Noticias del mercado

-

21:00

U.S.: Consumer Credit , February $15.52B (forecast 13.6)

-

18:42

European Central Bank purchased almost 61 billion euros of government bonds in the first month of its quantitative easing programme

The European Central Bank (ECB) said on Tuesday that it purchased almost 61 billion euros of government bonds and other assets in March. The central bank beat its target in the first month of a quantitative easing programme. The ECB started to buy government bonds on March 09.

The ECB purchased 52.555 billion euros of government bonds since March 09: 11.1 billion euros of German government bonds, 8.75 billion euros of French government bonds and 7.6 billion euros of Italian government bonds.

The ECB said that it settled 64.670 billion euros in total covered bond purchases as of April 03, and 4.888 billion euros in purchases of asset-backed securities (ABS).

-

18:32

European Central Bank (ECB) Executive Board Member Yves Mersch: the central bank could adjust its quantitative easing programme

The European Central Bank (ECB) Executive Board Member Yves Mersch said in an interview on Tuesday that the central bank could adjust its quantitative easing programme if inflation target will be achieved faster than expected.

He noted that the exchange rate should not be used to lift Eurozone's competitiveness because it would breach European Union law.

-

18:18

Federal Reserve Bank of Atlanta President Dennis Lockhart prefers the Fed will start to raise its interest rate in July or September

The Federal Reserve Bank of Atlanta President Dennis Lockhart said in an interview Monday on Monday that he prefers the Fed will start to raise its interest rate in July or September. He added that the Fed will have more data, and that the first quarter was "anomalous again".

The Federal Reserve Bank of Atlanta president expects a rebound in the second quarter.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

18:12

Minneapolis Fed President Narayana Kocherlakota: the Fed should delay its interest rate hike until the second half of 2016

The Minneapolis Fed President Narayana Kocherlakota said on Tuesday that the Fed should delay its interest rate hike until the second half of 2016. He added that the Fed should hike interest rate gradually to 2% by the end of 2017.

Kocherlakota noted that "the ongoing conversation about tightening monetary policy" may be a risk to the U.S. economy.

The Minneapolis Fed president believes that it is better not raise interest rate this year as employment grows slowly and inflation is still low.

He expects that the U.S. economy would need at least three more years of labour market improvement, and inflation will not increase back to the Fed's 2% target until 2018.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. job openings figures

The U.S. dollar traded mixed to higher against the most major currencies after the better-than-expected U.S. job openings figures. Job openings climbed to 5.133 million in February from 4.965 million in January. It was the highest level since January 2001.

January's figure was revised down from 4.998 million.

Analysts had expected job openings to rise to 4.978 million.

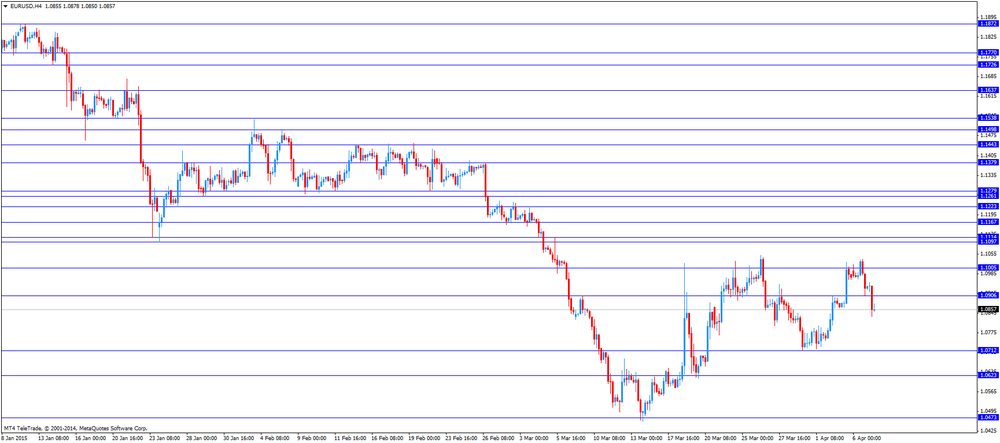

The euro traded mixed against the U.S. dollar. Concerns over Greece's debt problems continue to weigh on the euro. Greece have to repay the International Monetary Fund (IMF) tranche of 448 million euros on April 09. Greek Finance Minister Yanis Varoufakis has said that Greece will make a payment to the IMF on time.

