Noticias del mercado

-

17:30

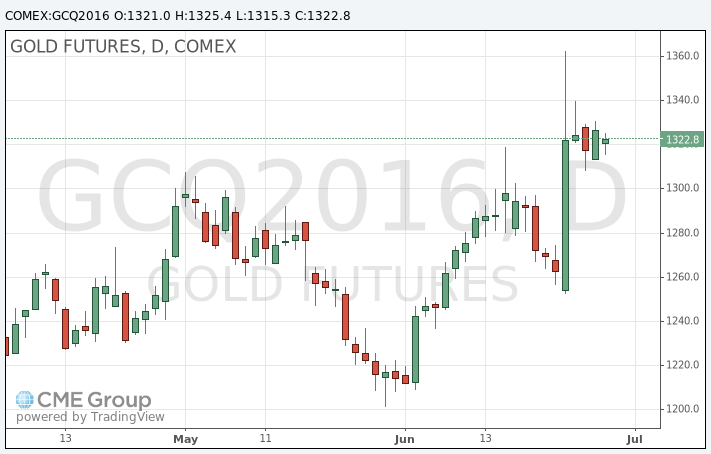

Gold prices rose moderately, while the broader markets showed signs of stabilization

Gold can have the maximum monthly gain since February, due to the British decision to withdraw from the European Union last week.

Last Friday, the price of the yellow metal jumped to a 27-month high of $ 1,362.60 on the unexpected decision of the UK to leave the European Union, so that investors have turned to gold and other safe assets.

News triggered fears that other countries can withdraw from the block, and global growth will be under considerable pressure, while the actual time frame of Brexit remain unclear.Britain has so far refrained from Article 50.

Gold was supported as market players exclude further interest rate rise.. Moreover, the futures market is not considering raising interest rates this year and began to price in the likelihood of a rate cut.

According Fed Watch service group CME, currently the chance of a rate increase in July estimated at 0%, and probability of lowering rate is estimated at 3%.

The assets of the world's largest gold exchange-traded fund (ETF) SPDR Gold Trust rose by 2.7 tonnes to a maximum of three years.

Gold from the beginning of the month has added 8.6% in value. Silver, which has risen in price by about 19%, can show the best quarter in nearly four years.

The cost of the August gold futures on COMEX rose to $ 1325.4 per ounce.

-

17:05

Bank of England Governor, Mark Carney says that stimulus likely to be needed

- some monetary policy stimulus likely to be needed over summer.

- economic outlook worse.

- MPC will make initial assessment at July 14th meeting and make a decision at August meeting.

- uncomfortable truth that the BOE cannot fully offset a large economic shock from leaving the EU.

So rate cuts or QE from Bank of England this summer. This will add to the already high pound volatility.

-

17:03

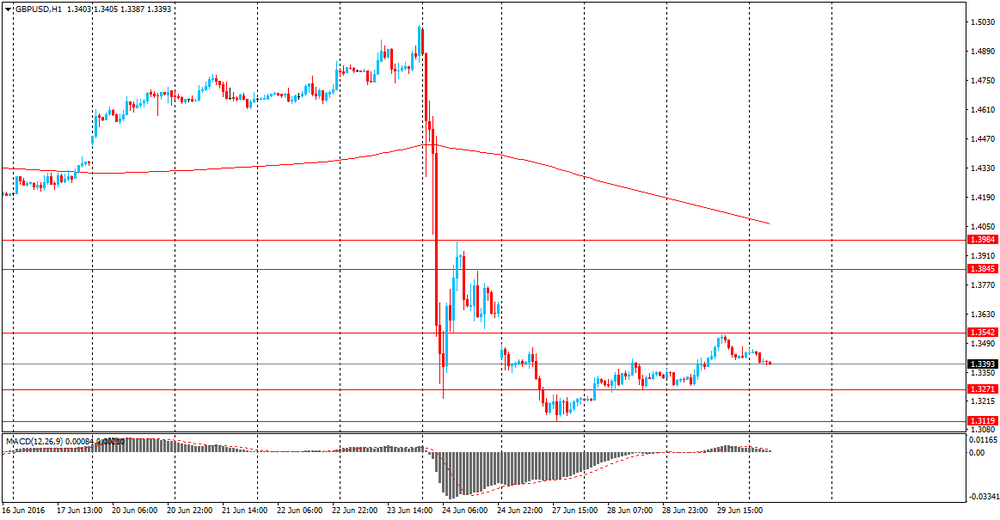

Sharp move down on Gbp pairs as Carney starts the speech

-

17:01

IMF: Brexit uncertainty may be the biggest risk to the global economy

- Brexit is likely to dampen UK, EU and global growth.

