Noticias del mercado

-

22:08

U.S. stocks fell

U.S. stocks continued a rout sparked by Britain's shock vote to leave the European Union, with the Dow Jones Industrial Average falling more than 250 points after equities on Friday tumbled the most in 10 months.

Banks remained the focal point in the downdraft, with no sign of the pummeling letting up as lenders marked the worst two-day drop in almost five years. Raw-material and industrial shares also posted the steepest back-to-back slide since 2011. Sentiment was dealt another blow after S&P Global Ratings today cut the U.K.'s top credit grade by two levels.

"Today seems to be a repeat of Friday," said Ben Rozin, senior analyst and portfolio manager at Manning & Napier Advisors, which manages $37.3 billion. "We came into this year with first-quarter earnings being weak, and we were just beginning to see signs that the second quarter would be better. A big shock isn't good for confidence or investments. There's a lot of uncertainty and people weren't positioned for the vote ahead of time."

Risk assets have been under pressure since Britons voted to secede from the EU, raising concerns that an already-fragile global economic recovery will falter as trade snarls in one of the world's biggest consumer blocs. Friday's losses reversed a weekly advance in the S&P 500 and pushed the CBOE Volatility Index up 49 percent. The measure of market turmoil known as the VIX fell Monday, even as stocks continued to drop.

The U.K.'s Brexit vote left investors around the world scurrying toward safe havens for a second session after the S&P 500 on Friday fell 3.6 percent to erase its advance for the year. Investors are watching for policy action by central banks worldwide to ease the turmoil and pump liquidity into financial markets. European equities continued to bear the brunt of the selling, with the Stoxx Europe 600 Index losing 4.1 percent to its lowest since February.

-

21:00

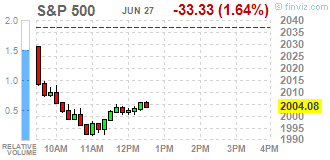

DJIA 17093.98 -306.77 -1.76%, NASDAQ 4581.54 -126.43 -2.69%, S&P 500 1995.63 -41.78 -2.05%

-

18:35

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Wall Street on Monday as aftershocks from Britain's vote to leave the European Union roiled global markets for a second day.

Almost all Dow stocks in negative area (28 of 30). Top looser - American Express Company (AXP, -4,00%). Top gainer - Johnson & Johnson (JNJ, +0,55%).

Almost all S&P sectors in negative area. Top gainer - Financial (-3,1%). Top gainer - Utilities (+0,4%).

At the moment:

Dow 17062.00 -185.00 -1.07%

S&P 500 1994.25 -24.25 -1.20%

Nasdaq 100 4196.00 -66.25 -1.55%

Oil 46.24 -1.40 -2.94%

Gold 1324.50 +2.10 +0.16%

U.S. 10yr 1.46 -0.12

-

18:02

European stocks closed: FTSE 5982.20 -156.49 -2.55%, DAX 9268.66 -288.50 -3.02%, CAC 4030.28 -76.45 -1.86%

