Noticias del mercado

-

20:20

American focus: the dollar fell slightly

The US dollar fell slightly against the yen and the euro, as some investors open large positions ahead of the release of the July report, the Labor Department employment. Traders expect the Friday data will clarify the situation with the terms of higher interest rates and help to determine the future direction for the dollar.

Investors expect that the dollar will rise against the currencies of developed economies as they approach the Fed to raise short-term interest rates. Many believe that the data on the number of jobs outside agriculture in the USA, which will be published on Friday, bringing the central bank to ensure that the state to tighten monetary policy at the September meeting.

Higher interest rates could lead to an increase in return on assets denominated in dollars, thus increasing the attractiveness of the currency to investors.

The Fed is closely monitoring the data on the labor market and will analyze the July report for signals on increase of salaries and the level of involvement of the population in the labor force, and will also look for signs of a decline in unemployment. Economists predict that in July, was created 218,000 new jobs, which is consistent with an improving labor market situation.

Today published statistics on initial applications for unemployment insurance have little support to the dollar. The US Labor Department reported that the number of Americans who first applied for unemployment benefits, increased moderately last week but remained at a level which indicates an improvement in the labor market.

According to the report for the week ended August 1, the number of initial applications for unemployment benefits rose by 3,000 to a seasonally adjusted and reached 270 000. Economists had expected 273,000 new claims. The figure for the previous week was not revised (267,000). It is worth emphasizing the number of calls remained below the psychological threshold of 300 000 for 22 th consecutive week.

The Ministry of Labour said that the data of recent weeks reflect some seasonal volatility, as automakers shut plants for temporary service. It should be emphasized at the end of July the number of initial claims fell to 255,000, its lowest value since 1973.

Meanwhile, it became known that the moving average for 4 weeks, which smooths the volatile weekly figures, dropped to 6500 - up to 268 to 250 (at least from mid-May)

Meanwhile, the number of people who continue to receive unemployment benefits fell by 14,000 to 2.255 million. For the week ended July 25th. The figure for the previous week was revised to 2.269 million. To 2.262 million. Recall data on re-treatment come with a week delay.

The pound depreciated significantly against the dollar, reaching its lowest level since July 24, which was associated with the outcome of the meeting of the Bank of England. As expected, the Bank of England decided to leave its key rate at around 0.5%. The Committee also voted to leave intact the program of asset purchases at GBP 375 billion. The last time the Central Bank changed the rate, he lowered it to 0.5% by March 5, 2009. Minutes of the meeting of the Bank of England, published today, showed that MPC split vote in the first time since the beginning of this year. Representatives of the committee not agreed about whether to raise rates. According to the protocol, only one member of the MPC - Ian McCafferty - endorsed the rate increase. Markets had expected the Hawks will be 2. So, for the last time, in December, for a rate hike by 25 basis points We made McCafferty and Martin Weale. Now the Central Bank to raise rates implies in the first half of 2016: 1.0% to the end of 2016 and 1.5% by the end of 2017. Also, the Central Bank predicts the return of consumer prices to the target level of 2% over the next 2 years. Today the head of the Bank of England Carney stressed that the date of the rate increase has become closer, and the subsequent tightening will be gradual.

Pressure on the euro earlier had data for Germany. According to the report the Ministry of Economy of Germany, the volume of orders in the manufacturing sector in Germany in June rose sharply by 2%, exceeding the forecast of 0.2%. This is due to orders from outside the euro zone, as well as placing large orders. Thus, orders returned to the level of April 2008. The volume of export orders compared to May increased by 4.8%, supported by the decline of the euro, to increase the competitiveness of goods from the eurozone beyond. Orders within the country as compared to the previous month decreased by 2.0%.

Another report showed that construction sector in Germany continued to show expansion in July, but the growth rate slowed down to 6-month low. The seasonally adjusted index for the construction sector PMI fell to 50.6 from 50.7 in June. However, the index remained above 50, indicating expansion. Add the expansion of activity has marked the 6th consecutive month, but the latest growth was the weakest in this sequence.

