Noticias del mercado

-

17:51

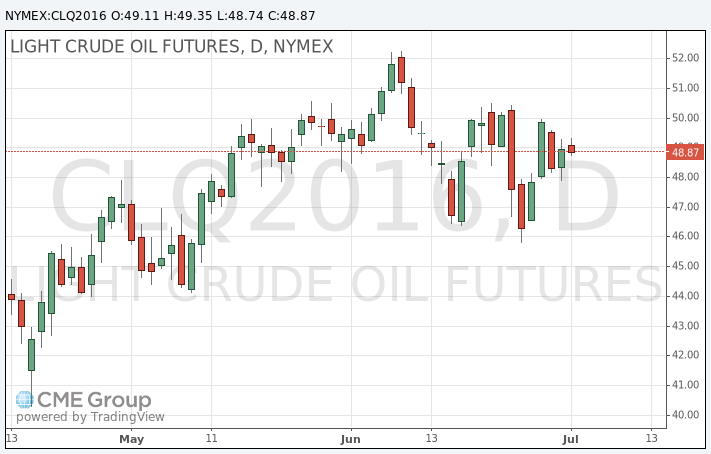

Oil price traded in a tight range today

During today's trading oil fluctuated in a narrow range as market players monitor the supply disruptions around the world to find the instructions to change the balance in the oil market (accumulation).

Militant group "Avengers Niger Delta" has claimed responsibility for the five new attacks on Nigeria's oil industry facilities on the weekend, that negate all the efforts of the Government to ensure the ceasefire agreement.

Trading volumes are low, as US markets are closed for Independence Day.

Crude oil futures for Brent jumped last week $ 1.92, or 4.01%, showing the best weekly trend over the past month, amid concerns on oil demand and Brexit.

WTI rose last week $ 1.18, or 2.83%, showing the first weekly gain in three weeks.

Signs of a potential recovery of production levels inhibit the growth of prices. On Friday, oil services provider Baker Hughes said that the number of drilling rigs in the US increased by 11 to 341, noting a fourth weekly gain in the past five weeks.

Growing drilling activity in the US has increased speculation that production may increase in the coming weeks, renewing concerns about excess inventories.

The cost of the August futures for US light crude oil WTI fell to 48.74 dollars per barrel.

September futures price for North Sea petroleum Brent fell to 50.03 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:33

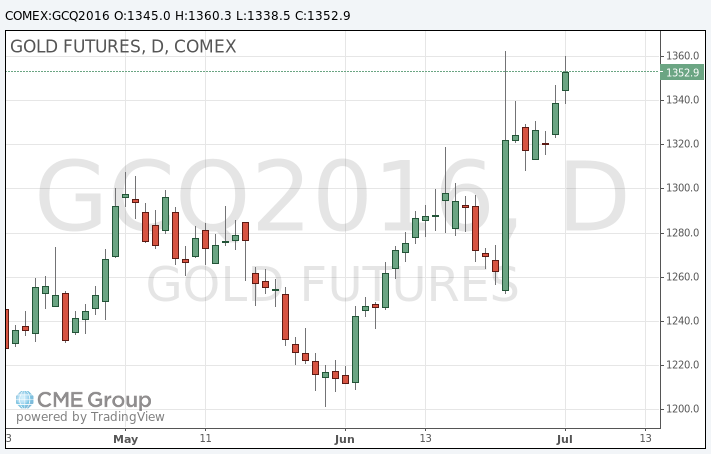

Gold price near two-year high

Gold prices continue to rise, trading close to 2 year high, while silver soared to July2014 highs.

On Monday, US financial markets are closed for the celebration of Independence Day, resulting in lower trading volumes. Tomorow conditions will return to normal.

Weekly, gold futures rose $ 16.70, or 1.27%, showing weekly gain for the fifth time in a row. In June, the precious metal has risen in price by almost 9%, becoming the largest monthly increase since February. So far this year, prices rose almost 25%, ending six months of record growth.

Gold is a good trading idea supported in recent sessions by the backdrop of fading Fed hikes expectations, while investors continue to assess the political and economic consequences of Brexit.

The precious metal rose a little more than two-year high of $ 1362.60 on 24 June after the shocking results of the UK referendum, leading to the withdrawal from the EU, forcing investors to turn to safe assets.

Market participants completely ruled out the possibility of further Fed raising interest rates this year In fact, some traders even expcet a small cut in the key Fed rate until the end of the year.

According to CME FedWatch, now there probability of a Fed rate hike is 0 in July and 3% chance of a rate cut.

The cost of the August gold futures on the COMEX rose to $ 1360.3 per ounce.

-

09:16

Oil increased in early trading

This morning, New York crude oil futures WTI rose by 0.29% to $ 49.13 per barrel. At the same time, crude oil futures for Brent rose by 0.38% to $ 50.54 per barrel. Thus, the black gold is gaining on the background of rising fuel demand from car owners in the United States in the summer. In addition, the strike in Norway stopped after the signing of a weekend labor agreement between unions and employers. Analysts believe that the oil market as a whole remain favorable for further price recovery.

-

01:00

Commodities. Daily history for Jul 01’2016:

(raw materials / closing price /% change)

Oil 49.28 +0.59%

Gold 1,344.90 +0.44%

-