Noticias del mercado

-

22:06

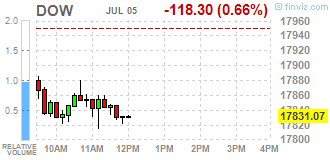

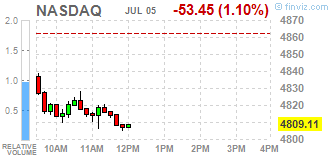

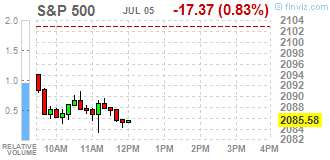

Major US stock indexes lost less than one percent

Major stock indexes in Wall Street fell moderately Tuesday amid falling oil prices.

Oil prices have fallen by about 4%, which was due to increased concerns about a slowdown in economic growth after the UK from the EU. Pressure on the quotes also provided data on oil stocks in the Cushing terminal. "The deterioration of the forecast of world economic growth, uncertainty in financial markets and their impact on the demand for oil is likely to exacerbate the trend of growth in demand from the industry," - noted experts Barclays. Today, the company Genscape said that for the week to July 1, oil terminal in Cushing rose by 230,025 barrels. On the dynamics of trading also continues to influence Friday's report from the oilfield services company Baker Hughes. It was reported that the number of drilling rigs in the US rose last week by 11 units to 341 units.

Also today, the yield on 10-year US Treasury yield fell to its lowest level in the history of the uncertainty in the markets after the British decision to withdraw from the European Union structure.

Focus also appeared on the US data. It is learned that US factory orders fell in May, against the background of weak demand for steel, aluminum, furniture, electrical appliances and warplanes. The Commerce Department reported that factory orders fell by 1% in May, after rising in the previous two months. The decline suggests that manufacturers in the United States still can not fully recover from the effects of weaker economic growth around the world.

However, another report showed that an index of economic optimism in the US, calculated by the newspaper Investor's Business Daily and research firm TechnoMetrica Institute of Policy and Politics, fell in July by 2.7 points, or 5.6%, reaching 45 5 points. Economists had expected the index to rise to 49.3 points.

Most components of the DOW index finished trading in negative territory (18 of 30). Outsider were shares of JPMorgan Chase & Co. (JPM, -2,79%). More rest up shares Johnson & Johnson (JNJ, + 1,20%).

Almost all sectors of the S & P index showed a decline. Most of the basic materials sector fell (-2.0%). The leader turned utilities sector (+ 0.6%).

At the close:

Dow -0.61% 17,839.11 -110.26

Nasdaq -0.82% 4,822.90 -39.67

S & P -0.69% 2,088.37 -14.58

-

21:00

Dow -0.81% 17,804.25 -145.12 Nasdaq -1.16% 4,806.18 -56.39 S&P -0.97% 2,082.61 -20.34

-

18:03

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday as oil prices kept sliding and tepid U.S. data added to global growth worries. Oil prices were down more than 4% as a potential economic slowdown weighed on prospects of demand.

Most of all Dow stocks in negative area (20 of 30). Top looser - Caterpillar Inc. (CAT, -2,77%). Top gainer - Johnson & Johnson (JNJ, +1,38%).

Almost all of S&P sectors also in negative area. Top looser - Basic Materials (-2,3%). Top gainer - Utilities (+0,3%).

At the moment:

Dow 17729.00 -137.00 -0.77%

S&P 500 2076.75 -19.50 -0.93%

Nasdaq 100 4389.25 -44.00 -0.99%

Oil 46.86 -2.13 -4.35%

Gold 1352.90 +13.90 +1.04%

U.S. 10yr 1.36 -0.09

-

18:01

WSE: Session Results

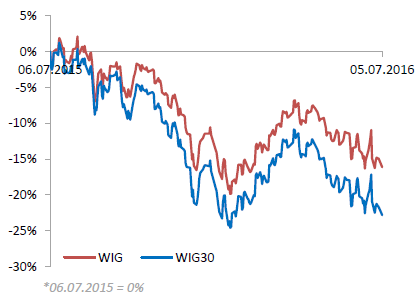

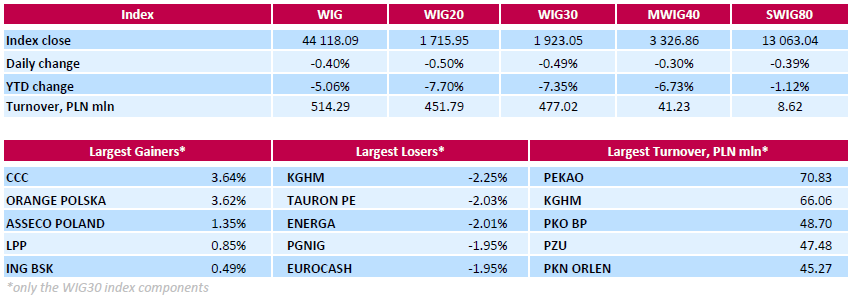

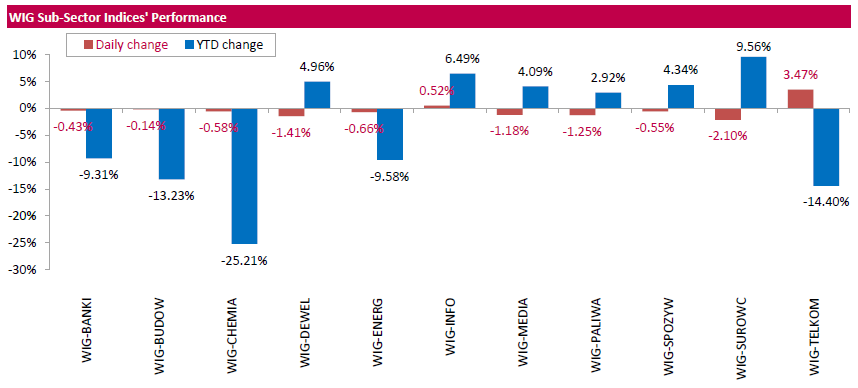

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, fell by 0.4%. Except for information technology (+0.52%) and telecommunication services (+3.47%), every sector in the WIG Index declined, with materials (-2.10%) lagging behind.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.49%. 22 out of all 30 index components recorded losses, led by copper producer KGHM (WSE: KGH) and two gencos TAURON PE (WSE: TPE) and ENERGA (WSE: ENG), tumblimg by 2.25%, 2.03% and 2.01% respectively. Oil and gas producer PGNIG (WSE: PGN) and FMCG-wholesaler EUROCASH (WSE: EUR), also produced noticeable declines, each plunging by 1.95%. On the other side of the ledger, footwear retailer CCC (WSE: CCC) and telecommunication services provider ORANGE POLSKA (WSE: OPL) were the biggest gainers, surging by 3.64% and 3.62% respectively.

-

18:00

European stocks closed: FTSE 100 6,545.37 +23.11 +0.35% CAC 40 4,163.42 -71.44 -1.69% DAX 9,532.61 -176.48 -1.82%

-

17:52

The price of oil fell more than 4% today

Oil prices have fallen dramatically, losing more than 4 percent, which was due to increased concerns about a slowdown in economic growth. Data on oil stocks in the Cushing terminal also put preasure on black gold.

"The deterioration of the forecast of world economic growth, uncertainty in financial markets and their impact on the demand for oil is likely to exacerbate the trend of growth in demand from the industry," - noted experts Barclays.

The pound dropped to a new 31-year low and the correlation between the British currency as a risk barometer and oil prices is obvious. Experts also believe that the data for China, which will be released in the coming weeks, will point to a weakness in the area of trade and investment.

In addition, Genscape said that for the week ending on July 1, oil terminal in Cushing rose by 230,025 barrels.

It was reported that the number of drilling rigs in the US rose last week by 11 units to 341 units and this continue to influence the trading dynamics. It was the fourth weekly gain in the past five weeks. Growing drilling activity in the US has increased speculation that production may increase in the coming weeks, renewing concerns about excess inventories.

The cost of the August futures for US light crude oil WTI fell to 46.83 dollars per barrel.

The price of August futures for Brent fell to 47.97 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:26

Gold prices fell slightly

Gold prices fell slightly, stepping back from the two-year high, and dropped below $ 1,350 an ounce. The pressure on the precious metal was a strengthening US dollar. However, the fall in prices constrains the continuing uncertainty regarding the effects of Brexit.

