Noticias del mercado

-

20:20

American focus: the dollar rose

The US dollar rose against other major currencies, supported by data on factory orders and comments from Fed Lockhart.

The volume of new orders for manufactured goods increased markedly at the end of June, thus offsetting the May decline. This was reported in the Ministry of Commerce.

The report noted that factory orders rose in June by 1.8% or $ 8.7 billion., Reaching $ 478.5 billion. This change followed a 1.1% drop in May, which was revised from -1.0 %. Excluding transportation, orders rose 0.5% compared with a fall of 0.1% in April and May.

Also, the data showed that the supply of industrial goods increased $ 2.2 billion., Or 0.5%, to $ 483.5. We recall that in the previous month delivery fell by 0.2%.

Unfilled orders, which declined in the previous two months, he added in June, less than $ 0.1 million., Reaching a level of $ 1194.7 billion. This followed a 0.5 percent decline in May. Meanwhile, the ratio of unfilled orders to shipments in June was 6.94 compared with 6.99 in the previous month.

The Ministry of Commerce said that inventories increased by $ 3.6 billion., Or by 0.6% to $ 653.6 billion. This change followed 0,1protsentnyh increase in May.

The ratio of inventories to shipments amounted to 1.35 in June, unchanged compared with May.

In turn, the Atlanta Fed President Lockhart said the Fed is "close" to the short-term readiness to increase interest rates. In this September may be "appropriate" time to raise interest rates. At the same time, he noted that "a significant deterioration" of data can convince him of the need to postpone the rate hike.

The euro came under pressure earlier data for the euro area. Statistical Office, Eurostat reported, on the basis of producer prices in June evrzone and the EU decreased by 0.1% compared with the previous month. Recall that in May, prices remained stable in the euro area and increased by 0.1% among the 28 EU countries. In annual terms, the producer price index fell in July by 2.2% in the euro area and fell by 2.7% in the EU. It should be emphasized at the end of May prices in the euro area decreased by 2.0%. The monthly change in the index was due to a decrease in prices in the sector of industrial production (-0.1%) and in the energy sector (-0.2%). In the field of production of consumer non-durable goods. and intermediate goods prices remained unchanged. Meanwhile, the rise in prices of 0.1% was recorded in the sector of capital goods and consumer durables. In general, prices in the industry, excluding energy remained stable. The largest decline in industrial producer prices was observed in Lithuania (-1.5%), Denmark, Slovakia and Sweden (by -0.9%), while the highest growth rates were recorded in Spain (+ 0.9%), Estonia (+0 6%), Hungary (+ 0.5%) and Poland (+ 0.4%).

The pound fell against the dollar under the influence of data on Britain, showed that the growth of business activity in the construction sector unexpectedly slowed in July, hurt by the loss of momentum in the field of housing and civil construction. According to the monthly index of purchasing managers in the construction sector fell in July to 57.1 points against 58.1 points in June (four-month high). Analysts had expected the index to rise to the level of 58.4 points. "The slowdown in July, is the first in three months, and possibly an indication that the impact of the election on building the confidence began to decline," - said Tim Moore, senior economist at Markit. Companies that reported an increase in business activity mainly recorded strong inflows of new orders. Meanwhile, the data pointed to a general slowdown in employment growth in the construction sector. Nevertheless, looking ahead, the construction companies of the country spoke very optimistic about their growth prospects over the next 12 months, with more than half of expected growth in business activity.

Markets are waiting for a meeting of the Bank of England, which will take place on Thursday. For the first time the central bank at the same time announce a decision on interest rates and to publish the minutes of its meetings, and new forecasts for the UK economy.

-

17:07

European Central Bank purchases €61.3 billion of public and private debt in July

The European Central Bank (ECB) purchased €61.3 billion of public and private debt under its quantitative-easing program in July, compared to €63.2 billion in June.

ECB Executive Board member Benoit Coeure said on May 18 that the central bank would raise the pace of asset-buying due to lower liquidity in July and August.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €51.4 billion of government and agency bonds in July, €9.0 billion of covered bonds, and €944 million of asset-backed securities.

