Noticias del mercado

-

22:15

U.S. stocks advanced

U.S. stocks advanced amid a global rally, with the S&P 500 Index posting its strongest two-day climb in four months, as tension eased over the impact of a U.K. exit from the European Union.

Fears that Britain's EU withdrawal will further stymie global growth continued to ebb, soothed by speculation policy makers will counter the effects. Energy shares capped their best two days since March as crude jumped. A Goldman Sachs Group Inc. basket of the most shorted shares in the Russell 3000 Index saw its biggest surge since 2009, while the Dow Jones Industrial Average stretched its rebound to more than 550 points since Monday's close.

With Britain in limbo as EU leaders gathered in Brussels to discuss the nation's withdrawal from the bloc, traders have pushed back bets on Federal Reserve interest-rate increases, indicating higher borrowing costs are unlikely before 2018. Meanwhile, a majority of economists surveyed by Bloomberg predict that the Bank of England will add more stimulus, including cutting rates in the third quarter.

Equities recovered for a second session after two days of heavy selling sparked by the Brexit decision last week wiped $3.6 trillion from global equities. The S&P 500 had tumbled 5.3 percent to briefly erase its 2016 advance, and has since cut its post-vote drop by more than half. The CBOE Volatility Index slid for a third day, the longest in two weeks. The measure of market turbulence known as the VIX dropped 11 percent Wednesday to 16.64, the lowest since June 9.

Investors are looking to policy makers for support as they await Britain's plan for its extrication from the EU. While European Central Bank President Mario Draghi called for global policy alignment, South Korea announced a fiscal stimulus package on Tuesday and Bank of Japan Chief Haruhiko Kuroda said Wednesday that more funds can be injected into the market should they be needed.

-

21:01

DJIA 17911.57 216.89 1.23%, NASDAQ 4833.69 54.44 1.14%, S&P 500 2096.19 25.42 1.23%

-

18:42

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Thursday as consumer staples stocks rose after reports that Oreo cookies maker Mondelez had made a bid to buy Hershey Co. The three major indexes have recouped more than half of the losses suffered after a shock vote by Britain to leave the European Union. In a two-day panic selloff after the vote, global markets lost about $3 trillion in value.

Almost all Dow stocks in positive area (28 of 30). Top looser - Visa Inc. (V, -2,40%). Top gainer - General Electric Company (GE, +2,27%).

All S&P sectors in positive area. Top gainer - Consumer goods (+1,6%).

At the moment:

Dow 17775.00 +151.00 +0.86%

S&P 500 2082.75 +16.00 +0.77%

Nasdaq 100 4396.00 +33.25 +0.76%

Oil 48.82 -1.06 -2.13%

Gold 1320.30 -6.60 -0.50%

U.S. 10yr 1.46 -0.02

-

18:00

European stocks closed: FTSE 6504.33 144.27 2.27%, DAX 9680.09 67.82 0.71%, CAC 4237.48 42.16 1.00%

-

17:47

Oil prices fall

Oil prices have decreased today while investors are closely watching the Brexit uncertainties.

Earlier today, the former mayor of London, Boris Johnson, suddenly abandoned the race for the post of the next prime minister of Great Britain, which was another surprise against the backdrop of a faltering political stability in the country after the last week's vote.

Meanwhile on Thursday, Justice Minister Michael Gove, one of the main instigators of Brexit, said he intends to become prime minister. Interior Minister Theresa May, primarily in favor of keeping membership in the EU, announced that enter into the struggle for the post of leader of the ruling Conservative Party.

A day earlier, prices in New York WTI for August delivery rose $ 2.03, or 4.24%, showing the largest gain since April, after the weekly statistics showed a sharp decline in US crude inventories last week, while oil production rate continued to decline.

According to the US Energy Information Administration, the total crude oil inventories fell last week by 4.1 million barrels to 526.6 million, compared with expectations of a reduction of 2.4 million barrels.

At the same time, the volume of daily oil production in the US as of last week was 8.62 million barrels, compared with a peak of more than 9.6 million barrels last year.

Fears of a sharp reduction in production due to the impending strike in Norway's oil sector eased as the volume of supplies from the main producer in the North Sea will be reduced by only 7% in the case of the start of the strike, according to the Norwegian Petroleum Directorate.

About 755 workers at seven oil and gas fields are planning to go on strike from Saturday, if before the deadline on Friday is not reached a new agreement on wages.

The cost of the August futures for US light crude oil WTI fell to 48.56 dollars per barrel.

The price of August futures for Brent fell to 49.95 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:42

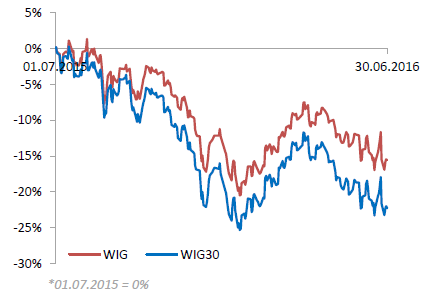

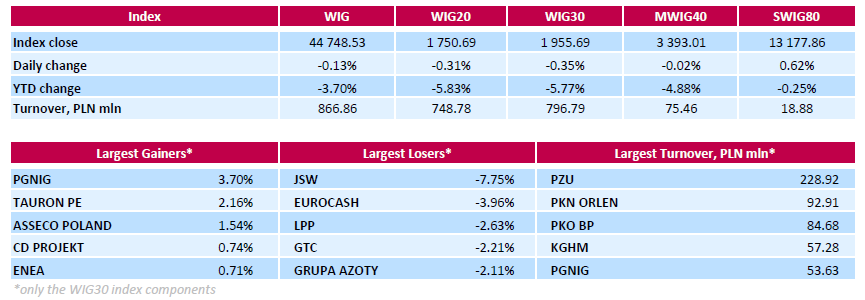

WSE: Session Results

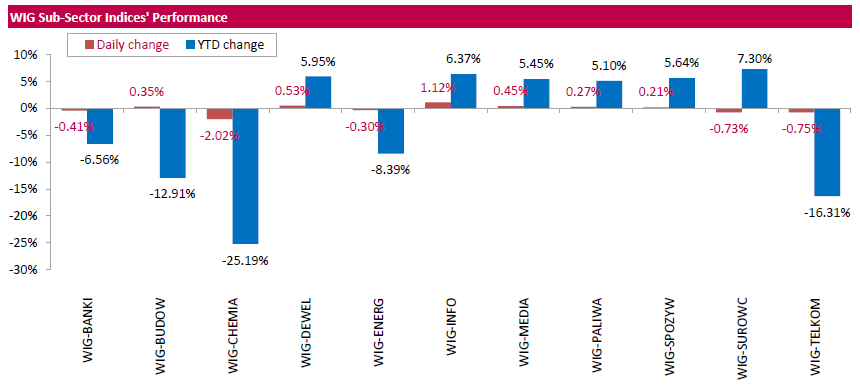

Polish equity market closed lower on Thursday. The broad measure, the WIG index, recorded a 0.13% drop. Sector-wise, chemicals (-2.02%) recorded the worst result, while information technology (+1.12%) was the best performing group.

The large-cap stocks fell by 0.35 %, as measured by the WIG30 Index. In the index basket, coking coal miner JSW (WSE: JSW) posted the sharpest decline of 7.75%, dragged down by the announcement the company will sell its WZK Victoria mine for PLN 350 mln ($88 mln) as it continues to struggle with falling coal prices. The other notable losers were FMCG-wholesaler EUROCASH (WSE: EUR), clothing retailer LPP (WSE: LPP) and property developer GTC (WSE: GTC), which plunged by 3.96%, 2.63% and 2.21% respectively. On the other side of the ledger, oil and gas producer PGNIG (WSE: PGN) led the gainers, rising 3.7%. It was followed by genco TAURON PE (WSE: TPE) and IT-company ASSECO POLAND (WSE: ACP), advancing by 2.16% and 1.54% respectively.

