Noticias del mercado

-

22:07

U.S. stocks fluctuated

U.S. stocks fluctuated, after two days of declines, amid quarterly results from Regeneron Pharmaceuticals Inc. to Allstate Corp. while Apple Inc. slipped further into a correction.

Allstate lost 10 percent as the insurer's profit plunged on a surge in auto claims. CVS Health Corp. fell 1.4 percent after narrowing its earnings forecast. Apple sank 2.2 percent to a six-month low. Regeneron and Sprint Corp. gained more than 5.3 percent as their earnings exceeded analysts' forecasts. Baxalta Inc. surged 14 percent after Shire Plc offered to buy the company for about $30 billion.

The Standard & Poor's 500 Index lost 0.1 percent to 2,095.06 at 3:04 p.m. in New York, after falling as much as 0.5 percent. The Dow Jones Industrial Average lost 36.72 points, or 0.2 percent, to 17,561.48. The Nasdaq Composite Index was little changed.

"There's some concern over Apple -- it's a big stock that has a big impact on all the indexes," said Randy Warren, who manages more than $100 million at Exton, Pennsylvania-based Warren Financial Service & Associates Inc. "We've seen a lot of companies struggling this earnings season. There are a lot of global growth concerns out there."

The S&P 500 rose 2 percent in July, the best monthly gain since February, as earnings from Amazon.com Inc. and Google Inc. countered declines by energy and mining stocks. The index closed Monday 1.5 percent below a record set in May.

Some 31 S&P 500-listed companies are scheduled to release financial results today. Almost three-quarters of the benchmark's members have reported earnings this season, with 74 percent beating profit estimates and about half exceeding sales projections. Analysts now forecast a 2.8 percent drop in second-quarter earnings, shallower than calls for a 6.4 percent fall about three weeks ago.

"When investors look at the tail-end of earnings season, you've had some companies come out and disappoint, and they've been punished for it," said Bill Schultz, who oversees $1.2 billion as chief investment officer at McQueen, Ball & Associates Inc. in Bethlehem, Pennsylvania.

Data today showed factory orders rose 1.8 percent in June from the month before, in line with forecasts from economists surveyed by Bloomberg, and rebounding from two months of declines. Reports on the services industries and monthly payrolls are also due later this week, giving investors a gauge on the strength of the economy.

The jobs report Friday will show an increase of 225,000 in July with the unemployment rate holding at 5.3 percent, according to economists surveyed by Bloomberg.

Federal Reserve policy makers have expressed a desire to see signs of a further pickup in the labor market before raising interest rates. Fed Chair Janet Yellen said in July she expected the central bank to raise its benchmark rate this year, while emphasizing the pace of increases will probably be gradual.

The Chicago Board Options Exchange Volatility Index rose 0.7 percent Tuesday to 12.65. The gauge, known as the VIX, on Friday posted its biggest monthly drop since February, down more than 33 percent.

Six of the S&P 500's 10 main groups declined, led by utilities, energy and technology stocks. Raw-materials and consumer discretionary shares increased the most.

Technology companies lost 0.5 percent as Apple fell for a fifth day, extending its decline over the period to 6.4 percent. The stock's retreat yesterday pushed it below the 200-day moving average, a level of resistance commonly watched by market technicians, for the first time since 2013.

A group of semiconductor stocks in the benchmark U.S. equity gauge slipped for the third time in four sessions. Skyworks Solutions Inc. and Avago Technologies Ltd. decreased more than 2.1 percent.