-

17:49

WSE: Session Results

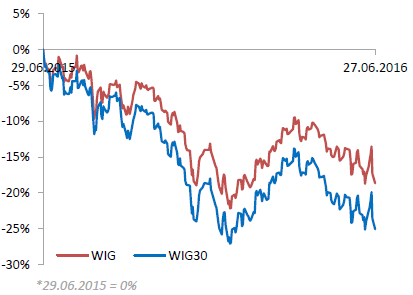

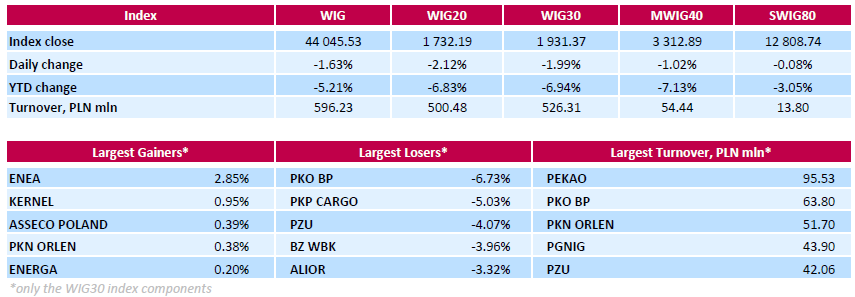

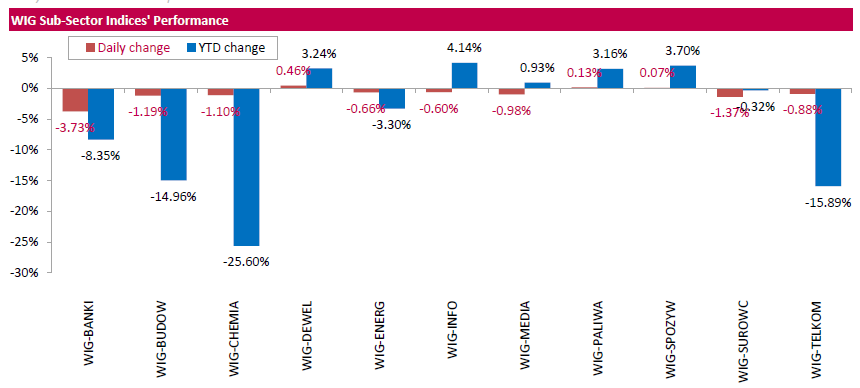

Polish equity market continued to decline on Monday. The broad market measure, the WIG index, lost 1.63%. From a sector perspective, banking sector (-3.73%) fared the worst, while developing sector (+0.46%) was the best-performing group.

The large-cap stocks' measure, the WIG30 Index, fell by 1.99%. Within the WIG30 Index components, bank PKO BP (WSE: PKO) recorded the biggest decline, slumping 6.73%. It was followed by railway freight transport operator PKP CARGO (WSE: PKP), insurer PZU (WSE: PZU) and two banks BZ WBK (WSE: BZW) and ALIOR (WSE: ALR), dropping between 3.32% and 5.03%. On the other side of the ledger, genco ENEA (WSE: ENA) led a handful of advancers with a 2.85% gain, followed by agricultural producer KERNEL (WSE: KER), climbing by 0.95%.

-

15:58

WSE: After start on Wall Street

The session on Wall Street began with the discount, which is not a special surprise in the face of falling from this morning contracts. We are concerned, however, about the scale of declines, which already exceeding 1%. So, the trade of the main indices begins below the important supports, which are the May lows. Their loss opens the door to the development of the profits taking from this year's approach, which of course Euroland done a long time ago. The American market remains surprisingly weak in the face of Brexit, especially in the context of the previously presented fairly resistant and irreverent attitude towards the possibility of the UK exit from the EU. It does not help Europe, and the Warsaw parquet comes back around session lows.

-

15:34

U.S. Stocks open: Dow -1.11%, Nasdaq -1.10%, S&P -1.06%

-

15:28

Before the bell: S&P futures -0.62%, NASDAQ futures -0.77%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 15,309.21 +357.19 +2.39%

Hang Seng 20,227.3 -31.83 -0.16%

Shanghai Composite 2,895.52 +41.24 +1.44%

FTSE 6,013.01 -125.68 -2.05%

CAC 4,014.13 -92.60 -2.25%

DAX 9,361.9 -195.26 -2.04%

Crude $46.77 (-1.83%)

Gold $1333.30 (+0.82%)

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.27

-0.11(-1.1727%)

50479

ALTRIA GROUP INC.

MO

66.58

-0.44(-0.6565%)

3955

Amazon.com Inc., NASDAQ

AMZN

691.77

-7.19(-1.0287%)

76756

American Express Co

AXP

59.09

-0.97(-1.6151%)

320

AMERICAN INTERNATIONAL GROUP

AIG

49.65

-1.07(-2.1096%)

7936

Apple Inc.

AAPL

93.1

-0.30(-0.3212%)

204430

AT&T Inc

T

41.35

-0.17(-0.4094%)

32405

Barrick Gold Corporation, NYSE

ABX

21.03

0.56(2.7357%)

184034

Boeing Co

BA

125.77

-0.75(-0.5928%)

2814

Caterpillar Inc

CAT

71.9

-1.13(-1.5473%)

6215

Chevron Corp

CVX

100.97

-0.93(-0.9127%)

8805

Cisco Systems Inc

CSCO

27.55

-0.20(-0.7207%)

26094

Citigroup Inc., NYSE

C

39.58

-0.72(-1.7866%)

346866

Deere & Company, NYSE

DE

81.25

-0.47(-0.5751%)

2131

E. I. du Pont de Nemours and Co

DD

65

-1.00(-1.5152%)

250

Exxon Mobil Corp

XOM

88.75

-0.64(-0.716%)

5841

Facebook, Inc.

FB

111.31

-0.77(-0.687%)

137802

FedEx Corporation, NYSE

FDX

147.51

-3.06(-2.0323%)

1288

Ford Motor Co.

F

12.41

-0.11(-0.8786%)

131420

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.44

-0.14(-1.3233%)

113421

General Electric Co

GE

29.57

-0.25(-0.8384%)

23129

General Motors Company, NYSE

GM

28.11

-0.24(-0.8466%)

17120

Goldman Sachs

GS

140.29

-1.57(-1.1067%)

56795

Google Inc.

