Noticias del mercado

-

16:30

U.S.: Crude Oil Inventories, July -4.407 (forecast -1.95)

-

16:25

ISM non-manufacturing purchasing managers’ index hits the highest level since August 2005

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index soared to 60.3 in July from 56.0 in June, exceeding expectations for an increase to 56.2. It was the highest level since August 2005.

A reading above 50 indicates a growth in the service sector.

The increase was driven by rises in in business activity, employment and new orders.

The business activity/production index rose to 64.9 in July from 61.5 in June, the highest level since December 2004.

The ISM's new orders index increased to 63.8 in July from 58.3 in June, the highest level since August 2005.

The ISM's employment index climbed to 59.6 in July from 52.7 in June, the highest level since August 2005.

-

16:04

Makit’s final U.S. services PMI is up to 55.7 in July

Markit Economics released its final services purchasing managers' index (PMI) for the U.S. on Wednesday. The final U.S. services PMI rose to 55.7 in July from 54.8 in June, up from the preliminary reading of 55.2.

A reading over 50 indicates expansion in the sector.

The increase was driven by a faster pace in new work.

"Growth has clearly slowed compared to this time last year, and a further drop in service sector companies' optimism about the year ahead to one of the lowest seen over the past five years indicates that firms are expecting growth to slip further in coming months. Hiring could soon wane unless business confidence picks up again soon," Markit Economics Chief Economist Chris Williamson noted.

-

16:00

U.S.: ISM Non-Manufacturing, July 60.3 (forecast 56.2)

-

15:52

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E778mn), $1.0945-50(E600mn), $1.1000(E251mn)

USD/JPY: Y123.70($300mn), Y125.00($500mn)

AUD/USD: $0.7300(A$821mn), $0.7390-0.7400(A$250mn)

AUD/JPY: Y89.00(A$1.184bn), Y91.00(A$1.238bn), Y93.00(A$1.235bn)

-

15:47

Federal Reserve Governor Jerome Powell: the Fed has not decided whether to hike interest rates or not

Federal Reserve Governor Jerome Powell said on Wednesday that the U.S. labour market continues to strengthen. He added that he did not make a decision whether interest rates should be hiked next month.

"Nothing has been decided and I haven't made any decisions of what I would support and certainly the committee hasn't," Powell said.

Fed governor added that he is awaiting the release of the incoming economic data.

-

15:45

U.S.: Services PMI, July 39.1 (forecast 55.2)

-

15:21

Industrial production in Italy declines 1.1% in June

The Italian statistical office Istat released its industrial production data on Wednesday. Industrial production in Italy declined at a seasonally-adjusted rate of 1.1% in June, after a 0.9% gain in May.

Output in the manufacturing sector dropped at an annual rate of 1.1% in June, while production in the capital goods sector was down 1.3%.

On a yearly basis, industrial production in Italy fell at a seasonally-adjusted rate of 0.3% in June, after a 3.1% increase in May.

-

15:07

U.S. trade deficit widens to $43.84 billion in June

The U.S. Commerce Department released the trade data on Wednesday. The U.S. trade deficit widened to $43.84 billion in June from a deficit of $40.94 billion in May. May's figure was revised up from a deficit of $41.87 billion.

Analysts had expected a trade deficit of $42.8 billion.

The rise of a deficit was driven by lower exports. Exports fell by 0.1% in June, while imports increased by 1.2%, driven by Imports of food and automobiles.

A stronger U.S. dollar weighs on exports as it makes U.S. goods and services less affordable abroad. Weak overseas demand also weighed on exports.

Exports to the European Union declined 2.3% in June, exports to Canada were down 0.1%, exports to China jumped by 10.6%, while exports to Mexico were up.

Imports from China climbed 4.9% in June.

-

14:54

Canada's trade deficit narrows to C$0.48 billion in June

Statistics Canada released the trade data on Wednesday. Canada's trade deficit narrowed to C$0.48 billion in June from a deficit of C$3.37 billion in May. May's figure was revised down from a deficit of C$3.34 billion.

