Noticias del mercado

-

22:15

U.S. stocks advanced

U.S. stocks advanced amid a global rally, with the S&P 500 Index posting its strongest two-day climb in four months, as tension eased over the impact of a U.K. exit from the European Union.

Fears that Britain's EU withdrawal will further stymie global growth continued to ebb, soothed by speculation policy makers will counter the effects. Energy shares capped their best two days since March as crude jumped. A Goldman Sachs Group Inc. basket of the most shorted shares in the Russell 3000 Index saw its biggest surge since 2009, while the Dow Jones Industrial Average stretched its rebound to more than 550 points since Monday's close.

With Britain in limbo as EU leaders gathered in Brussels to discuss the nation's withdrawal from the bloc, traders have pushed back bets on Federal Reserve interest-rate increases, indicating higher borrowing costs are unlikely before 2018. Meanwhile, a majority of economists surveyed by Bloomberg predict that the Bank of England will add more stimulus, including cutting rates in the third quarter.

Equities recovered for a second session after two days of heavy selling sparked by the Brexit decision last week wiped $3.6 trillion from global equities. The S&P 500 had tumbled 5.3 percent to briefly erase its 2016 advance, and has since cut its post-vote drop by more than half. The CBOE Volatility Index slid for a third day, the longest in two weeks. The measure of market turbulence known as the VIX dropped 11 percent Wednesday to 16.64, the lowest since June 9.

Investors are looking to policy makers for support as they await Britain's plan for its extrication from the EU. While European Central Bank President Mario Draghi called for global policy alignment, South Korea announced a fiscal stimulus package on Tuesday and Bank of Japan Chief Haruhiko Kuroda said Wednesday that more funds can be injected into the market should they be needed.

-

21:01

DJIA 17911.57 216.89 1.23%, NASDAQ 4833.69 54.44 1.14%, S&P 500 2096.19 25.42 1.23%

-

18:42

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Thursday as consumer staples stocks rose after reports that Oreo cookies maker Mondelez had made a bid to buy Hershey Co. The three major indexes have recouped more than half of the losses suffered after a shock vote by Britain to leave the European Union. In a two-day panic selloff after the vote, global markets lost about $3 trillion in value.

Almost all Dow stocks in positive area (28 of 30). Top looser - Visa Inc. (V, -2,40%). Top gainer - General Electric Company (GE, +2,27%).

All S&P sectors in positive area. Top gainer - Consumer goods (+1,6%).

At the moment:

Dow 17775.00 +151.00 +0.86%

S&P 500 2082.75 +16.00 +0.77%

Nasdaq 100 4396.00 +33.25 +0.76%

Oil 48.82 -1.06 -2.13%

Gold 1320.30 -6.60 -0.50%

U.S. 10yr 1.46 -0.02

-

18:00

European stocks closed: FTSE 6504.33 144.27 2.27%, DAX 9680.09 67.82 0.71%, CAC 4237.48 42.16 1.00%