The referendum on Britain's membership of the EU has caused turmoil in the financial markets and raised the gold price to its highest level since the beginning of 2014. While concerns about global economic growth and monetary policy support gold, the up move can not continue today.

British referendum results also increased the pressure on central banks to ease their monetary policy. Recently, the Bank of England raised the possibility of further stimulus in the coming months, and today decided to reduce the capital requirements for banks in the UK, which would allow British banks to issue more loans to companies and households totaling 150 billion pounds and ensure adequate levels of lending to the economy. Many investors also expect policy easing from the ECB, the Bank of Japan and the People's Bank of China. In addition, market participants believe that the Fed will refrain from raising interest rates this year instead of the previously planned hikes. Recall, the gradual increase of the rate shall be less of a threat to the gold price.

"Currently, there is some profit-taking in gold, - said an analyst at Mitsubishi Jonathan Butler -. Long positions in gold reached record highs, and many investors are clearly in the profits now with gold price about $ 100 higher than in the middle of last month, however.. , heightened risk aversion is likely to continue to support the price. "

The cost of the August gold futures on the COMEX fell to $ 1345.6 per ounce.

-

16:48

European Commission: UK will not use article 50 of the EC Treaty until the autumn of 2017

The European Commission believes that the British government will not submit a statement of withdrawal from the EU, in accordance with Article 50 of the EC Treaty. This was stated by the German weekly newspaper WIWO, citing unnamed sources.

"If British politicians involve Article 50, they will do so after the elections in France and Germany", - noted WIWO, citing an anonymous official of the Commission. The next parliamentary elections in France, is likely to take place in June 2017, while the German - in September 2017.

"Anyone who submits an application will be in a weaker position," - said the unnamed official. - A two-year period for the negotiations begins after the notification is received.

-

16:40

Nzd/Usd declines as Fonterra global dairy trade index is down 0.4% after today’s auction

-

16:10

Us factory orders drop 1% in May

According to abcnews, orders at U.S. factories dipped in May, dragged by less demand for steel, aluminum, furniture, electrical appliances and military aircraft.

The Commerce Department says factory orders fell 1 percent in May, after gains in the two prior months.

The decline suggests that U.S. manufacturers have yet to fully recover from the sting of weaker economic growth worldwide. Measures of factory activity increasingly look mixed, with some still showing the pain caused earlier this year by a stronger dollar hurting exports and lower oil prices leading to cutbacks in orders for equipment and pipelines.

Demand in a category that serves as a proxy for business investment - non-military goods that exclude the volatile aircraft category - slipped 0.4 percent in May.

-

16:02

US economic optimism declines

The IBD/TIPP Economic Optimism Index dropped 2.7 points, or 5.6%, in July, posting a reading of 45.5 vs. 48.2 in June. The index is 1.1 points below its 12-month average of 46.6, 1.1 points above its reading of 44.4 in December 2007 when the economy entered the last recession, and 3.5 points below its all-time average of 49.0.

• The Six-Month Economic Outlook, a measure of how consumers feel about the economy's prospects in the next six months, dropped 6.9 points, or 15.8%, to 36.7. The sub-index was 32.1 when the economy entered the last recession in December 2007.

• The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months declined 0.5 points, or 0.9%, to 57.2.

• Confidence in Federal Economic Policies, a proprietary IBD/TIPP measure of views on how government economic policies are working, lost 0.6 points, or 1.4%, to 42.7.

-

16:00

U.S.: Factory Orders , May -1% (forecast -0.9%)

-

15:54

WSE: After start on Wall Street

The afternoon trade phase brought new lows for the DAX and the CAC40. The American market started trading from discounts, which means that after the dynamic rebound of Brexit declines to the market comes back gray reality which is not conducive to beating historical records that were close last week. The realities of several months of consolidation inspire caution, which, combined with a weak session in Europe leads to declines. Thus further approach will be difficult, and the scale of discounts will tell a lot about the condition of the market. On the Warsaw market today the situation is stable while turnover on the WIG20 index is about PLN 320 million.

-

15:53

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0950,1.1000 (878m),1.1100 (776m), 1.1153/55,1.1200, 1.1290,1.1325/30, 1.1340/50/55 (1bn)

USD/JPY 100.00,101.00,104.00, 104.50,106

GBP/USD 1.2700,1.3000,1.3200,1.3300,1.3500 (1.46bn),1.3600 (827m)

AUD/USD 0.7330/35, 0.7350,0.7425, 0.7463/65,0.7500, 0.7560

AUD/NZD 1.0350

AUD/JPY 76.50,78.30

USD/CAD 1.2715,1.2825/30,1.3050 (493m)

EUR/JPY 117.25,118.00, 118.18,119.25

EUR/GBP 0.7930,0.8260 (500m),0.8300,0.8400

-

15:42

Bank of England Governor, Carney: we have a clear plan

- We will take any measures necessary to maintain stability

- The fall of the pound was a necessary correction for the economy

- As before, there was a significant slowdown in the economy, despite the decline of the pound

- The UK banks have more capital than needed

- UK banks can be "part of the solution rather than part of the problem"

- It is important to make informed decisions on monetary policy

- World markets felt the lack of risk appetite

- At our disposal are a variety of tools that we can use for further easing if necessary

-

15:33

U.S. Stocks open: Dow -0.38%, Nasdaq -0.49%, S&P -0.52%

-

15:02

Before the bell: S&P futures -0.58%, NASDAQ futures -0.61%

U.S. stock-index futures declined, tracking a selloff in markets overseas amid simmering concerns that Britain's exit from the EU will further weigh on already fragile global growth.

Global Stocks:

Nikkei 15,669.33 -106.47 -0.67%

Hang Seng 20,750.72 -308.48 -1.46%

Shanghai Composite 3,007.11 +18.51 +0.62%

FTSE 6,532.89 +10.63 +0.16%

CAC 4,166.03 -68.83 -1.63%

DAX 9,543.25 -165.84 -1.71%

Crude $47.47 (-3.10%)

Gold $1348.90 (+0.74%)

-

14:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.43

-0.12(-1.2565%)

24020

ALTRIA GROUP INC.

MO

68.9

-0.12(-0.1739%)

2181

Amazon.com Inc., NASDAQ

AMZN

721.95

-3.73(-0.514%)

14702

American Express Co

AXP

60.63

-0.06(-0.0989%)

341

AMERICAN INTERNATIONAL GROUP

AIG

52.4

-0.47(-0.889%)

1435

Apple Inc.

AAPL

95.2

-0.69(-0.7196%)

130778

AT&T Inc

T

43.41

-0.06(-0.138%)

19136

Barrick Gold Corporation, NYSE

ABX

22.45

0.24(1.0806%)

116631

Boeing Co

BA

129

-0.69(-0.532%)

202

Caterpillar Inc

CAT

75.89

-0.56(-0.7325%)

3394

Cisco Systems Inc

CSCO

28.46

-0.08(-0.2803%)

14015

Citigroup Inc., NYSE

C

41.58

-0.59(-1.3991%)

130612

Deere & Company, NYSE

DE

79.93

-0.97(-1.199%)

2000

E. I. du Pont de Nemours and Co

DD

64.19

-0.17(-0.2641%)

600

Exxon Mobil Corp

XOM

93.05

-0.79(-0.8419%)

4610

Facebook, Inc.

FB

113.72

-0.47(-0.4116%)

66080

Ford Motor Co.

F

12.59

-0.13(-1.022%)

35450

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.04

-0.31(-2.7313%)

170353

General Electric Co

GE

31.28

-0.21(-0.6669%)

31038

General Motors Company, NYSE

GM

28.73

-0.16(-0.5538%)

1501

Goldman Sachs

GS

146.75

-1.50(-1.0118%)

7129

Google Inc.

GOOG

695.66

-3.55(-0.5077%)

1423

Hewlett-Packard Co.

HPQ

12.67

-0.06(-0.4713%)

500

Home Depot Inc

HD

129.25

-0.37(-0.2854%)

1175

Intel Corp

INTC

32.53

-0.22(-0.6718%)

700

International Business Machines Co...