-

17:30

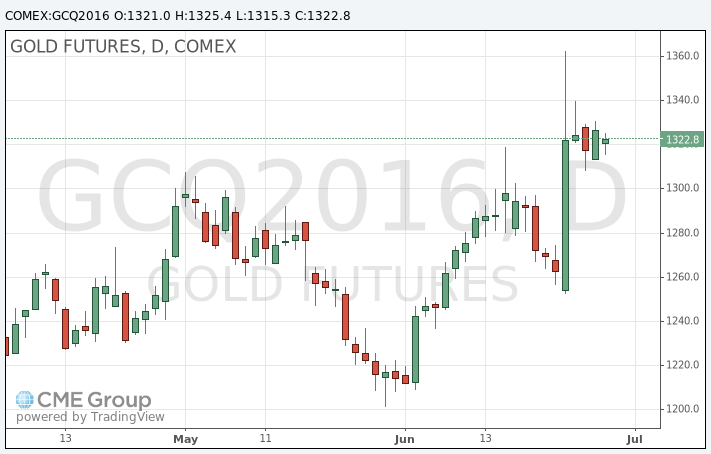

Gold prices rose moderately, while the broader markets showed signs of stabilization

Gold can have the maximum monthly gain since February, due to the British decision to withdraw from the European Union last week.

Last Friday, the price of the yellow metal jumped to a 27-month high of $ 1,362.60 on the unexpected decision of the UK to leave the European Union, so that investors have turned to gold and other safe assets.

News triggered fears that other countries can withdraw from the block, and global growth will be under considerable pressure, while the actual time frame of Brexit remain unclear.Britain has so far refrained from Article 50.

Gold was supported as market players exclude further interest rate rise.. Moreover, the futures market is not considering raising interest rates this year and began to price in the likelihood of a rate cut.

According Fed Watch service group CME, currently the chance of a rate increase in July estimated at 0%, and probability of lowering rate is estimated at 3%.

The assets of the world's largest gold exchange-traded fund (ETF) SPDR Gold Trust rose by 2.7 tonnes to a maximum of three years.

Gold from the beginning of the month has added 8.6% in value. Silver, which has risen in price by about 19%, can show the best quarter in nearly four years.

The cost of the August gold futures on COMEX rose to $ 1325.4 per ounce.

-

17:05

Bank of England Governor, Mark Carney says that stimulus likely to be needed

- some monetary policy stimulus likely to be needed over summer.

- economic outlook worse.

- MPC will make initial assessment at July 14th meeting and make a decision at August meeting.

- uncomfortable truth that the BOE cannot fully offset a large economic shock from leaving the EU.

So rate cuts or QE from Bank of England this summer. This will add to the already high pound volatility.

-

17:03

Sharp move down on Gbp pairs as Carney starts the speech

-

17:01

IMF: Brexit uncertainty may be the biggest risk to the global economy

- Brexit is likely to dampen UK, EU and global growth.

- Central banks have provided support by providing liquidity to calm markets.

- recent market moves have been large but not excessively disorderly.

-

16:33

Long Usd/Cad: an opportunity to express structural view in risk-neutral way - Credit Agricole

The post-Brexit trading range in USD/CAD has been "just" 3.2%, among the narrowest in the G10. In our view, this relative insensitivity to the EU/UK headlines offers an opportunity to express a fundamental view in a more risk-neutral way.

We are bullish on USDCAD as we see the forces that supported the Canadian currency in H1 (rising oil prices, receding BoC easing expectations and an unwind of short positioning) as largely reversing in the second half of the year. Furthermore, US politics are a particular risk factor that may ultimately turn out to be more important than Brexit, given the ramping up of protectionist rhetoric and open criticism of NAFTA from one of the presumed Presidential candidates.

We remain long USDCAD via a ratio call spread in our portfolio.

-

16:04

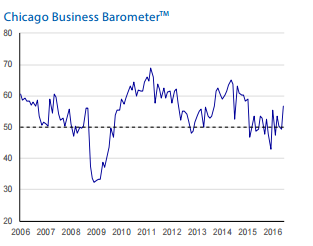

US Chicago PMI increased significantly

The MNI Chicago Business Barometer rose 7.5 points to 56.8 in June from 49.3 in May, the highest since January 2015, led by strong gains in New Orders and Production. June's rebound was just enough to offset the previous two months of weakness, leaving the Barometer broadly unchanged over the quarter at an average of 52.2 in Q2 compared with 52.3 in Q1.

New Orders increased sharply on the month to thehighest since October 2014, while Order Backlogs rose to the highest since March 2011, breaking a 16-month run of below 50 readings. Production also ncreased significantly to the highest since January 2016.

-

15:55

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1000 (EUR 1.1bln) 1.1050 (469m) 1.1100 (416m)

GBPUSD 1.3500 ( GBP 1.25bln)

USDCAD 1.2900 (USD 621m) 1.2995-1.3000 (1.1bln) 1.3100 (692m)

NZDUSD 0.6875 (NZD 741m) 0.6900 (1.0bln) 0.6925 (490m)

-

15:50

WSE: After start on Wall Street

In the afternoon we met weekly number of applications for unemployment benefits in the US, which increased by 10k., what is translated as the end of the school year. The same level remains low and does not bring anything new to the situation on the market.

American stock indexes after the start of trading on Wall Street rose slightly after two days of considerable growth. This situation with the Americans does not significantly affect the atmosphere of European parquets and we do not see any movement on the indices.

Volatility in our market is still small and the index of the largest companies stays in the vicinity of 1,750 points.

-

15:49

Company news: Bank of America (BAC) confirmed the intention to increase the quarterly dividends by 50%

The Bank of America reported that the company's board of directors plans to increase the quarterly dividend on common shares by 50% to $ 0.075/share, since the third quarter of 2016.

In addition, the Board approved to carry out buy back in the amount of $ 5 billion, in the period from July 1, 2016 at June 30, 2017, 50% more than was agreed last year.

BAC's shares rose in premarket trading to $ 13.33 (+ 1.06%).

-

15:45

U.S.: Chicago Purchasing Managers' Index , June 56.8 (forecast 50.7)

-

15:33

U.S. Stocks open: Dow +0.14%, Nasdaq +0.17%, S&P +0.15%

-

15:31

OPEC output rises to 32.82 mbpd in June - Reuters

According to a survey from Reuters:

- June output up 250 kbpd.

- Output led by Nigeria, Iran, Saudi Arabia and UAE.

- Higher output held back by lower production in Iraq and Venezuela.