-

17:42

WSE: Session Results

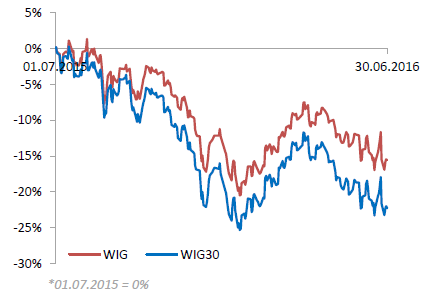

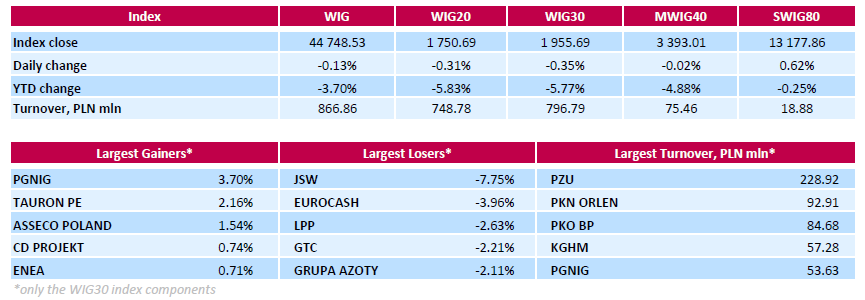

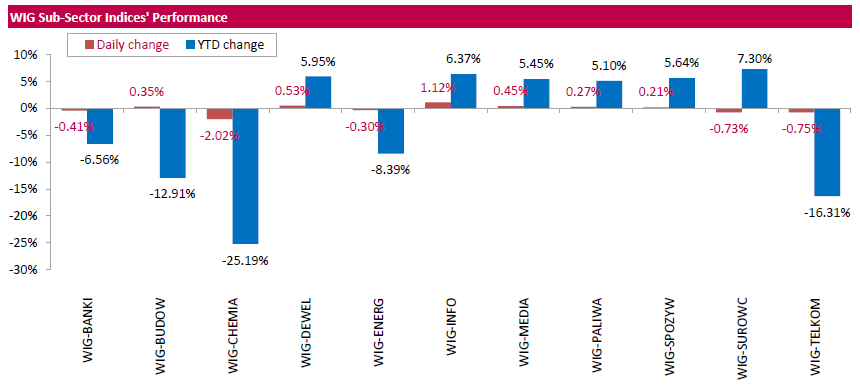

Polish equity market closed lower on Thursday. The broad measure, the WIG index, recorded a 0.13% drop. Sector-wise, chemicals (-2.02%) recorded the worst result, while information technology (+1.12%) was the best performing group.

The large-cap stocks fell by 0.35 %, as measured by the WIG30 Index. In the index basket, coking coal miner JSW (WSE: JSW) posted the sharpest decline of 7.75%, dragged down by the announcement the company will sell its WZK Victoria mine for PLN 350 mln ($88 mln) as it continues to struggle with falling coal prices. The other notable losers were FMCG-wholesaler EUROCASH (WSE: EUR), clothing retailer LPP (WSE: LPP) and property developer GTC (WSE: GTC), which plunged by 3.96%, 2.63% and 2.21% respectively. On the other side of the ledger, oil and gas producer PGNIG (WSE: PGN) led the gainers, rising 3.7%. It was followed by genco TAURON PE (WSE: TPE) and IT-company ASSECO POLAND (WSE: ACP), advancing by 2.16% and 1.54% respectively.

-

15:50

WSE: After start on Wall Street

In the afternoon we met weekly number of applications for unemployment benefits in the US, which increased by 10k., what is translated as the end of the school year. The same level remains low and does not bring anything new to the situation on the market.

American stock indexes after the start of trading on Wall Street rose slightly after two days of considerable growth. This situation with the Americans does not significantly affect the atmosphere of European parquets and we do not see any movement on the indices.

Volatility in our market is still small and the index of the largest companies stays in the vicinity of 1,750 points.

-

15:49

Company news: Bank of America (BAC) confirmed the intention to increase the quarterly dividends by 50%

The Bank of America reported that the company's board of directors plans to increase the quarterly dividend on common shares by 50% to $ 0.075/share, since the third quarter of 2016.

In addition, the Board approved to carry out buy back in the amount of $ 5 billion, in the period from July 1, 2016 at June 30, 2017, 50% more than was agreed last year.

BAC's shares rose in premarket trading to $ 13.33 (+ 1.06%).

-

15:33

U.S. Stocks open: Dow +0.14%, Nasdaq +0.17%, S&P +0.15%

-

15:28

Before the bell: S&P futures +0.04%, NASDAQ futures +0.03%

U.S. stock-index futures were flat.

Global Stocks:

Nikkei 15,575.92 +9.09 +0.06%

Hang Seng 20,794.37 +358.25 +1.75%

Shanghai Composite 2,929.61 -1.99 -0.07%

FTSE 6,366.94 +6.88 +0.11%

CAC 4,208.08 +12.76 +0.30%

DAX 9,606.57 -5.70 -0.06%

Crude $48.85 (-2.06%)

Gold $1321.40 (-0.21%)

-

15:24

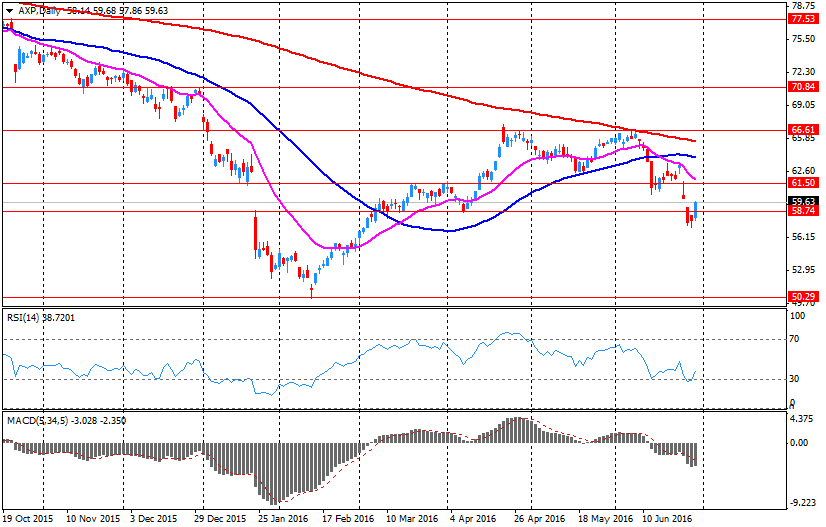

Company News: American Express (AXP) plans to increase its quarterly dividend by 10% and buy back for up to $ 3.3 billion.

