Noticias del mercado

-

21:00

U.S.: Consumer Credit , June 20.74 (forecast 17)

-

17:11

Reserve Bank of Australia lowers its GDP and unemployment forecasts

The Reserve Bank of Australia lowered its GDP and unemployment forecasts on Friday. The Australian GDP for 2016 was cut to 2.5%-3.5% from 2.75%-3.75%, while core inflation is expected to be 2%-3%.

The unemployment rate is expected to be below 6.5%, down from the mid to high-6% range.

"The unemployment rate is now forecast to remain little changed over the next 18 months or so from recent levels, before declining over 2017," the central bank said.

-

16:37

Bank of England Deputy Governor Ben Broadbent: there is no urgency to start raising interest rates

The Bank of England (BoE) Deputy Governor Ben Broadbent said in an interview on Friday that there is no urgency to start raising interest rates.

"We are clearly closer to the time at which rates may have to go up, but that does not mean we're fixing some particular point in the future," he said.

Broadbent added that "there is not that much inflationary pressure at the moment".

The BoE deputy governor pointed out that it would be foolish to pre-announce when the central bank starts to hike its interest rate.

-

16:17

Canada’s Ivey purchasing managers’ index drops to 52.9 in June

Canada's seasonally adjusted Ivey purchasing managers' index dropped to 52.9 in June from 55.9 in May. Analysts had expected the index to decrease to 52.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was at 47.6 in June, while employment index was at 49.1.

Inventories index was at 41.2.

-

16:00

Canada: Ivey Purchasing Managers Index, July 52.9 (forecast 52)

-

15:51

Greek consumer prices decline 1.3% in July

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Friday. Greek consumer prices fell 1.3% in July, after the 0.6% increase in June.

On a yearly basis, the Greek consumer price index declined 2.2% in July, after a 2.2 drop in June. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 7.4% in July, transport costs dropped by 3.5%, clothing and footwear prices declined 3.3%, while household equipment prices were down 2.3%.

Prices of food and non-alcoholic beverages increased 0.9% in July, while alcoholic beverages and tobacco prices climbed by 2.1%.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0700(E1.722bn), $1.0750(E740mn), $1.0775(E734mn), $1.0800(E1.787bn), $1.0850(E571mn), $1.0900(E523mn), $1.0925(E2.215bn), $1.0930-40(E866mn), $1.0965-75(E472mn), $1.1000(E1.836mn), $1.1125(E582mn)

USD/JPY: Y123.00($478mn), Y123.50($395mn), Y125.00($1.46bn), Y125.75($800mn)

GBP/USD: $1.5450(Gbp431mn), $1.5500(Gbp400mn)

EUR/GBP: Gbp0.7000(E478mn)

AUD/USD: $0.7300(A$401mn), $0.7350(A$667mn), $0.7450(A$592mn)

USD/CAD: C$1.3000($391mn), C$1.3025($300mn), C$1.3175($305mn)

-

15:25

Industrial production in Spain increases 0.4% in June

Spanish statistical office INE released its industrial production figures for Spain on Friday. Industrial production in Spain was up 0.4% in June, after a 0.6% gain in May.

On a yearly basis, industrial production in Spain climbed at adjusted 4.5% in June, after a revised 3.2% increase in May.

Output of capital goods jumped 10.9% in June, output of intermediate goods climbed 0.8%, energy production was up 3.4%, while consumer goods output rose 0.8%.

-

15:07

U.S. unemployment rate remains unchanged at 5.3% in July, 215,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 215,000 jobs in July, missing expectations for a rise of 223,000 jobs, after a gain of 231,000 jobs in June. June's figure was revised up from a rise of 223,000 jobs.

The increase was driven by a rise in construction and manufacturing employment. Construction added 6,000 jobs in July, while the manufacturing sector added 2,000 jobs.

Factory employment climbed by 15,000, while mining sector shed 4,000 jobs.

The U.S. unemployment rate remained unchanged at 5.3% in July, in line with expectations. It was the lowest level since April 2008.

