits fell last week, offering yet another confirmation that the labor market remains on a sound basis, despite weak jobs growth in May. unemployment initial claims for benefits decreased by 16,000 and reached a seasonally adjusted 254,000 for the week ending July 2nd. The drop rate closer to 43-year low of 248,000 reached in mid-April.

DOW index components ended the session mixed (16 black, 14 red). Outsider were shares of Verizon Communications Inc. (VZ, -1,62%). Most remaining shares rose Intel Corporation (INTC, + 0,88%).

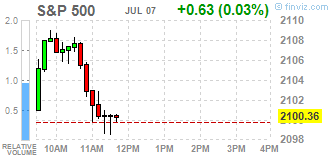

Sector of the S & P closed without any dynamics. Most utilities sector fell (-1.7%). The leader turned out to be the service sector (+ 0.4%).

At the close:

Dow -0.14% 17,894.19 -24.43

Nasdaq + 0.36% 4,876.81 +17.65

S & P -0.09% 2,097.83 -1.90

-

21:00

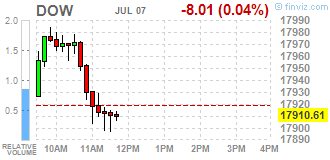

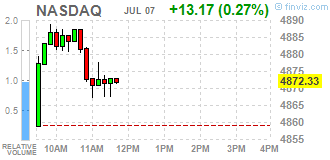

Dow -0.46% 17,836.10 -82.52 Nasdaq +0.02% 4,860.34 +1.18 S&P -0.41% 2,091.20 -8.53

-

18:00

European stocks closed: FTSE 100 6,533.79 +70.20 +1.09% CAC 40 4,117.85 +32.55 +0.80% DAX 9,418.78 +45.52 +0.49%

-

17:51

The price of oil dropped about 3%

Oil prices are down significantly, under the pressure of a report on US petroleum reserves, much weaker than yesterday's data on the API.

US Department of Energy reported that in the week of June 25 - July 1, oil stocks fell by 2.2 million barrels to 524.4 million barrels. This is close to the highest level for more than 80 years. Forecasts indicated a decrease of 2.5 million barrels. Oil reserves in Cushing terminal fell by 82,000 barrels to 64.1 million barrels. It was predicted a decline of 400,000 barrels. Gasoline inventories fell by 122,000 barrels to 238.9 million barrels. Analysts had expected stocks to fall 300,000 barrels. Distillate stocks fell 1.6 million barrels to 148.9 million barrels as nalysts had forecast an increase of 100,000 barrels. The utilization of refining capacity fell by 0.5% to 92.5% and oil production fell to 8.428 million barrels per day versus 8.622 million barrels the previous week, the maximum rates since September 2013.

Yesterday the American Petroleum Institute reported that for the week to July 3, crude oil inventories fell to 6.736 million barrels, a record change from June 2015. Gasoline inventories also fell 3.6 million barrels. Distillate stocks fell 2.3 million barrels, while crude oil stocks in the Cushing terminal rose by 80 thousand barrels.

Continued high demand for oil in China and India gave little suport to prices. Experts disagree on when the supply and demand balance will be restored, but more and more analysts are inclined to think that the situation has tightened the supply of oil, and the market could be in deficit within two years.

However, Libyan officials said that export oil terminals, which have been closed since 2014, may reopen in the near future. As a result, the export potential can be restored to 600,000 barrels per day.

The cost of the August futures for WTI fell to 46.46 dollars per barrel.

The price of August futures for Brent fell to 47.62 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:46

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday as strong private sector employment data and a drop in jobless claims pointed to a steadying labor market ahead of the monthly payrolls report on Friday. The ADP national employment report showed that 172,000 jobs were added in the private sector in June, compared to economists' expectation of 159,000. The number of Americans filing for unemployment benefits also fell unexpectedly last week, confirming that the labor market remains on solid footing despite tepid job gains in May. Claims fell to 254,000 in the week ended July 2, compared with expectations of 270,000

Dow stocks mixed (14 in positive area, 16 in negative). Top looser - Verizon Communications Inc. (VZ, -1,09%). Top gainer - Visa Inc. (V, +1,13%).

Most of S&P sectors in positive area. Top looser - Utilities (-1,5%). Top gainer - Conglomerates (+0,5%).

At the moment:

Dow 17822.00 -12.00 -0.07%

S&P 500 2093.00 -1.00 -0.05%

Nasdaq 100 4443.75 +4.25 +0.10%

Oil 46.52 -0.91 -1.92%

Gold 1356.20 -10.90 -0.80%

U.S. 10yr 1.40 +0.01

-

17:44

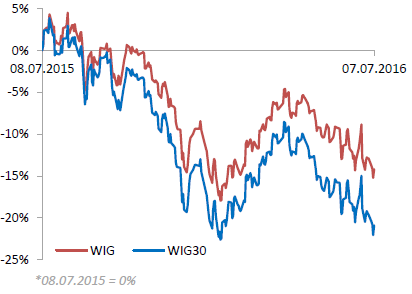

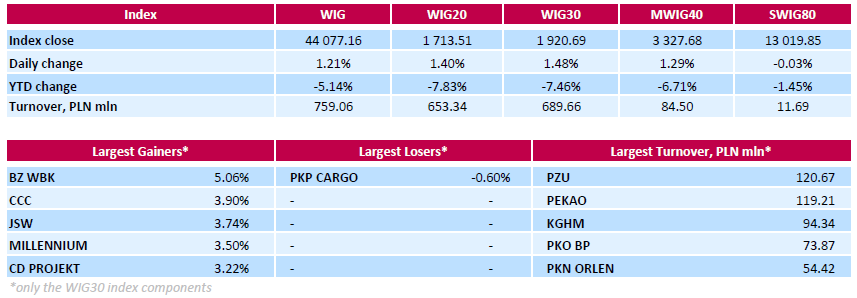

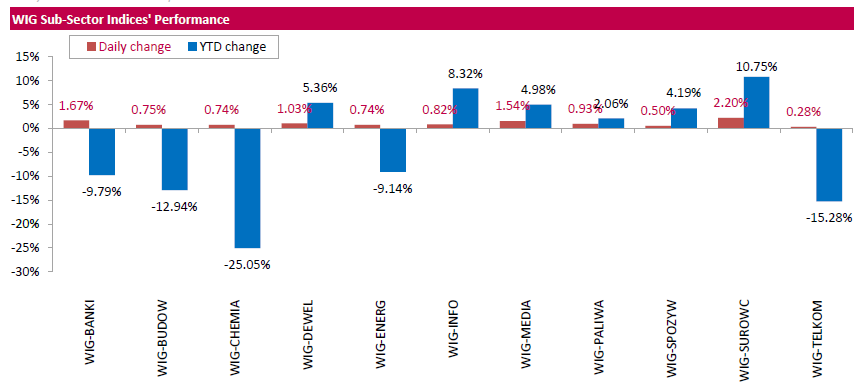

WSE: Session Results

Polish equity market surged on Thursday. The broad market measure, the WIG index, rose by 1.21%. All sectors in the WIG gained, with materials (+2.2%) outperforming.

