Noticias del mercado

-

22:15

U.S. stocks rose for the first time in four days

U.S. stocks rose for the first time in four days, amid better-than-estimated earnings from technology companies while services-industry data indicated the economy is on track for faster growth.

The Standard & Poor's 500 Index rose 0.3 percent to 2,099.91. at 4 p.m. in New York, after slipping 0.7 percent over the previous three sessions.

Investors are watching economic reports to gauge when the Federal Reserve will increase interest rates, a decision it has forecast for this year. Data today showed service providers from restaurants to real estate agencies expanded in July at the strongest pace in a decade, putting the U.S. economy on track for faster growth. The share of services companies boosting employment was the highest since records began in 1997.

A separate report Wednesday from ADP Research Institute said companies added fewer workers than expected to payrolls in July, casting doubt on whether labor-market gains can accelerate beyond this year's current pace. The government's monthly job report on Friday is projected to show employers took on 225,000 workers last month, while the jobless rate held at a seven-year low of 5.3 percent.

Fed's Powell

Fed Governor Jerome Powell said there is more labor-market slack in the economy than the jobless rate indicates, during an interview on CNBC. He also said financial assets aren't in bubble territory, and reiterated that a shallow path for rate increases would be appropriate.

Investors are also weighing corporate earnings for hints on the economy's health. Four out of five S&P 500 members have reported results this season, with about three-quarters beating profit estimates and half topping sales projections. Analysts now call for a 2.8 percent drop in second-quarter earnings, shallower than July 10 estimates for a 6.4 percent fall.

Equities earlier pared gains as energy companies erased an increase and raw-material shares trimmed their advance. Oil fell to a four-month low, after rallying 2 percent, amid signs of ample crude stockpiles.

-

21:00

DJIA 17553.54 2.85 0.02%, NASDAQ 5145.76 40.21 0.79%, S&P 500 2101.65 8.33 0.40%

-

19:15

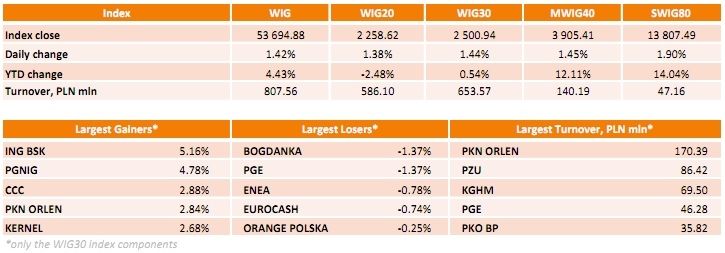

WSE: Session Results

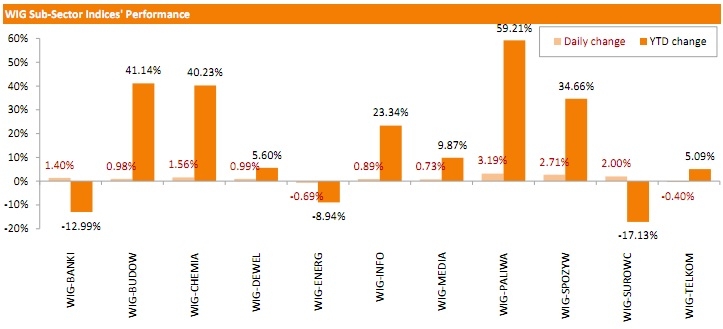

Polish equity market finished Wednesday on a positive note. The broad market measure, the WIG Index, added 1.42%. 9 out of 11 sectors in the WIG Index increased, led by oil and gas sector stocks, which rose by 3.19%.

The large-cap companies' measure, the WIG30 Index, surged by 1.44%. Within the Index components, the advancers pack was led by ING BSK (WSE: ING), which skyrocketed by 5.16% after the company reported 2Q15 financials that exceeded analysts' estimates. PGNIG (WSE: PGN) jumped by 4.78% on news the negotiations with Russia's Gazprom regarding imported gas prices advanced. On the other side of the ledger, BOGDANKA (WSE: LWB) remained among the weakest performers, losing 1.37%. PGE (WSE: PGE) also went down by 1.37% after the company announced it ran test for impairment of its assets and it might have to write down some of them.

