Noticias del mercado

-

22:18

U.S. stocks advanced

U.S. stocks advanced amid a global rally, with the S&P 500 Index posting its strongest two-day climb in four months, as tension eased over the impact of a U.K. exit from the European Union.

Fears that Britain's EU withdrawal will further stymie global growth continued to ebb, soothed by speculation policy makers will counter the effects. Energy shares capped their best two days since March as crude jumped. A Goldman Sachs Group Inc. basket of the most shorted shares in the Russell 3000 Index saw its biggest surge since 2009, while the Dow Jones Industrial Average stretched its rebound to more than 550 points since Monday's close.

With Britain in limbo as EU leaders gathered in Brussels to discuss the nation's withdrawal from the bloc, traders have pushed back bets on Federal Reserve interest-rate increases, indicating higher borrowing costs are unlikely before 2018. Meanwhile, a majority of economists surveyed by Bloomberg predict that the Bank of England will add more stimulus, including cutting rates in the third quarter.

Equities are recovering for a second session after two days of heavy selling sparked by the Brexit decision last week wiped $3.6 trillion from global equities. The S&P 500 had tumbled 5.3 percent to briefly erase its 2016 advance, and has since cut its post-vote drop by more than half. The CBOE Volatility Index tumbled for a third day, the longest in two weeks.

Investors are looking to policy makers for support as they await Britain's plan for its extrication from the EU. While European Central Bank President Mario Draghi called for global policy alignment, South Korea announced a fiscal stimulus package on Tuesday and Bank of Japan Chief Haruhiko Kuroda said Wednesday that more funds can be injected into the market should they be needed.

The turmoil spurred by the U.K. vote interrupted the S&P 500's march toward an all-time high this month, a move stoked by optimism that a mixture of low rates and moderate growth would bolster rising stock prices. The benchmark came within 1 percent of a record on June 8 and again last Thursday, on the day of the referendum as investors wagered Britain would remain in the EU. The gauge is now on track for its first monthly decline since February.

-

21:01

DJIA 17677.97 268.25 1.54%, NASDAQ 4782.24 90.37 1.93%, S&P 500 2070.52 34.43 1.69%

-

18:18

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes sharply higher on Wednesday, with the three major indexes recovering about half the losses suffered in the aftermath of Britain's shock vote to leave the European Union. Investors looked for bargains among beaten-down stocks, pushing up markets for the second day after the "Brexit" verdict wiped out about $3 trillion globally in a two-day selloff.

Almost all Dow stocks in positive area (29 of 30). Top looser - The Home Depot, Inc. (HD, -0,27%). Top gainer - Chevron Corporation (CVX, +2,58%).

All S&P sectors in positive area. Top gainer - Basic Materials (+2,7%).

At the moment:

Dow 17535.00 +234.00 +1.35%

S&P 500 2056.50 +28.00 +1.38%

Nasdaq 100 4349.00 +68.00 +1.59%

Oil 49.12 +1.27 +2.65%

Gold 1329.50 +11.60 +0.88%

U.S. 10yr 1.46 +0.00

-

18:00

European stocks closed: FTSE 6360.06 219.67 3.58%, DAX 9612.27 164.99 1.75%, CAC 4195.32 106.47 2.60%

-

17:56

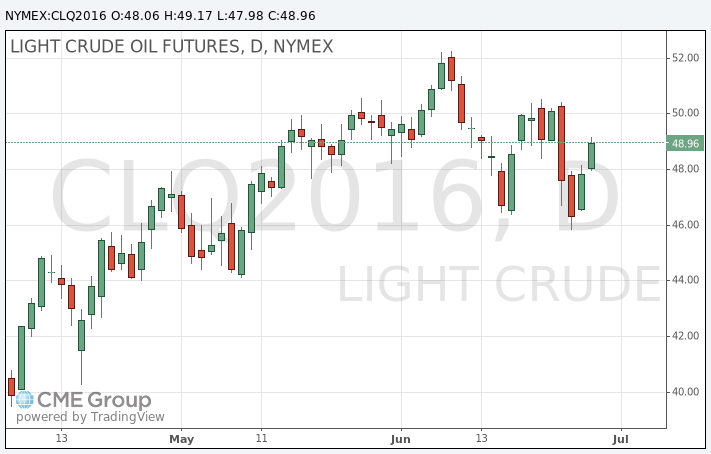

Oil prices rise after data shows a reduction in inventories

Prices for West Texas Intermediate have accelerated growth after data showed that US crude stocks fell last week more than forecast.

US Energy Information Administration said in its weekly report that crude oil inventories fell by 4.1 million barrels for the week ended June 24. Market analysts expect stocks to fall by 2.4 million barrels, while on Tuesday, the American Petroleum Institute reported a decline in inventories of 3.9 million barrels.

Inventories at Cushing, Oklahoma, a key oil storage point for the Nymex, fell by 951,000 barrels last week. In total, US crude stocks last week amounted to 526.6 million barrels.

The report also showed that gasoline inventories increased by 1.4 million barrels compared to expectations for 58,000 barrels, while distillate stocks fell by 1.8 million barrels.

A day earlier, crude oil rose $ 1.52, or 3.28%, as Brexit concerns weaken, boosting appetite for riskier assets.

London Brent crude gained amid concerns about supply disruptions from Norway, where about 7,500 workers at seven oil and gas fields may go on strike from Saturday if not agreed upon the issue of wages until Friday.

These fields account for nearly 18% of the total oil production in Norway, which has a negative impact on production in the North Sea's largest oil producer.

The cost of the August futures for US WTI rose at 49.17 dollars per barrel.

The price of August futures for Brent crude rose to 49.90 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:55