-

15:28

Before the bell: S&P futures +0.04%, NASDAQ futures +0.03%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 15,575.92 +9.09 +0.06%

Hang Seng 20,794.37 +358.25 +1.75%

Shanghai Composite 2,929.61 -1.99 -0.07%

FTSE 6,366.94 +6.88 +0.11%

CAC 4,208.08 +12.76 +0.30%

DAX 9,606.57 -5.70 -0.06%

Crude $48.85 (-2.06%)

Gold $1321.40 (-0.21%)

-

15:24

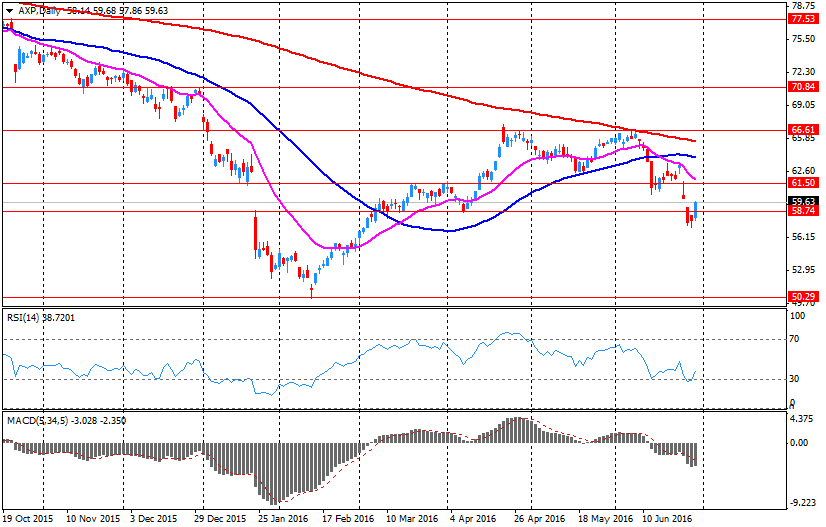

Company News: American Express (AXP) plans to increase its quarterly dividend by 10% and buy back for up to $ 3.3 billion.

The American Express (AXP) reported that the Federal Reserve does not object to the plan for the capital of the company as set out in the program of comprehensive inspection and analysis of capital adequacy (CCAR). This plan includes the following items: 1) an increase in the quarterly dividend of up to $ 0.32 per share from the third quarter of 2016; 2) an increase in repurchase ordinary shares up to $ 3.3 billion in the period from the third quarter of 2016 to the second quarter of 2017. Thus, the entire company will be able to buy back shares worth about $ 4.4 bn, including the redemption of approximately $ 1.7 billion.

AXP shares fell in premarket trading to $ 59.20 (-0.72%).

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.2

0.10(1.0989%)

61207

3M Co

MMM

171.51

-0.01(-0.0058%)

130

ALTRIA GROUP INC.

MO

68.07

0.24(0.3538%)

1724

Amazon.com Inc., NASDAQ

AMZN

717

1.40(0.1956%)

12515

American Express Co

AXP

59.5

-0.13(-0.218%)

8636

AMERICAN INTERNATIONAL GROUP

AIG

51.71

0.25(0.4858%)

3210

Apple Inc.

AAPL

94.2

-0.20(-0.2119%)

63298

AT&T Inc

T

42.7

0.16(0.3761%)

17511

Barrick Gold Corporation, NYSE

ABX

20.93

0.16(0.7703%)

47172

Boeing Co

BA

127.49

0.50(0.3937%)

165

Caterpillar Inc

CAT

74

-0.23(-0.3098%)

570

Chevron Corp

CVX

103.42

-0.00(-0.00%)

810

Cisco Systems Inc

CSCO

28.35

0.09(0.3185%)

6973

Citigroup Inc., NYSE

C

42.61

0.49(1.1633%)

242521

Exxon Mobil Corp

XOM

92.35

-0.11(-0.119%)

3750

Facebook, Inc.

FB

114.07

-0.09(-0.0788%)

63803

FedEx Corporation, NYSE

FDX

151.01

0.75(0.4991%)

3201

Ford Motor Co.

F

12.57

0.02(0.1594%)

10168

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.89

0.12(1.1142%)

238249

General Electric Co

GE

30.61

0.06(0.1964%)

34222

General Motors Company, NYSE

GM

28.17

0.00(0.00%)

1156

Goldman Sachs

GS

146.58

1.08(0.7423%)

9056

Google Inc.

GOOG

685.01

0.90(0.1316%)

2663

Home Depot Inc

HD

126.76

-0.61(-0.4789%)

2970

Intel Corp

INTC

32.09

0.16(0.5011%)

6232

International Business Machines Co...

IBM

148.26

-0.20(-0.1347%)

386

Johnson & Johnson

JNJ

119.1

-0.23(-0.1927%)

1267

JPMorgan Chase and Co

JPM

61.7

0.50(0.817%)

46237

McDonald's Corp

MCD

120.3

0.81(0.6779%)

1167

Microsoft Corp

MSFT

50.55

0.01(0.0198%)

3507

Nike

NKE

55.21

0.08(0.1451%)

18274

Pfizer Inc

PFE

35.03

0.02(0.0571%)

755

Procter & Gamble Co

PG

84.02

0.11(0.1311%)

2119

Starbucks Corporation, NASDAQ

SBUX

56.98

0.24(0.423%)

230

Tesla Motors, Inc., NASDAQ

TSLA

212.99

2.80(1.3321%)

35737

Twitter, Inc., NYSE

TWTR

16.7

-0.13(-0.7724%)

64554

UnitedHealth Group Inc

UNH

140.96

0.44(0.3131%)

136

Verizon Communications Inc

VZ

55.15

0.09(0.1635%)

2899

Visa

V

76.8

0.06(0.0782%)

458

Wal-Mart Stores Inc

WMT

72.55

0.09(0.1242%)

2967

Walt Disney Co

DIS

97.15

0.17(0.1753%)

1204

Yahoo! Inc., NASDAQ

YHOO

36.95

0.09(0.2442%)

230

Yandex N.V., NASDAQ

YNDX

21.22

-0.25(-1.1644%)

2150

-

14:40

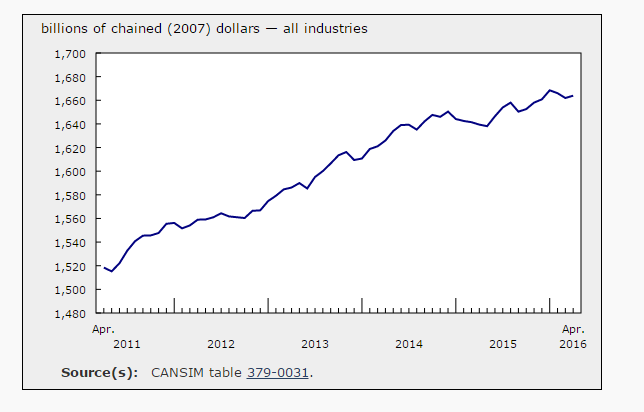

Canada Gross Domestic Product stable at 0.1%

After decreasing in February and March, real gross domestic product edged up 0.1% in April. Widespread gains, notably in manufacturing, utilities and the public sector, were largely offset by a significant decline in non-conventional oil extraction.

Service-producing industries rose 0.2% in April, after being essentially unchanged in March. Notable gains were posted by the public sector (education, health and public administration combined), the finance and insurance sector, and wholesale and retail trade. In contrast, the arts, entertainment and recreation sector notably declined.

The output of goods-producing industries edged down 0.1% in April, mainly as a result of a decrease in mining, quarrying, and oil and gas extraction. Manufacturing and utilities posted notable increases, while the agriculture and forestry sector was down.

Mining, quarrying, and oil and gas extraction fell for a third consecutive month in April, declining 1.4%.

After two consecutive monthly decreases, manufacturing output rose 0.4% in April.

-

14:35

Unemployment claims in US continue the down trend

In the week ending June 25, the advance figure for seasonally adjusted initial claims was 268,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 259,000 to 258,000. The 4-week moving average was 266,750, unchanged from the previous week's revised average. The previous week's average was revised down by 250 from 267,000 to 266,750.