- Central banks have provided support by providing liquidity to calm markets.

- recent market moves have been large but not excessively disorderly.

-

16:33

Long Usd/Cad: an opportunity to express structural view in risk-neutral way - Credit Agricole

The post-Brexit trading range in USD/CAD has been "just" 3.2%, among the narrowest in the G10. In our view, this relative insensitivity to the EU/UK headlines offers an opportunity to express a fundamental view in a more risk-neutral way.

We are bullish on USDCAD as we see the forces that supported the Canadian currency in H1 (rising oil prices, receding BoC easing expectations and an unwind of short positioning) as largely reversing in the second half of the year. Furthermore, US politics are a particular risk factor that may ultimately turn out to be more important than Brexit, given the ramping up of protectionist rhetoric and open criticism of NAFTA from one of the presumed Presidential candidates.

We remain long USDCAD via a ratio call spread in our portfolio.

-

16:04

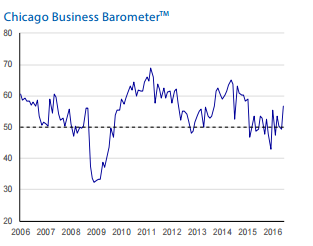

US Chicago PMI increased significantly

The MNI Chicago Business Barometer rose 7.5 points to 56.8 in June from 49.3 in May, the highest since January 2015, led by strong gains in New Orders and Production. June's rebound was just enough to offset the previous two months of weakness, leaving the Barometer broadly unchanged over the quarter at an average of 52.2 in Q2 compared with 52.3 in Q1.

New Orders increased sharply on the month to thehighest since October 2014, while Order Backlogs rose to the highest since March 2011, breaking a 16-month run of below 50 readings. Production also ncreased significantly to the highest since January 2016.

-

15:55

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1000 (EUR 1.1bln) 1.1050 (469m) 1.1100 (416m)

GBPUSD 1.3500 ( GBP 1.25bln)

USDCAD 1.2900 (USD 621m) 1.2995-1.3000 (1.1bln) 1.3100 (692m)

NZDUSD 0.6875 (NZD 741m) 0.6900 (1.0bln) 0.6925 (490m)

-

15:45

U.S.: Chicago Purchasing Managers' Index , June 56.8 (forecast 50.7)

-

14:40

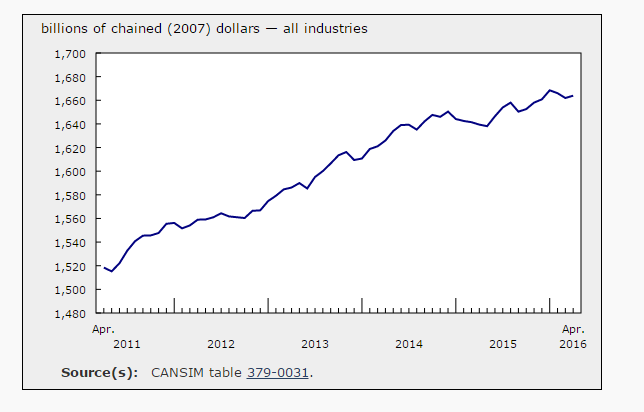

Canada Gross Domestic Product stable at 0.1%

After decreasing in February and March, real gross domestic product edged up 0.1% in April. Widespread gains, notably in manufacturing, utilities and the public sector, were largely offset by a significant decline in non-conventional oil extraction.

Service-producing industries rose 0.2% in April, after being essentially unchanged in March. Notable gains were posted by the public sector (education, health and public administration combined), the finance and insurance sector, and wholesale and retail trade. In contrast, the arts, entertainment and recreation sector notably declined.

The output of goods-producing industries edged down 0.1% in April, mainly as a result of a decrease in mining, quarrying, and oil and gas extraction. Manufacturing and utilities posted notable increases, while the agriculture and forestry sector was down.

Mining, quarrying, and oil and gas extraction fell for a third consecutive month in April, declining 1.4%.

After two consecutive monthly decreases, manufacturing output rose 0.4% in April.

-

14:35

Unemployment claims in US continue the down trend

In the week ending June 25, the advance figure for seasonally adjusted initial claims was 268,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 259,000 to 258,000. The 4-week moving average was 266,750, unchanged from the previous week's revised average. The previous week's average was revised down by 250 from 267,000 to 266,750.

There were no special factors impacting this week's initial claims. This marks 69 consecutive weeks of initial claims below 300,000, the longest streak since 1973.

