Noticias del mercado

-

17:47

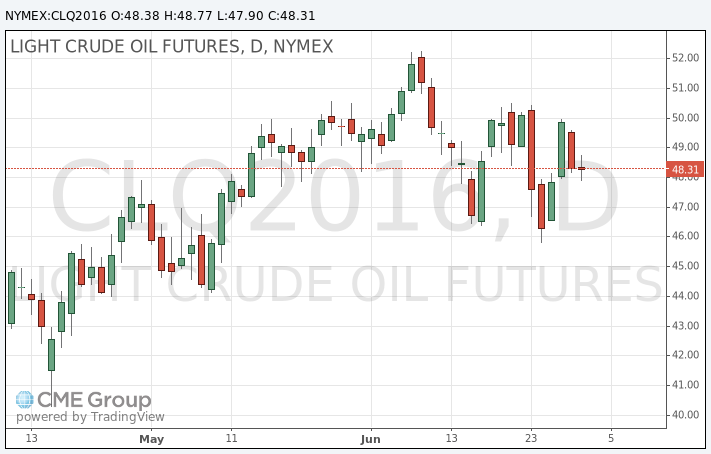

OIL prices decreased slightly

Oil prices fall as fears of a glut of world reserves resumed on the background of output growth in Nigeria and Canada.

Oil prices fell as production in Nigeria is slowly recovering in the absence of new threats and attacks which on June 16 reduced the production of raw materials to the lowest level in the last 30 years.

Production from Canada also shows growth after massive forest fires, because of which production in Alberta ceased in the past two months.

In addition, Reuters survey found that OPEC production in June rose to a record volume of 32.82 million barrels per day.

Meanwhile, investors remain cautious as markets continue to recover from the shocking results of voting in the UK last week, which resulted in the country leaving the European Union.

Sentiment in the markets also deteriorated after Friday data showed that China's PMI index for the production sector fell to 48.6 in June from 49.2 in the previous month.

The official PMI indicator for the production sector in China fell to 50.0 last month from 50.1 in May, in line with expectations.

The cost of the August futures for US light crude oil WTI fell to 47.90 dollars per barrel.

September futures price for Brent fell to 49.25 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:25

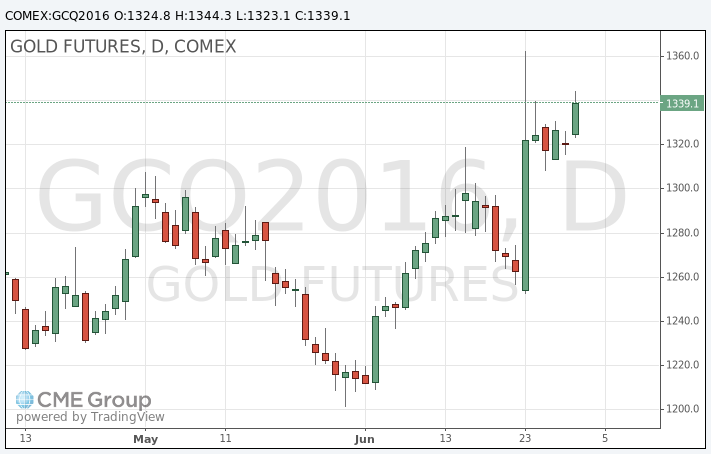

Gold price rose

Gold price rose as weak economic data in China and the effects of Brexit increased demand for the metal as a safe-haven asset.

The official Chinese purchasing managers' index for the production sector in June fell to 50.0, while the previous three months, the index was above 50, indicating a growth of activity in the sector. Managers' Index Caixin in June was 48.6 against 49.2 in May, demonstrating the most significant drop in 4 months.

In addition, concerns about the political and economic uncertainty after the British decision to withdraw from the European Union continues to strengthen demand for gold.

Data for the Chinese manufacturing industry, published on Friday, strengthened the feeling that the prospects for global economic growth are deteriorating, said Matthew Turner, analyst at Macquarie. The deterioration in the global economy makes it less likely the Fed raising interest rates in the coming months, traders believe.

"After the British referendum, taking into account some not very positive economic data, observers expect a longer maintenance of low interest rates, and this is positive for the precious metals," - Turner said.

Higher interest rates usually put pressure on gold, which become less atractive against a background of higher-yielding instruments.

Over the past six months the price of gold showed the most significant growth since 2007, amid doubts about the sustainability of the global economy and in view of the negative interest rates in different countries. During this period, gold has risen in price in 2016 to 26%.

The cost of the August gold futures on COMEX rose to $ 1344.3 per ounce.

-

00:33

Commodities. Daily history for Jun 30’2016:

(raw materials / closing price /% change)

Oil 48.40 -2.97%

Gold 1,324.70 +0.31%

-