Noticias del mercado

-

22:06

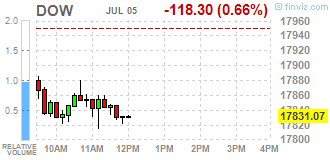

Major US stock indexes lost less than one percent

Major stock indexes in Wall Street fell moderately Tuesday amid falling oil prices.

Oil prices have fallen by about 4%, which was due to increased concerns about a slowdown in economic growth after the UK from the EU. Pressure on the quotes also provided data on oil stocks in the Cushing terminal. "The deterioration of the forecast of world economic growth, uncertainty in financial markets and their impact on the demand for oil is likely to exacerbate the trend of growth in demand from the industry," - noted experts Barclays. Today, the company Genscape said that for the week to July 1, oil terminal in Cushing rose by 230,025 barrels. On the dynamics of trading also continues to influence Friday's report from the oilfield services company Baker Hughes. It was reported that the number of drilling rigs in the US rose last week by 11 units to 341 units.

Also today, the yield on 10-year US Treasury yield fell to its lowest level in the history of the uncertainty in the markets after the British decision to withdraw from the European Union structure.

Focus also appeared on the US data. It is learned that US factory orders fell in May, against the background of weak demand for steel, aluminum, furniture, electrical appliances and warplanes. The Commerce Department reported that factory orders fell by 1% in May, after rising in the previous two months. The decline suggests that manufacturers in the United States still can not fully recover from the effects of weaker economic growth around the world.

However, another report showed that an index of economic optimism in the US, calculated by the newspaper Investor's Business Daily and research firm TechnoMetrica Institute of Policy and Politics, fell in July by 2.7 points, or 5.6%, reaching 45 5 points. Economists had expected the index to rise to 49.3 points.

Most components of the DOW index finished trading in negative territory (18 of 30). Outsider were shares of JPMorgan Chase & Co. (JPM, -2,79%). More rest up shares Johnson & Johnson (JNJ, + 1,20%).

Almost all sectors of the S & P index showed a decline. Most of the basic materials sector fell (-2.0%). The leader turned utilities sector (+ 0.6%).

At the close:

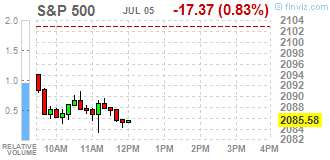

Dow -0.61% 17,839.11 -110.26

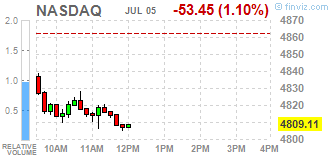

Nasdaq -0.82% 4,822.90 -39.67

S & P -0.69% 2,088.37 -14.58

-

21:00

Dow -0.81% 17,804.25 -145.12 Nasdaq -1.16% 4,806.18 -56.39 S&P -0.97% 2,082.61 -20.34

-

18:03

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday as oil prices kept sliding and tepid U.S. data added to global growth worries. Oil prices were down more than 4% as a potential economic slowdown weighed on prospects of demand.

Most of all Dow stocks in negative area (20 of 30). Top looser - Caterpillar Inc. (CAT, -2,77%). Top gainer - Johnson & Johnson (JNJ, +1,38%).

Almost all of S&P sectors also in negative area. Top looser - Basic Materials (-2,3%). Top gainer - Utilities (+0,3%).

At the moment:

