Noticias del mercado

-

21:04

DJIA 17929.51 -0.48 0%, NASDAQ 4852.04 9.36 0.19%, S&P 500 2099.09 0.23 0.01%

-

18:05

European stocks closed: FTSE 6577.83 73.50 1.13%, DAX 9776.12 96.03 0.99%, CAC 4273.96 36.48 0.86%

-

17:54

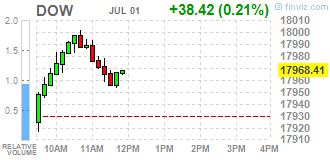

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose for the fourth straight day as increased prospects of central bank stimulus around the world bolstered investor confidence. Investors were also taking stock of their holdings after a tumultuous week in the wake of Britain's vote to leave the European Union. The vote sparked a two-day panic selloff, but markets clawed back their losses in the last three days.

Most of all Dow stocks in positive area (20 of 30). Top looser - JPMorgan Chase & Co. (JPM, -1,13%). Top gainer - The Home Depot, Inc. (HD, +1,85%).

Most of all S&P sectors also in positive area. Top looser - Utilities (-0,3%). Top gainer - Services (+1,0%).

At the moment:

Dow 17857.00 +38.00 +0.21%

S&P 500 2095.50 +5.25 +0.25%

Nasdaq 100 4433.75 +26.75 +0.61%

Oil 48.33 0.00 0.00%

Gold 1339.50 +18.90 +1.43%

U.S. 10yr 1.46 -0.03

-

17:47

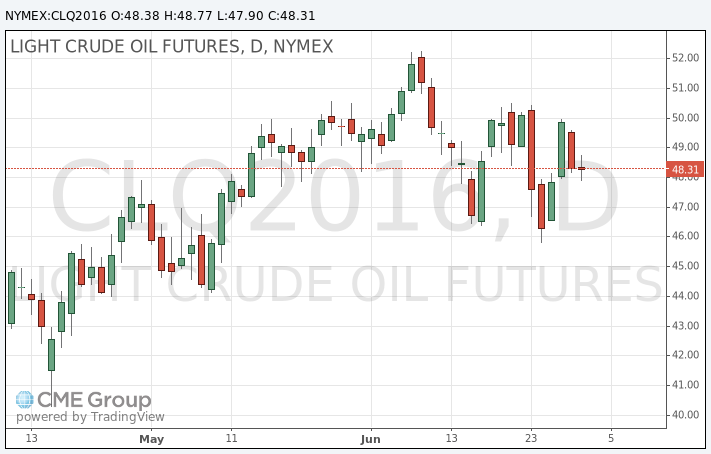

OIL prices decreased slightly

Oil prices fall as fears of a glut of world reserves resumed on the background of output growth in Nigeria and Canada.

Oil prices fell as production in Nigeria is slowly recovering in the absence of new threats and attacks which on June 16 reduced the production of raw materials to the lowest level in the last 30 years.

Production from Canada also shows growth after massive forest fires, because of which production in Alberta ceased in the past two months.

In addition, Reuters survey found that OPEC production in June rose to a record volume of 32.82 million barrels per day.

Meanwhile, investors remain cautious as markets continue to recover from the shocking results of voting in the UK last week, which resulted in the country leaving the European Union.

Sentiment in the markets also deteriorated after Friday data showed that China's PMI index for the production sector fell to 48.6 in June from 49.2 in the previous month.

The official PMI indicator for the production sector in China fell to 50.0 last month from 50.1 in May, in line with expectations.

The cost of the August futures for US light crude oil WTI fell to 47.90 dollars per barrel.

September futures price for Brent fell to 49.25 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:37

WSE: Session Results

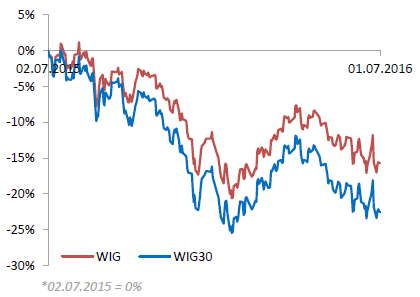

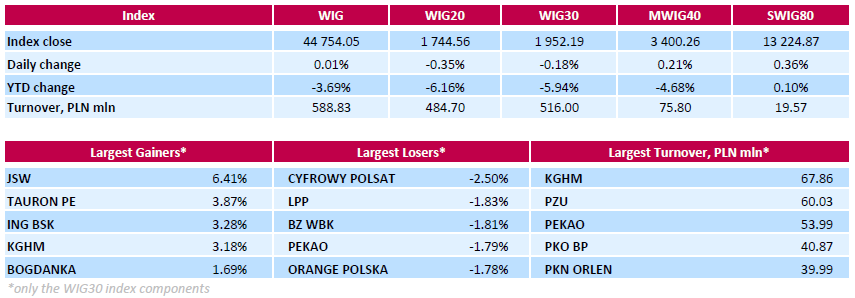

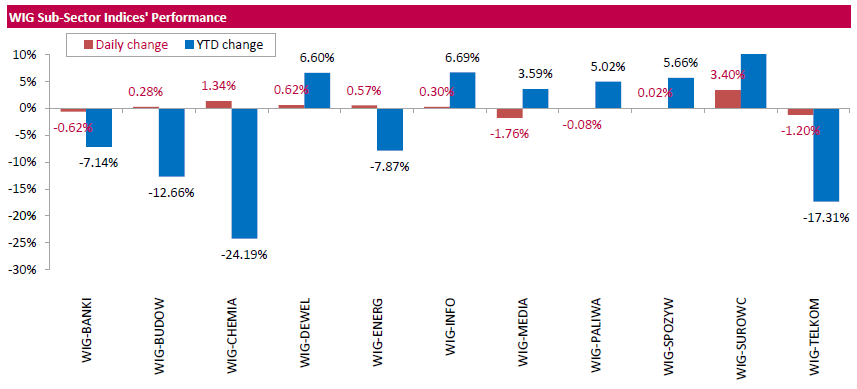

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, inched up 0.01%. Sector performance within the WIG Index was mixed. Media (-1.76%) and telecoms (-1.20%) recorded the most notable declines, while materials (+3.40%) and chemicals (+1.34%) fared the best.

The large-cap stocks' measure, the WIG30 Index fell by 0.18%. Within the Index components, media group CYFROWY POLSAT (WSE: CPS), clothing retailer LPP (WSE: LPP), telecommunication services provider ORANGE POLSKA (WSE: OPL) and two banking sector names BZ WBK (WSE: BZW) and PEKAO (WSE: PEO) were the weakest performers, returning losses between 1.83% and 2.5%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the advancers pack with a 6.41% growth, bouncing back after yesterday's sharp decline. It was followed by genco TAURON PE (WSE: TPE), bank ING BSK (WSE: ING) and copper producer KGHM (WSE: KGH), gaining 3.87%, 3.28% and 3.18% respectively.

-

17:25

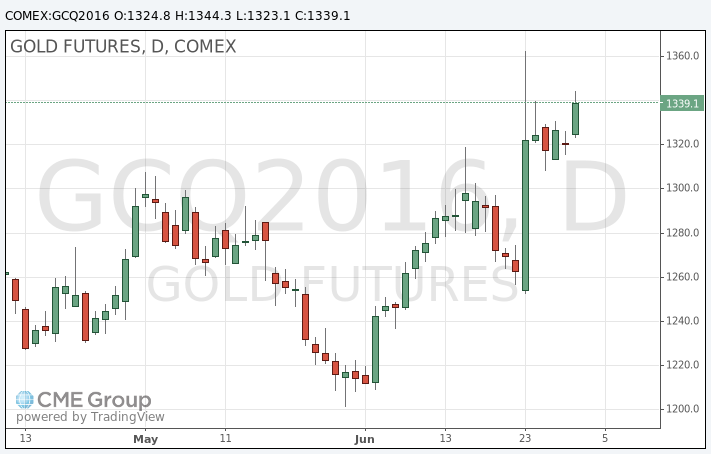

Gold price rose

Gold price rose as weak economic data in China and the effects of Brexit increased demand for the metal as a safe-haven asset.