-

18:02

European stocks closed: FTSE 6752.41 65.84 0.98%, DAX 11636.30 180.23 1.57%, CAC 40 5196.73 84.59 1.65%

-

18:00

European stocks close: stocks closed higher on positive corporate earnings reports

Stock indices closed higher on positive corporate earnings reports. Shares of Société Générale SA and Beiersdorf AG among the biggest gainers.

Meanwhile, the economic data from the Eurozone was mixed. Retail sales in the Eurozone dropped 0.6% in June, missing expectations for a 0.3% fall, after a 0.1% increase in May. May's figure was revised down from a 0.2% rise.

The increase was driven by lower food, drinks and tobacco and non-food sales. Food, drinks and tobacco sales declined 0.8% in June, while non-food sales decreased 0.2% in May.

Gasoline sales were flat in June.

On a yearly basis, retail sales in the Eurozone rose 1.2% in June, missing forecasts of a 1.9% gain, after a 2.6% increase in May. May's figure was revised up from a 2.4% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Non-food sales gained 2.3% in June, gasoline sales increased 1.8%, while food, drinks and tobacco sales rose 0.1%.

Eurozone's final services purchasing managers' index (PMI) decreased to 54.0 in July from 54.4 in June, up from the preliminary reading of 53.8.

The index was driven by rises in new business and employment.

Eurozone's final composite output index fell to 53.9 in July from 54.2 in June, up from the preliminary reading of 53.7.

"The Eurozone economy showed reassuring resilience in the face of the Greek debt crisis in July. Despite a record deterioration in Greek business conditions amid extended bank closures, the overall pace of economic growth across the region barely slowed from June's four-year high," Chief Economist at Markit Chris Williamson said.

He added that Eurozone's GDP expanded 0.4% in the second quarter, according to the recent data.

Germany's final services purchasing managers' index (PMI) remained unchanged at 53.8 in July, up from the preliminary reading of 53.7.

The index was driven by rises in business activity and new orders.

France's final services purchasing managers' index (PMI) dropped to 52.0 in July from 54.1 in June, in line with the preliminary reading.

The decline was partly driven by a weaker rise in incoming new business.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 57.4 in July from 58.5 in June, missing expectations for a decline to 58.0.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in employment.

"A deterioration in service sector growth is the latest in a stream of signals that the economy has slowed as we move into the second half of the year. The fall in the services PMI follows signs of ongoing weakness in manufacturing and a renewed slowing in the construction sector," the Chief Economist at Markit Chris Williamson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,686.57 -2.05 -0.03 %

DAX 6,752.41 +65.84 +0.98 %

CAC 40 5,196.73 +84.59 +1.65 %

-

17:57

Wall Street. Major U.S. stock-indexes slightly rose

Major U.S. stock-indexes higher on Wednesday, after three straight days of declines, as weak private sector hiring tempered expectations of a September interest rate hike. The ADP National Employment Report showed private employers added 185,000 workers in July, the smallest growth since April and lower than the 215,000 increase forecast by economists surveyed by Reuters. The weaker-than-expected data indicates that the economy lost some momentum at the start of the third quarter and reduces expectations of a strong reading in the government's payrolls report due Friday.

Almost all of Dow stocks in positive area (27 of 30). Top looser - The Walt Disney Company (DIS, -8.08%). Top gainer - Apple Inc. (AAPL, +2.00).

All S&P index sectors also in positive area. Top gainer - Technology (+1,5%).

At the moment:

Dow 17557.00 +103.00 +0.59%

S&P 500 2102.50 +19.50 +0.94%

Nasdaq 100 4623.25 +71.50 +1.57%

10 Year yield 2,28% +0,07

Oil 45.35 -0.39 -0.85%

Gold 1082.80 -7.90 -0.72%

-

16:25

ISM non-manufacturing purchasing managers’ index hits the highest level since August 2005

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Wednesday. The index soared to 60.3 in July from 56.0 in June, exceeding expectations for an increase to 56.2. It was the highest level since August 2005.

A reading above 50 indicates a growth in the service sector.

The increase was driven by rises in in business activity, employment and new orders.

The business activity/production index rose to 64.9 in July from 61.5 in June, the highest level since December 2004.

The ISM's new orders index increased to 63.8 in July from 58.3 in June, the highest level since August 2005.

The ISM's employment index climbed to 59.6 in July from 52.7 in June, the highest level since August 2005.