There were no special factors impacting this week's initial claims. This marks 69 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

-

14:30

Canada: Industrial Product Price Index, m/m, May 1.1% (forecast 0.4%)

-

14:30

U.S.: Initial Jobless Claims, June 268 (forecast 267)

-

14:30

Canada: Industrial Product Price Index, y/y, May -1.1%

-

14:30

Canada: GDP (m/m) , April 0.1% (forecast 0.1%)

-

14:30

U.S.: Continuing Jobless Claims, June 2120 (forecast 2150)

-

13:51

Boris Johnson pulls out of race to be UK prime minister

According to cnbc, in a further twist to the U.K.'s political fallout following the vote to leave the European Union, former London Mayor Boris Johnson has ruled himself out of the race to be the U.K.'s next prime minister.

Several high-profile members of the U.K.'s ruling Conservatives had thrown their hats into the ring Thursday to become the next leader of the party, prime minister and chief negotiator for Britain's future in Europe.

-

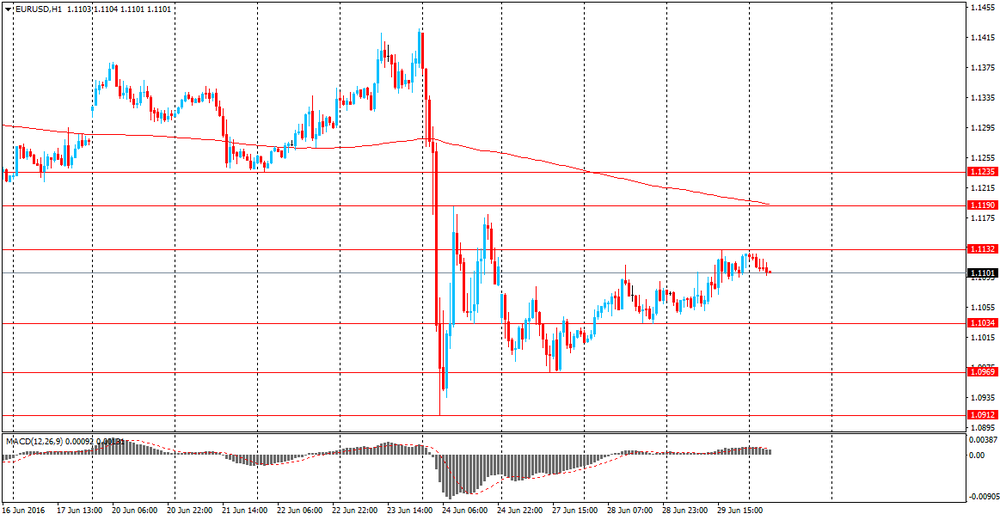

13:49

Orders

EUR/USD

Offers 1.1125-30 1.1150 1.1170 1.1200 1.1200 1.1230-40 1.1280 1.1300

Bids 1.1075-80 1.1050-55 1.1025-30 1.1000 1.0975-80 1.0930 1.0900

GBP/USD

Offers 1.3475-80 1.3500 1.3520 1.3535 1.3550 1.3580 1.3600

Bids 1.3420 1.3400 1.3380 1.3345-50 1.3330 1.3280 1.3255-60 1.3230 1.3200

EUR/GBP

Offers 0.8285 0.8300 0.8320 0.8330-35 0.8350 0.8370-75 0.8400

Bids 0.8250 0.8230 0.8200-0.8195 0.8165 0.8150 0.8130 0.8100

EUR/JPY

Offers 114.50 114.80 115.00 115.30 115.50 116.00

Bids 114.00 113.80 113.60 113.30 113.00 112.55-60 112.30-35 112.00

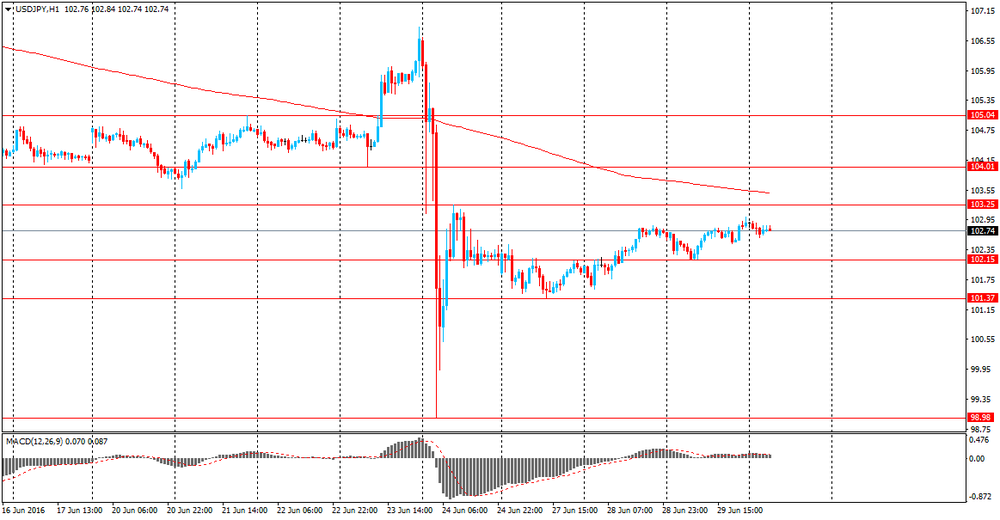

USD/JPY

Offers 102.80 103.00 103.20-25 103.50 103.85 104.00

Bids 102.45-50 102.20-25 102.00 101.80 101.65 101.50 101.20-25 101.00

AUD/USD

Offers 0.7450-55 0.7475-80 0.7500 0.7520 0.7550

Bids 0.7400 0.7375 0.7360 0.7325-30 0.7300 0.7285 0.7265 0.7230 0.7200

-

13:22

WSE: Mid session comment

Today's Annual General Meeting of PZU decided that the dividend for 2015 years hit PLN 1.8 billion, which will give PLN 2,08 per share. The adopted resolution is in line with the recommendation of the board. The record date is 30 September, with payout on October 21, 2016 year. This decision had a positive impact on the valuation of PZU shares, which were still one of the weakest components among the blue chips. Currently PZU rate increases by 0.95%. Generally, southern phase of the trading takes place peacefully. After a morning decline and subsequent rebound volatility on the Warsaw local market is not great. The WIG20 index lost about 0.5% with turnover at the level of PLN 280 mln.

-

12:46

-

12:43

Major stock indices in Europe recover

European stocks are trading with a moderate increase, aided by fading fears about the long-term consequences of Brexit.

Yesterday, EU's Tusk confirmed that Britain not officially notified the EU of its intention to withdraw from the Union and there are no negotiations on any future relationship. Meanwhile, German Chancellor Merkel said that it is difficult to determine the future relations of Great Britain and the EU, but for the single European market will be a tangible loss.

However, experts of the International Monetary Fund warned that the expected British withdrawal from the EU bears the risk of reducing the economic outlook in Germany. "Britain is an important economic partner for Germany and the change in the economic relations between the largest economie in Europe and the second largest member of it can not go unnoticed". Earlier, the IMF published a forecast for GDP growth in Germany, raising the estimate for 2016 by 0.2% to 1.7% of GDP. However, the forecast for 2017 was lowered by 0.1 percentage points to 1.5%.