The official Chinese purchasing managers' index for the production sector in June fell to 50.0, while the previous three months, the index was above 50, indicating a growth of activity in the sector. Managers' Index Caixin in June was 48.6 against 49.2 in May, demonstrating the most significant drop in 4 months.

In addition, concerns about the political and economic uncertainty after the British decision to withdraw from the European Union continues to strengthen demand for gold.

Data for the Chinese manufacturing industry, published on Friday, strengthened the feeling that the prospects for global economic growth are deteriorating, said Matthew Turner, analyst at Macquarie. The deterioration in the global economy makes it less likely the Fed raising interest rates in the coming months, traders believe.

"After the British referendum, taking into account some not very positive economic data, observers expect a longer maintenance of low interest rates, and this is positive for the precious metals," - Turner said.

Higher interest rates usually put pressure on gold, which become less atractive against a background of higher-yielding instruments.

Over the past six months the price of gold showed the most significant growth since 2007, amid doubts about the sustainability of the global economy and in view of the negative interest rates in different countries. During this period, gold has risen in price in 2016 to 26%.

The cost of the August gold futures on COMEX rose to $ 1344.3 per ounce.

-

17:08

Fed, Fischer: will have better idea of conditions by July FOMC meeting

-

we make our decisions one meeting at a time.

-

we've got to look over a longer horizon than a few months.

-

most of the data since May payrolls looking good.

-

hard to predict USD but Fed takes it into account.

-

Fed's primary goal is to do right for US economy.

-

expects US economy to continue on slow very gradual path we've been on.

-

Brexit probably less important for US than others.

-

Fed has no plans to move into negative territory.

-

will try to avoid ever getting to negative rates.

-

-

16:12

US ISM manufacturing up to 53.2

The report was issued today by Bradley J. Holcomb, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee. "The June PMI registered 53.2 percent, an increase of 1.9 percentage points from the May reading of 51.3 percent. The New Orders Index registered 57 percent, an increase of 1.3 percentage points from the May reading of 55.7 percent. The Production Index registered 54.7 percent, 2.1 percentage points higher than the May reading of 52.6 percent. The Employment Index registered 50.4 percent, an increase of 1.2 percentage points from the May reading of 49.2 percent. Inventories of raw materials registered 48.5 percent, an increase of 3.5 percentage points from the May reading of 45 percent. The Prices Index registered 60.5 percent, a decrease of 3 percentage points from the May reading of 63.5 percent, indicating higher raw materials prices for the fourth consecutive month. Manufacturing registered growth in June for the fourth consecutive month, as 12 of our 18 industries reported an increase in new orders in June (down from 14 in May), and 12 of our 18 industries reported an increase in production in June (same as in May)."

-

16:09

U.S. construction spending fell for a second straight month

According to Reuters, U.S. construction spending fell for a second straight month in May after the biggest drop in more than five years in April, which could prompt economists to lower their second-quarter growth estimates.

Construction spending was down 0.8 percent after a downwardly revised 2.0 percent drop in April, the Commerce Department said on Friday. The revised April drop was the largest since January 2011.

Economists polled by Reuters had forecast construction spending rising 0.6 percent after a previously reported April drop of 1.8 percent. May construction outlays were up 2.8 percent from a year earlier.

May construction spending was held down by a 2.3 percent drop in public construction spending. Outlays on state and local construction projects, the largest of the public sector segment, tumbled 3.0 percent, while federal construction spending rose 7.5 percent.

-

16:00

U.S.: ISM Manufacturing, June 53.2 (forecast 51.4)

-

16:00

U.S.: Construction Spending, m/m, May -0.8% (forecast 0.6%)

-

15:56

WSE: After start on Wall Street

The US market started at neutral level, then began to gain and slightly exceeded the level of 2100 points on the S&P500 index, which is already at the levels of the last Friday opening. The movement from lows was very strong and it seems that today's session can only seal it before the long weekend in the US due to Monday's Independence Day.

Major European indices show good posture and both the DAX-a and the CAC40 are approx. + 0.8%. We also may see very well behavior in the British market, which set new highs this year, and maintains them. At the Warsaw market there is still no major changes, the WIG20 index is currently at the level of 1,744 points (-0.36%).

-

15:51

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0940-50 (EUR 686m) 1.1000-15 (683m) 1.1100 (717m)

USDJPY 104.00 (USD 604m)

GBPUSD 1.3150 (GBP 789m) 1.3300 (559m) 1.3500 (568m)

AUDUSD 0.7310 (AUD 770m) 0.7350 (425m) 0.7500 (636m)

USDCAD 1.3090 (USD 320m)

-

15:48

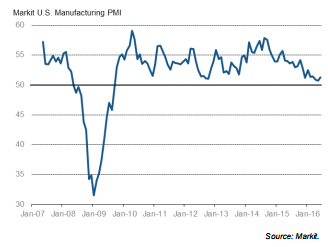

U.S. manufacturers indicated a slight rebound in production - PMI

U.S. manufacturers indicated a slight rebound in production volumes during June, helped by the fastest rise in new work since March. However, the latest survey signalled that growth momentum remained relatively subdued in comparison to its post-crisis trend, which contributed to cautious job hiring and further efforts to reduce inventories in June. The seasonally adjusted final Markit U.S. Manufacturing Purchasing Managers' Index (PMI) registered 51.3 in June, up from 50.7 in May and the highest reading for three months. The earlier 'flash' reading for June was 51.4. Higher levels of production, new orders and employment all helped to boost the headline index, while an accelerated fall in stocks of purchases was the only negative influence. June data signalled a marginal expansion of manufacturing output, following the decline recorded during the previous month. Greater production volumes reflected a sustained upturn in new business intakes. Although still weaker than the longrun survey average, the latest rise in new orders was the fastest since March. Reports from survey respondents suggested that heightened economic uncertainty and delayed decision making ahead of the presidential election had acted as a brake on client demand. A rebound in export sales provided a boost to manufacturers' workloads in June. Moreover, the increase in new orders from abroad was the fastest since September 2014. This contributed to an upturn in backlogs of work across the manufacturing sector for the first time since the start of 2016.

-

15:45

U.S.: Manufacturing PMI, June 51.3 (forecast 51.4)

-

15:32

U.S. Stocks open: Dow -0.04%, Nasdaq -0.06%, S&P -0.03%

-

15:10

Before the bell: S&P futures -0.04%, NASDAQ futures -0.04%

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 15,682.48 +106.56 +0.68%

Hang Seng Closed

Shanghai Composite 2,932.82 +3.22 +0.11%

FTSE 6,558.17 +53.84 +0.83%

CAC 4,275.23 +37.75 +0.89%

DAX 9,767.78 +87.69 +0.91%

Crude $48.19 (-0.29%)

Gold $1336.90 (+1.23%)

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.26

-0.01(-0.1079%)

54839

ALTRIA GROUP INC.

MO

68.96

-0.00(-0.00%)

20584

Amazon.com Inc., NASDAQ

AMZN

716.61

0.99(0.1383%)

20590

American Express Co

AXP

61.18

0.42(0.6912%)

848

AMERICAN INTERNATIONAL GROUP

AIG

52.73

-0.16(-0.3025%)

501

Apple Inc.

AAPL

95.56

-0.04(-0.0418%)

53214

AT&T Inc

T

43.35

0.14(0.324%)

6675

Barrick Gold Corporation, NYSE

ABX

21.85

0.50(2.3419%)

91962

Boeing Co

BA

129.31

-0.56(-0.4312%)

780

Chevron Corp

CVX

104.82

-0.01(-0.0095%)

687

Cisco Systems Inc

CSCO

28.77

0.08(0.2788%)

113087

Citigroup Inc., NYSE

C

42.29

-0.10(-0.2359%)

97861

Deere & Company, NYSE

DE

80.8

-0.24(-0.2961%)

25266

Exxon Mobil Corp

XOM

93.26

-0.48(-0.5121%)

1139

Facebook, Inc.