IBM

151.32

-1.03(-0.6761%)

1567

International Paper Company

IP

42.16

-0.55(-1.2878%)

4023

Johnson & Johnson

JNJ

121.22

-0.07(-0.0577%)

5190

JPMorgan Chase and Co

JPM

60.7

-0.56(-0.9141%)

10430

McDonald's Corp

MCD

120.14

-0.26(-0.2159%)

820

Merck & Co Inc

MRK

57.27

-0.67(-1.1564%)

100

Microsoft Corp

MSFT

50.97

-0.19(-0.3714%)

14801

Nike

NKE

55.47

-0.14(-0.2518%)

6459

Pfizer Inc

PFE

35.42

-0.15(-0.4217%)

2400

Procter & Gamble Co

PG

84.6

-0.18(-0.2123%)

3610

Starbucks Corporation, NASDAQ

SBUX

56.82

-0.17(-0.2983%)

540

Tesla Motors, Inc., NASDAQ

TSLA

210.35

-6.15(-2.8406%)

204363

The Coca-Cola Co

KO

45

-0.12(-0.266%)

3630

Twitter, Inc., NYSE

TWTR

17.18

-0.10(-0.5787%)

56613

UnitedHealth Group Inc

UNH

139.82

-1.04(-0.7383%)

649

Verizon Communications Inc

VZ

56.23

-0.00(-0.00%)

4057

Visa

V

74.3

-0.18(-0.2417%)

6860

Walt Disney Co

DIS

97.85

-0.18(-0.1836%)

2278

Yahoo! Inc., NASDAQ

YHOO

37.7

-0.29(-0.7634%)

13302

Yandex N.V., NASDAQ

YNDX

21.51

-0.22(-1.0124%)

2700

-

14:20

European session review: pound updated multi-year lows

The following data was published:

(Time / country / index / period / previous value / forecast)

7:50 France Business activity index in the services sector (final data) June 51.6 49.9 49.9

Germany 7:55 PMI in the service sector (final data) June 55.2 53.2 53.7

8:00 Eurozone business activity index in the services sector (final data) June 53.3 52.4 52.8

8:30 UK PMI index for the services sector in June 53.5 52.7 52.3

9:00 Eurozone Retail Sales m / m in May 0.0% 0.4% 0.4%

9:00 Eurozone Retail sales, y / y in May 1.4% 1.6% 1.6%

UK 9:30 Report the Bank of England financial stability

10:00 UK BOE Speech Mark Carney

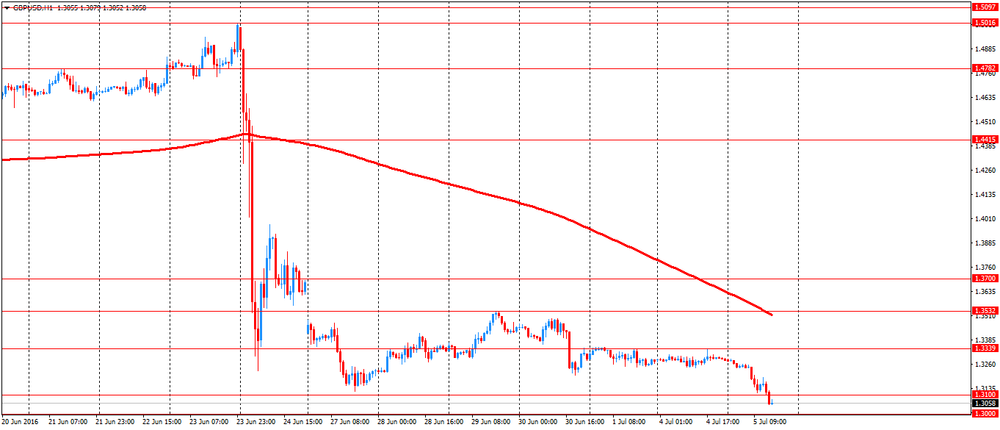

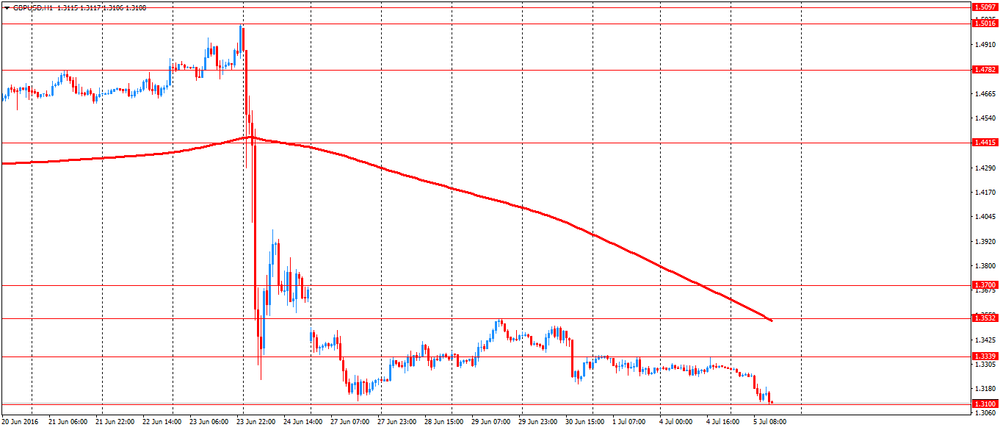

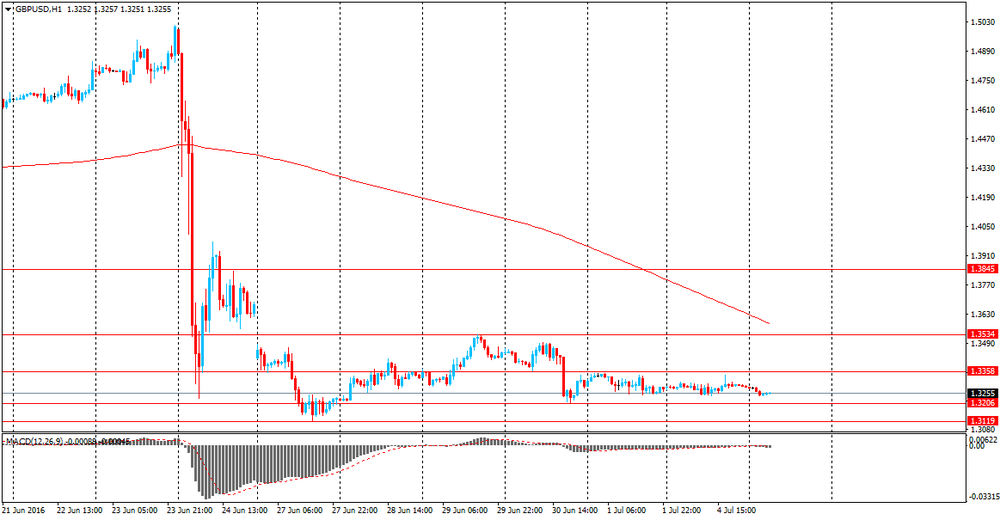

The British pound fell to a new 31-year low against the dollar after the Bank of England published the Financial Stability Report. The central bank said it sees risks reducing capital inflows after the referendum and believes that a sustained reduction in capital inflows will put further downward pressure on the pound.

All of the assets that are considered risky were hit by a new wave of fears as to the consequences of the UK's withdrawal from the European Union become clearer.

Most analysts believe that the pound will continue to fall.

Deutsche Bank analysts suggest that the GBP / USD pair will dropped by the end of the year to $ 1.15, while Morgan Stanley analysts believe that it will end the year in the range of $ 1.25 - $ 1.30.

"Apparently, the pound will continue to fall, given the risks associated with large current account deficit the UK balance of payments, and expectations of slowing economic growth and monetary easing from Bank of England", - said the head of foreign exchange strategy ABN AMRO Group.

UK imports more goods and services than it exports, and invests abroad more than it receives. This means that the country's economy depends on the willingness of investors from around the world to fill the deficit of the current account of balance of payments, which implies a constant demand for assets denominated in the pound. The attractiveness of these assets has declined in the eyes of some investors.

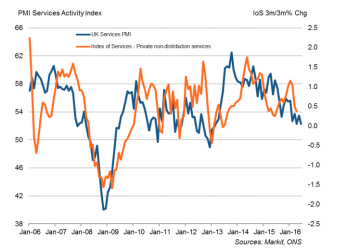

Also,economic data from UK put preasure on the pound. Increased activity in the UK services sector eased to 38-month low recorded in April, results of a survey by Markit showed.