The Swiss franc fell sharply against the US currency, updating yesterday's low, which was associated with the publication of weak statistics on Switzerland. As it became known, the level of consumer sentiment in Switzerland weakened sharply in the past month as the strong franc put pressure on future economic and financial expectations. This was announced by the results of studies of the State Secretariat for Economic Affairs (SECO). According to consumer confidence index fell to -19 in July compared to -6 in April. Experts expect that figure will drop only to -7. Consumer expectations for the future economic development deteriorated significantly in July - the corresponding index was -25 points in July compared with -8 points in April. At the same time, expectations for increased unemployment - rose to 65 in July from 51 points in April. We also add that households were more negative with respect to their future financial situation - the indicator fell to -4 points in July from 5 points in April. Consumers were also less optimistic about the level of their savings in the next 12 months compared with April. The data also showed that the sensor, which shows good if now is the time to make major purchases, fell in July to six from 15 in April.

-

17:12

NIESR’s gross domestic product rises by 0.7% in three months to July

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Thursday. The GDP estimate rose by 0.7% in three months to July, after a 0.7% growth in three months to June.

"We expect an average rate of growth of 2.5 per cent for 2015 as a whole," the NIESR said.

The think tank expects the Bank of England to raise its interest rate in February 2016.

-

16:55

German government doubts a deal on a third bailout programme for Greece can be reached in August

According to the German newspaper Bild, the German government doubts that a deal on a third bailout programme for Greece can be reached in August. The government believes that Greece will need another bridge loan.

Athens had to repay €3.4 billion loans to the European Central Bank on August 20.

-

16:17

Eurozone's retail PMI jumps to 54.2 in July

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Thursday. Eurozone's construction purchasing managers' index (PMI) jumped to 54.2 in July from 50.4 in June. It was the highest level since January 2011.

A reading above 50 indicates expansion in the sector.

Germany, France and Italy were the main contributors.

"July's retail PMI showed sales growth accelerating sharply as levels of trade rose across Germany, France and Italy. Each made positive strides since June though it was Germany that remained by far the brightest performer, recording a sharp increase in sales that was the fastest since late-2006," an economist at Markit, Phil Smith, said.

-

16:00

United Kingdom: NIESR GDP Estimate, July 0.7%

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E2.4bn), $1.0850(E1.1bn), $1.0950(E505mn), $1.1000(E402mn), $1.1050-55(E820mn)

USD/JPY: Y123.00($787mn), Y124.00($825mn), Y124.70-75($700mn), Y125.00($1.67bn)

GBP/USD: $1.5615(Gbp222mn)

AUD/USD: $0.7300(A$251mn), $0.7350-60(A$450mn)

NZD/USD: $0.6550(NZ$330mn)

AUD/NZD: NZ$1.1000(A$200mn)

USD/CAD: C$1.3050($490mn), C$1.3160($425mn)

-

15:44

Germany's construction PMI falls to 50.6 in July

Markit Economics released construction purchasing managers' index (PMI) for Germany on Thursday. Germany's construction purchasing managers' index (PMI) fell to 50.6 in July from 50.7 in June.

A reading above 50 indicates expansion in the sector.

The index was driven by lower commercial activity.

"The data highlighted that the sector is becoming more and more dependent on work on residential building projects, as civil engineering activity continued to decline at a marked pace and commercial building activity stagnated," an economist at Markit, Oliver Kolodseike, said.

-

15:25

Greek unemployment rate declines to 25.0% in May, the lowest level since June 2012

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 25.0% in May from 25.6% in April.

It was the lowest level since June 2012.

The number of unemployed fell to 1.201 million in May from 1.3 million a year ago.

The youth unemployment rate was 51.8% in May.

-

15:09

Bank of England Governor Mark Carney repeats that the time for interest rate hike is nearing

The Bank of England (BoE) Governor Mark Carney repeated at a press conference on Thursday that the time for interest rate hike is nearing.

"The likely timing of the first bank rate increase is drawing closer. However the exact timing of the first move cannot be predicted in advance," he said.

Carney added that the timing of the interest rate hike will depend on the economic data.

