Noticias del mercado

-

17:40

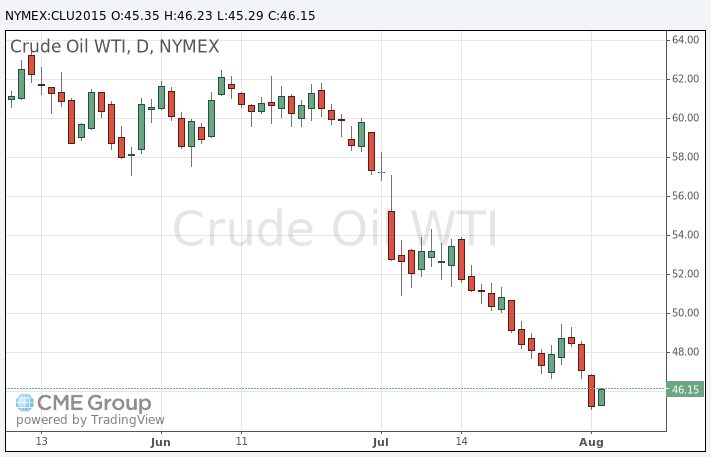

Oil prices increase on a weaker U.S. dollar and due to profit taking

Oil prices increased on a weaker U.S. dollar and due to profit taking. Oil prices yesterday dropped on concerns over the global oil oversupply and on the weaker-than-expected Chinese manufacturing data. The Chinese manufacturing PMI declined to 50.0 in July from 50.2 in June. Analysts had expected the index to remain unchanged.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.8 in July from 49.4 in June, missing expectations for a fall to 48.2.

Concerns over the global oil oversupply still weigh on oil prices as OPEC continue to raise its oil output, and Iran may raise its oil output after reaching a nuclear deal.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for September delivery increased to $46.23 a barrel on the New York Mercantile Exchange.

Brent crude oil for September rose to $50.25 a barrel on ICE Futures Europe.

-

17:22

Gold price rises after the yesterday’s 0.52% decline

Gold price rose after the yesterday's 0.52% decline. Speculation that the Fed starts raising interest rate soon weighed on gold price. St. Louis Federal Reserve President James Bullard said on Friday that the Fed may start raising interest rates in September due to the latest U.S. economic growth data.

Market participants are awaiting the release of the U.S. labour market data.

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. rose 1.8% in June, in line expectations, after a 1.1% decrease in May. May's figure was revised down from a 1.0% decline.

The increase was driven by a rise in demand for commercial aircraft.

October futures for gold on the COMEX today increased to 1093.80 dollars per ounce.

-

09:00

Oil prices rebounded slightly, but remained below $50

West Texas Intermediate futures for September delivery rebounded to $45.46 (+0.64%), while Brent crude climbed to $49.68 (+0.32%) after yesterday's sharp declines, which were triggered by weak U.S. data.

A report by the Institute for Supply Management showed that activity in the industrial sector of the U.S. economy weakened sharply despite forecasts of a slight improvement. The ISM manufacturing index fell to 52.7 in July from 53.5 reported previously. The index was expected to come in at 53.6.

Intensive oil production in OPEC and the U.S. continues to keep prices under pressure.

-

08:40

Gold remains under pressure

Gold is currently at $1,083.60 (-0.53%). Expectations of an imminent rate hike in the U.S. continued weighing on the non-interest bearing precious metal, although the first rate increase in almost ten years may happen later this year, not in September when Fed policymakers meet next, because the latest data on the U.S. economy showed some weakness.

Demand in top consumers China and India remained weak. However South Koreans are on track to buy $860 million in gold this year as investors are concerned about stock markets.

-

00:32

Commodities. Daily history for Aug 3’2015:

(raw materials / closing price /% change)

Oil 45.30 +0.29%

Gold 1,085.60 -0.35%

-