The large-cap stocks' measure, the WIG30 Index, grew by 1.48%. Railway freight transport operator PKP CARGO (WSE: PKP) was the sole decliner among the index constituents. It lost 0.6%. At the same time, bank BZ WBK (WSE: BZW) was the biggest advancer, climbing by 5.06%. Other noticeable gainers were footwear retailer CCC (WSE: CCC), coking coal miner JSW (WSE: JSW), bank MILLENNIUM (WSE: MIL), videogame developer CD PROJEKT (WSE: CDR) and FMCG-wholesaler EUROCASH (WSE: EUR), which added between 3.14% and 3.9%.

-

17:33

Gold price declined

The cost of gold has decreased from the highest level since March 2014, which was due to the strengthening of the dollar against the backdrop of the US employment statistics. However, a further decline in prices constrain concerns about the effects of Brexit.

Financial markets remain highly volatile after results of the referendum provoked a collapse of stocks, bonds reduced the yield to a record low, as well as increased demand for safe-haven assets such as gold and silver. Yesterday the spot price of gold toucked the high of March 2014, but there was no follow through due to rise of stocks and the US dollar.

Mitsubishi analyst Jonathan Butler said while the strong dollar is a "headwind" for gold, there are good opportunities for further rally of the precious metal. "I believe that gold can go up to $ 1381 or even higher than the psychological level of $ 1,400"

One of the reasons for today's strengthening of the US dollar was ADP data, which showed that employment growth in the private sector accelerated in June, and was higher than forecast. According to the report, the number of employees increased by 172K. It was expected that the number of employees to increase by 159 thousand.

Investors are also awaiting the publication of Friday's employment report in the US non-farm sector, which could affect the prospects of US monetary policy. Adverse findings reinforce the view that the Fed has little reason to raise interest rates this year. Until recently, it had been widely expected that the Fed will raise rates at some point this summer. Nevertheless, given Brexit and US data, investors are now skeptical about that.

The cost of the August gold futures on the COMEX fell to $ 1358.4 per ounce.

-

17:13

Crude oil inventories in US declined last week

- Oil: -2.223 (forecast -2.5)

- Gasoline: -122K (350K forecast).

- Distillates: -1574K (500K forecast).

- Cushing: -82K (-400K forecasts).

-

17:09

Still selling AUD, target 0.67 - BNP

"The S&P have cut Australia's sovereign outlook to negative from stable (while affirming the AAA rating), citing persistent budget deficits. We are bearish on the AUD and target a move to 0.67 by year-end in AUDUSD.

The current fragile risk environment should not be supportive for G10 commodity exporter currencies. Furthermore, our economists expect the RBA to cut rates by 25bp at their next meeting on 2 August, a view now 60% priced into rates markets. The key policy consideration for the RBA is likely that inflationary pressures remain soft and we think Q2 CPI data (released 27 June) is will print in line with the RBA's 1.0% y/y forecast which would be enough to prompt a rate cut

Our medium-term forecasting model BNP Paribas CLEER™ also signals downside in AUDUSD below 70 cents this year".

-

17:00

U.S.: Crude Oil Inventories, July -2.223 (forecast -2.5)

-

16:40

-

16:34

The UK economy is moving to slowdown in the second quarter after rising - NIESR

The UK economy seems to show a significant slowdown after a strong second quarter, said NIESR, based on data obtained mainly before voters decided last month to leave the European Union.

Warning from the National Institute of Economic and Social Research (NIESR) comes from some of the early signs that businesses and consumers can suffer from the uncertainty created by the June 23 referendum.

NIESR estimated the UK economy grew by 0.6 percent in the second quarter, compared with an increase of 0.4 percent in the first three months of the year.

But NIESR warned that the acceleration was due to a sharp increase in activity in April, adding that gross domestic product is likely to remain at the same level in May and in June decline.

-

16:07

United Kingdom: NIESR GDP Estimate, Quarter II 0.6%

-

16:03

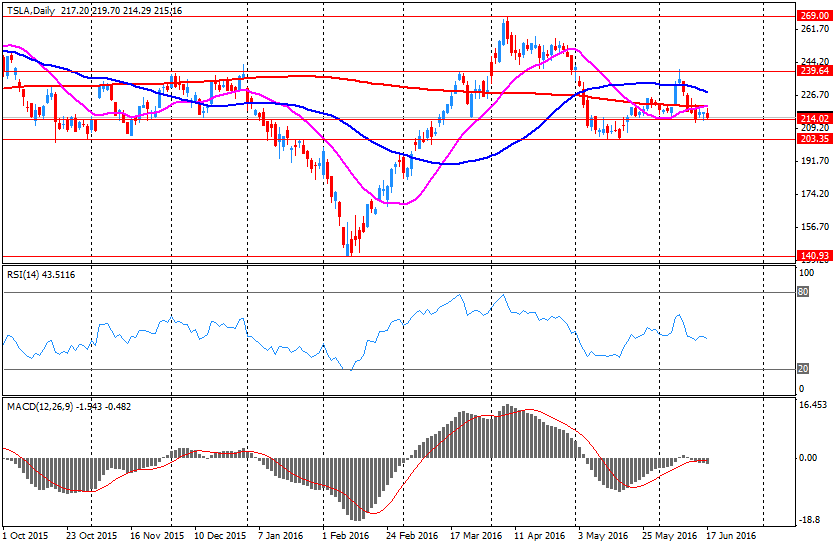

Company News: Tesla Motors (TSLA) may soon introduce Autopilot 2.0

As TechNoBuffalo reports, citing a source close to Tesla Motors, Autopilot 2.0 will be available in the near future. According to the source, the new autopilot will use two cameras that will recognize and react to brake lights and traffic lights without driver intervention. Currently Tesla autopilot automatically slows or stops only when the car ahead does the same.

TSLA shares fell in premarket trading to $ 212.98 (-0.68%).

-

16:00

Canada: Ivey Purchasing Managers Index, June 51.7 (forecast 51)

-

15:50

WSE: After start on Wall Street

Behind us good data from the US labor market. In the afternoon we met the ADP report, which shows that tomorrow's monthly important indication should return to the area of 200 k newly created jobs.

The beginning of the US session is slightly upward, and the first trades stand under the sign of enlargement gains of the demand side, which leads to new highs on the futures market in the US. Thus there is no trace after a short correction on Wall Street, but there is a well-known problem of proximity to the historical maximum.

-

15:46

Option expiries for today's 10:00 ET NY cut

USD/JPY 99.00, 100 (710m),102.00/05 (585m), 102.40, 102.50, 102.70/75,103.00, 103.20,104.00, 104.80 (511m),105.00 (760m)

GBP/USD 1.2500 (626m),1.3000 (1bn),1.3500 (987m)

AUD/USD 0.7200, 0.7250, 0.7265/65,0.7300 (402m), 0.7350, 0.7375,0.7440/45/50 (730m), 0.7458/60, 0.7470/75/80,0.7500, 0.7535, 0.7585,0.7600, 0.7610 (541m),0.7700 (558m)

NZD/USD 0.6965,0.7010,0.7104/05/06, 0.7140, 0.7150, 0.7175

AUD/JPY 74.50 (550m)

USD/CAD 1.2750/55,1.2775,1.2800, 1.2875/80,1.3000, 1.3020,1.3100, 1.3140, 1.3180,1.3300

EUR/GBP 0.8250, 0.8280,0.8340,0.8500 (400m)

-

15:35

U.S. Stocks open: Dow +0.17%, Nasdaq +0.33%, S&P +0.21%

-

15:29

Before the bell: S&P futures -0.07%, NASDAQ futures +0.01%

U.S. stock-index futures were little changed as traders turned their focus to the upcoming monthly jobs report.