Eurozone' final services purchasing managers' index (PMI) fell to 54.2 in March from a preliminary reading of 54.3. Analysts had expected the final index to remain unchanged at 54.3.

Germany's final services PMI rose to 55.4 in March from a preliminary reading of 55.3. Analysts had expected the final index to remain unchanged at 55.3.

France's final services PMI declined to 52.4 in March from a preliminary reading of 52.8. Analysts had expected the final index to remain unchanged at 52.8.

The Sentix investor confidence index for the Eurozone rose to 20.0 in April from 18.6 in March, missing expectations for an increase to 20.9.That was the highest level since August 2007.

Eurozone's producer price index climbed 0.5% in February, exceeding expectations for a 0.1% increase, after a 1.1% decline in January. January's figure was revised down from 0.9% drop.

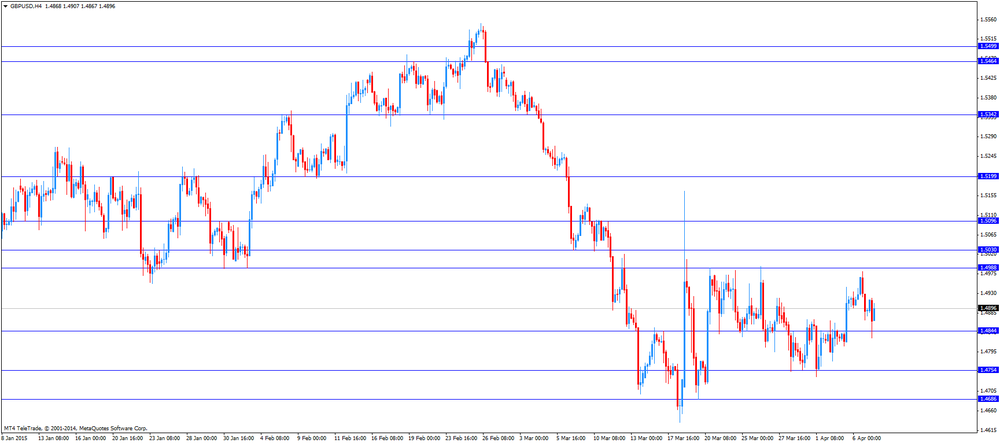

The British pound traded lower against the U.S. dollar after the better-than-expected services PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. increased to 58.9 in March from 56.7 in February, beating expectations for a rise to 57.1.

The rise was driven by an increase in new business.

The Swiss franc traded mixed against the U.S. dollar. The Swiss National Bank's foreign exchange reserves increased to 522.323 billion Swiss francs in March from 509.245 billion francs in February. February's figure was revised down from 509.250 billion francs.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded mixed against the greenback in the absence of any economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie rose against the greenback after the Reserve Bank of Australia (RBA) kept its monetary policy unchanged. The RBA kept its interest rate unchanged at 2.25%. Analysts had expected this decision.

The RBA might cut its interest rate in coming months. "Further easing of policy may be appropriate over the period ahead," the RBA Governor Glenn Stevens said today.

Retail sales in Australia rose 0.7% in February, exceeding expectations for a 0.4% increase, after a 0.5% gain in January. January's figure was revised up from a 0.4% rise.

The increase was driven by food retailing and household goods retailing.

Job advertisements in Australia dropped 1.4% in March, after a 0.7% rise in February. February's figure was revised down from a 0.9% gain.

The Australian Industry Group's services index fell to 50.2 in March from 51.7 in February.