-

14:30

Canada: Industrial Product Price Index, m/m, May 1.1% (forecast 0.4%)

-

14:30

U.S.: Initial Jobless Claims, June 268 (forecast 267)

-

14:30

Canada: Industrial Product Price Index, y/y, May -1.1%

-

14:30

Canada: GDP (m/m) , April 0.1% (forecast 0.1%)

-

14:30

U.S.: Continuing Jobless Claims, June 2120 (forecast 2150)

-

13:51

Boris Johnson pulls out of race to be UK prime minister

According to cnbc, in a further twist to the U.K.'s political fallout following the vote to leave the European Union, former London Mayor Boris Johnson has ruled himself out of the race to be the U.K.'s next prime minister.

Several high-profile members of the U.K.'s ruling Conservatives had thrown their hats into the ring Thursday to become the next leader of the party, prime minister and chief negotiator for Britain's future in Europe.

-

13:49

Orders

EUR/USD

Offers 1.1125-30 1.1150 1.1170 1.1200 1.1200 1.1230-40 1.1280 1.1300

Bids 1.1075-80 1.1050-55 1.1025-30 1.1000 1.0975-80 1.0930 1.0900

GBP/USD

Offers 1.3475-80 1.3500 1.3520 1.3535 1.3550 1.3580 1.3600

Bids 1.3420 1.3400 1.3380 1.3345-50 1.3330 1.3280 1.3255-60 1.3230 1.3200

EUR/GBP

Offers 0.8285 0.8300 0.8320 0.8330-35 0.8350 0.8370-75 0.8400

Bids 0.8250 0.8230 0.8200-0.8195 0.8165 0.8150 0.8130 0.8100

EUR/JPY

Offers 114.50 114.80 115.00 115.30 115.50 116.00

Bids 114.00 113.80 113.60 113.30 113.00 112.55-60 112.30-35 112.00

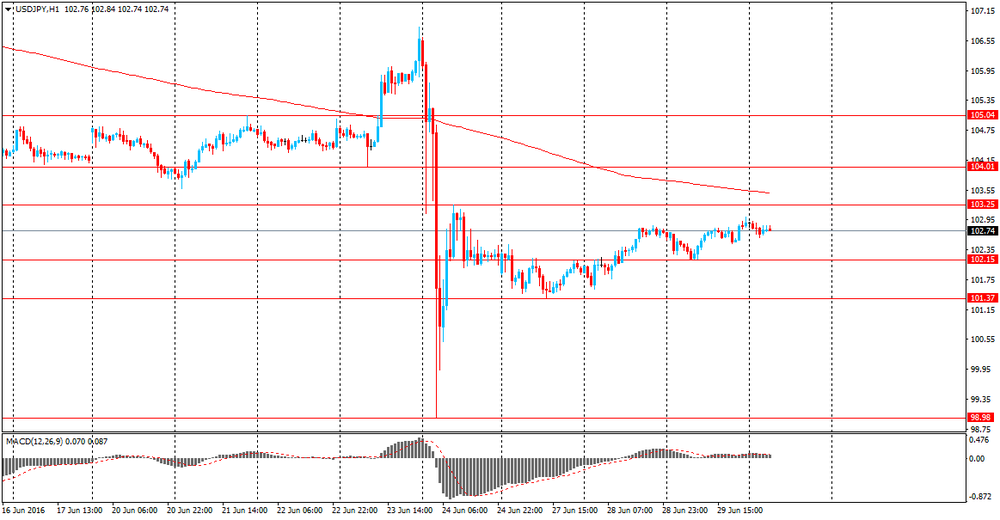

USD/JPY

Offers 102.80 103.00 103.20-25 103.50 103.85 104.00

Bids 102.45-50 102.20-25 102.00 101.80 101.65 101.50 101.20-25 101.00

AUD/USD

Offers 0.7450-55 0.7475-80 0.7500 0.7520 0.7550

Bids 0.7400 0.7375 0.7360 0.7325-30 0.7300 0.7285 0.7265 0.7230 0.7200

-

12:46

-

11:49

Review of financial and economic press: former European Commissioner: There was a danger that the European Union will not survive

D/W

In an interview with DW journalist Tim Sebastian the former deputy chairman of the European Commission, former EU Commissioner for Enlargement and Neighbourhood Policy, Günter Verheugen said that Brexit was "producing healthy shock" for the EU, at the same time compromised the very existence of the union. "There was a clear risk that the European Union will not survive", - said Verheugen.

