Noticias del mercado

-

23:59

Schedule for today, Wednesday, Jun 29’2016:

(time / country / index / period / previous value / forecast)

01:00 Australia HIA New Home Sales, m/m May -4.7%

06:00 Switzerland UBS Consumption Indicator May 1.47

08:30 United Kingdom Net Lending to Individuals, bln May 1.6

08:30 United Kingdom Consumer credit, mln May 1287 1400

08:30 United Kingdom Mortgage Approvals May 66.25 64

09:00 Eurozone Economic sentiment index June 104.7 104.7

09:00 Eurozone Consumer Confidence (Finally) June -7 -7

09:00 Eurozone Business climate indicator June 0.26 0.26

09:00 Eurozone Industrial confidence June -3.6 -3.4

12:00 Germany CPI, m/m (Preliminary) June 0.3% 0.2%

12:00 Germany CPI, y/y (Preliminary) June 0.1% 0.4%

12:30 U.S. Personal Income, m/m May 0.4% 0.3%

12:30 U.S. Personal spending May 1% 0.4%

13:30 U.S. PCE price index ex food, energy, m/m May 0.2% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y May 1.6%

14:00 U.S. Pending Home Sales (MoM) May 5.1% -1%

14:30 U.S. Crude Oil Inventories June -0.917

22:45 New Zealand Building Permits, m/m May 6.6%

23:05 United Kingdom Gfk Consumer Confidence June -1 -3

23:50 Japan Industrial Production (MoM) (Preliminary) May 0.5% -0.1%

23:50 Japan Industrial Production (YoY) (Preliminary) May -3.3%

-

22:27

U.S. stocks rose

U.S. stocks rose for the first time since Britain voted to leave the European Union, with the S&P 500 Index surging the most in nearly four months, amid optimism that policy makers are committed to limit the fallout from the U.K.'s exit.

Tuesday's turnaround gathered pace late in the day, with the Dow Jones Industrial Average adding more than 260 points. Banks had the strongest rally in six weeks, after their worst two sessions in almost five years. Facebook Inc., Apple Inc. and Microsoft Corp rose at least 1.6 percent to boost the technology group, while energy producers climbed the most in 2 1/2 months as crude prices jumped.

The U.K.'s decision last week triggered a rush toward safe havens as global equities lost about $3.6 trillion in market value and the S&P 500 tumbled 5.3 percent to erase its 2016 advance. The CBOE Volatility Index tumbled for a second day, though the measure of market turbulence known as the VIX is still on the way to its biggest monthly climb since a record jump last August.

European Central Bank President Mario Draghi added to speculation of a more coordinated effort by policy makers to mitigate the Brexit repercussions, calling for global policy alignment in a speech at the ECB Forum in Sintra, Portugal. Draghi said there is a "common responsibility" to address the world's economic weaknesses. U.K. Prime Minister David Cameron will face EU leaders at a dinner in Brussels on Tuesday, after both the Bank of England and European Central Bank pledged to increase liquidity.

EU leaders are gathering for a two-day European Council summit to discuss Britain's exit. Germany, France and Italy prodded the U.K. government to start the process, saying they want to move forward and limit market risks. Britain's Chancellor of the Exchequer George Osborne sought to reassure investors on Monday, saying that contingency plans were in place to shore up the economy amid ongoing volatility, but that Brexit won't be "plain sailing" -- something that Cameron reiterated in Parliament.

Aside from the Brexit drama, a report today showed the U.S. economy expanded more than previously projected in the first quarter as improved performance in trade and business investment more than made up for weaker consumer spending. Separate data showed consumer confidence rose to the highest since October as Americans became somewhat more optimistic about the economy.

-

21:01

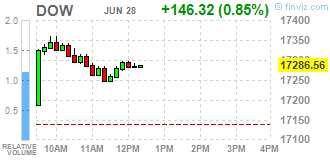

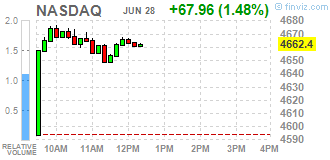

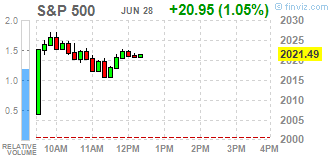

DJIA 17374.39 234.15 1.37%, NASDAQ 4687.54 93.10 2.03%, S&P 500 2032.68 32.14 1.61%

-

18:27

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Tuesday as investors rushed to pick up stocks after Britain's decision to leave the European Union sparked a massive two-day selloff in global markets. Banks, which were the worst hit since the referendum on Thursday, were among the most attractive stocks for bargain hunters. A rebound in oil prices on Tuesday signaled an appetite for riskier assets, while gold retreated.

Almost all Dow stocks in positive area (27 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -2,95%). Top gainer - The Travelers Companies, Inc. (TRV, +2,32%).

All S&P sectors in positive area. Top gainer - Basic Materials (+1,9%).

At the moment:

Dow 17187.00 +202.00 +1.19%

S&P 500 2012.25 +27.25 +1.37%

Nasdaq 100 4249.50 +71.50 +1.71%

Oil 47.18 +0.85 +1.83%

Gold 1317.70 -7.00 -0.53%

U.S. 10yr 1.46 +0.00

-

18:00

European stocks closed: FTSE 6140.39 158.19 2.64%, DAX 9447.28 178.62 1.93%, CAC 4088.85 104.13 2.61%

-

17:45

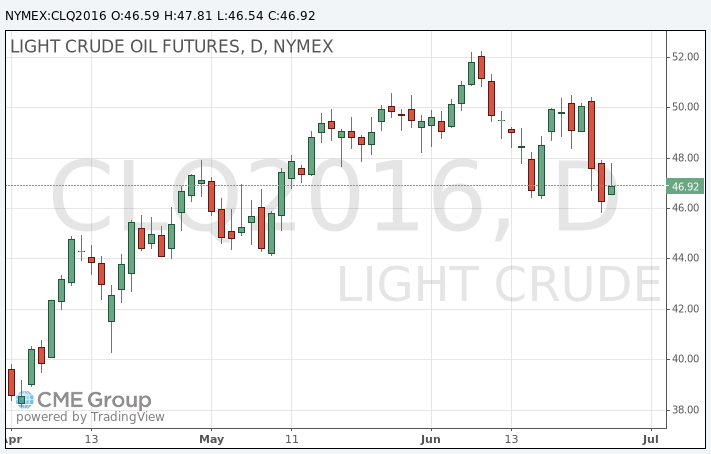

Oil gains for the first time in the last three sessions

Oil prices rose today, rising for the first time in three sessions as investors took advantage of a drop in prices on the results of the referendum in the UK.

The British pound, the global stock market and most of the commodity markets rose as investor sentiment improved after the shocking results of Brexit.

Oil prices lost more than 7% in the last two sessions, as global stock markets lost $ 3 trillion in two days of trading.

Oil received additional support amid concerns about supply disruptions from Norway, where about 7,500 workers at seven oil and gas fields may go on strike from Saturday if will not agree on wages.

These fields account for nearly 18% of the total oil production in Norway, which has a negative impact on production in the North Sea's largest oil producer.

A day earlier, futures for Brent crude fell to seven-week low of $ 47.30, as investors dumped risky assets on the results of voting in the UK, where the majority of citizens were in favor of withdrawal from the European Union.

The news intensified fears that Europe will return to recession, putting increased pressure on the global economy and undermining prospects for future oil demand.