-

16:21

U.S. factory orders jump 1.8% in June

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. rose 1.8% in June, in line expectations, after a 1.1% decrease in May. May's figure was revised down from a 1.0% decline.

The increase was driven by a rise in demand for commercial aircraft.

Durable goods increased by 3.4% in June.

Orders for transportation equipment jumped by 9.3% in June.

-

16:00

U.S.: Factory Orders , June 1.8% (forecast 1.8%)

-

15:42

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E721mn), $1.0835/40(E500mn), $1.0900(E308mn), $1.1095/00(E2.1bn)

USD/JPY: Y123.00($391mn), Y123.85($250mn), Y124.45($200mn)

USD/CHF: Chf0.9550 ($210mn)

AUD/USD: $0.7400(A$230mn)

USD/CAD: Cad1.3100 ($315mn)

-

15:34

Labour cash earnings in Japan drops 2.4% in June

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Tuesday. Labour cash earnings in Japan dropped at an annual rate of 2.4% in June, after a 0.7% rise in May.

May's figure was revised up from a 0.6% gain.

The decline was partly driven by a fall in bonuses. Bonuses in June plunged 6.5% year-on-year.

Wages, excluding bonuses and overtime, climbed 0.4% in June.

-

14:18

Foreign exchange market. European session: the euro traded higher against the U.S. dollar despite the weak producer price index from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Retail Sales, M/M June 0.4% Revised From 0.3% 0.5% 0.7%

01:30 Australia Trade Balance June -2.68 Revised From -2.75 -3.1 -2.93

01:30 Japan Labor Cash Earnings, YoY June 0.7% Revised From 0.6% -2.4%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index July -0.2% 0.4% 0.4%

06:00 United Kingdom Nationwide house price index, y/y July 3.3% 3.5% 3.5%

08:30 United Kingdom PMI Construction July 58.1 58.4 57.1

09:00 Eurozone Producer Price Index, MoM June 0% 0% -0.1%

09:00 Eurozone Producer Price Index (YoY) June -2% -2.2% -2.2%

The U.S. dollar traded mixed to lower against the most major currencies ahead of the U.S. factory orders data. The U.S. factory orders are expected to increase 1.8% in June, after a 1.0 drop in May.

The euro traded higher against the U.S. dollar despite the weak producer price index from the Eurozone. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

The British pound traded higher against the U.S. dollar despite the weaker-than-expected the construction PMI from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

The Nationwide Building Society released its house prices data for the U.K. on Tuesday. UK house prices rose 0.4% in July, in line with expectations, after a 0.2% decline in June.

On a yearly basis, house prices increased to 3.5% in July from 3.3% in June, in line with expectations.

"The outlook on the demand side remains encouraging. Employment growth has remained relatively robust in recent quarters, and, after a prolonged period of subdued growth, wage growth is also edging up. With consumer confidence buoyant and mortgage rates still close to all-time lows, demand for housing is likely to firm up in the quarters ahead," Nationwide's chief economist, Robert Gardner, said.