IMF: Brexit threatens the growth of the German economy

IMF experts say that the expected yield of the UK's exit carries the "risk reduction" of German economic prospects. "The United Kingdom is an important economic partner for Germany and the change in the economic relations between the largest economies in Europe and the second largest member of it can not go unnoticed," - IMF mission to Germany Enrico Detragiash.

The Prime Minister of Scotland: We want to stay in the EU

First Minister of Scotland Nicola Sturgeon believes that negotiations on the preservation of Scotland's place in the EU after Brexit will not be simple. "I can not underestimate the challenges facing us," - she said on Wednesday, in Brussels after meetings with leading European politicians.

Newspaper. ru

WSJ: IMF may lower GDP forecast for Germany due to Brexit

Assistant Director of the European Department of the International Monetary Fund Enrica Detredzhich said that the IMF plans to lower the forecast for GDP growth in Germany in 2016 in connection with the decision of the UK to leave the European Union, according to The Wall Street Journal.

Obama: Brexit become a barrier to investment in the UK and EU

-

11:07

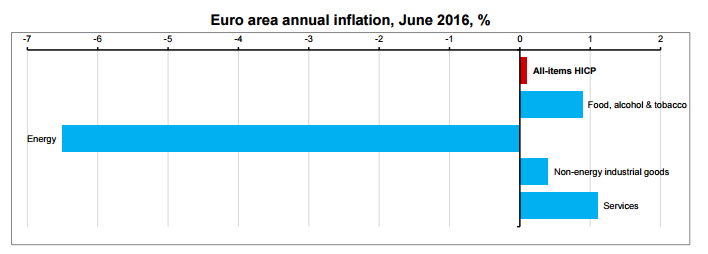

Euro area annual inflation increased 0.1%

Euro area annual inflation is expected to be 0.1% in June 2016, up from -0.1% in May 2016, according to a flash estimate from Eurostat.

Looking at the main components of euro area inflation, services is expected to have the highest annual rate in June (1.1%, compared with 1.0% in May), followed by food, alcohol & tobacco (0.9%, stable compared with May), non-energy industrial goods (0.4%, compared with 0.5% in May) and energy (-6.5%, compared with -8.1% in May).

-

11:01

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 1.1bln) 1.1050 (469m) 1.1100 (416m)

GBP/USD 1.3500 ( GBP 1.25bln)

USD/CAD 1.2900 (USD 621m) 1.2995-1.3000 (1.1bln) 1.3100 (692m)

NZD/USD 0.6875 (NZD 741m) 0.6900 (1.0bln) 0.6925 (490m)

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, June 0.9% (forecast 0.8%)

-

11:00

Eurozone: Harmonized CPI, Y/Y, June 0.1% (forecast 0%)

-

10:49

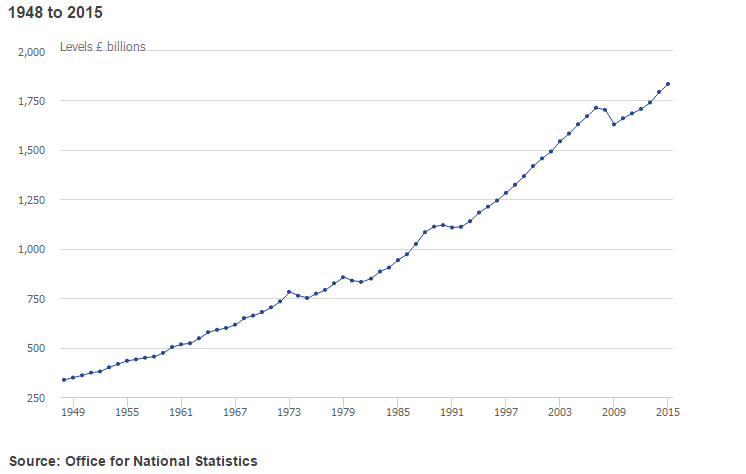

UK GDP stable at 0.4% in the 1st quarter

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.4% in Quarter 1 (Jan to Mar) 2016, unrevised from the second estimate of GDP published on 26 May 2016. This is the 13th consecutive quarter of positive growth since Quarter 1 2013.

Since Quarter 1 2015, revisions to GDP quarterly volume growths are small - with a 0.2 percentage point downward revision to Quarter 1 2015 and Quarter 2 (Apr to June) 2015 partially being offset by a 0.1 percentage point upward revision to Quarter 4 (Oct to Dec) 2015.

Between 2014 and 2015, GDP in volume terms increased by 2.2%, revised down 0.1 percentage points from the previous estimate. Between Quarter 1 2015 and Quarter 1 2016, GDP in volume terms increased by 2.0%, unrevised from the previously published estimate.