FB

114.27

-0.01(-0.0088%)

114908

FedEx Corporation, NYSE

FDX

154

2.22(1.4626%)

7568

Ford Motor Co.

F

12.64

0.07(0.5569%)

63611

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11

-0.14(-1.2567%)

114660

General Electric Co

GE

31.31

-0.17(-0.54%)

58687

General Motors Company, NYSE

GM

28.6

0.30(1.0601%)

16432

Goldman Sachs

GS

148.04

-0.54(-0.3634%)

760

Google Inc.

GOOG

692.1

-0.00(-0.00%)

1138

Intel Corp

INTC

32.71

-0.09(-0.2744%)

107318

JPMorgan Chase and Co

JPM

61.44

-0.22(-0.3568%)

11398

McDonald's Corp

MCD

120

-0.34(-0.2825%)

2040

Merck & Co Inc

MRK

57.53

-0.08(-0.1389%)

582

Microsoft Corp

MSFT

51.21

0.04(0.0782%)

152353

Nike

NKE

55.3

0.10(0.1812%)

4782

Pfizer Inc

PFE

35.21

-0.00(-0.00%)

1115

Procter & Gamble Co

PG

84.64

-0.03(-0.0354%)

28705

Starbucks Corporation, NASDAQ

SBUX

56.7

-0.42(-0.7353%)

6283

Tesla Motors, Inc., NASDAQ

TSLA

208.11

-4.17(-1.9644%)

59588

The Coca-Cola Co

KO

45.37

0.04(0.0882%)

12076

Twitter, Inc., NYSE

TWTR

16.9

-0.01(-0.0591%)

19853

UnitedHealth Group Inc

UNH

142.14

0.94(0.6657%)

509

Verizon Communications Inc

VZ

55.71

-0.13(-0.2328%)

17734

Visa

V

74.5

0.33(0.4449%)

44574

Wal-Mart Stores Inc

WMT

72.41

-0.61(-0.8354%)

38335

Walt Disney Co

DIS

97.82

-0.00(-0.00%)

14511

Yahoo! Inc., NASDAQ

YHOO

37.75

0.19(0.5059%)

3175

Yandex N.V., NASDAQ

YNDX

21.82

-0.03(-0.1373%)

2700

-

14:41

European session review: US dollar fell moderatly against the euro

The following data was published:

(Time / country / index / period / previous value / forecast)

7:15 Switzerland Retail Sales m / m in May 0.1%

Switzerland 7:15 Retail sales, y / y in May -1.9%

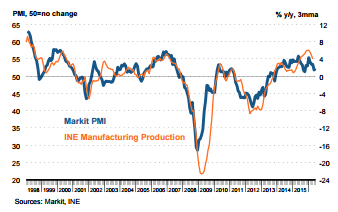

Switzerland 7:30 PMI in the manufacturing sector in June 55.8 55.4 51.6

France 7:50 PMI in the manufacturing sector (the final data) June 48.4 47.9 48.3

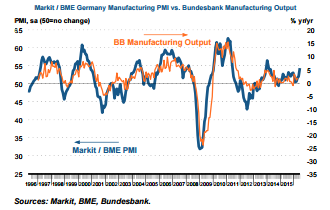

Germany 7:55 PMI in the manufacturing sector (the final data) June 52.1 54.4 54.5

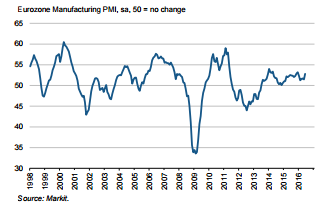

8:00 Eurozone PMI in the manufacturing sector (the final data) June 51.5 52.6 52.8

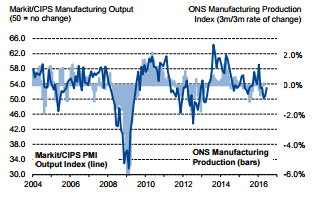

8:30 UK Index of manufacturing activity PMI June 50.1 52.1

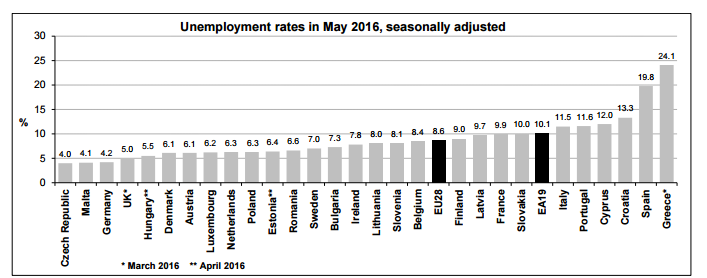

9:00 The Eurozone unemployment rate in May 10.2% 10.1% 10.1%

12:00 Canada official holiday

The euro rose moderately against the US dollar, updating the session highs. Data on business activity in the euro area gave support for the single currency, which exceeded the forecasts. The final report submitted by the Markit Economics, showed that business activity expanded significantly in the euro area's manufacturing sector in June, registering maximum growth since the beginning of this year. However, experts warn that the decision of Britain to leave the EU can slow down the sector in the coming months. The final manufacturing PMI index rose to 52.8 in June against 51.5. Earlier it was reported to increase to 52.6. The sub-index measuring the volume of production, jumped to 53.9 from 52.4, which was slightly more than a preliminary assessment of 53.8.

Markit Economics said one of the reasons for the increase in demand for industrial products in June was another reduction of prices by companies that continued for almost a year. As a result, new orders rose at the fastest pace this year - the corresponding indicator improved to 53.6 points versus 51.7 points in May. In addition, data showed that manufacturing index for Germany rose to a 28-month high and amounted to 54.5 against 52.1 in May and the preliminary reading in June at 51.4. Meanwhile, the PMI index for France declined to 48.3 from 48.4 in May. The initial estimate was 47.9.

A report on the euro area labor market was also in focus. Eurostat Statistical Office announced that at the end of May the unemployment rate in the eurozone was 10.1%, a decrease of 0.1% compared to the previous month and confirming experts' forecasts. The latter value was the lowest since July 2011. Recall that in May 2015 unemployment was 11.0%. Among the 28 EU countries, the unemployment rate fell from 8.7% to 8.6% in May. In the corresponding month in 2015, unemployment was at 9.6%.

ECB Praet said that the economy has shown signs of strengthening, and this suggests that monetary policy works. "The ECB is set to continue to play a crucial role in this process, however, the ECB's policy can not be the only remedy for the current economic problems, need more actors." - Praet said. In addition, the politician said that among the uncertainties threatening the euro-zone economy, we can distinguish the British withdrawal from the European Union and the weakness of world economic growth.

The British pound consolidated against the dollar, while remaining near the opening levels of the session. Market participants ignored today's strong data on the UK, since it was calculated before Brexit. Recall Carney signaled yesterday that the Bank of England on the background of the results of the referendum may reduce interest rates during the summer. He added that the Bank of England has a number of other tools to support the economy and the banking system, which may indicate a resumption of the bond purchase program.

With regard to statistics, Markit Economics reported that manufacturing activity in the UK sector expanded in June at the fastest pace in five months. The report showed that the index of manufacturing activity rose to 52.1 in June from 50.4 in May. The last reading was the highest since January. Analysts had expected the index to decline to 49.9. Employment declined for the sixth consecutive month, but the purchasing and selling prices increased. Meanwhile, exports of industrial products grew at the fastest pace in seven months. "The main question is whether it will be possible to partially offset any negative impact of the uncertainty by increasing the volume of exports as a result of the fall of the pound," - said Markit economist Rob Dobson.