"The strength of sterling, and even taking into account the fiscal cosolidation that were going to see over the coming years and the weakness in global demand, we see robust private sector growth here and consistent with that is a need to begin to increase interest rates," the BoE governor noted.

-

14:57

Initial jobless claims rise by 3,000 to 270,000 in the week ending August 01

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending August 01 in the U.S. rose by 3,000 to 270,000 from 267,000 in the previous week.

Analysts had expected the number of initial jobless claims to be 273,000.

Jobless claims remained below 300,000 the 22th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 14,000 to 2,255,000 in the week ended July 25.

-

14:44

Bank of England's Monetary Policy Committee minutes: 8-1 split to keep monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its August meeting minutes on Thursday. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

Analysts had expected that at least two members will vote to hike interest rate.

The central bank said in its statement that the monetary policy will depend on the incoming economic data.

Most MPC members noted that the interest rate hike was not necessary.

-

14:34

Bank of England keeps its interest rate on hold at 0.5% in August

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

The central bank expects the inflation to reach 2% target by the third quarter of 2017, while Britain's economy is expected to expand 2.8% in 2015.

-

14:30

U.S.: Continuing Jobless Claims, July 2255 (forecast 2240)

-

14:30

U.S.: Initial Jobless Claims, August 270 (forecast 273)

-

14:19

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of the Bank of England’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Unemployment rate July 6.1% Revised From 6.0% 6% 6.3%

01:30 Australia Changing the number of employed July 7.0 Revised From 7.3 10 38.5

05:00 Japan Leading Economic Index (Preliminary) June 106.2 107.2

05:00 Japan Coincident Index (Preliminary) June 109.0 112.0

06:00 Germany Factory Orders s.a. (MoM) June -0.3% Revised From -0.2% 0.2% 2.0%

08:30 United Kingdom Industrial Production (MoM) June 0.3% Revised From 0.4% 0.1% -0.4%

08:30 United Kingdom Industrial Production (YoY) June 1.9% Revised From 2.1% 2.2% 1.5%

08:30 United Kingdom Manufacturing Production (YoY) June 1% 0.4% 0.5%

08:30 United Kingdom Manufacturing Production (MoM) June -0.6% 0.2% 0.2%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

11:00 United Kingdom BOE Inflation Letter

11:00 United Kingdom Bank of England Minutes

11:45 United Kingdom BOE Gov Mark Carney Speaks

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. initial jobless claims data. The number of initial jobless claims in the U.S. is expected to increase by 6,000 to 273,000.

The euro traded higher against the U.S. dollar despite the better-than-expected factory orders data from Germany. German seasonal adjusted factory orders climbed 2.0% in June, beating expectations for a 0.2% gain, after a 0.3% decline in May. May's figure was revised down from a 0.2% fall.

The increase was driven by rises in new orders from the Eurozone and from other countries. New orders from the Eurozone rose 2.3% in June, while orders from other countries increased 6.3%.

The British pound traded higher against the U.S. dollar after the release of the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its August meeting minutes today. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

The central bank expects the inflation to remain around zero for the next two months.

The Swiss franc traded lower against the U.S. dollar. The State Secretariat for Economic Affairs (SECO) released its consumer climate index for Switzerland on Thursday. The SECO consumer climate index plunged to -19 in July from -6 in April.