Analysts had expected a trade deficit of C$2.8 billion.

The decrease in deficit was driven by an increase in exports. Exports jumped 6.3% in June.

Exports of energy products climbed by 3.7% in June, exports of consumer goods jumped 17.2%, while exports of metal and non-metallic mineral products soared 10.8%.

Imports fell 0.6% in June.

Imports of aircraft and other transportation equipment and parts dropped by 19.0% in June, imports of metal and non-metallic mineral products rose 3.6%, while imports of energy products plunged 10.4%.

-

14:44

ADP report: private sector adds 185,000 jobs in July

Private sector in the U.S. added 185,000 jobs in July, according the ADP report on Wednesday. June's figure was revised down to 229,000 jobs from a previous reading of 237,000 jobs.

Analysts expected the private sector to add 215,000 jobs.

"Job growth is strong, but it has moderated since the beginning of the year. Layoffs in the energy industry and weaker job gains in manufacturing are behind the slowdown. Nonetheless, even at this slower pace of growth, the labour market is fast approaching full employment," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.3% in July. The U.S. economy is expected to add 218,000 jobs in July, after adding 223,000 jobs in June.

-

14:38

Spian’s services PMI jumps to 59.7 in July

Markit Economics released final services purchasing managers' index (PMI) for Spain on Wednesday. Spain's final services purchasing managers' index (PMI) climbed to 59.7 in July from 56.1 in June.

"Improvements in the labour market have been the key feature of this month's PMI surveys, with the combined rise in employment across manufacturing and services the strongest since early-2007. We can therefore expect to see further reductions in the unemployment rate in coming months, with this hopefully feeding through into improving demand," Senior Economist at Markit Andrew Harker said.

-

14:30

Canada: Trade balance, billions, June -0.48 (forecast -2.8)

-

14:30

U.S.: International Trade, bln, June -43.84 (forecast -42.8)

-

14:24

Italy’s services PMI declines to 52.0 in July

Markit/ADACI's services purchasing managers' index (PMI) for Italy was down to 52.0 in July from 53.4 in June.

A reading above 50 indicates expansion in the sector.

The fall was driven by a decline in employment.

"The service sector maintained its recent growth spell at the start of the third quarter and has now expanded in each of the past five months - the longest sequence since 2010. However, rather than building momentum, as is the case in manufacturing, growth appears to be fixed in a low gear," an economist at Markit Phil Smith said.

-

14:15

U.S.: ADP Employment Report, July 185 (forecast 215)

-

14:12

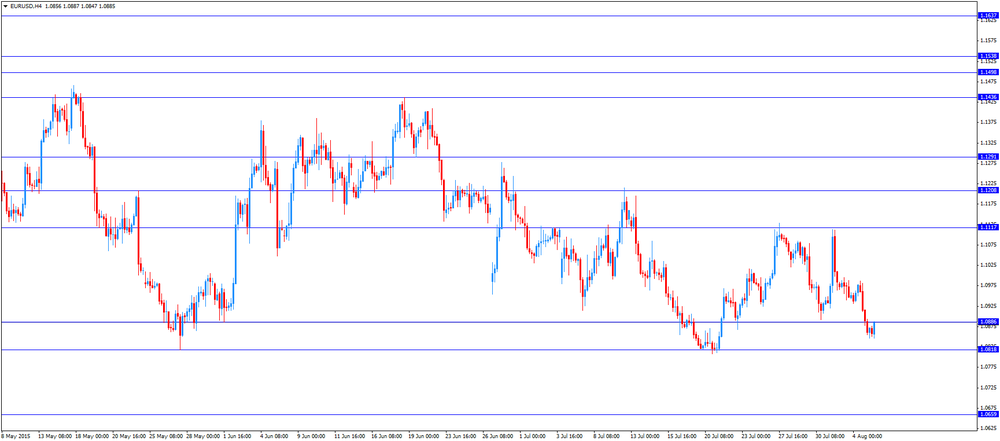

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:45 China Markit/Caixin Services PMI July 51.8 53.8

