Noticias del mercado

-

23:59

Schedule for today, Tuesday, Jul 05’2016:

(time / country / index / period / previous value / forecast)

01:30 Australia Trade Balance May -1.58 -1.5

01:30 Australia Retail Sales, M/M May 0.2% 0.3%

01:45 China Markit/Caixin Services PMI June 51.2

04:30 Australia Announcement of the RBA decision on the discount rate 1.75% 1.75% 04:30 Australia RBA Rate Statement

07:50 France Services PMI (Finally) June 51.6 49.9

07:55 Germany Services PMI (Finally) June 55.2 53.2

08:00 Eurozone Services PMI (Finally) June 53.3 52.4

08:30 United Kingdom Purchasing Manager Index Services June 53.5 52.7

09:00 Eurozone Retail Sales (MoM) May 0.0% 0.3%

09:00 Eurozone Retail Sales (YoY) May 1.4% 1.7%

14:00 U.S. Factory Orders May 1.9% -0.5%

-

18:00

European stocks closed: FTSE 6526.52 -51.31 -0.78%, DAX 9720.19 -55.93 -0.57%, CAC 4242.00 -31.96 -0.75%

-

17:51

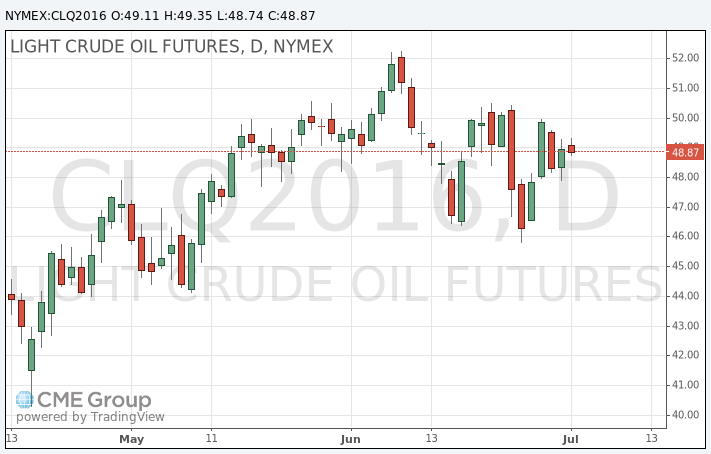

Oil price traded in a tight range today

During today's trading oil fluctuated in a narrow range as market players monitor the supply disruptions around the world to find the instructions to change the balance in the oil market (accumulation).

Militant group "Avengers Niger Delta" has claimed responsibility for the five new attacks on Nigeria's oil industry facilities on the weekend, that negate all the efforts of the Government to ensure the ceasefire agreement.

Trading volumes are low, as US markets are closed for Independence Day.

Crude oil futures for Brent jumped last week $ 1.92, or 4.01%, showing the best weekly trend over the past month, amid concerns on oil demand and Brexit.

WTI rose last week $ 1.18, or 2.83%, showing the first weekly gain in three weeks.

Signs of a potential recovery of production levels inhibit the growth of prices. On Friday, oil services provider Baker Hughes said that the number of drilling rigs in the US increased by 11 to 341, noting a fourth weekly gain in the past five weeks.

Growing drilling activity in the US has increased speculation that production may increase in the coming weeks, renewing concerns about excess inventories.

The cost of the August futures for US light crude oil WTI fell to 48.74 dollars per barrel.

September futures price for North Sea petroleum Brent fell to 50.03 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:33

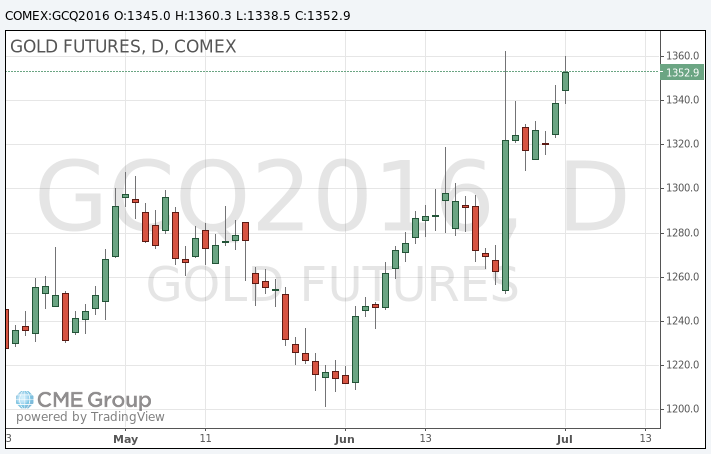

Gold price near two-year high

Gold prices continue to rise, trading close to 2 year high, while silver soared to July2014 highs.

On Monday, US financial markets are closed for the celebration of Independence Day, resulting in lower trading volumes. Tomorow conditions will return to normal.

Weekly, gold futures rose $ 16.70, or 1.27%, showing weekly gain for the fifth time in a row. In June, the precious metal has risen in price by almost 9%, becoming the largest monthly increase since February. So far this year, prices rose almost 25%, ending six months of record growth.

Gold is a good trading idea supported in recent sessions by the backdrop of fading Fed hikes expectations, while investors continue to assess the political and economic consequences of Brexit.

The precious metal rose a little more than two-year high of $ 1362.60 on 24 June after the shocking results of the UK referendum, leading to the withdrawal from the EU, forcing investors to turn to safe assets.

Market participants completely ruled out the possibility of further Fed raising interest rates this year In fact, some traders even expcet a small cut in the key Fed rate until the end of the year.

According to CME FedWatch, now there probability of a Fed rate hike is 0 in July and 3% chance of a rate cut.

The cost of the August gold futures on the COMEX rose to $ 1360.3 per ounce.

-

16:48

Sell Eur & Gbp rallies - BofA Merrill

"Following the sharp sell-off after the Brexit vote, markets have rallied this week. Equities, EM, EUR and GBP are up; vol, JPY and USD down.

In our view, the market rally reflects in part the realization that Brexit is more a UK than a global shock and expectations that it will allow central banks to be dovish.

However, in our view, it also reflects hopes that the UK may not activate Art. 50. We are sympathetic to the former, but concerned about the latter. Backtracking from Brexit requires too many "ifs": deep recession, soon enough, changing the public view on the EU, and making it politically popular to ignore the referendum.

We like selling GBP and EUR rallies, but would be constructive on risk assets if NFP data improves next week".