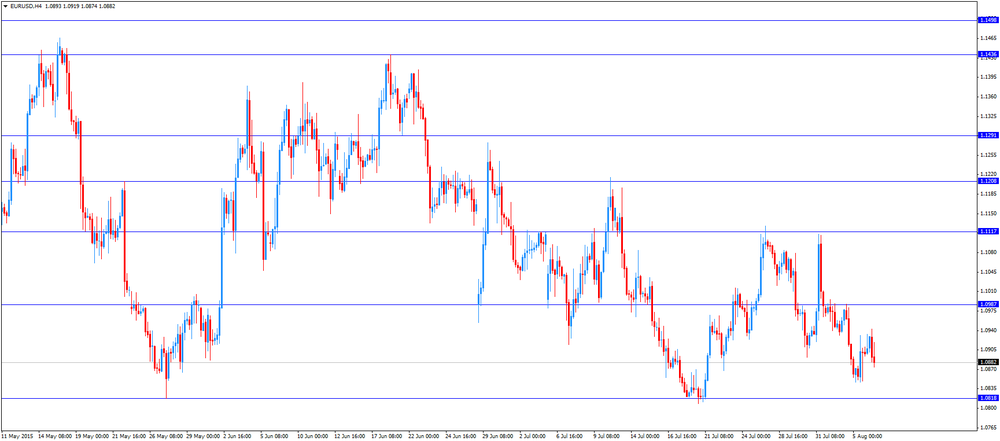

EUR/USD: the currency pair decreased to $1.0874

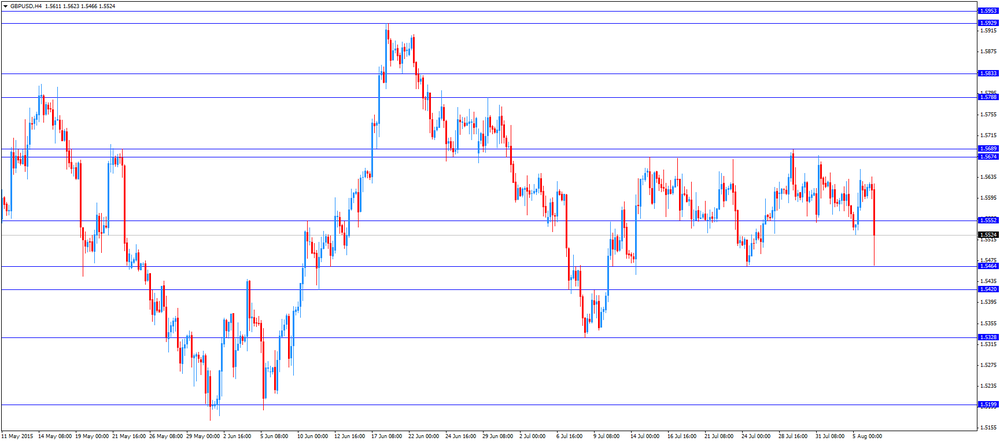

GBP/USD: the currency pair fell to $1.5466

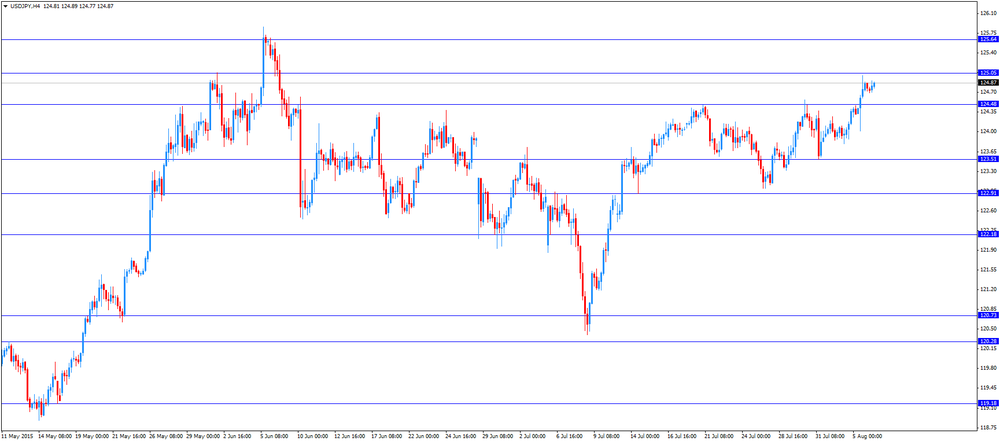

USD/JPY: the currency pair rose to Y124.91

The most important news that are expected (GMT0):