07:15 Switzerland Consumer Price Index (YoY) July -1.0% -1.1% -1.3%

07:15 Switzerland Consumer Price Index (MoM) July 0.1% -0.4% -0.6%

07:50 France Services PMI (Finally) July 54.1 52 52

07:55 Germany Services PMI (Finally) July 53.8 53.7 53.8

08:00 Eurozone Services PMI (Finally) July 54.4 53.8 54

08:30 United Kingdom Purchasing Manager Index Services July 58.5 58 57.4

09:00 Eurozone Retail Sales (MoM) June 0.1% Revised From 0.2% -0.3% -0.6%

09:00 Eurozone Retail Sales (YoY) June 2.6% Revised From 2.4% 1.9% 1.2%

11:00 U.S. MBA Mortgage Applications July 0.8% 4.7%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. economic data. According to the ADP employment report, the U.S. economy is expected to add 215,000 jobs.

The U.S. trade deficit is expected to widen to $42.8 billion in June from $41.87 billion in May.

The ISM non-manufacturing purchasing managers' index is expected to rise to 56.2 in July from 56.0 in June.

The euro traded higher against the U.S. dollar after the mixed economic data from the Eurozone. Retail sales in the Eurozone dropped 0.6% in June, missing expectations for a 0.3% fall, after a 0.1% increase in May. May's figure was revised down from a 0.2% rise.

The increase was driven by lower food, drinks and tobacco and non-food sales. Food, drinks and tobacco sales declined 0.8% in June, while non-food sales decreased 0.2% in May.

Gasoline sales were flat in June.

On a yearly basis, retail sales in the Eurozone rose 1.2% in June, missing forecasts of a 1.9% gain, after a 2.6% increase in May. May's figure was revised up from a 2.4% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Non-food sales gained 2.3% in June, gasoline sales increased 1.8%, while food, drinks and tobacco sales rose 0.1%.

Eurozone's final services purchasing managers' index (PMI) decreased to 54.0 in July from 54.4 in June, up from the preliminary reading of 53.8.

The index was driven by rises in new business and employment.

Eurozone's final composite output index fell to 53.9 in July from 54.2 in June, up from the preliminary reading of 53.7.

"The Eurozone economy showed reassuring resilience in the face of the Greek debt crisis in July. Despite a record deterioration in Greek business conditions amid extended bank closures, the overall pace of economic growth across the region barely slowed from June's four-year high," Chief Economist at Markit Chris Williamson said.

He added that Eurozone's GDP expanded 0.4% in the second quarter, according to the recent data.

Germany's final services purchasing managers' index (PMI) remained unchanged at 53.8 in July, up from the preliminary reading of 53.7.

The index was driven by rises in business activity and new orders.

France's final services purchasing managers' index (PMI) dropped to 52.0 in July from 54.1 in June, in line with the preliminary reading.

The decline was partly driven by a weaker rise in incoming new business.