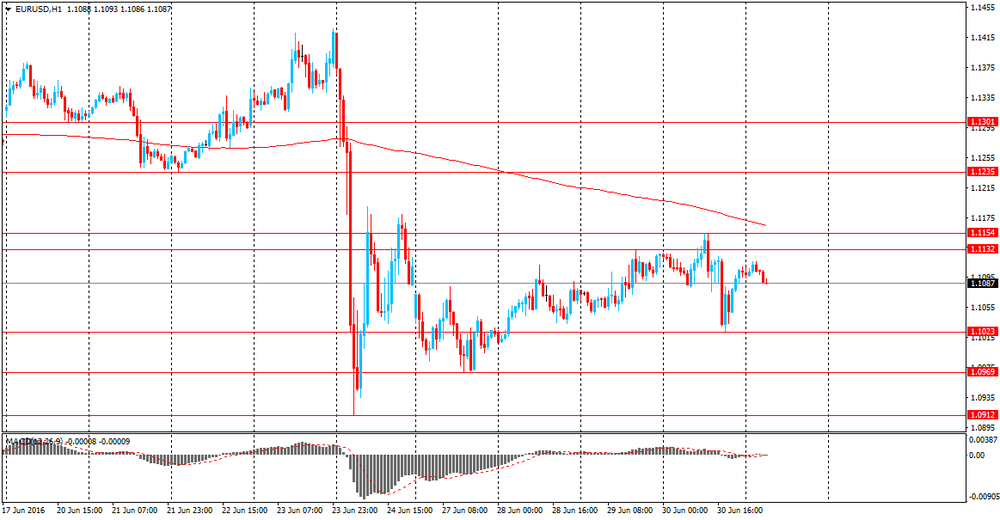

EUR / USD: during the European session, the pair risen to $ 1.1140

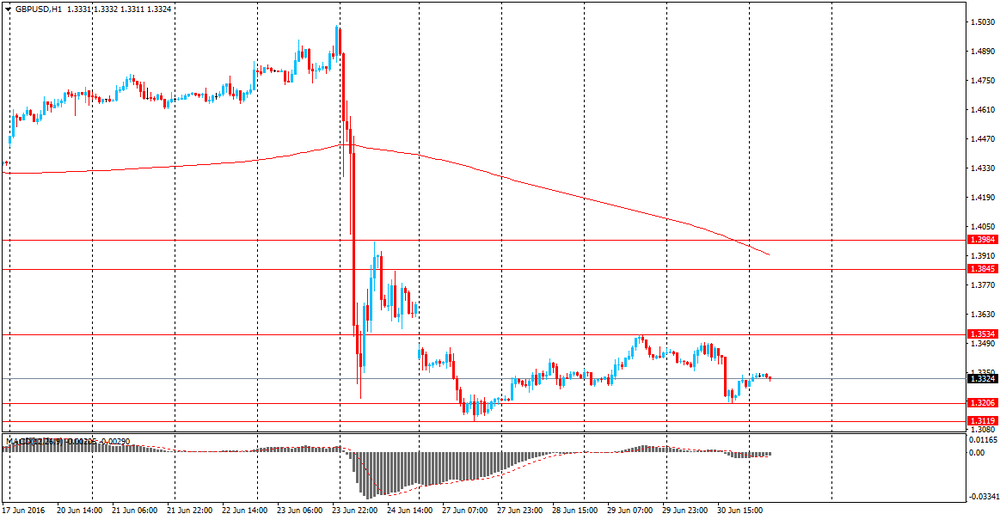

GBP / USD: traded in $ 1.3250- $ 1.3325 range

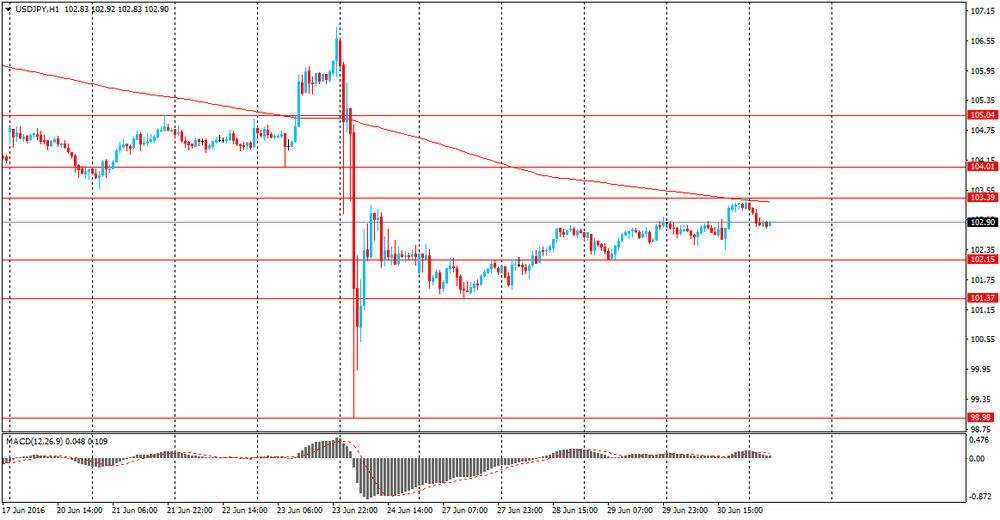

USD / JPY: fell to Y102.43

-

14:01

Orders

EUR/USD

Offers 1.1120-25 1.1150-55 1.1170 1.1185 1.1200 1.1230-40 1.1280 1.1300

Bids 1.1070-75 1.1050-55 1.1025-30 1.1000 1.0975-80 1.0930 1.0900

GBP/USD

Offers 1.3330 1.3350 1.3400 1.3450 1.3475-80 1.3500 1.3520 1.3535 1.3550

Bids 1.3280 1.3255-60 1.3230 1.3200 1.3175-80 1.3150 1.3120 1.3100

EUR/GBP

Offers 0.8360 0.8370-75 0.8400 0.8430 0.8450

Bids 0.8320 0.8300 0.8280 0.8250 0.8230 0.8200-0.8195 0.8165 0.8150

EUR/JPY

Offers 114.30 114.50 114.80 115.00 115.30 115.50 116.00

Bids 113.50-60 113.30 113.00 112.55-60 112.30-35 112.00

USD/JPY

Offers 102.80-85 103.00 103.20 103.35 103.50 103.85 104.00

Bids 102.40-45 102.20-25 102.00 101.80 101.65 101.50

AUD/USD

Offers 0.7490- 0.7500 0.7520 0.7550 0.7600 0.7650

Bids 0.7450-55 0.7430 0.7400 0.7375 0.7360 0.7325-30 0.7300

-

13:38

Positioning For A Grind Downwards In Eur/Usd - BNPP

efxnews with the latest BNP Paribas trade recommendation:

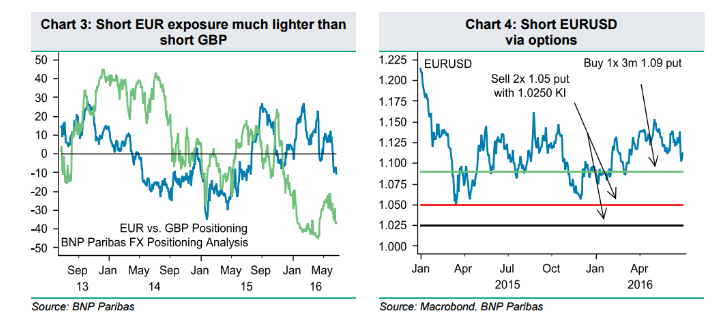

The still-elevated level of GBP volatility renders downside GBP structures very expensive after last Thursday's UK referendum. Financial markets appear to view the UK's vote to exit the EU as creating political stress within the eurozone. Positioning in the EUR has deviated from exposure to the JPY (+43) and CHF (+17) but is only moderately short at -16 compared to -45 for the GBP. Uncertainty and financial market stress are likely to remain high. In this environment, the EUR short exposure may catch up with the GBP's short exposure.

We favour positioning for a grind downwards in EURUSD, rather than a sharp move, as we see two key factors preventing a sharp decline in the EUR:

1. European Central Bank policy (asset purchase programme) will limit the widening of peripheral spreads through its purchases. Hence borrowing costs should not return to levels which would compromise fiscal sustainability. Peripheral spreads (Spain and Italy) versus Germany did initially widen by around 30bp but have since narrowed back.