Dow 17729.00 -137.00 -0.77%

S&P 500 2076.75 -19.50 -0.93%

Nasdaq 100 4389.25 -44.00 -0.99%

Oil 46.86 -2.13 -4.35%

Gold 1352.90 +13.90 +1.04%

U.S. 10yr 1.36 -0.09

-

18:01

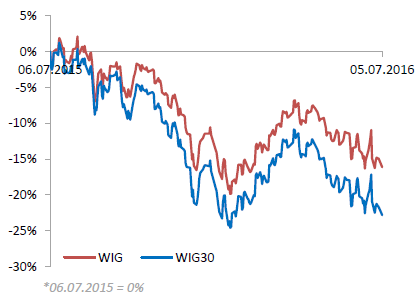

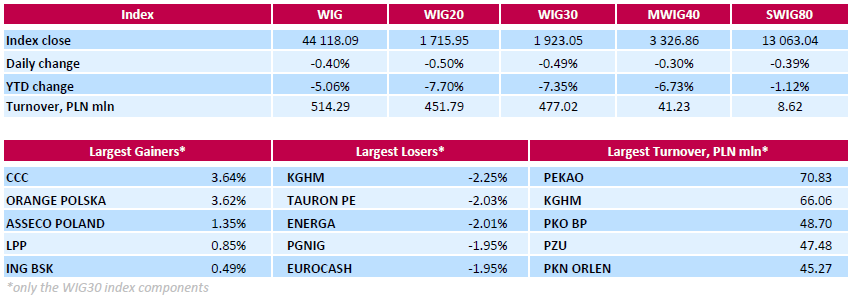

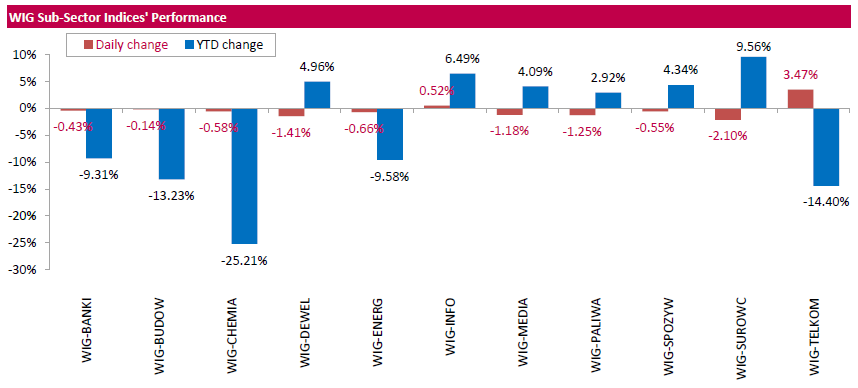

WSE: Session Results

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, fell by 0.4%. Except for information technology (+0.52%) and telecommunication services (+3.47%), every sector in the WIG Index declined, with materials (-2.10%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.49%. 22 out of all 30 index components recorded losses, led by copper producer KGHM (WSE: KGH) and two gencos TAURON PE (WSE: TPE) and ENERGA (WSE: ENG), tumblimg by 2.25%, 2.03% and 2.01% respectively. Oil and gas producer PGNIG (WSE: PGN) and FMCG-wholesaler EUROCASH (WSE: EUR), also produced noticeable declines, each plunging by 1.95%. On the other side of the ledger, footwear retailer CCC (WSE: CCC) and telecommunication services provider ORANGE POLSKA (WSE: OPL) were the biggest gainers, surging by 3.64% and 3.62% respectively.

-

18:00

European stocks closed: FTSE 100 6,545.37 +23.11 +0.35% CAC 40 4,163.42 -71.44 -1.69% DAX 9,532.61 -176.48 -1.82%

-

15:54

WSE: After start on Wall Street

The afternoon trade phase brought new lows for the DAX and the CAC40. The American market started trading from discounts, which means that after the dynamic rebound of Brexit declines to the market comes back gray reality which is not conducive to beating historical records that were close last week. The realities of several months of consolidation inspire caution, which, combined with a weak session in Europe leads to declines. Thus further approach will be difficult, and the scale of discounts will tell a lot about the condition of the market. On the Warsaw market today the situation is stable while turnover on the WIG20 index is about PLN 320 million.

-

15:33

U.S. Stocks open: Dow -0.38%, Nasdaq -0.49%, S&P -0.52%

-

15:02

Before the bell: S&P futures -0.58%, NASDAQ futures -0.61%

U.S. stock-index futures declined, tracking a selloff in markets overseas amid simmering concerns that Britain's exit from the EU will further weigh on already fragile global growth.