12:30 U.S. Initial Jobless Claims August 267 273

14:00 United Kingdom NIESR GDP Estimate July 0.7%

-

14:00

Orders

EUR/USD

Offers 1.0925-30 1.0950 1.0980 1.1000 1.1020 1.1050 1.1065 1.1080-85 1.1100

Bids 1.0880 1.0850 1.0820-25 1.0800 1.0780 1.0750 1.0725 1.0700

GBP/USD

Offers 1.5650 1.5680 1.5700-10 1.5725-30 1.5750 1.5780 1.5800

Bids 1.5600 1.5580 1.5545-50 1.5520-25 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7000 0.7025-30 0.7050 0.7080 0.7100 0.7125 0.7150-55 0.7180-85 0.7200

Bids 0.6965 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850 0.6830 0.6800

EUR/JPY

Offers 136.25 136.50 136.80 137.00 137.30 137.50

Bids 135.80 135.60 135.20 135.00 134.85 134.50 134.30 134.00

USD/JPY

Offers 125.00 125.30 125.50 125.75 126.00 126.25 126.50

Bids 124.70 124.50 124.25 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7345-50 0.7380 0.7400 0.7420-25 0.7450 0.7475 0.7500

Bids 0.7300 0.7280 0.7250 0.7230 0.7200 0.7180 0.7150

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

13:00

United Kingdom: Asset Purchase Facility, 375

-

11:41

SECO consumer climate index for Switzerland plunges to -19 in July

The State Secretariat for Economic Affairs (SECO) released its consumer climate index for Switzerland on Thursday. The SECO consumer climate index plunged to -19 in July from -6 in April.

The future economic expectations subindex dropped to -25 in July from -8 in April.

The unemployment trends subindex jumped to 65 in July from 51 in April.

The assessment of previous economic trends subindex fell to -36 in July from -22 in April.

The price trends over the last twelve months was down to -5 in July from -3 in April, while the future price trends subindex rose to +18 from +6.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E2.4bn), $1.0850(E1.1bn), $1.0950(E505mn), $1.1000(E402mn), $1.1050-55(E820mn)

USD/JPY: Y123.00($787mn), Y124.00($825mn), Y124.70-75($700mn), Y125.00($1.67bn)

GBP/USD: $1.5615(Gbp222mn)

AUD/USD: $0.7300(A$251mn), $0.7350-60(A$450mn)

NZD/USD: $0.6550(NZ$330mn)

AUD/NZD: NZ$1.1000(A$200mn)

USD/CAD: C$1.3050($490mn), C$1.3160($425mn)

-

11:18

House prices in the U.K. fall 0.6% in July

Halifax released its house prices data for the U.K. on Wednesday. House prices in the U.K. decreased 0.6% in July, after a 1.6% rise in June. June's figure was revised down from a 1.7% gain.

On a yearly basis, house prices climbed 7.9% in three months to July, after a 9.6% increase in three months to June. It was the slowest pace since December 2014.

"The underlying pace of house price growth remains robust notwithstanding the easing in July," Halifax's managing director for retail customer products, Stephen Noakes, said.

-

11:04

U.K. manufacturing production rises 0.2% in June, but industrial production declines 0.4%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Thursday. Manufacturing production in the U.K. rose 0.2% in June, in line with expectations, after a 0.6% decrease in May.

Manufacturing output was driven by a rise in the manufacture of weapons and ammunition, which jumped 31.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.5% in June, beating forecast of a 0.4% gain, after a 1.0% rise in May.

Industrial production in the U.K. dropped 0.4% in June, missing forecasts of a 0.1% rise, after a 0.3% gain in May. May's figure was revised down from 0.4% increase.

The decline in the industrial output was driven by a drop in oil and gas output. Oil and gas production plunged 5.8% in June, the biggest fall since January 2014.

On a yearly basis, industrial production in the U.K. gained 1.5% in June, missing expectations for a 2.2% rise, after a 1.9% increase in May. May's figure was revised down from 2.1% gain.

-

10:53

German seasonal adjusted factory orders climb 2.0% in June

Destatis released its factory orders data for Germany on Thursday. German seasonal adjusted factory orders climbed 2.0% in June, beating expectations for a 0.2% gain, after a 0.3% decline in May. May's figure was revised down from a 0.2% fall.

