Noticias del mercado

-

22:27

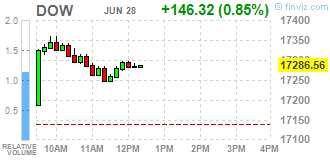

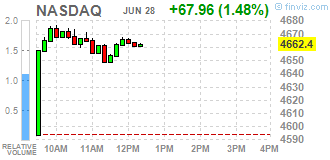

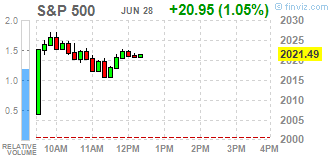

U.S. stocks rose

U.S. stocks rose for the first time since Britain voted to leave the European Union, with the S&P 500 Index surging the most in nearly four months, amid optimism that policy makers are committed to limit the fallout from the U.K.'s exit.

Tuesday's turnaround gathered pace late in the day, with the Dow Jones Industrial Average adding more than 260 points. Banks had the strongest rally in six weeks, after their worst two sessions in almost five years. Facebook Inc., Apple Inc. and Microsoft Corp rose at least 1.6 percent to boost the technology group, while energy producers climbed the most in 2 1/2 months as crude prices jumped.

The U.K.'s decision last week triggered a rush toward safe havens as global equities lost about $3.6 trillion in market value and the S&P 500 tumbled 5.3 percent to erase its 2016 advance. The CBOE Volatility Index tumbled for a second day, though the measure of market turbulence known as the VIX is still on the way to its biggest monthly climb since a record jump last August.

European Central Bank President Mario Draghi added to speculation of a more coordinated effort by policy makers to mitigate the Brexit repercussions, calling for global policy alignment in a speech at the ECB Forum in Sintra, Portugal. Draghi said there is a "common responsibility" to address the world's economic weaknesses. U.K. Prime Minister David Cameron will face EU leaders at a dinner in Brussels on Tuesday, after both the Bank of England and European Central Bank pledged to increase liquidity.

EU leaders are gathering for a two-day European Council summit to discuss Britain's exit. Germany, France and Italy prodded the U.K. government to start the process, saying they want to move forward and limit market risks. Britain's Chancellor of the Exchequer George Osborne sought to reassure investors on Monday, saying that contingency plans were in place to shore up the economy amid ongoing volatility, but that Brexit won't be "plain sailing" -- something that Cameron reiterated in Parliament.

Aside from the Brexit drama, a report today showed the U.S. economy expanded more than previously projected in the first quarter as improved performance in trade and business investment more than made up for weaker consumer spending. Separate data showed consumer confidence rose to the highest since October as Americans became somewhat more optimistic about the economy.

-

21:01

DJIA 17374.39 234.15 1.37%, NASDAQ 4687.54 93.10 2.03%, S&P 500 2032.68 32.14 1.61%

-

18:27

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Tuesday as investors rushed to pick up stocks after Britain's decision to leave the European Union sparked a massive two-day selloff in global markets. Banks, which were the worst hit since the referendum on Thursday, were among the most attractive stocks for bargain hunters. A rebound in oil prices on Tuesday signaled an appetite for riskier assets, while gold retreated.

Almost all Dow stocks in positive area (27 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -2,95%). Top gainer - The Travelers Companies, Inc. (TRV, +2,32%).

All S&P sectors in positive area. Top gainer - Basic Materials (+1,9%).