Average hourly earnings rose 0.2% in July, in line with forecasts, after a flat reading in June.

The labour-force participation rate remained unchanged at 62.6% in July. It was the lowest level since October 1977.

These figures added to speculation that the Fed may start to hike its interest rate soon, despite the weak wage growth figures and low inflation.

-

14:51

Building permits in Canada soar 14.8% in June

Statistics Canada released housing market data on Friday. Building permits in Canada jumped 14.8% in June, exceeding expectations for a 5.0% rise, after a 13.9% drop in May. May's figure was revised down from a 14.5% decline.

The rise was driven by higher construction intentions for multi-family dwellings in Quebec, Alberta and Ontario, institutional buildings in Alberta and commercial buildings in British Columbia.

Building permits for non-residential construction rose 13.2% in May, while permits in the residential sector climbed 15.9%.

-

14:41

Canada’s economy adds 6,600 jobs in July

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 6.8% in July, in line with expectations.

The number of employed people fell by 6,600 jobs in July, beating expectations for a rise of 5,000 jobs, after a 6,400 decline in June.

The increase was driven by a rise in self- employed and part-time work. Self-employment rose by 40,500 jobs, while part-time employment climbed by 23,900 jobs.

Full-time employment declined by 17,300 in July.

The labour participation rate was 65.7% in July.

The Bank of Canada monitors closely the labour participation rate.

-

14:30

Canada: Unemployment rate, July 6.8% (forecast 6.8%)

-

14:30

U.S.: Unemployment Rate, July 5.3% (forecast 5.3%)

-

14:30

U.S.: Average hourly earnings , July 0.2% (forecast 0.2%)

-

14:30

U.S.: Nonfarm Payrolls, 215 (forecast 223)

-

14:30

U.S.: Average workweek, July 34.6 (forecast 34.5)

-

14:30

Canada: Building Permits (MoM) , June 14.8% (forecast 5%)

-

14:30

Canada: Employment , July 6.6 (forecast 5)

-

14:22

Bank of Japan will reduce the number of monetary policy meetings in 2016 to 8 from the current 14

The Bank of Japan (BoJ) released its new schedule of monetary policy meetings for the next year on Friday. The central bank will reduce the number of meetings to 8 from the current 14. The first monetary policy meeting in 2016 is scheduled to be on January 28-29.

BoJ's economic and inflation forecasts are scheduled to be released four times next year: on January 29, April 28, July 29 and November 01.

-

14:11

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies ahead of the U.S. labour market data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans June -7.3% Revised From -6.1% 5% 4.4%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Monetary Policy Statement

05:45 Switzerland Unemployment Rate (non s.a.) July 3.1% 3.1%

06:00 Germany Current Account June 11.8 Revised From 11.1 24.4

06:00 Germany Trade Balance June 19.5 Revised From 19.6 24.0

06:00 Germany Industrial Production s.a. (MoM) June 0.2% Revised From 0.0% 0.3% -1.4%

06:00 Germany Industrial Production (YoY) June 2.4% Revised From 2.1% 0.6%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln June -4.0 -2.7