The increase was driven by rises in new orders from the Eurozone and from other countries. New orders from the Eurozone rose 2.3% in June, while orders from other countries increased 6.3%.

Foreign orders climbed by 4.8% in June, while domestic orders decreased by 2.0%.

Orders of the intermediate goods fell by 0.2% in June, capital goods orders were up 3.7%, while consumer goods orders decreased 0.6%.

-

10:43

Australia's unemployment rate is up to 6.3% in July

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.3% in July from 6.1% in June, missing expectations for a decline to 6.0%. June's figure was revised up from 6.0%.

The number of employed people in Australia climbed by 38,500 in July, beating forecast of a rise by 10,000, after a gain by 7,000 in June. June's figure was revised down from a rise by 7,300.

Full-time employment rose by 12,400, while part-time employment climbed by 26,100.

The participation rate was 65.1%.

-

10:34

Portugal’s unemployment rate declines to 11.9% in the second quarter

Statistics Portugal released its labour market data on Wednesday. The unemployment rate declined to 11.9% in the second quarter from 13.7% in the first quarter, the lowest level since the fourth quarter of 2010.

The number of unemployed persons fell to 620,400 in the second quarter from 712,900 in the first quarter.

The youth jobless rate decreased to 29.8% in the second quarter from 34.4% in the previous quarter.

The number of persons employed rose to 4.58 million from 4.48 million. The participation rate was up to 58.6% from 58.5%.

-

10:30

United Kingdom: Manufacturing Production (YoY), June 0.5% (forecast 0.4%)

-

10:30

United Kingdom: Industrial Production (YoY), June 1.5% (forecast 2.2%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , June 0.2% (forecast 0.2%)

-

10:30

United Kingdom: Industrial Production (MoM), June -0.4% (forecast 0.1%)

-

10:25

NIESR expects Britain’s economy to expand 2.5% in 2015

The National Institute of Economic and Social Research (NIESR) said on Wednesday that it expect Britain's economy to expand 2.5% in 2015, driven by consumption and business investment.

The think tank also expects the inflation to remain around zero throughout the rest of this year, while the unemployment rate is expected to run in the range between 5.0% and 5.5%. A stronger pound and low oil prices weigh on the inflation.

The inflation is expected to increase toward the BoE's 2.0% target by 2017.

The NIESR said that the BoE will start raising its interest rate in the first quarter of 2016 and will reach 2% per annum by 2019.

An absolute budget surplus is expected to be reached in 2019-2020.

-

10:11

European Central Bank decided not to raise the amount of emergency funding (ELA)

The European Central Bank (ECB) decided not to raise the amount of emergency funding (ELA) on Wednesday. The amount the Greek central bank can lend its banks totals around €91.0 billion.

Sources familiar with the situation said that Greek banks have built up a liquidity buffer of around €5 billion.

The ECB will review ELA in two weeks.

The Greek government is negotiating with its creditors the third bailout programme.

-

09:48

Foreign exchange market. Asian session: the pound rose ahead of MPC meeting

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Unemployment rate July 6.1% Revised From 6.0% 6% 6.3%

01:30 Australia Changing the number of employed July 7.0 Revised From 7.3 10 38.5

05:00 Japan Leading Economic Index (Preliminary) June 106.2 107.2

05:00 Japan Coincident Index (Preliminary) June 109.0 112.0

06:00 Germany Factory Orders s.a. (MoM) June -0.3% Revised From -0.2% 0.2% 2.0%

The sterling advanced against the dollar ahead of today's Bank of England meeting. Starting from January all members of the Monetary Policy Committee voted to keep the bank's benchmark rate at 0.5%. MPC members voted so in July too, however there are signs that policymakers are getting ready to raise rates. Economists expect two members of the committee to vote for a rate hike. Today the BOE will announce its interest rate decision and publish minutes of its meeting and updated economic forecasts at once for the first time.

The euro rose due to disappointing data on employment in private sector of the U.S. economy. Nevertheless the single currency is still under pressure ahead of U.S. payrolls data, which will be published tomorrow.

The Australian dollar surged and then gave up its gains amid economic data. The unemployment rate rose by 0.3% to 6.3% in July. Analysts expected the index to come in at 6%.