Bidders have focused on fresh weekly data on oil and petroleum products to gauge the strength of demand from the world's largest consumer.

The American Petroleum Institute is scheduled to release its report on stocks today, while on Wednesday, a government report may show a drop in crude oil reserves by 2.4 million barrels for the week ended June 24.

The cost of the August futures for US light crude oil WTI rose to 47.81 dollars per barrel.

The price of August futures for Brent crude rose to 48.58 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:41

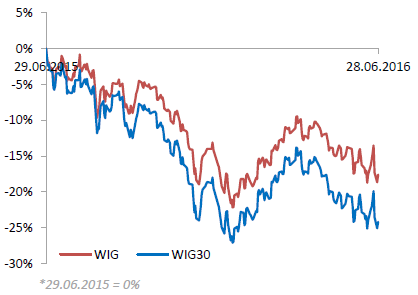

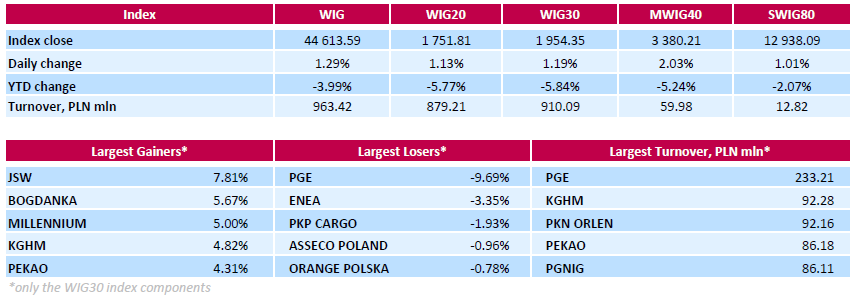

WSE: Session Results

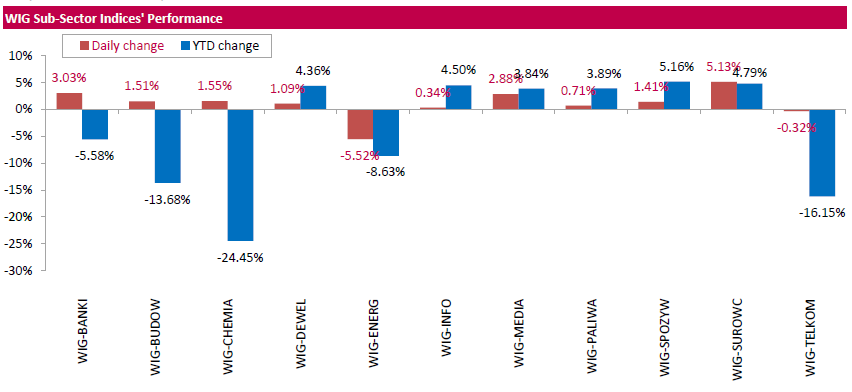

Polish equity market advanced on Tuesday. The broad market measure, the WIG Index, surged by 1.29%. Except for utilities (-5.52%) and telecoms (-0.32%), every sector in the WIG Index advanced, with materials (+5.13%) outperforming.

The large-cap stocks' measure, the WIG30 Index, added 1.19%. A majority of the index components returned gains, with the way up led by two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), which climbed by 7.81% and 5.67% respectively. They were followed by copper producer KGHM (WSE: KGH), FMCG-wholesaler EUROCASH (WSE: EUR) and two banks PEKAO (WSE: PEO) and MILLENNIUM (WSE: MIL), which gained between 4.14% and 5%. At the same time, the decliners's list was topped by genco PGE (WSE: PGE), which tumbled by 9.69% as the company's shareholders approved the state treasury's late motion to cut the 2015 dividend payout to PLN 0.25 versus PLN 0.92 management recommendation.

-

17:26

Gold prices decreased

Gold prices declined in today's trading, falling for the first time in three sessions as investors took profits after futures jumped to their highest level since March 2014, after Brexit.

Last Friday, gold prices rose to 27-month high of $ 1,362.60 on the unexpected decision of the UK to leave the European Union, so that investors have turned to gold and other safe assets.

News raised fears that other countries may also withdraw from the block, and global growth will be under considerable pressure, while the actual British EU exit timing remain unclear.

On Monday, the rating Standard & Poor's downgraded the sovereign credit rating of the UK from "AAA" to "AA", refering to the outcome of the referendum.

At the moment, the precious metal rose in price by almost 25% for the year, helped by concerns about global growth and the introduction of negative interest rates by central banks worldwide.

The cost of the August gold futures on COMEX fell to $ 1308.2 per ounce.

-

16:12

Consumer confidence in US rose more than forecasts

The Conference Board Consumer Confidence Index, which had decreased in May, improved in June. The Index now stands at 98.0 (1985=100), up from 92.4 in May. The Present Situation Index increased from 113.2 to 118.3, while the Expectations Index rose from 78.5 to 84.5 in June.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was June 16.

"Consumer confidence rebounded in June, after declining in May," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers were less negative about current business and labor market conditions, but only moderately more positive, suggesting no deterioration in economic conditions, but no strengthening either. Expectations regarding business and labor market conditions, as well as personal income prospects, improved moderately. Overall, consumers remain cautiously optimistic about economic growth in the short-term."

Less important economic data in the current post-Brexit environment.

-

16:07

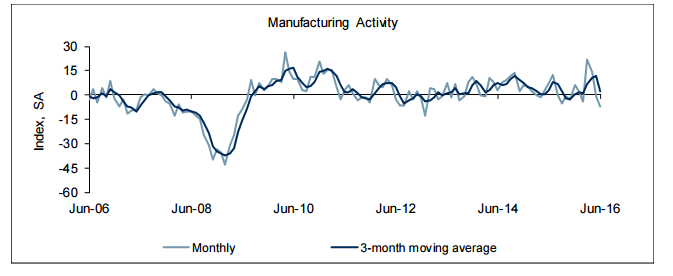

Richmond’s manufacturing sector lost momentum in June

Fifth District manufacturing activity weakened in June, according to the most recent survey by the Federal Reserve Bank of Richmond. New orders and shipments declined this month, while backlogs decreased further compared to last month.

Manufacturing employment softened, while firms continued to increase wages. Prices of raw materials rose somewhat more slowly this month and finished goods prices rose slightly faster in June, compared to last month.

Manufacturers' positive expectations faded in June. Producers anticipated mild growth in shipments and in the volume of new orders in the next six months.

Compared to last month's outlook, backlogs and capacity utilization were expected to level off. Firms looked for vendor lead times to lengthen slightly during the six months ahead.

-

16:00

U.S.: Consumer confidence , June 98 (forecast 93.7)

-

15:59

U.S.: Richmond Fed Manufacturing Index, June -7 (forecast 2)

-

15:56

Option expiries for today's 10:00 ET NY cut

EURUSD 1.1100 (EUR 1.5bln) 1.1100 (251m)

USDJPY 104.50 (USD 750m)

AUDUSD 0.7290 (AUD 691m) 0.7350 (455m) 0.7500 (452m)

-

15:49

WSE: After start on Wall Street

The highlight of this afternoon on the Warsaw market was the decision of the shareholders of PGE (at the request of the Treasury) to distribute a dividend of only PLN 0.25 per share compared to previously proposed amount of PLN 0,92 per share. The scale of sales at PGE after the voting exceeded expectations. This can be seen not only by breaking through the course of the lower collars, but also by the turnover, which has already exceeded PLN 115 mln. The course itself goes below the minimum of Friday's massacre, which turns out that a dividend cut is a bigger problem than Brexit.