GDP decreased by 6.3% from the peak in Quarter 1 2008 to the trough in Quarter 2 2009, a little deeper than previously estimated. Having regained its pre-downturn peak in Quarter 3 2013 (one quarter later than previously published), GDP in Quarter 1 2016 is currently 7.0% above its pre-downturn peak.

-

10:30

United Kingdom: Current account, bln , Quarter I -32.6 (forecast -27.1)

-

10:30

United Kingdom: GDP, q/q, Quarter I 0.4% (forecast 0.4%)

-

10:30

United Kingdom: GDP, y/y, Quarter I 2% (forecast 2%)

-

10:16

Germany’s unemployment falling to record low

In June the unemployment rate was 6.15, unchanged from previos month but the total number of unemployed people drops to 2.69 mln from 2.696 prior. Also the NSA rate was 5.9%, below 6% for first time since reunification. Eur/Usd on the rise, appreciating 55 pips so far.

-

09:56

Germany: Unemployment Change, June -6 (forecast -5)

-

09:55

Germany: Unemployment Rate s.a. , June 6.1% (forecast 6.1%)

-

09:28

At 15:00 GMT Bank of England Governor Mark Carney will deliver a speech on Brexit.

Today's events:

At 09:00 GMT Italy will hold a 10-year bonds auction.

At 11:30 GMT ECB to report on monetary policy meeting.

At 15:00 GMT Bank of England Governor Mark Carney will deliver a speech on Brexit.

At 17:30 GMT FOMC member James Bullard will give a speech.

-

09:17

Fitch: no direct impact on Asia-Pacific sovereigns, no bank ratings impact from Brexit

-

UK's vote to leave European Union has no immediate direct ratings impact on Asia-Pacific. sovereigns or banks.

-

Spike in political uncertainty in UK - and resulting effects on investor risk appetite - could pose greatest challenges for Asia in short term.

-

Brexit will add to short-term challenges for japan to escape deflation as well as raise risks to export sector.

-

Direct impact from UK trade on Asian economies is also likely to be limited.

-

Emerging Asia will remain fastest-growing global region.

-

China is likely to remain a much more significant driver of economic outcomes in APAC than Brexit.

-

US Fed slowing pace of its rate increases, could play a key role in calming markets.

-

-

09:11

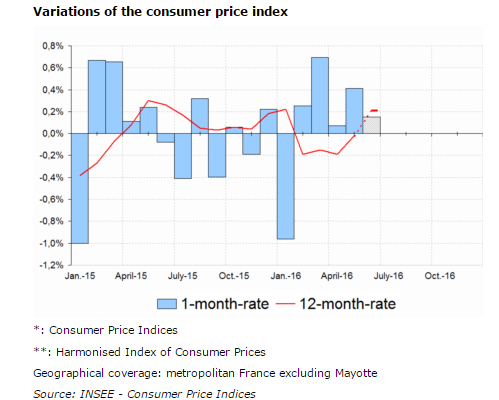

French CPI up 0.2% in June

In June 2016, according to the provisional estimate made at the end of the month, the Consumer Price Index (CPI) is set to rise by 0.1% month-on-month (versus -0.1% over one month in June 2015). This increase should result from a strengthening in petroleum products prices for the fourth month in a row, and a seasonal rebound in prices of some services at the edge of summer. It should be partly offset by the seasonal decline in fresh food and manufactured products prices, with the beginning of summer sales.

Year-on-year, consumer prices should rise by 0.2% in June 2016 after a stabiltity during the previous month. This slight increase should arise mainly from a smaller decrease in energy prices. Similarly, the decline in manufactured products prices should be less pronounced than in May. Food and service prices should contribute again to the rise in consumer prices year-on-year.

In June 2016, the Harmonised Index of Consumer Prices is set to grow by 0.2% over the month. Year-on-year, it should increase by 0.3% after +0.1% in the previous month.

-

09:09

Switzerland: KOF economic indicator unchanged

In June, the value of the KOF Economic Barometer continued to be above its historical average. It reached a value of 102.4 compared to 101.8 (revised from 102.9) in May. Overall, the KOF Economic Barometer indicates a stable condition of the Swiss economy.

Positive impetus for the development of the Barometer in June came from the indicators related to export opportunities for Swiss companies and from the indicators of construction activity, the positive development here being mainly driven by project engineering bureaus. In the actual construction industry, the situation is unchanged. Within the manufacturing sector the prospects for mechanical engineering brightened. For chemistry and food manufacturers the outlook, however, is not as good as before. The perspectives for private consumption as well as for the banking industry worsened.