GOOG

671.45

-3.77(-0.5583%)

8054

Hewlett-Packard Co.

HPQ

12.2

-0.06(-0.4894%)

200

Home Depot Inc

HD

125.31

-1.09(-0.8623%)

5504

HONEYWELL INTERNATIONAL INC.

HON

111.48

-1.50(-1.3277%)

610

Intel Corp

INTC

31.33

-0.22(-0.6973%)

33737

International Business Machines Co...

IBM

145.55

-1.04(-0.7095%)

3925

International Paper Company

IP

41.13

-0.24(-0.5801%)

2797

Johnson & Johnson

JNJ

114.72

-0.91(-0.787%)

3620

JPMorgan Chase and Co

JPM

58.65

-0.95(-1.594%)

150996

McDonald's Corp

MCD

118.5

-0.94(-0.787%)

4133

Merck & Co Inc

MRK

55.38

-0.50(-0.8948%)

872

Microsoft Corp

MSFT

49.25

-0.58(-1.164%)

95851

Nike

NKE

52.26

-0.33(-0.6275%)

14643

Pfizer Inc

PFE

33.7

-0.27(-0.7948%)

4873

Procter & Gamble Co

PG

81.89

-0.37(-0.4498%)

4192

Starbucks Corporation, NASDAQ

SBUX

54

-0.68(-1.2436%)

13467

Tesla Motors, Inc., NASDAQ

TSLA

190.25

-2.90(-1.5014%)

42536

The Coca-Cola Co

KO

43.75

-0.18(-0.4097%)

2277

Travelers Companies Inc

TRV

109.6

-1.42(-1.2791%)

365

Twitter, Inc., NYSE

TWTR

16.32

-0.12(-0.7299%)

95455

United Technologies Corp

UTX

98

-0.89(-0.90%)

931

UnitedHealth Group Inc

UNH

135.85

-1.44(-1.0489%)

1876

Verizon Communications Inc

VZ

54.25

-0.18(-0.3307%)

6605

Visa

V

74.1

-0.95(-1.2658%)

3939

Wal-Mart Stores Inc

WMT

71.47

-0.49(-0.6809%)

1638

Walt Disney Co

DIS

94.86

-0.86(-0.8985%)

11791

Yahoo! Inc., NASDAQ

YHOO

35.92

-0.32(-0.883%)

20650

Yandex N.V., NASDAQ

YNDX

21.1

-0.29(-1.3558%)

8700

-

14:43

Upgrades and downgrades before the market open

Upgrades:

Barrick Gold (ABX) upgraded to Sector Outperform from Sector Perform at CIBC

Downgrades:Other:

Barrick Gold (ABX) added to Conviction Buy List at Goldman

-

13:11

WSE: Mid session comment

Poor sentiment in Europe means that European indexes are trading at minima, losing approx. 2% in Frankfurt and Paris. The main declining sectors are banks whose index is near the lows from the end of the last week and clearly below support at minima of February and early April. Paradoxically, the relatively well copes London.

On the Warsaw market bulls managed so far to halt the downward above support at 1,720 points. However, the style of correction may suggest that this is not the last word of the supply side and the market could include the next wave, which will reduce the WIG20 towards support at 1,720 points. Also, the attitude of the other markets where Friday's approach is clearly tested, may encourage such a scenario.

-

09:55

Major stock exchanges trading mixed: DAX 9,564.68 + 7.52 + 0.08%, FTSE 100 6,109.26-228.84-3.61%, CAC 40 4,104.83-1.90-0.05%

-

09:19

WSE: After opening

The futures market started the new week from decrease of 0.17% to 1,756 points, means in the area close to Friday's end. So we start a little more interesting period, when the dust settles and we may look at the situation calmly.

WIG20 index opened at 1759.88 points (-0.55%)*

WIG 44662.18 -0.25%

WIG30 1962.15 -0.43%

mWIG40 3356.62 0.28%

*/ - change to previous close

The cash market opens from a decrease of 0.58% to 1,759 points at relatively modest turnover. The German DAX lost on a similar scale, what after the huge volatility on Friday may be called a quiet and relatively neutral opening.

Usually after such sessions of a solstice (low beginning, growth and above-average rotation) market likes to test later the credibility of return, which will may happen on the market today.