The American market began with increases of about 1%, which helps our WIG20 index to some recovery.

-

15:40

Eurogroup President, Dijsselbloem: Britain's new trade deal with the EU will be less favourable than as a member of EU

No surprises here. Most of the European leaders are presenting tough comments about what would happen next to the UK's status. After the markets return to normal conditions, this will be reflected in the pound's quotes.

-

15:34

US house price growth slowed slightly in April

Housing prices in 20 major US cities continued to rise in April, but slightly less than in March. This was reported in the S & P / Case-Shiller data.

According to the data, the index of housing prices, covering the entire country, increased in April by 5.0% in annual terms, which was slightly less than the March increase of 5.1%. In the meantime, the house price index for the 10 largest cities and has grown by 4.7% compared to 4.8% a month earlier.

The comparable figure for the 20-largest cities rose by 5.4% after rising 5.5% in March (revised from + 5.4%). Analysts had expected the house prices in the 20 largest cities to increase by 5.5%.

Most "hot" markets in the country continued to show double-digit price increases. The maximum increase was noted in Portland - by 12.3% y/y. A significant increase in the cost of housing has also been recorded in Seattle (+ 10.7%) and Denver (+ 9.5%).

On a monthly basis, seasonally adjusted house prices rose in April by 0.1%. The price index for the 10-largest cities rose by 0.3%, and for the 20 mega-cities index rose 0.5%. Without seasonal adjustment, the national index increased by 1.0% compared to March. Indicators for the 10 and 20 cities ose by 1.0% and 1.1% respectively.

-

15:32

U.S. Stocks open: Dow +0.81%, Nasdaq +1.19%, S&P +0.88%

-

15:16

Before the bell: S&P futures +1.27%, NASDAQ futures +1.29%

U.S. stock-index futures climbed as optimism grew that policy makers will move to support financial markets.

Global Stocks:

Nikkei 15,323.14 +13.93 +0.09%

Hang Seng 20,172.46 -54.84 -0.27%

Shanghai Composite 2,912.76 +17.06 +0.59%

FTSE 6,161.22 +179.02 +2.99%

CAC 4,115.11 +130.39 +3.27%

DAX 9,547.88 +279.22 +3.01%

Crude $47.65 (+2.85%)

Gold $1317.00 (-0.58%)

-

15:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, April 5.4% (forecast 5.5%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

168.52

1.33(0.7955%)

1651

ALCOA INC.

AA

9.38

0.28(3.0769%)

55634

ALTRIA GROUP INC.

MO

68.16

0.23(0.3386%)

5264

Amazon.com Inc., NASDAQ

AMZN

700.2

8.84(1.2786%)

57355

American Express Co

AXP

58.47

0.80(1.3872%)

2724

AMERICAN INTERNATIONAL GROUP

AIG

49.94

1.15(2.357%)

3631

Apple Inc.

AAPL

93.25

1.21(1.3146%)

251306

AT&T Inc

T

42.29

0.26(0.6186%)

32355

Barrick Gold Corporation, NYSE

ABX

20.54

-0.57(-2.7001%)

208593

Boeing Co

BA

124.9

2.20(1.793%)

4602

Caterpillar Inc

CAT

72.71

1.33(1.8633%)

4972

Chevron Corp

CVX

101.4

1.04(1.0363%)

4970

Cisco Systems Inc

CSCO

27.66

0.35(1.2816%)

29941

Citigroup Inc., NYSE

C

39.69

1.21(3.1445%)

196229

E. I. du Pont de Nemours and Co

DD

64.3

0.22(0.3433%)

1934

Exxon Mobil Corp

XOM

90

1.14(1.2829%)

5763

Facebook, Inc.

FB

110.5

1.53(1.4041%)

328284

Ford Motor Co.

F

12.45

0.29(2.3849%)

95438

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.67

0.54(5.3307%)

496062

General Electric Co

GE

29.64

0.32(1.0914%)

57656

General Motors Company, NYSE

GM

27.89

0.38(1.3813%)

22954

Goldman Sachs

GS

142.49

2.98(2.1361%)

21432

Google Inc.

GOOG

677.8

9.54(1.4276%)

13041

Hewlett-Packard Co.

HPQ

11.7

0.15(1.2987%)

380

Home Depot Inc

HD

126

1.33(1.0668%)

5424

HONEYWELL INTERNATIONAL INC.

HON

113.38

1.92(1.7226%)

700

Intel Corp

INTC

31.03

0.31(1.0091%)

10332

International Business Machines Co...

IBM

145.2

1.70(1.1847%)

7092

Johnson & Johnson

JNJ

117.1

0.55(0.4719%)

10467

JPMorgan Chase and Co

JPM

58.9

1.29(2.2392%)

85262

McDonald's Corp

MCD

117

0.70(0.6019%)

4210

Merck & Co Inc

MRK

56.01

0.70(1.2656%)

604

Microsoft Corp

MSFT

48.95

0.52(1.0737%)

84744

Nike

NKE

52.45

0.56(1.0792%)

19196

Pfizer Inc

PFE

34.18

0.38(1.1243%)

16399

Procter & Gamble Co

PG

81.6

0.37(0.4555%)

1536

Starbucks Corporation, NASDAQ

SBUX

54.32

0.63(1.1734%)

5184

Tesla Motors, Inc., NASDAQ

TSLA

201.4

2.85(1.4354%)

62106

The Coca-Cola Co

KO

43.99

0.21(0.4797%)

6161

Twitter, Inc., NYSE

TWTR

16.2

0.36(2.2727%)

128586

United Technologies Corp

UTX

98.7

1.49(1.5328%)

200

UnitedHealth Group Inc

UNH

138.19

1.08(0.7877%)

826

Verizon Communications Inc

VZ

55.15

0.41(0.749%)

1953

Visa

V

75

1.66(2.2634%)

11559

Wal-Mart Stores Inc

WMT

71.9

0.40(0.5594%)

2320

Walt Disney Co

DIS

95.62

1.24(1.3138%)

8216

Yahoo! Inc., NASDAQ

YHOO

35.8

0.58(1.6468%)

4621

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Travelers (TRV) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:Tesla Motors (TSLA) downgraded to Hold from Buy at Argus

DuPont (DD) downgraded to Neutral from Overweight at JP Morgan

Other:

-

14:34

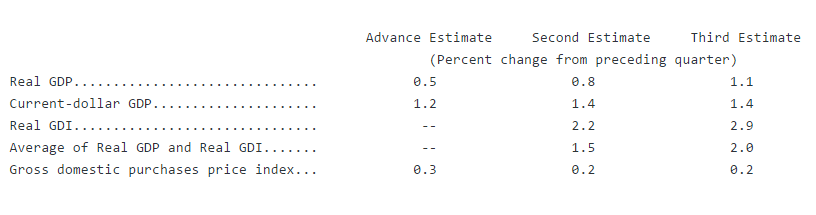

US: better GDP but lower prices and spending

Real gross domestic product -- the value of the goods and services produced by the nation's economy less the value of the goods and services used up in production, adjusted for price changes -- increased at an annual rate of 1.1 percent in the first quarter of 2016, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2015, real GDP increased 1.4 percent.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 0.8 percent. With the third estimate for the first quarter, the general picture of economic growth remains the same; exports increased more than previously estimated.