Purchasing Managers' Index in the services sector by Markit / Chartered Institute of Purchasing and Supply fell to 52.3 in June from 53.5 in May. The index was lower than the expected level of 52.7.

A reading above 50.0 indicates growth in the sector compared to the previous month, but below 50.0 indicates contraction.

The period of data collection for the study was between 13 and 28 June, and 89 percent of the responses were received before June 24, when the British voted for withdrawal from the EU.

Chris Williamson, chief economist at Markit, said: "Studies of PMI indicates that the pace of UK economic growth slowed to just 0.2 percent in the second quarter, with a further loss of momentum in June, as the anxiety of Brexit intensified."

12-month outlook was the gloomiest since December 2012, the service providers said that the uncertainty associated with Brexit had a negative impact on new orders and workloads.

The euro rose against the dollar after a decline earlier in the day because of uncertainty about the future of the UK and Italian banks. The Italian Government is considering the possibility of recapitalization of banks in the country at the expense of budget funds. Such a measure likely will be opposed by the EU authorities.

The growth of the private sector in the euro area remained unchanged in June.

Composite Production index was 53.1 in June, as well as in May, but was above 52.8 preliminary evaluation. A reading above 50 indicates expansion.

In the second quarter the index fell to 53.1 from 53.2 in the previous quarter, and it was the lowest since the last quarter of 2014.

National PMI data showed strong expansion in Germany, Italy, Spain and Ireland. On the other hand, the French reported a decrease in output and new orders.

The rise in the German service sector weakened at the end of the second quarter. The final PMI index in the services sector fell to 13-month low of 53.7 from 55.2 in May. However, the reading was above 53.2 preliminary evaluation.

The composite PMI fell slightly to 54.4 from 54.5 in May. The initial assessment in June was 54.1.

In France, the services sector remained overall at the same level in June. The final PMI in the service sector fell to 49.9, according to a preliminary estimate, from 51.6 in May.

In addition, the euro zone retail sales rose for the second month in a row in May, according to Eurostat data released on Tuesday.

Retail sales rose 0.4 percent for the month in May, after rising 0.2 percent in April, which was revised with the same values.

Sales of non-food products except automotive fuel, increased by 0.7 percent for the month, while sales of food products, beverages and tobacco showed no changes.

In annual terms, retail sales growth accelerated to 1.6 percent in May, compared with 1.4 percent in the previous month. This was in line with economists' expectations.

Among the Member States, the highest monthly increase in the overall volume of retail trade was registered in Sweden, Estonia and Ireland, while the largest decrease was observed in Portugal, Romania and Denmark.

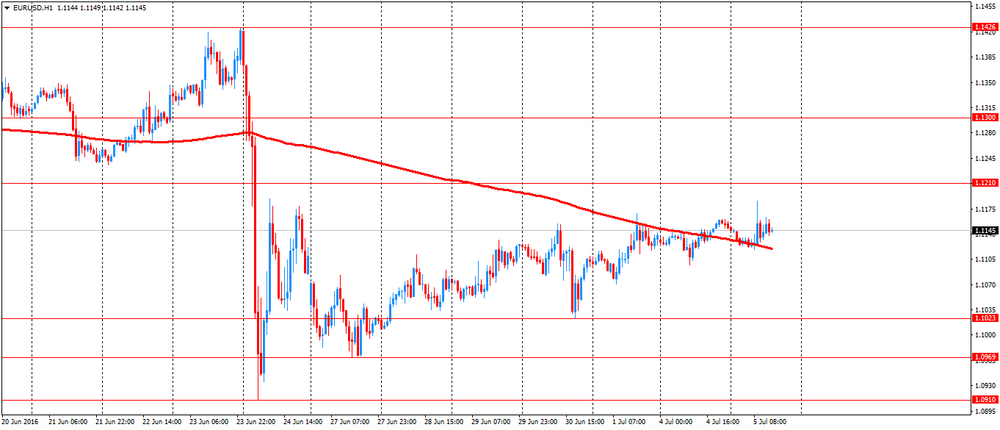

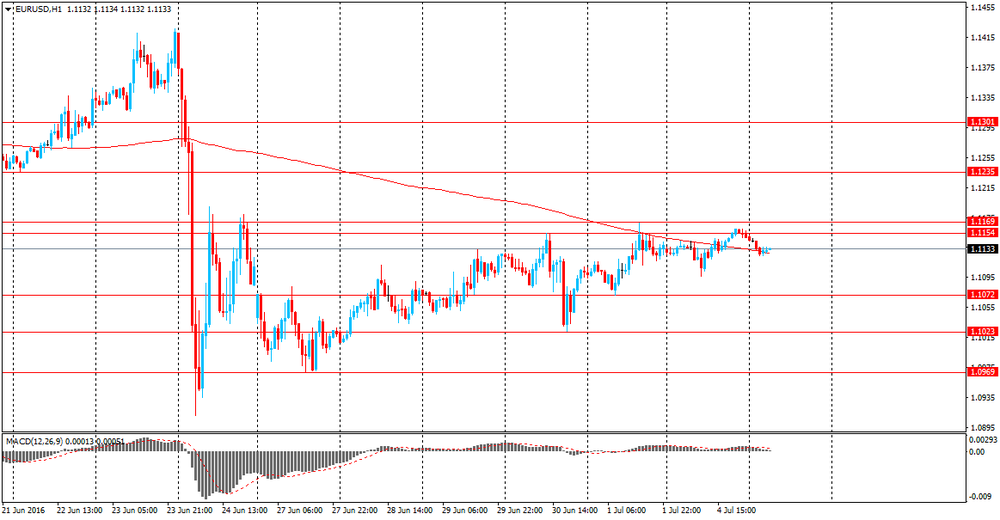

EUR / USD: during the European session, the pair fell to $ 1.1119 and then rose to $ 1.1186