Global Stocks:

Nikkei 15,669.33 -106.47 -0.67%

Hang Seng 20,750.72 -308.48 -1.46%

Shanghai Composite 3,007.11 +18.51 +0.62%

FTSE 6,532.89 +10.63 +0.16%

CAC 4,166.03 -68.83 -1.63%

DAX 9,543.25 -165.84 -1.71%

Crude $47.47 (-3.10%)

Gold $1348.90 (+0.74%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.43

-0.12(-1.2565%)

24020

ALTRIA GROUP INC.

MO

68.9

-0.12(-0.1739%)

2181

Amazon.com Inc., NASDAQ

AMZN

721.95

-3.73(-0.514%)

14702

American Express Co

AXP

60.63

-0.06(-0.0989%)

341

AMERICAN INTERNATIONAL GROUP

AIG

52.4

-0.47(-0.889%)

1435

Apple Inc.

AAPL

95.2

-0.69(-0.7196%)

130778

AT&T Inc

T

43.41

-0.06(-0.138%)

19136

Barrick Gold Corporation, NYSE

ABX

22.45

0.24(1.0806%)

116631

Boeing Co

BA

129

-0.69(-0.532%)

202

Caterpillar Inc

CAT

75.89

-0.56(-0.7325%)

3394

Cisco Systems Inc

CSCO

28.46

-0.08(-0.2803%)

14015

Citigroup Inc., NYSE

C

41.58

-0.59(-1.3991%)

130612

Deere & Company, NYSE

DE

79.93

-0.97(-1.199%)

2000

E. I. du Pont de Nemours and Co

DD

64.19

-0.17(-0.2641%)

600

Exxon Mobil Corp

XOM

93.05

-0.79(-0.8419%)

4610

Facebook, Inc.

FB

113.72

-0.47(-0.4116%)

66080

Ford Motor Co.

F

12.59

-0.13(-1.022%)

35450

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.04

-0.31(-2.7313%)

170353

General Electric Co

GE

31.28

-0.21(-0.6669%)

31038

General Motors Company, NYSE

GM

28.73

-0.16(-0.5538%)

1501

Goldman Sachs

GS

146.75

-1.50(-1.0118%)

7129

Google Inc.

GOOG

695.66

-3.55(-0.5077%)

1423

Hewlett-Packard Co.

HPQ

12.67

-0.06(-0.4713%)

500

Home Depot Inc

HD

129.25

-0.37(-0.2854%)

1175

Intel Corp

INTC

32.53

-0.22(-0.6718%)

700

International Business Machines Co...

IBM

151.32

-1.03(-0.6761%)

1567

International Paper Company

IP

42.16

-0.55(-1.2878%)

4023

Johnson & Johnson

JNJ

121.22

-0.07(-0.0577%)

5190

JPMorgan Chase and Co

JPM

60.7

-0.56(-0.9141%)

10430

McDonald's Corp

MCD

120.14

-0.26(-0.2159%)

820

Merck & Co Inc

MRK

57.27

-0.67(-1.1564%)

100

Microsoft Corp

MSFT

50.97

-0.19(-0.3714%)

14801

Nike

NKE

55.47

-0.14(-0.2518%)

6459

Pfizer Inc

PFE

35.42

-0.15(-0.4217%)

2400

Procter & Gamble Co

PG

84.6

-0.18(-0.2123%)

3610

Starbucks Corporation, NASDAQ

SBUX

56.82

-0.17(-0.2983%)

540

Tesla Motors, Inc., NASDAQ

TSLA

210.35

-6.15(-2.8406%)

204363

The Coca-Cola Co

KO

45

-0.12(-0.266%)

3630

Twitter, Inc., NYSE

TWTR

17.18

-0.10(-0.5787%)

56613

UnitedHealth Group Inc

UNH

139.82

-1.04(-0.7383%)

649

Verizon Communications Inc

VZ

56.23

-0.00(-0.00%)

4057

Visa

V

74.3

-0.18(-0.2417%)

6860

Walt Disney Co

DIS

97.85

-0.18(-0.1836%)

2278

Yahoo! Inc., NASDAQ

YHOO

37.7

-0.29(-0.7634%)

13302

Yandex N.V., NASDAQ

YNDX

21.51

-0.22(-1.0124%)

2700

-

13:44

Company News: results of Tesla Motors (TSLA) for the second quarter 2016 worse than expected

The company reported that in the second quarter it produced 18,345 cars, which is 20% more than in the first quarter, but lower than the forecast of 20.000 cars. Production reached 2.000 cars per week. Thanks to intensive unfolding of production, almost half of the total quarterly production took place in the last four weeks of the quarter.