-

16:20

Overview of expected economic data from UK

Industrial production

The indicator will be published on Thursday, July 7 at 08:30 GMT

In the first quarter, real GDP in Britain rose by a modest 2.0 percent year on year. The services sector has been the driving force of economic growth during this period, but industrial production fell. Recall that in April, the volume of industrial production advanced by 2 percent, while the growth of production in the manufacturing sector accelerated to 2.3 percent from 0.1 percent. On an annual basis, industrial output jumped by 1.6 percent, recorded the maximum increase in October. Experts point out that in May a report on industrial production is likely to confirm the imbalance with regards to economic growth in the 2nd quarter. It is expected that the production in the manufacturing industry, and the overall industrial production fell in May after a very strong performance in April.

-

16:02

Canada’s manufacturing sector slowed down in June

June data suggested that the Canadian manufacturing recovery stepped down a gear at the end of the second quarter, with output, new business and employment growth all easing slightly since May. Moreover, new export orders were virtually unchanged in June, which contrasted with the solid contribution to growth seen earlier in 2016. At the same time, stocks of finished goods dropped at a survey-record pace in June, with manufacturers noting that subdued client demand and uncertainty about the economic outlook had encouraged tighter inventory management at their plants.

Key findings from the June survey included:

- Output growth eases from May's 11-month high

- Marginal increase in new business volumes

- Stocks of finished goods fall at fastest pace since the survey began in October 2010

-

15:44

WSE: Afternoon comment

Due to the holiday in the US today's afternoon trading phase will be calmer, although the market after the southern threshold variation came out at the bottom, which may indicate that on the final straight we will face a variant of the testing area of the morning lows. For solace it remains only the fact that in this phase of the session it happens together with the deterioration of sentiment in Euroland, which has a lot of space for the implementation of downward move after increases from previous days.

-

15:40

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900, 1.1170, 1.1190, 1.1200

GBP/USD 1.3600

USD/CAD 1.2870

AUD/USD 0.7180, 0.7400, 0.7420/25, 0.7500

NZD/USD 0.7125

-

15:25

ECB officials: UK should decide quickly with a further plan of action

Representatives of the European Central Bank call for the United Kingdom as soon as possible to decide on a plan of action after the decision of the country to withdraw from the European Union.

As noted by the ECB, Brexit inevitably has an impact on economic growth in the euro area.

According to the chief economist and board member of the ECB Peter Praet, the uncertainty created by the British decision to withdraw from the EU, could adversely affect the confidence of both businesses and consumers in the euro area.

He called on the UK authorities and the EU to move swiftly to make arrangements.

Praet confirmed that the ECB "clearly aimed" at ensuring inflation and strengthening the protection of financial stability in the euro area.

Meanwhile, ECB board member Benoit Koere said that "uncertainty shock" after Brexit will inevitably affect the pace of economic recovery in the euro area.

Global central banks will monitor the situation closely and are ready for action, he added.

Bank of England governor, Mark Carney said last week that the British Central Bank may be forced to ease monetary policy in the summer, to compensate for the Brexit risks.

Experts believe that the ECB will also soften the policy by September, by further rate cuts or by increasing the bond repurchase program.

However, the head of the Bundesbank, Jens Weidmann on Friday saying that he would oppose the further expansion of the European Central Bank stimulus.

According to him, the current ECB policy, including a negative interest rate on deposits and repayment of bonds in the amount of EUR 80 billion per month, is already a "very challenging."

"I do not see the need for further easing," - said Y.Vaydman.

ECB President Mario Draghi, speaking at a summit in Brussels last week, said that Brexit reduce the rate of economic growth in the euro area in the next three years by 0.5 percentage points, taking into account the importance of the UK as a trading partner for the region.

-

14:36

European session review: euro recovered in thin liquidity

The following data was published:

(Time / country / index / period / previous value / forecast)

8:30 Eurozone indicator of investor confidence from Sentix July 9.9 1.7

8:30 UK index of business activity in the construction sector, m / m in June 51.2 50.5 46

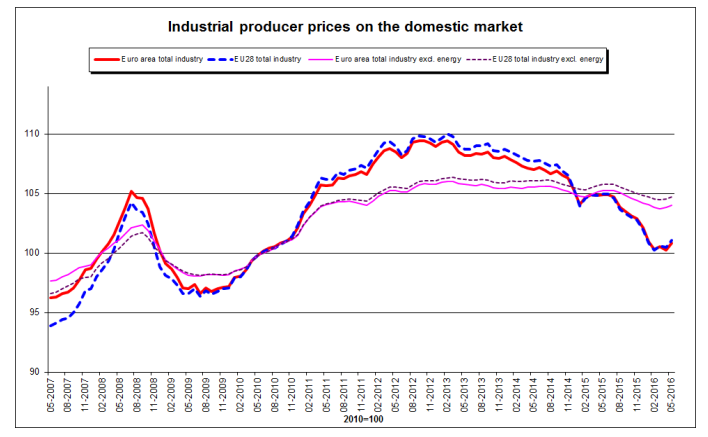

9:00 Eurozone Producer Price Index m / m in May 0.3% 0.3% 0.6%

9:00 Eurozone Producer Price Index y / y in May -4.4% -4.1% -3.9%

The euro regained lost ground against the US dollar, returning to the opening levels. Initially, the euro decline was due to weaker data for nvestor confidence from Sentix. The survey results, published by the research group Sentix revealed that the mood among investors deteriorated significantly in July, reaching a 18-month low, which was associated with increased concerns about the economic impact of Brexit. It should be emphasized that the survey was conducted among 1056 investors from 30 June to 2 July.

According to the data, investors confidence indicator fell in June to 1.7 points versus 9.9 points prior. Analysts had expected the index to decline only to 5.0 points. The last reading was the lowest since January 2015.

"The outcome of the British referendum on membership in the EU has different effects on the global level in terms of economic expectations of investors abd mainly affected the euro zone abd therefore the euro zone economy is dangerously close to stagnation..", - Reported Sentix.

In addition, the sub-index measuring expectations dropped to -2.0 points from 10 points in June, reaching its lowest level since November 2014. Meanwhile, the index measuring the current state of the euro zone fell to 5.5 points from 9.8 points. The Sentix added that the European Central Bank is faced with huge pressure from the markets to act. The sub-index measuring expectations regarding monetary policy, rose to 30.5 points from 15 points.

The data also showed that the sentiment index in Germany - Europe's largest economy - fell to 18.4 from 20.7. Investors are also skeptical about the prospects for the German economy - the index measuring expectations fell to 2.7 from 7.9 in June.

A little later came the data on producer prices in the euro area, which have helped the single currency recover. Eurostat said that at the end of May, producer prices in the euro area increased by 0.6%. Analysts had expected growth only by 0.3%. Among the 28 EU countries was also recorded an increase of 0.6%. Recall that in April, prices fell by 0.3% in the euro area and by 0.1% in the EU28

In annual terms, the producer price index decreased by 3.9% in the euro area and by 3.7% in the EU. It was predicted that the index for the euro zone to fell by 4.1% after falling 4.4% in April.