2. The EUR should draw support from its circa 3% of GDP current account surplus, which has expanded considerably since 2012. Furthermore, to the extent that global investor confidence is currently at a low level, eurozone investor outflows (recycling of the current account surplus) through portfolio outflows may slow.

Finally, we note that BNP Paribas FX Positioning Analysis signals that short EUR exposure is much lighter than short GBP positioning (Chart 3). Short EUR positioning stands at -16 (on a scale of +/- 50), while short GBP positioning has reached -45. Therefore, there is considerable scope for investors to add to short EUR positions to position for further European stress.

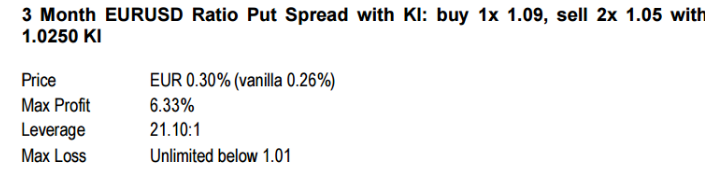

We favour the following trade recommendation which positions for a grind downwards in EURUSD but does not reach new lows below the 1.0524 of December 2015.

Adding a knock-in at 1.0250 is cheap as risk-reversals strongly favour EUR puts. The structure is flat vega at inception and has 6bp of positive rolldown over the first month. We would hedge the structure if the knock-in is activated.

-

13:33

Praet: the ECB's monetary policy works

- the financial sector and liquidity showed a surprisingly high stability.

- ECB policy supports the new borrowing, consumption, investment.

- low interest rates almost no effect on the disposable income of the euro area households.

- low interest rates provide essential support to company's profitability.

- recovering of the eurozone economy is showing signs of strengthening.

- among the uncertainties threatening the euro zone economy can be identified Brexit and weak global economic growth.

- ECB policy may not be the only remedy for the current economic problems, need more actors.

- i would not jump to conclusions regarding Brexit.

- the uncertainty associated with Brexit is a very important aspect.

-

13:08

WSE: Mid session comment

After an unsuccessful morning try of clearance over the week high, in the last minutes of the session slightly higher initiative show bears. As a result, the WIG20 index went below 1,740 pts. The behavior of our market presents a detachment from the environment where demand is trying to keep the indexes in the vicinity of neutral. European indexes, the Dax and the CAC40 are listed on delicate pros. In this context, the decline in WIG20 by 0.5%, once again has reflected the weakness of the local market and at the same time resistance to the increases.

The half of the session is behind us, and the turnover on the WIG20 index is only PLN 172 mln. It is clearly seen, that the demand side is absent. Unfortunately, scrubbing in the mid-session on its minima forecasts rather more trouble in the second part of the day.

-

13:01

Major European stock indices traded in the green zone

European stock indices show a slight increase, helped by easing fears about the consequences of Brexit. Investors expect that central banks will continue to provide support after the decision of the UK to leave the EU.

Yesterday the head of the Bank of England Governor Mark Carney signaled that the Bank of England on the background of the results of the referendum may reduce interest rates during the summer. He added that the Bank of England has a number of other tools to support the economy and the banking system, which may indicate a resumption of the bond purchase program. Lower interest rates lead to a weakening of the national currency, making it less attractive to investors.

"We believe that the downside risks for the pound remain significant, since the referendum effects become more apparent, and the ruling and opposition parties are in a political struggle," - noted Scotiabank experts.

At the same time, a representative of the ECB, Pret, said that the ECB is determined to ensure price and financial stability. According to him, the key rate will remain at current levels for an extended period. "The effect of the ECB's policy on the economy gradually increases. However, I see increased risks, including external". - The politician said.

The focus of investors was also statistics on Britain and the euro zone. A report published by Markit Economics and CIPS showed that the index of manufacturing activity in Britain rose in June to 52.1 points compared to 50.4 points in May. The last reading was the highest since January. Analysts had expected the index to decline to 49.9 points. It is worth emphasizing, the data were collected prior to the referendum. Employment declined for the sixth consecutive month, but the purchasing and selling prices increased. Meanwhile, exports of industrial products grew at the fastest pace in seven months.

With regard to the data for the euro area, Markit Economics said that business activity in the manufacturing sector has grown significantly in June, registering maximum growth since the beginning of this year. However, experts warn that the decision of Britain to leave the EU can slow down the sector in the coming months. According to the report, the final manufacturing PMI index rose in June to 52.8 points versus 51.5 points. Previously it was reported to increase to 52.6 point. The sub-index measuring the volume of production, jumped to 53.9 points from 52.4 points, which was a little more tha forecasts.

The composite index of the largest companies in the region, Stoxx Europe 600, up 0.1 percent. Currently, the index is on track for its biggest weekly gain in a month.

Automakers shares shows the most increase among the 19 industry groups capitalization of the Stoxx 600. Volkswagen AG and PSA Peugeot Citroen rose more than 4 percent.

Temenos Group AG climbed 3.9 percent after the Swiss software maker said that Standard Chartered Plc will use their software on more than 30 markets.

Telefonica Deutschland Holding AG fell by 4.5 percent, as experts at Credit Suisse Group AG downgraded the stock to 'neutral', citing increased competition in Germany.

At the moment:

FTSE 100 6,518.24 +13.91 + 0.21%

CAC 40 4,240.41 +2.93 + 0.07%

DAX 9,683.77 +3.68 + 0.02%

-

12:25

ECB, Praet: ECB is committed to ensure price and financial stability

- I expect key rates will remain at the current low levels for a prolonged period.

- I see increased risks, including foreign.

- Impact of ECB policy on the economy gradually strengthened.

- Negative interest rates increase the impact of ECB action.

-

11:30

Review of financial and economic press: S & P downgraded the rating of the European Union due to Brexit

D/W

Greece sold the port of Piraeus to Chinese shipping company Cosco

The process of privatization of the largest Greek port of Piraeus ended on the night of Friday, July 1, after Greece's parliament authorized the sale of to the Chinese state shipping company Cosco. As Reuters reported, the new owner will pay 280.5 million euros for a 51 percent stake. Five years later, Cosco to buy back 16 percent of these shares for 88 million euros.

S & P downgraded the rating of the European Union

Standard & Poor's (S & P) was the first international rating agencies to downgraded the credit rating of the European Union from "AA +" to "AA" in connection with the decision of the UK to leave the EU.

Newspaper. ru

IMF ready to help all those affected by Brexit

The International Monetary Fund (IMF) has been actively involved in the process of financial stabilization after last week's referendum in the UK's.

-

11:25

EU unemployment at 10.1% in May

The euro area (EA19) seasonally-adjusted unemployment rate was 10.1% in May 2016, down from 10.2% in April 2016 and from 11.0% in May 2015. This is the lowest rate recorded in the euro area since July 2011. The EU28 unemployment rate was 8.6% in May 2016, down from 8.7% in April 2016 and from 9.6% in May 2015. This is the lowest rate recorded in the EU28 since March 2009. These figures are published by Eustat. Eurostat estimates that 21.084 million men and women in the EU28, of whom 16.267 million were in the euro area, were unemployed in May 2016. Compared with April 2016, the number of persons unemployed decreased by 96 000 in the EU28 and by 112 000 in the euro area. Compared with May 2015, unemployment fell by 2.166 million in the EU28 and by 1.440 million in the euro area.

-

11:02

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1000 (EUR 1.1bln) 1.1050 (469m) 1.1100 (416m)

GBP/USD 1.3500 ( GBP 1.25bln)

USD/CAD 1.2900 (USD 621m) 1.2995-1.3000 (1.1bln) 1.3100 (692m)

NZD/USD 0.6875 (NZD 741m) 0.6900 (1.0bln) 0.6925 (490m)

-

11:00

Eurozone: Unemployment Rate , May 10.1% (forecast 10.1%)

-

10:48

Oil gains moderately

This morning, New York crude oil futures WTI rose by 0.19% to $ 48.41 per barrel. At the same time, Brent oil futures climbed 0.24% to $ 49.80 per barrel. Thus, the black gold is gaining, because market returns to its normal, less volatile conditions. OPEC oil production rose to 32.82 million barrels per day in June. In addition, traders expect the new easing of monetary policy by the Central Bank amid slowing growth in Asian economies.