GBP / USD: during the European session, the pair fell to $ 1.3104

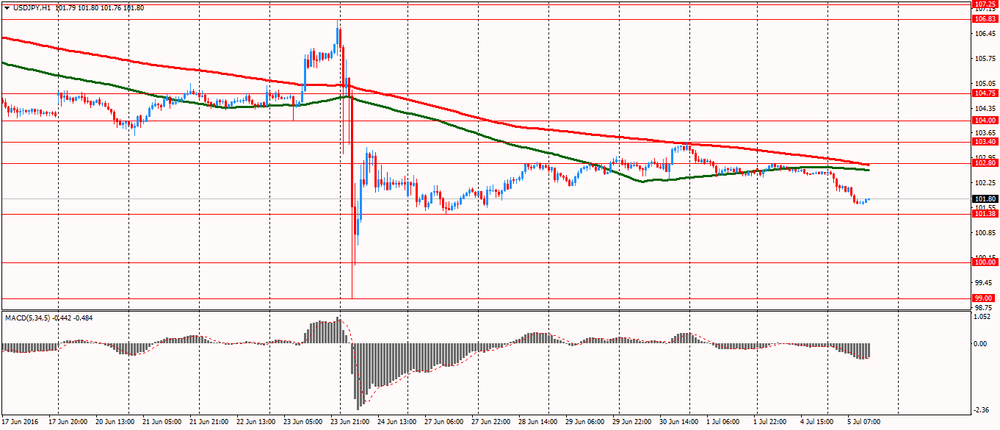

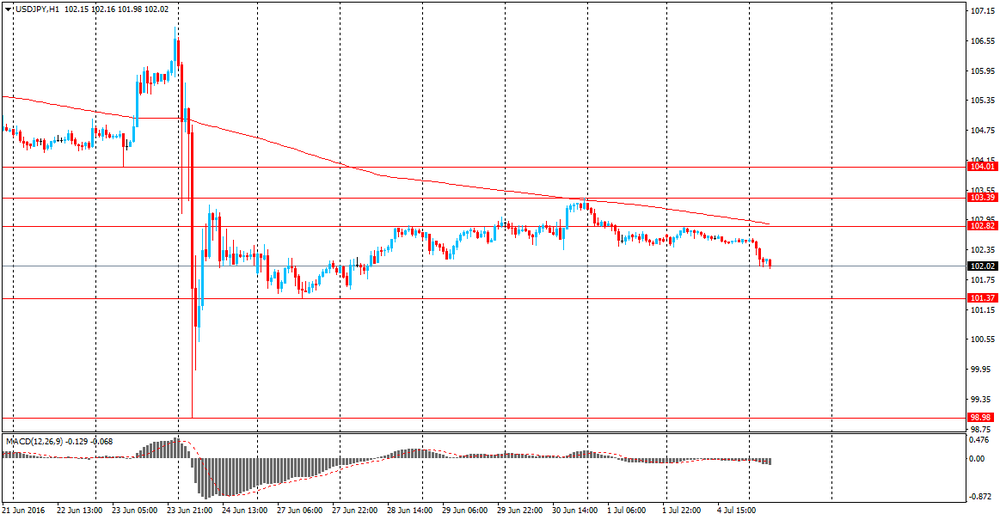

USD / JPY: during the European session, the pair fell to Y101.64

-

13:50

Orders

EUR/USD

Offers : 1.1300 1.1280/85 1.1250 1.1220/25 1.1200

Bids: 1.1120 1.1110 1.1100 1.1085/90 1.1070 1.1050

GBP/USD

Offers : 1.3300 1.3285/90 1.3260 1.3220 1.3200 1.3180

Bids: 1.3120 1.3100 1.3080 1.3050

EUR/GBP

Offers : 0.8550 0.8530 0.8500 0.8490

Bids: 0.8450 0.8420/25 0.8400

EUR/JPY

Offers : 115.00 114.50 114.20/25 114.00 113.75/80

Bids: 113.00 112.50 112.30 112.00

USD/JPY

Offers : 103.00 102.80 102.60 102.20 102.00

Bids: 101.00 101.50 101.20 101.00 100.80

AUD/USD

Offers : 0.7600 0.7580 0.7530 0.7540

Bids: 0.7490 0.7480 0.7445/50 0.7400

-

13:46

China initiates the process of lifting the ban of beef, poultry meat and by-products from the Russian Federation

-

13:44

Company News: results of Tesla Motors (TSLA) for the second quarter 2016 worse than expected

The company reported that in the second quarter it produced 18,345 cars, which is 20% more than in the first quarter, but lower than the forecast of 20.000 cars. Production reached 2.000 cars per week. Thanks to intensive unfolding of production, almost half of the total quarterly production took place in the last four weeks of the quarter.

Given the continued improvement in performance, Tesla expected to reach the level of production of 2.200 cars per week in the third quarter and 2,400 cars per week in the fourth quarter. In total the company plans to produce and deliver about 50 000 cars in the second half of 2016, which roughly corresponds to the entire volume produced in 2015.

TSLA shares fell in premarket trading to $ 207.80 (-4.02%).

-

13:04

WSE: Mid session comment

Today's readings of PMI for the services sector in European countries were not as favorable as the previous PMI's for the industry. We may see slowing down, which is somewhat surprising, since the first signs of a possible short of breath in the economy should be signaled by the industry, not the services. Readings in principles say that the growth is still present, although unsatisfactory persistent. After data European stock exchanges slightly cooled down and decreases exceeds 1%.

In the south part of trading the process of falls on European stock exchanges was halted and thereby also on our market there is no incentive to create volatility. In front of us is likely prospect of southern calm.

In the mid-session the WIG20 index was at the level of 1,724 points (-0,01%) and with almost of PLN 200 mln turnover.

-

12:47

Major stock indices in Europe showing losses

Stock indices in Europe, after rising to February's highs are declining for the second day in a row due to the fall of the financial and commodity sectors, while the Italian bank Monte dei Paschi reached a new record low.

The indices opened lower on fresh concerns about the global effects of Brexit, while investors focused on today's Bank of England report on financial stability.

Investors remain cautious after the shocking decision of Britain to leave the European Union sparked uncertainty about the consequences for the world economy as a whole.

On Monday, Nigel Farage, one of the main supporters of Brexit campaign, resigned from his post as head of the UK Independence Party, saying that he "played his role."

On Tuesday, the research firm Markit Economics published the final PMI data for eurozone countries.

Composite PMI in eurozone remained at the May level of 53.1 points, although preliminary data point to a decline to 52.8 points.

The service sector indicator fell to 52.8 points from 53.3 points. It was expected a more significant fall - to 52.4 points.

The composite index of the largest companies in the region, Stoxx Europe 600, fell during trading 1,4% - to 325.30 points. Last week, the index jumped 7.6%, recovering more than half of the losses incurred as a result of the British decision to leave the EU.

All 19 industry subgroups of Stoxx Europe 600 Index show losses.

The capitalization of Italian banks fell for the third consecutive session.

As it became known earlier, the Italian Government is considering the possibility of recapitalization of banks in the country at the expense of budget funds. In particular, plans for Banca Monte dei Paschi di Siena involve the issue of new convertible bonds in favor of the state in the amount of no less than 3 billion euros. On this news the bank's shares fell 5.4%.

This measure surely meet resistance from the EU authorities, noted Fitch.

The price of shares of Chr. Hansen Holding, which produces natural colors and enzymes for food products decreased by 5.1% on the data worse than expected about quarterly sales.

Securities of the construction company Balfour Beatty fell by 2.6%.

Shares of British developer Persimmon fell 5.4%. The company reported an increase in revenue in the first half of 2016 by 12% to 1.49 billion pounds.

Sports Direct Shares fell 5% as the group should report on Thursday about the drop in profits due to lower sales in the summer against the backdrop of bad weather.

Shares of British American Tobacco rise by 0.9% after Credit Suisse analysts confirmed their rating to "outperform."

At the moment:

FTSE 6525.09 2.83 0.04%

DAX 9575.40 -133.69 -1.38%

CAC 4177.72 -57.14 -1.35%

-

12:03

Bank of England financial stability report: will give insurers more flexibility to deal with a sharp fall in market interest rates

-

Will reduce counter cyclical capital buffer to 0.0% from 0.5% with immediate effect until June 2017 at the least

-

CCB cut will reduce buffer by £5.7bn and raise bank lending capacity by £150bn (not mil as I put in the title)

-

FPC is ready to take any further action needed to support financial stability

-

Will give insurers more flexibility to deal with a sharp fall in market interest rates

-

BOE stands ready to take action to ensure capital and liquidity buffers can be drawn on to support lending

-

BOE needs to reduce any pressure on firms to restrict supply of credit and provision of financial services

-

BOE closely monitoring commercial real-estate, buy-to-let, investor appetite for UK assets and fragile market liquidity

-

Current outlook for financial stability is challenging and some Brexit risks are starting to crystallise

-

-

12:01

Review of financial and economic press: London Stock Exchange shareholders approved merger

D / W

LSE shareholders approved the merger with German counterpart

Almost unanimously was the vote on Monday, July 4 when shareholders of the London Stock Exchange (LSE) aproved a planned merger with the German Stock Exchange (DB) in Frankfurt am Main. The decision was supported by 99.89 percent of holders of securities. Now shareholders DB got a little more than a week out to explore an offer to exchange their shares for the securities of the new joint venture.

Newspaper. ru

The level of British business pessimism doubled after the referendum on withdrawal from the EU

The level of business confidence in the UK fell sharply after Brexit, according to BBC. This is highligthed by the sociological research agency YouGov and the Centre for Economics and Business Research (CEBR). The proportion of companies with pessimistic views on the prospects for the British econom, has doubled within a week after the referendum - from 25% to 49%.

RBC

US bypassed Russia in terms of recoverable oil reserves

US bypassed Russia and Saudi Arabia in terms of recoverable reserves, according to Rystad Energy. More than half of stocks accounted for shale oil, which will be developed after 2025.

Brexit initiator resigned as head of his party

One of the main initiators of the referendum on the withdrawal of Great Britain from the EU, the leader of UKIP Nigel Farage stepping down as head of the party. His political mission is considered done.

-

11:09

WTI losing almost 2% so far

This morning, New York crude oil futures for WTI fell -1.86% to $ 48.09 per barrel. At the same time, Brent oil futures were down -1.30% to $ 49.45 per barrel. Thus, the black gold lost value, on the background of an increase in the output of oil production data in Nigeria. Oil production has increased by 90 000 barrels per day. Nigeria managed to increase its production of oil after the restoration of infrastructure affected by militant attacks. Alos, Baker Hughes reported that the number of oil wells operating in the US rose last week increased by 11 to 341.