The increase in real GDP in the first quarter reflected positive contributions from personal consumption expenditures (PCE), residential fixed investment, state and local government spending, and exports that were partly offset by negative contributions from nonresidential fixed investment, private inventory investment, and federal government spending. Imports, which are a subtraction in the calculation of GDP, decreased.

The deceleration in real GDP in the first quarter primarily reflected a deceleration in PCE, a larger decrease in nonresidential fixed investment, and a downturn in federal government spending that were partly offset by upturns in state and local government spending and exports and an acceleration in residential fixed investment.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, increased 0.2 percent in the first quarter, compared with an increase of 0.4 percent in the fourth. Excluding food and energy prices, the price index for gross domestic purchases increased 1.4 percent, compared with an increase of 1.0 percent.

-

14:30

U.S.: PCE price index ex food, energy, q/q, Quarter I 2.0% (forecast 2.1%)

-

14:30

U.S.: GDP, q/q, Quarter I 1.1% (forecast 1%)

-

14:26

European session review: the pound gradually recovering after the massive fall

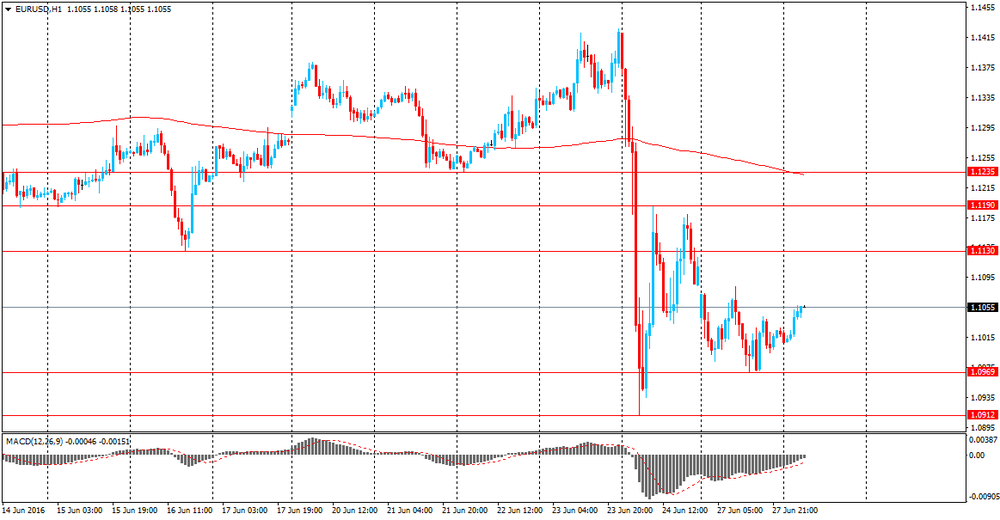

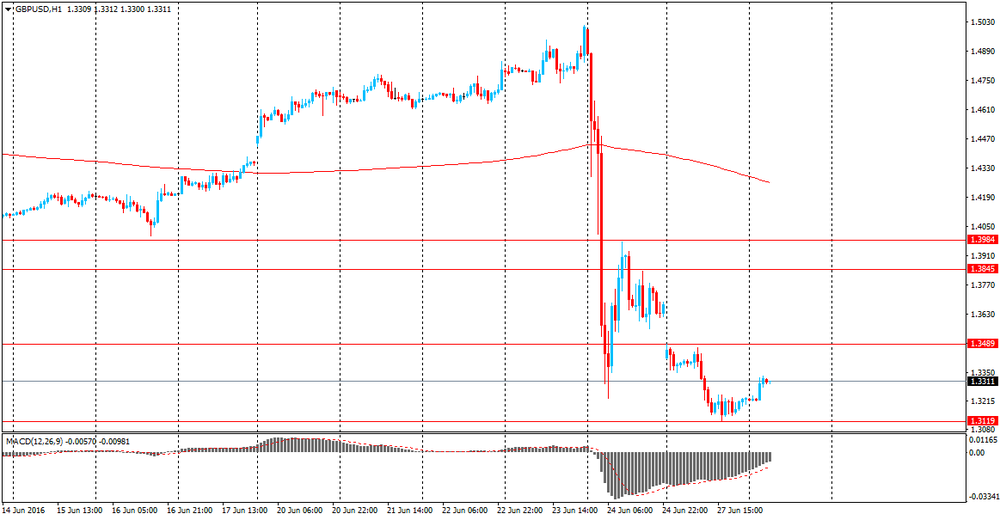

The euro rose against the dollar significantly, fully recovering after yesterday's decline. Investors continue to analyze the impact of the unexpected results of Brexit for the global economy and the political situation in Europe. However, restoration of confidence is seen after the initial reaction of panic and the markets realized that the consequences of Brexit may not be as bad as many had feared at first.

Meanwhile, the US dollar depreciates, as market participants price in a lower chance fo the increase in Fed's intrest rate for the foreseeable future. Currently, futures on the Fed rate indicates 18 percent chance of rate cuts at the September and November meetings. Prior to the British referendum there were zero chances of lowering rates and 52% chance of a rate hike at the September meeting.

Market participants are also waiting for news from the summit of EU leaders, during which will be discussed Britain's decision to leave the EU structure.

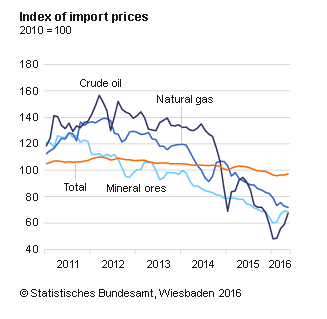

Little impact on price action from the economic data The Statistical Office Destatis reported that import prices in Germany fell again at the end of May, slowing the pace compared to the previous month. In addition, last fall proved slower than experts expected. According to the data, the import price index fell in May by 5.5 percent year on year, compared with a decline of 6.6 percent in April, which proved to be the biggest since October 2009. Economists expect that the prices will decrease by 5.8 percent. Excluding energy, import prices decreased by 2.7 percent. On a monthly basis, import prices rose in May by 0.9 percent, offsetting a decline of 0.1 percent in April. Analysts predicted that the prices will increase by 0.6 percent.

The British pound appreciated by about 1.2% against the US dollar, approaching $ 1.3400. Today, the UK Chancellor said that Britain will have to raise taxes and cut spending to counter the economic problems that will arise after the British voted for withdrawal from the European Union. "We have to ensure absolute safety for the people and show the country and the world that the government can work at full capacity". Osborne also said that the UK is a key to financial stability, which was broken by a vote. "We have entered into a long period of economic restructuring of the UK We will adapt to life outside the EU, and it will not be economically rosy as life within the EU." - Said Osborne.

Yesterday the rating agency S & P downgraded the credit rating of the UK from "AAA" to "AA" and stated that the vote against leaving the EU in Scotland and Northern Ireland UK aggravated constitutional problems. Another major rating agency - Fitch Ratings - also downgraded by one notch and warned about the likelihood of a sharp slowdown in economic growth due to the fact that the company will postpone investments at a later time. In addition, Fitch Ratings has revised downwards its forecast for UK economic growth for 2016 to 1.6% compared with 1.9% previously.