At the moment:

Dow 17187.00 +202.00 +1.19%

S&P 500 2012.25 +27.25 +1.37%

Nasdaq 100 4249.50 +71.50 +1.71%

Oil 47.18 +0.85 +1.83%

Gold 1317.70 -7.00 -0.53%

U.S. 10yr 1.46 +0.00

-

18:00

European stocks closed: FTSE 6140.39 158.19 2.64%, DAX 9447.28 178.62 1.93%, CAC 4088.85 104.13 2.61%

-

17:41

WSE: Session Results

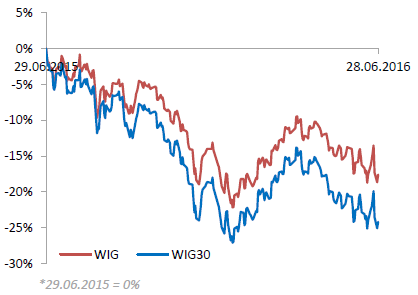

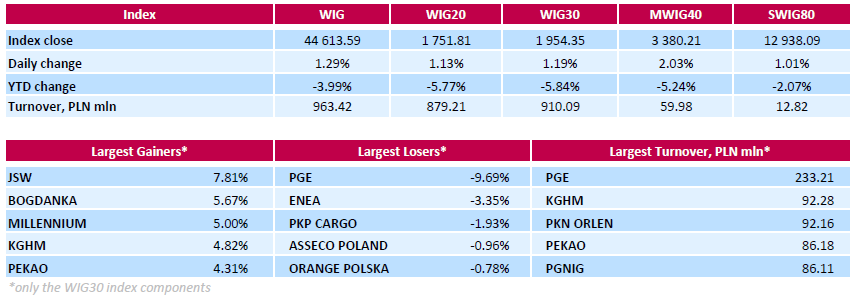

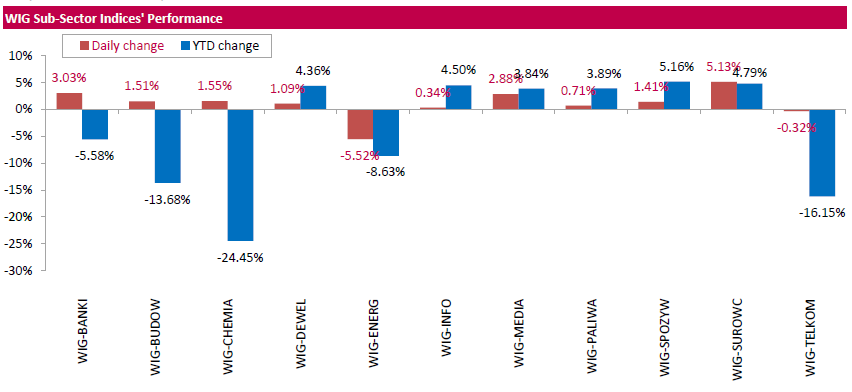

Polish equity market advanced on Tuesday. The broad market measure, the WIG Index, surged by 1.29%. Except for utilities (-5.52%) and telecoms (-0.32%), every sector in the WIG Index advanced, with materials (+5.13%) outperforming.

The large-cap stocks' measure, the WIG30 Index, added 1.19%. A majority of the index components returned gains, with the way up led by two coal miners JSW (WSE: JSW) and BOGDANKA (WSE: LWB), which climbed by 7.81% and 5.67% respectively. They were followed by copper producer KGHM (WSE: KGH), FMCG-wholesaler EUROCASH (WSE: EUR) and two banks PEKAO (WSE: PEO) and MILLENNIUM (WSE: MIL), which gained between 4.14% and 5%. At the same time, the decliners's list was topped by genco PGE (WSE: PGE), which tumbled by 9.69% as the company's shareholders approved the state treasury's late motion to cut the 2015 dividend payout to PLN 0.25 versus PLN 0.92 management recommendation.

-

15:49

WSE: After start on Wall Street

The highlight of this afternoon on the Warsaw market was the decision of the shareholders of PGE (at the request of the Treasury) to distribute a dividend of only PLN 0.25 per share compared to previously proposed amount of PLN 0,92 per share. The scale of sales at PGE after the voting exceeded expectations. This can be seen not only by breaking through the course of the lower collars, but also by the turnover, which has already exceeded PLN 115 mln. The course itself goes below the minimum of Friday's massacre, which turns out that a dividend cut is a bigger problem than Brexit.