-

08:45

Expected negative start for the major stock exchanges in Europe: DAX -0,6%, FTSE 100 -2,2%, CAC 40 -1.5%

-

08:30

WSE: Before opening

Friday's session on Wall Street was one of the worst sessions since 2011. All indexes lost and almost the entire 3-month hardship of climb indices in the vicinity of 2,100 points on the S&P500 was offset by one session. It turned out that Thursday's breakout above this level was false, which usually is a sign of trouble. Declines on US stock exchanges were led by the banking sector - the same that for the last 3 sessions was the strongest one. It is worth to note almost 10% plunge in Citigroup. Heavily lost also companies from the biotechnology and transport sectors. There was no positive impact on the stock prices from weak data on orders for durable goods. In May, they declined by 2.2%. There was no help also from consumer confidence index which finally fell to 93.5 points. The main reason was to look on the other side of the ocean - in the UK. The strong rise in prices of US bonds, gold (+ 4.99%), and the yen shows that investors are beginning to buy so-called "safe" instruments. Ultimately, the S&P500 lost 3.59% and the technological Nasdaq fell by 4.13%.

In Asia the Nikkei and Shanghai indices reflect, what should gently support Europe, but we must remember that the Old Continent together with the Warsaw Stock Exchange on Friday quite clearly caught his breath after the first shock. In the morning, it seems that political uncertainty will be at the most hit in Britain and other markets should be quieter and the same opening may be close to neutral. A positive factor may be the result of Sunday's elections in Spain, where the ruling conservatives have increased their participation in Parliament, however, it still looks like it will be hard to build a coalition there.

Today's macro calendar is virtually empty, and from this site we should not expect an impulse to trade.

-

07:09

Global Stocks

European stocks posted their worst daily drop in nearly eight years Friday, after investors dumped risk assets following the U.K.'s historic referendum that left the country on course to leave the European Union.

The Stoxx Europe 600 SXXP, -7.03% tumbled 7% to 321.98, marking its worst session since October 2008 in fallout of Lehman Brothers bankruptcy, according to FactSet data. The stock gauge had been on pace for its largest daily drop since October 1987, but pared losses.

In London, the FTSE 100 UKX, -3.15% slid 3.2% to 6,138.69, bouncing back from steeper early losses.

U.S. stocks plunged Friday, posting largest drops in 10 months after U.K. citizens voted to end the country's membership in the European Union. The main indexes ended with weekly losses for a third straight week.

The S&P 500 SPX, -3.59% plummeted 75.92 points, or 3.6%, to 2,037.40, its largest one-day percentage decline since Aug 24, 2015. For the week, the benchmark index lost 1.6%, the largest one-week drop since February.

The Dow Jones Industrial Average DJIA, -3.39% suffered its largest one-day drop in 10 months, plunging 611.21 points, or 3.4%, to 17,399.86. The blue-chip index lost 1.6% over the week.

Meanwhile, the Nasdaq Composite COMP, -4.12% was hit the hardest, as investors dumped technology and biotech stocks. The index lost 202.06 points, or 4.1%, to 4,707.98 and declined 1.9% over the week.

Asian stocks fell and the British pound tumbled more than 2 percent on Monday as markets struggled to shake off deep uncertainty sparked by Britain's decision to leave the European Union.

Sentiment remained weak even though the worst of the turmoil seen on Friday, when global stock markets suffered their biggest decline in nearly five years, had eased.

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS shrank losses to 0.6% as companies with UK exposure in particular came under more pressure.

Financials led declines in Australia and Hong Kong with the sector seen the among worst hit by Brexit and the prospect of London losing its prized "EU passport".

June 27 Japan's Nikkei share average rebounded on Monday as government officials stepped up warnings that they may intervene in currency markets to stabilise the yen after Britain voted to leave the European Union.

Prime Minister Shinzo Abe said on Monday he has instructed Finance Minister Taro Aso to watch currency markets "ever more closely" and take steps if necessary.

Abe summoned Aso and Bank of Japan Deputy Governor Hiroshi Nakaso to discuss how to deal with the market turbulence caused by Brexit.

-

04:06

Nikkei 225 15,178.81 +226.79 +1.52 %, Hang Seng 20,031.14 -227.99 -1.13 %, Shanghai Composite 2,857.19 +2.91 +0.10 %

-

01:08

Stocks. Daily history for Jun 24’2016:

(index / closing price / change items /% change)

Nikkei 225 14,952.02 -1,286.33 -7.92 %

Hang Seng 20,259.13 -609.21 -2.92 %

S&P/ASX 200 5,113.18 -167.50 -3.17 %

Shanghai Composite 2,853.63 -38.33 -1.33 %

FTSE 100 6,138.69 -199.41 -3.15 %

CAC 40 4,106.73 -359.17 -8.04 %

Xetra DAX 9,557.16 -699.87 -6.82 %

S&P 500 2,037.41 -75.91 -3.59 %

NASDAQ Composite 4,707.98 -202.06 -4.12 %

Dow Jones 17,400.75 -610.32 -3.39 %

-