Noticias del mercado

-

22:09

US stocks declined

The Standard & Poor's 500 Index declined for the fourth time in five sessions, as biotechnology shares tumbled while media companies sold off on disappointing results from Viacom Inc. and Twenty-First Century Fox Inc.

The S&P 500 lost 0.8 percent to 2,083.79 at 4 p.m. in New York, falling below its average prices during the past 50 and 100 days.

Media shares were battered for a second day, with quarterly earnings at CBS and Fox marked by shrinking U.S. ad sales and profits propped up by stock buybacks. Viacom, owner of MTV, Nickelodeon and Comedy Central, posted a third-quarter revenue decline that was wider than analysts had forecast.

Media stocks have been the darlings of the U.S. bull market that began 6 1/2 years ago. Since global equities bottomed in March 2009, the 15-member S&P 500 Media Industry Index has risen 464 percent, second only to automakers. Within the gauge, CBS and Tegna Inc. -- up more than 15 fold over the period -- are among companies with the 20 biggest gains.

About 85 percent of S&P 500 members have released earnings figures, with three-quarters beating profit estimates and half topping sales projections. Analysts now call for a 2.8 percent drop in second-quarter earnings, shallower than July 10 estimates for a 6.4 percent fall.

Along with corporate earnings, investors are also watching economic reports to gauge when the Fed will increase interest rates. A report today showed jobless claims rose by 3,000 to 270,000, hovering near four-decade lows as employers hold on to more workers in response to increased demand following a slump in early 2015.

Friday's monthly payroll data will be parsed for indications on the likelihood of a September rate increase, with a particular interest in any signs of stronger wage growth. The government's report is projected to show employers took on 225,000 workers last month, while the jobless rate held at a seven-year low of 5.3 percent.

The S&P 500 snapped a three-day losing streak Wednesday amid better-than-expected earnings from technology companies. The gauge is coming off its best monthly gain since February, and closed Thursday 2.2 percent below its record set in May.

-

21:00

DJIA 17411.96 -128.51 -0.73%, NASDAQ 5055.55 -84.40 -1.64%, S&P 500 2082.96 -16.88 -0.80%

-

18:43

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Thursday as a spate of poor earnings reports. Moreover, the number of Americans filing new applications for unemployment benefits rose less than expected last week, suggesting labor market conditions are continuing to tighten. Initial claims for state unemployment benefits increased 3,000 to a seasonally adjusted 270,000 for the week ended Aug. 1, the Labor Department said on Thursday. It was the 22nd consecutive week that claims held below the 300,000 threshold, which is associated with a strengthening labor market.

Almost all of Dow stocks in negative area (26 of 30). Top looser - The Walt Disney Company (DIS, -4.74%). Top gainer - Chevron Corporation (CVX, +1.01).

Almost all S&P index sectors also in negative area. Top gainer - Healthcare (-2.2%). Top gainer - Basic Materials (+0,3%).

At the moment:

