Noticias del mercado

-

17:56

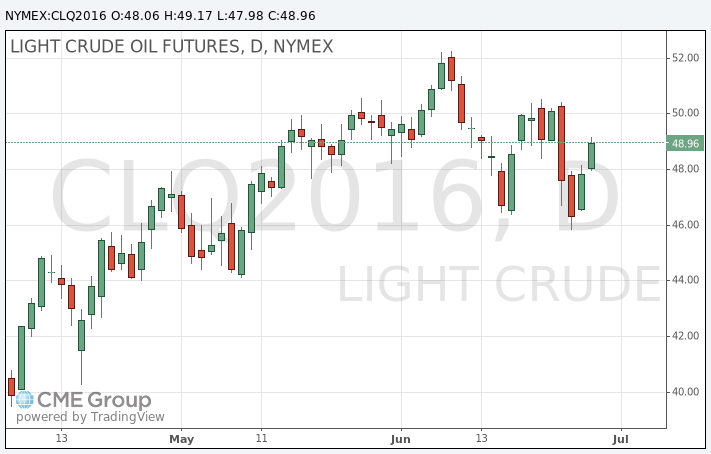

Oil prices rise after data shows a reduction in inventories

Prices for West Texas Intermediate have accelerated growth after data showed that US crude stocks fell last week more than forecast.

US Energy Information Administration said in its weekly report that crude oil inventories fell by 4.1 million barrels for the week ended June 24. Market analysts expect stocks to fall by 2.4 million barrels, while on Tuesday, the American Petroleum Institute reported a decline in inventories of 3.9 million barrels.

Inventories at Cushing, Oklahoma, a key oil storage point for the Nymex, fell by 951,000 barrels last week. In total, US crude stocks last week amounted to 526.6 million barrels.

The report also showed that gasoline inventories increased by 1.4 million barrels compared to expectations for 58,000 barrels, while distillate stocks fell by 1.8 million barrels.

A day earlier, crude oil rose $ 1.52, or 3.28%, as Brexit concerns weaken, boosting appetite for riskier assets.

London Brent crude gained amid concerns about supply disruptions from Norway, where about 7,500 workers at seven oil and gas fields may go on strike from Saturday if not agreed upon the issue of wages until Friday.

These fields account for nearly 18% of the total oil production in Norway, which has a negative impact on production in the North Sea's largest oil producer.

The cost of the August futures for US WTI rose at 49.17 dollars per barrel.

The price of August futures for Brent crude rose to 49.90 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:30

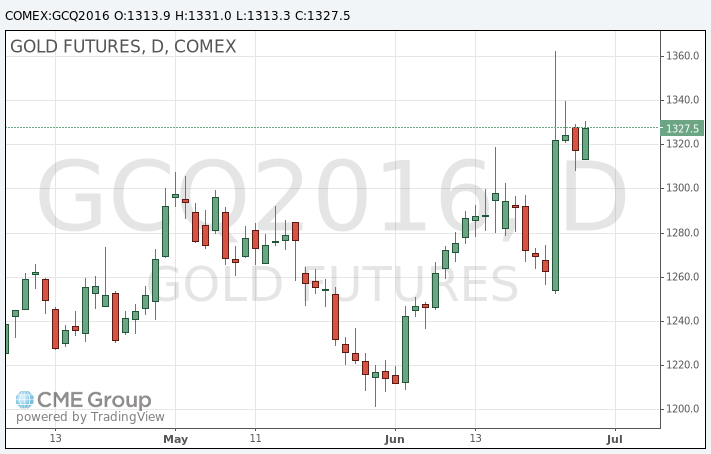

Gold price gains momentum

Gold prices rose in today's trading, rebounding from losses, as market players excluded further increase in interest rates this year after Britain voted in favor of withdrawal from the European Union.

According Fed Watch CME, the chance of a rate increase in July is estimated at 0%, and the probability of lowering rate is estimated at 5%. A cut in September has 10.5%.

On Tuesday, Fed policy maker Jerome Powell said that Brexit shifted the global risks to the economic slowdown, which could pose a threat to the forecast of the US central bank.

News raised fears that other countries may also withdraw from the block, and global growth will be under considerable pressure, while the actual British EU exit timing remain unclear.

At the moment, the precious metal rose in price by almost 25% for the year, helped by concerns about global growth and the introduction of negative interest rates by central banks worldwide.

The cost of the August gold futures on the COMEX rose to $ 1331.0 per ounce.

-

16:34

Crude oil inventories in US declined 4.1 mln barrels

U.S. crude oil refinery inputs averaged 16.7 million barrels per day during the week ending June 24, 2016, 190,000 barrels per day more than the previous week's average. Refineries operated at 93.0% of their operable capacity last week. Gasoline production decreased last week, averaging about 10.0 million barrels per day. Distillate fuel production increased last week, averaging over 5.0 million barrels per day.

U.S. crude oil imports averaged about 7.6 million barrels per day last week, down by 884,000 barrels per day from the previous week. Over the last four weeks, crude oil imports averaged over 7.8 million barrels per day, 12.0% above the same four-week period last year. Total motor gasoline imports (including both finished gasoline and gasoline blending components) last week averaged 904,000 barrels per day. D

istillate fuel imports averaged 25,000 barrels per day last week. U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 4.1 million barrels from the previous week. At 526.6 million barrels, U.S. crude oil inventories are at historically high levels for this time of year. Total motor gasoline inventories increased by 1.4 million barrels last week, and are well above the upper limit of the average range.

Both finished gasoline inventories and blending components inventories increased last week. Distillate fuel inventories decreased by 1.8 million barrels last week but are well above the upper limit of the average range for this time of year. Propane/propylene inventories rose 2.5 million barrels last week and are near the upper limit of the average range. Total commercial petroleum inventories decreased by 1.0 million barrels last week.

-

00:32

Commodities. Daily history for Jun 28’2016:

(raw materials / closing price /% change)

Oil 48.11 +0.54%

Gold 1,314.50 -0.26%

-