-

11:06

Euro Zone retail trade little changed

In May 2016 compared with April 2016, the seasonally adjusted volume of retail trade rose by 0.4% in both the euro area (EA19) and the EU28, according to estimates from Eurostat. In April the retail trade volume increased by 0.2% in the euro area and by 0.6% in the EU28. In May 2016 compared with May 2015 the calendar adjusted retail sales index increased by 1.6% in the euro area and by 2.8% in the EU28.

The 0.4% increase in the volume of retail trade in the euro area in May 2016, compared with April 2016, is due to a rise of 0.7% for non-food products, while "Food, drinks and tobacco" and automotive fuel remained stable. In the EU28, the 0.4% increase in the volume of retail trade is due to rises of 0.6% for non-food products and of 0.4% for "Food, drinks and tobacco", while automotive fuel remained stable. Among Member States for which data are available, the highest increases in total retail trade were registered in Sweden (+2.1%), Estonia (+1.5%) and Ireland (+1.3%), while the largest decreases were observed in Portugal (-1.7%), Romania (-1.6%) and Denmark (-1.1%).

-

11:00

Eurozone: Retail Sales (YoY), May 1.6% (forecast 1.6%)

-

11:00

Eurozone: Retail Sales (MoM), May 0.4% (forecast 0.4%)

-

10:42

Growth of UK service sector activity weakened in June

Growth of UK service sector activity weakened in June to match the 38-month low recorded in April, according to the latest PMI® survey data from Markit and CIPS. Growth over the second quarter as a whole was the weakest since the first quarter of 2013 when the current upturn began. Moreover, the 12-month outlook was the darkest since December 2012. Companies often reported that uncertainty linked to the EU referendum had weighed on workloads and incoming new business.

The data collection window for the June survey was 13-28 June, with 89% of responses received before 24 June. The headline figure for the survey is the seasonally adjusted Markit/CIPS UK Services Business Activity Index, a single-figure measure designed to track changes in total UK services activity compared with one month previously. Readings above 50.0 signal growth of activity compared with the previous month, and below 50.0 contraction.

The Business Activity Index fell from 53.5 in May to 52.3 in June, matching April's 38-month low and signalling a relatively weak rate of growth in UK services output. Activity has risen every month since January 2013, but the index averaged just 52.7 in the second quarter, the weakest of any quarter since Q1 2013. The index has averaged 55.2 since it was first compiled in July 1996.

-

10:30

United Kingdom: Purchasing Manager Index Services, June 52.3 (forecast 52.7)

-

10:21

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0950,1.1000 (878m),1.1100 (776m), 1.1153/55,1.1200, 1.1290,1.1325/30, 1.1340/50/55 (1bn)

USD/JPY 100.00,101.00,104.00, 104.50,106

GBP/USD 1.2700,1.3000,1.3200,1.3300,1.3500 (1.46bn),1.3600 (827m)

AUD/USD 0.7330/35, 0.7350,0.7425, 0.7463/65,0.7500, 0.7560

AUD/NZD 1.0350

AUD/JPY 76.50,78.30

USD/CAD 1.2715,1.2825/30,1.3050 (493m)

EUR/JPY 117.25,118.00, 118.18,119.25

EUR/GBP 0.7930,0.8260 (500m),0.8300,0.8400

-

10:06

Eurozone services PMI better than forecasts but weakest since the end of 2014 - Markit

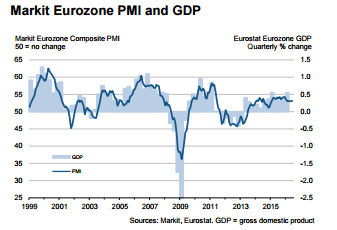

June saw the growth rate of eurozone economic output hold steady at a moderate pace. After rising slightly from the earlier flash estimate of 52.8, the final Markit Eurozone PMI Composite Output Index posted 53.1, unchanged from May. This left the average reading for the headline index for the second quarter a shade below that for the opening quarter (53.1 versus 53.2) and at its lowest level since the final quarter of 2014.

Manufacturing production registered its fastest growth in the year so far in June, and outperformed the service sector for the first time in three months. Service sector activity rose at the slowest pace in almost one-and-a-half years. National PMI data indicated solid expansions in Germany, Italy, Spain and Ireland during June. Growth accelerated in the latter three and German output rose at a pace almost identical to May's fourmonth high. All of these nations scaled up activity in response to faster inflows of new business.

France remained well behind the rest of the pack in June, with French companies seeing output and new orders edge back into contraction territory. The downturn in manufacturing production continued, while the trend in service sector activity slid slightly below the stagnation mark.

-

10:00

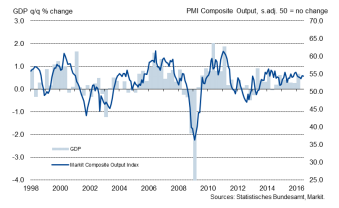

The upturn in Germany’s service sector slowed

According to Markit, the upturn in Germany's service sector slowed at the end of the second quarter, with business activity and new order intakes both increasing at weaker rates. Nonetheless, companies raised their employment levels, while backlogs of work accumulated for the first time in three months. Moreover, charges rose only marginally and firms remained confident about their 12-month outlook for output.

June data signalled a slowing in the pace of output growth at German service providers, with the final seasonally adjusted Markit Germany Services Business Activity Index falling from May's 55.2 to a 13-month low of 53.7.

Transport & Storage firms noted a slight decrease in output, while particularly strong growth was reported by companies in the Financial Services sub-sector. Anecdotal evidence attributed the overall rise in activity to increased new business and the processing of backlogs. Meanwhile, total private sector output expanded in June at a pace that was little-changed from May. This was highlighted by the final Markit Germany Composite Output Index - which measures the combined output of the manufacturing and service sectors - posting 54.4, down a tick from 54.5 in the previous month.

Latest survey results pointed to a slowdown in new business growth placed with German service providers, with the June rise the weakest in just under a year. As was the case with output, companies in the Transport & Storage sub-sector reported a decline.

-

10:00

Eurozone: Services PMI, June 52.8 (forecast 52.4)

-

09:55

Germany: Services PMI, June 53.7 (forecast 53.2)

-

09:51

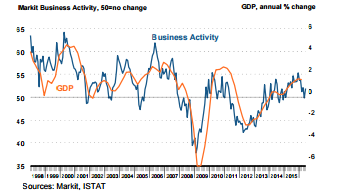

Business activity returned to growth across Italy’s service sector

Business activity returned to growth across Italy's service sector at the end of the second quarter, after falling slightly and for the first time in 17 months during May. There was also positive news on the employment front, with job creation reaching the fastest in 2016 so far. However, survey data pointed to a squeeze on margins, as cost inflation accelerated to a 13-month high but prices charged decreased. The headline Markit Business Activity Index - which is based on a single question asking respondents to report on the actual change in business activity at their companies compared to one month ago - registered 51.9 in June, up from May's 49.8. That signalled a renewed upturn in service sector business activity, albeit with the rate of expansion being only moderate. Growth in incoming new business picked up to the fastest for four months in June, with a number of panel members commenting on new client wins amid a general strengthening of demand. Nevertheless, the amount of work-in-hand (both in progress and not yet started) at Italian services firms decreased for the tenth month in a row and at a faster rate than during May. One factor helping firms keep atop of workloads was rising staffing capacity. June saw the level of employment increase across Italy's services economy for the ninth straight month, with the pace of job creation reaching the fastest in the year to date.

-

09:50

France: Services PMI, June 49.9 (forecast 49.9)

-

09:31

Major stock exchanges trading mixed: DAX 9,652.92-56.17-0.58%, FTSE 100 6,527.84 + 5.58 + 0.09%, CAC 40 4,214.56-20.30-0.48%

-

09:30

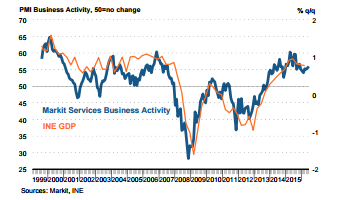

Spanish services sector expand faster than expected

Faster rises in activity and new business helped lead to the sharpest increase in employment at Spanish service providers for almost nine years at the end of the second quarter. The rate of input cost inflation was unchanged from that seen in May, while output prices continued to rise marginally. The headline seasonally adjusted Business Activity Index rose to 56.0 in June from 55.4 in the previous month, signalling a sharp monthly expansion of business activity, and the fastest since last November. Growth of activity has now been recorded in each of the past 32 months. Five of the six monitored sectors registered higher activity, the exception being 'Other Services'. The Post & Telecommunications category recorded the fastest rise in output, a picture matched in terms of new business and employment. Some respondents indicated that improving client demand had led their activity to rise. Supporting this evidence was a marked increase in new business, the sharpest in seven months. A number of panellists indicated that successful marketing campaigns had contributed to rising new orders.