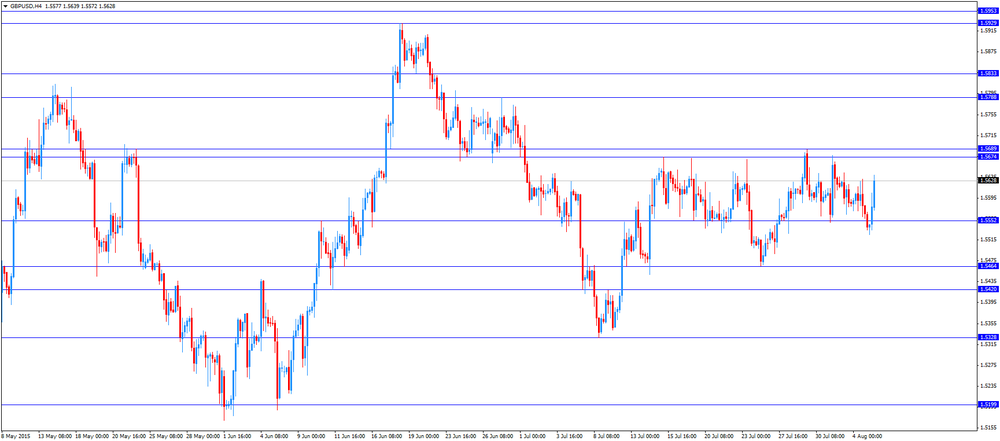

The British pound traded higher against the U.S. dollar despite the weaker-than-expected the services PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 57.4 in July from 58.5 in June, missing expectations for a decline to 58.0.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in employment.

"A deterioration in service sector growth is the latest in a stream of signals that the economy has slowed as we move into the second half of the year. The fall in the services PMI follows signs of ongoing weakness in manufacturing and a renewed slowing in the construction sector," the Chief Economist at Markit Chris Williamson said.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian trade data. The Canadian trade deficit is expected to narrow to C$2.8 billion in June from C$3.34 billion in May.

The Swiss franc traded mixed against the U.S. dollar after the weaker-than-expected consumer price inflation data from Switzerland. Switzerland's consumer price index declined 0.6% in July, missing expectations for a 0.4% decrease, after a 0.1% rise in June.

On a yearly basis, Switzerland's consumer price index decreased to -1.3% in July from -1.0% in June, missing forecasts of a 1.1% decline.