The American Express (AXP) reported that the Federal Reserve does not object to the plan for the capital of the company as set out in the program of comprehensive inspection and analysis of capital adequacy (CCAR). This plan includes the following items: 1) an increase in the quarterly dividend of up to $ 0.32 per share from the third quarter of 2016; 2) an increase in repurchase ordinary shares up to $ 3.3 billion in the period from the third quarter of 2016 to the second quarter of 2017. Thus, the entire company will be able to buy back shares worth about $ 4.4 bn, including the redemption of approximately $ 1.7 billion.

AXP shares fell in premarket trading to $ 59.20 (-0.72%).

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.2

0.10(1.0989%)

61207

3M Co

MMM

171.51

-0.01(-0.0058%)

130

ALTRIA GROUP INC.

MO

68.07

0.24(0.3538%)

1724

Amazon.com Inc., NASDAQ

AMZN

717

1.40(0.1956%)

12515

American Express Co

AXP

59.5

-0.13(-0.218%)

8636

AMERICAN INTERNATIONAL GROUP

AIG

51.71

0.25(0.4858%)

3210

Apple Inc.

AAPL

94.2

-0.20(-0.2119%)

63298

AT&T Inc

T

42.7

0.16(0.3761%)

17511

Barrick Gold Corporation, NYSE

ABX

20.93

0.16(0.7703%)

47172

Boeing Co

BA

127.49

0.50(0.3937%)

165

Caterpillar Inc

CAT

74

-0.23(-0.3098%)

570

Chevron Corp

CVX

103.42

-0.00(-0.00%)

810

Cisco Systems Inc

CSCO

28.35

0.09(0.3185%)

6973

Citigroup Inc., NYSE

C

42.61

0.49(1.1633%)

242521

Exxon Mobil Corp

XOM

92.35

-0.11(-0.119%)

3750

Facebook, Inc.

FB

114.07

-0.09(-0.0788%)

63803

FedEx Corporation, NYSE

FDX

151.01

0.75(0.4991%)

3201

Ford Motor Co.

F

12.57

0.02(0.1594%)

10168

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.89

0.12(1.1142%)

238249

General Electric Co

GE

30.61

0.06(0.1964%)

34222

General Motors Company, NYSE

GM

28.17

0.00(0.00%)

1156

Goldman Sachs

GS

146.58

1.08(0.7423%)

9056

Google Inc.

GOOG

685.01

0.90(0.1316%)

2663

Home Depot Inc

HD

126.76

-0.61(-0.4789%)

2970

Intel Corp

INTC

32.09

0.16(0.5011%)

6232

International Business Machines Co...

IBM

148.26

-0.20(-0.1347%)

386

Johnson & Johnson

JNJ

119.1

-0.23(-0.1927%)

1267

JPMorgan Chase and Co

JPM

61.7

0.50(0.817%)

46237

McDonald's Corp

MCD

120.3

0.81(0.6779%)

1167

Microsoft Corp

MSFT

50.55

0.01(0.0198%)

3507

Nike

NKE

55.21

0.08(0.1451%)

18274

Pfizer Inc

PFE

35.03

0.02(0.0571%)

755

Procter & Gamble Co

PG

84.02

0.11(0.1311%)

2119

Starbucks Corporation, NASDAQ

SBUX

56.98

0.24(0.423%)

230

Tesla Motors, Inc., NASDAQ

TSLA

212.99

2.80(1.3321%)

35737

Twitter, Inc., NYSE

TWTR

16.7

-0.13(-0.7724%)

64554

UnitedHealth Group Inc

UNH

140.96

0.44(0.3131%)

136

Verizon Communications Inc

VZ

55.15

0.09(0.1635%)

2899

Visa

V

76.8

0.06(0.0782%)

458

Wal-Mart Stores Inc

WMT

72.55

0.09(0.1242%)

2967

Walt Disney Co

DIS

97.15

0.17(0.1753%)

1204

Yahoo! Inc., NASDAQ

YHOO

36.95

0.09(0.2442%)

230

Yandex N.V., NASDAQ

YNDX

21.22

-0.25(-1.1644%)

2150

-

13:22

WSE: Mid session comment

Today's Annual General Meeting of PZU decided that the dividend for 2015 years hit PLN 1.8 billion, which will give PLN 2,08 per share. The adopted resolution is in line with the recommendation of the board. The record date is 30 September, with payout on October 21, 2016 year. This decision had a positive impact on the valuation of PZU shares, which were still one of the weakest components among the blue chips. Currently PZU rate increases by 0.95%. Generally, southern phase of the trading takes place peacefully. After a morning decline and subsequent rebound volatility on the Warsaw local market is not great. The WIG20 index lost about 0.5% with turnover at the level of PLN 280 mln.