-

21:00

DJIA 17552.36 -45.84 -0.26%, NASDAQ 5111.32 -4.06 -0.08%, S&P 500 2094.48 -3.56 -0.17%

-

18:21

WSE: Session Results

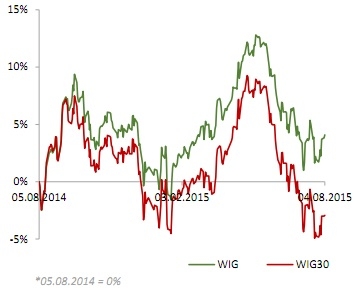

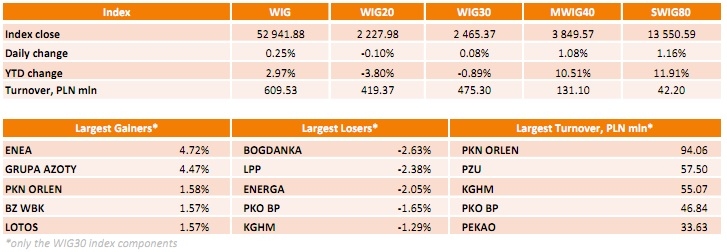

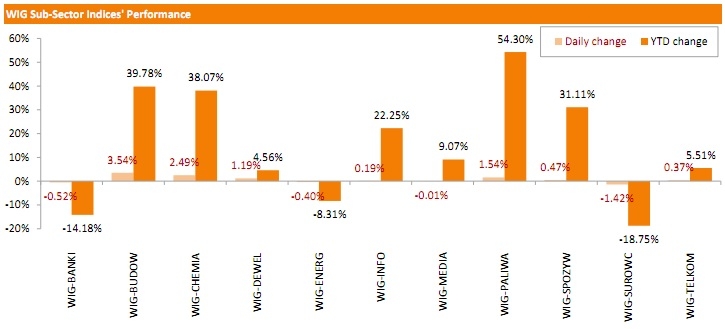

Polish equity market advanced on Tuesday. The broad market measure, the WIG Index, added 0.25%. Sector-wise, construction sector (+3.54%) and chemicals (+2.49%) fared the best, while materials (-1.42%) lagged behind.

The large-cap companies' measure, the WIG30 Index, inched up 0.08%. Within the index components, ENEA (WSE: ENA) and GRUPA AZOTY (WSE: ATT) led the gainers, recording advances of a respective 4.72% and 4.47%. Other major outperformers were PKN ORLEN (WSE: PKN), BZ WBK (WSE: BZW), LOTOS (WSE: LTS) and PGNIG (WSE: PGN), surging by 1.56%-1.58%. On the other side of the ledger, BOGDANKA (WSE: LWB) continued to plunge, losing 2.63% on gloomy outlook for the coal sector. It was followed by LPP (WSE: LPP), ENERGA (WSE: ENG) and PKO BP (WSE: PKO), declining 2.38%, 2.05% and 1.65% respectively.

-

18:02

Wall Street. Major U.S. stock-indexes slightly fell

Major U.S. stock-indexes fell on Tuesday as Apple's shares remained under pressure, hitting their lowest in more than six months, and investors digested earnings reports from a host of companies. While there was no clear trigger for the selloff, traders said worries over China slowdown. With a bulk of the S&P 500 companies having reported results, investors are taking to the sidelines ahead of Friday's monthly jobs data.

Dow stocks are mixed (15 in positive area, 15 in negative area). Top looser - Apple Inc. (CVX, -2.95%). Top gainer - Microsoft Corporation (MSFT, +1.31).

S&P index sectors are mixed. Top looser - Utilities (-0.8%). Top looser - Basic Materials (+0.4%).

At the moment:

Dow 17503.00 -8.00 -0.05%

S&P 500 2090.25 -0.75 -0.04%

Nasdaq 100 4557.25 -15.75 -0.34%

10 Year yield 2,18% +0,03

Oil 46.10 +0.93 +2.06%

Gold 1091.00 +1.60 +0.15%

-

18:00

European stocks closed: FTSE 6686.57 -2.05 -0.03%, DAX 11456.07 12.35 0.11%, CAC 40 5112.14 -8.38 -0.16%

-

18:00

European stocks close: stocks closed mixed on corporate earnings

Stock indices closed mixed on corporate earnings.