-

10:45

UK PMI increased in June - data calculated before Brexit

June saw a modest improvement in the performance of the UK manufacturing sector. The seasonally adjusted Markit/CIPS Purchasing Managers' Index (PMI) posted 52.1, up from a revised reading of 50.4 in May, its highest level since January. It should be noted that the data collection window for this month's survey was between the 13th and 27th June. Almost all of the responses included in the final index readings were received prior to the end of 23rd June (the day of the UK's EU referendum). June data signalled a faster rate of increase in UK manufacturing production, underpinned by a solid acceleration in inflows of new work. New orders rose at the quickest pace since last October, reflecting the ongoing strength of the domestic market and a marginal uptick in new export business.

-

10:30

United Kingdom: Purchasing Manager Index Manufacturing , June 52.1

-

10:14

Italian unemployment at 11.5% in May

In May 2016, 22.677 million persons were employed, +0.1% compared with April. Unemployed were 2.950 million, -0.8% over the previous month.

Employment rate was 57.1%, +0.1 percentage points compared with April, unemployment rate was 11.5%, -0.1 percentage points over the previous month, and inactivity rate was 35.3%, -0.1 percentage points in a month. Youth unemployment rate (aged 15-24) was 36.9% and youth unemployment ratio in the same age group was 9.7%, both unchanged over the previous month.

-

10:11

German manufacturing PMI at 28 month high

German manufacturers reported their best performance since February 2014 at the end of the second quarter, with the seasonally adjusted final Markit/BME Germany Manufacturing Purchasing Managers' Index (PMI) - a single-figure snapshot of the performance of the manufacturing economy - rising from May's 52.1 to 54.5 in June. This was up marginally from an earlier 'flash' estimate of 54.4. Moreover, business conditions have now improved in each of the past 19 months. Particularly positive contributions to the PMI came from the new orders, output and employment indices. June data highlighted solid growth of production at German manufacturers, with the respective rate of expansion the fastest in over two years. In line with the trend for output, companies reported a sharp rise in the level of new work received during the month. Anecdotal evidence suggested that favourable economic conditions supported growth at the end of the second quarter. Moreover, panellists also commented on stronger demand from foreign markets, with China and the US specifically mentioned as sources of export growth. Although rising demand was partly satisfied by a reduction in post-production inventories, backlogs of work accumulated further during June. The rate of increase accelerated since the previous month and was the most marked in 2016 so far - said Markit.

-

10:07

The recovery in the eurozone manufacturing sector gathered momentum in June

Growth of both production and new orders accelerated to the fastest in the year so far, taking the respective rates of expansion during the second quarter as a whole a tick above those achieved in quarter one. The final Markit Eurozone Manufacturing PMI® posted a six-month high of 52.8 in June, up from 51.5 in May and above the earlier flash estimate of 52.6. Growth was led by a resurgent Germany and Austria, where the rates of expansion accelerated to the fastest since February 2014 and May 2011 respectively. Upturns in Italy, Spain and Ireland also gathered pace, but slowed in the Netherlands. The Greek PMI moved back into expansion territory for the first time in six months, posting a 25-month peak of 50.4. The only nation to signal contraction was France. Moreover, the gap between the French and German PMI readings (6.2 points) was at its widest since the start of 2014.

-

10:00

Eurozone: Manufacturing PMI, June 52.8 (forecast 52.6)

-

09:55

Germany: Manufacturing PMI, June 54.5 (forecast 54.4)

-

09:50

France: Manufacturing PMI, June 48.3 (forecast 47.9)

-

09:30

Switzerland: Manufacturing PMI, June 51.6 (forecast 55.4)

-

09:22

WSE: After opening

WIG20 index opened at 1756.47 points (+0.33%)*

WIG 44973.52 0.50%

WIG30 1964.32 0.44%

mWIG40 3396.07 0.09%

*/ - change to previous close

The WIG20 futures started trading with a slight indication on a plus, which distinguishes us from other European parquets, where the morning shows indication of contracts rather with cosmetic changes down.

The WIG20 index started from increase by 0.33% to 1,756 points. As might be expected spot market is opening with advantage of increases and the WIG20 is close the peaks of this week. Their eventual break-up would open the way for the closing "after-brexit" gap from last Friday. Unfortunately, a little bothered is the weaker-than-expected reading of the PMI index for Polish industry, which cosmetically falling from 52.1 points. to 51.8 pts., what is slightly disappointing.

-

09:20

Business conditions in the Spanish manufacturing sector improved modestly - PMI

Business conditions in the Spanish manufacturing sector improved modestly in June. While the rate of new order growth eased further and was marginal, output rose at a faster pace, in turn leading firms to take on extra staff and increase purchasing activity. Meanwhile, input costs were broadly unchanged and output prices continued to fall. The seasonally adjusted Markit Spain Purchasing Managers' Index (PMI) - a composite indicator designed to measure the performance of the manufacturing economy - ticked up to 52.2 in June from 51.8 in May. This signalled a modest strengthening of operating conditions, and one that was slightly more marked than one month previously. The health of the sector has improved continuously since December 2013.

-

08:50

Mixed start expected on the major stock exchanges in Europe: DAX + 0,2%, FTSE 100 -0,1%, CAC 40 + 0.1%

-

08:49

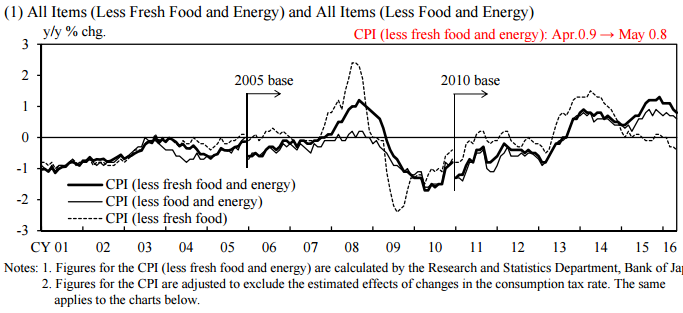

Assian session review: conflicting reports on the state of Japan’s economy

The yen traded near 29 June low. Today there were published numerous conflicting reports on the state of the economy of Japan. As reported today, the Bureau of Statistics of Japan, in May, on an annualized basis, the consumer price index in Japan fell by 0.4% after falling 0.3% in the same period of the previous year.

The base consumer price index, which excludes food prices, also fell monthly by 0.4% compared to the same period of the previous year, which corresponds to the median forecast of economists. Core consumer prices in Tokyo fell by 0.5% in June. Prices in Tokyo are considered a leading indicator of national price trends. Core CPI, which excludes prices of food and energy, rose by 0.6% compared to the same period of the previous year, after rising 0.7% in April.

Consumer prices in Japan continued to fall in May and household spending weakened again. This is likely to increase pressure on the Bank of Japan for additional measures in their attempts to stimulate the growth of inflation in the world's third largest economy.

Household spending in May fell by 1.1% compared to the same period of the previous year, declining for the third consecutive month. The previous value was -0.4%. Forecasts indicated a decline to -1.4%.

The data indicate that Prime Minister Shinzo Abe is still experiencing difficulties in stabilizing the economy of Japan.

The unemployment rate in May remained unchanged at 3.2%, the ratio of jobs and job seekers rose to 1.36 from 1.34. This is the highest level since October 1991.

According to the Tankan Report the sentiment of large manufacturers in Japan in the second quarter remained unchanged at 6, but was higher than the previous value of 4. The index value above 0 is a positive factor for the Japanese currency, the value of the indicator below the 0 - negative.

The mood among the banks at the lowest level in three and a half years

The reports published today were completed prior to the referendum on the UK's membership of the EU.