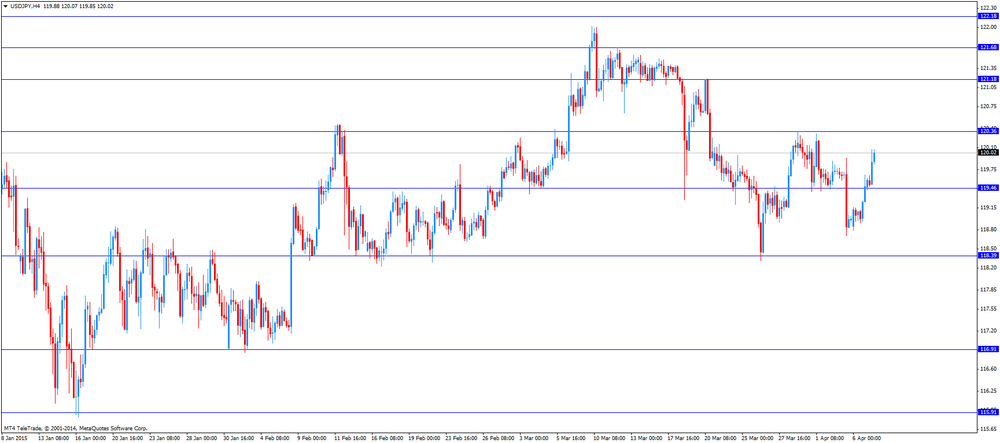

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback in the absence of any economic reports from Japan.

-

16:32

Job openings rises to 5.133 million in February, the highest level since January 2001

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 5.133 million in February from 4.965 million in January. It was the highest level since January 2001.

January's figure was revised down from 4.998 million.

Analysts had expected job openings to rise to 4.978 million.

The number of job openings rose for total private (4.649 million), while decreased for government (484,000) in February.

The hires rate was 3.5% in February.

Total separations declined to 4.650 million in February from 4.834 million in January.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:03

Sentix investor confidence index for the Eurozone reaches the highest level since August 2007

Market research group Sentix released its investor confidence index for the Eurozone on Tuesday. The index rose to 20.0 in April from 18.6 in March, missing expectations for an increase to 20.9.

That was the highest level since August 2007.

A reading above 0.0 indicates optimism, below indicates pessimism.

The index benefited from a weaker euro and quantitative easing by the European Central Bank.

The current conditions index climbed to 9 in April from 6.5 in March. It was the highest level since July 2011.

The expectations index remained unchanged at 31.5 in April, its highest level since February 2006.

German investor confidence index dropped to 31.4 in April from 39.5 in March. It was the biggest decline since August 2014.

-

16:01

U.S.: JOLTs Job Openings, February 5.133M (forecast 4978)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E2.1bn), $1.0900(E2.1bn), $1.1000(E3.0bn)

USD/JPY: Y118.35($430mn), Y119.00($927mn), Y119.95/120.05($1.0bn)

GBP/USD: $1.4900(Gbp1.0bn)

AUD/USD: $0.7500(A$252mn), $0.7700(A$344mn)

NZD/USD: $0.7460(NZ$596mn), $0.7595/00(NZ$791mn), $0.7700(NZ$377mn)

-

14:37

Swiss National Bank's foreign exchange reserves rose to 522.323 billion Swiss francs in March

The Swiss National Bank's foreign exchange reserves increased to 522.323 billion Swiss francs in March from 509.245 billion francs in February.

February's figure was revised down from 509.250 billion francs.

The increase was likely driven by a decline in the Swiss franc. The rise could also reflect the intervention by the central bank.

The SNB declined to comment if it may have intervened.

-

14:05

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the better-than-expected services PMI from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail Sales, M/M March 0.5% Revised From 0.4% 0.4% 0.7%

01:30 Australia Retail Sales Y/Y March 0.5% Revised From 3.1% 0.7%

01:30 Australia ANZ Job Advertisements (MoM) March 0.7% Revised From 0.9% -1.4%

04:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2.25% 2.25%

04:30 Australia RBA Rate Statement

07:00 Switzerland Foreign Currency Reserves March 509.3 522.3

07:50 France Services PMI (Finally) March 52.8 52.8 52.4

07:55 Germany Services PMI (Finally) March 55.3 55.3 55.4

08:00 Eurozone Services PMI (Finally) March 54.3 54.3 54.2

08:30 Eurozone Sentix Investor Confidence April 18.6 20.9 20

08:30 United Kingdom Purchasing Manager Index Services March 56.7 57.1 58.9

09:00 Eurozone Producer Price Index, MoM February -1.1% 0.1% 0.5%

09:00 Eurozone Producer Price Index (YoY) February -3.5% -3.0% -2.8%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to decline to 4.978 million in February from 4.998 million in January.

The euro declined against the U.S. dollar. Concerns over Greece's debt problems continue to weigh on the euro. Greece have to repay the International Monetary Fund (IMF) tranche of 448 million euros on April 09. Greek Finance Minister Yanis Varoufakis has said that Greece will make a payment to the IMF on time.