-

09:20

WSE: After opening

The futures market opened with decrease of 0.46% (1,715 points). The contract on the DAX dropped of 1% and the discount clearly accelerated in the first minutes of trading, which was not without effect on the Warsaw Stock Exchange.

WIG20 index opened at 1722.62 points (-0.11%)

WIG 44344.85 0.11%

WIG30 1933.39 0.04%

mWIG40 3343.65 0.20%

*/ - change to previous close

The cash market began with a modest discount, while the German DAX drops of 0.6%. We may see that the supply is not determined and the market can stabilize around yesterday's opening and closing, which is de facto in the vicinity of many hours of yesterday afternoon consolidation.

To the weaker global sentiment fits today also the zloty, increasingly weakening to the major currencies. It seems like continuation of yesterday's movement.

-

09:03

Today’s events:

At 09:30 GMT the Bank of England report on financial stability.

At 10:00 GMT the Bank of England Governor Mark Carney will deliver a speech.

At 12:05 GMT the ECB member Yves Mersch will make a speech.

At 17:00 GMT Member of the Executive Board of ECB Sabine Lautenshleger deliver a speech.

At 18:30 GMT FOMC member William Dudley will make a speech.

-

08:59

Asian session review: the Australian dollar dropped

The Australian dollar rose for a short time, reaching yesterday's session high, after that the Reserve Bank of Australia decided at today's meeting, to maintain the interest rate at 1.75%.

In his comments, the head of the RBA Glenn Stevens drew attention to the preservation of national economic growth, despite a sharp reduction in the volume of investments. Stevens added that in low inflation, low discount rate support domestic demand and a lower Australian dollar supports the trade sector.

The Central Bank also noted that the financial markets have been volatile in recent years, as investors re-evaluate the assets after the referendum in the UK. "Any implications of the outcome of the referendum on global economic activity remains to be seen," - said RBA.

Earlier, at the begining of the session the Australian currency declined after trade data was published. As it became known, the Australian trade balance in May amounted to -. $ 2.218. Previous value of the index was revised to - $ 1.579 billion to - $ 1.785 billion.

Export of goods and services from Australia increased by 1% in May as in April. Imports increased by 2%, after declining by 1% in April.

The Australian Bureau of Statistics also reported in terms of trends, the balance on goods and services was in May - $ 1,885mln, after a decline to - $ 290mln in April 2016.

Seasonally adjusted, the balance on goods and services amounted to - $ 2,218m in May 2016, an increase of $ 433M in April 2016.

At the same time, the volume of retail sales in Australia increased by 0.2% in May, but the figure was below analysts' expectations of +0.3%. The previous value was revised downward from 0.2% to 0.1%.

The yen gained support as a safe haven, after the publication of data on the index of business activity in China's services sector. In June the index was 52.7, higher than the previous value of 51.2. The index value was the highest for the past eleven months.

Markit Economics also noted that a significant increase in the number of new orders in the service sector reached the highest level since July 2015.

Director of Macroeconomic Analysis company CEBM Group Zhong Cheng-sheng said that the growth of the service sector is now supporting the economy as a whole. Development in this area occurs simultaneously with a decrease in business activity index of the manufacturing sector. This indicates that the structure of the economy becomes becomes more balanced.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1120-30 range.

GBP / USD: during the Asian session, the pair is trading in the range $ 1.1.3215-25 range.

USD / JPY: during the Asian session, the pair was trading in range Y101.90- 102.00 range.

-

08:50

Expected positive start of trading on the major stock exchanges in Europe: DAX -0,5%, FTSE 100 -0,3%, CAC 40 -0.2%

-

08:24

WSE: Before opening

Sentiment about this morning is slightly offset, the contract for the S&P500 index go down of 0.38%. Also Asian stock markets indices are falling, with the exception of China, where after the publication of PMI for services, which rose from 51.2 points. to 52.7 points, the investment climate has improved. Today the Americans return to the game and come up more macro data. Around 10:00 (Warsaw time) will be published data regarding the PMI for services in Germany, France, Italy and the Euro zone, and at 11:00 we will know the data on retail sales in the Euro zone.

During the Asian session we also observed correction in precious metals. About 10 usd compared to yesterday's price went down gold. More than 2% is cheaper silver and is again below 20 usd per ounce. The morning strengthens the dollar and the Swiss franc. Such an arrangement may not appeal to investors in Europe who yesterday began to lose faith in growth, and today after such a miserable session in Asia may continue on sale of shares.

-

08:17

Australian services sector continued to expand in June

The Australian Industry Group Australian Performance of Services Index (Australian PSI) fell by 0.2 points to 51.3 points in June, indicating a modest expansion in activity across the services sector for a second consecutive month (results above 50 points indicate expansion, with higher numbers indicating a stronger rate of expansion).

• Of the five activity sub-indexes in the Australian PSI , employment (53.1 points) lifted 4 points into positive territory in June, its first positive reading since August 2015. Sales (52.8 points) picked up 1.1 points while new orders (51.8 points) lost 3.5 points, indicating a positive but slower pace of growth. Stocks (46.6 points) slipped into negative territory (down 4.6 points from May), while deliveries (48.5 points) remained negative, indicating a reduction in inventories and supplier deliveries for the end of the financial year in June.

• Two of the nine services sub-sectors in the Australian PSI® expanded in June (in three month moving averages) and two were stable. Retail trade (66.5 points and a record high for this sub-sector) and finance & insurance (66.8 points) expanded in June. Health &community services (49.4 points) and property & business services (49.4 points) were stable in June. Communication services (44.7 points), wholesale trade (42.0 points), personal & recreational services (39.9 points), hospitality (37.3) and transport & storage (36.2) all contracted, with a relatively faster rate of contraction evident in hospitality and transport.

-

08:11

Risk of a drop to 1.25. Sell any Gbp/Usd rallies - BofA Merrill

"Rarely in UK political history has there been a situation where there has been a concurrent leadership contest in the two largest parties in Parliament. In our pre-Brexit notes, we had outlined our concerns over the political ramifications at the top of the ruling Conservative Party irrespective of the outcome as the party was already split on whether to Remain or Leave. What we did not foresee was crisis engulfing the opposition Labour Party in its own political crisis. Whilst this may seem like a sideshow against the broader debate on the EU, we think this has important implications in the ability of the Labour Party to mount a credible opposition to the government when negotiations eventually begin. This is particularly relevant given that there has been increasing chatter in the media on whether Article 50 will be activated or if indeed the UK will actually trigger a Brexit.

One of the most common questions we have received in recent days is whether there could be a General Election or second referendum, which could open a route to the UK remaining in the EU, or at least seeking a 'Norway-style' trade deal that preserved single market access. A General Election is clearly a possible scenario but there is a long way to go before we have a good sense on what it would mean for economics and markets. Another referendum also seems unlikely to us at this stage. Both David Cameron and Jeremy Corbyn, along with other politicians, have been clear in recent days that they would accept the public's decision to "Leave" and this has been reinforced by Theresa May in her speech announcing her candidature for the Conservative Party Leadership. Our caveat to this assumption is if the economic fallout from the referendum is significant.

Given some expectation that a Brexit may in some way be avoided, would suggest that markets are not fully positioned for this prospect and may go some way in explaining why GBP is off its lows from last Friday.

In our view this poses risks to further downside in the pound as it eventually becomes apparent that Brexit is the only option on the table. But the bounce that we had expected following the sharp fall has materialised and we reiterate our view that GBP is vulnerable to further losses as the political vacuum heightens policy uncertainty.