The monthly change was due to the increase in prices in the energy sector (+ 1.7%), intermediate goods (+ 0.3%) and consumer non-durable goods (+ 0.1%). Meanwhile, the prices of capital goods and durable consumer goods remained unchanged. In general, rates in the energy industry increased by 0.2% in May.

The greatest increase compared with April was noted in Belgium (+ 2.7%), the Netherlands (+ 2.0%), Hungary (+ 1.6%) and Greece (+ 1.3%). Decrease was recorded in Latvia (-0.4%), Sweden (-0.2%) and Bulgaria (-0.1%).

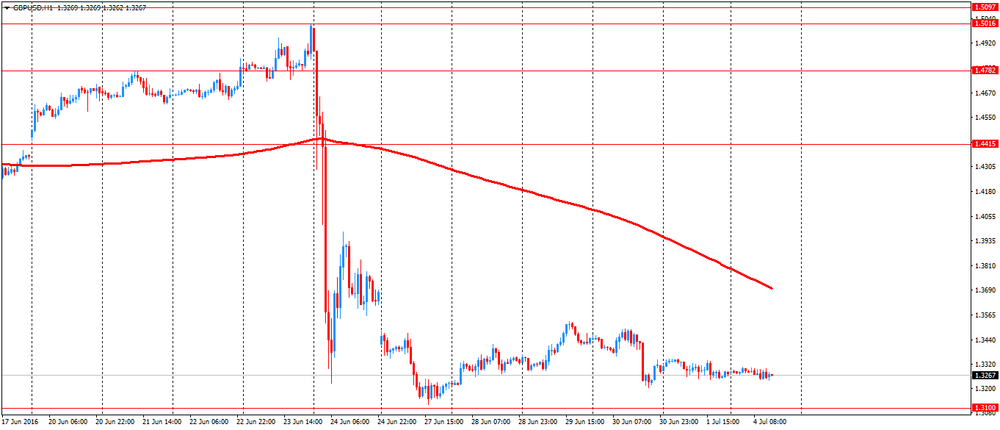

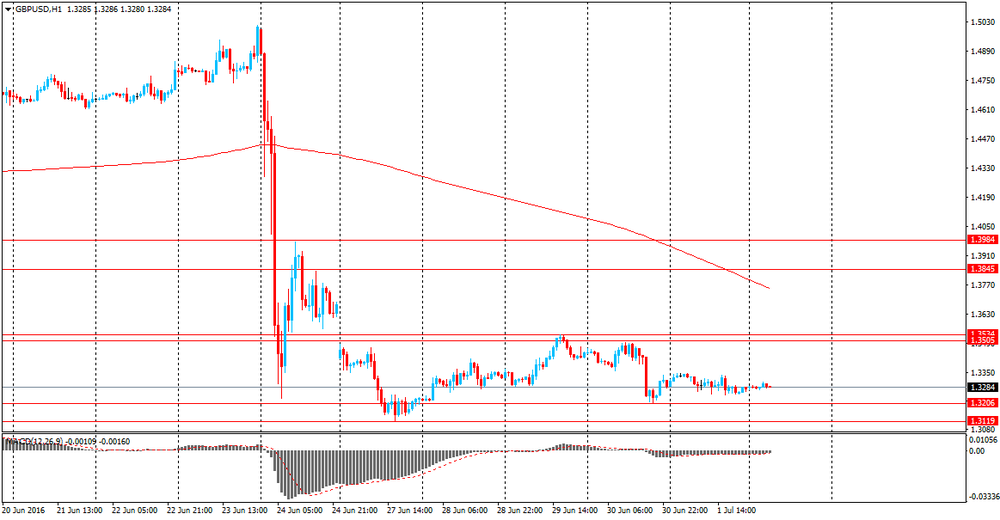

The British pound is stable against the US dollar and still trading near 31-year lows, after data showed that construction sector activity in the UK unexpectedly fell in June to a seven-year low, adding to concerns over a slowdown in the British economy after Brexit referendum.

Today, US financial markets will be closed in celebration of Independence Day, resulting in reduced trading volumes.

Reported by Markit and the Chartered Institute of Purchasing and Supply showed that the index of business activity in the UK construction sector fell to a seasonally adjusted 46.0 from 51.2 in May.

Economists expected a decline to 50.5 in June.

Markit also indicated that the rate of decline was significantly lower than in the recession of 2008-2009.

The pound is under strong selling pressure after Britain shocked markets the decision to leave the European Union, causing uncertainty regarding the consequences for the economy and the world economy as a whole.

Pressure on the British currency strengthened after the Bank of England head Mark Carney indicated at the end of last week, that additional stimulus may be required, reinforcing expectations of future rate cuts.