EUR / USD: during the European session rose to $ 1.1112

GBP / USD: during the European session rose to $ 1.3385

USD / JPY: during the European session rose to Y102.42

-

14:00

Orders

EUR/USD

Offers 1.1080-85 1.1100 1.1120-25 1.1150 1.1170 1.1200 1.1200 1.1230-40 1.1280 1.1300

Bids 1.1025-30 1.1000 1.0975-80 1.0930 1.0900 1.0885 1.0850 1.0820-251.0800

GBP/USD

Offers 1.3320 1.3335 1.3350 1.3385-90 1.3400 1.3430 1.3450 1.3475-80 1.3500 1.3550 1.3580 1.3600

Bids 1.3280 1.3255-60 1.3230 1.3200 1.3170 1.3150 1.3100 1.3080 1.3050 1.3000

EUR/GBP

Offers 0.8330-35 0.8350 0.8370-75 0.8400 0.8465 0.8500

Bids 0.8285 0.8270 0.8250 0.8200-0.8195 0.8165 0.8150 0 0.8130 0.8100

EUR/JPY

Offers 113.00 113.20-25 113.50-55 114.00 114.30 114.50 115.00

Bids 112.50 112.30-35 112.00 111.70 111.50 111.00 110.60 110.00 109.50 109.00

USD/JPY

Offers 102.20-25 102.50 102.80-85 103.00 103.25 103.50 103.85 104.00

Bids 101.80 101.65 1101.50 101.20-25 100.65 100.00 99.85 99.50 99.00

AUD/USD

Offers 0.7420-25 0.7450-55 0.7485 0.7500 0.7520 0.7550 0.7570 0.7600

Bids 0.7380 0.7350-55 0.7320 0.7300 0.7285 0.7265 0.7230 0.7200

-

13:17

WSE: Mid session comment

After yesterday's, rather weak session, today comes a rebound in stock prices of banks and commodity companies in line with increases of the prices of oil and copper.

Goldman Sachs after taking into account the different macroeconomic of Brexit scenarios lowered the valuation of banks in the CEE region. In the case of our largest banks they were reduced valuations by 15 percent of PKO BP to PLN 23, 10 percent of Pekao to PLN 117 and 15 percent of BZ WBK to PLN 195.

Noteworthy is the relatively good behavior of the British market, which returned higher than minima from April and May. This may be due to the reluctance of British politicians to activate Article 50 of the EU Treaty, which officially starts the procedure of exit from the Union. There is also information about the fund for Italian banks, which could stabilize the precarious situation of the local financial institutions. Italian stock market gains over 4%.

At the halfway point of the session the WIG20 index was at the level of 1,760 points (+1,62%) and with quite satisfactory turnover of over PLN 270 mln.

-

13:00

Fitch: latest Spanish election may reduce political risk but uncertainty remains

-

Sunday's outcome is less likely to result in a repeat of 6-month political stalemate that followed that in Dec 2015.

-

signs that a high level of consumer confidence may have reduced Brexit -related falls in fin markets represent key downside risk.

-

further period of political stalemate likely to have more negative impact on confidence and growth than after December's election.

-

-

12:57

Major stock indices in Europe on the rise

European stocks rise again after the largest two-day drop since 2008, as investors believe that politicians can take action to support the markets after Brexit.

Today in Brussels starts a two-day summit of EU leaders, during which they discuss Britain's decision to leave the Union. British Prime Minister David Cameron will only take part at the first day of the summit.

Investors will also keep an eye on the comments of Fed Yellen. At present, the markets expects with greater confidence that in the foreseeable future, the Fed will not raise rates. In addition, futures on interest rates point to 18 percent chance of lowering rates at the September and November meetings. Up to the British referendum there were zero chance of lowering rates and 52% chance of a rate hike at the September meeting.

According to Goldman Sachs estimates, the eurozone GDP will grow in the next to years by an average of 1.25 percent against the 1.5 percent expected before the vote. As for the US economy, Goldman Sachs is now expecting that GDP growth in the second half of 2016 will amount to 2 percent compared with the previous forecast of 2.25 percent.

Meanwhile, J.P. Morgan experts warn that Britain's exit from the EU will encourage the ECB to ease monetary policy more than expected. According to the analysts, in September, the ECB will implement additional easing by lowering interest rates on deposits by 0.10% and the extension of QE program until 2018.

The composite index of the largest companies in the region Stoxx Europe 600 grew 2.4%.

Italian banks, including Mediobanca SpA, show the greatest increase among the euro area creditors after the vice-president for European Policy Valdis Dombrovskis said that the European Commission is in contact with the Italian authorities on possible support measures after the recent sales. Shares of Greek and Spanish banks also becoming more expensive.

G4S Plc cost jumped by 8.7 percent, reaching the highest level since October 2011, after analysts at Credit Suisse Group AG raised the stock rating to "buy" from "neutral," citing the benefits of a weaker pound and the stability of their business.

Redrow Plc shares rose 2.9 percent. The company said that the amount of the annual profit may exceed analysts' forecasts.

Ocado Group Plc shares rose 8.6 percent as analysts Goldman Sachs Group Inc recommended buying the shares after the retailer reported a further increase in sales.

At the moment:

FTSE 100 6,128.96 +146.76 + 2.45%

CAC 40 4,091.45 +106.73 + 2.68%

DAX 9,474.31 +205.65 + 2.22%

-

12:39

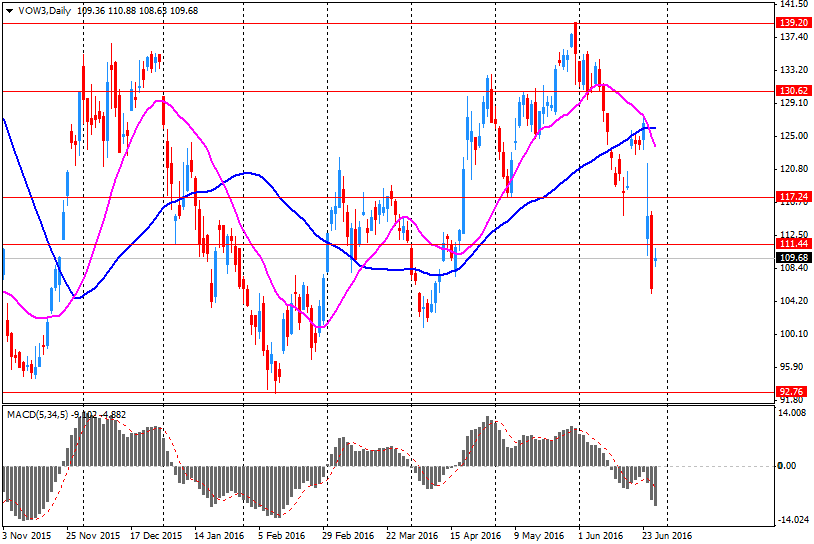

Company News: Volkswagen AG (VOW3) will pay about $ 15 billion on diesel lawsuits in the United States

As reported by Bloomberg, Volkswagen's expenses for the settlement of "diesel scandal" in the US will reach $ 15 billion, -. $ 5 billion more than previously reported.

Under the deal, VW will spend about $ 10.03 billion, as well as compensation to each buyer of the car in the amount of $ 10K. This amount may increase.

Another $ 2.7 billion fines should be directed to the US Environmental Protection Agency and the California Air Resources Board. In addition, the company will invest $ 2 billion in emission control technology.

Shares VOW3 rose to 109.35 Euro (+ 3.06%).