Global Stocks:

Nikkei 15,276.24 -102.75 -0.67%

Hang Seng 20,706.92 +211.63 +1.03%

Shanghai Composite 3,016.93 -0.36 -0.01%

FTSE 6,543.73 +80.14 +1.24%

CAC 4,124.91 +39.61 +0.97%

DAX 9,411.12 +37.86 +0.40%

Crude $48.00 (+1.20%)

Gold $1364.10 (-0.22%)

-

14:55

US: initial unemployment claims continue to drop

In the week ending July 2, the advance figure for seasonally adjusted initial claims was 254,000, a decrease of 16,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 268,000 to 270,000. The 4-week moving average was 264,750, a decrease of 2,500 from the previous week's revised average. The previous week's average was revised up by 500 from 266,750 to 267,250. There were no special factors impacting this week's initial claims. This marks 70 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

175.5

0.34(0.1941%)

200

ALCOA INC.

AA

9.22

0.03(0.3264%)

51420

ALTRIA GROUP INC.

MO

69.85

0.13(0.1865%)

1780

Amazon.com Inc., NASDAQ

AMZN

738.8

1.19(0.1613%)

19941

Apple Inc.

AAPL

95.65

0.12(0.1256%)

32897

AT&T Inc

T

42.7

-0.40(-0.9281%)

82611

Barrick Gold Corporation, NYSE

ABX

23

-0.16(-0.6908%)

127509

Boeing Co

BA

126.95

-0.01(-0.0079%)

200

Cisco Systems Inc

CSCO

28.66

-0.06(-0.2089%)

9055

Citigroup Inc., NYSE

C

41.18

0.12(0.2923%)

19843

Exxon Mobil Corp

XOM

94.25

0.16(0.17%)

725

Facebook, Inc.

FB

116.84

0.14(0.12%)

93033

Ford Motor Co.

F

12.56

-0.01(-0.0796%)

5003

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.02

0.13(1.1938%)

146826

General Electric Co

GE

31.8

0.06(0.189%)

5835

General Motors Company, NYSE

GM

28.38

-0.02(-0.0704%)

352

Goldman Sachs

GS

146.4

0.82(0.5633%)

510

Google Inc.

GOOG

699.25

1.48(0.2121%)

1469

Intel Corp

INTC

32.96

-0.01(-0.0303%)

2420

JPMorgan Chase and Co

JPM

60.2

0.01(0.0166%)

6079

McDonald's Corp

MCD

121.03

0.40(0.3316%)

314

Merck & Co Inc

MRK

59.02

-0.14(-0.2366%)

888

Microsoft Corp

MSFT

51.41

0.03(0.0584%)

13396

Pfizer Inc

PFE

35.69

-0.17(-0.4741%)

744

Procter & Gamble Co

PG

85.02

-0.01(-0.0118%)

450

Tesla Motors, Inc., NASDAQ

TSLA

212.98

-1.46(-0.6808%)

19933

The Coca-Cola Co

KO

45.5

0.23(0.5081%)

5500

Twitter, Inc., NYSE

TWTR

17.25

0.05(0.2907%)

6961

UnitedHealth Group Inc

UNH

143.05

0.67(0.4706%)

1000

Verizon Communications Inc

VZ

56.17

-0.09(-0.16%)

5649

Visa

V

74.32

0.26(0.3511%)

226

Walt Disney Co

DIS

98.01

0.27(0.2762%)

948

Yahoo! Inc., NASDAQ

YHOO

37.61

0.10(0.2666%)

1927

Yandex N.V., NASDAQ

YNDX

21.68

0.12(0.5566%)

7500

-

14:45

Canadian building permits dowm 1.9%

Municipalities issued building permits worth $6.8 billion in May, down 1.9% from the previous month. Lower construction intentions for commercial buildings in Quebec and Ontario and single-family homes in Ontario contributed most to the decrease.

The value of non-residential permits fell 3.3% to $2.5 billion in May, following a 1.9% increase in April. The decrease resulted mainly from lower construction intentions for commercial structures.

In the residential sector, the value of building permits was down 1.1% to $4.3 billion, following a 0.9% drop the previous month. The increase in the value of multi-family dwelling permits was not sufficient to offset the decline for single-family dwellings. Decreases were posted in six provinces, led by Alberta.

-

14:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Bank of America (BAC) downgraded to Mkt Perform from Outperform at Raymond James

AT&T (T) downgraded to Neutral from Buy at Citigroup; target raised to $46 from $42

Other:

Disney (DIS) initiated with a Hold at Brean Capital

-

14:43

European session review: pound rose

The following data was published:

(Time / country / index / period / previous value / forecast)

6:00 Germany Industrial Production (m / m) in May 0.5% Revised to 0.8% 0% -1.3%

France 6:45 Trade balance, bn May -5.2 -4.9 -2.8

7:15 Switzerland Consumer Price Index m / m in June 0.1% 0.1% 0.1%

7:15 Switzerland Consumer Price Index y / y in June -0.4% -0.5% -0.4%

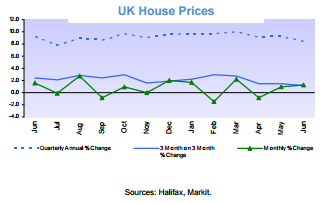

7:30 UK House Price Index from Halifax, m / m in June from 0.9% Revised 0.6% 0.4% 1.3%