06:45 France Industrial Production, m/m June 0.4% 0.2% -0.1%

06:45 France Industrial Production, y/y June 1.6% Revised From 2.4% 1.0%

08:30 United Kingdom Total Trade Balance June -0.9 Revised From -0.393 -1.6

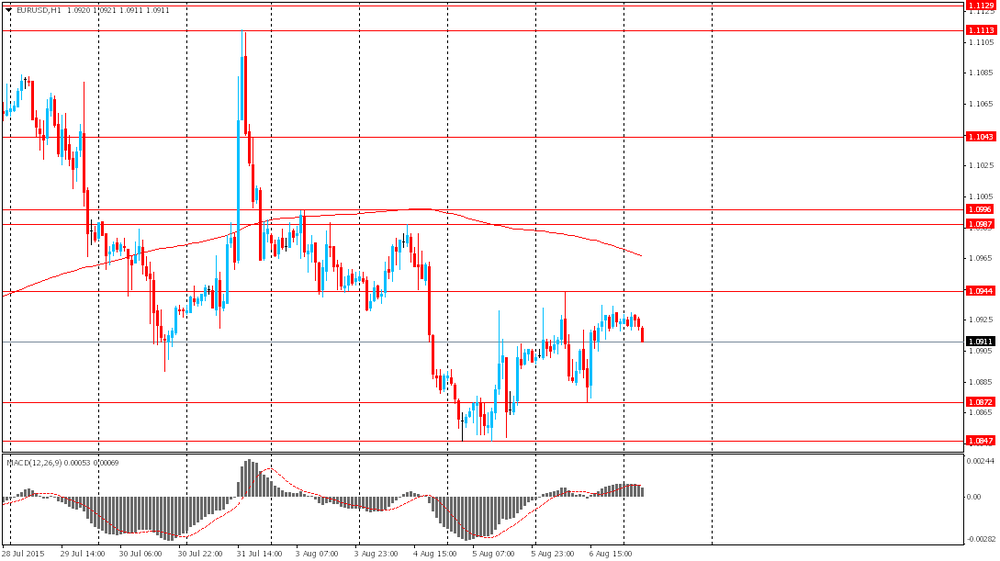

The U.S. dollar traded lower against the most major currencies ahead of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.3% in July. The U.S. economy is expected to add 218,000 jobs in July, after adding 223,000 jobs in June.

The euro traded higher against the U.S. dollar after the mixed data from the Eurozone. German industrial production dropped 1.4% in June, missing expectations for a 0.3% gain, after a 0.2% rise in May. It was the biggest decline since August 2014.

May's figure was revised up from a flat reading.

The output of capital goods plunged 2.6% in June, energy output climbed 2.3%, and the production in the construction sector was down 4.5%, while the production of intermediate goods fell 0.3%.

The output of consumer goods decreased 0.2%.

Germany's seasonally adjusted trade surplus was €22.0 billion in June.

Exports fell at a seasonally and calendar-adjusted 1.0% in June, while imports declined 0.5%.

According to the French Customs, France's trade deficit narrowed to €2.66 billion in June from €4.0 billion in May. It was the lowest level since March 2007.

The decline in deficit was driven by a rise in exports of transport equipment.

Industrial production in France fell 0.1% in June, missing expectations for a 0.2% rise, after a 0.4% gain in May.

The decline was driven by a drop in manufacturing and construction output. Manufacturing output was down 0.7% in June, while construction output decreased 2.5%.

On a yearly basis, the French industrial production rose 1.0% in June, after a 1.6% gain in May. May's figure was revised down from a 2.4% increase.

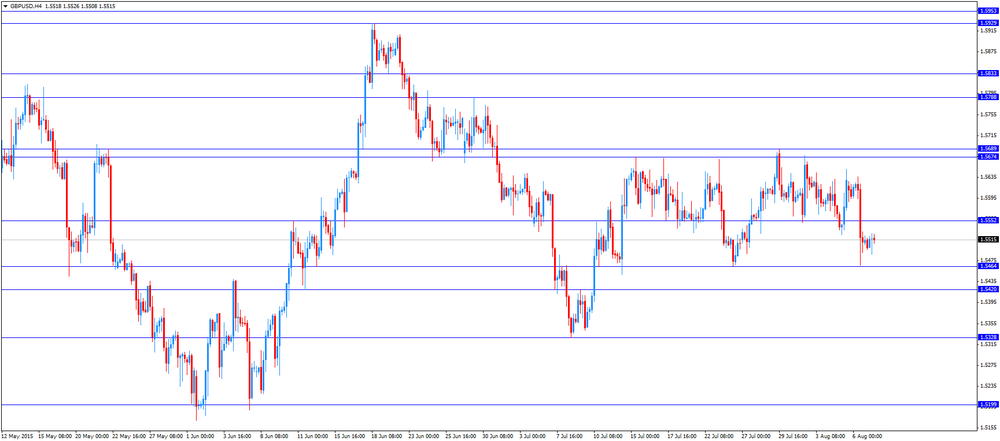

The British pound traded higher against the U.S. dollar despite the weak U.K. trade data. The U.K. trade deficit in goods widened to £9.2 billion in June from £8.4 billion in May. May's figure was revised up from a deficit of £8.00 billion.