EUR/USD: the currency pair increased to $1.0887

GBP/USD: the currency pair rose to $1.5639

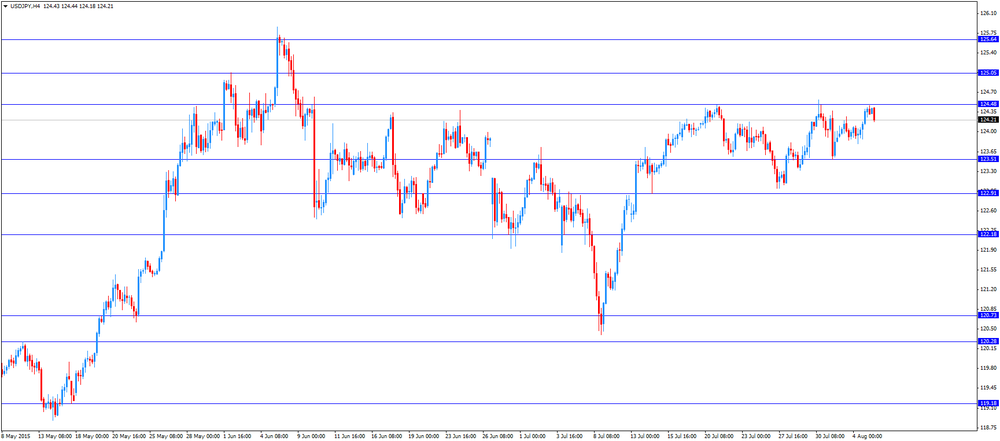

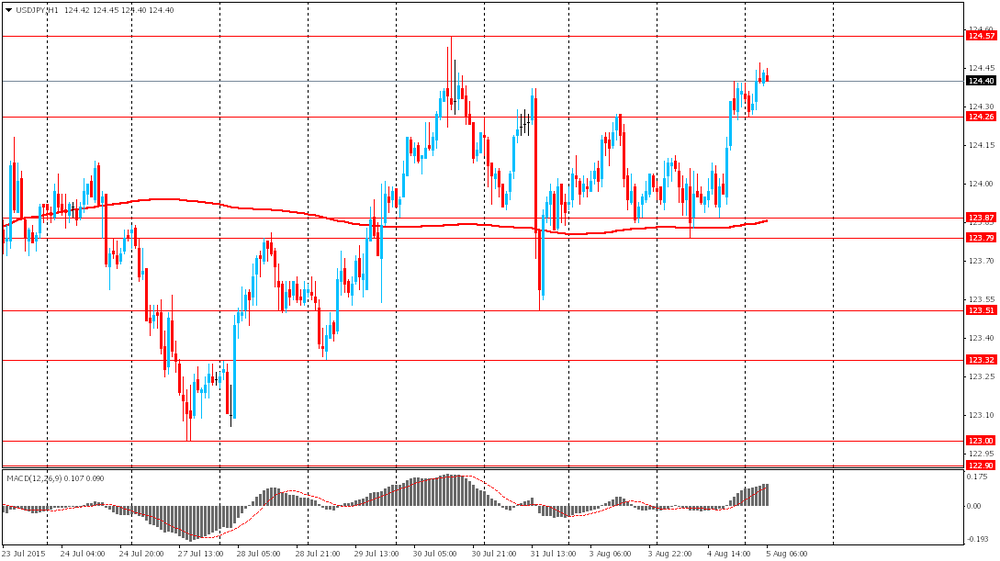

USD/JPY: the currency pair fell to Y124.18

The most important news that are expected (GMT0):

12:15 U.S. ADP Employment Report July 237 215

12:30 Canada Trade balance, billions June -3.34 -2.8

12:30 U.S. International Trade, bln June -41.87 -42.8

14:00 U.S. ISM Non-Manufacturing July 56 56.2

-

13:45

Orders

EUR/USD

Offers 1.0885 1.0900 1.0930 1.0950 1.0980 1.1000 1.1020 1.1050 1.1065 1.1080-85 1.1100

Bids 1.0840 1.0820-25 1.0800 1.0780 1.0750 1.0725 1.0700

GBP/USD

Offers 1.5585 1.5600 1.5620-25 1.5650 1.5680 1.5700-10 1.5725-30 1.5750

Bids 1.5540 1.5520-25 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7000 0.7025-30 0.7050 0.7080 0.7100 0.7125 0.7150-55 0.7180-85 0.7200

Bids 0.6965 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850 0.6830 0.6800

EUR/JPY

Offers 135.50 135.80 136.00 136.80 137.00 137.30 137.50

Bids 135.00 134.85 134.50 134.30 134.00

USD/JPY

Offers 124.50 124.75 125.00 125.30 125.50

Bids 124.25 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7385 0.7400 0.7420-25 0.7450 0.7475 0.7500

Bids 0.7325-30 0 0.7300 0.7280 0.7250 0.7230 0.7200 0.7180 0.7150

-

13:01

U.S.: MBA Mortgage Applications, July 4.7%

-

11:54

Switzerland’s consumer price inflation is down 0.6% in July

The Swiss Federal Statistics Office released its consumer inflation data on Wednesday. Switzerland's consumer price index declined 0.6% in July, missing expectations for a 0.4% decrease, after a 0.1% rise in June.

On a yearly basis, Switzerland's consumer price index decreased to -1.3% in July from -1.0% in June, missing forecasts of a 1.1% decline.

Food and beverages prices dropped at an annual rate of 1.5% in July, clothing and footwear prices fell 0.1%, while housing and energy prices declined 0.5%.

Education costs increased by 1.2%.

-

11:44

Eurozone’s retail sales drops 0.6% in June

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone dropped 0.6% in June, missing expectations for a 0.3% fall, after a 0.1% increase in May. May's figure was revised down from a 0.2% rise.

The increase was driven by lower food, drinks and tobacco and non-food sales. Food, drinks and tobacco sales declined 0.8% in June, while non-food sales decreased 0.2% in May.

Gasoline sales were flat in June.

On a yearly basis, retail sales in the Eurozone rose 1.2% in June, missing forecasts of a 1.9% gain, after a 2.6% increase in May. May's figure was revised up from a 2.4% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Non-food sales gained 2.3% in June, gasoline sales increased 1.8%, while food, drinks and tobacco sales rose 0.1%.

-

11:37

UK’s services PMI falls to 57.4 in July

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 57.4 in July from 58.5 in June, missing expectations for a decline to 58.0.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in employment.