Eurozone' final services purchasing managers' index (PMI) fell to 54.2 in March from a preliminary reading of 54.3. Analysts had expected the final index to remain unchanged at 54.3.

Germany's final services PMI rose to 55.4 in March from a preliminary reading of 55.3. Analysts had expected the final index to remain unchanged at 55.3.

France's final services PMI declined to 52.4 in March from a preliminary reading of 52.8. Analysts had expected the final index to remain unchanged at 52.8.

The Sentix investor confidence index for the Eurozone rose to 20.0 in April from 18.6 in March, missing expectations for an increase to 20.9.That was the highest level since August 2007.

Eurozone's producer price index climbed 0.5% in February, exceeding expectations for a 0.1% increase, after a 1.1% decline in January. January's figure was revised down from 0.9% drop.

The British pound traded mixed against the U.S. dollar after the better-than-expected services PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. increased to 58.9 in March from 56.7 in February, beating expectations for a rise to 57.1.

The rise was driven by an increase in new business.

The Swiss franc traded lower against the U.S. dollar. The Swiss National Bank's foreign exchange reserves increased to 522.323 billion Swiss francs in March from 509.245 billion francs in February. February's figure was revised down from 509.250 billion francs.

EUR/USD: the currency pair fell to $1.0833

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair rose to Y120.07

The most important news that are expected (GMT0):

14:00 U.S. JOLTs Job Openings February 4998 4978

23:50 Japan Current Account, bln February 61 1150

-

13:50

Orders

EUR/USD

Offers 1.1000 1.0920 1.0900 1.0875/80

Bids 1.0820/00 1.0750 1.0700

GBP/USD

Offers 1.5000 1.4950 1.4900

Bids 1.4805/00 1.4750 1.4725/20 1.4710/00

EUR/JPY

Offers 132.00 131.50 130.45/50

Bids 130.00 129.50 129.20/00

USD/JPY

Offers 121.00 120.50

Bids 119.00 118.50

EUR/GBP

Offers 0.7400 0.7390

Bids 0.7285/80 0.7250 0,7210/00

AUD/USD

Offers 0.7800 0.7750 0.7720

Bids 0.7655/50 0.7610/00 0.7550

-

13:33

Federal Reserve Bank of New York President William C. Dudley: the U.S. economy will grow faster

The Federal Reserve Bank of New York President William C. Dudley said on Monday that the U.S. economy will grow faster as a slowdown in the first quarter was partly caused by the bad weather.

He noted that a stronger U.S. dollar is "another significant shock" to the U.S. economy, making U.S. exports more expensive.

The Federal Reserve Bank of New York president pointed out that falling oil drilling and exploration is a risk to the economy.

Dudley is a voting member of the Federal Open Market Committee.

-

11:40

Australia: RBA keeps rates at 2.25%

After cutting rates in February the Reserve Bank of Australia kept its rates steady at 2.25% although the fall of commodity prices weighs on the Australian economy - the price of iron ore, accounting for 20% of Australia's exports, set a new 10-year low last week. In China, the country's biggest trade partner, the economy is slowing. The RBA wants to assess the effects of the last cut before taking further measures but another rate-cut is likely to happen. In a statement the RBA noted that even lower exchange rates will be needed in order to achieve the targeted economic growth. The bank said that domestic demand is quite weak.

The Australian dollar rallied after the announcement, currently trading at USD0.7674.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E2.1bn), $1.0900(E2.1bn), $1.1000(E3.0bn)

USD/JPY: Y118.35($430mn), Y119.00($927mn), Y119.95/120.05($1.0bn)

GBP/USD: $1.4900(Gbp1.0bn)

AUD/USD: $0.7500(A$252mn), $0.7700(A$344mn)

NZD/USD: $0.7460(NZ$596mn), $0.7595/00(NZ$791mn), $0.7700(NZ$377mn)

-

10:55

Eurozone: Sentix Investor Confidence and Services PMI

Today data on the Sentix Investor Confidence and Services PMI were reported.

The final Services PMI rose less than expected with a reading of 54.2 points compared to forecasts of 54.3 points but still higher than the previous reading of 53.7 points. Data on German Services PMI for March came in higher than expected at 55.4 compared to forecasts of 55.3. The French Services PMI was reported at 52.4, below the estimated 52.8.vand below the February reading of 53.4.