The rise in the trade deficit was driven by a weaker demand in the Eurozone and a stronger pound.

The total trade deficit, including services, widened to £1.60 billion in June from £0.89 billion in May. May's figure was revised up from a deficit of £0.39 billion.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 6.8% in July.

Canada's economy is expected to add 5,000 jobs in July.

The Canadian building permits are expected to rise 5.0% in June, after a 14.5% drop in May.

The Swiss franc traded lower against the U.S. dollar. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in July.

On a seasonally unadjusted basis, the unemployment rate in Switzerland remained unchanged at 3.1% in July.

The number of unemployed people in Switzerland rose to 133,754 in July from 133,256 in June.

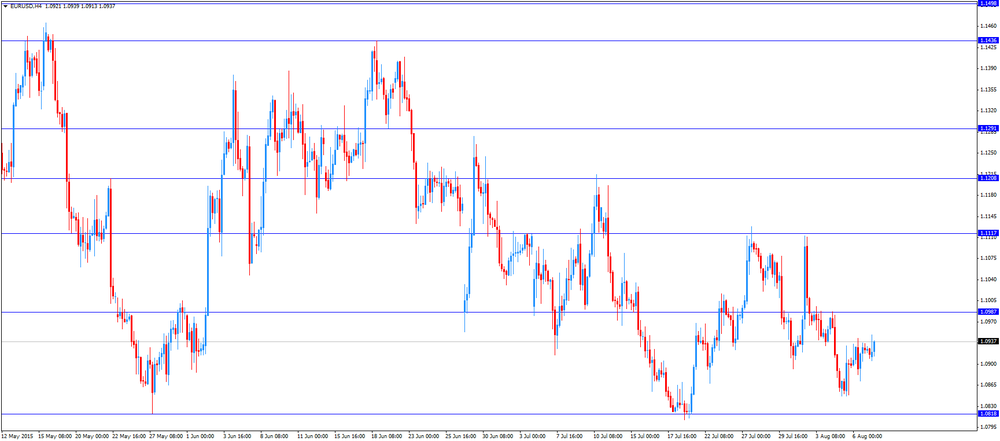

EUR/USD: the currency pair increased to $1.0949

GBP/USD: the currency pair rose to $1.5527

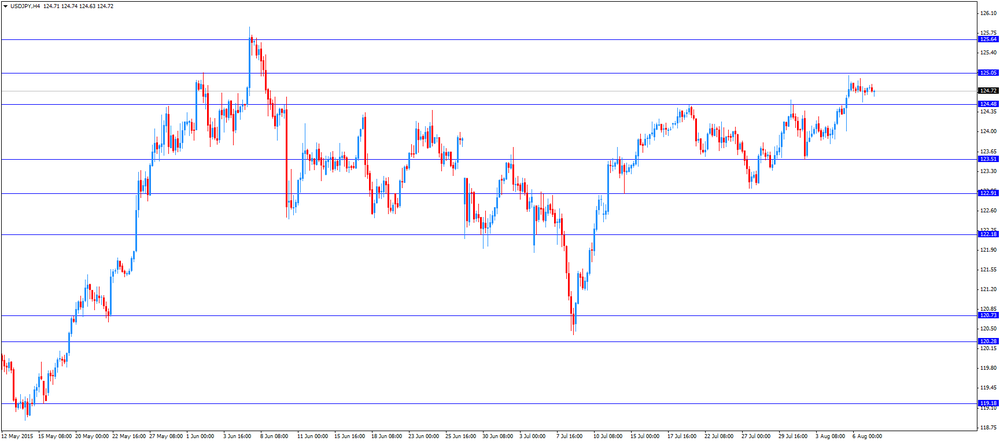

USD/JPY: the currency pair fell to Y124.63

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) June -14.5% 5%

12:30 Canada Unemployment rate July 6.8% 6.8%

12:30 Canada Employment July -6.4 5

12:30 U.S. Average hourly earnings July 0.0% 0.2%

12:30 U.S. Nonfarm Payrolls 223 223

12:30 U.S. Unemployment Rate July 5.3% 5.3%

14:00 Canada Ivey Purchasing Managers Index July 55.9 52