"A deterioration in service sector growth is the latest in a stream of signals that the economy has slowed as we move into the second half of the year. The fall in the services PMI follows signs of ongoing weakness in manufacturing and a renewed slowing in the construction sector," the Chief Economist at Markit Chris Williamson said.

-

11:29

Eurozone's final services PMI decreases to 54.0 in July

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) decreased to 54.0 in July from 54.4 in June, up from the preliminary reading of 53.8.

The index was driven by rises in new business and employment.

Eurozone's final composite output index fell to 53.9 in July from 54.2 in June, up from the preliminary reading of 53.7.

"The Eurozone economy showed reassuring resilience in the face of the Greek debt crisis in July. Despite a record deterioration in Greek business conditions amid extended bank closures, the overall pace of economic growth across the region barely slowed from June's four-year high," Chief Economist at Markit Chris Williamson said.

He added that Eurozone's GDP expanded 0.4% in the second quarter, according to the recent data.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E778mn), $1.0945-50(E600mn), $1.1000(E251mn)

USD/JPY: Y123.70($300mn), Y125.00($500mn)

AUD/USD: $0.7300(A$821mn), $0.7390-0.7400(A$250mn)

AUD/JPY: Y89.00(A$1.184bn), Y91.00(A$1.238bn), Y93.00(A$1.235bn)

-

11:17

Germany's final services PMI remains unchanged at 53.8 in July

Markit Economics released final services purchasing managers' index (PMI) for Germany on Wednesday. Germany's final services purchasing managers' index (PMI) remained unchanged at 53.8 in July, up from the preliminary reading of 53.7.

The index was driven by rises in business activity and new orders.

"The latest set of PMI results suggest that Germany's private sector continued to grow at a solid pace heading into the second semester of 2015. The combined output of the service and manufacturing sectors increased at an above average rate and companies reported further growth of new business. With employment levels rising further and some firms signalling ongoing spare capacity at their units, there is plenty of scope for further improvements in coming months," an economist at Markit, Oliver Kolodseike, said.

-

11:12

France's final services PMI declines to 52.0 in July

Markit Economics released final services purchasing managers' index (PMI) for France on Wednesday. France's final services purchasing managers' index (PMI) dropped to 52.0 in July from 54.1 in June, in line with the preliminary reading.

The decline was partly driven by a weaker rise in incoming new business.

"The service sector looks to be still struggling to generate much upward momentum in a persistently subdued demand environment. A return to job cutting and dip in business expectations in the latest survey period suggests that companies are far from convinced about the recovery and that last month's stronger numbers may have been something of a false dawn," Senior Economist at Markit Jack Kennedy said.

-

11:04

Federal Reserve Bank of Atlanta President Dennis Lockhart: the U.S. economy is ready for the first interest rate hike

Federal Reserve Bank of Atlanta President Dennis Lockhart said on Tuesday that the U.S. economy is ready for the first interest rate hike. He added that only a "significant deterioration" in the economic data could convince him not to raise interest rates.

"I think there is a high bar right now to not acting, speaking for myself," Lockhart said.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

11:01

Eurozone: Retail Sales (YoY), June 1.2% (forecast 1.9%)

-

11:01

Eurozone: Retail Sales (MoM), June -0.6% (forecast -0.3%)

-

10:58

Greek government plans to reach an agreement with its creditors within two weeks

The Greek government plans to reach an agreement with its creditors within two weeks. It is important for Greece to reach a deal until August 20 as it has to repay €3.5 billion loans to the European Central Bank.

The third Greek bailout programme is expected to be up to €86 billion. If a deal is not reached, Greece will need the next bridge loan.

-

10:52

New Zealand’s unemployment rate climbs to 5.9% in the second quarter

Statistics New Zealand released its labour market data on late Tuesday evening. The unemployment rate rose to 5.9% in the second quarter from 5.8% in the first quarter, in line with expectations.