We are therefore inclined to sell any sterling rallies and affirm our view that the Brexit vote now implies a structurally lower equilibrium value for GBP. We see risks of a move towards 1.25 in GBP/USD sooner rather than later".

-

07:59

China: Caixin services better than forecasts

Caixin China Composite PMI data (which covers both manufacturing and services) signalled increased total business activity across China at the end of the second quarter.

That said, the Composite Output Index posted 50.3 in June, down from 50.5 in May, to signal a fractional rate of growth that was the weakest in four months. Latest data signalled a further slowdown in overall Chinese business activity, with the rate of expansion slowing to the weakest in the current

four-month sequence. There were differing trends at the sector level, however, with services companies reporting a stronger expansion of business activity in June, while manufacturing output declined at the sharpest pace since February. Notably, it was the quickest increase in services activity in 11 months, with the Caixin China General Services Business Activity Index posting 52.7, up from 51.2 in May.

-

07:55

Australian trade balance deficit rose

In trend terms, the balance on goods and services was a deficit of $1,885m in May 2016, a decrease of $290m (13%) on the deficit in April 2016.

In seasonally adjusted terms, the balance on goods and services was a deficit of $2,218m in May 2016, an increase of $433m (24%) on the deficit in April 2016.

In seasonally adjusted terms, goods and services credits rose $188m (1%) to $26,170m. Non-rural goods rose $420m (3%). Non-monetary gold fell $186m (10%) and rural goods fell $77m (2%). Net exports of goods under merchanting remained steady at $28m. Services credits rose $31m (1%).

In seasonally adjusted terms, goods and services debits rose $620m (2%) to $28,387m. Intermediate and other merchandise goods rose $385m (5%), capital goods rose $182m (4%) and non-monetary gold rose $124m (29%). Consumption goods fell $81m (1%). Services debits rose $10m.

-

07:52

Retail sales in Australia declined slightly in May

The trend estimate rose 0.2% in May 2016. This follows a rise of 0.2% in April 2016 and a rise of 0.2% in March 2016.

The seasonally adjusted estimate rose 0.2% in May 2016. This follows a rise of 0.1% in April 2016 and a rise of 0.4% in March 2016.In trend terms, Australian turnover rose 3.3% in May 2016 compared with May 2015.

The following industries rose in trend terms in May 2016: Other retailing (0.5%), Food Retailing (0.1%), Cafes, restaurants and takeaway food services (0.4%) and Clothing, footwear and personal accessory retailing (0.3%). Household goods retailing (0.0%) and Department stores (0.0%) were relatively unchanged in trend terms in May 2016.

The following states and territories rose in trend terms in May 2016: New South Wales (0.4%), Victoria (0.2%), South Australia (0.3%), Western Australia (0.1%), Tasmania (0.4%) and the Australian Capital Territory (0.2%). Queensland (-0.2%) and the Northern Territory (-0.2%) fell in trend terms in May 2016.

-

07:49

RBA decided to leave the interest rate unchanged at 1.75%

- Australia's terms of trade are much lower than they were in recent years,

- The world economy continues to grow at a lower than average rate. Several developed economies have recorded improvement in conditions over the past year, but the conditions are more difficult for a number of emerging market economies.

- The growth rate of China's economy continues to slow, although the recent actions offers support near-term.

- Commodity prices are above recent lows, but it should be a very significant decline in the past few years.

- Financial markets have been volatile recent, as investors re-evaluate the assets after the referendum in the UK.

- Any consequences of the referendum results on global economic activity remains to be seen.

- Recent data point to the continuing overall growth in Australia, despite the very large decline in business investment.

- Other areas of domestic demand and exports are expanding.

- Labour market indicators were more mixed lately, but they are consistent with a moderate pace of expansion of employment in the near future.

- Inflation has been relatively low, given the very depressed growth in labor costs and a very low cost in other countries.

- Low interest rates are supporting domestic demand and the low exchange rate.

-

07:12

Global Stocks

Stocks in Europe slipped Monday, with losses among Italian banks helping to hand the pan-European benchmark its first loss in four sessions.

Stoxx Europe 600 SXXP, -0.74% dropped 0.7% to end at 329.78.

Italy's Banca Monte dei Paschi di Siena SpA BMPS, -13.99% closed down 14%. The move came after a report that the European Central Bank is pushing the lender to draft a new plan aimed at reducing non-performing loans.

Equities have been clawing back Brexit-fueled losses, as the U.K. government has yet to start formal talks about its terms in exiting the European Union after last month's referendum.

Asian shares snapped a five-day winning streak on Tuesday as investors took stock of a rally driven by hopes that central banks will provide more stimulus to offset a likely downturn triggered by Brexit.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.7 percent, but was still within reach of its June 9 peak, having risen 5.6 percent from its low after the Brexit vote on June 23.

Japan's Nikkei .N225 dropped 0.9 percent.

Chinese shares rose, with the CSI 300 .CSI300 up 0.3 percent, while the Shanghai Composite .SSEC added 0.6 percent, buoyed in part by a private business survey which showed growth in the services sector jumped to an 11-month high. But Hong Kong's Hang Seng .HSI retreated 0.8 percent.

But trade was thin, with financial and commodities markets in the United States closed on Monday for Independence Day.

-

07:04

Options levels on tuesday, July 5, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1314 (2287)

$1.1242 (3252)

$1.1198 (1319)

Price at time of writing this review: $1.1124

Support levels (open interest**, contracts):

$1.1067 (9695)

$1.0988 (8852)

$1.0943 (5459)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 42739 contracts, with the maximum number of contracts with strike price $1,1500 (5318);

- Overall open interest on the PUT options with the expiration date July, 8 is 88883 contracts, with the maximum number of contracts with strike price $1,0900 (15189);

- The ratio of PUT/CALL was 2.08 versus 2.11 from the previous trading day according to data from July, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.3504 (2002)

$1.3407 (221)

$1.3312 (445)

Price at time of writing this review: $1.3243

Support levels (open interest**, contracts):

$1.3192 (2887)

$1.3095 (433)

$1.2997 (2001)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 33721 contracts, with the maximum number of contracts with strike price $1,5000 (4014);

- Overall open interest on the PUT options with the expiration date July, 8 is 44535 contracts, with the maximum number of contracts with strike price $1,3500 (4751);

- The ratio of PUT/CALL was 1.32 versus 1.32 from the previous trading day according to data from July, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 1.75% (forecast 1.75%)

-

04:04

Nikkei 225 15,643.35 -132.45 -0.84 %, Hang Seng 20,851.65 -207.55 -0.99 %, Shanghai Composite 2,993.27 +4.66 +0.16 %

-

03:45

China: Markit/Caixin Services PMI, June 52.7 (forecast 52.3)

-

03:30

Australia: Retail Sales, M/M, May 0.2% (forecast 0.3%)

-

03:30

Australia: Trade Balance , May -2.22 (forecast -1.5)

-

01:46

Australia: AIG Services Index, June 51.3

-

00:33

Commodities. Daily history for Jul 04’2016:

(raw materials / closing price /% change)

Oil 48.76 -0.47%

Gold 1,353.50 +1.08%

-

00:32

Stocks. Daily history for Jun Jul 04’2016:

(index / closing price / change items /% change)

Nikkei 225 15,775.8 +93.32 +0.60 %

Hang Seng 21,059.2 +264.83 +1.27 %

S&P/ASX 200 5,281.78 +35.17 +0.67 %

Shanghai Composite 2,988.14 +55.66 +1.90 %

FTSE 100 6,522.26 -55.57 -0.84 %

CAC 40 4,234.86 -39.10 -0.91 %

Xetra DAX 9,709.09 -67.03 -0.69 %

S&P 500 2,102.95 +4.09 +0.19 %

NASDAQ Composite 4,862.57 +19.90 +0.41 %

Dow Jones 17,949.37 +19.38 +0.11 %

-

00:30

Currencies. Daily history for Jul 04’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1148 +0,09%

GBP/USD $1,3280 +0,04%

USD/CHF Chf0,9712 -0,15%

USD/JPY Y102,52 -0,01%

EUR/JPY Y114,30 +0,12%

GBP/JPY Y136,16 +0,04%

AUD/USD $0,7530 +0,44%

NZD/USD $0,7226 +0,76%

USD/CAD C$1,2847 -0,48%

-

00:00

New Zealand: NZIER Business Confidence, Quarter II 19%

-