Noticias del mercado

-

17:49

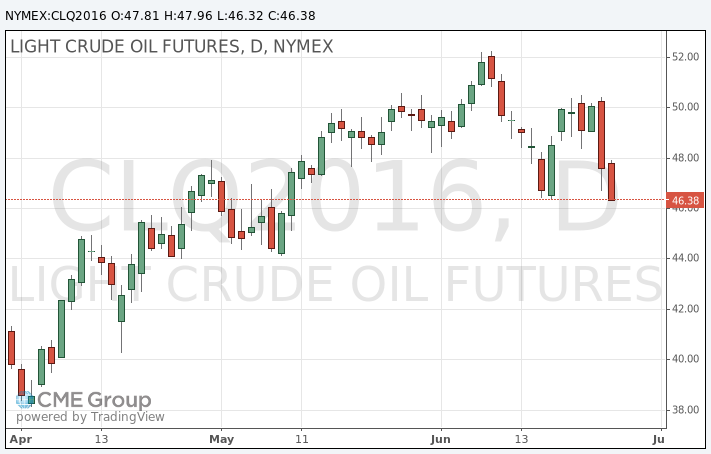

Oil lower in today’s trading

Oil prices fell as markets continue to show a decline in the unexpected results of the referendum in the UK, which led investors turn to safer assets.

On Friday, the contracts fell at the fastest pace since February - about 5%.

But on Monday, prices have stabilized, as market analysts argue that Brexit would have little impact on the levels of supply and demand on the world market.

Oil demand from the UK is less than 2% of the global demand.

On Friday, Baker Hughes said that the number of drilling rigs in the US fell for the first time in four weeks.

Increasing the number of drilling rigs in recent weeks intensified fears that the price of oil at $ 50 a barrel could push US producers to increase production volume and increase the already excessive supply of oil on the world market.

However, some analysts have warned that the global market is still oversupplied and prices could fall in the coming months.

The cost of the August futures for US light crude oil WTI fell to 46.32 dollars per barrel.

The price of August futures for Brent fell to 47.05 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:30

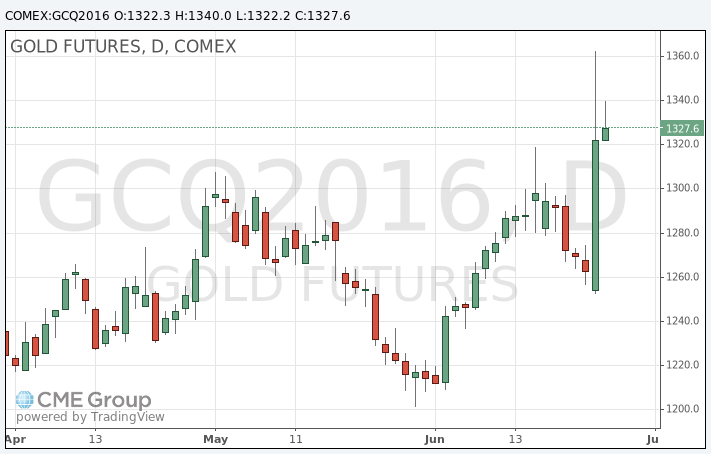

Gold up 1% on increasing risk sentiment

Gold rose more than 1% in today's trading, remaining near the highs of the last two years, recorded on Friday as uncertainty due to Britain's decision to withdraw from the European Union has forced investors to sell shares and invest in safe assets.

On Friday, the increase in the price of gold reached 8%, touching $ 1358.20 - the highest since March 2014.

"The uncertainty around the timing of talks on the withdrawal from the EU not only means that investors become more cautious and buy gold and dollars, but also continues to put pressure on the pound sterling and converted into an irreversible loss of economic activity at the domestic level," - Martin Arnold of ETF Securities said.

Goldman Sachs raised its forecast for gold prices, citing the fact that Brexit could have a more lasting impact on the trajectory of rising interest rates in the United States.

"The price of gold will rise in the third quarter, when they start to feel the full impact of Brexit, but expect it to fall in the fourth quarter after the elections in the United States and against the background of preparations for the next Fed raise rates", - said the financial company Macquarie.

The cost of the August gold futures on the COMEX rose to $ 1340.0 per ounce.

-

10:46

Oil gains moderately

This morning, New York crude oil futures WTI rose by 0.46% to $ 47.85 per barrel and crude oil futures for Brent rose 0.69% to $ 49.37 per barrel. Thus, the black gold is recording some gains, after the recent collapse associated with market volatility after Brexit. It became known that the number of employees in the US oil rigs has decreased over the previous week for 7 to 330 and this could support the prices.

-

01:09

Commodities. Daily history for Jun 24’2016:

(raw materials / closing price /% change)

Oil 47.57 -0.15%

Gold 1,319.10 -0.25%

-