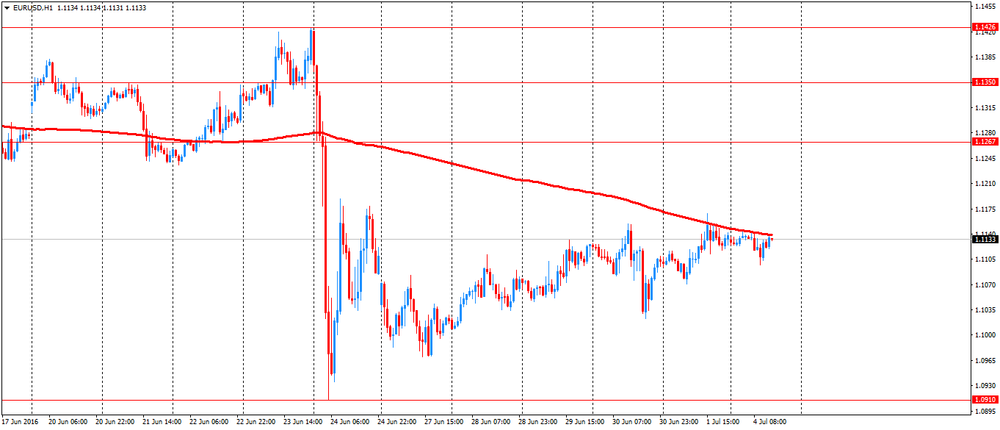

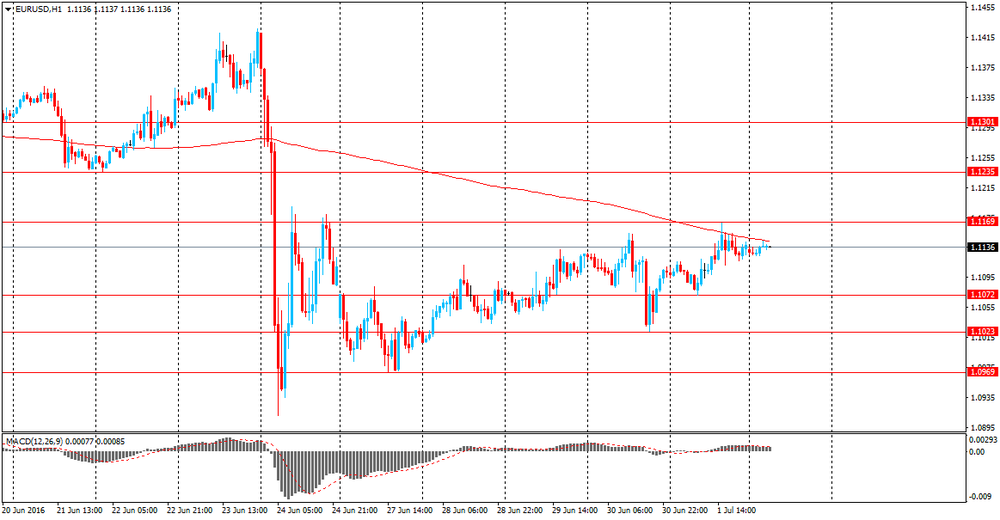

EUR / USD: during the European session, the pair fell to $ 1.1097 and then rose to $ 1.1139

GBP / USD: trading in $ 1.3239 - $ 1.3307 range.

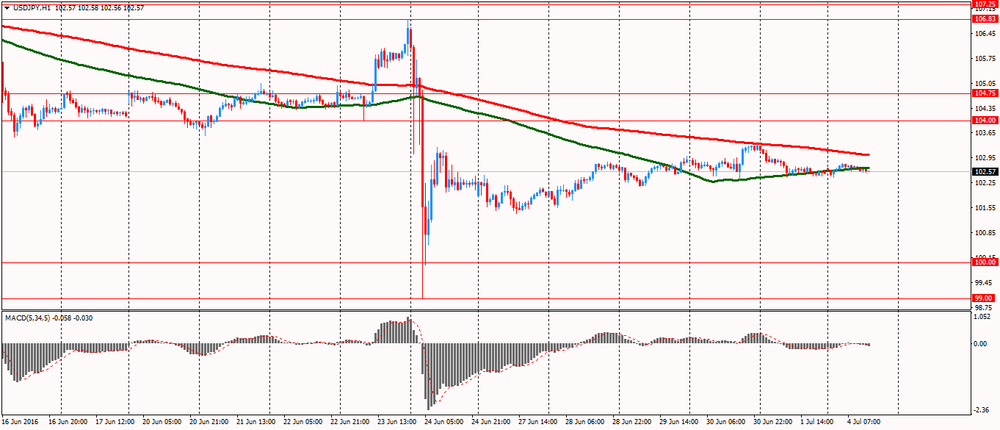

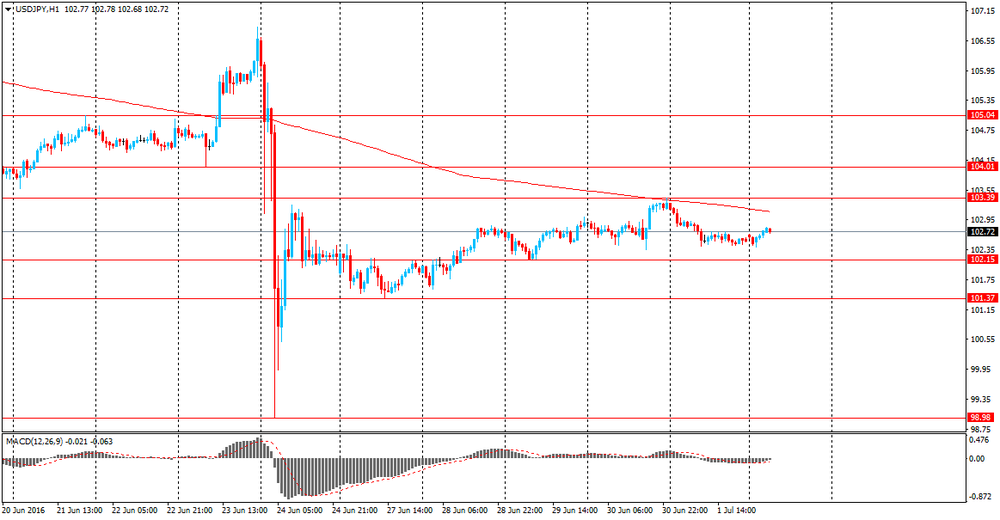

USD / JPY: fell to Y102.54.

-

14:00

Orders

EUR/USD

Offers 1.1145-50 1.1160 1.1170-75 1.1185-90 1.1200

Bids 1.1085-90 1.1070 1.1050 1.1020-25 1.1000-10

GBP/USD

Offers 1.3300 1.3320 1.3345-50 1.3365-70 1.3380 1.3400 1.3450

Bids 1.3240 1.3220-25 1.3205-10 1.3200 1.3185-90 1.3160

EUR/GBP

Offers 0.8400 0.8420 0.8450 0.8475-80 0.8500

Bids 0.8350 0.8320 0.8300 0.8280 0.8250

EUR/JPY

Offers 114.50 114.80 115.00 115.30 115.50 116.00

Bids 114.00 113.50-60 113.30 113.00 112.55-60 112.30-35 112.00

USD/JPY

Offers 102.80-85 103.00 103.25-30 103.50 103.60 103.80-85 104.00

Bids 102.60 102,50 102,40 102.20 102.00 101.80 101.50

AUD/USD

Offers 0.7550 0,7590 0.7600

Bids 0.74800 0.7460 0.7440 0.7400

-

13:45

UKIP leader Nigel Farage to stand down - BBC

Nigel Farage says he is standing down as leader of the UK Independence Party. Mr Farage said he had "done my bit" following the UK's referendum vote to leave the EU. He said the party was in a "pretty good place" and said he would not change his mind about quitting as he did after the 2015 general election. Leading UKIP was "tough at times" but "all worth it" said Mr Farage, who is also an MEP. He added that the UK needed a "Brexit prime minister".

-

13:12

WSE: Mid session comment

After four hours of trading and publication by the Ministry of information showing more details of the proposed changes regarding the Pension Funds (OFE) investors are slowly embracing this topic. It does not look as bad as it seemed at beginning, as OFE in part consist of stock (PLN 103 bln) de facto will stay after conversion to already known in the market accounts - IKE (Individual Retirement Accounts). The WIG20 index has returned above the level of 1,720 points., but there is still difficult to positively approach to the planned changes. It is still too many question marks to be able to form a clear view.