In the manufacturing sector, in particular the stock and the business situation had a negative effect. Positive signals came, however, from production and to a lesser extent from the order books and the intermediary products.

-

09:01

Switzerland: KOF Leading Indicator, June 102.4 (forecast 102.8)

-

08:59

Asian session review: Yen little changed

The dollar took a breather, but remained near a 3 month high against a basket of currencies affected by the vote in the UK to leave the European Union.

Despite the stabilization of exchange rates, the uncertainty as to how the UK will affect the output of the global economy remains extremely high. 2nd quarter flows will increase volatility and investors cand close their positions before the long weekend in the US. Month end is a volatile period that can offer trading oportunities.

The pound traded near the 28 June high rebounded from a 31-year low reached on Monday, the lowest level since 1985. Recall the two-day decline of the pound on Friday and Monday was the largest in recent history.

EU leaders discussed the consequences of brexit at the summit in Brussels. On Tuesday, EU leaders said that the UK should not expect any preferences from the former partners on the trade block.

The last meeting of EU leaders has become hot, although it was probably a premature farewell to the British Prime Minister David Cameron and sluggish approval of the previously approved plans in the sphere of economy. The leaders of the European Union, bearing their share of responsibility for creating an atmosphere in the EU that favored Brexit.

According to the data released today, the consumer confidence index from the GfK UK in June remained unchanged at -1. Analysts had expected a decline to -2.

Today's data on consumer confidence index was calculated through a survey conducted from June 1 to June 15

The GfK said that they are going to do a new survey, which will be published on July 8 to try to assess the impact of the UK decision to withdraw from the EU structure.

The yen was little changed from the closing session on 28 June, despite trade and industry weak preliminary data . The Japanese industrial production fell by 2.3%. Analysts had expected a decline to -0.1%. In annual terms, industrial production fell by 0.1% after a decline of -3.3% in April.

Japanese Ministry of Economy, Trade and Industry predicts growth of industrial production in the coming months. Growth of industrial production is expected in June at 1.7% and in July to 1.3%.

The Australian dollar fell to some extent, influenced by the data released today by private sector lending. Lending to the private sector in Australia increased by 0.4% in June, lower than the previous value of 0.5%. In annual terms, this figure decreased from 6.7% in May to 6.5% in June.

The report on private sector lending, published by the Reserve Bank of Australia, reflects the amount of funds borrowed by Australian private sector. It shows whether the private sector can afford large expenses that will support economic growth. This figure is considered an indicator of business conditions and economic situation in Australia as a whole.

Housing loans increased in June by 0.5% after the credit growth in May by 0.4%. On an annualized basis, +6.9%.

Personal loans decreased 0.1% in June and 1.1% in annual terms.

Business loans, though increased by + 0.3%, the rate was lower than the previous value of + 0.8%.

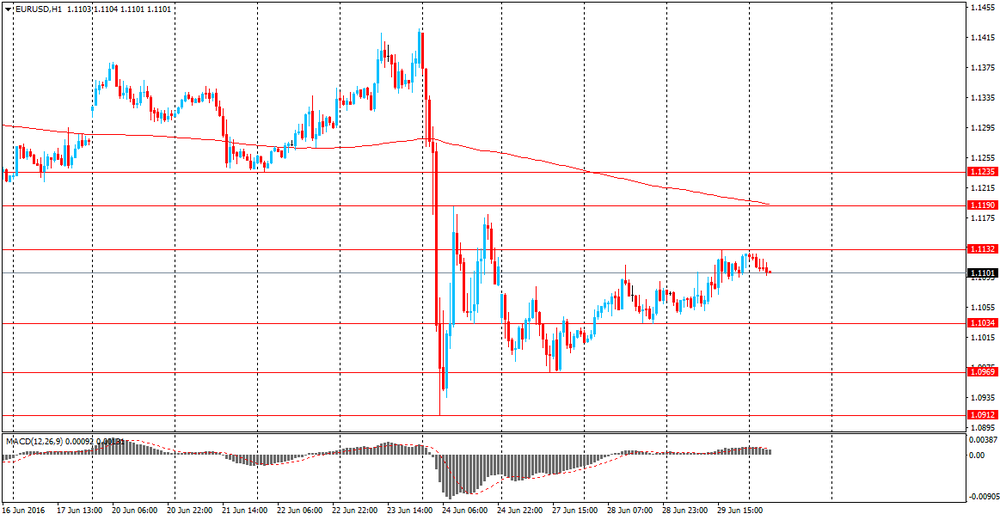

EUR / USD: during the Asian session, the pair traded in $ 1.1080-1.1100 range.

