Noticias del mercado

-

17:47

Oil prices fall

Oil prices have decreased today while investors are closely watching the Brexit uncertainties.

Earlier today, the former mayor of London, Boris Johnson, suddenly abandoned the race for the post of the next prime minister of Great Britain, which was another surprise against the backdrop of a faltering political stability in the country after the last week's vote.

Meanwhile on Thursday, Justice Minister Michael Gove, one of the main instigators of Brexit, said he intends to become prime minister. Interior Minister Theresa May, primarily in favor of keeping membership in the EU, announced that enter into the struggle for the post of leader of the ruling Conservative Party.

A day earlier, prices in New York WTI for August delivery rose $ 2.03, or 4.24%, showing the largest gain since April, after the weekly statistics showed a sharp decline in US crude inventories last week, while oil production rate continued to decline.

According to the US Energy Information Administration, the total crude oil inventories fell last week by 4.1 million barrels to 526.6 million, compared with expectations of a reduction of 2.4 million barrels.

At the same time, the volume of daily oil production in the US as of last week was 8.62 million barrels, compared with a peak of more than 9.6 million barrels last year.

Fears of a sharp reduction in production due to the impending strike in Norway's oil sector eased as the volume of supplies from the main producer in the North Sea will be reduced by only 7% in the case of the start of the strike, according to the Norwegian Petroleum Directorate.

About 755 workers at seven oil and gas fields are planning to go on strike from Saturday, if before the deadline on Friday is not reached a new agreement on wages.

The cost of the August futures for US light crude oil WTI fell to 48.56 dollars per barrel.

The price of August futures for Brent fell to 49.95 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:30

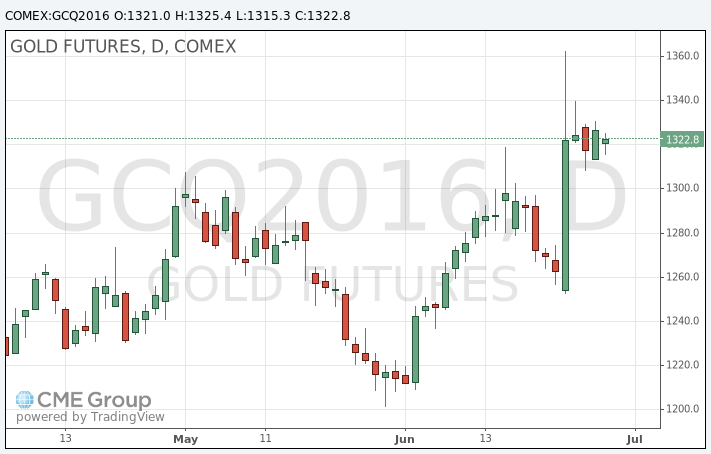

Gold prices rose moderately, while the broader markets showed signs of stabilization

Gold can have the maximum monthly gain since February, due to the British decision to withdraw from the European Union last week.

Last Friday, the price of the yellow metal jumped to a 27-month high of $ 1,362.60 on the unexpected decision of the UK to leave the European Union, so that investors have turned to gold and other safe assets.

News triggered fears that other countries can withdraw from the block, and global growth will be under considerable pressure, while the actual time frame of Brexit remain unclear.Britain has so far refrained from Article 50.

Gold was supported as market players exclude further interest rate rise.. Moreover, the futures market is not considering raising interest rates this year and began to price in the likelihood of a rate cut.

According Fed Watch service group CME, currently the chance of a rate increase in July estimated at 0%, and probability of lowering rate is estimated at 3%.

The assets of the world's largest gold exchange-traded fund (ETF) SPDR Gold Trust rose by 2.7 tonnes to a maximum of three years.

Gold from the beginning of the month has added 8.6% in value. Silver, which has risen in price by about 19%, can show the best quarter in nearly four years.

The cost of the August gold futures on COMEX rose to $ 1325.4 per ounce.

-

15:31

OPEC output rises to 32.82 mbpd in June - Reuters

According to a survey from Reuters:

- June output up 250 kbpd.

- Output led by Nigeria, Iran, Saudi Arabia and UAE.

- Higher output held back by lower production in Iraq and Venezuela.

-

10:55

Oil falls in early trading

This morning, New York crude oil futures for WTI fell 1.36% to $ 49.20 per barrel and Brent oil futures were down -1.34% to $ 50.63 per barrel. Thus, the black gold is down, on the background of latest news. The strike of workers in the oil and gas industry in Norway and improvement the situation with production in Nigeria undermine the prices. In Nigeria due to attacks on the country's oil infrastructure, oil production fell to 600,000 barrels per day. In addition, because of forest fires in Canada, oil production fell 1.5 million barrels per day, according to analysts at Goldman Sachs. According to the Energy Information Administration (EIA) data released on Wednesday, US oil inventories fell by 4.05 million barrels to 526.57 million barrels, while analysts had expected a decrease of 2.37 million.

-

00:25

Commodities. Daily history for Jun 29’2016:

(raw materials / closing price /% change)

Oil 49.54 -0.68%

Gold 1,321.80 -0.38%

-