-

16:04

Makit’s final U.S. services PMI is up to 55.7 in July

Markit Economics released its final services purchasing managers' index (PMI) for the U.S. on Wednesday. The final U.S. services PMI rose to 55.7 in July from 54.8 in June, up from the preliminary reading of 55.2.

A reading over 50 indicates expansion in the sector.

The increase was driven by a faster pace in new work.

"Growth has clearly slowed compared to this time last year, and a further drop in service sector companies' optimism about the year ahead to one of the lowest seen over the past five years indicates that firms are expecting growth to slip further in coming months. Hiring could soon wane unless business confidence picks up again soon," Markit Economics Chief Economist Chris Williamson noted.

-

15:47

Federal Reserve Governor Jerome Powell: the Fed has not decided whether to hike interest rates or not

Federal Reserve Governor Jerome Powell said on Wednesday that the U.S. labour market continues to strengthen. He added that he did not make a decision whether interest rates should be hiked next month.

"Nothing has been decided and I haven't made any decisions of what I would support and certainly the committee hasn't," Powell said.

Fed governor added that he is awaiting the release of the incoming economic data.

-

15:33

U.S. Stocks open: Dow +0.15%, Nasdaq +0.54%, S&P +0.48%

-

15:27

Before the bell: S&P futures +0.92%, NASDAQ futures +0.90%

U.S. stock-index futures rose as investors speculated disappointing private-payroll data may delay the Federal Reserve's plans for higher interest rates.

Global Stocks:

Nikkei 20,614.06 +93.70 +0.46%

Hang Seng 24,514.16 +108.04 +0.44%

Shanghai Composite 3,695.76 -60.78 -1.62%

FTSE 6,753.37 +66.80 +1.00%

CAC 5,183.1 +70.96 +1.39%

DAX 11,603.06 +146.99 +1.28%

Crude oil $46.42 (+1.49%)

Gold $1088.80 (-0.18%)

-

15:21

Industrial production in Italy declines 1.1% in June

The Italian statistical office Istat released its industrial production data on Wednesday. Industrial production in Italy declined at a seasonally-adjusted rate of 1.1% in June, after a 0.9% gain in May.

Output in the manufacturing sector dropped at an annual rate of 1.1% in June, while production in the capital goods sector was down 1.3%.

On a yearly basis, industrial production in Italy fell at a seasonally-adjusted rate of 0.3% in June, after a 3.1% increase in May.

-

15:07

U.S. trade deficit widens to $43.84 billion in June

The U.S. Commerce Department released the trade data on Wednesday. The U.S. trade deficit widened to $43.84 billion in June from a deficit of $40.94 billion in May. May's figure was revised up from a deficit of $41.87 billion.

Analysts had expected a trade deficit of $42.8 billion.

The rise of a deficit was driven by lower exports. Exports fell by 0.1% in June, while imports increased by 1.2%, driven by Imports of food and automobiles.

A stronger U.S. dollar weighs on exports as it makes U.S. goods and services less affordable abroad. Weak overseas demand also weighed on exports.

Exports to the European Union declined 2.3% in June, exports to Canada were down 0.1%, exports to China jumped by 10.6%, while exports to Mexico were up.

Imports from China climbed 4.9% in June.

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

The Coca-Cola Co

KO

41.99

+0.33%

10.3K

Hewlett-Packard Co.

HPQ

29.86

+0.34%

0.3K

McDonald's Corp

MCD

99.50

+0.36%

0.6K

Starbucks Corporation, NASDAQ

SBUX

58.91

+0.36%

15.3K

Deere & Company, NYSE

DE

93.50

+0.42%

8.3K

Johnson & Johnson

JNJ

100.25

+0.45%

4.0K

Procter & Gamble Co

PG

76.25

+0.45%

24.5K

AT&T Inc

T

34.75

+0.49%

11.4K

Wal-Mart Stores Inc

WMT

72.13

+0.52%

0.2K

Pfizer Inc

PFE

36.02

+0.53%

16.1K

UnitedHealth Group Inc

UNH

121.50

+0.55%

0.8K

Travelers Companies Inc

TRV

107.26

+0.59%

1.7K

Ford Motor Co.