The final index of business activity in the manufacturing sector from Markit / Nikkei rose to 48.1 in June, seasonally adjusted, compared with a preliminary reading of 47.8 and a final reading of 47.7 in May.

The index of business activity in the manufacturing sector by Markit / Nikkei - an important indicator of business conditions and the general economic conditions in Japan. The index value above 50 indicates growth and is bullish for the JPY, while the value index below 50 - bearish.

Japanese manufacturing activity declined in June for the fourth month in a row. Business survey showed that both domestically and overseas demand remains stubbornly weak.

The revised new orders index rose to 46.1, higher than the preliminary reading of 45.8 and higher than 44.7 in the previous month, but still remains weak for the past five months.

The British pound is trading near the low of June 24. During the Asian session, the pound rose slightly after yesterday's sharp decline on the statement of the Bank of England head Mark Carney that the UK central bank may cut interest rates this summer.

During his speech on the effects of the British decision to withdraw from the European Union, Carney said the central bank will need to reduce its key interest rate "during the summer." He added that the Bank of England has a number of other tools to support the economy and the banking system, which may indicate a resumption of the bond purchase program.

Lower interest rates lead to the weakening of the national currency, making it less attractive to investors.

However, analysts warn that most of the economic and political consequences of the referendum are known.

Australian and New Zealand dollars strengthened slightly. According to data published today the official Purchasing Managers Index of China's manufacturing sector fell in June after rising for three consecutive months. The index of business activity in June was 50.0, in line with analysts' forecasts but was slightly lower than the previous value of 50.1.

Also, as reported today by the Chinese Federation of Logistics and Supply, the index of business activity in the non-manufacturing sector rose to 53.7 from 53.3 the previous value.

Sub-index for the services sector in June rose to 52.2 from 52.0 in May. Sub-index for construction rose to 62.0 from 59.4. The new orders sub-index for the sector rose to 50.8 from 49.2.

According to Caixin, sub-indices of production and new orders in June were down more rapidly.

The index declined for the third month in a row, and the deterioration of the situation in the manufacturing sector was the fastest since February.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1070-75 range.

GBP / USD: traded in $ 1.1.3360-65 range.

USD / JPY: traded in Y102.65-70 range.

-

08:31

Options levels on friday, July 1, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1312 (2323)

$1.1232 (3266)

$1.1173 (1288)

Price at time of writing this review: $1.1077

Support levels (open interest**, contracts):

$1.1005 (3560)

$1.0970 (8904)

$1.0930 (5686)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 42495 contracts, with the maximum number of contracts with strike price $1,1500 (5303);

- Overall open interest on the PUT options with the expiration date July, 8 is 89633 contracts, with the maximum number of contracts with strike price $1,0900 (15211);

- The ratio of PUT/CALL was 2.11 versus 2.10 from the previous trading day according to data from June, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.3603 (829)

$1.3505 (2161)

$1.3408 (217)

Price at time of writing this review: $1.3279

Support levels (open interest**, contracts):

$1.3188 (3033)

$1.3091 (441)

$1.2994 (1985)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 34131 contracts, with the maximum number of contracts with strike price $1,5000 (4014);

- Overall open interest on the PUT options with the expiration date July, 8 is 44941 contracts, with the maximum number of contracts with strike price $1,3500 (5038);

- The ratio of PUT/CALL was 1.32 versus 1.36 from the previous trading day according to data from June, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:30

BOJ, Tankan report: big manufacturers sentiment index above expectations

Japan's large manufacturers sentiment index in the second quarter remained unchanged at 6, but was higher than the previous value of 4

The index of the Tankan large manufacturers, published by the Bank of Japan, reflects the general business conditions for large Japanese manufacturing companies. This index is an economic indicator of Japan, which is heavily dependent on the industrial activity, causing the growth of export-oriented economy. The index value above 0 is a positive factor for the yen, and the indicator is below 0 - negative.

Forecast of the Bank of Japan Tankan large enterprises;

- Capital expenditures in the current fiscal year increased by + 6.2%.

- Pretax profit in the current fiscal year will fall by -11.6%

- Dollar exchange rate in the current fiscal year will be 111.41 yen.

- The mood among the banks at the lowest level in three and a half years.

The report was completed prior to the referendum on the UK's membership of the EU

-

08:26

WSE: before opening

Today's session begins the next month and the next half-year on the markets. The current week has brought the global improvement in sentiment and yesterday's session on Wall Street was another successful one, which resulted in the increase of the US indexes of more than 1%. The impact on this has probably the situation on the currency market, the weakening of the pound after the speech of Mark Carney, the head of the Bank of England, signaled the need for loosening monetary policy this summer. The Euro also weakened after the news of Bloomberg about the possibility of easing bond purchases conducted by the ECB. As a result of growth in the US market losses from Friday have been almost entirely made up and in the morning it should support the Warsaw Stock Exchange, which had no opportunity to react to it. The index in Shanghai maintains a relatively neutral stance, while other Asian parquets are on the gain. This day will show whether the Warsaw market will react positively to the global improvement or remain resistant, which we experienced in recent days.

-

08:25

The international Standard & Poor's rating agency downgraded the credit rating of the European Union

International rating Standard & Poor's downgraded the credit rating of EU by one notch to "AA", saying that Brexit has a negative impact on the budget flexibility, and reflects the loss of political solidarity.

The agency also said that in all scenarios, including in the event of failure of the UK to fulfill its budgetary obligations in the future, the rating will remain at the current level.

Earlier, Standard & Poor's confirmed the long-term sovereign credit rating of the US on "the AA +" level, and the short-term credit rating at "A-1 +", outlook "stable". "This forecast is based on expectations that inherent in the US economic and political power will continue to compensate for the high levels of debt and a weak political cohesion" - say the agency.

-

08:23

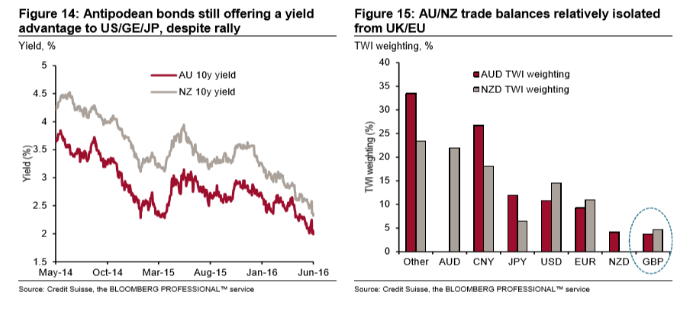

Credit Suisse downgraded AUD, NZD forecasts. Targets

"Our antipodean view in the wake of the Brexit vote is predicated on two observations:

In the short-term context of high volatility, elevated risk aversion and high correlations, currencies like the AUD and NZD tend to trade in line with broader risk sentiment without much differentiation. Given that we expect the current climate of politically-induced market dislocations to continue for some time, AUD and NZD are likely to underperform 'safe-haven' currencies such as JPY, CHF, and USD.

Balanced against this is the ongoing political instability in the UK and Europe, as well as potential "Trumpxit" risk from the US, which can drive longer-term portfolio capital flows to Australia and New Zealand. As they are highly rated sovereigns with stable political environments and still carry some risk free yield, they have considerable potential to become viewed as 'safe-haven' currencies in their own right.

Thus, we express this sentiment by downgrading our 3m AUDUSD forecast from 0.74 to 0.72, and our 3m NZDUSD forecast from 0.7250 to 0.7060 (continuing to target 3m AUDNZD 1.02), while leaving our 12m forecasts unchanged at 0.70 and 0.66, respectively".

-

08:13

Japan’s inflation declined despite the latest stimulus measures

Japan's national consumer price index (CPI) excluding fresh food declined 0.4% in May from a year earlier, the state-run Statistics Bureau said in a report on Friday. The so-called core inflation rate had plunged 0.3% annually in each of the past two months.

The national consumer price index fell 0.4% in the 12 months through May following a 0.3% decline the previous month.