The American market began with increases of about 1%, which helps our WIG20 index to some recovery.

-

15:32

U.S. Stocks open: Dow +0.81%, Nasdaq +1.19%, S&P +0.88%

-

15:16

Before the bell: S&P futures +1.27%, NASDAQ futures +1.29%

U.S. stock-index futures climbed as optimism grew that policy makers will move to support financial markets.

Global Stocks:

Nikkei 15,323.14 +13.93 +0.09%

Hang Seng 20,172.46 -54.84 -0.27%

Shanghai Composite 2,912.76 +17.06 +0.59%

FTSE 6,161.22 +179.02 +2.99%

CAC 4,115.11 +130.39 +3.27%

DAX 9,547.88 +279.22 +3.01%

Crude $47.65 (+2.85%)

Gold $1317.00 (-0.58%)

-

14:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

168.52

1.33(0.7955%)

1651

ALCOA INC.

AA

9.38

0.28(3.0769%)

55634

ALTRIA GROUP INC.

MO

68.16

0.23(0.3386%)

5264

Amazon.com Inc., NASDAQ

AMZN

700.2

8.84(1.2786%)

57355

American Express Co

AXP

58.47

0.80(1.3872%)

2724

AMERICAN INTERNATIONAL GROUP

AIG

49.94

1.15(2.357%)

3631

Apple Inc.

AAPL

93.25

1.21(1.3146%)

251306

AT&T Inc

T

42.29

0.26(0.6186%)

32355

Barrick Gold Corporation, NYSE

ABX

20.54

-0.57(-2.7001%)

208593

Boeing Co

BA

124.9

2.20(1.793%)

4602

Caterpillar Inc

CAT

72.71

1.33(1.8633%)

4972

Chevron Corp

CVX

101.4

1.04(1.0363%)

4970

Cisco Systems Inc

CSCO

27.66

0.35(1.2816%)

29941

Citigroup Inc., NYSE

C

39.69

1.21(3.1445%)

196229

E. I. du Pont de Nemours and Co

DD

64.3

0.22(0.3433%)

1934

Exxon Mobil Corp

XOM

90

1.14(1.2829%)

5763

Facebook, Inc.

FB

110.5

1.53(1.4041%)

328284

Ford Motor Co.

F

12.45

0.29(2.3849%)

95438

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.67

0.54(5.3307%)

496062

General Electric Co

GE

29.64

0.32(1.0914%)

57656

General Motors Company, NYSE

GM

27.89

0.38(1.3813%)

22954

Goldman Sachs

GS

142.49

2.98(2.1361%)

21432

Google Inc.

GOOG

677.8

9.54(1.4276%)

13041

Hewlett-Packard Co.

HPQ

11.7

0.15(1.2987%)

380

Home Depot Inc

HD

126

1.33(1.0668%)

5424

HONEYWELL INTERNATIONAL INC.

HON

113.38

1.92(1.7226%)

700

Intel Corp

INTC

31.03

0.31(1.0091%)

10332

International Business Machines Co...

IBM

145.2

1.70(1.1847%)

7092

Johnson & Johnson

JNJ

117.1

0.55(0.4719%)

10467

JPMorgan Chase and Co

JPM

58.9

1.29(2.2392%)

85262

McDonald's Corp

MCD

117

0.70(0.6019%)

4210

Merck & Co Inc

MRK

56.01

0.70(1.2656%)

604

Microsoft Corp

MSFT

48.95

0.52(1.0737%)

84744

Nike

NKE

52.45

0.56(1.0792%)

19196

Pfizer Inc

PFE

34.18

0.38(1.1243%)

16399

Procter & Gamble Co

PG

81.6

0.37(0.4555%)

1536

Starbucks Corporation, NASDAQ

SBUX

54.32

0.63(1.1734%)

5184

Tesla Motors, Inc., NASDAQ

TSLA

201.4

2.85(1.4354%)

62106

The Coca-Cola Co

KO

43.99

0.21(0.4797%)