F

15.00

+0.60%

1.1K

General Electric Co

GE

26.06р

+0.62%

14.9K

Home Depot Inc

HD

118.28

+0.64%

1.6K

Merck & Co Inc

MRK

59.08

+0.65%

0.7K

Goldman Sachs

GS

206.57

+0.68%

1.4K

3M Co

MMM

151.44

+0.69%

0.2K

Yahoo! Inc., NASDAQ

YHOO

37.38

+0.70%

0.7K

Verizon Communications Inc

VZ

47.00

+0.71%

1.4K

Boeing Co

BA

143.65

+0.72%

1.7K

Microsoft Corp

MSFT

47.88

+0.72%

17.8K

General Motors Company, NYSE

GM

31.75

+0.73%

0.6K

Cisco Systems Inc

CSCO

28.24

+0.75%

1.6K

Twitter, Inc., NYSE

TWTR

29.56

+0.75%

20.2K

International Business Machines Co...

IBM

158.80

+0.76%

5.0K

JPMorgan Chase and Co

JPM

69.00

+0.78%

32.1K

Exxon Mobil Corp

XOM

77.78

+0.79%

24.8K

Intel Corp

INTC

29.12

+0.80%

37.4K

United Technologies Corp

UTX

99.82

+0.80%

1.0K

Citigroup Inc., NYSE

C

58.94

+0.80%

37.7K

E. I. du Pont de Nemours and Co

DD

55.09

+0.82%

0.8K

Amazon.com Inc., NASDAQ

AMZN

536.25

+0.82%

1.3K

Visa

V

75.90

+0.84%

1.2K

Chevron Corp

CVX

85.97

+0.89%

6.3K

Facebook, Inc.

FB

94.90

+0.89%

134.9K

Google Inc.

GOOG

635.25

+0.95%

2.6K

Nike

NKE

116.99

+1.05%

1K

American Express Co

AXP

76.57

+1.12%

0.1K

Caterpillar Inc

CAT

77.49

+1.16%

0.9K

Barrick Gold Corporation, NYSE

ABX

6.90

+1.47%

14.3K

Yandex N.V., NASDAQ

YNDX

13.98

+1.60%

0.4K

ALCOA INC.

AA

09.93

+2.37%

15.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.45

+3.71%

36.6K

Tesla Motors, Inc., NASDAQ

TSLA

264.00

-0.86%

40.7K

Apple Inc.

AAPL

113.63

-0.88%

837.7K

Walt Disney Co

DIS

112.35

-7.68%

1.2M

-

14:54

Canada's trade deficit narrows to C$0.48 billion in June

Statistics Canada released the trade data on Wednesday. Canada's trade deficit narrowed to C$0.48 billion in June from a deficit of C$3.37 billion in May. May's figure was revised down from a deficit of C$3.34 billion.

Analysts had expected a trade deficit of C$2.8 billion.

The decrease in deficit was driven by an increase in exports. Exports jumped 6.3% in June.

Exports of energy products climbed by 3.7% in June, exports of consumer goods jumped 17.2%, while exports of metal and non-metallic mineral products soared 10.8%.

Imports fell 0.6% in June.

Imports of aircraft and other transportation equipment and parts dropped by 19.0% in June, imports of metal and non-metallic mineral products rose 3.6%, while imports of energy products plunged 10.4%.

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Walt Disney (DIS) downgraded from Buy to Hold at Jefferies, target $112

Apple (AAPL) downgraded from Buy to Neutral at BofA/Merrill

Other:

-

14:44

ADP report: private sector adds 185,000 jobs in July

Private sector in the U.S. added 185,000 jobs in July, according the ADP report on Wednesday. June's figure was revised down to 229,000 jobs from a previous reading of 237,000 jobs.

Analysts expected the private sector to add 215,000 jobs.

"Job growth is strong, but it has moderated since the beginning of the year. Layoffs in the energy industry and weaker job gains in manufacturing are behind the slowdown. Nonetheless, even at this slower pace of growth, the labour market is fast approaching full employment," the Chief Economist of Moody's Analytics Mark Zandi said.

Official labour market data will be released on Friday. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.3% in July. The U.S. economy is expected to add 218,000 jobs in July, after adding 223,000 jobs in June.

-

14:38

Spian’s services PMI jumps to 59.7 in July

Markit Economics released final services purchasing managers' index (PMI) for Spain on Wednesday. Spain's final services purchasing managers' index (PMI) climbed to 59.7 in July from 56.1 in June.