Dow 17332.00 -143.00 -0.82%

S&P 500 2073.50 -20.25 -0.97%

Nasdaq 100 4513.00 -80.50 -1.75%

10 Year yield 2,22% -0,05

Oil 44.28 -0.87 -1.93%

Gold 1091.50 +5.90 +0.54%

-

18:09

WSE: Session Results

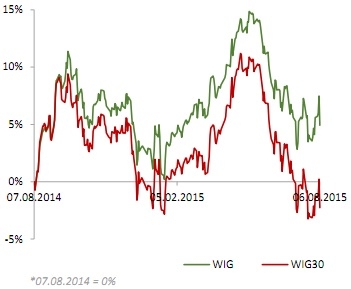

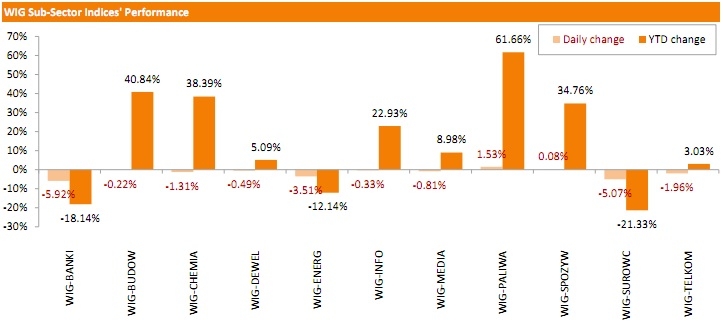

Polish equity market recorded a notable decline on Thursday. The broad market measure, the WIG Index, lost 2.38%. Sector-wise, banks fared the worst, slumping 5.92% on an amended draft law on Swiss franc mortgage conversion, suggesting that the lenders will have to pay 90% of the conversion cost. The best-performing group was oil and gas sector, gaining 1.53%.

The large-cap stocks' measure, the WIG30 Index, fell by 2.47%, dragged down by extremely weak performance of banking sector stocks, namely MBANK (WSE: MBK), PKO BP (WSE: PKO), BZ WBK (WSE: BZW), HANDLOWY (WSE: BHW) and PEKAO (WSE: PEO), which produced losses between 4.03% and 7.79%. In addition, significant declines were posted by PGE (WSE: PGE) and KGHM (WSE: KGH), which tumbled by 5.98% and 5.45% respectively. On the other side of the ledger, oil and gas name PKN ORLEN (WSE: PKN) recorded the strongest daily performance, soaring by 3.75%. It was followed by KERNEL (WSE: KER) and ASSECO POLAND (WSE: ACP), adding 0.90% and 0.50% respectively.

-

18:00

European stocks closed: FTSE 6747.09 -5.32 -0.08%, DAX 11585.10 -51.20 -0.44%, CAC 40 5192.11 -4.62 -0.09%

-

18:00

European stocks close: stocks closed lower ahead the release of U.S. labour market data on Friday

Stock indices closed lower ahead the release of U.S. labour market data on Friday. The better-than-expected U.S. labour market data could force the Fed to start raising its interest rate.

Meanwhile, the economic data from the Eurozone was better than expected. German seasonal adjusted factory orders climbed 2.0% in June, beating expectations for a 0.2% gain, after a 0.3% decline in May. May's figure was revised down from a 0.2% fall.

The increase was driven by rises in new orders from the Eurozone and from other countries. New orders from the Eurozone rose 2.3% in June, while orders from other countries increased 6.3%.

The Bank of England (BoE) kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its August meeting minutes today. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

The central bank expects the inflation to reach 2% target by the third quarter of 2017, while Britain's economy is expected to expand 2.8% in 2015.

The BoE Governor Mark Carney repeated at a press conference on Thursday that the time for interest rate hike is nearing.

"The likely timing of the first bank rate increase is drawing closer. However the exact timing of the first move cannot be predicted in advance," he said.

Carney added that the timing of the interest rate hike will depend on the economic data.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Thursday. Manufacturing production in the U.K. rose 0.2% in June, in line with expectations, after a 0.6% decrease in May.

Manufacturing output was driven by a rise in the manufacture of weapons and ammunition, which jumped 31.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.5% in June, beating forecast of a 0.4% gain, after a 1.0% rise in May.

Industrial production in the U.K. dropped 0.4% in June, missing forecasts of a 0.1% rise, after a 0.3% gain in May. May's figure was revised down from 0.4% increase.

The decline in the industrial output was driven by a drop in oil and gas output. Oil and gas production plunged 5.8% in June, the biggest fall since January 2014.

On a yearly basis, industrial production in the U.K. gained 1.5% in June, missing expectations for a 2.2% rise, after a 1.9% increase in May. May's figure was revised down from 2.1% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,747.09 -5.32 -0.08 %

DAX 11,585.1 -51.20 -0.44 %

CAC 40 5,192.11 -4.62 -0.09 %

-

17:12

NIESR’s gross domestic product rises by 0.7% in three months to July

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Thursday. The GDP estimate rose by 0.7% in three months to July, after a 0.7% growth in three months to June.