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

Meanwhile, the economic data from the Eurozone was weak. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,686.57 -2.05 -0.03 %

DAX 11,456.07 +12.35 +0.11 %

CAC 40 5,112.14 -8.38 -0.16 %

-

17:07

European Central Bank purchases €61.3 billion of public and private debt in July

The European Central Bank (ECB) purchased €61.3 billion of public and private debt under its quantitative-easing program in July, compared to €63.2 billion in June.

ECB Executive Board member Benoit Coeure said on May 18 that the central bank would raise the pace of asset-buying due to lower liquidity in July and August.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €51.4 billion of government and agency bonds in July, €9.0 billion of covered bonds, and €944 million of asset-backed securities.

-

16:21

U.S. factory orders jump 1.8% in June

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. rose 1.8% in June, in line expectations, after a 1.1% decrease in May. May's figure was revised down from a 1.0% decline.

The increase was driven by a rise in demand for commercial aircraft.

Durable goods increased by 3.4% in June.

Orders for transportation equipment jumped by 9.3% in June.

-

15:36

U.S. Stocks open: Dow +0.05%, Nasdaq -0.10%, S&P +0.01%

-

15:34

Labour cash earnings in Japan drops 2.4% in June

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Tuesday. Labour cash earnings in Japan dropped at an annual rate of 2.4% in June, after a 0.7% rise in May.

May's figure was revised up from a 0.6% gain.

The decline was partly driven by a fall in bonuses. Bonuses in June plunged 6.5% year-on-year.

Wages, excluding bonuses and overtime, climbed 0.4% in June.

-

15:30

Before the bell: S&P futures +0.02%, NASDAQ futures -0.08%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 20,520.36 -27.75 -0.14%

Hang Seng 24,406.12 -5.30 -0.02%

Shanghai Composite 3,756.54 +133.64 +3.69%

FTSE 6,685.7 -2.92 -0.04%

CAC 5,093.77 -26.75 -0.52%

DAX 11,423.27 -20.45 -0.18%

Crude oil $46.02 (+1.88%)

Gold $1093.50 (+0.37%)

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

72.21

+0.04%

1.6K

Goldman Sachs

GS

204.79

+0.05%

0.2K

AT&T Inc

T

34.72

+0.17%

0.5K

Exxon Mobil Corp

XOM

78.27

+0.27%

18.5K

Caterpillar Inc

CAT

77.48

+0.28%

2.8K

Merck & Co Inc

MRK

59.24

+0.32%

11.1K

Yahoo! Inc., NASDAQ

YHOO

36.85

+0.44%

14.8K

Starbucks Corporation, NASDAQ

SBUX

58.29

+0.45%

2.2K

Chevron Corp

CVX

86.00

+0.47%

4.3K

Walt Disney Co

DIS

121.70

+0.48%

29.9K

Google Inc.

GOOG

634.30

+0.49%

0.1K

Barrick Gold Corporation, NYSE

ABX

06.84

+2.09%

41.4K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.44

+2.14%

24.3K

ALCOA INC.

AA

09.87

+2.39%

119.4K

American Express Co

AXP

75.98

0.00%

1.0K

Johnson & Johnson

JNJ

100.02

0.00%

1.1K

The Coca-Cola Co

KO

41.54

0.00%

1.1K

United Technologies Corp

UTX

99.42

0.00%

1.0K

Hewlett-Packard Co.

HPQ

30.02

0.00%

1.0K

Tesla Motors, Inc., NASDAQ

TSLA

259.95

-0.02%

5.2K

Microsoft Corp

MSFT

46.79

-0.04%

19.6K

Procter & Gamble Co

PG

76.36

-0.05%

1.1K

General Motors Company, NYSE

GM

31.66

-0.06%

0.4K

Ford Motor Co.