-

14:00

Orders

EUR/USD

Offers 1.0950 1.0980 1.1000 1.1020 1.1050 1.1065 1.1080-85 1.1100 1.1125 1.1150

Bids 1.0900 1.0880 1.0850 1.0820-25 1.0800 1.0780 1.0750 1.0725 1.0700

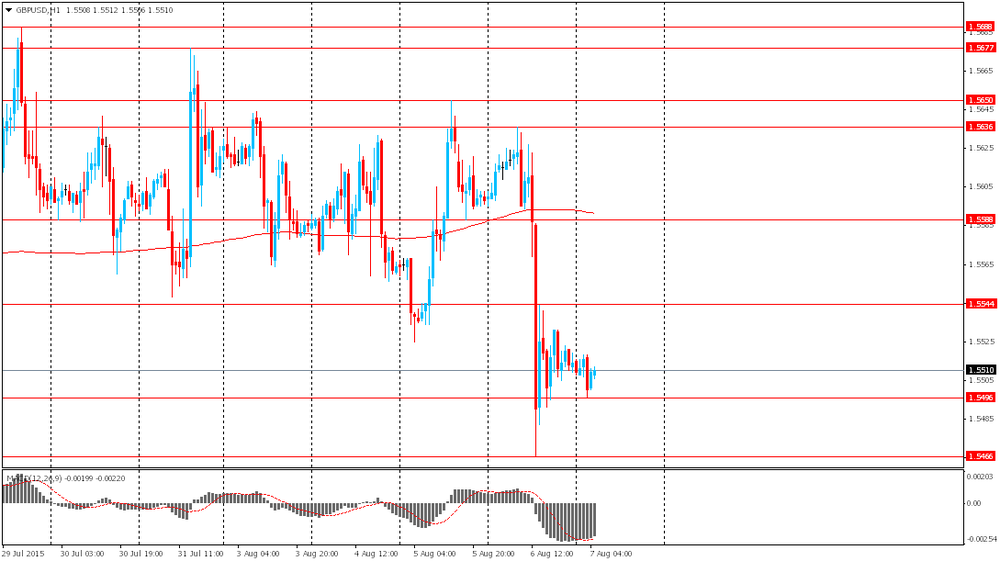

GBP/USD

Offers 1.5520-25 1.5550 1.5580-85 1.5600 1.5625 1.5650 1.5680 1.5700-10

Bids 1.5485 1.5465 1.5450 1.5425-30 1.5400 1.5385 1.5360 1.5330 1.5300

EUR/GBP

Offers 0.7080-85 0.7100 0.7125 0.7150-55 0.7180-85 0.7200

Bids 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 136.80 137.00 137.30 137.50 137.75 138.00 138.50

Bids 136.20 136.00 135.80 135.60 135.20 135.00 134.85 134.50

USD/JPY

Offers 125.00 125.30 125.50 125.75 126.00 126.25 126.50

Bids 124.60 124.400 124.25 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7380 0.7400 0.7420-25 0.7450 0.7475 0.7500

Bids 0.7345-50 0.7320 0.7300 0.7280 0.7250 0.7230 0.7200

-

11:53

Bank of Japan Governor Haruhiko Kuroda: the timing for achieving 2% inflation target depends on oil prices

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said at a press conference on Friday that the timing for achieving 2% inflation target depends on oil prices. He added that low oil prices affect inflation, the central bank will adjust its monetary policy.

Kuroda pointed that a low oil prices are positive for Japan's economy.