Sentix Investor Confidence in the Eurozone rose to a seasonally adjusted 20.0 for April, higher than the previous reading of 18.6 but below the estimated increase to 20.9.

The single currency came under pressure after the data was reported, currently trading at USD1.0853.

-

10:30

United Kingdom: Purchasing Manager Index Services, March 58.9 (forecast 57.1)

-

10:20

Press Review: Greece moves to quell default fears, pledges to meet 'all obligations'

BLOOMBERG

Dollar Drop Signals World's Best Forecaster to Start Buying

It's time for investors who bailed on the dollar in the past few weeks to get back in, says the most-accurate currencies forecaster.

The greenback has tumbled 4.3 percent versus the euro since touching a 12-year high last month amid speculation the Federal Reserve will delay raising interest rates, in part because the dollar's strength is hurting U.S. economic growth. That concern is overblown, according to ING Groep NV, which topped Bloomberg's rankings of foreign-exchange analysts for the second quarter in a row.

"The market is now pricing in a very subdued pace of the tightening cycle -- we disagree," Petr Krpata, a foreign-exchange strategist at ING in London, said on April 1 by phone. "We just see the latest correction as a perfect opportunity to get into the trade again."

REUTERS

Greece moves to quell default fears, pledges to meet 'all obligations'(Reuters) - Greek Finance Minister Yanis Varoufakis said on Sunday that Greece intends to meet all obligations to all its creditors, ad infinitum," seeking to quell default fears ahead of a big loan payment Athens owes the IMF later this week.

Following a meeting with the head of the International Monetary Fund, Varoufakis told reporters the government plans to "reform Greece deeply" and would seek to improve the "efficacy of negotiations" with its creditors.

Greece has not received bailout funds since August last year and has resorted to measures such as borrowing from state entities to tide it over. It offered a new package of reforms last week in the hope of unlocking funds, but has yet to win agreement on the proposals with its EU and IMF lenders.

Source: http://www.reuters.com/article/2015/04/07/us-eurozone-greece-imf-idUSKBN0MX01D20150407

BLOOMBERG

Rajan Holds India Rate as Banks Fail to Pass on Earlier Cuts

India's central bank left interest rates unchanged as commercial lenders in Asia's third-largest economy have yet to pass on two previous cuts to customers.

Governor Raghuram Rajan kept the benchmark repurchase rate at 7.50 percent, the Reserve Bank of India said in a statement in Mumbai on Tuesday, a move predicted by 33 of 42 economists in a Bloomberg survey. The rest saw a cut to 7.25 percent.

"Going forward, the accommodative stance of monetary policy will be maintained, but monetary policy actions will be conditioned by incoming data," Rajan said. The bank will watch for transmission of previous rate cuts, price rises, government moves to ease supply and normalization of U.S. policy even as India is "better buffered" against volatility, he said.

-

09:01

Switzerland: Foreign Currency Reserves, March 522.3

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers – aussie skyrockets on rate decision

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail Sales, M/M March 0.5% 0.4% 0.7%

01:30 Australia Retail Sales Y/Y March 0.5% 0.7%

01:30 Australia ANZ Job Advertisements (MoM) March 0.7% -1.4%

04:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2.25% 2.25

04:30 Australia RBA Rate Statement

The U.S. dollar is trading mixed against its major peers after yesterday's ISM-Non Manufacturing slightly below estimates. New York Fed President William Dudley said in a more or less dovish speech that temporary factors will have to be considered in order to determine the timing of a rate hike as the future developments of the economy cannot be anticipated.

The Australian dollar jumped against the U.S. dollar as the RBA left rates unchanged at 2.25% but said that future rate cuts could be necessary and appropriate in order to keep growth and inflation consistent with the target and that the bank will assess the case for such action in the meetings to come. The AIG Services Index for March declined from 51.7 to 50.2. Australia's Retail Sales rose above forecast +0.7% from a previous reading of 0.5% revised up from +0.4%). Analysts expected a lower growth at +0.4%. Year on year Retail Sales rose +0.7 in March compared to +0.5% a year ago (revised from 3.1%). ANZ Job Advertisements for March declined -1.4%. Last month's reading of +0.9% was revised down to +0.7%.