-

12:05

UK, CBI: weak retail sales growth

The survey, undertaken before the EU referendum, showed that orders placed on suppliers fell over the year at a somewhat slower pace than in the previous month. Sales growth is expected to pick up next month, but orders are expected to continue falling although at a slightly slower pace. Growth in the volume of internet sales slowed in the year to June, with the survey balance falling below the long-run average. However, internet sales growth is set to pick up strongly in July

-

12:03

CASS: China's GDP will grow this year by 6.6%

According to estimates from the Chinese Academy of Social Sciences (CASS), at the end of this year, China's economy will expand by 6.6%, but in the second half of the year the economy will need to rely on the support of monetary policy to counter the downward pressure. Recall that in May CASS analysts had forecast GDP growth of 6.6% to 6.8% this year.

"Consumer price inflation is likely to increase by 2% y/y, while the decline in producer prices slowed down. According to our calculations, in the first five months of this year inflation will rose to 2.1 percent, costs will be stable, but money supply growth will slow down in investment in fixed assets and real estate. " CASS also said that China should deepen economic reforms and restructuring, optimize the leverage levels.

-

12:00

United Kingdom: CBI retail sales volume balance, June 4 (forecast 9)

-

11:40

Lukoil expects market volatility to increase due to Brexit, but it will not affect the company

Lukoil does not expect a major impact due to Brexit consequences on the company's operations, although predicts strengthening of volatility in the markets, Alexander Matytsyn told reporters.

"The consequences of Brexit will not have a material impact on the financial-economic activity of" Lukoil ". In the current situation, we can predict increase in volatility in the currency and commodity markets, but conservative financial and budgetary policy of the company allows to us feel confident in terms of price volatility" - he said.

-

11:07

French consumer confidence fell in June

The index of consumer confidence, reflecting consumer sentiment in France dropped to 97 from the previous value of 98, and coincided with the forecast. In May the index touched the highest value since October 2007. The consumer confidence index shows the general state of the economy in the short term. However, recently there has been a downward trend, which is negative for the euro as the indicator moved further away from its long-term average of 100.

As can be seen from this figure, consumers are less optimistic about their financial prospects and the possibility to make large purchases. This economic data shown the activity before Brexit.

-

11:00

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.1100 (EUR 1.5bln) 1.1100 (251m)

USD/JPY 104.50 (USD 750m)

AUD/USD 0.7290 (AUD 691m) 0.7350 (455m) 0.7500 (452m)

-

10:34

Oil is gaining in early trading

This morning, New York crude oil futures WTI rose by 1.86% to $ 47.18 per barrel and crude oil futures for Brent rose 1.61% to $ 48.52 per barrel. Thus, the black gold appreciates, on the background of a strike in Norway, which may lead to a reduction in production of the largest oil producer in Western Europe. At the same time Britain's decision to withdraw from the European Union is still putting pressure on the markets. Production of oil increased in Nigeria about 1.9 million barrels per day from 1.6 million, after the repair of pipelines.

-

10:30

ECB, Draghi: monetary policy has inevitably created destabilising spill-overs

-

we would all clearly benefit from enhanced understanding between CBs

-

global economy can benefit from alignment of policies

-

we may not need formal coordination of policies but we can benefit from more alignment

-

monetary policy has inevitably created destabilising spill-overs as well

-

divergent monetary policy can create uncertainty about future policy intentions that can lead to higher FX volatility and risk premia

-

-

10:05

Review of financial and economic press: Standard & Poor's downgraded the credit rating of UK

D / W

Germany's finance minister: Brexit is a permanent decision

After the decision to withdraw from the European Union there is no turning back siad the German Finance Minister Wolfgang Schäuble. "I do not think that this decision is reversible", - the politician said. "There is a feeling that the British themselves repent, but it is useless - they should have thought of that before," - said Schäuble. The Minister also expressed the hope that London will soon transmit the formal request to withdraw from the EU, the so-called Brexit.

Standard & Poor's downgraded the credit rating of the UK

International rating Standard & Poor's downgraded the credit rating of the UK on Monday, June 27th. The maximum AAA rating was lowered to AA as a consequence of the outcome of the referendum on the withdrawal of Great Britain from the EU, but economists do not exclude the possibility that it could fall even lower. "In our opinion, this is a landmark event that will lead to less predictable, less stable and less effective policy framework in the UK", - said in a statement the agency. The negative outlook reflects the economic risks and the future of the pound sterling as a reserve currency, the expert said.

EU expect formal Brexit

In Berlin was held a meeting with German Chancellor Angela Merkel, the President of France Francois Hollande and Italian Prime Minister Matteo Renzi. The leaders discussed the future of the European Union following the decision of the British withdrawal from the EU.

newspaper. ru

Total will develop the largest oil field in Qatar

The French oil company Total has been selected to develop the largest oil field in Qatar, Bloomberg writes. It is noted that Total has won a 30% stake in partnership with Qatar Petroleum. The two companies will create a new company, North Oil Co. for Shaheen field development in the next 25 years.

TransCanada filed a lawsuit against the Obama administration for $ 15 billion

The energy company TransCanada filed a lawsuit against the US government claiming $ 15 billion due to the fact that the US authorities blocked the construction of the Keystone XL oil pipeline under the North American Free Trade Agreement (NAFTA), writes The Daily Caller.

US rely on negotiations for a free trade issue after Brexit

The White House is counting on the completion of negotiations on a Transatlantic Free Trade Area (TTIP) said White House spokesman Eric Schultz. He noted that negotiations with the United Kingdom will be held separately, but not with a clean slate.

Cameron: Scotland will retain access to the markets of the UK and EU

British Prime Minister David Cameron said that Scotland will retain access to both the British and the European market after Brexit, according to RIA "Novosti".

RBC

Bank of China lowered the yuan to the lowest levels in five and a half years

Bank of China lowered the RMB exchange rate to its lowest level in the last five and a half years, Reuters reports, in early trading China's central bank set the yuan's exchange rate to the level of 6.6528 dollars, which was the lowest level since December 2010.

Volkswagen will send $ 15 billion to settle "diesel scandal"

Volkswagen will provide $15 bln for the settlement of the "diesel scandal", according to Reuters, citing two sources familiar with the situation. Slightly more than $ 10 billion will be allocated to owners of cars on the buy-back system, another $ 5 billion will be sent to a special fund created to compensate for the emissions consequences. Representatives of the US and Volkswagen declined to comment.

-

09:55

Positive start of trading: DAX 9,463.61 + 194.95 + 2.10%, FTSE 100 6,107.35 + 125.15 + 2.09%, CAC 40 4,075.12 + 90.40 + 2.27%.

-

09:22

WSE: After opening

WIG20 index opened at 1753.04 points (+1.20%)*

WIG 44507.90 1.05%

WIG30 1956.39 1.30%

mWIG40 3322.79 0.30%

*/ - change to previous close

The cash market (the WIG20) opened with increase by 1.2% to 1,753 points with the same as yesterday modest turnover.

Investors expect that markets will now slowly stabilizing, but "the dust after Brexit" will not settle so quickly. There will be running down another negative forecasts regarding the condition of the British and world economy in 2017. These forecasts will not be comforting and most of them are already included in the prices of various assets, but will still keep a short-term rotten mood on the stock markets.

The good news is that the market was not weak enough to permanently appoint a new bottom. The contract on the WIG20 remains in the area of 1715-1775 points and exceeding of these levels will appoint another short-term price movement.

-

09:06

Today’s events:

- at 08:00 GMT The European Parliament will vote for the resolution on the referendum in the United Kingdom and ECB President Mario Draghi will deliver a speech.

- at 08:30 GMT the ECB board member Benoit Kerra will deliver a speech.