"We expect an average rate of growth of 2.5 per cent for 2015 as a whole," the NIESR said.

The think tank expects the Bank of England to raise its interest rate in February 2016.

-

16:55

German government doubts a deal on a third bailout programme for Greece can be reached in August

According to the German newspaper Bild, the German government doubts that a deal on a third bailout programme for Greece can be reached in August. The government believes that Greece will need another bridge loan.

Athens had to repay €3.4 billion loans to the European Central Bank on August 20.

-

16:17

Eurozone's retail PMI jumps to 54.2 in July

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Thursday. Eurozone's construction purchasing managers' index (PMI) jumped to 54.2 in July from 50.4 in June. It was the highest level since January 2011.

A reading above 50 indicates expansion in the sector.

Germany, France and Italy were the main contributors.

"July's retail PMI showed sales growth accelerating sharply as levels of trade rose across Germany, France and Italy. Each made positive strides since June though it was Germany that remained by far the brightest performer, recording a sharp increase in sales that was the fastest since late-2006," an economist at Markit, Phil Smith, said.

-

15:44

Germany's construction PMI falls to 50.6 in July

Markit Economics released construction purchasing managers' index (PMI) for Germany on Thursday. Germany's construction purchasing managers' index (PMI) fell to 50.6 in July from 50.7 in June.

A reading above 50 indicates expansion in the sector.

The index was driven by lower commercial activity.

"The data highlighted that the sector is becoming more and more dependent on work on residential building projects, as civil engineering activity continued to decline at a marked pace and commercial building activity stagnated," an economist at Markit, Oliver Kolodseike, said.

-

15:32

U.S. Stocks open: Dow +0.07%, Nasdaq +0.13%, S&P +0.10%

-

15:26

Before the bell: S&P futures +0.02%, NASDAQ futures +0.09%

U.S. stock-index futures were little changed amid corporate earnings while data showed jobless claims hovered near four-decade lows.

Global Stocks:

Nikkei 20,664.44 +50.38 +0.24%

Hang Seng 24,375.28 -138.88 -0.57%

Shanghai Composite 3,662 -32.58 -0.88%

FTSE 6,745.61 -6.80 -0.10%

CAC 5,211.05 +14.32 +0.28%

DAX 11,633.74 -2.56 -0.02%

Crude oil $44.63 (-1.28%)

Gold $1084.10 (-0.13%)

-

15:25

Greek unemployment rate declines to 25.0% in May, the lowest level since June 2012

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece declined to 25.0% in May from 25.6% in April.

It was the lowest level since June 2012.

The number of unemployed fell to 1.201 million in May from 1.3 million a year ago.

The youth unemployment rate was 51.8% in May.

-

15:09

Bank of England Governor Mark Carney repeats that the time for interest rate hike is nearing

The Bank of England (BoE) Governor Mark Carney repeated at a press conference on Thursday that the time for interest rate hike is nearing.

"The likely timing of the first bank rate increase is drawing closer. However the exact timing of the first move cannot be predicted in advance," he said.

Carney added that the timing of the interest rate hike will depend on the economic data.

"The strength of sterling, and even taking into account the fiscal cosolidation that were going to see over the coming years and the weakness in global demand, we see robust private sector growth here and consistent with that is a need to begin to increase interest rates," the BoE governor noted.

-

15:08

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Citigroup Inc., NYSE

C

58.75

+0.02%

1.1K

JPMorgan Chase and Co

JPM

68.77

+0.06%

0.3K

Microsoft Corp

MSFT

47.64

+0.13%

1.3K

Starbucks Corporation, NASDAQ

SBUX

59.10

+0.15%

5.3K

Procter & Gamble Co

PG

75.91

+0.18%

0.4K

Amazon.com Inc., NASDAQ

AMZN

538.00

+0.18%

1.1K

Verizon Communications Inc

VZ

46.74

+0.21%

2.0K

Google Inc.

GOOG

645.25

+0.23%

0.8K

International Business Machines Co...