7:30 UK House Price Index from Halifax, 3m y / y in June 9.2% 7.7% 8.4%

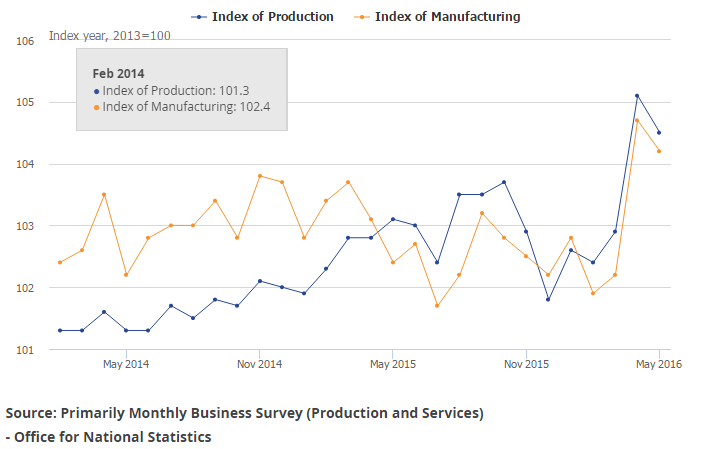

8:30 UK Industrial Production m / m in May 2.1% Revised from 2% to 1% -0.5%

8:30 UK Industrial Production y / y in May from 2.2% Revised 1.6% 0.5% 1.4%

8:30 UK Manufacturing production m / m in May to 2.4% Revised 2.3% -1% -0.5%

8:30 UK Manufacturing production, y / y in May 0.8%

11:30 Eurozone ECB's report on the meeting dedicated to monetary policy

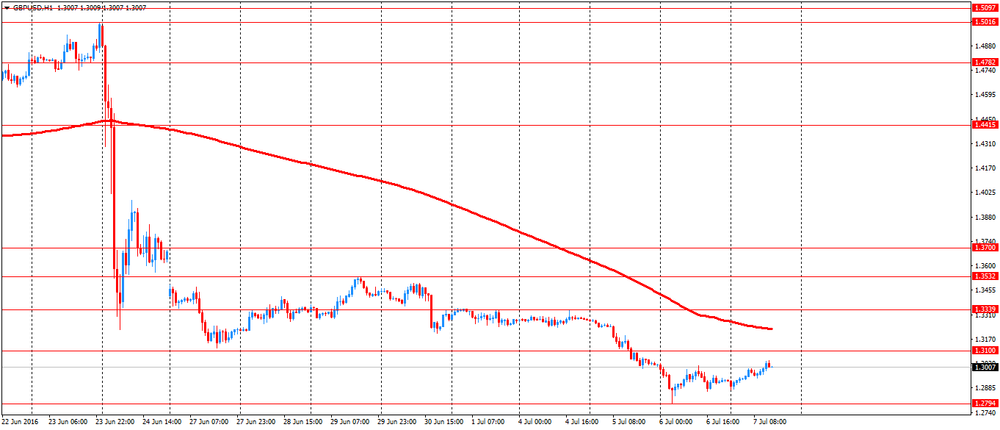

The pound rose from record lows against the US dollar after the release of positive manufacturing data in Great Britain, although concerns about Brexit consequences for the national economy continue to weigh.

The Office for National Statistics said that output in the UK manufacturing fell in May to a seasonally

The volume of industrial production decreased by 0.5 percent in May after the growth with 2.1 percent in April. It was the biggest drop in the past five months, but less than the expected decline of 1 percent.

In addition, manufacturing output fell by 0.5 percent, in contrast to an increase of 2.4 percent a month ago.

In annual terms, industrial production growth slowed to 1.4 percent in May, compared with 2.2 percent. Economists had forecast an increase of 0.5 percent.

Investors are now preparing for the meeting of the Bank of England next week, after the head of the central bank Governor Mark Carney signaled last week that it may take action during the summer, increasing expectations of the upcoming rate cut.

On Tuesday, the Bank of England warned of "representing the complexity of financial stability risks resulting after" Brexit and reduced requirements for the volume of capital reserves for banks.

Mark Carney said that this move implies "substantial changes" to help the economy to overcome the consequences of Britain leaving the EU.

At the same time, sentiment on the dollar slightly weakened after the June Fed meeting minutes released on Wednesday showed that officials of the US central bank decided that it is necessary to postpone the increase in interest rates, while evaluating British referendum consequences.

The minutes also stated that members of FOMC agreed to "reasonable wait for the new statistics before considering another rate hike".

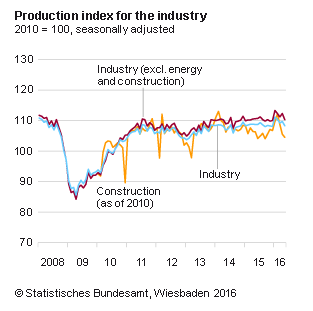

Euro fell against the dollar after the release of weak data on industrial production in Germany. In May, industrial production in Germany fell by 1.3% compared with the previous month, according to the Ministry of Economics and Labour.

The decline os the index was the most significant since August 2014, on average the market is not expected to change. Industrial production decreased by 0.4% compared to May last year.

The April growth rate of industrial production in Germany was revised from 0.8% to 0.5% compared to March and from 1.2% to 0.8% in annual terms.

Construction output in May decreased by 0.9% compared with the previous month, the release of capital goods fell by 3.9%. Electricity generation increased by 3.9%, consumer goods production - by 0.5%.

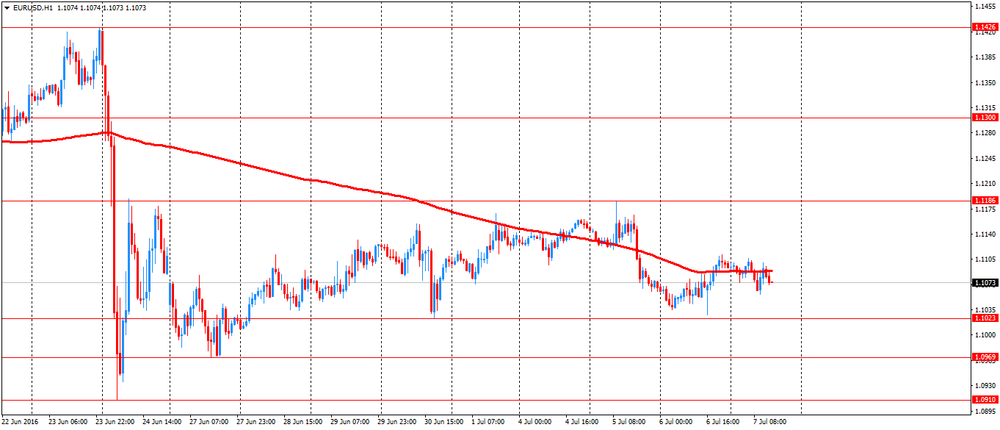

EUR / USD: during the European session, the pair fell to $ 1.1056

GBP / USD: during the European session, the pair has risen to $ 1.3046

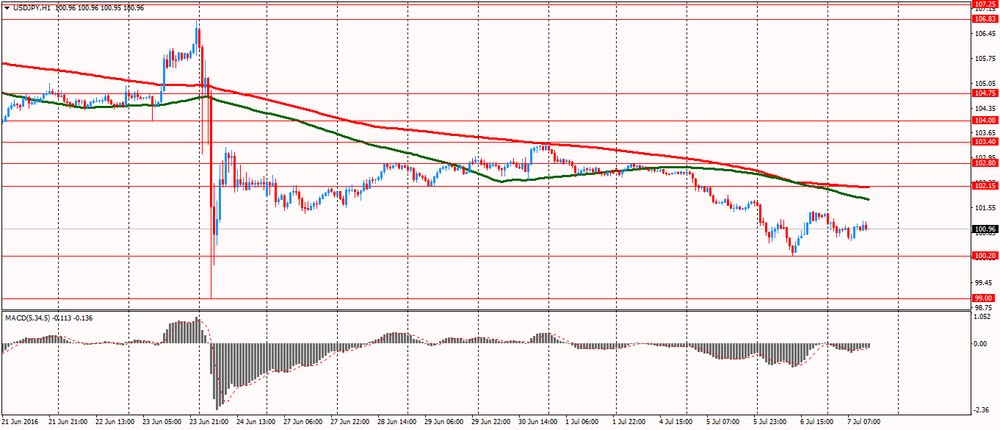

USD / JPY: during the European session, the pair fell to Y100.62 and then rose to Y101.19