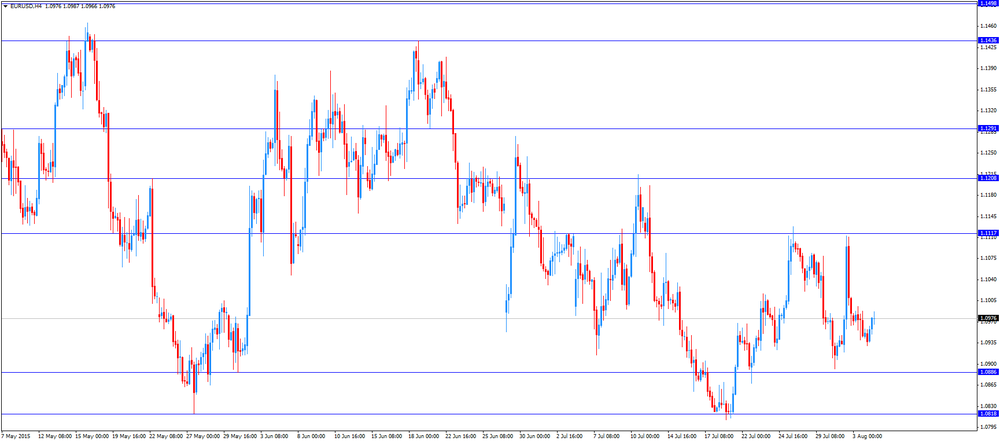

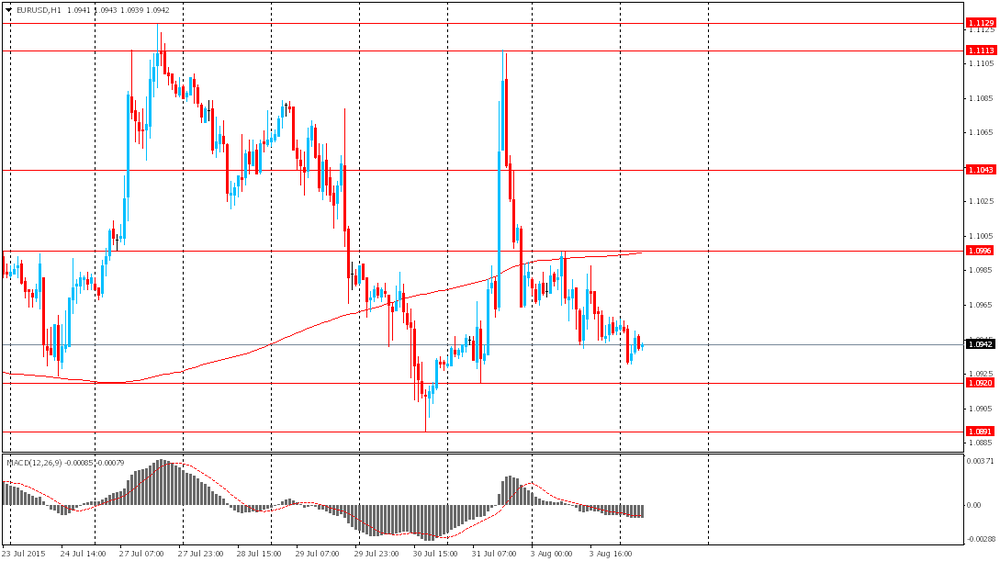

EUR/USD: the currency pair increased to $1.0987

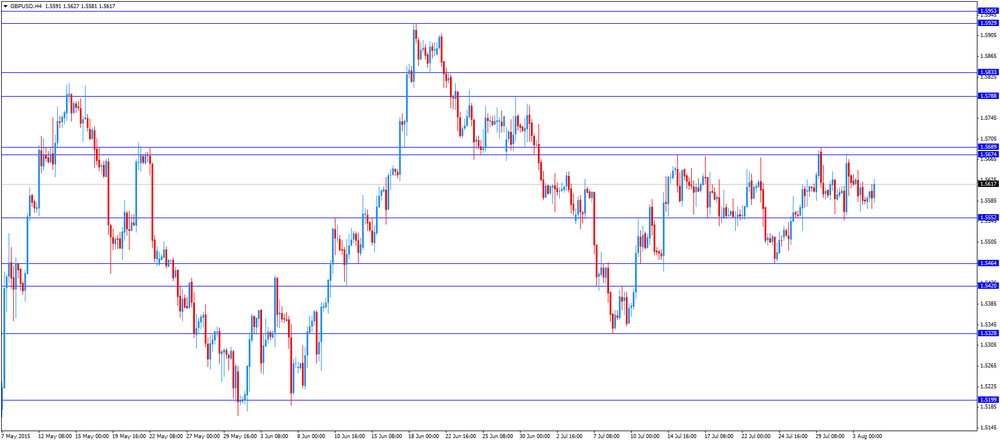

GBP/USD: the currency pair rose to $1.5627

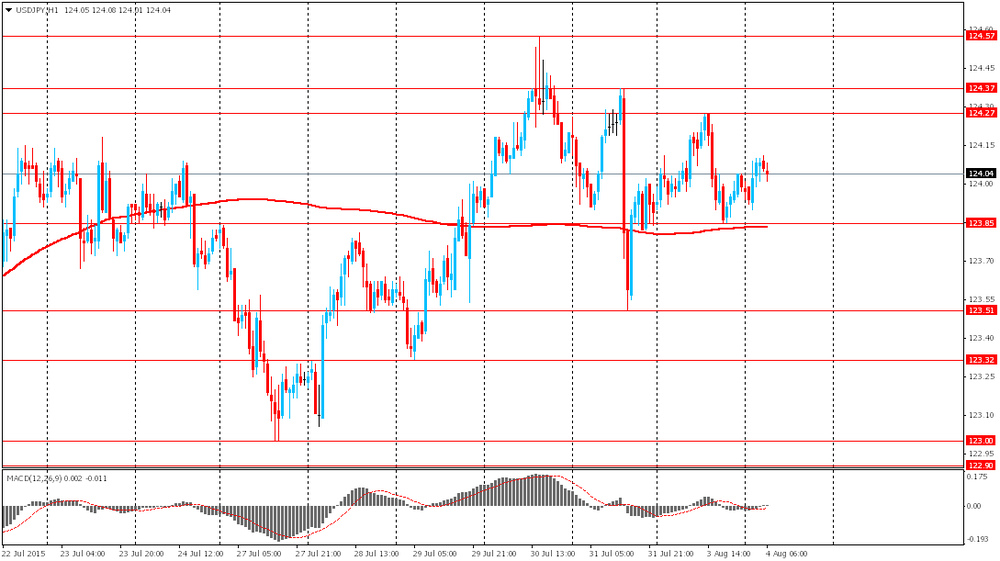

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 U.S. Factory Orders June -1% 1.8%

22:45 New Zealand Unemployment Rate Quarter II 5.8% 5.9%

22:45 New Zealand Employment Change, q/q Quarter II 0.7% 0.5%

-

14:00

Orders

EUR/USD

Offers 1.0980 1.1000 1.1020 1.1050 1.1065 1.1080-85 1.1100 1.1120 1.1160 1.1185 1.1200

Bids 1.0925-30 1.0900 1.0880 1.0860 1.0820-25 1.0800 1.0780 1.0750

GBP/USD

Offers 1.5620-25 1.5650 1.5680 1.5700-10 1.5725-30 1.5750 1.5785 1.5800

Bids 1.5570-75 1.5550 1.5520-25 1.5500 1.5485 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7030-35 0.7050 0.7080 0.7100 0.7125 0.7150-55 0.7180-85 0.7200

Bids 0.7000 0.6975-80 0.6950 0.6930 0.6900 0.6885 0.6865 0.6850

EUR/JPY

Offers 136.50 136.80 137.00 137.30 137.50

Bids 136.00 135.80 135.60 135.30 135.00 134.85 134.50 134.30 134.00

USD/JPY

Offers 124.25-30 124.50 124.75 125.00 125.30 125.50

Bids 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7385 0.7400 0.7420-25 0.7450 0.7475 0.7500

Bids 0.7350 0.7320 0.7300 0.7280 0.7250 0.7230 0.7200 0.7180 0.7150

-

11:43

Standard & Poor's downgrades its outlook for the European Union to "negative" from "stable"

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

-

11:25

Eurozone's producer price index declines 0.1% in June

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E721mn), $1.0835/40(E500mn), $1.0900(E308mn), $1.1095/00(E2.1bn)

USD/JPY: Y123.00($391mn), Y123.85($250mn), Y124.45($200mn)

USD/CHF: Chf0.9550 ($210mn)

AUD/USD: $0.7400(A$230mn)

USD/CAD: Cad1.3100 ($315mn) -

11:12

Number of registered unemployed people in Spain decline by 74,028 in July

Spain's labour ministry release its labour market figures on Tuesday. The number of registered unemployed people fell 74,028 in July. It was the sixth consecutive decline.