- at 11:00 GMT the ECB Board Member Peter Prat makes a speech.

- at the 23:00 GMT FOMC member Jerome Powell will deliver a speech.

-

09:02

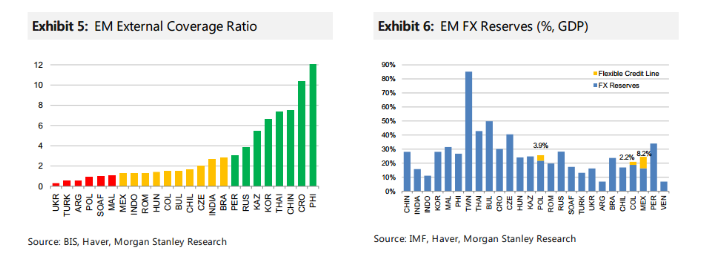

Fade Any Near-Term Stabilisation Effort - Morgan Stanley

"The vote to leave the EU has already and unsurprisingly prompted a significant market reaction, with the USD and JPY strengthening significantly, and GBP and EM currencies weakening substantially. While the risk of a policy response at multiple levels to stabilise markets is high, and has already led to a modest reversal of early losses, we believe the medium-term implications for growth, cross-border capital flows and risk taking more broadly mean that we are likely to see further USD and JPY strength and GBP, EM and commodity market weakness. As such, we would recommend fading any near-term stabilisation efforts.

Pressure points: We see a number of pressure points that are likely to lead to further volatility in currency markets, with more USD and JPY strength and weakness in EM currencies.

First, the initial move lower in GBP, EUR, and other major and EM currencies has of course resulted in significant USD strength. This will likely create a self-reinforcing effect, with pressure likely to now emerge on CNY. Our RMB model suggests that the USD/CNY fixing will be 400pips higher, and this would create a second-round impact on regional peers such as KRW, TWD, THB and SGD.

Second, the market is quite likely to worry about the reverberations of this decision on the rest of Europe, with the risk that other countries may attempt to pursue a similar course of action. This could result in a tightening of financial conditions, retrenchment in the European banking sector, and a growth slowdown should concerns over a Euro breakup start to get priced back into the market. This would naturally spill over into global growth concerns.

Third, global monetary firepower to cope with another global economic downturn is relatively limited. Not only will this raise the odds of markets turning risk-negative, but it also allows for a more significant differentiation between those markets where we see scope for a monetary response and those where we do not. Economies where policy rates are still relatively elevated and there are no concerns about the currency reaction to easing are likely to see their currencies weaken. This is largely in the low-yielding Asia block, versus JPY and to some extent EUR".

-

08:45

France: Consumer confidence , June 97 (forecast 97)

-

08:34

Options levels on tuesday, June 28, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1319 (1893)

$1.1238 (2861)

$1.1171 (567)

Price at time of writing this review: $1.1064

Support levels (open interest**, contracts):

$1.0998 (6099)

$1.0965 (9794)

$1.0914 (9110)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 39555 contracts, with the maximum number of contracts with strike price $1,1500 (5263);

- Overall open interest on the PUT options with the expiration date July, 8 is 90621 contracts, with the maximum number of contracts with strike price $1,0900 (15121);

- The ratio of PUT/CALL was 2.29 versus 2.46 from the previous trading day according to data from June, 27

GBP/USD

Resistance levels (open interest**, contracts)

$1.3606 (310)

$1.3508 (842)

$1.3411 (91)

Price at time of writing this review: $1.3295

Support levels (open interest**, contracts):

$1.3179 (3051)

$1.3084 (413)

$1.2987 (2459)

Comments:

- Overall open interest on the CALL options with the expiration date July, 8 is 27367 contracts, with the maximum number of contracts with strike price $1,5000 (4020);

- Overall open interest on the PUT options with the expiration date July, 8 is 43942 contracts, with the maximum number of contracts with strike price $1,3500 (3709);

- The ratio of PUT/CALL was 1.61 versus 1.87 from the previous trading day according to data from June, 27

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:29

Expected positive start of trading on the major stock exchanges in Europe: DAX + 1,7%, FTSE 100 + 1,1%, CAC 40 + 1.6%

-

08:27

WSE: Before opening

Yesterday's session on Wall Street was another unsuccessful one. The S&P fell by almost 2% and closed below the support levels in the form of the April-May's lows.

Yesterday the rating agency Standard & Poor's downgraded the UK from their highest classification of "AAA" immediately by two notches to "AA -" indicating that the prospect here is also negative. In the follow of the S&P, the Fitch agency also downgraded on Monday the level of creditworthiness of the UK from the second highest level of "AA +" to "AA" and also with a negative outlook - which means that it is not excluded further degradation.

Today in the morning we see the strengthening of the pound, which may indicate that not so many people took the warning of agency seriously, probably because they were all aware of it since Friday. Contracts in the US also rebound and gaining approx. 1%. The prices of oil and copper are rising and the price of gold is declining. This may indicate improving the investment climate. Morning mood in Asia are balanced, although the increases do not exceed 1%.

Everything points to the fact that today's session should take place in a better mood than yesterday. It is worth to pay attention today to the shareholders' meetings of large state-owned companies: KGHM, Lotos, PGNiG and PGE. Particularly important will be the final approval of the dividends.

-

08:26

Asian session review: Gbp/Usd retreated from a 31-year low

Pound Sterling retreated from a 31-year low against the US dollar while the market remains concerned about the possible consequences of the UK decision to leave the European Union.

The pound touched its lowest level since mid-1985 - $ 1.3119, having fallen by 11.5% compared to the closing level on June 23.

Most economists agree that the referendum affected the economy of Britain, Europe, and possibly other countries. Some of them believe that the short-term damage can be limited, if the authorities in Britain and other countries will manage the consequences. Impact of Brexit is expected to increase due to the potential negative impact in the European economic and political landscape. "The focus right now is Europe, where Brexit can cause a domino effect among the States that wish to withdraw from the EU. The main problem for the foreign exchange market is the European political uncertainty, which could lead to monetary and credit paralysis." - Said Junichi Ishikawa, an analyst at IG Securities .

Yesterday, the pound dropped after failing to recover, despite assurances from the UK finance minister George Osborne that the fifth-largest economy in the world is able to cope with the upcoming challenges. He said that the government has a plan of action in emergency situations, which will help support the economy. However, he explained that it is not necessary to wait for the launch of new financial measures until the new prime minister will be elected, that is, until the autumn.

Today, the international rating agency Fitch downgraded the UK long-term credit rating in foreign and national currencies to "AA" from "AA +" with "negative" outlook on the background of the referendum held in the UK on 23 June.

"The uncertainty surrounding the referendum could lead to slower growth in UK GDP in the short term", - said the agency.

Fitch downgraded the outlook for GDP growth in the UK in 2016 to 1.6% from the previous value of 1.9% and to 0.9% in 2017 - 2018 from 2%.

The euro was also stable and is trading near yesterday's high against the backdrop of reviving risk appetite, which reflects the dynamics of futures on the DAX and FTSE. In addition, players take profits on short positions in anticipation of the start of the EU Economic Summit, where the main issue on the agenda may be Brexit. Accordingly, it can have a strong impact on the euro and pound.

Europe's economic calendar is empty today. The market is awaiting for US GDP data.

EUR / USD: during the Asian session, the pair was trading in the $ 1.1010-50 range.

GBP / USD: during the Asian session, the pair was trading in the $ 1.3215-85 range.