-

14:30

U.S.: Initial Jobless Claims, 254 (forecast 270)

-

14:30

Canada: Building Permits (MoM) , May -1.9% (forecast 2%)

-

14:30

U.S.: Continuing Jobless Claims, June 2124 (forecast 2113)

-

14:25

ECB minutes: Brexit is "an important source of uncertainty" for eurozone

- Brexit can have significant negative consequences for the euro area economy

- The impact on the eurozone can manifest itself through trade and financial markets

- It is of great importance which assets will be purchased under the program of quantitative easing

- What does matter is the total amount of purchases of assets

- The composition of the bonds purchased by the ECB still has value for investors

- While there are no clear signs of an uptrend in core inflation

- Overall inflationary pressures remain weak

- We will closely monitor the inflation outlook

- ECB ready to take action and use all the tools, if necessary

-

14:21

US: more new jobs than expected - ADP

Private sector employment increased by 172,000 jobs from May to June according to the June ADP National Employment Report. Broadly distributed to the public each month the ADP National Employment Report is produced by the ADP Research Institute® in collaboration with Moody's Analytics. The report, which is derived from ADP's actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.

-

14:15

U.S.: ADP Employment Report, June 172 (forecast 159)

-

13:44

Orders

EUR/USD

Offers : 1.1200 1.1180 1.1150 1.1120/25 1.1100

Bids: 1.1050 1.1030 1.1000/10 1.0980 1.0950

GBP/USD

Offers : 1.3120 1.3100 1.3090 1.3080 1.3050 1.3030 1.3000

Bids: 1.2940 1.2920/25 1.2900/10 1.2870/75 1.2850 1.2800 1.2700

EUR/GBP

Offers : 0.8650 0.8625/30 0.8600 0.8580 0.8560

Bids: 0.8500 0.8475 0.8450 0.8400/10 0.8350

EUR/JPY

Offers : 113.50 113.00 112.80 112.50 112.30 112.00

Bids: 111.50 111.25/30 111.00/10 110.75 110.50 110.00

USD/JPY

Offers : 102.25 102.00 101.75/80 101.50 101.40 101.20/25 101.00/10

Bids: 100.60 100.50 100.40 100.20 100.00 99.80 99.50

AUD/USD

Offers : 0.7650 0.7600 0.7585/90 0.7550 0.7540 0.7530

Bids: 0.7480 0.7435 0.7420 0.7400 0.7350

-

13:22

Grece unemployment at 4 years low

Greece's unemployment rate dropped for a third straight month to its lowest level in more than four years, data from the Hellenic Statistical Authority showed Thursday.

The seasonally adjusted jobless rate fell to 23.3 percent from 23.7 percent in March, revised from 24.1 percent reported earlier. A year ago, the rate was 25.3 percent.

The latest figure was the lowest since March 2012, when it was 22.6 percent.

The number of unemployed dropped to 1.11 million from 1.13 million in the previous month. On a year-on-year basis, the jobless figure declined by 90,955 persons, or 7.5 percent.

Employment grew by 3 percent year-on-year and by 1.8 percent from the previous month.

The youth unemployment rate, which applies to the 15-24 age group, was 47.4 percent in Apirl versus 51.7 percent in the same month last year.

-

13:08

WSE: Mid session comment

The morning trading phase was marked by expansion of so successful achievements from the first hour of trading. The scale of increasing growth after the trauma of the three previous sessions may surprise even the bigger optimists. The WIG20 grows by 2 per cent, and with each fragment of the session bulls are doing more and more confident. It looks as the market has already cleaned after the Brexit and uncertainty associated with the future of Pension Funds (OFE). The Warsaw Stock Exchange stands out against the background of Europe. The growth of the German DAX exceeds a bit 1% and the French CAC40 1.2%. The WIG20 index managed to go over the level of 1,720 points, which means full make up for yesterday's losses and at the same time shows the first sign of a possible improvement in future sessions. However in the south part of the session we face with consolidation.

The improvement in sentiment on European markets, resulting in the best session since the beginning of the week on stock exchanges, is also reflected in currency trading. The zloty begins to strengthen, which is evident especially in the last hour of trading.

-

12:56

UK Foreign Secretary Philip Hammond cited by Reuters: the legal position is that it is up to the government to trigger article 50

- Parliament will be involved in Brexit process and will need to repeal legislation but decision of the public was clear.

-

12:54

European stocks on the rise

In today's trading, European stocks are actively growing for the first time in four sessions after the UK market and Italian banks, investors are counting on a gradual stabilization of the situation in the region.

The composite index of Europe's largest enterprises Stoxx 600 rose by 1.6% - to 323.80 points, an increase is observed in all 19 industry groups indicator. Over the previous three sessions Stoxx 600 fell by 4.1%.

The value of the UK's FTSE 100 increased 1.5% after the decline of the pound after and improvedvprospects for companies profits.

Some support for market was given by the minutes of the last meeting of the Federal Open Market Committee (FOMC) that showed the majority of the Central Bank managers still prefer to refrain from raising interest rates.

Investors were also evaluating data on British industrial production. Industrial production fell less than expected in May, data showed on Thursday, the Office for National Statistics said.

The volume of industrial production decreased by 0.5 percent in May after the growth with 2.1 percent in April. It was the biggest drop in the past five months, but less than the expected decline of 1 per cent.

In addition, manufacturing output fell by 0.5 percent, in contrast to an increase of 2.4 percent a month ago.

In annual terms, industrial production growth slowed to 1.4 percent in May, compared with 2.2 percent. Economists had forecast an increase of 0.5 percent.

Shares of the largest Italian bank Unicredit rose 1,3%, Intesa Sanpaolo 2,6%, Banca Monte dei Paschi di Siena - by 1.4%.

Securities of Associated British Foods Plc jumped 5.7% due to better annual profit forecast due to the weakening pound.

The market value of the French Danone SA, the world's largest yogurt maker, climbed 4.3% after the purchase announcement of American WhiteWave Foods Co. for $ 12.5 billion including debt.

Shares of Rentokil Initial Plc rose 5.4%. The Company has agreed to acquire US distributor of means to combat pests Residex LLC for $ 30 million.