Unemployment among youth people below 25 years decreased by 8,989 in July.

-

11:00

Eurozone: Producer Price Index, MoM , June -0.1% (forecast 0%)

-

11:00

Eurozone: Producer Price Index (YoY), June -2.2% (forecast -2.2%)

-

10:52

UK construction PMI falls to 57.1 in July

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

A reading above 50 indicates expansion in the construction sector.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

-

10:45

Nationwide: UK house prices rise 0.4% in July

The Nationwide Building Society released its house prices data for the U.K. on Tuesday. UK house prices rose 0.4% in July, in line with expectations, after a 0.2% decline in June.

On a yearly basis, house prices increased to 3.5% in July from 3.3% in June, in line with expectations.

"The outlook on the demand side remains encouraging. Employment growth has remained relatively robust in recent quarters, and, after a prolonged period of subdued growth, wage growth is also edging up. With consumer confidence buoyant and mortgage rates still close to all-time lows, demand for housing is likely to firm up in the quarters ahead," Nationwide's chief economist, Robert Gardner, said.

-

10:38

Reserve Bank of Australia kept its interest rate at 2.00%

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He said that the economic growth was "below longer-term averages", growth of employment was stronger, and "domestic inflationary pressures have been contained".

The central bank removed the sentence that the further interest rate cut is "both likely and necessary".

-

10:30

United Kingdom: PMI Construction, July 57.1 (forecast 58.4)

-

10:21

Australia’s trade deficit widens to A$2.75 billion in June

The Australian Bureau of Statistics released its trade data on Tuesday. Australia's trade deficit widened to A$2.93 billion in June from A$2.68 billion in May, beating expectations for a rise to a deficit of A$3.1 billion.

May's figure was revised up from a deficit of A$2.75 billion.

Exports rose by 3.0% in June, while imports climbed by 4.0%.

-

10:12

Retail sales in Australia rise 0.7% in June

The Australian Bureau of Statistics released its retail sales data on Tuesday. Retail sales in Australia rose 0.7% in June, exceeding expectations for a 0.5% gain, after a 0.4% increase in May.

May's figure was revised up from a 0.3% rise.

Food retailing climbed 0.2% in June and household goods retailing rose 0.8%, while department stores sales dropped 0.2%, clothing, footwear and personal accessory retailing was up 0.1% and cafes, restaurants and takeaway food services sales increased 0.3%.

Australian retail sales climbed 0.8% in the second quarter of 2015.

-

08:26

Options levels on tuesday, August 4, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1160 (2516)

$1.1078 (2293)

$1.1018 (1646)

Price at time of writing this review: $1.0955

Support levels (open interest**, contracts):

$1.0909 (4646)

$1.0858 (6338)

$1.0823 (4059)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 55758 contracts, with the maximum number of contracts with strike price $1,1200 (4581);

- Overall open interest on the PUT options with the expiration date August, 7 is 68560 contracts, with the maximum number of contracts with strike price $1,0800 (6483);

- The ratio of PUT/CALL was 1.23 versus 1.24 from the previous trading day according to data from August, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.5900 (1212)

$1.5801 (1701)

$1.5702 (1219)

Price at time of writing this review: $1.5616

Support levels (open interest**, contracts):

$1.5496 (1604)

$1.5399 (1301)

$1.5299 (1342)

Comments:

- Overall open interest on the CALL options with the expiration date August, 7 is 22193 contracts, with the maximum number of contracts with strike price $1,5750 (3178);

- Overall open interest on the PUT options with the expiration date August, 7 is 23405 contracts, with the maximum number of contracts with strike price $1,5250 (2275);

- The ratio of PUT/CALL was 1.05 versus 1.06 from the previous trading day according to data from August, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:14