The BoJ governor said that household sentiment continues to recover, but consumer spending remains weak.

Kuroda expect inflation to increase later this fiscal year.

He noted that there should be no market turbulences if the Fed starts raising its interest rate this year as this development is already priced in.

-

11:40

U.K. trade deficit in goods widens to £9.2 billion in June

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods widened to £9.2 billion in June from £8.4 billion in May. May's figure was revised up from a deficit of £8.00 billion.

The rise in the trade deficit was driven by a weaker demand in the Eurozone and a stronger pound.

The total trade deficit, including services, widened to £1.60 billion in June from £0.89 billion in May. May's figure was revised up from a deficit of £0.39 billion.

-

11:28

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.3% in July

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Friday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in July.

On a seasonally unadjusted basis, the unemployment rate in Switzerland remained unchanged at 3.1% in July.

The number of unemployed people in Switzerland rose to 133,754 in July from 133,256 in June.

The youth unemployment rate was up to 3.0% in July from 2.8% in June.

-

11:24

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0700(E1.722bn), $1.0750(E740mn), $1.0775(E734mn), $1.0800(E1.787bn), $1.0850(E571mn), $1.0900(E523mn), $1.0925(E2.215bn), $1.0930-40(E866mn), $1.0965-75(E472mn), $1.1000(E1.836mn), $1.1125(E582mn)

USD/JPY: Y123.00($478mn), Y123.50($395mn), Y125.00($1.46bn), Y125.75($800mn)

GBP/USD: $1.5450(Gbp431mn), $1.5500(Gbp400mn)

EUR/GBP: Gbp0.7000(E478mn)

AUD/USD: $0.7300(A$401mn), $0.7350(A$667mn), $0.7450(A$592mn)

USD/CAD: C$1.3000($391mn), C$1.3025($300mn), C$1.3175($305mn)

-

11:22

French industrial production falls 0.1% in June

The French statistical office Insee its industrial production figures on Friday. Industrial production in France fell 0.1% in June, missing expectations for a 0.2% rise, after a 0.4% gain in May.

The decline was driven by a drop in manufacturing and construction output. Manufacturing output was down 0.7% in June, while construction output decreased 2.5%.

Output in mining and quarrying, energy, water supply and waste management rose 2.2% in June.

On a yearly basis, the French industrial production rose 1.0% in June, after a 1.6% gain in May. May's figure was revised down from a 2.4% increase.

-

11:10

France's trade deficit narrows to €2.66 billion in June, the lowest level since March 2007

According to the French Customs, France's trade deficit narrowed to €2.66 billion in June from €4.0 billion in May. It was the lowest level since March 2007.

The decline in deficit was driven by a rise in exports of transport equipment.

-

11:01

Germany's seasonally adjusted trade surplus is €22.0 billion in June

Destatis released its trade data for Germany on Friday. Germany's seasonally adjusted trade surplus was €22.0 billion in June.

Exports fell at a seasonally and calendar-adjusted 1.0% in June, while imports declined 0.5%.

On an annual basis, exports were up 13.7% in June, while imports increased 6.4%.

Germany's current account surplus was at €24.4 billion in June, up from €11.8 billion in May.

-

10:52

German industrial production drops 1.4% in June

Destatis released its industrial production data for Germany on Friday. German industrial production dropped 1.4% in June, missing expectations for a 0.3% gain, after a 0.2% rise in May. It was the biggest decline since August 2014.

May's figure was revised up from a flat reading.

The output of capital goods plunged 2.6% in June, energy output climbed 2.3%, and the production in the construction sector was down 4.5%, while the production of intermediate goods fell 0.3%.

The output of consumer goods decreased 0.2%.

-

10:43

Bank of Japan keeps its monetary policy unchanged

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The BoJ board members voted 8-1 to keep monetary policy unchanged.

The BoJ noted that the country's economy continued to recover moderately.

-

10:34

European Central Bank Governing Council member Bostjan Jazbec: the central bank’s quantitative easing (QE) is working

The European Central Bank Governing Council member Bostjan Jazbec said on Thursday that the central bank's quantitative easing (QE) was working.