At the moment:

FTSE 6561.80 98.21 1.52%

DAX 9473.28 100.02 1.07%

CAC 4148.61 63.31 1.55%

-

11:40

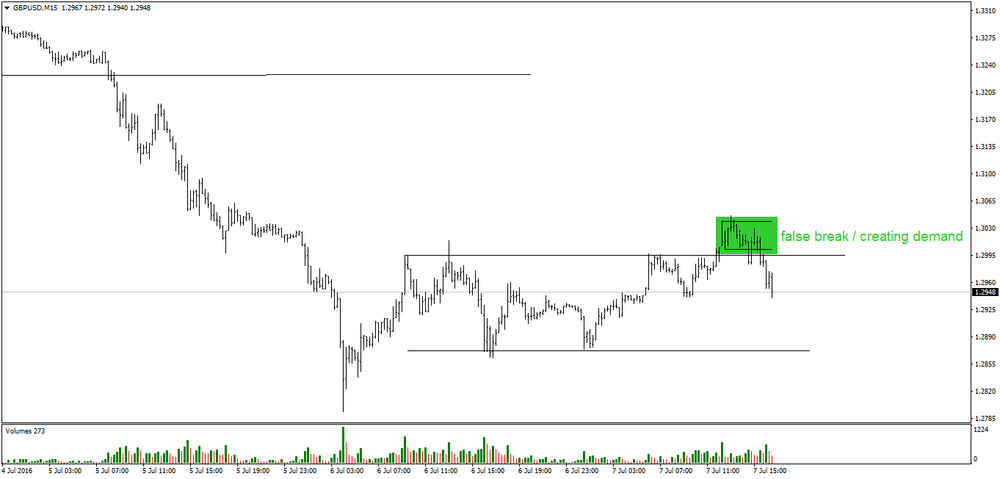

Gbp/Usd range trading after better data. Offers are building

-

11:18

Conservative leadership candidate Andrea Leadsom: expects continued growth post-Brexit

-

Brexit forecasts of a disaster for sterling, equities and interest rates have not proven correct.

-

Weak pound means we may import less and buy more at home, which are good things for the economy.

-

Expects continued growth post-Brexit.

-

Financial sector has been boosted by Barclays and HSBC saying their plans are to stick with the UK.

-

-

11:06

Oil is gaining in early trading

This morning, New York crude oil futures WTI rose 0.51% to $ 47.69 per barrel and crude oil futures for Brent rose 0.43% to $ 49.02 per barrel. Thus, the black gold is rising, amid the release of data that show a decrease in US oil inventories and dollar weakness. According to the American Petroleum Institute, oil reserves fell 6.7 million barrels to 520.9 million over the week. Analysts said the US data on the reduction of oil reserves was the main cause of rising prices.

-

10:46

Review of financial and economic press: France surpassed Britain in the ranking of the largest economies in the world

newspaper. ru

S & P downgraded the credit rating of Australia

The rating agency Standart & Poors (S & P) downgraded the credit rating AAA of Australia from stable to negative, Bloomberg writes. "The negative outlook reflects our view hat without decisive policy action shortfall in the budget can be kept for several years. Current budget deficit may not be compatible with a high level of external debt and does not match the rating AAA », - explained S & P.

ECB threatened Slovenia with a lawsuit

The European Central Bank (ECB) said that it would go to legal action against the Slovenian authorities after police raided the country's central bank in Ljubljana and grabbed information belonging to the ECB, Reuters reported with reference to the ECB President Mario Draghi.

German Finance Ministry: British referendum has not yet affected the German economy

The outcome of the British referendum does not have a significant impact on the German economy, according to Finance Minister Wolfgang Schaeuble. He noted that "no significant changes have occurred", which is confirmed by the German regulator.

RBC

France surpassed Britain in the ranking of the largest economies in the world

After another weakening of the pound sterling France surpassed the UK in the ranking of the largest economies of the world according to Reuters. Both countries in turn occupy the fifth place, depending on the exchange rate

-

10:33

UK industrial production in May better than forecasts

Total production output is estimated to have increased by 1.4% in May 2016 compared with May 2015. There were increases in 3 of the 4 main sectors, with the largest contribution coming from manufacturing (the largest component of production), which increased by 1.7%.

The largest contribution to the increase in manufacturing came from the manufacture of transport equipment, which increased by 6.6%.

Total production output is estimated to have decreased by 0.5% in May 2016 compared with April 2016. There were decreases in 3 of the 4 main sectors, with the largest downward movement coming from manufacturing, which decreased by 0.5% and contributed -0.3 percentage points to total production.

The largest contribution to the decrease in manufacturing came from the manufacture of basic pharmaceutical products & pharmaceutical preparations, which decreased by 6.5%, having increased in the previous month by 9.0%.

-

10:30

United Kingdom: Manufacturing Production (MoM) , May -0.5% (forecast -1%)

-

10:30

United Kingdom: Industrial Production (YoY), May 1.4% (forecast 0.5%)

-

10:30

United Kingdom: Industrial Production (MoM), May -0.5% (forecast -1%)

-

10:20

Option expiries for today's 10:00 ET NY cut

USD/JPY 99.00, 100 (710m),102.00/05 (585m), 102.40, 102.50, 102.70/75,103.00, 103.20,104.00, 104.80 (511m),105.00 (760m)

GBP/USD 1.2500 (626m),1.3000 (1bn),1.3500 (987m)

AUD/USD 0.7200, 0.7250, 0.7265/65,0.7300 (402m), 0.7350, 0.7375,0.7440/45/50 (730m), 0.7458/60, 0.7470/75/80,0.7500, 0.7535, 0.7585,0.7600, 0.7610 (541m),0.7700 (558m)

NZD/USD 0.6965,0.7010,0.7104/05/06, 0.7140, 0.7150, 0.7175

AUD/JPY 74.50 (550m)

USD/CAD 1.2750/55,1.2775,1.2800, 1.2875/80,1.3000, 1.3020,1.3100, 1.3140, 1.3180,1.3300

EUR/GBP 0.8250, 0.8280,0.8340,0.8500 (400m)

-

09:45

Mixed start of trading on major stock exchanges: DAX 9,431.89 + 58.63 + 0.63%, FTSE 100 6,521.05-24.32-0.37%, CAC 40 4,115.07 + 29.77 + 0.73%

-

09:38

UK: house prices increased in June (data calculated before Brexit)

Prices in the three months to June were 8.4% higher than in the same three months of 2015

• House prices in the last three months (April-June) were 1.2% higher than in the preceding three months.

House prices in the three months to June were 1.2% higher than in the preceding three months (JanuaryMarch). This was slightly below May's 1.5% increase and was the lowest rise on this basis since December 2014 (1.0%).

• Prices in the three months to June were 8.4% higher than in the same three months a year earlier. This was down from 9.2% in May and was the lowest since July 2015 (7.8%).

• House prices increased by 1.3% between May and June. This followed a 0.9% rise in May. The month-on-month changes can be erratic and the quarter on quarter change is a more reliable indicator of the underlying trend.

Somewhat irelevant considering that Brexit was on june 24. The smart money will probably take advantage of the good news and increased demand for the pound to sell further.

-

09:31

United Kingdom: Halifax house price index 3m Y/Y, June 8.4% (forecast 7.7%)

-

09:31

United Kingdom: Halifax house price index, June 1.3% (forecast 0.4%)

-

09:27

Swiss CPI up 0.1% in June

The Swiss Consumer Price Index (CPI) increased by 0.1% in June 2016 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was -0.4% in comparison with the same month in the previous year. These are the findings of the Federal Statistical Office (FSO).

-

09:15

WSE: After opening

WIG20 index opened at 1697.51 points (+0.45%)*

WIG 43790.36 0.55%

WIG30 1905.33 0.66%

mWIG40 3297.89 0.38%

*/ - change to previous close

The futures market began today's from the growth of 0.41% to 1,694 points. This optimism of contracts was not accidental. At the beginning of the session, most of the values among blue chips glows green, mainly banks sector. Bulls quickly regain the level of 1,700 points on the WIG20 index, which gives hope to avoid a collision with a key support level that is January minimum index, affected by the results of the British referendum.