6161

Twitter, Inc., NYSE

TWTR

16.2

0.36(2.2727%)

128586

United Technologies Corp

UTX

98.7

1.49(1.5328%)

200

UnitedHealth Group Inc

UNH

138.19

1.08(0.7877%)

826

Verizon Communications Inc

VZ

55.15

0.41(0.749%)

1953

Visa

V

75

1.66(2.2634%)

11559

Wal-Mart Stores Inc

WMT

71.9

0.40(0.5594%)

2320

Walt Disney Co

DIS

95.62

1.24(1.3138%)

8216

Yahoo! Inc., NASDAQ

YHOO

35.8

0.58(1.6468%)

4621

-

14:51

Upgrades and downgrades before the market open

Upgrades:

Travelers (TRV) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:Tesla Motors (TSLA) downgraded to Hold from Buy at Argus

DuPont (DD) downgraded to Neutral from Overweight at JP Morgan

Other:

-

13:17

WSE: Mid session comment

After yesterday's, rather weak session, today comes a rebound in stock prices of banks and commodity companies in line with increases of the prices of oil and copper.

Goldman Sachs after taking into account the different macroeconomic of Brexit scenarios lowered the valuation of banks in the CEE region. In the case of our largest banks they were reduced valuations by 15 percent of PKO BP to PLN 23, 10 percent of Pekao to PLN 117 and 15 percent of BZ WBK to PLN 195.

Noteworthy is the relatively good behavior of the British market, which returned higher than minima from April and May. This may be due to the reluctance of British politicians to activate Article 50 of the EU Treaty, which officially starts the procedure of exit from the Union. There is also information about the fund for Italian banks, which could stabilize the precarious situation of the local financial institutions. Italian stock market gains over 4%.

At the halfway point of the session the WIG20 index was at the level of 1,760 points (+1,62%) and with quite satisfactory turnover of over PLN 270 mln.

-

12:57

Major stock indices in Europe on the rise

European stocks rise again after the largest two-day drop since 2008, as investors believe that politicians can take action to support the markets after Brexit.

Today in Brussels starts a two-day summit of EU leaders, during which they discuss Britain's decision to leave the Union. British Prime Minister David Cameron will only take part at the first day of the summit.

Investors will also keep an eye on the comments of Fed Yellen. At present, the markets expects with greater confidence that in the foreseeable future, the Fed will not raise rates. In addition, futures on interest rates point to 18 percent chance of lowering rates at the September and November meetings. Up to the British referendum there were zero chance of lowering rates and 52% chance of a rate hike at the September meeting.

According to Goldman Sachs estimates, the eurozone GDP will grow in the next to years by an average of 1.25 percent against the 1.5 percent expected before the vote. As for the US economy, Goldman Sachs is now expecting that GDP growth in the second half of 2016 will amount to 2 percent compared with the previous forecast of 2.25 percent.

Meanwhile, J.P. Morgan experts warn that Britain's exit from the EU will encourage the ECB to ease monetary policy more than expected. According to the analysts, in September, the ECB will implement additional easing by lowering interest rates on deposits by 0.10% and the extension of QE program until 2018.

The composite index of the largest companies in the region Stoxx Europe 600 grew 2.4%.

Italian banks, including Mediobanca SpA, show the greatest increase among the euro area creditors after the vice-president for European Policy Valdis Dombrovskis said that the European Commission is in contact with the Italian authorities on possible support measures after the recent sales. Shares of Greek and Spanish banks also becoming more expensive.

G4S Plc cost jumped by 8.7 percent, reaching the highest level since October 2011, after analysts at Credit Suisse Group AG raised the stock rating to "buy" from "neutral," citing the benefits of a weaker pound and the stability of their business.

Redrow Plc shares rose 2.9 percent. The company said that the amount of the annual profit may exceed analysts' forecasts.

Ocado Group Plc shares rose 8.6 percent as analysts Goldman Sachs Group Inc recommended buying the shares after the retailer reported a further increase in sales.