However in the area of the south part of trading the market calmed down and we may clearly see, that any major deviation down of the market triggers bigger demand for purchases.

At the halfway point of quotations, the WIG20 index was at the level of 1729 points (-0,84%) and with the turnover of PLN 322 mln.

-

12:56

European stocks down after a four-day rally

European stocks down after a four-day rally, as the decline in shares of Italian banks eliminates the rise in price of securities of mining companies. However, because of the celebration of Independence Day, trading volume today will be lower than usual.

Statistics for the euro area and Britain put pressure on the indices The survey results, published by research group Sentix, revealed that the mood among investors deteriorated significantly in July, reaching a 18-month low, which was associated with increased concerns about the economic impact of Brexit. According to the data, investors confidence indicator fell in June to 1.7 points versus 9.9 points in June. Analysts had expected the index to decline to 5.0 points. The last reading was the lowest since January 2015. Sub-index measuring expectations dropped to -2.0 points from 10 points in June, reaching its lowest level since November 2014. Meanwhile, the index measuring the current state of the euro zone fell to 5.5 from 9.8 in June. The data also showed that the sentiment index in Germany fell to 18.4 from 20.7. Investors are also skeptical about the prospects for the German economy - the index measuring expectations fell to 2.7 from 7.9 in June.

With regard to data on the UK, Markit Economics said that business activity in the construction sector deteriorated significantly by the end of June, exceeding the forecasts of experts, and dropping to its lowest level in seven years. The index of business activity in the construction sector fell in June to 46.0 points compared to 51.2 points in May. The last reading was the lowest since June 2009. Economists had expected the index to decline to 50.5 points. The Markit Economics said that almost all respondents have linked the decline in business activity with the uncertainty in the run-up to the referendum on EU membership. "The latest data raise the possibility that the Bank of England will apply additional measures this summer in an attempt to ease the short-term impact of uncertainty on the real economy", - said Tim Moore, senior economist at Markit.

Chancellor George Osborne's plans to cut corporate tax to less than 15 percent in an attempt to offset the shock of investors on the decision to leave the European Union. In addition, the Financial Times said that Osborne will make more efforts in establishing the UK's relations with China. He told the newspaper that wants to build a "super competitive economy" with low taxes for business. However, Osborne did not specify the date of tax reduction.

Experts warn that a further reduction of the tax can enhance the discontent of some EU countries, which have expressed their concern about the competitive tax policies.

The composite index of the largest companies in the region Stoxx Europe 600 fell by 0.2 percent.

"European stocks took a breather after last week's rally and due to the holiday in the US - said Guillermo Samper, director of trading at MPPM EK -We continue to see a shift from the financial and peripheral actions in safe assets such as gold paper companies. . Italian banks remain losers, even with the support of the government, as the main opinion is that they will continue to be under-capitalized. "

The capitalization of the Italian bank Banca Monte dei Paschi di Siena SpA fell by 8 percent, while the value of mining companies Fresnillo Plc and Randgold Resources Ltd. increased by at least 3.5 percent amid gold rise.

Rightmove Plc Shares fell 4.5 percent after the experts have lowered the company's stock rating to "sell".

Volkswagen shares fell 2.3 percent after Executive Officer Matthias Mueller rejected the compensation claims of European customers because of the emissions scandal.

Shares of Deutsche Lufthansa rose 0.2 percent, as the German airline announced the appointment of Chief Financial Officer Ulrich Svensson, which will replace the current head Simone Menezes. since August this year.

At the moment:

FTSE 100 -4.73 6,573.1 -0.1%

CAC 40 4,261.49 -12.47 -0.3%

DAX 9,761.15 -14.97 -0.2%

-

12:27

EU will provide Spain and Portugal another three weeks, in order to avoid sanctions because of the budget deficit

The European Commission will give Spain and Portugal three weeks to take steps to reduce excessive budget deficit and avoid the financial sanctions. This was stated by an official, sign with the discussion of this issue.

This step will be a temporary compromise between fiscal "hawks" led by Germany, and supporters of budgetary flexibility that are in favor of greater flexibility in times of weak growth, high unemployment and growing support for parties that support withdrawal from the EU.

Italian Prime Minister Renzi urged not to penalize Portugal and Spain, while the head of the Central Bank of Germany Jens Weidmann opposed the easing of fiscal EU rules, despite the fact that Brexit may adversely affect the rate of economic unit growth in the coming years.

"At a meeting on Tuesday in Strasbourg, the EU's executive board will say that these two countries have not taken effective action to correct its excessive deficit. The Commission will give Spain and Portugal, the time until July 27 to offer effective means to deal with the deficit and avoid financial penalties provided by the EU rules, which have never been used, "- the official said.

In May, the Commission decided to grant Spain and Portugal another year to reduce their deficits, but under pressure from their more militant members, said that will announce its final assessment of the sanctions in July. Recall that in the past year, Spain and Portugal have broken EU budget rules, which require to keep the budget deficit below 3 percent of gross domestic product. In 2015, Spain's budget deficit stood at 5.1 percent, well above the permissible limit and more than the target of 4.2 percent agreed with EU partners. Meanwhile, Portugal recorded a budget deficit of 4.4 percent of GDP.

-

11:54

Review of financial and economic press: secretary general of OPEC said that oil market approaching stabilization

newspaper. ru

Minister of Energy of Saudi Arabia Khalid Al-Falih, as well as the newly elected Mohammed Barkindo OPEC Secretary General said that the world oil market are stabilizing, reports Reuters.

In Libya, two rival oil companies announced a merger

The heads of the warring Libyan oil companies agreed to merge, while recognizing the government the highest executive power in the country, reports Reuters. National Oil Corporation (NOC) of Libya was divided into two companies - the east and west, and they are regularly in conflict.

ECB: Britain expect inflation and recession after Brexit

After the Brexit, UK will face two challenges - inflation and recession in the economy, said member of the Board of Governors of the European Central Bank, the Governor of the Bank of France, François Villeroy de Galo, according to Reuters.

Until the end of the year Novak may meet with the new head of OPEC

Russian Ministry of Energy plans by the end of the year to organize a meeting with the new head of OPEC Mohammed Barkindo, reports RIA. "After August 1, we get in touch with the OPEC Secretariat to make an appointment," - said the head of the International Relations Department of Energy Roman Marshavin.

RBC

Saudi Arabia and OPEC have noticed that the movement of the oil market is towards balance

The oil market is moving towards balance, according to Minister of Energy, Industry and Mineral Resources of Saudi Arabia Khalid al-Falih and Muhammad Barkindo OPEC secretary general. On Sunday, they met in Dhahran, Saudi informs SPA.