GBP / USD: traded in 1.1.3360-1.3400 range.

USD / JPY: traded in Y101.45-55 range.

-

08:24

Options levels on thursday, June 30, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1320 (2350)

$1.1246 (2979)

$1.1195 (1209)

Price at time of writing this review: $1.1100

Support levels (open interest**, contracts):

$1.1010 (3388)

$1.0972 (8580)

$1.0931 (5716)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 42264 contracts, with the maximum number of contracts with strike price $1,1500 (5281);

- Overall open interest on the PUT options with the expiration date July, 8 is 88889 contracts, with the maximum number of contracts with strike price $1,0900 (15211);

- The ratio of PUT/CALL was 2.10 versus 2.16 from the previous trading day according to data from June, 29

GBP/USD

Resistance levels (open interest**, contracts)

$1.3704 (187)

$1.3607 (538)

$1.3511 (1653)

Price at time of writing this review: $1.3392

Support levels (open interest**, contracts):

$1.3291 (871)

$1.3194 (3001)

$1.3096 (419)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 32945 contracts, with the maximum number of contracts with strike price $1,5000 (4020);

- Overall open interest on the PUT options with the expiration date July, 8 is 44707 contracts, with the maximum number of contracts with strike price $1,3500 (5034);

- The ratio of PUT/CALL was 1.36 versus 1.42 from the previous trading day according to data from June, 29

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:17

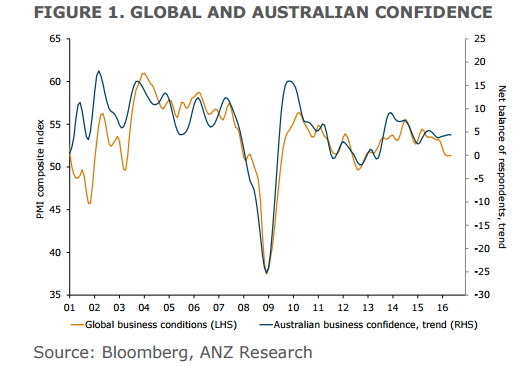

AUD: to underperform vs USD, JPY, CHF; Fade data-driven rallies - ANZ

eFX news with the latest ANZ recommendation:

Brexit is now a reality. The damage is done and we now have to navigate through an environment of heightened uncertainty. Though the UK is far away, this kind of global uncertainty is never a good thing for global confidence or risk appetite. By extension, as a small, open economy dependent on global trade and funding, the AUD should weaken in this environment. We expect the AUD to underperform safe havens such as the USD, JPY and the CHF. The AUD is likely to remain within our existing forecast range (above USD0.66).

Increased pricing of RBA rate cuts has also contributed to the weakness in the AUD. Since the Brexit vote, rates markets have added 20bps of rate cuts and now expect ~40bps of easing. This looks fully priced and as such domestic factors will take a backseat for now

For the AUD, we would fade better-than-expected data although worse-than-expected data may see markets reinforce expectations of near-term RBA easing and see the AUD trade lower. Brexit also raises questions about the medium-term outlook for the Australian economy and in turn, the AUD. Australia has benefited from a globalised economy, with free trade and capital mobility at its centre. While Brexit is not sufficient to declare that globalisation has peaked, the global economic model is clearly under pressure. A continued trend towards less international cooperation would justify a bigger premium on AUD assets and weigh on the AUD.

-

08:12

The index of business confidence in New Zealand increased in June

The index of business confidence in New Zealand, published by the ANZ Bank in June was 20.2, which is significantly higher than the previous value of 11.3. This figure was the highest since December 2015.

The business confidence index assesses the business outlook in New Zealand. Business confidence allows us to analyze the economic situation in the short term. The growth of the index indicates an increase in business investment, which helps production.

The outlook on the business activity, which is a review of the results of surveys on business prospects in the New Zealand economy as a whole, rose to 35.1 in June from 30.4 the previous value.

The ANZ also expect inflation in the next year to 1.49% from the previous forecast of 1.39%.

-

08:10

Lending to the private sector in Australia increased 0.4% in June

Lending to the private sector in Australia increased by 0.4% in June, lower than the previous value of 0.5%. In annual terms, this figure decreased from 6.7% in May to 6.5% in June.

The report on private sector lending, published by the Reserve Bank of Australia, reflects the amount of funds borrowed by Australian private sector. It shows whether the private sector can afford large expenses that will support economic growth. This figure is considered an indicator of business conditions and economic situation in Australia as a whole.