WSE: Session Results

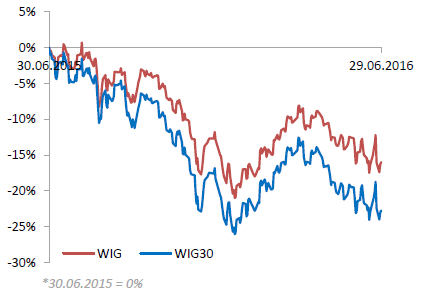

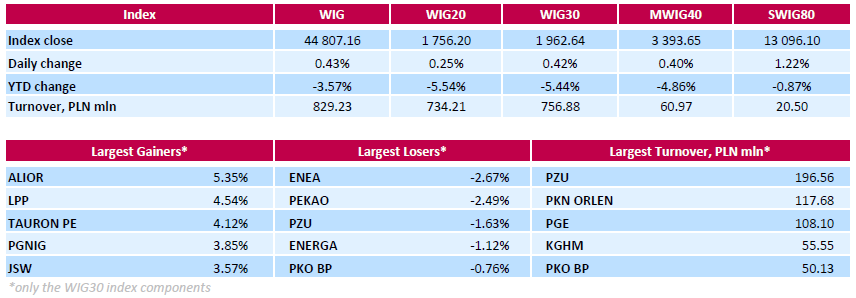

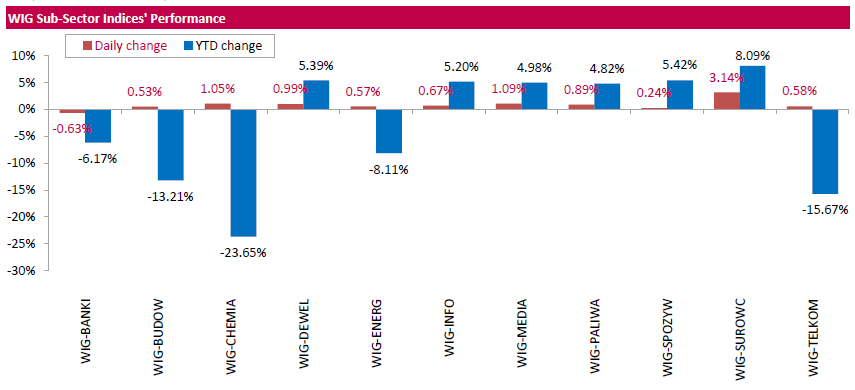

The Polish equity market continued its upward trend on Wednesday. The broad market measure, the WIG index, advanced 0.43%. Almost all sectors in the WIG generated positive returns. The only exception was banking sector (-0.63%). At the same time, materials (+3.14%) and media (+1.09%) were the best-performers.

The large-cap stocks' measure, the WIG30 Index, surged by 0.42%. In the index basket, banking sector name ALIOR (WSE: ALR), clothing retailer LPP (WSE: LPP) and genco TAURON PE (WSE: TPE) generated the biggest advances, soaring by 5.35%, 4.54% and 4.12% respectively. Other major gainers were oil and gas producer PGNIG (WSE: PGN), coking coal miner JSW (WSE: JSW) and copper producer KGHM (WSE: KGH), adding between 3.22% and 3.85%. On the other side of the ledger, genco ENEA (WSE: ENA) led the decliners, dropping by 2.67% on news that Poland's state treasury was in talks with Polish billionaire Zygmunt Solorz-Zak to swap his controlling stake in ENEA's rival ZE PAK for ENEA's new shares. It was followed by bank PEKAO (WSE: PEO) and insurer PZU (WSE: PZU), sliding by 2.49% and 1.63% respectively.

-

17:30

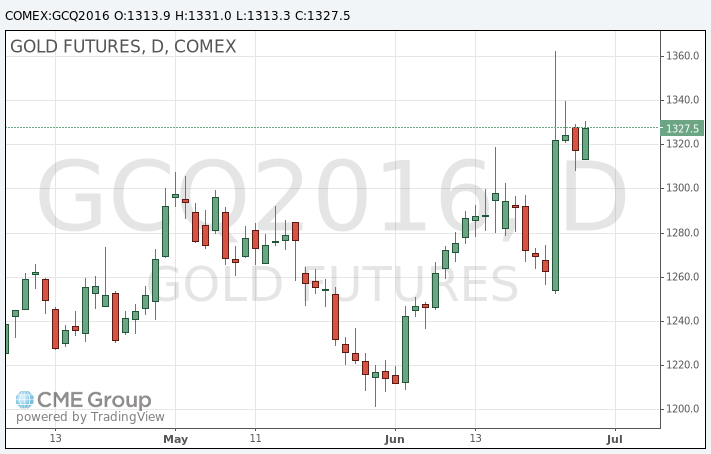

Gold price gains momentum

Gold prices rose in today's trading, rebounding from losses, as market players excluded further increase in interest rates this year after Britain voted in favor of withdrawal from the European Union.

According Fed Watch CME, the chance of a rate increase in July is estimated at 0%, and the probability of lowering rate is estimated at 5%. A cut in September has 10.5%.

On Tuesday, Fed policy maker Jerome Powell said that Brexit shifted the global risks to the economic slowdown, which could pose a threat to the forecast of the US central bank.

News raised fears that other countries may also withdraw from the block, and global growth will be under considerable pressure, while the actual British EU exit timing remain unclear.

At the moment, the precious metal rose in price by almost 25% for the year, helped by concerns about global growth and the introduction of negative interest rates by central banks worldwide.

The cost of the August gold futures on the COMEX rose to $ 1331.0 per ounce.

-

16:34

Crude oil inventories in US declined 4.1 mln barrels

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending June 24, 2016, 190,000 barrels per day more than the previous week's average. Refineries operated at 93.0% of their operable capacity last week. Gasoline production decreased last week, averaging about 10.0 million barrels per day. Distillate fuel production increased last week, averaging over 5.0 million barrels per day.

U.S. crude oil imports averaged about 7.6 million barrels per day last week, down by 884,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 7.8 million barrels per day, 12.0% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 904,000 barrels per day. D

istillate fuel imports averaged 25,000 barrels per day last week. U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.1 million barrels from the previous week. At 526.6 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories increased by 1.4 million barrels last week, and are well above the upper limit of the average range.

Both finished gasoline inventories and blending components inventories increased last week. Distillate fuel inventories decreased by 1.8 million barrels last week but are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 2.5 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories decreased by 1.0 million barrels last week.

-

16:30

U.S.: Crude Oil Inventories, June -4.053

-

16:04

Pending home sales in US down 3.7%

The Pending Home Sales Index, a forward-looking indicator based on contract signings, slid 3.7 percent to 110.8 in May from a downwardly revised 115.0 in April and is now slightly lower (0.2 percent) than May 2015 (111.0). With last month's decline, the index reading is still the third highest in the past year, but declined year-over-year for the first time since August 2014.

Lawrence Yun, NAR chief economist, says pending sales slumped in May across most of the country. "With demand holding firm this spring and homes selling even faster than a year ago1, the notable increase in closings in recent months took a dent out of what was available for sale in May and ultimately dragged down contract activity," he said. "Realtors are acknowledging with increasing frequency lately that buyers continue to -

16:00

U.S.: Pending Home Sales (MoM) , May -3.7% (forecast -1%)

-

15:50

WSE: After start on Wall Street

Start of trading by the Americans changed little in our market like the earlier handful of macro data. Surrounding holds firmly, but it does not tend to leave by the WIG20 the current, low volatility. Higher opening overseas resulted even in a slight decline in our index the largest companies.

Despite the weaker attitude of blue chips, the sWIG80 index recently established session highs gaining almost 1%. Small entities stand out positively after the turmoil associated with the Brexit and consistently work out related losses. Medium-sized entities (the mWIG40 index) in this respect are only a little worse and still retain the advantage over large companies.

-

15:49

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1050 (636m)

GBPUSD 1.3500 ( GBP 382m)

AUDUSD 0.7290-7300 (AUD 800m) 0.7350 (254m) 0.7500 (670m)

USDCAD 1.3150 (USD 284m)

-

15:47

German Finance Minister Schäuble: We can not exclude a "domino effect" after Brexit

- It would be correct if the UK would have notified the EU of its plans to exit from the block in the foreseeable future.

- We manage to prevent chaos in the financial markets after Brexit.

- Uncertainty in the financial markets will persist.

-

15:33

U.S. Stocks open: Dow +0.87%, Nasdaq +1.00%, S&P +0.92%

-

15:24

Before the bell: S&P futures +0.75%, NASDAQ futures +0.75%

U.S. stock-index futures advanced on speculation central bankers will counter the impact of a U.K. exit from the European Union.