-

11:11

Producer prices in Euro Zone increased in May

In May 2016, compared with April 2016, industrial producer prices rose by 0.6% in both the euro area (EA19) and the EU28, according to estimates from Eurostat, the statistical office of the European Union. In April 2016 prices fell by 0.3% in the euro area and by 0.1% in the EU28. In May 2016, compared with May 2015, industrial producer prices decreased by 3.9% in the euro area and by 3.7% in the EU28.

The 0.6% increase in industrial producer prices in total industry in the euro area in May 2016, compared with April 2016, is due to rises of 1.7% in the energy sector, of 0.3% for intermediate goods and of 0.1% for non-durable consumer goods. Prices remained stable for both capital goods and durable consumer goods. Prices in total industry excluding energy increased by 0.2%. In the EU28, the 0.6% increase is due to rises of 2.1% in the energy sector, of 0.3% for intermediate goods and of 0.1% for non-durable consumer goods. Prices remained stable for both capital goods and durable consumer goods. Prices in total industry excluding energy increased by 0.2%. Industrial producer prices rose in nearly all Member States, with the highest increases observed in Belgium (+2.7%), the Netherlands (+2.0%), Hungary (+1.6%) and Greece (+1.3%). Industrial producer prices decreased only in Latvia (-0.4%), Sweden (-0.2%) and Bulgaria (-0.1%).

u

-

11:00

Eurozone: Producer Price Index (YoY), May -3.9% (forecast -4.1%)

-

11:00

Eurozone: Producer Price Index, MoM , May 0.6% (forecast 0.3%)

-

10:51

Damage to economic expectations in Euro Zone due to brexit - Sentix survey

The sentix economic survey is the first indicator of its kind to provide an indication whether UK's decision to leave the EU affects the economy of other world regions. Thereby, it turns out that the spring recovery of the sentix economic expectations for the Eurozone has abruptly halted. The British voters' verdict to depart the Eu-ropean Union should be a decisive reason for that. Besides Switzerland, the Eurozone is the biggest loser of the Brexit decision.

-

The Brexit referendum in the UK hurts investors' expectations for Eurozone. Expectations plummeted from June's +10 points to -2 points in July which mark the lowest level since November 2014. At the same time, the headline index falls to +1.7 points.

-

The US economy is not able to remain resilient. Economic expectations fall 4.5 points.

-

Selected emerging markets display positive improvements, though. The process of stabilisation proceeds and Asia remains largely unaffected by the turmoil the UK caused.

-

-

10:40

Collapse of UK’s construction sector, PMI lowest since June 2009

Markit construction PMI was in contraction teritory after registering the value of 46 (below 50 = contraction). Forecasts indicated 50.5. Data calculated before Brexit so imagine how UK's major economic indicators will look next month.

"Widespread delays to investment decisions and housing market jitters saw the UK construction sector experience its worst month for seven years in June. Construction firms are at the sharp end of domestic economic uncertainty and jolts to investor sentiment, so trading conditions were always going to be challenging in the run-up to the EU referendum. However, the extent and speed of the downturn in the face of political and economic uncertainty is a clear warning flag for the wider post Brexit economic outlook".

-

10:30

Eurozone: Sentix Investor Confidence, July 1.7

-

10:30

United Kingdom: PMI Construction, June 46 (forecast 50.5)

-

10:19

ECB Villeroy: Britain will face rising inflation and a drop in GDP due to Brexit

"Britain offers two major problems, namely an increase in inflation and economic contraction, after leaving the UE", - said a member of the Board of Governors of the European Central Bank, François Villeroy de Galo.

"In the short term, two opposite problems pose a challenge to the British economic and monetary policy: there is the problem of inflation, which is exacerbated by the recent depreciation of the pound by 11 percent against the US dollar then arises the recession problem.. . the effect of uncertainty on investment in such a situation makes it very difficult to properly adjust monetary and economic policy ", - said Villeroy.

-

09:45

S&P: UK will barely escape a full recession

- Brexit will cause a drag on UK economy of 1.2% in 2017 and 1.0% in 2018.

- Eurozone GDP to slow down 0.8% over 2017 & 2018.

-

09:28

Positive start for major stock exchanges: DAX 9,803.49 + 27.37 + 0.3%, FTSE 100 6,606.4 + 102.07 + 1.6%, CAC 40 4,288.35 + 14.39 + 0.3%

-

09:16

Oil increased in early trading

This morning, New York crude oil futures WTI rose by 0.29% to $ 49.13 per barrel. At the same time, crude oil futures for Brent rose by 0.38% to $ 50.54 per barrel. Thus, the black gold is gaining on the background of rising fuel demand from car owners in the United States in the summer. In addition, the strike in Norway stopped after the signing of a weekend labor agreement between unions and employers. Analysts believe that the oil market as a whole remain favorable for further price recovery.

-

09:14

WSE: After opening

When the futures on European indices were on green side, our FW20 took off with more than 1% drop, thus there is a noticeable disparity in response to the ongoing conference of the Deputy Prime Minister.

WIG20 index opened at 1728.89 points (-0.90%)*

WIG 44316.43 -0.98%

WIG30 1928.09 -1.23%

mWIG40 3356.92 -1.27%

*/ - change to previous close

Cash market opens with discount at considerable turnover as on Monday with the American holiday in the background. This is a consequence of a negative reaction to the words of Deputy Prime Minister, who finally said that funds from open pension funds would be transferred to the third pillar and demographic reserve fund. It seems that ultimately OFE and so will be eliminated, and a portion of is to be used for "important project of economic policy." All blue chips are losing value and investors did not like as yet communicated messages regarding pension funds.

-

09:08

Spanish economy showing signs of accelerated recovery - unemployment at record lows

The number of unemployed registered at the offices of the Public Employment Services has fallen by 124,349 people in June from the previous month. This reduction is the second largest in the historical series, surpassed only by that of June 2013. Thus, the total number of registered unemployed stood at 3,767,054, the lowest since September 2009.

In seasonally adjusted terms, unemployment reduced by 48,579 people in June. It is the largest reduction of the entire series in June. The monthly change of seasonally adjusted unemployment has fallen in 37 of the last 38 months.

In the last 12 months unemployment has fallen by 353,250 people. The annual rate of decline in registered unemployment stood at 8.57% in June, the best figure since 1999.

Unemployment among young people under 25 is reduced in June at 24,522 people (-7.55%) compared to the previous month.