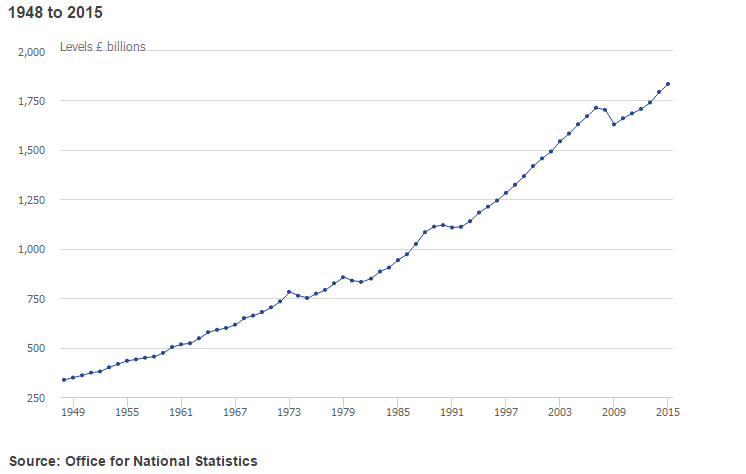

Support for indices also provides statistics on Britain and the euro zone. Final data provided by ONS showed that UK GDP grew by 0.4 percent in the first quarter, confirming the last assessment and forecasts. Consumer spending rose by 0.7% (the fastest pace in almost a year), while exports fell by 0.4% and business investment declined by 0.6%. The services sector - a large part of the economy - grew by 0.6%. Overall, GDP growth slowed down in comparison with the 4th quarter, when economic expansion of 0.7% was recorded. In annual terms, GDP grew by 2.0% in the 1st quarter 2015, after rising 1.8% in the 4th quarter (revised from + 2.1%). Last change coincided with forecasts.

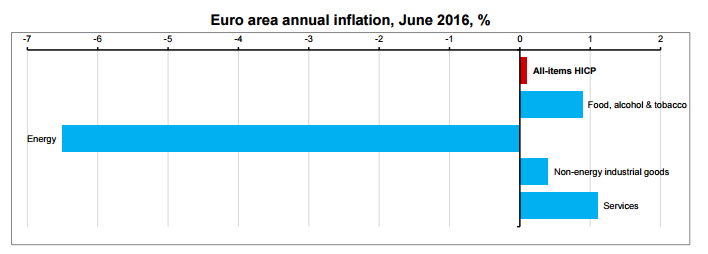

However, a preliminary report from the Eurostat showed that in June, consumer prices in the eurozone rose by 0.1% after falling 0.1% last month. Analysts had expected the index to remain unchanged. Higher prices were recorded for the first time in five months. Meanwhile, the core consumer price index, which does not take into account the volatile energy and food prices, rose in June by 0.9%, which was slightly faster than in May (+ 0.8%), and more than forecasts ( +0.8 percent). The June rate growth was the highest since March 2016. The report also stated that prices of services recorded the largest growth in June - 1.1% versus + 1.0% in May. Meanwhile, the prices of food, alcohol and tobacco increased by 0.9% after a similar increase in May. The cost of non-energy industrial goods increased by 0.4% compared to 0.5% in May. Energy prices fell 6.5%, the pace has slowed sharply compared to May (-8.1%).

The composite index of the largest companies in the region, Stoxx Europe 600, up 0.2%, recovering all the early losses, which reached 0.9%. Since the beginning of the month the index fell by 5.8%, the worst result since January 2016. For the second quarter the index has lost about 3%.

Shares of mining companies shows the maximum growth among the 19 industry groups, aided by the increasing Anglo American Plc quotes and Glencore Plc.

Banks shares fall, mainly due to the falling value of Royal Bank of Scotland Group Plc. Today, Morgan Stanley downgraded the stock to 'hold'

The capitalization of Deutsche Bank AG fell 1.8 percent after it became known that the bank failed the stress tests conducted by the Federal Reserve. Shares of Banco Santander SA, which also did not meet the requirements of the Federal Reserve, fell 1.2 percent.

At the moment:

FTSE 100 6,386.21 +26.15 + 0.41%

CAC 40 4,217.19 +21.87 + 0.52%

DAX 9,622.24 +9.97 + 0.10%

-

11:49

Review of financial and economic press: former European Commissioner: There was a danger that the European Union will not survive

D/W

In an interview with DW journalist Tim Sebastian the former deputy chairman of the European Commission, former EU Commissioner for Enlargement and Neighbourhood Policy, Günter Verheugen said that Brexit was "producing healthy shock" for the EU, at the same time compromised the very existence of the union. "There was a clear risk that the European Union will not survive", - said Verheugen.

IMF: Brexit threatens the growth of the German economy

IMF experts say that the expected yield of the UK's exit carries the "risk reduction" of German economic prospects. "The United Kingdom is an important economic partner for Germany and the change in the economic relations between the largest economies in Europe and the second largest member of it can not go unnoticed," - IMF mission to Germany Enrico Detragiash.

The Prime Minister of Scotland: We want to stay in the EU

First Minister of Scotland Nicola Sturgeon believes that negotiations on the preservation of Scotland's place in the EU after Brexit will not be simple. "I can not underestimate the challenges facing us," - she said on Wednesday, in Brussels after meetings with leading European politicians.

Newspaper. ru

WSJ: IMF may lower GDP forecast for Germany due to Brexit

Assistant Director of the European Department of the International Monetary Fund Enrica Detredzhich said that the IMF plans to lower the forecast for GDP growth in Germany in 2016 in connection with the decision of the UK to leave the European Union, according to The Wall Street Journal.

Obama: Brexit become a barrier to investment in the UK and EU

-

11:07

Euro area annual inflation increased 0.1%

Euro area annual inflation is expected to be 0.1% in June 2016, up from -0.1% in May 2016, according to a flash estimate from Eurostat.

Looking at the main components of euro area inflation, services is expected to have the highest annual rate in June (1.1%, compared with 1.0% in May), followed by food, alcohol & tobacco (0.9%, stable compared with May), non-energy industrial goods (0.4%, compared with 0.5% in May) and energy (-6.5%, compared with -8.1% in May).

-

11:01

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 1.1bln) 1.1050 (469m) 1.1100 (416m)

GBP/USD 1.3500 ( GBP 1.25bln)

USD/CAD 1.2900 (USD 621m) 1.2995-1.3000 (1.1bln) 1.3100 (692m)

NZD/USD 0.6875 (NZD 741m) 0.6900 (1.0bln) 0.6925 (490m)

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, June 0.9% (forecast 0.8%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, June 0.1% (forecast 0%)

-

10:55

Oil falls in early trading

This morning, New York crude oil futures for WTI fell 1.36% to $ 49.20 per barrel and Brent oil futures were down -1.34% to $ 50.63 per barrel. Thus, the black gold is down, on the background of latest news. The strike of workers in the oil and gas industry in Norway and improvement the situation with production in Nigeria undermine the prices. In Nigeria due to attacks on the country's oil infrastructure, oil production fell to 600,000 barrels per day. In addition, because of forest fires in Canada, oil production fell 1.5 million barrels per day, according to analysts at Goldman Sachs. According to the Energy Information Administration (EIA) data released on Wednesday, US oil inventories fell by 4.05 million barrels to 526.57 million barrels, while analysts had expected a decrease of 2.37 million.

-

10:49

UK GDP stable at 0.4% in the 1st quarter

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.4% in Quarter 1 (Jan to Mar) 2016, unrevised from the second estimate of GDP published on 26 May 2016. This is the 13th consecutive quarter of positive growth since Quarter 1 2013.

Since Quarter 1 2015, revisions to GDP quarterly volume growths are small - with a 0.2 percentage point downward revision to Quarter 1 2015 and Quarter 2 (Apr to June) 2015 partially being offset by a 0.1 percentage point upward revision to Quarter 4 (Oct to Dec) 2015.

Between 2014 and 2015, GDP in volume terms increased by 2.2%, revised down 0.1 percentage points from the previous estimate. Between Quarter 1 2015 and Quarter 1 2016, GDP in volume terms increased by 2.0%, unrevised from the previously published estimate.