"Improvements in the labour market have been the key feature of this month's PMI surveys, with the combined rise in employment across manufacturing and services the strongest since early-2007. We can therefore expect to see further reductions in the unemployment rate in coming months, with this hopefully feeding through into improving demand," Senior Economist at Markit Andrew Harker said.

-

14:24

Italy’s services PMI declines to 52.0 in July

Markit/ADACI's services purchasing managers' index (PMI) for Italy was down to 52.0 in July from 53.4 in June.

A reading above 50 indicates expansion in the sector.

The fall was driven by a decline in employment.

"The service sector maintained its recent growth spell at the start of the third quarter and has now expanded in each of the past five months - the longest sequence since 2010. However, rather than building momentum, as is the case in manufacturing, growth appears to be fixed in a low gear," an economist at Markit Phil Smith said.

-

12:05

European stock markets mid session: stocks traded higher on positive corporate earnings reports

Stock indices traded higher on positive corporate earnings reports. Shares of Société Générale SA and Beiersdorf AG among the biggest gainers.

Meanwhile, the economic data from the Eurozone was mixed. Retail sales in the Eurozone dropped 0.6% in June, missing expectations for a 0.3% fall, after a 0.1% increase in May. May's figure was revised down from a 0.2% rise.

The increase was driven by lower food, drinks and tobacco and non-food sales. Food, drinks and tobacco sales declined 0.8% in June, while non-food sales decreased 0.2% in May.

Gasoline sales were flat in June.

On a yearly basis, retail sales in the Eurozone rose 1.2% in June, missing forecasts of a 1.9% gain, after a 2.6% increase in May. May's figure was revised up from a 2.4% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Non-food sales gained 2.3% in June, gasoline sales increased 1.8%, while food, drinks and tobacco sales rose 0.1%.

Eurozone's final services purchasing managers' index (PMI) decreased to 54.0 in July from 54.4 in June, up from the preliminary reading of 53.8.

The index was driven by rises in new business and employment.

Eurozone's final composite output index fell to 53.9 in July from 54.2 in June, up from the preliminary reading of 53.7.

"The Eurozone economy showed reassuring resilience in the face of the Greek debt crisis in July. Despite a record deterioration in Greek business conditions amid extended bank closures, the overall pace of economic growth across the region barely slowed from June's four-year high," Chief Economist at Markit Chris Williamson said.

He added that Eurozone's GDP expanded 0.4% in the second quarter, according to the recent data.

Germany's final services purchasing managers' index (PMI) remained unchanged at 53.8 in July, up from the preliminary reading of 53.7.

The index was driven by rises in business activity and new orders.

France's final services purchasing managers' index (PMI) dropped to 52.0 in July from 54.1 in June, in line with the preliminary reading.

The decline was partly driven by a weaker rise in incoming new business.

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 57.4 in July from 58.5 in June, missing expectations for a decline to 58.0.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in employment.

"A deterioration in service sector growth is the latest in a stream of signals that the economy has slowed as we move into the second half of the year. The fall in the services PMI follows signs of ongoing weakness in manufacturing and a renewed slowing in the construction sector," the Chief Economist at Markit Chris Williamson said.

Current figures:

Name Price Change Change %

FTSE 100 6,698.72 +12.15 +0.18 %

DAX 11,580.4 +124.33 +1.09 %

CAC 40 5,165.4 +53.26 +1.04 %

-

11:54

Switzerland’s consumer price inflation is down 0.6% in July

The Swiss Federal Statistics Office released its consumer inflation data on Wednesday. Switzerland's consumer price index declined 0.6% in July, missing expectations for a 0.4% decrease, after a 0.1% rise in June.

On a yearly basis, Switzerland's consumer price index decreased to -1.3% in July from -1.0% in June, missing forecasts of a 1.1% decline.

Food and beverages prices dropped at an annual rate of 1.5% in July, clothing and footwear prices fell 0.1%, while housing and energy prices declined 0.5%.

Education costs increased by 1.2%.

-

11:44

Eurozone’s retail sales drops 0.6% in June

Eurostat released its retail sales data for the Eurozone on Wednesday. Retail sales in the Eurozone dropped 0.6% in June, missing expectations for a 0.3% fall, after a 0.1% increase in May. May's figure was revised down from a 0.2% rise.

The increase was driven by lower food, drinks and tobacco and non-food sales. Food, drinks and tobacco sales declined 0.8% in June, while non-food sales decreased 0.2% in May.