-

09:02

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0900, 1.1170, 1.1190, 1.1200

GBP/USD 1.3600

USD/CAD 1.2870

AUD/USD 0.7180, 0.7400, 0.7420/25, 0.7500

NZD/USD 0.7125

-

08:41

Expected positive start of trading on the major stock exchanges in Europe: DAX + 0,3%, FTSE 100 + 0,1%, CAC 40 + 0.2%

-

08:23

WSE: Before opening

At the beginning of the new week, the situation on the global market is calm. Contracts in the US are quoted on the levels of Friday afternoon, and despite the absence of the session on Wall Street (the US celebrated Independence Day) determine the level of global sentiment. Friday's session in the US brought no surprises and the S&P500 index gained a modest 0.2%. Slightly better cope on this morning Asian stock markets led by China and gaining more than 1%. Economic calendar is almost empty today.

On the Warsaw market an important element will be starting at 08:30 (Warsaw time) the press conference organized by the Ministry of Development, where will be presented plans for the future of the pension system and the Open Pension Funds. For the Warsaw Stock Exchange the OFE (Open Pension Funds) is one of the key element, so the session has a chance to be subordinated to the information given at the conference. On Friday, after the end of the session, the rating agency Standard&Poor's confirmed the rating of Poland for "BBB plus" and maintained a negative outlook. There was no surprise, the agency in January lowered our national rating. More important will be the review of the rating by the Fitch agency, which will be held on July 15.

-

08:19

Asian session review: the Australian dollar has strengthened

Dollar little changed against the euro. US markets are closed today because of Independence Day holiday.

Friday, euro strengthened against the dollar amid eurozone labor market report. Eurostat announced that at the end of May the unemployment rate in the eurozone was 10.1%, a decline of 0.1% compared to the previous month and confirming experts' forecasts. The latter value was the lowest since July 2011. Recall that in May 2015 unemployment was 11.0%. Among the 28 EU countries, the unemployment rate fell from 8.7% to 8.6% in May (low from March 2009). In the corresponding month in 2015, the unemployment rate was at 9.6%.

Growth of the euro has also been confirmed with statements by the representatives of the ECB Praet. He said the economy has shown signs of strengthening, and this suggests that monetary policy works, "the ECB is set to continue to play a crucial role in this process, however, the ECB's policy can not be the only remedy for the current economic problems, need more actors." - Praet said. In addition, the politician said that among the uncertainties threatening the euro-zone economy, we can distinguish the British withdrawal from the European Union and the weakness of world economic growth.

This week, on Tuesday, the focus of investors will be on retail sales in the euro zone, and on Thursday the market's attention will be focused on data on industrial production in Germany. Analysts predict a slight increase in both indicators.

In addition, on Thursday European Central Bank minutes are published, from the meeting in early June. Investors will be interested in how ECB was preparing for Brexit

.

During the Asian session, the Australian dollar rose towards the 1 July high, after rating agency Moody 's Investors Service said that political uncertainty will be short-lived and have limited consequences for the coveted triple-A credit rating.

Inflation expectations increased by 0.6% in June, after declining 0.2% in May. It was the biggest gain since December 2013. In annual terms, this indicator also increased from 1.0% to 1.5% although tomorrow the RBA is expected to leave interest rates unchanged at 1.75%.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1125-35.

GBP / USD: during the Asian session, the pair is trading in the range of $ 1.1.3270-85.

USD / JPY: during the Asian session, the pair was trading in range Y102.40-65.

-

08:06

Goldman Sachs: we do not at this stage forecast a large under-shooting of the Pound

"We explain how we think about the Pound in the wake of the Brexit surprise.

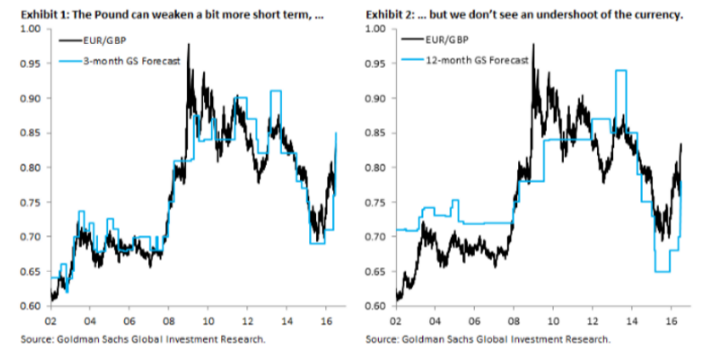

Following the "leave" vote, we revised our Sterling forecast substantially weaker, taking our view on EUR/GBP to 0.85, 0.82 and 0.78 in 3, 6 and 12 months, from 0.76, 0.74 and 0.70 previously. This forecast, together with our unchanged EUR/$ forecast of 1.12, 1.10 and 1.05 over the same period, implies GBP/$ at 1.32, 1.34 and 1.35 in 3, 6 and 12 months.

In other words, while we marked-to-market for the greater uncertainty and consequent hit to UK growth, we do not at this stage forecast a large under-shooting of the Pound, as exchange rates in emerging markets often do when there are adverse shocks.

The distinction with emerging markets is important. Emerging markets often have large current account deficits, much like the UK. Capital inflows then halt abruptly or even reverse on an adverse shock, a "sudden stop," and exchange rates tumble. This is not what is going on in the UK. In the wake of the Brexit vote, markets are functioning normally, capital is flowing in as well as out of the UK, and global risk markets are looking through what is a relatively minor shock for the global economy (the UK is less than 4 percent of world GDP).

The repercussions of recent events for the Pound are therefore not to be found in emerging market "sudden stops," but in the calmer realm of G10 growth shocks, where effects can still be sizeable, but nowhere near as large as "sudden stops."This is why our 3-month forecast for EUR/GBP allows for some modest further weakening in Sterling, with the cross going to 0.85 (Exhibit 1), but on a 12-month view we expect normalization, with EUR/GBP reverting to 0.78 (Exhibit 2). So think growth shock, not "sudden stop," and resist the temptation to extrapolate from EM to the UK".

-

07:59

Moody's: short-lived political uncertainty has limited credit implications for Australia

• short-lived political uncertainty would have limited credit implications for Australia.

• electoral outcome would affect Australia's credit profile only if it changed broad policy priorities.

• expects fiscal consolidation to remain a key policy objective of the new Australian government, when it is formed - Reuters.