Employment increased 0.3% in the second quarter, after a 0.7% gain in the first quarter, missing expectations for a 0.5% rise.

The participation rate declined by 0.2% to 69.3% in the second quarter.

"Even though employment grew over the quarter, population growth was greater, which resulted in a lower overall employment rate for New Zealand," labour market and household statistics manager Diane Ramsay said.

-

10:45

Chinese Caixin/Markit services PMI increases to 53.8 in July

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China increased to 53.8 in July from 51.8 in June. It was the highest level since August 2014.

A reading above 50 indicates expansion in the sector.

The new business sub-index rose to 54.0 in July from 54.2 in June, while the employment sub-index also increased. Input prices and selling prices climbed in July.

-

10:39

Canadian manufacturing PMI declines to 50.8 in July

RBC released its RBC Canadian manufacturing PMI on Tuesday. The index declined to 50.8 in July from 51.3 in June.

"The RBC PMI indicates a second consecutive month of improving business conditions in July though still at a very modest pace and slightly below that achieved in June. As we enter the second half the year, a strengthening U.S. economy and weaker Canadian dollar should provide a greater boost to exports and business conditions for manufacturers," RBC assistant chief economist, Paul Ferley, said.

-

10:30

United Kingdom: Purchasing Manager Index Services, July 57.4 (forecast 58)

-

10:27

New York’s current business conditions index rises to 68.8 in July

The Institute for Supply Management (ISM) released its business condition index for New York on Tuesday. The current business conditions index rose to 68.8 in July from 63.1 in June.

The gain was driven by the employment subindex, which jumped to 64.8.

The six-month outlook fell to 69.2 in July from 78.0 in June, while the inflation gauge declined below 50.

-

10:14

OECD: consumer price inflation in the OECD area remains unchanged at 0.6% year-on-year in June

OECD released its consumer price inflation (CPI) data. Consumer price inflation in the OECD area remained unchanged at 0.6% year-on-year in June.

Energy prices dropped at an annual rate of 9.3% in June, food prices decreased to 1.5% in June from 1.6% in May.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.6% in June.

June's CPI was up 0.3% in France, 0.9% in Canada, and 0.1% in Italy. The consumer price inflation in Greece fell 2.2% in June.

-

10:00

Eurozone: Services PMI, July 54 (forecast 53.8)

-

09:55

Germany: Services PMI, July 53.8 (forecast 53.7)

-

09:50

France: Services PMI, July 51.5 (forecast 52)

-

09:15

Switzerland: Consumer Price Index (YoY), July -1.3% (forecast -1.1%)

-

09:15

Switzerland: Consumer Price Index (MoM) , July -0.6% (forecast -0.4%)

-

08:30

Options levels on wednesday, August 5, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1062 (2218)

$1.1021 (2552)

$1.0957 (892)

Price at time of writing this review: $1.0863

Support levels (open interest**, contracts):

$1.0840 (6329)

$1.0812 (4010)

$1.0778 (7349)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 55256 contracts, with the maximum number of contracts with strike price $1,1200 (4323);

- Overall open interest on the PUT options with the expiration date August, 7 is 68787 contracts, with the maximum number of contracts with strike price $1,0800 (7349);

- The ratio of PUT/CALL was 1.24 versus 1.23 from the previous trading day according to data from August, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5801 (1707)

$1.5702 (1263)

$1.5605 (2147)

Price at time of writing this review: $1.5542

Support levels (open interest**, contracts):

$1.5496 (1596)

$1.5399 (1255)

$1.5300 (1330)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22215 contracts, with the maximum number of contracts with strike price $1,5750 (3189);

- Overall open interest on the PUT options with the expiration date August, 7 is 23098 contracts, with the maximum number of contracts with strike price $1,5250 (2263);

- The ratio of PUT/CALL was 1.04 versus 1.05 from the previous trading day according to data from August, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:13

Foreign exchange market. Asian session: the dollar advanced against major currencies

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:45 China Markit/Caixin Services PMI July 51.8 53.8

The dollar continued to strengthen against major currencies after Federal Reserve Bank of Atlanta President Dennis Lockhart said yesterday that the economy is ready for higher short-term interest rates and only significant falls in data could change his opinion.