Global Stocks:

Nikkei 15,566.83 +243.69 +1.59%

Hang Seng 20,436.12 +263.66 +1.31%

Shanghai Composite 2,932.52 +19.96 +0.69%

FTSE 6,278.88 +138.49 +2.26%

CAC 4,188.57 +99.72 +2.44%

DAX 9,605.36 +158.08 +1.67%

Crude $48.40 (+1.15%)

Gold $1325.10 (+0.55%)

-

15:18

-

14:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.48

0.15(1.6077%)

15545

3M Co

MMM

170.34

0.75(0.4422%)

2546

ALTRIA GROUP INC.

MO

68.1

0.19(0.2798%)

3921

Amazon.com Inc., NASDAQ

AMZN

713.45

5.50(0.7769%)

33782

American Express Co

AXP

58

0.39(0.677%)

2255

AMERICAN INTERNATIONAL GROUP

AIG

49.9

0.08(0.1606%)

440

Apple Inc.

AAPL

94.13

0.54(0.577%)

97339

AT&T Inc

T

42.15

0.13(0.3094%)

9890

Barrick Gold Corporation, NYSE

ABX

20.95

0.32(1.5511%)

54601

Boeing Co

BA

125

1.11(0.896%)

1675

Caterpillar Inc

CAT

73.23

0.71(0.979%)

1160

Chevron Corp

CVX

102.68

1.05(1.0332%)

490

Cisco Systems Inc

CSCO

28.1

0.31(1.1155%)

7826

Citigroup Inc., NYSE

C

41.14

0.70(1.731%)

179778

Exxon Mobil Corp

XOM

91.25

0.34(0.374%)

4227

Facebook, Inc.

FB

113.55

0.85(0.7542%)

125840

Ford Motor Co.

F

12.53

0.14(1.1299%)

27226

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.96

0.27(2.5257%)

156258

General Electric Co

GE

30.21

0.27(0.9018%)

19372

General Motors Company, NYSE

GM

28.01

0.27(0.9733%)

14063

Goldman Sachs

GS

144

1.59(1.1165%)

13459

Google Inc.

GOOG

684.89

4.85(0.7132%)

5837

Home Depot Inc

HD

127.88

0.35(0.2744%)

4115

HONEYWELL INTERNATIONAL INC.

HON

114.06

-0.00(-0.00%)

1830

Intel Corp

INTC

31.49

0.30(0.9618%)

3015

International Business Machines Co...

IBM

146.8

1.10(0.755%)

886

International Paper Company

IP

40.39

0.13(0.3229%)

229

Johnson & Johnson

JNJ

119

0.77(0.6513%)

703

JPMorgan Chase and Co

JPM

60.2

0.68(1.1425%)

53935

McDonald's Corp

MCD

118.52

0.02(0.0169%)

3870

Merck & Co Inc

MRK

56.35

0.77(1.3854%)

100

Microsoft Corp

MSFT

49.95

0.51(1.0316%)

16407

Nike

NKE

53.64

0.55(1.036%)

1217450

Pfizer Inc

PFE

34.64

0.20(0.5807%)

1608

Procter & Gamble Co

PG

82.71

0.25(0.3032%)

235

Starbucks Corporation, NASDAQ

SBUX

55.4

0.55(1.0027%)

3974

Tesla Motors, Inc., NASDAQ

TSLA

204.94

3.15(1.561%)

32846

Twitter, Inc., NYSE

TWTR

16.61

0.19(1.1571%)

114757

UnitedHealth Group Inc

UNH

140

1.29(0.93%)

1028

Verizon Communications Inc

VZ

55.09

0.27(0.4925%)

7140

Visa

V

76.09

0.93(1.2374%)

1126

Wal-Mart Stores Inc

WMT

71.39

-0.12(-0.1678%)

21742

Walt Disney Co

DIS

96.6

0.55(0.5726%)

778

Yahoo! Inc., NASDAQ

YHOO

36.39

0.35(0.9711%)

12840

-

14:56

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

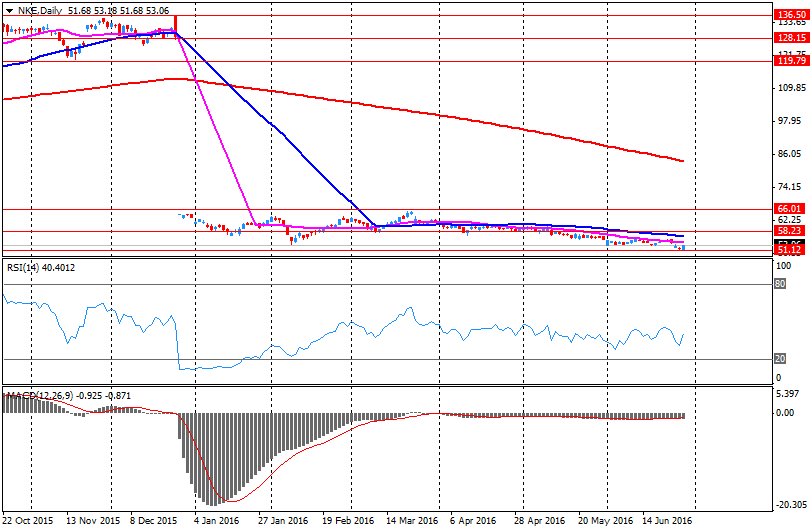

NIKE (NKE) target lowered to $58 from $69 at Piper Jaffray

NIKE (NKE) target lowered to $68 from $73 at Stifel

-

14:34

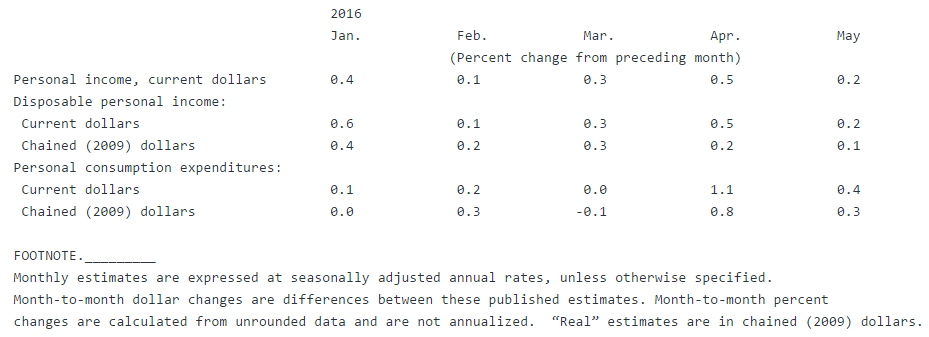

Personal income in US increased slightly lower than forecasts

Personal income increased $37.1 billion, or 0.2 percent, and disposable personal income (DPI) increased $33.9 billion, or 0.2 percent, in May, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $53.5 billion, or 0.4 percent. In April, personal income increased $75.4 billion, or 0.5 percent, DPI increased $68.6 billion, or 0.5 percent, and PCE increased $141.2 billion, or 1.1 percent, based on revised estimates.

Real DPI increased 0.1 percent in May, compared with an increase of 0.2 percent in April.