At the moment:

FTSE 100 6,128.96 +146.76 + 2.45%

CAC 40 4,091.45 +106.73 + 2.68%

DAX 9,474.31 +205.65 + 2.22%

-

12:39

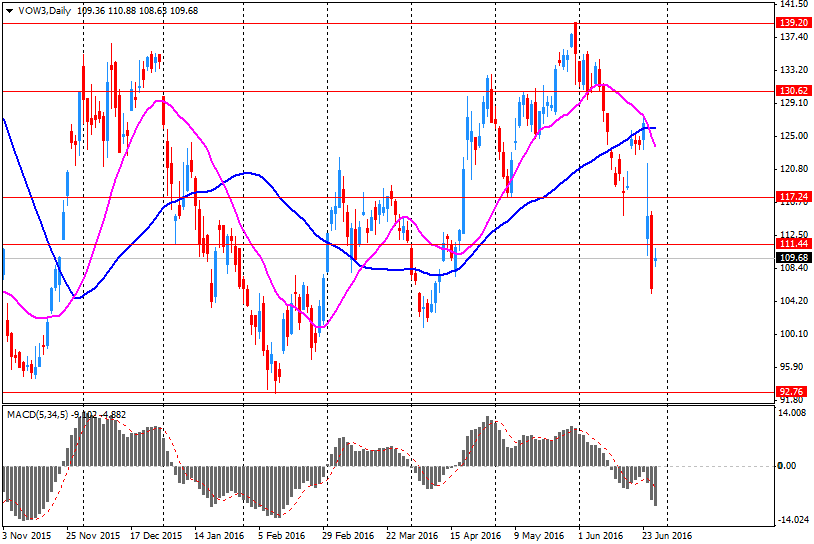

Company News: Volkswagen AG (VOW3) will pay about $ 15 billion on diesel lawsuits in the United States

As reported by Bloomberg, Volkswagen's expenses for the settlement of "diesel scandal" in the US will reach $ 15 billion, -. $ 5 billion more than previously reported.

Under the deal, VW will spend about $ 10.03 billion, as well as compensation to each buyer of the car in the amount of $ 10K. This amount may increase.

Another $ 2.7 billion fines should be directed to the US Environmental Protection Agency and the California Air Resources Board. In addition, the company will invest $ 2 billion in emission control technology.

Shares VOW3 rose to 109.35 Euro (+ 3.06%).

-

09:55

Positive start of trading: DAX 9,463.61 + 194.95 + 2.10%, FTSE 100 6,107.35 + 125.15 + 2.09%, CAC 40 4,075.12 + 90.40 + 2.27%.

-

09:22

WSE: After opening

WIG20 index opened at 1753.04 points (+1.20%)*

WIG 44507.90 1.05%

WIG30 1956.39 1.30%

mWIG40 3322.79 0.30%

*/ - change to previous close

The cash market (the WIG20) opened with increase by 1.2% to 1,753 points with the same as yesterday modest turnover.

Investors expect that markets will now slowly stabilizing, but "the dust after Brexit" will not settle so quickly. There will be running down another negative forecasts regarding the condition of the British and world economy in 2017. These forecasts will not be comforting and most of them are already included in the prices of various assets, but will still keep a short-term rotten mood on the stock markets.

The good news is that the market was not weak enough to permanently appoint a new bottom. The contract on the WIG20 remains in the area of 1715-1775 points and exceeding of these levels will appoint another short-term price movement.

-

08:29

Expected positive start of trading on the major stock exchanges in Europe: DAX + 1,7%, FTSE 100 + 1,1%, CAC 40 + 1.6%

-

08:27

WSE: Before opening

Yesterday's session on Wall Street was another unsuccessful one. The S&P fell by almost 2% and closed below the support levels in the form of the April-May's lows.