-

09:15

Switzerland: Consumer Price Index (YoY), June -0.4% (forecast -0.5%)

-

09:15

Switzerland: Consumer Price Index (MoM) , June 0.1% (forecast 0.1%)

-

08:45

France: Trade Balance, bln, May -2.8 (forecast -4.9)

-

08:43

Expected negative start of trading on the major stock exchanges in Europe: DAX -0,3%, FTSE 100 -0,8%, CAC 40 -0.1%

-

08:42

Asian session review: the Australian dollar decreased

During the Asian session, the euro was trading almost unchanged against the US dollar on the eve of the release of important economic data on Friday. Experts note that the June data is likely to point to the relative strength of the US labor market after disappointing May report. According to forecasts, the number of people employed in non-agricultural sectors of the economy increased by 178.000, after rising a meager 38.000. In May. According to some analysts the employment report is unlikely to change the Fed's cautious plan for interest rates.

The yen strengthened slightly during the session following a statement by the head of the Bank of Japan Kuroda that the Bank of Japan will maintain the quantitative and qualitative easing of negative interest rates as long as is necessary to achieve a stable inflation rate of 2%. He also said that Japan's economy is expected to grow at a moderate pace, and the Japanese financial system remains stable.

The leading index, published by the Cabinet of Ministers of Japan and tracking the current state of the Japanese economy amounted to 110.5, lower than the previous value of 112.

The Bank of Japan lowered its quarterly report on the assessment of the 4 regions of consumption. Assessment of other regions remained unchanged

The Australian dollar fell after Standard & Poor's international rating agency (S & P) downgraded the long-term credit rating of Australia from "stable" to "negative." Australia keeps the AAA highest credit rating, but with a warning about a possible downgrade, if not taken effective measures to stabilize the budget.

According to Aozora Bank analysts, the loose monetary policy of the Fed has had a positive impact on commodity exporters, which include Australia, but slowing global growth.

Head of Treasury of Australia stated that the S & P decision points to the need to improve the budget situation, improvement of the budget can not be postponed and that the government has time to avoid the loss of the AAA rating.

Earlier, the index of activity in the construction sector in Australia has been published by HIA / AiG..

The index of activity in the construction sector of Australia HIA / AiG rose in June by 6.5 points to 53.2, after rising to 46.7 in May. This is the highest growth rate in 10 months.

The Australia Industry Group noted that national construction industry returned to growth in June. The rebound was driven by a solid rise in new orders, which returned to growth (above 50) for the first time in eight months. Also it became known, the construction of houses gained momentum to grow at the highest rate in the last 30 months. Engineering construction is growing for the second time in the last three months, though only slightly, while commercial construction activity rebounded in June after two months of decline. House builders were generally positive in assessing business conditions with reference to the improvement in new orders, the sustained support of the ongoing projects and activities of investors.

The New Zealand dollar appreciated strongly after the deputy head of the Reserve Bank of New Zealand Grant Spencer spoke about macroprudential policy and the risks associated with the housing market. Mr. Spencer said that against the backdrop of the current global environment, the RBNZ interest rates are likely to remain low for some time. He also added that it is necessary to balance concerns about financial stability. As for the housing market, Spencer said: "the longer the boom in the housing market, the higher the risk of a serious correction".

-

08:30

Bank of Japan Governor, Kuroda: Japan consumer inflation likely to be slightly negative or around 0% for time being

-

Japan's economy expected to expand moderately as a trend.

-

Japan consumer inflation likely to be slightly negative or around zero % for time being.

-

Japan's financial system maintaining stability.

-

BOJ will maintain QQE with negative rates for as long as needed to achieve 2% inflation in stable manner.

-

BOJ will take additional easing steps via quantity, quality of asset buying and interest rates if needed.

-

-

08:29

Options levels on thursday, July 7, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1260 (2917)

$1.1220 (3868)

$1.1164 (1463)

Price at time of writing this review: $1.1084

Support levels (open interest**, contracts):

$1.0992 (8680)

$1.0946 (5362)

$1.0898 (14343)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 44305 contracts, with the maximum number of contracts with strike price $1,1500 (5313);

- Overall open interest on the PUT options with the expiration date July, 8 is 86108 contracts, with the maximum number of contracts with strike price $1,0900 (14343);

- The ratio of PUT/CALL was 1.94 versus 2.04 from the previous trading day according to data from July, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.3301 (480)

$1.3201 (1747)

$1.3102 (185)

Price at time of writing this review: $1.2979

Support levels (open interest**, contracts):

$1.2894 (314)

$1.2797 (499)

$1.2699 (269)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 37233 contracts, with the maximum number of contracts with strike price $1,5000 (4009);

- Overall open interest on the PUT options with the expiration date July, 8 is 44067 contracts, with the maximum number of contracts with strike price $1,3500 (4724);

- The ratio of PUT/CALL was 1.18 versus 1.24 from the previous trading day according to data from July, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Fed uncertain about rate hikes - FOMC minutes

In a report made somewhat irrelevant by the UK's shocking Brexit decision, the minutes of the June Federal Reserve meeting revealed that officials are still leaning toward raising interest rates this year.

"Most participants judged that, in the absence of significant economic or financial shocks, raising the target rate for the federal funds rate would be appropriate if incoming information confirmed that economic growth had picked up, that job gains were continuing at a pace sufficient to sustain progress toward the Committee's maximum-employment objective, and that inflation was likely to rise to 2% over the medium term," the minutes of the June 14-15 meeting said.

However, there was no specific guidance offered about the timing of such a rate hike - rttnews said.

Analysts say a July rate hike is off the table, given weakness in the U.S. jobs market and the unexpected decision by U.K. citizens to leave the European Union.

"A couple of members" said they would need "sufficient evidence to increase their confidence that economic growth was strong enough to withstand a possible downward shock to demand and that inflation was moving closer to 2% on a sustained basis."

-

08:19

WSE: Before opening

After yesterday's session in the US where the S&P500 index gained 0.54% and closed at daily highs, it seems that today we may expect some growth on the markets.

Another day strengthened the Japanese yen and gold, on the other hand, since this morning we have a small correction in the dollar and the Swiss franc. Investors from the beginning of the session for the Asian markets are clearly hesitant as to the direction that they should take. On the one hand, yesterday's behavior of overseas parquets gave a little courage for buyers, but awareness of the dangers that arise on the horizon does not allow buyers to develop wings and causes that assets considered as "safe havens" such as gold and the yen are still more expensive.

In the morning in Asia is dominated by the green color, although with some exceptions, such as the Nikkei index, falling in response to the still strong yen. Europe, however, gets a chance to fight for reflection after a disastrous first part of the week, and the Warsaw Stock Exchange should take advantage of it. The scale of the possible reaction in Warsaw will be able to build up a new opinion about the condition of our market, which yesterday was not the best.