GDP decreased by 6.3% from the peak in Quarter 1 2008 to the trough in Quarter 2 2009, a little deeper than previously estimated. Having regained its pre-downturn peak in Quarter 3 2013 (one quarter later than previously published), GDP in Quarter 1 2016 is currently 7.0% above its pre-downturn peak.

-

10:30

United Kingdom: Current account, bln , Quarter I -32.6 (forecast -27.1)

-

10:30

United Kingdom: GDP, q/q, Quarter I 0.4% (forecast 0.4%)

-

10:30

United Kingdom: GDP, y/y, Quarter I 2% (forecast 2%)

-

10:16

Germany’s unemployment falling to record low

In June the unemployment rate was 6.15, unchanged from previos month but the total number of unemployed people drops to 2.69 mln from 2.696 prior. Also the NSA rate was 5.9%, below 6% for first time since reunification. Eur/Usd on the rise, appreciating 55 pips so far.

-

09:56

Germany: Unemployment Change, June -6 (forecast -5)

-

09:55

Germany: Unemployment Rate s.a. , June 6.1% (forecast 6.1%)

-

09:47

Declines for major stock markets after opening : DAX 9,533.85-78.42-0.82%, CAC 40 4,164.79-30.53-0.73%, FTSE 100 6,331.69-28.37-0.45%

-

09:28

At 15:00 GMT Bank of England Governor Mark Carney will deliver a speech on Brexit.

Today's events:

At 09:00 GMT Italy will hold a 10-year bonds auction.

At 11:30 GMT ECB to report on monetary policy meeting.

At 15:00 GMT Bank of England Governor Mark Carney will deliver a speech on Brexit.

At 17:30 GMT FOMC member James Bullard will give a speech.

-

09:17

Fitch: no direct impact on Asia-Pacific sovereigns, no bank ratings impact from Brexit

-

UK's vote to leave European Union has no immediate direct ratings impact on Asia-Pacific. sovereigns or banks.

-

Spike in political uncertainty in UK - and resulting effects on investor risk appetite - could pose greatest challenges for Asia in short term.

-

Brexit will add to short-term challenges for japan to escape deflation as well as raise risks to export sector.

-

Direct impact from UK trade on Asian economies is also likely to be limited.

-

Emerging Asia will remain fastest-growing global region.

-

China is likely to remain a much more significant driver of economic outcomes in APAC than Brexit.

-

US Fed slowing pace of its rate increases, could play a key role in calming markets.

-

-

09:16

WSE: After opening

WIG20 index opened at 1751.77 points (-0.25%)*

WIG 44735.14 -0.16%

WIG30 1956.50 -0.31%

mWIG40 3403.43 0.29%

*/ - change to previous close

The futures contracts on the WIG 20 index (WSE: FW20U1620) started the day from downward move by 0.4% to 1,740 points. The WIG20 index opens with a decline of 0.25% to 1,751 points at lower than yesterday turnover. Banks sector is still relatively weaker, but so far the stabilization known form two days is maintained. In Europe the German DAX opened with fairly modest loss of 0.3%, but it increased rapidly, which confirms that after two days of better mood, today we may expect the first attack of supply side. The Warsaw market is in line with the global sentiment, while maintaining lower volatility. Consolidation is naturally maintained, but the sentiment has changes a little from looking at resistance to peeking at closer support.

-

09:11

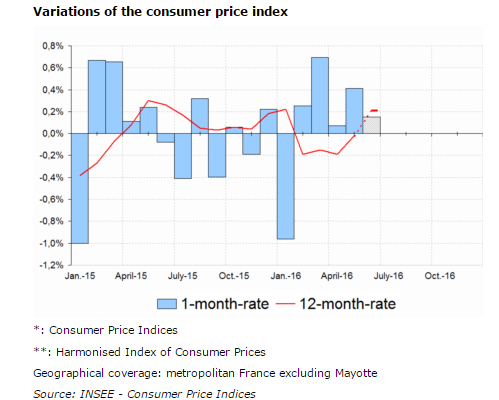

French CPI up 0.2% in June

In June 2016, according to the provisional estimate made at the end of the month, the Consumer Price Index (CPI) is set to rise by 0.1% month-on-month (versus -0.1% over one month in June 2015). This increase should result from a strengthening in petroleum products prices for the fourth month in a row, and a seasonal rebound in prices of some services at the edge of summer. It should be partly offset by the seasonal decline in fresh food and manufactured products prices, with the beginning of summer sales.

Year-on-year, consumer prices should rise by 0.2% in June 2016 after a stabiltity during the previous month. This slight increase should arise mainly from a smaller decrease in energy prices. Similarly, the decline in manufactured products prices should be less pronounced than in May. Food and service prices should contribute again to the rise in consumer prices year-on-year.

In June 2016, the Harmonised Index of Consumer Prices is set to grow by 0.2% over the month. Year-on-year, it should increase by 0.3% after +0.1% in the previous month.

-

09:09

Switzerland: KOF economic indicator unchanged

In June, the value of the KOF Economic Barometer continued to be above its historical average. It reached a value of 102.4 compared to 101.8 (revised from 102.9) in May. Overall, the KOF Economic Barometer indicates a stable condition of the Swiss economy.

Positive impetus for the development of the Barometer in June came from the indicators related to export opportunities for Swiss companies and from the indicators of construction activity, the positive development here being mainly driven by project engineering bureaus. In the actual construction industry, the situation is unchanged. Within the manufacturing sector the prospects for mechanical engineering brightened. For chemistry and food manufacturers the outlook, however, is not as good as before. The perspectives for private consumption as well as for the banking industry worsened.

In the manufacturing sector, in particular the stock and the business situation had a negative effect. Positive signals came, however, from production and to a lesser extent from the order books and the intermediary products.

-

09:01

Switzerland: KOF Leading Indicator, June 102.4 (forecast 102.8)

-

08:59

Asian session review: Yen little changed

The dollar took a breather, but remained near a 3 month high against a basket of currencies affected by the vote in the UK to leave the European Union.

Despite the stabilization of exchange rates, the uncertainty as to how the UK will affect the output of the global economy remains extremely high. 2nd quarter flows will increase volatility and investors cand close their positions before the long weekend in the US. Month end is a volatile period that can offer trading oportunities.

The pound traded near the 28 June high rebounded from a 31-year low reached on Monday, the lowest level since 1985. Recall the two-day decline of the pound on Friday and Monday was the largest in recent history.

EU leaders discussed the consequences of brexit at the summit in Brussels. On Tuesday, EU leaders said that the UK should not expect any preferences from the former partners on the trade block.

The last meeting of EU leaders has become hot, although it was probably a premature farewell to the British Prime Minister David Cameron and sluggish approval of the previously approved plans in the sphere of economy. The leaders of the European Union, bearing their share of responsibility for creating an atmosphere in the EU that favored Brexit.

According to the data released today, the consumer confidence index from the GfK UK in June remained unchanged at -1. Analysts had expected a decline to -2.

Today's data on consumer confidence index was calculated through a survey conducted from June 1 to June 15

The GfK said that they are going to do a new survey, which will be published on July 8 to try to assess the impact of the UK decision to withdraw from the EU structure.

The yen was little changed from the closing session on 28 June, despite trade and industry weak preliminary data . The Japanese industrial production fell by 2.3%. Analysts had expected a decline to -0.1%. In annual terms, industrial production fell by 0.1% after a decline of -3.3% in April.

Japanese Ministry of Economy, Trade and Industry predicts growth of industrial production in the coming months. Growth of industrial production is expected in June at 1.7% and in July to 1.3%.

The Australian dollar fell to some extent, influenced by the data released today by private sector lending. Lending to the private sector in Australia increased by 0.4% in June, lower than the previous value of 0.5%. In annual terms, this figure decreased from 6.7% in May to 6.5% in June.