Gasoline sales were flat in June.

On a yearly basis, retail sales in the Eurozone rose 1.2% in June, missing forecasts of a 1.9% gain, after a 2.6% increase in May. May's figure was revised up from a 2.4% rise.

The annual rise was driven by non-food sales, gasoline sales, and food, drinks and tobacco and non-food sales.

Non-food sales gained 2.3% in June, gasoline sales increased 1.8%, while food, drinks and tobacco sales rose 0.1%.

-

11:37

UK’s services PMI falls to 57.4 in July

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. fell to 57.4 in July from 58.5 in June, missing expectations for a decline to 58.0.

A reading above 50 indicates expansion in the sector.

The decline was partly driven by a slower growth in employment.

"A deterioration in service sector growth is the latest in a stream of signals that the economy has slowed as we move into the second half of the year. The fall in the services PMI follows signs of ongoing weakness in manufacturing and a renewed slowing in the construction sector," the Chief Economist at Markit Chris Williamson said.

-

11:29

Eurozone's final services PMI decreases to 54.0 in July

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's final services purchasing managers' index (PMI) decreased to 54.0 in July from 54.4 in June, up from the preliminary reading of 53.8.

The index was driven by rises in new business and employment.

Eurozone's final composite output index fell to 53.9 in July from 54.2 in June, up from the preliminary reading of 53.7.

"The Eurozone economy showed reassuring resilience in the face of the Greek debt crisis in July. Despite a record deterioration in Greek business conditions amid extended bank closures, the overall pace of economic growth across the region barely slowed from June's four-year high," Chief Economist at Markit Chris Williamson said.

He added that Eurozone's GDP expanded 0.4% in the second quarter, according to the recent data.

-

11:17

Germany's final services PMI remains unchanged at 53.8 in July

Markit Economics released final services purchasing managers' index (PMI) for Germany on Wednesday. Germany's final services purchasing managers' index (PMI) remained unchanged at 53.8 in July, up from the preliminary reading of 53.7.

The index was driven by rises in business activity and new orders.

"The latest set of PMI results suggest that Germany's private sector continued to grow at a solid pace heading into the second semester of 2015. The combined output of the service and manufacturing sectors increased at an above average rate and companies reported further growth of new business. With employment levels rising further and some firms signalling ongoing spare capacity at their units, there is plenty of scope for further improvements in coming months," an economist at Markit, Oliver Kolodseike, said.

-

11:12

France's final services PMI declines to 52.0 in July

Markit Economics released final services purchasing managers' index (PMI) for France on Wednesday. France's final services purchasing managers' index (PMI) dropped to 52.0 in July from 54.1 in June, in line with the preliminary reading.

The decline was partly driven by a weaker rise in incoming new business.

"The service sector looks to be still struggling to generate much upward momentum in a persistently subdued demand environment. A return to job cutting and dip in business expectations in the latest survey period suggests that companies are far from convinced about the recovery and that last month's stronger numbers may have been something of a false dawn," Senior Economist at Markit Jack Kennedy said.

-

11:04

Federal Reserve Bank of Atlanta President Dennis Lockhart: the U.S. economy is ready for the first interest rate hike

Federal Reserve Bank of Atlanta President Dennis Lockhart said on Tuesday that the U.S. economy is ready for the first interest rate hike. He added that only a "significant deterioration" in the economic data could convince him not to raise interest rates.

"I think there is a high bar right now to not acting, speaking for myself," Lockhart said.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

10:58

Greek government plans to reach an agreement with its creditors within two weeks

The Greek government plans to reach an agreement with its creditors within two weeks. It is important for Greece to reach a deal until August 20 as it has to repay €3.5 billion loans to the European Central Bank.

The third Greek bailout programme is expected to be up to €86 billion. If a deal is not reached, Greece will need the next bridge loan.

-

10:52

New Zealand’s unemployment rate climbs to 5.9% in the second quarter

Statistics New Zealand released its labour market data on late Tuesday evening. The unemployment rate rose to 5.9% in the second quarter from 5.8% in the first quarter, in line with expectations.

Employment increased 0.3% in the second quarter, after a 0.7% gain in the first quarter, missing expectations for a 0.5% rise.

The participation rate declined by 0.2% to 69.3% in the second quarter.