New Zealand's dollar booked losses against the greenback during the Asian in the absence of any major economic news.

The Japanese yen is trading slightly higher against the greenback in the Asian session in the absence of major economic news.

EUR/USD: the euro traded almost flat against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling booked gains against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland Foreign Currency Reserves March 509.3

07:50 France Services PMI (Finally) March 52.8 52.8

07:55 Germany Services PMI (Finally) March 55.3 55.3

08:00 Eurozone Services PMIт (Finally) March 54.3 54.3

08:30 Eurozone Sentix Investor Confidence April 18.6 20.9

08:30 United Kingdom Purchasing Manager Index Services March 56.7 57.1

09:00 Eurozone Producer Price Index, MoM February -0.9% 0.1%

09:00 Eurozone Producer Price Index (YoY) February -3.4% -3.0%

14:00 U.S. JOLTs Job Openings February 4998 4978

19:00 U.S. Consumer Credit February 11.6 13.6

20:30 U.S. API Crude Oil Inventories April 5.2

23:50 Japan Current Account, bln February 61 1150

-

08:19

Options levels on tuesday, April 7, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1097 (1977)

$1.1052 (1060)

$1.1023 (1124)

Price at time of writing this review: $1.0915

Support levels (open interest**, contracts):

$1.0847 (1222)

$1.0790 (1746)

$1.0722 (2908)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 40858 contracts, with the maximum number of contracts with strike price $1,1200 (5299);

- Overall open interest on the PUT options with the expiration date May, 8 is 56463 contracts, with the maximum number of contracts with strike price $1,0000 (7535);

- The ratio of PUT/CALL was 1.38 versus 1.36 from the previous trading day according to data from April, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.5210 (568)

$1.5114 (1010)

$1.5018 (1009)

Price at time of writing this review: $1.4901

Support levels (open interest**, contracts):

$1.4878 (1127)

$1.4782 (2377)

$1.4686 (2546)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 15601 contracts, with the maximum number of contracts with strike price $1,5100 (1010);

- Overall open interest on the PUT options with the expiration date May, 8 is 22824 contracts, with the maximum number of contracts with strike price $1,4700 (2546);

- The ratio of PUT/CALL was 1.46 versus 1.47 from the previous trading day according to data from April, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:34

Australia: ANZ Job Advertisements (MoM), March -1.4%

-

03:31

Australia: Retail Sales, M/M, March 0.7% (forecast 0.4%)

-

01:31

Australia: AIG Services Index, March 50.2

-

00:31

Currencies. Daily history for Apr 6’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0933 -0,37%

GBP/USD $1,4889 -0,19%

USD/CHF Chf0,958 +0,76%

USD/JPY Y119,49 +0,43%

EUR/JPY Y130,65 +0,17%

GBP/JPY Y177,9 +0,24%

AUD/USD $0,7603 -0,37%

NZD/USD $0,7546 -0,66%

USD/CAD C$1,2472 -0,08%

-

00:02

Schedule for today,Tuesday, Apr 7’2015:

(time / country / index / period / previous value / forecast)

01:30имAustralia Retail Sales, M/M March 0.4% 0.4%

01:30 Australia Retail Sales Y/Y March 3.1%

01:30 Australia ANZ Job Advertisements (MoM) March 0.9%

04:30 Australia Announcement of the RBA decision on the discount rate 2.25% 2.25%

04:30 Australia RBA Rate Statement

07:00 United Kingdom Halifax house price index March -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y March 8.3%

07:00 Switzerland Foreign Currency Reserves March 509.3

07:50 France Services PMI (Finally) March 52.8 52.8

07:55 Germany Services PMI (Finally) March 55.3 55.3

08:00 Eurozone Services PMIт (Finally) March 54.3 54.3

08:30 Eurozone Sentix Investor Confidence April 18.6 20.9

08:30 United Kingdom Purchasing Manager Index Services March 56.7 57.1

09:00 Eurozone Producer Price Index, MoM February -0.9% 0.1%

09:00 Eurozone Producer Price Index (YoY) February -3.4% -3.0%

14:00 U.S. JOLTs Job Openings February 4998 4978

19:00 U.S. Consumer Credit February 11.6 13.6

20:30 U.S. API Crude Oil Inventories April 5.2

23:50 Japan Current Account, bln February 61 1150

-