USD / JPY: during the Asian session, the pair was trading in range Y101.55-95 range.

-

08:13

Pound regains some strenght - Goldman Sachs

"The decision of the majority of the UK voters to Leave the EU changes in a fundamental way the outlook for Sterling and has economic implications which are sizable for the European economy, but less so for places like the US that are further away.

In this FX Views, we mark-to-market our forecast for the British Pound, where up until this point we had anticipated substantial appreciation against the Euro in coming years.

Our new forecast for EUR/GBP is 0.85, 0.82 and 0.78 in 3, 6 and 12 months (from 0.76, 0.74 and 0.70 before), reflecting a weaker outlook for Sterling over the coming year.

In the medium term, we think the Pound regains some strength, with EUR/GBP falling to 0.70 on a 24-month horizon (versus 0.65 in our previous forecasts) and then to 0.65 on a three-year horizon (unchanged from before). We are for now keeping our EUR/$ forecast unchanged, but as we argued in the run-up to the UK referendum, we believe the "leave" vote is a material negative shock to the Euro zone economy, which was struggling to reflate even before the recent turn of events. Our existing forecast of 1.12, 1.10 and 1.05 in 3, 6 and 12 months therefore has clear downside risk, once the near-term bid for the Euro as a result of risk aversion - for which there was clear evidence on Friday - abates. The risk is now that we reach our 24-month forecast of 0.95 and our 36-month forecast of 0.90 sooner, in particular if the doves on the ECB Governing Council shift once again to more proactive easing.

Our GBP/$ forecast, given our for now unchanged EUR/$ forecast, is therefore 1.32, 1.34 and 1.35 on a 3-, 6- and 12-month horizon, with our 24- and 36-month forecasts being 1.36 and 1.38, respectively".

-

08:05

German import prices up 0.9% in May

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 5.5% in May 2016 compared with the corresponding month of the preceding year. In April and in March 2016 the annual rates of change were -6.6% and -5.9%, respectively. From April to May 2016 the index rose by 0.9%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 3.5% compared with the level of a year earlier.

The index of export prices decreased by 1.6% in May 2016 compared with the corresponding month of the preceding year. In April and in March 2016 the annual rates of change were -2.0% and -1.6%, respectively. From April to May 2016 the index rose by 0.2%.

-

07:55

Chinese Premier Li Keqiangl: China's efforts to maintain stability in the financial market will benefit the world economy

- China will take the necessary measures to prevent sharp fluctuations in the financial market of the country.

- it is difficult to avoid short-term fluctuations in the market, but we should avoid gushing ups or sudden falls.

- as a result of Brexit volatility already occured in global financial markets.

- we must work together to prevent the spread of panic and to maintain stability in the global capital market.

-

07:52

Yield on 30-year JGB falls to record low - Reuters

The yield on 30-year Japanese government bonds struck a record low on Tuesday, as investors fretted over the fallout from Britain's vote to quit the European Union. The 30-year JGB yield fell 4.5 basis points to a record low 0.050 percent. Earlier on Tuesday, the 10-year JGB yield fell to a record low of minus 0.225 percent, and the 20-year JGB yield fell to a record low 0.040 percent.

-

07:22

Global Stocks

European stock markets suffered another rout territory as the historic Brexit referendum last week continued to cast a shadow over global financial markets.

Monday's loss followed a 7% slide on Friday, when the pan-European benchmark posted its worst session since October 2008-in the wake of the Lehman Brothers bankruptcy-after the U.K. voted to leave the European Union.

The U.K.'s FTSE 100 index UKX, -2.55% slid 2.6% to 5,982.20 on Monday, with the banks posting some of the biggest losses. Traders also continued to dump the pound GBPUSD, +0.5142% sending sterling down to a fresh 31-year low at $1.3121, from $1.3676 late Friday in New York. The currency had momentarily steadied Monday morning after U.K. finance minister George Osborne stressed the country is strong enough to deal with the coming challenges.

U.S. stocks posted a second sharp daily loss Monday as investors continued to dump assets perceived as risky in the wake of the U.K.'s vote last week to leave the European Union.

The S&P 500 SPX, -1.81% closed 36.87 points lower, a loss of 1.8%, at 2,000.55, with eight of its 10 sectors in negative territory. The index trimmed its decline from an earlier 46-point deficit and narrowly avoided closing below 2,000. The last time the index closed below 2,000 was March 10.

The Dow Jones Industrial Average DJIA, -1.50% dropped 260.51 points, or 1.5%, to close at 17,140.24, led by a 4% loss in shares of American Express Co. AXP, -3.98% Earlier, the average was off by as many as 337 points.

Meanwhile, the Nasdaq Composite COMP, -2.41% lost 113.54 points, or 2.4%, to close at 4,594.44, following an earlier 134-point deficit.

June 28 Japanese stocks weakened in volatile trade on Tuesday morning, with automakers leading the declines on growing worries about the global economic fallout from Britain's vote to leave the European Union.

Japanese automakers underperformed, with the transport equipment sector falling 2.6 percent, the third worst performer on the board.

Toyota Motor Corp dropped 3.2 percent and Honda Motor Co shed 1.5 percent, while Mazda Motor Corp tumbled 4.7 percent.

-

04:01

Nikkei 225 15,289.8 -19.41 -0.13 %, Hang Seng 19,990.52 -236.78 -1.17 %, Shanghai Composite 2,885.01 -10.69 -0.37 %

-

00:34

Commodities. Daily history for Jun 27’2016:

(raw materials / closing price /% change)

Oil 46.61 +0.60%

Gold 1,327.60 +0.22%

-

00:32

Stocks. Daily history for Jun 27’2016:

(index / closing price / change items /% change)

Nikkei 225 15,309.21+357.19+2.39%

Hang Seng 20,227.3-31.83-0.16%

S&P/ASX 200 5,137.23+24.05+0.47%

Shanghai Composite 2,895.52+41.24+1.44%

Topix 1,225.76+21.28+1.77%

FTSE 100 5,982.2 -156.49 -2.55 %

CAC 40 3,984.72 -122.01 -2.97 %

Xetra DAX 9,268.66 -288.50 -3.02 %

S&P 500 2,000.54 -36.87 -1.81 %

NASDAQ Composite 4,594.44 -113.54 -2.41 %

Dow Jones 17,140.24 -260.51 -1.50 %

-

00:31

Currencies. Daily history for Jun 27’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1018 -0,83%

GBP/USD $1,3226 -3,42%

USD/CHF Chf0,9775 +0,48%

USD/JPY Y101,91 -0,29%

EUR/JPY Y112,28 -1,18%

GBP/JPY Y134,75 -3,63%

AUD/USD $0,7338 -1,79%

NZD/USD $0,6995 -1,92%

USD/CAD C$1,3079 +0,58%

-

00:03

Schedule for today, Tuesday, Jun 28’2016:

(time / country / index / period / previous value / forecast)

06:45 France Consumer confidence June 98 97

12:30 U.S. PCE price index ex food, energy, q/q (Finally) Quarter I 1.3% 2.1%

12:30 U.S. GDP, q/q (Finally) Quarter I 1.4% 1%

13:00 U.S. S&P/Case-Shiller Home Price Indices, y/y April 5.4% 5.5%

14:00 U.S. Richmond Fed Manufacturing Index June -1 2

14:00 U.S. Consumer confidence June 92.6 93.7

23:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Retail sales, y/y May -0.8% -1.6%

-