Given the continued improvement in performance, Tesla expected to reach the level of production of 2.200 cars per week in the third quarter and 2,400 cars per week in the fourth quarter. In total the company plans to produce and deliver about 50 000 cars in the second half of 2016, which roughly corresponds to the entire volume produced in 2015.

TSLA shares fell in premarket trading to $ 207.80 (-4.02%).

-

13:04

WSE: Mid session comment

Today's readings of PMI for the services sector in European countries were not as favorable as the previous PMI's for the industry. We may see slowing down, which is somewhat surprising, since the first signs of a possible short of breath in the economy should be signaled by the industry, not the services. Readings in principles say that the growth is still present, although unsatisfactory persistent. After data European stock exchanges slightly cooled down and decreases exceeds 1%.

In the south part of trading the process of falls on European stock exchanges was halted and thereby also on our market there is no incentive to create volatility. In front of us is likely prospect of southern calm.

In the mid-session the WIG20 index was at the level of 1,724 points (-0,01%) and with almost of PLN 200 mln turnover.

-

12:47

Major stock indices in Europe showing losses

Stock indices in Europe, after rising to February's highs are declining for the second day in a row due to the fall of the financial and commodity sectors, while the Italian bank Monte dei Paschi reached a new record low.

The indices opened lower on fresh concerns about the global effects of Brexit, while investors focused on today's Bank of England report on financial stability.

Investors remain cautious after the shocking decision of Britain to leave the European Union sparked uncertainty about the consequences for the world economy as a whole.

On Monday, Nigel Farage, one of the main supporters of Brexit campaign, resigned from his post as head of the UK Independence Party, saying that he "played his role."

On Tuesday, the research firm Markit Economics published the final PMI data for eurozone countries.

Composite PMI in eurozone remained at the May level of 53.1 points, although preliminary data point to a decline to 52.8 points.

The service sector indicator fell to 52.8 points from 53.3 points. It was expected a more significant fall - to 52.4 points.

The composite index of the largest companies in the region, Stoxx Europe 600, fell during trading 1,4% - to 325.30 points. Last week, the index jumped 7.6%, recovering more than half of the losses incurred as a result of the British decision to leave the EU.

All 19 industry subgroups of Stoxx Europe 600 Index show losses.

The capitalization of Italian banks fell for the third consecutive session.

As it became known earlier, the Italian Government is considering the possibility of recapitalization of banks in the country at the expense of budget funds. In particular, plans for Banca Monte dei Paschi di Siena involve the issue of new convertible bonds in favor of the state in the amount of no less than 3 billion euros. On this news the bank's shares fell 5.4%.

This measure surely meet resistance from the EU authorities, noted Fitch.

The price of shares of Chr. Hansen Holding, which produces natural colors and enzymes for food products decreased by 5.1% on the data worse than expected about quarterly sales.

Securities of the construction company Balfour Beatty fell by 2.6%.

Shares of British developer Persimmon fell 5.4%. The company reported an increase in revenue in the first half of 2016 by 12% to 1.49 billion pounds.

Sports Direct Shares fell 5% as the group should report on Thursday about the drop in profits due to lower sales in the summer against the backdrop of bad weather.

Shares of British American Tobacco rise by 0.9% after Credit Suisse analysts confirmed their rating to "outperform."

At the moment:

FTSE 6525.09 2.83 0.04%

DAX 9575.40 -133.69 -1.38%

CAC 4177.72 -57.14 -1.35%

-

09:31

Major stock exchanges trading mixed: DAX 9,652.92-56.17-0.58%, FTSE 100 6,527.84 + 5.58 + 0.09%, CAC 40 4,214.56-20.30-0.48%

-

09:20

WSE: After opening

The futures market opened with decrease of 0.46% (1,715 points). The contract on the DAX dropped of 1% and the discount clearly accelerated in the first minutes of trading, which was not without effect on the Warsaw Stock Exchange.