Real PCE increased 0.3 percent, compared with an increase of 0.8 percent.

-

14:31

U.S.: PCE price index ex food, energy, m/m, May 0.2% (forecast 0.1%)

-

14:31

U.S.: PCE price index ex food, energy, Y/Y, May 1.6%

-

14:30

U.S.: Personal Income, m/m, May 0.2% (forecast 0.3%)

-

14:30

U.S.: Personal spending , May 0.4% (forecast 0.4%)

-

14:30

European session review: the pound continues to recover after the collapse

The following data was published:

(Time / country / index / period / previous value / forecast)

1:00 Australia Sales of new buildings, m / m in May -4.7% -4.4%

6:00 UK House Price Index from Nationwide, m / m in June 0.2% 0% 0.2%

6:00 UK House Price Index from Nationwide, y / y in June 4.7% 4.9% 5.1%

6:00 Germany consumer confidence index from the GfK July 9.8 9.8 10.1

6:00 Switzerland indicator of consumer activity from May 1.24 1.35 UBS

8:30 Volume UK net lending to individuals, 1.6 billion in May 4.3

8:30 UK Changing the volume of consumer lending, million 1400 1503 May 1294

8:30 UK approved applications for mortgage loans, th. May 66.21 65.25 67.04

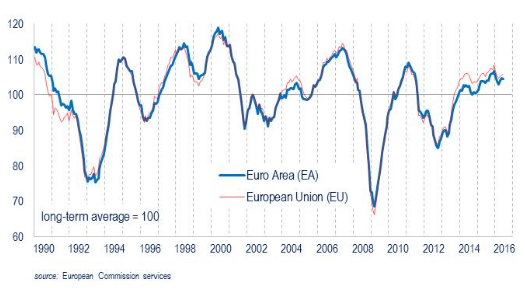

9:00 Eurozone index of sentiment in the economy in June 104.6 104.7 104.4

9:00 Eurozone consumer confidence index (final data) June -7 -7 -7.3

9:00 Eurozone Sentiment Index in the business community June 0.26 0.26 0.22

9:00 Eurozone business confidence index in industry in June -3.7 -3 -2.8

12:00 Germany Consumer Price Index m / m (preliminary data) June 0.3% 0.2% 0.1%

12:00 Germany Consumer Price Index y / y (preliminary data) June 0.1% 0.3% 0.3%

The euro rose slightly against the dollar, returning to yesterday's high, which was associated with the expectations of US reports, including personal income and expenses, and home sales. Investors also continue to follow the news from the EU summit, during which politicians discuss Britain's decision to leave the EU. Market analysts believe that European leaders will expect to see negative economic data, before taking measures against the consequences of the referendum.

he results of the research, published by the European Commission showed that economic confidence in the euro area fell in June, contrary to expectations of a slight increase. According to the data, the index of economic sentiment, which is a gauge of consumer and business confidence fell in June to 104.4 points from 104.6 points in May (revised from 104.7 points). In addition, it was announced that the final index of sentiment among consumers dropped in June from -7.0 points to -7.3 points, confirming the initial assessment, but exceeded the experts' forecasts (-7.0 points).

Sentiment in the services sector fell to 10.8 from 11.3 in May, but the index of business optimism in industry rose to -2.8 from -3.7. It was expected that the confidence in industry improved to -3.0. The index of sentiment in the business circles dropped to 0.22 from 0.26 in May. Analysts predicted that the rate will remain unchanged.

The pound rose moderately against the dollar, helped by renewed risk appetite, as well as statistics on Britain. The Bank of England said that the volume of consumer credit has increased significantly in May, recording the fastest pace since 2005. According to the data, in May, the number of approved applications for mortgage loans rose to 67 042 compared to 66 205 in April (revised from 66,250).

Analysts had forecast a contraction of approved applications to 65 250. In the meantime, consumer loans increased in May by 9.9 percent in annual terms (up to 1.503 billion gbp), showing the biggest gain since November 2005. Economists had expected a rise to 1.4 billion gbp.

Net mortgage lending rose in May to 2.824 billion pounds, which was more than forecast (2.2 billion). Consumer credit rose by 1.503 billion gbp. Lending to non-financial enterprises increased by 2.814 bn. pounds after falling 176 million n April.

Also today, Fitch revised the outlook on the reduction of Britain's GDP, adding that it may encourage the Central Bank to lower the rate to 0.25% by the end of the year.

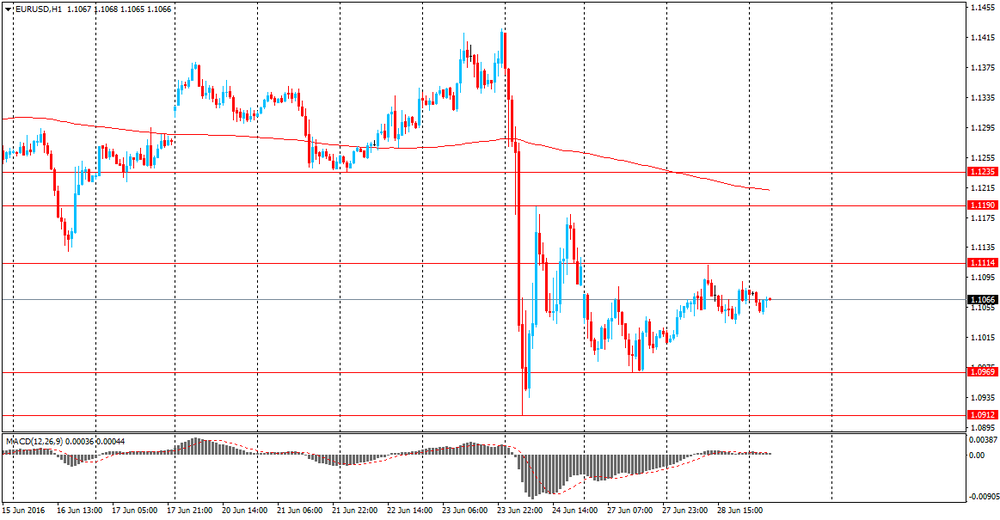

EUR / USD: during the European session rose to $ 1.1102

GBP / USD: rose to $ 1.3453

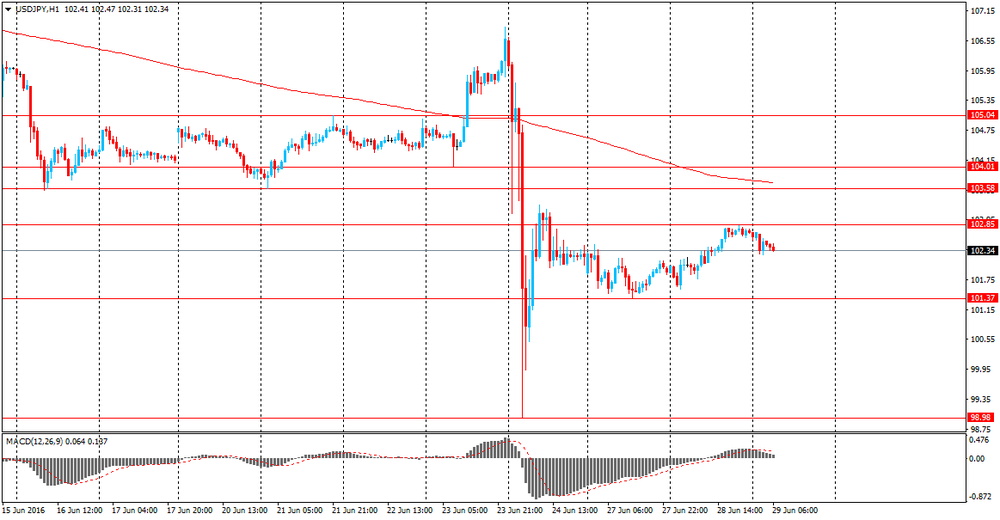

USD / JPY: rose from Y102.14 to Y102.75

-

14:10

Germany’s inflation lower in June

Flash CPI index in Germany fell monthly to 0.1% from a previous value of 0.3%. Bloomberg forecasts indicated the rise of inflation with 0.2%. CPI measures the changes in the price of goods and services purchased by consumers.