Additionally, today will flow to the market quite a lot of macro data, including industrial production in Germany, Norway and the UK as well as data from the US labor market, which can kick-start trade in Europe. We have to remember that there is a heavy atmosphere on the market and subsequent bad data will be intensified desire for selling off the shares.

-

08:17

S&P downgraded Australia’s rating to AAA “negative”

Australia's sovereign rating outlook was downgraded by Standard & Poor's Global Ratings on Thursday, without any remedial actions.

The outlook on 'AAA' rating was lowered to negative from stable. Accordingly, there is a one-in-three chance that the rating would be downgraded within the next two years if it believes that the Parliament is unlikely to legislate savings or revenue measures.

On credit ratings, the agency said along with strong institutions, a credible monetary policy, and floating exchange rate regime, Australia's public finances have traditionally been a credit strength for the sovereign rating.

S&P noted that without any forceful policy decisions, the government's fiscal stance may no longer be compatible with the country's high level of external indebtedness.

Australia's fiscal position continued to weaken delaying an eventual return to budget surpluses since the global financial crisis.

-

08:14

Japan leading index stable

Japan's leading index that signals the future economic activity, remained stable in May, preliminary survey data from the Cabinet Office showed Thursday.

The leading index came in at 100 in May, the same as in April and matched economists' expectations.

Meanwhile, the coincident index that reflects the current economic activity, fell to 110.5 in May from 112.0 a month ago. Nonetheless, the reading was above the expected level of 110.2.

Similarly, the lagging index that indicates the past economic activity, dropped to 113.7 from 115.3 in the previous month.

-

08:09

German industrial production down 1.3% in May

In May 2016, production in industry was down by 1.3% from the previous month on a price, seasonally and working day adjusted basis according to provisional data of the Federal Statistical Office (Destatis). In April 2016, the corrected figure shows an increase of 0.5% (primary +0.8%) from March 2016.

In May 2016, production in industry excluding energy and construction was down by 1.8%. Within industry, the production of capital goods decreased by 3.9% and the production of intermediate goods by 0.3%. The production of consumer goods increased by 0.5%. Energy production was up by 3.9% in May 2016 and the production in construction decreased by 0.9%.

-

08:00

Germany: Industrial Production s.a. (MoM), May -1.3% (forecast 0%)

-

07:16

Global Stocks

European stocks moved sharply lower again Tuesday, as concerns over the U.K.'s Brexit vote gripped the market after three London asset manages suspended trading in a property funds.

A more than 4% slide in oil prices further hurt the investment mood.

U.S. stocks shook off worries tied to the U.K.'s vote late last month to exit the European Union, dubbed Brexit, and closed higher Wednesday.

A stronger-than-expected report on nonmanufacturing activity helped nudge investors back into equities, while minutes from the Federal Reserve's June policy meeting showed the majority of policy makers were in favor of keeping rates on hold.

Some analysts attributed gains in the aftermath of Brexit to investors' strategy of buying stocks when the market dips, which tends to lead to up-and-down trading.

The S&P 500 index SPX, +0.54% rose 11.18 points, or 0.5%, to finish at 2,099.73. The health-care and consumer discretionary sectors led gains, while sectors considered defensive, such as telecoms and utilities, declined. The Dow Jones Industrial Average DJIA, +0.44% gained 78 points, or 0.4%, to finish at 17,918.62.

Asian share markets crept higher on Thursday after upbeat U.S. economic data took some of the sting out of the latest Brexit scare, while the Australian dollar slipped as the country's triple A credit rating came under threat.

The agency had warned it may act after inconclusive elections over the weekend suggested the next government would have a hard time getting reforms through to law.

Elsewhere in Asia, the mood was one of relief that Brexit fears had faded for the moment. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.8 percent.

Japanese shares were restrained by a strong yen and the Nikkei .N225 dipped 0.3 percent.

-

07:02

Japan: Coincident Index, May 110.5

-

07:01

Japan: Leading Economic Index , May 100 (forecast 100.1)

-

04:04

Nikkei 225 15,320.76 -58.23 -0.38 %, Hang Seng 20,698.29 +203.00 +0.99 %, Shanghai Composite 3,012.41 -4.88 -0.16 %

-

01:46

Australia: AiG Performance of Construction Index, June 53.2

-

00:33

Commodities. Daily history for Jul 06’2016:

(raw materials / closing price /% change)

Oil 47.89 +0.97%

Gold 1,365.70 -0.10%

-

00:32

Stocks. Daily history for Jun Jul 06’2016:

(index / closing price / change items /% change)

Nikkei 225 15,378.99 -290.34 -1.85 %

Hang Seng 20,495.29 -255.43 -1.23 %

S&P/ASX 200 5,197.55 -30.45 -0.58 %

Shanghai Composite 3,017.1 +10.71 +0.36 %

FTSE 100 6,463.59 -81.78 -1.25 %

CAC 40 4,085.3 -78.12 -1.88 %

S&P 500 2,099.73 +11.18 +0.54 %

NASDAQ Composite 4,859.16 +36.26 +0.75 %

Dow Jones 17,918.62 +78.00 +0.44 %

-

00:31

Currencies. Daily history for Jul 06’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1093 +0,24%

GBP/USD $1,2924 -0,74%

USD/CHF Chf0,9752 -0,19%

USD/JPY Y101,38 -0,33%

EUR/JPY Y112,47 -0,08%

GBP/JPY Y131,01 -1,08%

AUD/USD $0,7513 +0,75%

NZD/USD $0,7124 -0,35%

USD/CAD C$1,2965 -0,15%

-

00:03

Schedule for today, Thursday, Jul 07’2016:

(time / country / index / period / previous value / forecast)

00:30 Japan BOJ Governor Haruhiko Kuroda Speaks 05:00 Japan Leading Economic Index (Preliminary) May 100 100.1

05:00 Japan Coincident Index (Preliminary) May 112

06:00 Germany Industrial Production s.a. (MoM) May 0.8% 0%

06:45 France Trade Balance, bln May -5.2 -4.9

07:15 Switzerland Consumer Price Index (MoM) June 0.1% 0%

07:15 Switzerland Consumer Price Index (YoY) June -0.4% -0.5%

07:30 United Kingdom Halifax house price index June 0.6% 0.4%

07:30 United Kingdom Halifax house price index 3m Y/Y June 9.2% 7.7%

08:30 United Kingdom Industrial Production (MoM) May 2% -1%

08:30 United Kingdom Industrial Production (YoY) May 1.6% 0.5%

08:30 United Kingdom Manufacturing Production (MoM) May 2.3% -1%

08:30 United Kingdom Manufacturing Production (YoY) May 0.8%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:15 Canada Housing Starts June 188.6

12:15 U.S. ADP Employment Report June 173

12:30 Canada Building Permits (MoM) May -0.3% 2%

12:30 U.S. Continuing Jobless Claims June 2120 2113

12:30 U.S. Initial Jobless Claims 268 270

14:00 United Kingdom NIESR GDP Estimate Quarter II 0.5%

14:00 Canada Ivey Purchasing Managers Index June 49.4 51

15:00 U.S. Crude Oil Inventories July -4.053

23:50 Japan Current Account, bln May 1879 1750

-