WIG20 index opened at 1722.62 points (-0.11%)

WIG 44344.85 0.11%

WIG30 1933.39 0.04%

mWIG40 3343.65 0.20%

*/ - change to previous close

The cash market began with a modest discount, while the German DAX drops of 0.6%. We may see that the supply is not determined and the market can stabilize around yesterday's opening and closing, which is de facto in the vicinity of many hours of yesterday afternoon consolidation.

To the weaker global sentiment fits today also the zloty, increasingly weakening to the major currencies. It seems like continuation of yesterday's movement.

-

08:50

Expected positive start of trading on the major stock exchanges in Europe: DAX -0,5%, FTSE 100 -0,3%, CAC 40 -0.2%

-

08:24

WSE: Before opening

Sentiment about this morning is slightly offset, the contract for the S&P500 index go down of 0.38%. Also Asian stock markets indices are falling, with the exception of China, where after the publication of PMI for services, which rose from 51.2 points. to 52.7 points, the investment climate has improved. Today the Americans return to the game and come up more macro data. Around 10:00 (Warsaw time) will be published data regarding the PMI for services in Germany, France, Italy and the Euro zone, and at 11:00 we will know the data on retail sales in the Euro zone.

During the Asian session we also observed correction in precious metals. About 10 usd compared to yesterday's price went down gold. More than 2% is cheaper silver and is again below 20 usd per ounce. The morning strengthens the dollar and the Swiss franc. Such an arrangement may not appeal to investors in Europe who yesterday began to lose faith in growth, and today after such a miserable session in Asia may continue on sale of shares.

-

07:12

Global Stocks

Stocks in Europe slipped Monday, with losses among Italian banks helping to hand the pan-European benchmark its first loss in four sessions.

Stoxx Europe 600 SXXP, -0.74% dropped 0.7% to end at 329.78.

Italy's Banca Monte dei Paschi di Siena SpA BMPS, -13.99% closed down 14%. The move came after a report that the European Central Bank is pushing the lender to draft a new plan aimed at reducing non-performing loans.

Equities have been clawing back Brexit-fueled losses, as the U.K. government has yet to start formal talks about its terms in exiting the European Union after last month's referendum.

Asian shares snapped a five-day winning streak on Tuesday as investors took stock of a rally driven by hopes that central banks will provide more stimulus to offset a likely downturn triggered by Brexit.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.7 percent, but was still within reach of its June 9 peak, having risen 5.6 percent from its low after the Brexit vote on June 23.

Japan's Nikkei .N225 dropped 0.9 percent.

Chinese shares rose, with the CSI 300 .CSI300 up 0.3 percent, while the Shanghai Composite .SSEC added 0.6 percent, buoyed in part by a private business survey which showed growth in the services sector jumped to an 11-month high. But Hong Kong's Hang Seng .HSI retreated 0.8 percent.

But trade was thin, with financial and commodities markets in the United States closed on Monday for Independence Day.

-

04:04

Nikkei 225 15,643.35 -132.45 -0.84 %, Hang Seng 20,851.65 -207.55 -0.99 %, Shanghai Composite 2,993.27 +4.66 +0.16 %

-

00:32

Stocks. Daily history for Jun Jul 04’2016:

(index / closing price / change items /% change)

Nikkei 225 15,775.8 +93.32 +0.60 %

Hang Seng 21,059.2 +264.83 +1.27 %

S&P/ASX 200 5,281.78 +35.17 +0.67 %

Shanghai Composite 2,988.14 +55.66 +1.90 %

FTSE 100 6,522.26 -55.57 -0.84 %

CAC 40 4,234.86 -39.10 -0.91 %

Xetra DAX 9,709.09 -67.03 -0.69 %

S&P 500 2,102.95 +4.09 +0.19 %

NASDAQ Composite 4,862.57 +19.90 +0.41 %

Dow Jones 17,949.37 +19.38 +0.11 %

-