Harmonised Index of Consumer Prices (HICP) unchanged at +0.2%. No impact or Eur/Usd in a quiet trading so far.

-

14:00

Germany: CPI, y/y , June 0.3% (forecast 0.3%)

-

14:00

Germany: CPI, m/m, June 0.1% (forecast 0.2%)

-

13:46

Orders

EUR/USD

Offers 1.1120-25 1.1150 1.1170 1.1200 1.1200 1.1230-40 1.1280 1.1300

Bids 1.1050-55 1.1025-30 1.1000 1.0975-80 1.0930 1.0900 1.0885 1.0850

GBP/USD

Offers 1.3425-30 1.3450 1.3475-80 1.3500 1.3550 1.3580 1.3600

Bids 1.3345-50 1.3330 1.3280 1.3255-60 1.3230 1.3200 1.3170 1.3150 1.3100

EUR/GBP

Offers 0.8320 0.8330-35 0.8350 0.8370-75 0.8400 0.8465 0.8500

Bids 0.8275-80 0.8250 0.8200-0.8195 0.8165 0.81500 0.8130 0.8100

EUR/JPY

Offers 113.30 113.55-60 113.80 114.00 114.30 114.50 115.00

Bids 112.55-60 112.30-35 112.00 111.70 111.50 111.00 110.60 110.00 109.50 109.00

USD/JPY

Offers 102.50 102.75-80 103.00 103.25 103.50 103.85 104.00

Bids 102.00 101.80 101.65 101.50 101.20-25 100.65 100.00

AUD/USD

Offers 0.7420-25 0.7450-55 0.7485 0.7500 0.7520 0.7550

Bids 0.7375-80 0.7350-55 0.7320 0.7300 0.7285 0.7265 0.7230 0.7200

-

13:14

Fitch forecast: Bank of England will lower rates by 0.25% by year-end

US ratings agency out with a client note 29 June 2016

- UK to face large investment shock post-Brexit.

- 2017 & 2018 GDP to fall to around 1%.

- uncertainty to prompt firms to delay investment, hiring decisions.

-

13:11

WSE: Mid session comment

South phase of trading brought new highs in Europe, where the German DAX gaining around 2%, while the French CAC40 2.6%

On the Warsaw market we are dealing with stabilization at quite high turnover, what in recent times is not a common sight. The volatility is negligible.

Euroland encouraged to fight for higher levels, while the relative weakness in relation to the environment from the perspective of today's session may in turn suggest some caution.

In the mid-session the WIG20 index was at the level of 1,752 points (+ 0.03%) and with turnover of PLN 377 mln.

-

12:40

Company News: NIKE (NKE) Q4 earnings beat analysts’ estimate

NIKE reported Q4 FY 2016 earnings of $0.49 per share (versus $0.98 in Q4 FY 2015), beating analysts' consensus of $0.48.

The company's quarterly revenues amounted to $8.244 bln (+6% y/y), slightly missing consensus estimate of $8.277 bln.

NIKE reiterates FY17 revenue guidance, projecting growth at a high single digit rate.

NKE fell to $51.07 (-3.80%) in pre-market trading.

-

12:40

Major stock indices in Europe show a positive trend

European stocks rose for a second day, slowly recovering after a collapse on the background of the referendum on Britain's membership of the EU. Support to the markets was expectations that central banks will take additional stimulus measures to limit the impact of Brexit, as well as the rise in oil prices.

EU summit warned Britain that its decision is final, and called of the government of the country as soon as possible begin the formal exit procedures and discuss future relations. Financial markets are expected to remain volatile while the UK will try to resolve the issues with the EU.

However, market participants believe that the risks are now weaker than in the period of the bankruptcy of Lehman Brothers, which led to the global financial crisis, and as compared with the peak of the European debt crisis. "People are beginning to realize that the problem is more about a country and does not affect other markets, yet it does not pose a significant risk for the global economy." - Said Andrew Sheets, Morgan Stanley analyst.

The composite index Stoxx Europe 600 of the largest 600 companies in the region grew by 2.1 percent. Among the 19 industry groups shares of mining companies and energy producers grew the most.

Capitalization of GAM Holding AG rose 7.3 percent after the acquisition of Cantab Capital Partners LLP, a firm that uses mathematical models to determine when and which securities to buy and sell.

The cost of the tour operator TUI AG dropped 3.8 percent against the backdrop of coordinated terrorist attacks in Istanbul airport.

Shares of Deutsche Lufthansa AG fell 2.8 percent after the company announced plans to launch a internet satelite on board the short-haul flights, starting in October.

At the moment:

FTSE 100 6,294.28 +153.89 + 2.51%

CAC 40 4,196.98 +108.13 + 2.64%

DAX 9,626.13 +178.85 + 1.89%

-

11:41

BofA Merill Lynch: Gbp/Usd to 1.30 at the end of 2016

eFXnews quoting a Bank of America Merill Lynch forecast:

Sailing into the unknown:

FX markets were surprised by the Brexit vote. The implications of the referendum result are hard to nail down, but we expect them to be negative in most scenarios. We would also expect markets to start pricing some tail risks that other countries may decide to leave the EU as well. More broadly, we would expect Brexit to trigger a chain of non-linear events well into the long-term that are hard to predict and may seem unrelated today, a butterfly effect on steroids. Brexit could prove to be just the end of the beginning.

Negative for European currencies:

We believe that the result of the UK referendum for exit from the EU is negative for the major European currencies, most for GBP, then for EUR. We expect it to be positive for JPY, followed by the USD. High beta currencies could find support in further easing by major central banks in the short term.

New projections:

In this context, we are revising our G10 projections. Our baseline was assuming that the UK would stay in the EU, although this was a very close call. However, we avoid bold changes in projections beyond GBP, as no G10 economy is strong enough to afford a strong currency.

We expect EUR/USD to end 2016 at 1.05, from 1.08 before, appreciating to 1.10 by the end of 2017, from 1.15 before.

We expect JPY to remain strong and now forecast USD/JPY to end 2016 at 105. Our previous projection was 110, but with substantial downside risks. Moreover, USDJPY can overshoot below 100 in the short term.