-

07:56

Short term inflation expectations are higher in Australia

The Melbourne Institute Monthly Inflation Gauge rose by 0.6 per cent in June, after a 0.2 per cent fall in May. In the twelve months to June, the Inflation Gauge increased by 1.5 per cent, after a rise of 1.0 per cent for the twelve months to May. Contributing to the overall change in June were price rises for automotive fuel (+7.6 per cent), holiday travel and accommodation (+7.4 per cent) and fruit and vegetables (+6.4 per cent). These were primarily offset by decreases in clothing and footwear (‐1.1 per cent), and insurance and financial services (‐0.5 per cent). The trimmed mean measure of the Inflation Gauge rose by 0.2 per cent in June, after falling by 0.2 per cent in May. According to Dr Sam Tsiaplias, Senior Research Fellow at the Melbourne Institute, "Inflation rose sharply in the final month of this quarter, and this was heavily driven by a significant rise in fuel prices. Given this rise, it seems unlikely that we will get a repeat of last quarter's negative CPI result for the current quarter." "Since items such as fuel prices are quite volatile, it is often preferable to look at smoothed measures of inflation such as the trimmed mean. Both trimmed mean inflation and the inflation gauge excluding volatile items rose this month, although they are still below their long‐term averages" added Dr Tsiaplias.

-

07:53

Building approvals in Australia declined

The trend estimate for total dwellings approved rose 0.9% in May and has risen for six months. The seasonally adjusted estimate for total dwellings approved fell 5.2% in May after rising for two months. The trend estimate for private sector houses approved rose 0.2% in May and has risen for five months. The seasonally adjusted estimate for private sector houses rose 0.1% in May following a fall of 1.8% in the previous month.

-

07:09

Options levels on monday, July 4, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1314 (2287)

$1.1242 (3252)

$1.1198 (1319)

Price at time of writing this review: $1.1133

Support levels (open interest**, contracts):

$1.1067 (9695)

$1.0988 (8852)

$1.0943 (5459)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 42739 contracts, with the maximum number of contracts with strike price $1,1500 (5318);

- Overall open interest on the PUT options with the expiration date July, 8 is 88883 contracts, with the maximum number of contracts with strike price $1,0900 (15189);

- The ratio of PUT/CALL was 2.08 versus 2.11 from the previous trading day according to data from July, 1

GBP/USD

Resistance levels (open interest**, contracts)

$1.3603 (922)

$1.3504 (2002)

$1.3407 (221)

Price at time of writing this review: $1.3283

Support levels (open interest**, contracts):

$1.3192 (2887)

$1.3095 (433)

$1.2997 (2001)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 33721 contracts, with the maximum number of contracts with strike price $1,5000 (4014);

- Overall open interest on the PUT options with the expiration date July, 8 is 44535 contracts, with the maximum number of contracts with strike price $1,3500 (4751);

- The ratio of PUT/CALL was 1.32 versus 1.32 from the previous trading day according to data from July, 1

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:06

Global Stocks

European stocks ended higher Friday, pushing the Stoxx Europe 600 to its best week in five after a stunning series of sharp gains in the wake of the U.K.'s Brexit vote.

The index broke a four-week losing streak to end up 3.2% since last Friday, the strongest weekly rise since the week ended May 27. After sliding on Friday and Monday following Thursday's landmark referendum in the U.K. to leave the European Union, the index moved higher for four consecutive sessions.

Much of Thursday's rise of 1% was supported by a hint from Bank of England Gov. Mark Carney that a U.K. interest-rate cut was in store for the summer.

Meanwhile, investors on Friday were weighing the possibility that the European Central Bank loosening rules for bond purchases. The ECB is concerned there may not be enough debt available to buy under the terms of its current bond-buying program, as bond yields continued to fall after the Brexit vote.

U.K. stocks advanced Friday, kicking the second half of 2016 at their highest this year after hints the Bank of England could cut interest rates soon.

The FTSE 100 UKX, +1.13% climbed 1.1% to 6,577.83, with just 15 shares ending in the red. Friday's close marked the fourth straight win for the index, and a second consecutive day at a new high for 2016. The benchmark on Thursday ended the first quarter with a rise of 5.3%.

U.S. stocks booked a fourth straight daily gain Friday, and the Dow and S&P 500 marked their best week this year as stocks clawed back some of the losses scored in the wake of the tumult that followed the U.K.'s decision last week to sever ties with the European Union.

Better-than-expected manufacturing data combined with fading worries about the Brexit, or British exit from the EU, stoked appetite for equities.

Although marked by choppy trade, the Dow Jones Industrial Average DJIA, +0.11% rose 19.38 points, or 0.1%, to finish at 17,949.37. Home Depot Inc. shares, up 1.5%, led blue-chip advancers. The Dow came within a whisker of its pre-Brexit close of 18,011 before retreating in the afternoon.

Asian shares shrugged off early losses and edged higher on Monday, while the Australian dollar was under pressure after no clear winner emerged from a weekend election.

Activity across much of the region was subdued ahead of the U.S. Independence Day holiday, when financial and commodity markets will be closed.

Investors also continued to take stock of the potential financial market and economic fallout from the Brexit vote after days of volatile trade that followed in its wake.

While Australian politics usually have a muted impact on broader markets, the vote count so far suggests possible policy paralysis ahead which could pose a threat to the country's triple A credit rating.

But both Australian shares and the country's currency turned higher after Moody's Investors Service said short-lived political uncertainty would have limited implications for the country's coveted triple-A credit rating.

-

04:02

Nikkei 225 15,698.73 +16.25 +0.10 %, Hang Seng 20,963 +168.63 +0.81 %, Shanghai Composite 2,923.73 -8.75 -0.30 %

-

03:31

Australia: ANZ Job Advertisements (MoM), June 0.5%

-

03:30

Australia: Building Permits, m/m, May -5.2% (forecast -3.3%)

-

03:16

Australia: MI Inflation Gauge, m/m, June 0.6%

-

01:00

Commodities. Daily history for Jul 01’2016:

(raw materials / closing price /% change)

Oil 49.28 +0.59%

Gold 1,344.90 +0.44%

-

01:00

Stocks. Daily history for Jun Jul 01’2016:

(index / closing price / change items /% change)

Nikkei 225 15,682.48 +106.56 +0.68 %

Hang Seng 20,794.37 +358.25 +1.75 %

S&P/ASX 200 5,246.61 +13.23 +0.25 %

Shanghai Composite 2,932.82 +3.22 +0.11 %

FTSE 100 6,577.83 +73.50 +1.13 %

CAC 40 4,273.96 +36.48 +0.86 %

Xetra DAX 9,776.12 +96.03 +0.99 %

S&P 500 2,102.95 +4.09 +0.19 %

NASDAQ Composite 4,862.57 +19.89 +0.41 %

Dow Jones 17,949.37 +19.38 +0.11 %

-

00:59

Currencies. Daily history for Jul 01’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1138 +0,32%

GBP/USD $1,3275 -0,08%

USD/CHF Chf0,9727 -0,35%

USD/JPY Y102,53 -0,73%

EUR/JPY Y114,16 -0,45%

GBP/JPY Y136,1 -0,83%

AUD/USD $0,7497 +0,75%

NZD/USD $0,7171 +0,61%

USD/CAD C$1,2909 -0,31%

-