The report on private sector lending, published by the Reserve Bank of Australia, reflects the amount of funds borrowed by Australian private sector. It shows whether the private sector can afford large expenses that will support economic growth. This figure is considered an indicator of business conditions and economic situation in Australia as a whole.

Housing loans increased in June by 0.5% after the credit growth in May by 0.4%. On an annualized basis, +6.9%.

Personal loans decreased 0.1% in June and 1.1% in annual terms.

Business loans, though increased by + 0.3%, the rate was lower than the previous value of + 0.8%.

EUR / USD: during the Asian session, the pair traded in $ 1.1080-1.1100 range.

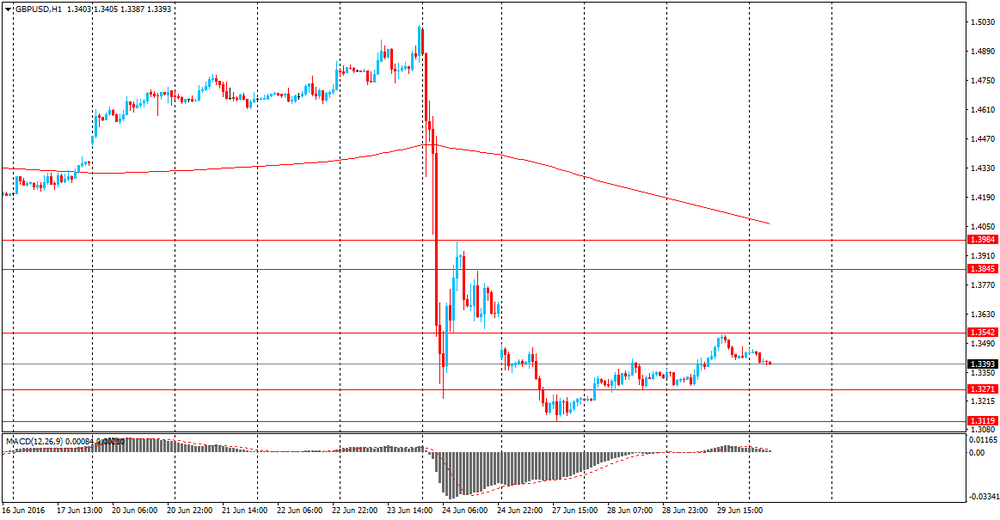

GBP / USD: traded in 1.1.3360-1.3400 range.

USD / JPY: traded in Y101.45-55 range.

-

08:24

Options levels on thursday, June 30, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1320 (2350)

$1.1246 (2979)

$1.1195 (1209)

Price at time of writing this review: $1.1100

Support levels (open interest**, contracts):

$1.1010 (3388)

$1.0972 (8580)

$1.0931 (5716)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 42264 contracts, with the maximum number of contracts with strike price $1,1500 (5281);

- Overall open interest on the PUT options with the expiration date July, 8 is 88889 contracts, with the maximum number of contracts with strike price $1,0900 (15211);

- The ratio of PUT/CALL was 2.10 versus 2.16 from the previous trading day according to data from June, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.3704 (187)

$1.3607 (538)

$1.3511 (1653)

Price at time of writing this review: $1.3392

Support levels (open interest**, contracts):

$1.3291 (871)

$1.3194 (3001)

$1.3096 (419)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 32945 contracts, with the maximum number of contracts with strike price $1,5000 (4020);

- Overall open interest on the PUT options with the expiration date July, 8 is 44707 contracts, with the maximum number of contracts with strike price $1,3500 (5034);

- The ratio of PUT/CALL was 1.36 versus 1.42 from the previous trading day according to data from June, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Mixed start of trading on the major stock exchanges in Europe expected: DAX + 0,1%, FTSE 100 + 0,2%, CAC 40 -0.2%

-

08:21

WSE: Before opening

Yesterday's session on Wall Street led to the growth of the S&P 500 index by 1.7%, which closed at session highs. Thus, the market recovered half of the losses from Friday and the morning behavior of contracts may be seen that after two days of recovery we may reckon with the first supply. Future contracts lose approx. 0.6%, which suppresses the previously observed optimism on Asian exchanges and may lead to a calmer early trading in Europe.

Thursday is another day of gains on Asian parquets. The Japanese Nikkei gains modest 0.5%, but we must remember that in this year Japan is one of the most overpriced markets, the same like China. Investments in the Chinese market in this year yielded investors a loss of more than 30%.

At the beginning of today's trading day reinforce the "safe" currency, namely the yen, dollar and CHF. Slight declines recorded oil and gold. We must also remember that institutional investors can "get ready" their portfolios at the end of the month and at the same time the first half of the year and try to improve their image, pulling indexes. Only Friday may be the date on which the determination of buyers will be actually proven.

-

08:17

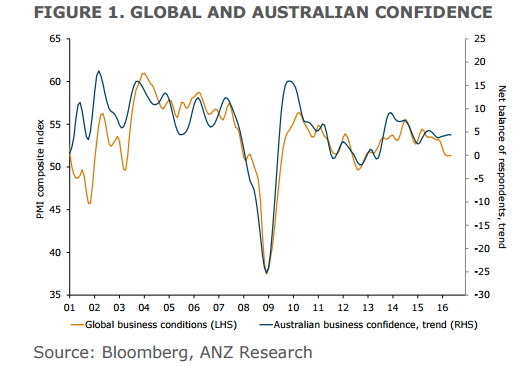

AUD: to underperform vs USD, JPY, CHF; Fade data-driven rallies - ANZ

eFX news with the latest ANZ recommendation:

Brexit is now a reality. The damage is done and we now have to navigate through an environment of heightened uncertainty. Though the UK is far away, this kind of global uncertainty is never a good thing for global confidence or risk appetite. By extension, as a small, open economy dependent on global trade and funding, the AUD should weaken in this environment. We expect the AUD to underperform safe havens such as the USD, JPY and the CHF. The AUD is likely to remain within our existing forecast range (above USD0.66).

Increased pricing of RBA rate cuts has also contributed to the weakness in the AUD. Since the Brexit vote, rates markets have added 20bps of rate cuts and now expect ~40bps of easing. This looks fully priced and as such domestic factors will take a backseat for now

For the AUD, we would fade better-than-expected data although worse-than-expected data may see markets reinforce expectations of near-term RBA easing and see the AUD trade lower. Brexit also raises questions about the medium-term outlook for the Australian economy and in turn, the AUD. Australia has benefited from a globalised economy, with free trade and capital mobility at its centre. While Brexit is not sufficient to declare that globalisation has peaked, the global economic model is clearly under pressure. A continued trend towards less international cooperation would justify a bigger premium on AUD assets and weigh on the AUD.

-

08:12

The index of business confidence in New Zealand increased in June

The index of business confidence in New Zealand, published by the ANZ Bank in June was 20.2, which is significantly higher than the previous value of 11.3. This figure was the highest since December 2015.

The business confidence index assesses the business outlook in New Zealand. Business confidence allows us to analyze the economic situation in the short term. The growth of the index indicates an increase in business investment, which helps production.

The outlook on the business activity, which is a review of the results of surveys on business prospects in the New Zealand economy as a whole, rose to 35.1 in June from 30.4 the previous value.

The ANZ also expect inflation in the next year to 1.49% from the previous forecast of 1.39%.

-

08:10

Lending to the private sector in Australia increased 0.4% in June

Lending to the private sector in Australia increased by 0.4% in June, lower than the previous value of 0.5%. In annual terms, this figure decreased from 6.7% in May to 6.5% in June.