We now expect GBP/USD to end 2016 at 1.30, from 1.59 in the Remain scenario. We expect further GBP weakness in 2017.

-

11:12

-

11:05

Shibayama: Bank of Japan won't hesitate to respond to excessive FX speculation

-

Should not rule out solo fx intervention in the case of excessive yen rises.

-

BOJ should stand ready to hold emergency policy meeting if market moves become excessive.

-

Further easing should take into account the fact that negative rates caused a bigger than expected impact.

-

-

11:01

Eurozone: Consumer Confidence, June -7.3 (forecast -7)

-

11:00

Eurozone: Economic sentiment index , June 104.4 (forecast 104.7)

-

11:00

Eurozone: Business climate indicator , June 0.22 (forecast 0.26)

-

11:00

Eurozone: Industrial confidence, June -2.8 (forecast -3)

-

10:38

United Kingdom: lending to individuals increased $4.3 bln

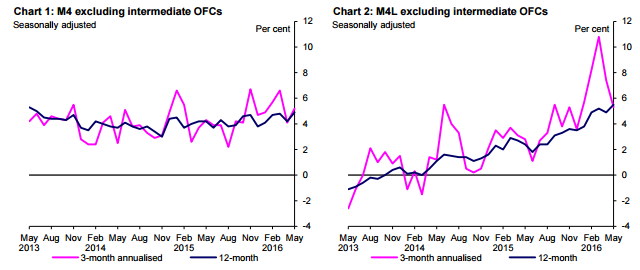

Total lending to individuals increased by £4.3 billion in May, compared to the average of £5.1 billion over the previous six months. The three-month annualised and twelve-month growth rates were 4.1% and 4.0% respectively.

-

10:36

Money supply in UK increased in May

UK broad money, M4ex, is defined as M4 excluding intermediate other financial corporations (OFCs). M4ex increased by £16.7 billion in May, compared to the average monthly increase of £6.9 billion over the previous six months. The three-month annualised and twelve-month growth rates were 5.2% and 4.9% respectively. M4Lex is defined as M4 lending excluding intermediate OFCs. M4Lex increased by £11.8 billion in May, compared to the average monthly increase of £9.6 billion over the previous six months. The three-month annualised and twelve-month growth rates were 5.3% and 5.5% respectively.

Economic data calculated before Brexit so next month's data will have a bigger impact on the pound.

-

10:31

Oil is rising in today’s trading

This morning, New York crude oil futures WTI rose by 1.09% to $ 48.37 per barrel and Brent oil futures climbed 0.89% to $ 49.69 per barrel. Thus, the black gold is gaining around 1%, as investors began to invest in commodity assets, after risks associated with the exit of Britain from the European Union fades. The second reason for the oil price growth - a strike in Norway and the crisis in Venezuela. In addition, data from the American Petroleum Institute (API) showed a reduction in reserves to 3.86 million barrels per week.

-

10:31

United Kingdom: Net Lending to Individuals, bln, May 4.3

-

10:30

United Kingdom: Consumer credit, mln, May 1503 (forecast 1400)

-

10:30

United Kingdom: Mortgage Approvals, May 67.04 (forecast 65.25)

-

10:01

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1050 (636m)

GBP/USD 1.3500 ( GBP 382m)

AUD/USD 0.7290-7300 (AUD 800m) 0.7350 (254m) 0.7500 (670m)

USD/CAD 1.3150 (USD 284m)

-

09:51

Review of financial and economic press: the Parliament of Netherlands rejected the Nexit idea

D / W

German Chancellor Angela Merkel believes that Brexit is a foregone conclusion and irreversible. In her opinion, as expressed on Tuesday, June 28 during a summit in Brussels, "everything can not be deployed again." Now is not the time for wishful thinking, the Chancellor said. It also welcomed the plan, according to which the new summit of EU heads of states will be held in September without the participation of London.

In London Brexit opponents rally

More than a thousand people (according to other sources - a few thousand) gathered on Tuesday, June 28 at London's Trafalgar Square for a rally aimed against Brexit. The action took place despite the fact that earlier the organizers said that it will be canceled because of the inability to guarantee the security of its members. The rally was held under the motto "Stay together" (Stand together). Leader of "Liberal Democrats" Tim Farron, also came to Trafalgar Square, said the gathering in question.

Brussels after Brexit: The EU recognizes its share of the blame for the results of the referendum

In Brussels on Tuesday, began the summit of heads of states and governments of EU member states - the first since the referendum on UK. The main working of the EU summit meeting will be held on Wednesday, 29 June. David Cameron will not take part in them.

The Parliament of the Netherlands rejected the Nexit idea

The Parliament of the Netherlands did not support the right Freedom Party leader Geert Wilders' proposal to hold a referendum on the country's membership in the European Union. At a meeting on Tuesday, the referendum idea was supported by only 14 deputies out of 75. Wilders proposed that the authorities do as much as possible to carry out "Nexit". However, under the current laws of the Netherlands a popular vote on EU membership is impossible.

Newspaper. ru

FT: Brexit day was the most unstable in the foreign exchange market history

The British Treasury has warned about the growth of tax due to Brexit.

UK Finance Minister George Osborne announced a tax increase and reduction of budget expenditures in connection with the referendum on withdrawal from the EU, according to Reuters.

FT: Brexit could cost the world economy more than $ 3 trillion

Stock markets around the world lost a record $ 3 trillion over two trading days after the results of the referendum. Provoked panic selling on the leading trading floors of the world, writes the Financial Times with reference to the market participants.

Total will develop the largest oil field in Qatar

The French oil company Total has been selected to develop the largest oil field in Qatar, Bloomberg writes. It is noted that Total has won a 30% stake in partnership with Qatar Petroleum. The two companies will create a new company North Oil Co. for Shaheen field development in the next 25 years.

RBC

Toyota announced a withdrawal of 1.43 million vehicles worldwide

Toyota announced a recall of 1.43 million hybrids Prius and Lexus CT200h due to a possible defect at the airbags. This will affect cars from 2010-2012.

-

09:41

Positive start for European stocks: DAX 9,531.97 + 84.69 + 0.90%, CAC 40 4,134.14 + 45.29 + 1.11%, FTSE 100 6,239.47 + 99.08 + 1.61%

-

09:17

Spanish inflation better than forecasts

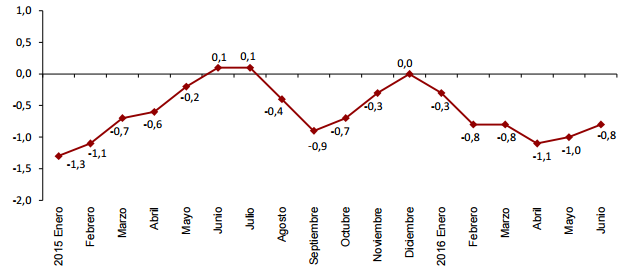

The estimated CPI annual inflation in June 2016 was -0.8%, according to the leading indicator compiled by the INE.

This indicator provides a preview of CPI, if confirmed, would be a increase of two tenths in the annual rate, since in May the change was -1.0%.

This behavior influences the rise in fuel prices (diesel and gas) and electricity.