EUR/USD: the pair traded above $1.0900 in Asian trade

USD/JPY: the pair traded around Y124.75

GBP/USD: the pair rose to $1.5625

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Industrial Production (MoM) June 0.4% 0.1%

08:30 United Kingdom Industrial Production (YoY) June 2.1% 2.2%

08:30 United Kingdom Manufacturing Production (YoY) June 1% 0.4%

08:30 United Kingdom Manufacturing Production (MoM) June -0.6% 0.2%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375

11:00 United Kingdom MPC Rate Statement

11:45 United Kingdom BOE Financial Stability Report

12:30 U.S. Continuing Jobless Claims July 2262 2240

12:30 U.S. Initial Jobless Claims August 267 273

14:00 United Kingdom NIESR GDP Estimate July 0.7%

23:30 Australia AiG Performance of Construction Index July 46.4

-

08:27

Options levels on thursday, August 6, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1062 (2486)

$1.1021 (2799)

$1.0957 (1010)

Price at time of writing this review: $1.0923

Support levels (open interest**, contracts):

$1.0880 (4194)

$1.0844 (6015)

$1.0815 (4118)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 56222 contracts, with the maximum number of contracts with strike price $1,1200 (4300);

- Overall open interest on the PUT options with the expiration date August, 7 is 67433 contracts, with the maximum number of contracts with strike price $1,0800 (7054);

- The ratio of PUT/CALL was 1.20 versus 1.24 from the previous trading day according to data from August, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1199)

$1.5801 (1763)

$1.5703 (1673)

Price at time of writing this review: $1.5624

Support levels (open interest**, contracts):

$1.5593 (1647)

$1.5497 (1646)

$1.5399 (1213)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22715 contracts, with the maximum number of contracts with strike price $1,5750 (3228);

- Overall open interest on the PUT options with the expiration date August, 7 is 23387 contracts, with the maximum number of contracts with strike price $1,5250 (2254);

- The ratio of PUT/CALL was 1.03 versus 1.04 from the previous trading day according to data from August, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Factory Orders s.a. (MoM), June 2.0% (forecast 0.2%)

-

07:16

Japan: Leading Economic Index , June 107.2

-

07:16

Japan: Coincident Index, June 112.0

-

03:30

Australia: Unemployment rate, July 6.3% (forecast 6%)

-

03:30

Australia: Changing the number of employed, July 38.5 (forecast 10)

-

00:34

Currencies. Daily history for Aug 5’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0898 +0,08%

GBP/USD $1,5598 +0,22%

USD/CHF Chf0,9791 +0,16%

USD/JPY Y124,86 +0,40%

EUR/JPY Y136,09 +0,49%

GBP/JPY Y194,76 +0,62%

AUD/USD $0,7349 -0,41%

NZD/USD $0,6511 -0,55%

USD/CAD C$1,3175 -0,08%

-

00:00

Schedule for today,Thursday, Aug 6’2015:

(time / country / index / period / previous value / forecast)

1:30 Australia Unemployment rate July 6.0% 6%

01:30 Australia Changing the number of employed July 7.3 15

05:00 Japan Leading Economic Index (Preliminary) June 106.2

05:00 Japan Coincident Index (Preliminary) June 109.0

06:00 Germany Factory Orders s.a. (MoM) June -0.2% 0.2%

08:30 United Kingdom Industrial Production (MoM) June 0.4% 0.1%

08:30 United Kingdom Industrial Production (YoY) June 2.1% 2.2%

08:30 United Kingdom Manufacturing Production (YoY) June 1% 0.4%

08:30 United Kingdom Manufacturing Production (MoM) June -0.6% 0.2%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375

11:00 United Kingdom MPC Rate Statement

11:45 United Kingdom BOE Financial Stability Report

12:30 U.S. Continuing Jobless Claims July 2262 2240

12:30 U.S. Initial Jobless Claims August 267 273

14:00 United Kingdom NIESR GDP Estimate July 0.7%

23:30 Australia AiG Performance of Construction Index July 46.4

-