The report on private sector lending, published by the Reserve Bank of Australia, reflects the amount of funds borrowed by Australian private sector. It shows whether the private sector can afford large expenses that will support economic growth. This figure is considered an indicator of business conditions and economic situation in Australia as a whole.

Housing loans increased in June by 0.5% after the credit growth in May by 0.4%. On an annualized basis, + 6.9%.

Personal loans decreased 0.1% in June and 1.1% in annual terms.

Business loans, though increased by + 0.3%, the rate was lower than the previous value of + 0.8%.

-

08:06

Retail sales up 0.9% m/m in Germany

According to provisional results of the Federal Statistical Office (Destatis), retail turnover in May 2016 in Germany increased in real terms 2.6% and in nominal terms 2.7% compared with the corresponding month of the previous year. The number of days open for sale was 24 in May 2016 and 23 in May 2015.

Compared with the previous year, turnover in retail trade was in the first five months 2016 in real terms 2.0% and in nominal terms 2.1% larger than in in the corresponding period of the previous year.

When adjusted for calendar and seasonal variations, the May turnover was in real terms 0.9% and in nominal terms 0.8% larger than that in April 2016.

-

08:00

Germany: Retail sales, real unadjusted, y/y, May 2.6% (forecast 3%)

-

08:00

Germany: Retail sales, real adjusted , May 0.9% (forecast 0.7%)

-

07:46

Japan: Construction Orders, y/y, May 34.5%

-

07:08

Global Stocks

European stocks closed sharply higher Wednesday, rising for a second straight session as investors picked up equities beaten down after last week's U.K. vote. to leave the European Union.

The Stoxx Europe 600 SXXP, +3.09% climbed 3.1% to settle at 326.49, as all sectors advanced, led by telecommunication, oil and gas SXER, +4.68% and utility SX6P, +4.33% shares.

Meanwhile, London's FTSE 100 UKX, +3.58% rose 3.6% to settle at 6,360, erasing its post-Brexit slide.

But travel services company TUI AG TUI, -3.82% dropped 2.6%, among the biggest decliners on the index, following a terrorist attack at Istanbul Atatürk Airport in Turkey that left at least 41 people dead. Other travel stocks that had been lower earlier, however, reversed course.

U.S. stocks closed higher Wednesday, rallying for a second day as a surge in crude-oil prices and a retrenchment in Brexit fears pared sharp losses stemming from the U.K.'s surprise vote to leave the European Union.

The Dow DJIA, +1.64% climbed 284.96 points, or 1.6%, to close at 17,694.68.

The S&P 500 SPX, +1.70% rose 34.68 points, or 1.7%, to 2,070.77.

Meanwhile, the tech-heavy Nasdaq Composite Index COMP, +1.86% jumped 87.38 points, or 1.9%, to 4,779.25.

A U.S. Energy Information Administration report showing a sharp drop in domestic crude supplies CLQ6, -0.94% sent oil prices soaring 4.2% to settle at $49.88 a barrel, which carried energy and materials shares higher.

Asia stocks rose across the board on Thursday, tracking an overnight rally on Wall Street, while the safe-haven Japanese yen stopped rising as global markets regained a semblance of calm after last week's Brexit shock.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 1.3 percent, pulling further away from a one-month low on Friday when it plunged more than 3 percent in reaction to Britain's decision to leave the European Union. The index was on track to end the April-June quarter down about 1 percent.

Japan's Nikkei .N225 climbed 0.8 percent.

-

07:07

Japan: Housing Starts, y/y, May 9.8% (forecast 4.8%)

-

04:01

Nikkei 225 15,654.37 +87.54 +0.56 %, Hang Seng 20,666.46 +230.34 +1.13 %, Shanghai Composite 2,931.83 +0.24 +0.01 %

-

03:31

Australia: Private Sector Credit, m/m, May 0.4% (forecast 0.5%)

-

03:31

Australia: Private Sector Credit, y/y, May 6.5%

-

03:01

New Zealand: ANZ Business Confidence, June 20.2

-

01:53

Japan: Industrial Production (MoM) , May -2,3% (forecast -0.1%)

-

01:52

Japan: Industrial Production (YoY), May -0,1%

-

01:06

United Kingdom: Gfk Consumer Confidence, June -1 (forecast -3)

-

00:46

New Zealand: Building Permits, m/m, May -0.9%

-

00:25

Commodities. Daily history for Jun 29’2016:

(raw materials / closing price /% change)

Oil 49.54 -0.68%

Gold 1,321.80 -0.38%

-

00:25

Stocks. Daily history for Jun 29’2016:

(index / closing price / change items /% change)

Nikkei 225 15,566.83 +243.69 +1.59 %

Hang Seng 20,436.12 +263.66 +1.31 %

S&P/ASX 200 5,142.4 +39.12 +0.77 %

Shanghai Composite 2,932.52 +19.96 +0.69 %

FTSE 100 6,360.06 +219.67 +3.58 %

CAC 40 4,195.32 +106.47 +2.60 %

Xetra DAX 9,612.27 +164.99 +1.75 %

S&P 500 2,070.77 +34.68 +1.70 %

NASDAQ Composite 4,779.25 +87.38 +1.86 %

Dow Jones 17,694.68 +284.96 +1.64 %

-

00:24

Currencies. Daily history for Jun 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1126 +0,44%

GBP/USD $1,3448 +0,89%

USD/CHF Chf0,9792 -0,08%

USD/JPY Y102,89 +0,18%

EUR/JPY Y114,50 +0,64%

GBP/JPY Y138,37 +1,08%

AUD/USD $0,7442 +0,74%

NZD/USD $0,7107 +0,76%

USD/CAD C$1,2944 -0,63%

-

00:06

Schedule for today, Thursday, Jun 30’2016:

(time / country / index / period / previous value / forecast)

01:00 New Zealand ANZ Business Confidence June 11.3

01:30 Australia Private Sector Credit, m/m May 0.5%

01:30 Australia Private Sector Credit, y/y May 6.7%

05:00Japan Construction Orders, y/y May -16.9%

05:00 Japan Housing Starts, y/y May 9.0% 4.8%

06:00 Germany Retail sales, real adjusted May -0.9% 0.7%

06:00 Germany Retail sales, real unadjusted, y/y May 2.3% 3%

07:00 Switzerland KOF Leading Indicator June 102.9 103

07:55 Germany Unemployment Change June -11 -5

07:55 Germany Unemployment Rate s.a. June 6.1% 6.1%

08:30 United Kingdom Current account, bln Quarter I -37.2 -26.5

08:30 United Kingdom GDP, q/q (Finally) Quarter I 0.6% 0.4%

08:30 United Kingdom GDP, y/y (Finally) Quarter I 2.1% 2%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) June -0.1% 0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) June 0.8% 0.8%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Industrial Product Price Index, m/m May -0.5%

12:30 Canada Industrial Product Price Index, y/y May -1.6%

12:30 Canada GDP (m/m) April -0.2%

12:30 U.S. Continuing Jobless Claims June 2142 2147

12:30 U.S. Initial Jobless Claims June 259 268

13:45 U.S. Chicago Purchasing Managers' Index June 49.3 50.9

15:00 United Kingdom BOE Gov Mark Carney Speaks

17:30 U.S. FOMC Member James Bullard Speaks

23:30 Australia AIG Manufacturing Index June 51.0

23:30 Japan Household spending Y/Y May -0.4% -1.4%

23:30 Japan Tokyo Consumer Price Index, y/y June -0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June -0.5% -0.5%

23:30 Japan National Consumer Price Index, y/y May -0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y May -0.3% -0.4%

23:30 Japan Unemployment Rate May 3.2% 3.2%

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 6 4

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 22 19

-