-

09:14

WSE: After opening

WIG20 index opened at 1756.86 points (+0.29%)*

WIG 44835.96 0.50%

WIG30 1963.86 0.49%

mWIG40 3402.31 0.65%

*/ - change to previous close

The cash market (the WIG20 index) began from increase by 0.29% to 1,756 points with the traditionally modest turnover. The German DAX at the same time gaining more than 1%, which shows the apparent disparity since yesterday. On the Warsaw market negatively distinguished Enea (WSE: ENA; -3,3%) after the press release about the possible acquisition of stake in ZE PAK from Mr. Solorz. The WIG20 index remains below the close from Friday, which is the nearest resistance level.

-

09:05

Today’s events:

At 08:00 GMT the ECB board member Benoit Coeure will deliver a speech.

At 10:30 GMT the ECB Vice-President Vitor Constancio will give a speech.

At 16:00 GMT the ECB member Yves Mersch owill make a speech.

Day 2 of the EU economic summit.

-

08:49

Asian session review: we know what happens after tight ranges

The yen has stabilized, halting its recent strong gains. Today, Japanese Prime Minister Shinzo Abe urged the Bank of Japan to provide sufficient funds to satisfy market liquidity. He also instructed the Minister of Finance Aso to pay the utmost attention to movements in the currency and the financial markets.

Abe said that the uncertainty and risks in the financial markets persist and the government is ready to mobilize all available means of policies to support the Japanese economy.

Bank of Japan governor, Kuroda, in turn, said that Japanese banks do not have problems with funding in foreign currency and the Bank of Japan will be able to add funds to the market if necessary.

The volume of retail sales in Japan remained unchanged at the level of 0.0% in May. In annual terms, this figure fell to -1.9% from the previous value of -0.9%. Analysts expected a decline to -1.6%.

Retail sales in large stores in Japan also declined, reaching 2.2% in May after falling 0.7% in April

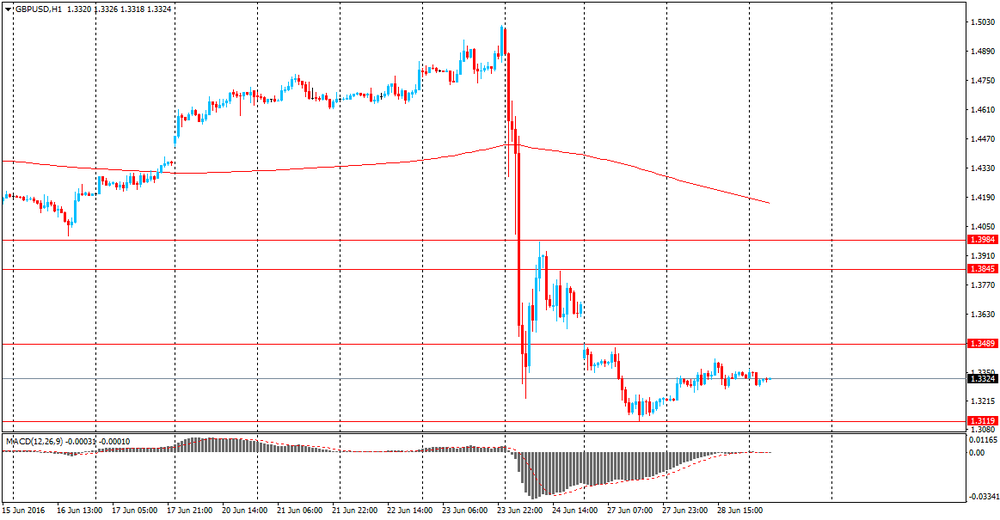

Pound traded near the low of June 24 as the market is concerned about the possible consequences of Brexit. Recall, the pound touched its lowest level since mid-1985 - $ 1.3119, having fallen by 11.5% compared to the closing level on June 23.

The euro has stabilized in a tight range, preparing the next sharp move. Yesterday ECB President Draghi in an interview with Bloomberg said that the UK decision to leave the EU could lead to a reduction in euro zone GDP growth of 0.5%. GDP growth will decline, at least for three years. Draghi also said that it is time to pay attention to the potential Brexit impact on the banking and could have a negative impact on the currency markets.

The Australian dollar generally traded around yesterday's high. Since the beginning of the session, the AUD/USD fell slightly against the background of negative data on new home sales in Australia. As it became known, new home sales in Australia declined in May to -4.4%, after declining in April at -4.7%.

Despite a slight improvement, sales of new homes continued to decline since the beginning of this year. Sales of detached houses fell by -6.7% and sales of apartment buildings rose by + 4.9%.

EUR / USD: during the Asian session, the pair traded in the $ 1.1045-60 range.

GBP / USD: traded in of $ 1.3285-1.3305 range.

USD / JPY: traded in Y101.15-25 range.

-

08:30

Options levels on wednesday, June 29, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1315 (1979)

$1.1234 (3074)

$1.1172 (1100)

Price at time of writing this review: $1.1059

Support levels (open interest**, contracts):

$1.1008 (9785)

$1.0949 (9021)

$1.0874 (15168)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 41778 contracts, with the maximum number of contracts with strike price $1,1500 (5265);

- Overall open interest on the PUT options with the expiration date July, 8 is 90102 contracts, with the maximum number of contracts with strike price $1,0900 (15168);

- The ratio of PUT/CALL was 2.16 versus 2.29 from the previous trading day according to data from June, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.3607 (455)

$1.3510 (679)

$1.3414 (95)

Price at time of writing this review: $1.3320

Support levels (open interest**, contracts):

$1.3190 (3034)

$1.3093 (419)

$1.2995 (2409)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 31281 contracts, with the maximum number of contracts with strike price $1,5000 (4020);

- Overall open interest on the PUT options with the expiration date July, 8 is 44370 contracts, with the maximum number of contracts with strike price $1,3500 (4293);

- The ratio of PUT/CALL was 1.42 versus 1.61 from the previous trading day according to data from June, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:26

WSE: Before opening

Yesterday's session on Wall Street was as successful as in Europe and investors may breathe a little after two days of strong declines. It is not certain whether the return was due to the onslaught of buyers of overvalued stocks, or perhaps more temporary lack of people willing to dispose of the shares at these levels. The main thing that was able to somewhat make up for the loss and cool down after the first reflex of panic. The US indices grew by almost 2%. The strongest growth was seen among biotechnology companies, the Nasdaq Biotech index rose by 3.8%, and - as it did in Europe - banks and transport companies. Incoming data very little change the market sentiment. This happens when the market is dominated by emotions rather than rational valuation of companies and macroeconomic foundations of the economy.

To increasing in price of indices came correction on the commodity market and currency. At the end of the US session the price of crude oil rose already more than 3%, and gold moved down by almost 1% falling to 1,311 usd per ounce. Also got cheaper currencies from the "Safe Haven" basket, the dollar, yen and chf, which confirms a slight return of optimism on the markets. The most important barrier to overcome are the levels before the referendum. Return to levels before the shock will be the first test of strength of the market. Until that happens we have to treat current increase as a correction.