F

14.93

-0.07%

4.4K

Amazon.com Inc., NASDAQ

AMZN

534.30

-0.14%

2.6K

Intel Corp

INTC

29.00

-0.17%

2.9K

General Electric Co

GE

25.82

-0.19%

2.0K

JPMorgan Chase and Co

JPM

68.40

-0.19%

1.0K

Cisco Systems Inc

CSCO

28.30

-0.21%

0.1K

Citigroup Inc., NYSE

C

58.32

-0.21%

1.5K

ALTRIA GROUP INC.

MO

54.51

-0.27%

0.1K

Facebook, Inc.

FB

93.88

-0.28%

57.4K

Verizon Communications Inc

VZ

46.81

-0.34%

1.1K

Twitter, Inc., NYSE

TWTR

29.13

-0.48%

44.0K

Apple Inc.

AAPL

117.40

-0.88%

526.9K

AMERICAN INTERNATIONAL GROUP

AIG

63.41

-1.15%

1.2K

-

15:01

Upgrades and downgrades before the market open

Upgrades:

Alcoa (AA) upgraded to Buy from Neutral at UBS

Downgrades:

Other:

Cisco Systems (CSCO) initiated with a Underperform at Macquarie, target $26

-

12:00

European stock markets mid session: stocks traded mixed, while Greek stocks dropped again after the reopening on Monday

Stock indices traded mixed, while Greek stocks dropped again after the reopening on Monday.

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

Meanwhile, the economic data from the Eurozone was weak. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

Current figures:

Name Price Change Change %

FTSE 100 6,699.76 +11.14 +0.17 %

DAX 11,459.5 +15.78 +0.14 %

CAC 40 5,103.98 -16.54 -0.32 %

-

11:43

Standard & Poor's downgrades its outlook for the European Union to "negative" from "stable"

Standard & Poor's Ratings Services downgraded its outlook for the European Union (EU) to "negative" from "stable" on Monday. The long-term credit rating remained at AA+.

One of the reasons for the downgrade was that the EU is providing "higher-risk financing to EU member states, without the member states' paying in capital".

-

11:25

Eurozone's producer price index declines 0.1% in June

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.1% in June, missing expectations for a flat reading, after a flat reading in May.

Intermediate goods and non-durable consumer goods prices were flat in June, and capital goods prices rose 0.1%, while durable consumer goods prices climbed 0.1%.

On a yearly basis, Eurozone's producer price index dropped 2.2% in June, in line with expectations, after a 2.0% fall in May.

Eurozone's producer prices excluding energy fell 0.4% year-on-year in May. Energy prices dropped at an annual rate of 7.0%.

-

11:12

Number of registered unemployed people in Spain decline by 74,028 in July

Spain's labour ministry release its labour market figures on Tuesday. The number of registered unemployed people fell 74,028 in July. It was the sixth consecutive decline.

Unemployment among youth people below 25 years decreased by 8,989 in July.

-

10:52

UK construction PMI falls to 57.1 in July

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. decreased to 57.1 in July from 58.1 in June, missing expectations for a rise to 58.4.

A reading above 50 indicates expansion in the construction sector.

The decline was driven by a slower increase in business activity and incoming new work.

"Commercial activity was a key growth driver during July, which partly offset ongoing weakness in civil engineering and softer residential building trends. Sustained growth across the UK economy so far this year has firmed up demand for commercial building work, with construction companies noting a particularly strong appetite for new development projects among clients," an economist at financial data company Markit, Tim Moore, said.

-

10:45

Nationwide: UK house prices rise 0.4% in July

The Nationwide Building Society released its house prices data for the U.K. on Tuesday. UK house prices rose 0.4% in July, in line with expectations, after a 0.2% decline in June.

On a yearly basis, house prices increased to 3.5% in July from 3.3% in June, in line with expectations.

"The outlook on the demand side remains encouraging. Employment growth has remained relatively robust in recent quarters, and, after a prolonged period of subdued growth, wage growth is also edging up. With consumer confidence buoyant and mortgage rates still close to all-time lows, demand for housing is likely to firm up in the quarters ahead," Nationwide's chief economist, Robert Gardner, said.