-

12:43

Major stock indices in Europe recover

European stocks are trading with a moderate increase, aided by fading fears about the long-term consequences of Brexit.

Yesterday, EU's Tusk confirmed that Britain not officially notified the EU of its intention to withdraw from the Union and there are no negotiations on any future relationship. Meanwhile, German Chancellor Merkel said that it is difficult to determine the future relations of Great Britain and the EU, but for the single European market will be a tangible loss.

However, experts of the International Monetary Fund warned that the expected British withdrawal from the EU bears the risk of reducing the economic outlook in Germany. "Britain is an important economic partner for Germany and the change in the economic relations between the largest economie in Europe and the second largest member of it can not go unnoticed". Earlier, the IMF published a forecast for GDP growth in Germany, raising the estimate for 2016 by 0.2% to 1.7% of GDP. However, the forecast for 2017 was lowered by 0.1 percentage points to 1.5%.

Support for indices also provides statistics on Britain and the euro zone. Final data provided by ONS showed that UK GDP grew by 0.4 percent in the first quarter, confirming the last assessment and forecasts. Consumer spending rose by 0.7% (the fastest pace in almost a year), while exports fell by 0.4% and business investment declined by 0.6%. The services sector - a large part of the economy - grew by 0.6%. Overall, GDP growth slowed down in comparison with the 4th quarter, when economic expansion of 0.7% was recorded. In annual terms, GDP grew by 2.0% in the 1st quarter 2015, after rising 1.8% in the 4th quarter (revised from + 2.1%). Last change coincided with forecasts.

However, a preliminary report from the Eurostat showed that in June, consumer prices in the eurozone rose by 0.1% after falling 0.1% last month. Analysts had expected the index to remain unchanged. Higher prices were recorded for the first time in five months. Meanwhile, the core consumer price index, which does not take into account the volatile energy and food prices, rose in June by 0.9%, which was slightly faster than in May (+ 0.8%), and more than forecasts ( +0.8 percent). The June rate growth was the highest since March 2016. The report also stated that prices of services recorded the largest growth in June - 1.1% versus + 1.0% in May. Meanwhile, the prices of food, alcohol and tobacco increased by 0.9% after a similar increase in May. The cost of non-energy industrial goods increased by 0.4% compared to 0.5% in May. Energy prices fell 6.5%, the pace has slowed sharply compared to May (-8.1%).

The composite index of the largest companies in the region, Stoxx Europe 600, up 0.2%, recovering all the early losses, which reached 0.9%. Since the beginning of the month the index fell by 5.8%, the worst result since January 2016. For the second quarter the index has lost about 3%.

Shares of mining companies shows the maximum growth among the 19 industry groups, aided by the increasing Anglo American Plc quotes and Glencore Plc.

Banks shares fall, mainly due to the falling value of Royal Bank of Scotland Group Plc. Today, Morgan Stanley downgraded the stock to 'hold'

The capitalization of Deutsche Bank AG fell 1.8 percent after it became known that the bank failed the stress tests conducted by the Federal Reserve. Shares of Banco Santander SA, which also did not meet the requirements of the Federal Reserve, fell 1.2 percent.

At the moment:

FTSE 100 6,386.21 +26.15 + 0.41%

CAC 40 4,217.19 +21.87 + 0.52%

DAX 9,622.24 +9.97 + 0.10%

-

09:47

Declines for major stock markets after opening : DAX 9,533.85-78.42-0.82%, CAC 40 4,164.79-30.53-0.73%, FTSE 100 6,331.69-28.37-0.45%

-

09:16

WSE: After opening

WIG20 index opened at 1751.77 points (-0.25%)*

WIG 44735.14 -0.16%

WIG30 1956.50 -0.31%

mWIG40 3403.43 0.29%

*/ - change to previous close

The futures contracts on the WIG 20 index (WSE: FW20U1620) started the day from downward move by 0.4% to 1,740 points. The WIG20 index opens with a decline of 0.25% to 1,751 points at lower than yesterday turnover. Banks sector is still relatively weaker, but so far the stabilization known form two days is maintained. In Europe the German DAX opened with fairly modest loss of 0.3%, but it increased rapidly, which confirms that after two days of better mood, today we may expect the first attack of supply side. The Warsaw market is in line with the global sentiment, while maintaining lower volatility. Consolidation is naturally maintained, but the sentiment has changes a little from looking at resistance to peeking at closer support.