Foreign exchange market. Asian session: the dollar advanced ahead of Friday's payrolls data

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Retail Sales, M/M June 0.4% Revised From 0.3% 0.5% 0.7%

01:30 Australia Trade Balance June -2.68 Revised From -2.75 -3.1 -2.93

01:30 Japan Labor Cash Earnings, YoY June 0.7% Revised From 0.6% -2.4%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2% 2.0%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index July -0.2% 0.4% 0.4%

06:00 United Kingdom Nationwide house price index, y/y July 3.3% 3.5% 3.5%

The euro slightly declined in Asian trade as the dollar advanced ahead of publication of employment data. Investors expect a strong report, which could shift expectations for a Federal Reserve rate increase to an earlier date.

The Australian dollar sharply advanced against the greenback after the Reserve Bank of Australia left its key interest rate unchanged at 2.0%. RBA Governor Glenn Stevens said that lower interest rates could spur housing price growth, which is already substantial in Sydney and Melbourne, and affect the economy in a negative way in general. This year the RBA has already lowered its benchmark rate twice amid declines in commodity prices and weak inflation. This time the bank reiterated that further cuts are possible in case the economy weakens. Nevertheless recent data showed that business confidence improved and unemployment fell, while it was expected to grow.

EUR/USD: the pair fell to $1.0930 in Asian trade

USD/JPY: the pair rose to Y124.10

GBP/USD: the pair traded around $1.5570-00

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom PMI Construction July 58.1 58.4

09:00 Eurozone Producer Price Index, MoM June 0% 0%

09:00 Eurozone Producer Price Index (YoY) June -2% -2.2%

14:00 U.S. Factory Orders June -1% 1.8%

20:30 U.S. API Crude Oil Inventories July 1.9

22:45 New Zealand Unemployment Rate Quarter II 5.8% 5.9%

22:45 New Zealand Employment Change, q/q Quarter II 0.7% 0.5%

23:30 Australia AIG Services Index July 51.2

-

08:01

United Kingdom: Nationwide house price index, y/y, July 3.5% (forecast 3.5%)

-

08:01

United Kingdom: Nationwide house price index , July 0.4% (forecast 0.4%)

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 2.0% (forecast 2%)

-

03:32

Japan: Labor Cash Earnings, YoY, June -2.4%

-

03:31

Australia: Retail Sales, M/M, June 0.7% (forecast 0.5%)

-

03:30

Australia: Trade Balance , June -2.93 (forecast -3.1)

-

00:30

Currencies. Daily history for Aug 3’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0952 -0,29%

GBP/USD $1,5585 -0,23%

USD/CHF Chf0,969 +0,37%

USD/JPY Y123,99 +0,08%

EUR/JPY Y135,79 -0,16%

GBP/JPY Y193,22 -0,14%

AUD/USD $0,7273 -0,36%

NZD/USD $0,6562 -0,43%

USD/CAD C$1,3156 +0,51%

-

00:01

Schedule for today, Tuesday, Aug 4’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Retail Sales, M/M June 0.3% 0.5%

01:30 Australia Trade Balance June -2.75 -3.1

01:30 Japan Labor Cash Earnings, YoY June 0.6%

04:30 Australia Announcement of the RBA decision on the discount rate 2.0% 2%

04:30 Australia RBA Rate Statement

06:00 United Kingdom Nationwide house price index July -0.2% 0.4%

06:00 United Kingdom Nationwide house price index, y/y July 3.3% 3.5%

08:30 United Kingdom PMI Construction July 58.1 58.4

09:00 Eurozone Producer Price Index, MoM June 0% 0%

09:00 Eurozone Producer Price Index (YoY) June -2% -2.2%

14:00 U.S. Factory Orders June -1% 1.9%

20:30 U.S. API Crude Oil Inventories July 1.9

22:45 New Zealand Unemployment Rate Quarter II 5.8% 5.9%

22:45 New Zealand Employment Change, q/q Quarter II 0.7% 0.5%

23:30 Australia AIG Services Index July 51.2

-