Core inflation in Tokyo, Japan's capital and largest city, fell 0.5% in June following a 0.5% drop the month before, official data showed.

-

08:08

China June PMI fall to 4-month low

According to cnbc, the manufacturing momentum in the world's number two economy skidded to a four-month low in June, show twin surveys released on Friday.

The government's manufacturing Purchasing Managers' Index (PMI), a survey that tracks the health of large and state-owned companies, came in at 50.0 last month, versus 50.1 logged in May and April. The report was bang in line with Reuters' estimates and marked the weakest result since February's 49.0 figure.

From March-May, the survey logged results above the key 50 level, which separates expansion from contraction. In the seven months before March, the survey remained stuck below 50.

Caixin's China June manufacturing PMI, which tracks smaller-scale private firms compared to the official gauge, also recorded the fastest rate of deterioration in four months. The index reported a 48.6 reading for June, compared with 49.2 in May.

-

08:05

Japan: Markit/Nikkei PMI rose in June

The final index of business activity in the manufacturing sector of Japan rose to 48.1 in June, seasonally adjusted, compared with a preliminary reading of 47.8 and a final reading of 47.7 in May.

The index of business activity in the manufacturing sector is an important indicator of business conditions and the general economic conditions in Japan. The index value above 50 indicates growth and is bullish for the JPY, while the value index below 50 - bearish.

Japanese manufacturing activity declined in June or the fourth month in a row. Business survey showed that both domestically and overseas demand remains stubbornly weak.

The revised new orders index rose to 46.1, higher than the preliminary reading of 45.8 and higher than 44.7 in the previous month, but still emains weak for the past five months.

-

08:01

Japan's consumer confidence better than expected

Japan's consumer confidence improved more-than-expected in June to the strongest level in five months, survey results from the Cabinet Office showed Friday.

The consumer confidence index rose to 41.8 in June from 40.9 in the previous month. Economists had expected the index to climb to 41.1.

The latest reading was the highest since January this year, when it marked 42.3.

Among components, the index for overall livelihood climbed to 40.4 in June from 39.7 in May. Similarly, the employment index increased to 43.7 from 42.9.

The index measuring income growth and the gauge for willingness to buy durables also improved during the month.

The survey was conducted among 8,400 households on June 15.

-

07:13

Global Stocks

European stocks closed higher Thursday following a choppy session where Deutsche Bank AG and Banco Santander SA shares fell under pressure fell further back into the rearview mirror

European stocks on Wednesday surged 3.1%, marking a second straight day of sharp gains after a two-session rout in the wake of the U.K.'s vote to leave the European Union. Stocks had appeared to have found, at least, a short-term foundation for gains as the U.K. government had yet to formally start the negotiation process for the U.K.'s exit from the 28-member bloc, or Brexit.

Further easing measures may be in the works to deal with heightened uncertainty created by the vote, Bank of England Gov. Mark Carney said in a speech, but he stressed there are limits as to what the central bank can do.

U.S. stocks rose for a third session on Thursday on mounting expectations for more accommodative policies from global central banks following the U.K.'s vote to leave the European Union last week.

The gains were the best three-day climb for the main stock-market gauges since Feb. 17, according to Dow Jones data. All three indexes are near the levels they were trading at ahead of last week's U.K. referendum as initial jitters over Brexit subsided.

July 1 Japan's Nikkei share average rose on Friday for a fifth day as bargain hunting continued and risk appetites remained solid after U.S. and European shares gained.

Japanese stocks have erased about the half of their losses in the wake of Britain's shock vote a week ago to leave the European Union.

For the week, the Nikkei has jumped 4.9 percent, the biggest weekly gain since mid-April.

Shares of securities firm gained ground, with Nomura Holdings rising 2.8 percent and Daiwa Securities advancing 1.2 percent.

Exporters were steady, with Toyota Motor Corp gaining 1.4 percent and Nissan Motor Co adding 1.1 percent.

-

07:01

Japan: Consumer Confidence, June 41.8

-

04:31

Japan: Manufacturing PMI, June 48.1 (forecast 47.8)

-

04:04

Nikkei 225 15,657.62 +81.70 +0.52 %, Hang Seng 20,794.37 +358.25 +1.75 %, Shanghai Composite 2,942.4 +12.80 +0.44 %

-

03:47

China: Markit/Caixin Manufacturing PMI, June 48,6

-

03:00

China: Manufacturing PMI , June 50.0 (forecast 50)

-

03:00

China: Non-Manufacturing PMI, June 53.7

-

01:51

Japan: BoJ Tankan. Non-Manufacturing Index, Quarter II 19 (forecast 19)

-

01:50

Japan: BoJ Tankan. Manufacturing Index, Quarter II 6 (forecast 4)

-

01:46

Australia: AIG Manufacturing Index, June 51.8

-

01:32

Japan: Household spending Y/Y, May -1.1% (forecast -1.4%)

-

01:31

Japan: National CPI Ex-Fresh Food, y/y, May -0.4% (forecast -0.4%)

-

01:31

Japan: Tokyo CPI ex Fresh Food, y/y, June -0.5% (forecast -0.5%)

-

01:31

Japan: Tokyo Consumer Price Index, y/y, June -0.5%

-

01:30

Japan: National Consumer Price Index, y/y, May -0.4%

-

01:30

Japan: Unemployment Rate, May 3.2% (forecast 3.2%)

-

00:33

Commodities. Daily history for Jun 30’2016:

(raw materials / closing price /% change)

Oil 48.40 -2.97%

Gold 1,324.70 +0.31%

-

00:32

Stocks. Daily history for Jun 30’2016:

(index / closing price / change items /% change)

Nikkei 225 15,575.92+9.09+0.06%

Hang Seng 20,719.87+283.75+1.39%

S&P/ASX 200 5,233.38+90.98+1.77%

Shanghai Composite 2,929.61-1.99-0.07%

FTSE 100 6,504.33 +144.27 +2.27 %

CAC 40 4,237.48 +42.16 +1.00 %

Xetra DAX 9,680.09 +67.82 +0.71 %

S&P 500 2,098.86 +28.09 +1.36 %

NASDAQ Composite 4,842.67 +63.43 +1.33 %

Dow Jones 17,929.99 +235.31 +1.33 %

-

00:31

Currencies. Daily history for Jun 30’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1102 -0,22%

GBP/USD $1,3285 -1,23%

USD/CHF Chf0,9761 -0,32%

USD/JPY Y103,28 +0,38%

EUR/JPY Y114,67 +0,15%

GBP/JPY Y137,23 -0,83%

AUD/USD $0,7441 -0,01%

NZD/USD $0,7127 +0,28%

USD/CAD C$1,2949 +0,04%

-

00:04

Schedule for today, Friday, Jul 01’2016:

(time / country / index / period / previous value / forecast)

01:00 China Manufacturing PMI June 50.1 50

01:00 China Non-Manufacturing PMI June 53.1

01:45 China Markit/Caixin Manufacturing PMI June 49.2

02:00 Japan Manufacturing PMI (Finally) June 47.7 47.8

05:00 Japan Consumer Confidence June 40.9

07:15 Switzerland Retail Sales (MoM) May 0.1%

07:15 Switzerland Retail Sales Y/Y May -1.9%

07:30 Switzerland Manufacturing PMI June 55.8 55.4

07:50 France Manufacturing PMI (Finally) June 48.4 47.9

07:55 Germany Manufacturing PMI (Finally) June 52.1 54.4

08:00 Eurozone Manufacturing PMI (Finally) June 51.5 52.6

08:30 United Kingdom Purchasing Manager Index Manufacturing June 50.1

09:00 Eurozone Unemployment Rate May 10.2% 10.1%

12:00 Canada Bank holiday

13:45 U.S. Manufacturing PMI (Finally) June 50.7 51.4

14:00 U.S. Construction Spending, m/m May -1.8% 0.6%

14:00 U.S. ISM Manufacturing June 51.3 51.4

20:00 U.S. Total Vehicle Sales, mln June 17.45 17.3

-