-

08:21

Mixed start of trading on the major stock exchanges in Europe expected: DAX + 0,1%, FTSE 100 + 0,2%, CAC 40 -0.2%

-

08:21

WSE: Before opening

Yesterday's session on Wall Street led to the growth of the S&P 500 index by 1.7%, which closed at session highs. Thus, the market recovered half of the losses from Friday and the morning behavior of contracts may be seen that after two days of recovery we may reckon with the first supply. Future contracts lose approx. 0.6%, which suppresses the previously observed optimism on Asian exchanges and may lead to a calmer early trading in Europe.

Thursday is another day of gains on Asian parquets. The Japanese Nikkei gains modest 0.5%, but we must remember that in this year Japan is one of the most overpriced markets, the same like China. Investments in the Chinese market in this year yielded investors a loss of more than 30%.

At the beginning of today's trading day reinforce the "safe" currency, namely the yen, dollar and CHF. Slight declines recorded oil and gold. We must also remember that institutional investors can "get ready" their portfolios at the end of the month and at the same time the first half of the year and try to improve their image, pulling indexes. Only Friday may be the date on which the determination of buyers will be actually proven.

-

07:08

Global Stocks

European stocks closed sharply higher Wednesday, rising for a second straight session as investors picked up equities beaten down after last week's U.K. vote. to leave the European Union.

The Stoxx Europe 600 SXXP, +3.09% climbed 3.1% to settle at 326.49, as all sectors advanced, led by telecommunication, oil and gas SXER, +4.68% and utility SX6P, +4.33% shares.

Meanwhile, London's FTSE 100 UKX, +3.58% rose 3.6% to settle at 6,360, erasing its post-Brexit slide.

But travel services company TUI AG TUI, -3.82% dropped 2.6%, among the biggest decliners on the index, following a terrorist attack at Istanbul Atatürk Airport in Turkey that left at least 41 people dead. Other travel stocks that had been lower earlier, however, reversed course.

U.S. stocks closed higher Wednesday, rallying for a second day as a surge in crude-oil prices and a retrenchment in Brexit fears pared sharp losses stemming from the U.K.'s surprise vote to leave the European Union.

The Dow DJIA, +1.64% climbed 284.96 points, or 1.6%, to close at 17,694.68.

The S&P 500 SPX, +1.70% rose 34.68 points, or 1.7%, to 2,070.77.

Meanwhile, the tech-heavy Nasdaq Composite Index COMP, +1.86% jumped 87.38 points, or 1.9%, to 4,779.25.

A U.S. Energy Information Administration report showing a sharp drop in domestic crude supplies CLQ6, -0.94% sent oil prices soaring 4.2% to settle at $49.88 a barrel, which carried energy and materials shares higher.

Asia stocks rose across the board on Thursday, tracking an overnight rally on Wall Street, while the safe-haven Japanese yen stopped rising as global markets regained a semblance of calm after last week's Brexit shock.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 1.3 percent, pulling further away from a one-month low on Friday when it plunged more than 3 percent in reaction to Britain's decision to leave the European Union. The index was on track to end the April-June quarter down about 1 percent.

Japan's Nikkei .N225 climbed 0.8 percent.

-

04:01

Nikkei 225 15,654.37 +87.54 +0.56 %, Hang Seng 20,666.46 +230.34 +1.13 %, Shanghai Composite 2,931.83 +0.24 +0.01 %

-

00:25

Stocks. Daily history for Jun 29’2016:

(index / closing price / change items /% change)

Nikkei 225 15,566.83 +243.69 +1.59 %

Hang Seng 20,436.12 +263.66 +1.31 %

S&P/ASX 200 5,142.4 +39.12 +0.77 %

Shanghai Composite 2,932.52 +19.96 +0.69 %

FTSE 100 6,360.06 +219.67 +3.58 %

CAC 40 4,195.32 +106.47 +2.60 %

Xetra DAX 9,612.27 +164.99 +1.75 %

S&P 500 2,070.77 +34.68 +1.70 %

NASDAQ Composite 4,779.25 +87.38 +1.86 %

Dow Jones 17,694.68 +284.96 +1.64 %

-