Housing loans increased in June by 0.5% after the credit growth in May by 0.4%. On an annualized basis, + 6.9%.

Personal loans decreased 0.1% in June and 1.1% in annual terms.

Business loans, though increased by + 0.3%, the rate was lower than the previous value of + 0.8%.

-

08:06

Retail sales up 0.9% m/m in Germany

According to provisional results of the Federal Statistical Office (Destatis), retail turnover in May 2016 in Germany increased in real terms 2.6% and in nominal terms 2.7% compared with the corresponding month of the previous year. The number of days open for sale was 24 in May 2016 and 23 in May 2015.

Compared with the previous year, turnover in retail trade was in the first five months 2016 in real terms 2.0% and in nominal terms 2.1% larger than in in the corresponding period of the previous year.

When adjusted for calendar and seasonal variations, the May turnover was in real terms 0.9% and in nominal terms 0.8% larger than that in April 2016.

-

08:00

Germany: Retail sales, real unadjusted, y/y, May 2.6% (forecast 3%)

-

08:00

Germany: Retail sales, real adjusted , May 0.9% (forecast 0.7%)

-

07:46

Japan: Construction Orders, y/y, May 34.5%

-

07:07

Japan: Housing Starts, y/y, May 9.8% (forecast 4.8%)

-

03:31

Australia: Private Sector Credit, y/y, May 6.5%

-

03:31

Australia: Private Sector Credit, m/m, May 0.4% (forecast 0.5%)

-

03:01

New Zealand: ANZ Business Confidence, June 20.2

-

01:53

Japan: Industrial Production (MoM) , May -2,3% (forecast -0.1%)

-

01:52

Japan: Industrial Production (YoY), May -0,1%

-

01:06

United Kingdom: Gfk Consumer Confidence, June -1 (forecast -3)

-

00:46

New Zealand: Building Permits, m/m, May -0.9%

-

00:24

Currencies. Daily history for Jun 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1126 +0,44%

GBP/USD $1,3448 +0,89%

USD/CHF Chf0,9792 -0,08%

USD/JPY Y102,89 +0,18%

EUR/JPY Y114,50 +0,64%

GBP/JPY Y138,37 +1,08%

AUD/USD $0,7442 +0,74%

NZD/USD $0,7107 +0,76%

USD/CAD C$1,2944 -0,63%

-

00:06

Schedule for today, Thursday, Jun 30’2016:

(time / country / index / period / previous value / forecast)

01:00 New Zealand ANZ Business Confidence June 11.3

01:30 Australia Private Sector Credit, m/m May 0.5%

01:30 Australia Private Sector Credit, y/y May 6.7%

05:00Japan Construction Orders, y/y May -16.9%

05:00 Japan Housing Starts, y/y May 9.0% 4.8%

06:00 Germany Retail sales, real adjusted May -0.9% 0.7%

06:00 Germany Retail sales, real unadjusted, y/y May 2.3% 3%

07:00 Switzerland KOF Leading Indicator June 102.9 103

07:55 Germany Unemployment Change June -11 -5

07:55 Germany Unemployment Rate s.a. June 6.1% 6.1%

08:30 United Kingdom Current account, bln Quarter I -37.2 -26.5

08:30 United Kingdom GDP, q/q (Finally) Quarter I 0.6% 0.4%

08:30 United Kingdom GDP, y/y (Finally) Quarter I 2.1% 2%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) June -0.1% 0%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) June 0.8% 0.8%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Industrial Product Price Index, m/m May -0.5%

12:30 Canada Industrial Product Price Index, y/y May -1.6%

12:30 Canada GDP (m/m) April -0.2%

12:30 U.S. Continuing Jobless Claims June 2142 2147

12:30 U.S. Initial Jobless Claims June 259 268

13:45 U.S. Chicago Purchasing Managers' Index June 49.3 50.9

15:00 United Kingdom BOE Gov Mark Carney Speaks

17:30 U.S. FOMC Member James Bullard Speaks

23:30 Australia AIG Manufacturing Index June 51.0

23:30 Japan Household spending Y/Y May -0.4% -1.4%

23:30 Japan Tokyo Consumer Price Index, y/y June -0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June -0.5% -0.5%

23:30 Japan National Consumer Price Index, y/y May -0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y May -0.3% -0.4%

23:30 Japan Unemployment Rate May 3.2% 3.2%

23:50 Japan BoJ Tankan. Manufacturing Index Quarter II 6 4

23:50 Japan BoJ Tankan. Non-Manufacturing Index Quarter II 22 19

-