"Even though employment grew over the quarter, population growth was greater, which resulted in a lower overall employment rate for New Zealand," labour market and household statistics manager Diane Ramsay said.

-

10:45

Chinese Caixin/Markit services PMI increases to 53.8 in July

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China increased to 53.8 in July from 51.8 in June. It was the highest level since August 2014.

A reading above 50 indicates expansion in the sector.

The new business sub-index rose to 54.0 in July from 54.2 in June, while the employment sub-index also increased. Input prices and selling prices climbed in July.

-

10:39

Canadian manufacturing PMI declines to 50.8 in July

RBC released its RBC Canadian manufacturing PMI on Tuesday. The index declined to 50.8 in July from 51.3 in June.

"The RBC PMI indicates a second consecutive month of improving business conditions in July though still at a very modest pace and slightly below that achieved in June. As we enter the second half the year, a strengthening U.S. economy and weaker Canadian dollar should provide a greater boost to exports and business conditions for manufacturers," RBC assistant chief economist, Paul Ferley, said.

-

10:27

New York’s current business conditions index rises to 68.8 in July

The Institute for Supply Management (ISM) released its business condition index for New York on Tuesday. The current business conditions index rose to 68.8 in July from 63.1 in June.

The gain was driven by the employment subindex, which jumped to 64.8.

The six-month outlook fell to 69.2 in July from 78.0 in June, while the inflation gauge declined below 50.

-

10:14

OECD: consumer price inflation in the OECD area remains unchanged at 0.6% year-on-year in June

OECD released its consumer price inflation (CPI) data. Consumer price inflation in the OECD area remained unchanged at 0.6% year-on-year in June.

Energy prices dropped at an annual rate of 9.3% in June, food prices decreased to 1.5% in June from 1.6% in May.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.6% in June.

June's CPI was up 0.3% in France, 0.9% in Canada, and 0.1% in Italy. The consumer price inflation in Greece fell 2.2% in June.

-

08:17

Global Stocks: U.S. indices ended lower

Federal Reserve Bank of Atlanta President Dennis Lockhart said in an interview with The Wall Street Journal the U.S. economy was ready for a rate hike. His statement weighed on stocks.

The U.S. Department of Commerce reported factory orders rose by 1.8% ($8.7 billion) in June to $478.5 billion. This gain offset the 1.1% decline in May, which was revised from -1.0%. Orders excluding transportation rose by 0.5% after the 0.1% decline reported previously.

The Dow Jones Industrial Average fell 47.5 points, or 0.3%, to 17550.69. The S&P 500 declined 4.72 points or 0.2% to 2093.32. The Nasdaq Composite lost 9.84 points, or 0.2%, to 5105.55.

Apple shares lost 3.5% sagging below a 200-day Moving Average, one of the key trading levels.

This morning in Asia Hong Kong Hang Seng climbed 0.27%, or 66.36 points, to 24,472.48. China Shanghai Composite Index fell 1.27%, or 47.89 points, to 3,708.66. The Nikkei gained 0.48%, or 99.22 points, to 20,619.58.

Asian stocks posted mixed results. Chinese stocks fell one more time despite favorable data on the country's services sector. The Caixin/Markit PMI rose to 53.8 in July from June's reading of 51.8, reaching the highest level since August 2014. This is the 12th straight month of expansion.

Japanese stocks declined at the beginning of the session, but advanced later. Analysts believe that investors are waiting for U.S. employment data.

-

04:02

Nikkei 225 20,682.66 +162.30 +0.8 %, Hang Seng 24,483.45 +77.33 +0.3 %, Shanghai Composite 3,764.82 +8.27 +0.2 %

-

00:32

Stocks. Daily history for Aug 4’2015:

(index / closing price / change items /% change)

Hang Seng 24,406.12 -5.30 -0.02 %

S&P/ASX 200 5,697.9 +18.56 +0.33 %

Shanghai Composite 3,756.54 +133.64 +3.69 %

Topix 1,659.83 +0.23 +0.01 %

FTSE 100 6,686.57 -2.05 -0.03 %

CAC 40 5,112.14 -8.38 -0.16 %

Xetra DAX 11,456.07 +12.35 +0.11 %

S&P 500 2,093.32 -4.72 -0.22 %

NASDAQ Composite 5,105.55 -9.84 -0.19 %

Dow Jones 17,550.69 -47.51 -0.27 %

-