-

10:38

Reserve Bank of Australia kept its interest rate at 2.00%

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board' decision was appropriate at this meeting.

He said that the economic growth was "below longer-term averages", growth of employment was stronger, and "domestic inflationary pressures have been contained".

The central bank removed the sentence that the further interest rate cut is "both likely and necessary".

-

10:21

Australia’s trade deficit widens to A$2.75 billion in June

The Australian Bureau of Statistics released its trade data on Tuesday. Australia's trade deficit widened to A$2.93 billion in June from A$2.68 billion in May, beating expectations for a rise to a deficit of A$3.1 billion.

May's figure was revised up from a deficit of A$2.75 billion.

Exports rose by 3.0% in June, while imports climbed by 4.0%.

-

10:12

Retail sales in Australia rise 0.7% in June

The Australian Bureau of Statistics released its retail sales data on Tuesday. Retail sales in Australia rose 0.7% in June, exceeding expectations for a 0.5% gain, after a 0.4% increase in May.

May's figure was revised up from a 0.3% rise.

Food retailing climbed 0.2% in June and household goods retailing rose 0.8%, while department stores sales dropped 0.2%, clothing, footwear and personal accessory retailing was up 0.1% and cafes, restaurants and takeaway food services sales increased 0.3%.

Australian retail sales climbed 0.8% in the second quarter of 2015.

-

08:21

Global Stocks: U.S. indices fell

Major U.S. stock indices ended lower on Monday amid declines in oil prices and after data showed that the U.S. economy lost momentum at the end of the second quarter.

The Dow Jones Industrial Average fell 91.66 points, or 0.5%, to 17598.20. The S&P 500 declined 5.8 points, or 0.3%, to 2098.40. The Nasdaq Composite dropped 12.90 points, or 0.3%, to 5115.38.

S&P's energy companies dropped 2%. Meanwhile utilities and real-estate investment trusts, which are considered more defensive, gained.

The U.S. Bureau of Economic Analysis reported that growth of personal spending slowed down significantly in June, suggesting that weak wage growth puts pressure on consumers. Personal spending rose by 0.2% m/m in June (the smallest gain since February). May reading was revised to +0.7% from +0.9%. Personal income rose by 0.4% in June after the 0.4% increase in May (revised from +0.5%). All changes were in line with expectations.

This morning in Asia Hong Kong Hang Seng fell 0.13%, or 32.59 points, to 24,378.83. China Shanghai Composite Index gained 1.34%, or 48.59 points, to 3,671.49. The Nikkei lost 0.36%, or 73.76 points, to 20,474.35.

Asian stocks mostly fell following declines in U.S. equities. However the Shanghai Composite gained amid new rules, which would make it more difficult to profit from hourly fluctuations in stock prices. Major stock exchanges have announced that they will temporarily suspend their short-selling services.

-

04:03

Nikkei 225 20,521.96 -26.15 -0.13 %, Hang Seng 24,277.61 -133.81 -0.55 %, Shanghai Composite 3,611.82 -11.09 -0.31 %

-

00:31

Stocks. Daily history for Aug 3’2015:

(index / closing price / change items /% change)

HANG SENG 24,413.46 -222.82 -0.90%

S&P/ASX 200 5,679.3 -19.86 -0.35%

TOPIX 1,659.6 +0.08 0.00%

SHANGHAI COMP 3,622.99 -40.74 -1.11%

FTSE 100 6,688.62 -7.66 -0.11 %

CAC 40 5,120.52 +37.91 +0.75 %

Xetra DAX 11,443.72 +134.73 +1.19 %

S&P 500 2,098.04 -5.80 -0.28 %

NASDAQ Composite 5,115.38 -12.90 -0.25 %

Dow Jones 17,598.2 -91.66 -0.52 %

-