"I think QE is working, that the results are there and that all other options are off the table as we clearly have evidence that we are on the right track," he said.

Jazbec is convinced that the inflation in the Eurozone will reach the central bank's 2% target in the medium term.

-

10:31

United Kingdom: Total Trade Balance, June -1.6

-

10:18

European Commission plans to reach a deal between Greece and its creditors by August 20

The European Commission spokeswoman Mina Andreeva said on Thursday that a deal between Greece and its creditors could be reached by August 20.

"What President Juncker himself said yesterday in an interview remains valid that the negotiations with the Greek authorities are 'progressing in a satisfactory way', that he believes 'an agreement this month preferably before August 20 is possible' because, as you know, August 20 is the date for an important payment to the ECB," she said.

According to the German newspaper Bild, the German government doubts that a deal on a third bailout programme for Greece can be reached in August. The government believes that Greece will need another bridge loan.

-

10:13

Greece repays €186.3 million loans to the International Monetary Fund

Greece repaid €186.3 million loans to the International Monetary Fund (IMF) on Thursday.

"Greece has paid the interest charges due to the IMF today," the IMF said in a statement.

The next Greek repayment to the IMF is scheduled for September 01.

-

08:47

France: Industrial Production, y/y, June 0.6%

-

08:46

Germany: Industrial Production (YoY), June 0.6%

-

08:45

France: Trade Balance, bln, June -2.7

-

08:45

France: Industrial Production, m/m, June -0.1% (forecast 0.2%)

-

08:22

Foreign exchange market. Asian session: the euro steady ahead of payrolls data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Home Loans June -7.3% Revised From -6.1% 5% 4.4%

03:00 Japan BoJ Interest Rate Decision 0% 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275 275

03:00 Japan BoJ Monetary Policy Statement

05:45 Switzerland Unemployment Rate (non s.a.) July 3.1% 3.1%

06:00 Germany Current Account June 11.8 Revised From 11.1 24.4

06:00 Germany Trade Balance June 19.6 24.0

The euro traded in a narrow range ahead of today's U.S. payrolls data. Investors expect a strong report, which could move expectations for a rate increase to an earlier date. Median forecast suggests 223,000 new jobs. Earlier ADP data missed expectations, but correlation between these two reports is low. That's why today's report still may raise probability of a rate hike in September.

The yen showed little reaction to the Bank of Japan decision to keep its monetary policy unchanged. The BOJ has also reiterated that the economy continued recovering at a moderate pace.

The Australian dollar advanced amid Reserve Bank of Australia statements and housing market data. The RBA cut its unemployment and GDP forecasts. GDP growth is likely to decline to 2.5%-3.5% by the end of the current year from 2.75%-3.75%. The RBA also said that accommodative monetary policy remained appropriate and signs that a weaker AUD supported the economy intensified. Meanwhile the Australian Bureau of Statistics reported that home loans rose by 4.4% in June from -7.3% (revised from -6.1%) reported previously.

EUR/USD: the pair declined to $1.0910 in Asian trade

USD/JPY: the pair traded Y124.65-85

GBP/USD: the pair traded within $1.5495-20

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:00 Germany Industrial Production s.a. (MoM) June 0.0% 0.3%

06:00 Germany Industrial Production (YoY) June 2.1%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln June -4.0

06:45 France Industrial Production, m/m June 0.4% 0.2%

06:45 France Industrial Production, y/y June 1.6%

07:00 United Kingdom Halifax house price index July 1.7%

07:00 United Kingdom Halifax house price index 3m Y/Y July 9.6%

08:30 United Kingdom Total Trade Balance June -0.393

12:30 Canada Building Permits (MoM) June -14.5% 5%

12:30 Canada Unemployment rate July 6.8% 6.8%

12:30 Canada Employment July -6.4 5

12:30 U.S. Average workweek July 34.5 34.5

12:30 U.S. Average hourly earnings July 0.0% 0.2%

12:30 U.S. Nonfarm Payrolls 223 223

12:30 U.S. Unemployment Rate July 5.3% 5.3%

14:00 Canada Ivey Purchasing Managers Index July 55.9 52

19:00 U.S. Consumer Credit June 16.09 17

-

08:16

Germany: Industrial Production s.a. (MoM), June -1.4% (forecast 0.3%)