The euro weakened ahead of U.S. payrolls data due Friday.

Lockhart's statement pushed the Australian dollar down. However the AUD was slightly supported by China services sector data. The Caixin/Markit PMI rose to 53.8 in July from June's reading of 51.8, reaching the highest level since August 2014. New orders grew further and employment in the services sector continued rising.

The New Zealand dollar fell amid weak labor market data. The seasonally adjusted unemployment level came in at 5.9% in the second quarter after it posted 5.8% in the first quarter. This reading matched expectations. Growing unemployment points to lack of growth in the country's labor market and weakens the kiwi.

EUR/USD: the pair fell to $1.0845 in Asian trade

USD/JPY: the pair rose to Y124.45

GBP/USD: the pair fell to $1.5525

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:15 Switzerland Consumer Price Index (YoY) July -1.0% -1.1%

07:15 Switzerland Consumer Price Index (MoM) July 0.1% -0.4%

07:50 France Services PMI (Finally) July 54.1 52

07:55 Germany Services PMI (Finally) July 53.8 53.7

08:00 Eurozone Services PMI (Finally) July 54.4 53.8

08:30 United Kingdom Purchasing Manager Index Services July 58.5 58

09:00 Eurozone Retail Sales (MoM) June 0.2% -0.3%

09:00 Eurozone Retail Sales (YoY) June 2.4% 1.9%

11:00 U.S. MBA Mortgage Applications July 0.8%

12:15 U.S. ADP Employment Report July 237 215

12:30 Canada Trade balance, billions June -3.34 -2.8

12:30 U.S. International Trade, bln June -41.87 -42.8

13:45 U.S. Services PMI (Finally) July 54.8 55.2

14:00 U.S. ISM Non-Manufacturing July 56 56.2

14:30 U.S. Crude Oil Inventories July -4.203 -1.95

-

01:31

Australia: AIG Services Index, July 54.1

-

00:45

New Zealand: Unemployment Rate, Quarter II 5.9% (forecast 5.9%)

-

00:45

New Zealand: Employment Change, q/q, Quarter II 0.3% (forecast 0.5%)

-

00:31

Currencies. Daily history for Aug 4’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0889 -0,58%

GBP/USD $1,5564 -0,13%

USD/CHF Chf0,9775 +0,87%

USD/JPY Y124,36 +0,30%

EUR/JPY Y135,42 -0,27%

GBP/JPY Y193,56 +0,18%

AUD/USD $0,7379 +1,44%

NZD/USD $0,6547 -0,23%

USD/CAD C$1,3186 +0,23%

-

00:02

Schedule for today, Wednesday, Aug 4’2015:

(time / country / index / period / previous value / forecast)

01:45 China Markit/Caixin Services PMI July 51.8

07:15 Switzerland Consumer Price Index (YoY) July -1.0%

07:15 Switzerland Consumer Price Index (MoM) July 0.1%

07:50 France Services PMI (Finally) July 54.1 52

07:55 Germany Services PMI (Finally) July 53.8 53.7

08:00 Eurozone Services PMI (Finally) July 54.4 53.8

08:30 United Kingdom Purchasing Manager Index Services July 58.5 58

09:00 Eurozone Retail Sales (MoM) June 0.2% -0.2%

09:00 Eurozone Retail Sales (YoY) June 2.4% 1.9%

11:00 U.S. MBA Mortgage Applications July 0.8%

12:15 U.S. ADP Employment Report July 237 220

12:30 Canada Trade balance, billions June -3.34 -2.6

12:30 U.S. International Trade, bln June -41.87 -42.5

13:45 U.S. Services PMI (Finally) July 54.8 55.2

14:00 U.S. ISM Non-Manufacturing July 56 56

14:30 U.S. Crude Oil Inventories July -4.203

-