-

08:19

Danske Bank about post-Brexit setup

EUR/USD. We are adjusting our EUR/USD forecasts in line with what we communicated before and immediately after Brexit. We now forecast EUR/USD at 1.09 in 1M (1.11 previously), 1.07 (1.10) in 3M, 1.10 (1.14) in 6M and 1.14 (1.18) in 12M. Short-term, we expect increased political uncertainty in the eurozone and the prospects of further monetary easing to weigh on EUR/USD. However, medium-term we continue to expect that the undervaluation of the EUR and the large eurozone-US current account differential will support the EUR.

USD/JPY. We are lowering our USD/JPY forecasts to 105 in 1M (108 previously), 107 in 3M (112), 108 in 6M (112) and 108 in 12M (112). Brexit and our call that the Fed will now be on hold for the rest of 2016 imply that there is less room for USD/JPY to move higher. We continue to expect that BoJ will ease aggressively in July by cutting interest rates by 20bp and to announce additional quantitative easing. In addition, the risks of FX intervention are increasing. Hence, we expect USD/JPY to edge higher on 0-3M and stabilise medium-term.

USD/CAD: We still expect the fundamentally undervalued 'loonie' to gradually appreciate over the coming year on the back of valuation, a gradually higher oil price, markets re-pricing BoC monetary policy and a generally improved growth outlook in North America. On the back of the decline in oil prices and with the outlook of more short-term USD strength we lift our forecast profile to 1.33 in 1M (from 1.31), 1.31 in 3M (1.28), 1.28 in 6M (1.26) and 1.25 in 12M (1.24).

-

08:15

FOMC member Jerome Powell: Fed ready to act if the pressure increase

- UK decision to withdraw from the EU has increased the risks with new challenges for the United States and other countries.

- It is too early to judge the effects of Brexit on the United States.

- Global economic and financial conditions are particularly important for the United States.

- The most important task of the Federal Reserve is to assess the implications for monetary policy, as the United States continues to make progress on employment and inflation targets.

- The Fed is closely watching inflation expectations, it is important that they remain fixed for the Fed to achieve the goal of 2%.

- Alarmingly possible loss of momentum in the labor market.

-

08:12

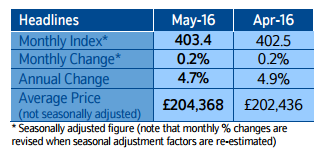

House price index in UK up 0.2%

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said:

"UK house prices edged up 0.2% in May and, as a result, the annual rate of house price growth was little changed at 4.7%, compared with 4.9% in April.

The annual pace of house price growth remains in the fairly narrow range between 3% and 5% that has been prevailing for much of the past twelve months.

In the near term, it's going to be difficult to gauge the underlying strength of activity in the housing market due to the volatility generated by the stamp duty changes which took effect from 1 April.

Indeed, the number of residential property transactions surged to an all-time high in March, some c11% higher than the pre-crisis peak as buyers of second homes sought to avoid the additional tax liabilities".

-

08:07

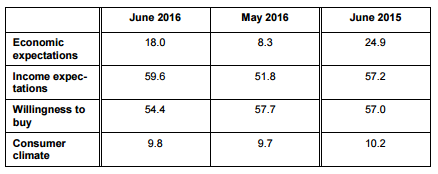

Economic expectations of German citizens have improved considerably

The overall consumer climate indicator is forecasting 10.1 points for July compared with 9.8 points in June. Economic and income expectations are markedly on the up, while willingness to buy fell slightly.

Consumers expect the German economy to be in good shape over the coming months. This has resulted in a considerable increase in economic expectations this month. Given this outlook, income expectations have reached their highest level since German reunification. Only willingness to

buy is slightly down, but is still at a very strong level.

The economic expectations of German citizens have improved considerably in June. The indicator has gained 9.7 points to reach a total of 18 points.

This represents the third increase in a row, and the highest value since June 2015, when the indicator stood at 18.4 points. There is currently a clear upward trend.

-

08:02

Germany: Gfk Consumer Confidence Survey, July 10.1 (forecast 9.8)

-

08:01

United Kingdom: Nationwide house price index , June 0.2% (forecast 0%)

-

08:01

United Kingdom: Nationwide house price index, y/y, June 5.1% (forecast 4.9%)

-

08:00

Switzerland: UBS Consumption Indicator, May 1.35

-

07:02

Global Stocks

Stocks in Europe climbed by the most in a week Tuesday, getting a break after two back-to-back selloffs sparked by the U.K.'s Brexit vote.

In London on Tuesday, the FTSE 100 UKX, +2.64% tacked on 2.6% to end at 6,140.39, while the midcap FTSE 250 MCX, +3.58% added 3.6% to close at 15,503.06.

U.S. stocks on Tuesday rebounded to close higher as some of the initial shock over the U.K.'s decision to withdraw from the European Union receded. All 10 sectors in the S&P 500 closed higher, led by energy shares, while the tech-laden Nasdaq Composite had its best daily percentage gain since March 1. The S&P 500 SPX, +1.78% gained 36 points, or 1.8%, to close at 2,036 and the Dow Jones Industrial Average DJIA, +1.57% rose 270 points, or 1.6%, to finish at 17,410. The Nasdaq COMP, +2.12% rallied 97 points, or 2.1% to close at 4,692.

Asian share markets joined a global rebound on Wednesday as the immediate drag from the Brexit vote began to ebb and investors wagered central banks would ultimately ride to the rescue with more stimulus measures.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 1 percent to recoup around a third of Friday's stinging loss. Japan's Nikkei climbed 1.4 percent, while Australian stocks added 0.8 percent.

-

04:01

Nikkei 225 15,494.54 +171.40 +1.12 %, Hang Seng 20,351.75 +179.29 +0.89 %, Shanghai Composite 2,918.53 +5.98 +0.21 %

-

03:16

Australia: HIA New Home Sales, m/m, May -4.4%

-

01:50

Japan: Retail sales, y/y, May -1.9% (forecast -1.6%)

-

00:32

Commodities. Daily history for Jun 28’2016:

(raw materials / closing price /% change)

Oil 48.11 +0.54%

Gold 1,314.50 -0.26%

-

00:32

Stocks. Daily history for Jun 28’2016:

(index / closing price / change items /% change)

Nikkei 225 15,323.14+13.93+0.09%

Hang Seng 20,178.8-48.50-0.24%

S&P/ASX 200 5,103.27-33.96-0.66%

Shanghai Composite 2,912.76+17.06+0.59%

Topix 1,224.62-1.14-0.09%

FTSE 100 6,140.39 +158.19 +2.64 %

CAC 40 4,088.85 +104.13 +2.61 %

Xetra DAX 9,447.28 +178.62 +1.93 %

S&P 500 2,036.09 +35.55 +1.78 %

NASDAQ Composite 4,691.87 +97.42 +2.12 %

Dow Jones 17,409.72 +269.48 +1.57 %

-

00:31

Currencies. Daily history for Jun 28’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1077 +0,53%

GBP/USD $1,3328 +0,77%

USD/CHF Chf0,98 +0,26%

USD/JPY Y102,70 +0,77%

EUR/JPY Y113,77 +1,31%

GBP/JPY Y136,87 +1,55%

AUD/USD $0,7387 +0,66%

NZD/USD $0,7053 +0,82%

USD/CAD C$1,3025 -0,41%

-