-

08:01

Germany: Current Account , June 24.4

-

08:00

Germany: Trade Balance, June 24.0

-

07:45

Switzerland: Unemployment Rate (non s.a.), July 3.1%

-

06:53

Options levels on friday, August 7, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1060 (2391)

$1.1021 (3197)

$1.0964 (1287)

Price at time of writing this review: $1.0915

Support levels (open interest**, contracts):

$1.0887 (3422)

$1.0862 (6411)

$1.0829 (4227)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 58017 contracts, with the maximum number of contracts with strike price $1,1200 (4267);

- Overall open interest on the PUT options with the expiration date August, 7 is 67364 contracts, with the maximum number of contracts with strike price $1,0800 (6925);

- The ratio of PUT/CALL was 1.16 versus 1.20 from the previous trading day according to data from August, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5800 (1731)

$1.5700 (1661)

$1.5601 (2291)

Price at time of writing this review: $1.5509

Support levels (open interest**, contracts):

$1.5496 (1380)

$1.5399 (1207)

$1.5300 (1316)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22939 contracts, with the maximum number of contracts with strike price $1,5750 (3215);

- Overall open interest on the PUT options with the expiration date August, 7 is 23286 contracts, with the maximum number of contracts with strike price $1,5250 (2254);

- The ratio of PUT/CALL was 1.02 versus 1.03 from the previous trading day according to data from August, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:21

Japan: Bank of Japan Monetary Base Target, 275 (forecast 275)

-

05:16

Japan: BoJ Interest Rate Decision, 0%

-

03:30

Australia: Home Loans , June 4.4% (forecast 5%)

-

01:31

Australia: AiG Performance of Construction Index, July 47.1

-

00:32

Currencies. Daily history for Aug 6’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0924 +0,24%

GBP/USD $1,5514 -0,54%

USD/CHF Chf0,9806 +0,15%

USD/JPY Y124,71 -0,12%

EUR/JPY Y136,22 +0,10%

GBP/JPY Y193,47 -0,67%

AUD/USD $0,7344 -0,07%

NZD/USD $0,6551 +0,61%

USD/CAD C$ 1,3109 -0,50%

-

00:01

Schedule for today, Friday, Aug 7’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans June -6.1% 5%

03:00 BoJ Interest Rate Decision 0%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

05:45 Switzerland Unemployment Rate (non s.a.) July 3.1%

06:00 Germany Current Account June 11.1

06:00 Germany Trade Balance June 19.6

06:00 Germany Industrial Production s.a. (MoM) June 0.0% 0.3%

06:00 Germany Industrial Production (YoY) June 2.1%

06:30 Japan BOJ Press Conference

06:45 France Trade Balance, bln June -4.0

06:45 France Industrial Production, m/m June 0.4% 0.2%

06:45 France Industrial Production, y/y June 1.6%

07:00 United Kingdom Halifax house price index July 1.7%

07:00 United Kingdom Halifax house price index 3m Y/Y July 9.6%

08:30 United Kingdom Total Trade Balance June -0.393

12:30 Canada Building Permits (MoM) June -14.5% 5%

12:30 Canada Unemployment rate July 6.8% 6.8%

12:30 Canada Employment July -6.4 5

12:30 U.S. Average workweek July 34.5 34.5

12:30 U.S. Average hourly earnings July 0.0% 0.2%

12:30 U.S. Nonfarm Payrolls 223 223

12:30 U.S. Unemployment Rate July 5.3% 5.3%

14:00 Canada Ivey Purchasing Managers Index July 55.9

19:00 U.S. Consumer Credit June 16.09 17

-