Yesterday the rating agency Standard & Poor's downgraded the UK from their highest classification of "AAA" immediately by two notches to "AA -" indicating that the prospect here is also negative. In the follow of the S&P, the Fitch agency also downgraded on Monday the level of creditworthiness of the UK from the second highest level of "AA +" to "AA" and also with a negative outlook - which means that it is not excluded further degradation.

Today in the morning we see the strengthening of the pound, which may indicate that not so many people took the warning of agency seriously, probably because they were all aware of it since Friday. Contracts in the US also rebound and gaining approx. 1%. The prices of oil and copper are rising and the price of gold is declining. This may indicate improving the investment climate. Morning mood in Asia are balanced, although the increases do not exceed 1%.

Everything points to the fact that today's session should take place in a better mood than yesterday. It is worth to pay attention today to the shareholders' meetings of large state-owned companies: KGHM, Lotos, PGNiG and PGE. Particularly important will be the final approval of the dividends.

-

07:22

Global Stocks

European stock markets suffered another rout territory as the historic Brexit referendum last week continued to cast a shadow over global financial markets.

Monday's loss followed a 7% slide on Friday, when the pan-European benchmark posted its worst session since October 2008-in the wake of the Lehman Brothers bankruptcy-after the U.K. voted to leave the European Union.

The U.K.'s FTSE 100 index UKX, -2.55% slid 2.6% to 5,982.20 on Monday, with the banks posting some of the biggest losses. Traders also continued to dump the pound GBPUSD, +0.5142% sending sterling down to a fresh 31-year low at $1.3121, from $1.3676 late Friday in New York. The currency had momentarily steadied Monday morning after U.K. finance minister George Osborne stressed the country is strong enough to deal with the coming challenges.

U.S. stocks posted a second sharp daily loss Monday as investors continued to dump assets perceived as risky in the wake of the U.K.'s vote last week to leave the European Union.

The S&P 500 SPX, -1.81% closed 36.87 points lower, a loss of 1.8%, at 2,000.55, with eight of its 10 sectors in negative territory. The index trimmed its decline from an earlier 46-point deficit and narrowly avoided closing below 2,000. The last time the index closed below 2,000 was March 10.

The Dow Jones Industrial Average DJIA, -1.50% dropped 260.51 points, or 1.5%, to close at 17,140.24, led by a 4% loss in shares of American Express Co. AXP, -3.98% Earlier, the average was off by as many as 337 points.

Meanwhile, the Nasdaq Composite COMP, -2.41% lost 113.54 points, or 2.4%, to close at 4,594.44, following an earlier 134-point deficit.

June 28 Japanese stocks weakened in volatile trade on Tuesday morning, with automakers leading the declines on growing worries about the global economic fallout from Britain's vote to leave the European Union.

Japanese automakers underperformed, with the transport equipment sector falling 2.6 percent, the third worst performer on the board.

Toyota Motor Corp dropped 3.2 percent and Honda Motor Co shed 1.5 percent, while Mazda Motor Corp tumbled 4.7 percent.

-

04:01

Nikkei 225 15,289.8 -19.41 -0.13 %, Hang Seng 19,990.52 -236.78 -1.17 %, Shanghai Composite 2,885.01 -10.69 -0.37 %

-

00:32

Stocks. Daily history for Jun 27’2016:

(index / closing price / change items /% change)

Nikkei 225 15,309.21+357.19+2.39%

Hang Seng 20,227.3-31.83-0.16%

S&P/ASX 200 5,137.23+24.05+0.47%

Shanghai Composite 2,895.52+41.24+1.44%

Topix 1,225.76+21.28+1.77%

FTSE 100 5,982.2 -156.49 -2.55 %

CAC 40 3,984.72 -122.01 -2.97 %

Xetra DAX 9,268.66 -288.50 -3.02 %

S&P 500 2,000.54 -36.87 -1.81 %

NASDAQ Composite 4,594.44 -113.54 -2.41 %

Dow Jones 17,140.24 -260.51 -1.50 %

-