IBM

157.00

+0.26%

0.8K

Intel Corp

INTC

29.20

+0.27%

1.4K

Visa

V

75.20

+0.29%

1.6K

ALCOA INC.

AA

9.82

+0.61%

26.8K

Walt Disney Co

DIS

111.27

+0.67%

93.0K

Apple Inc.

AAPL

115.69

+0.71%

220.8K

Facebook, Inc.

FB

97.14

+0.73%

151.9K

Barrick Gold Corporation, NYSE

ABX

6.69

+2.29%

15.7K

Caterpillar Inc

CAT

76.88

0.00%

0.2K

Johnson & Johnson

JNJ

100.52

0.00%

0.4K

McDonald's Corp

MCD

99.79

-0.01%

2.7K

AT&T Inc

T

34.56

-0.02%

1.4K

Ford Motor Co.

F

14.79

-0.07%

1.3K

Yahoo! Inc., NASDAQ

YHOO

37.20

-0.13%

5.3K

UnitedHealth Group Inc

UNH

123.75

-0.14%

1.1K

Exxon Mobil Corp

XOM

77.00

-0.22%

19.4K

Wal-Mart Stores Inc

WMT

73.25

-0.35%

14.4K

Chevron Corp

CVX

83.70

-0.39%

7.1K

The Coca-Cola Co

KO

41.93

-0.45%

3.4K

Twitter, Inc., NYSE

TWTR

28.35

-0.46%

53.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.86

-0.64%

18.8K

Yandex N.V., NASDAQ

YNDX

13.45

-2.18%

0.7K

Tesla Motors, Inc., NASDAQ

TSLA

252.64

-6.47%

169.4K

-

14:57

Initial jobless claims rise by 3,000 to 270,000 in the week ending August 01

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending August 01 in the U.S. rose by 3,000 to 270,000 from 267,000 in the previous week.

Analysts had expected the number of initial jobless claims to be 273,000.

Jobless claims remained below 300,000 the 22th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 14,000 to 2,255,000 in the week ended July 25.

-

14:44

Bank of England's Monetary Policy Committee minutes: 8-1 split to keep monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its August meeting minutes on Thursday. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

Analysts had expected that at least two members will vote to hike interest rate.

The central bank said in its statement that the monetary policy will depend on the incoming economic data.

Most MPC members noted that the interest rate hike was not necessary.

-

14:34

Bank of England keeps its interest rate on hold at 0.5% in August

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

The central bank expects the inflation to reach 2% target by the third quarter of 2017, while Britain's economy is expected to expand 2.8% in 2015.

-

12:00

European stock markets mid session: stocks traded slightly lower ahead of the Bank of England’s interest rate decision

Stock indices traded slightly lower ahead of the Bank of England's (BoE) interest rate decision. It will be the first time that the central bank will release its interest rate decision, the minutes of the monetary policy meeting and its quarterly forecasts for economic growth and inflation at the same time.

Analysts expect the BoE to keep its monetary policy unchanged.

The vote of the MPC members will be monitored closely. Analysts expect that two MPC members will vote for the interest rate hike.

The BoE Governor Mark Carney is expected to speak at a press conference after the release of the interest rate decision.

Meanwhile, the economic data from the Eurozone was better than expected. German seasonal adjusted factory orders climbed 2.0% in June, beating expectations for a 0.2% gain, after a 0.3% decline in May. May's figure was revised down from a 0.2% fall.

The increase was driven by rises in new orders from the Eurozone and from other countries. New orders from the Eurozone rose 2.3% in June, while orders from other countries increased 6.3%.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Thursday. Manufacturing production in the U.K. rose 0.2% in June, in line with expectations, after a 0.6% decrease in May.

Manufacturing output was driven by a rise in the manufacture of weapons and ammunition, which jumped 31.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.5% in June, beating forecast of a 0.4% gain, after a 1.0% rise in May.

Industrial production in the U.K. dropped 0.4% in June, missing forecasts of a 0.1% rise, after a 0.3% gain in May. May's figure was revised down from 0.4% increase.

The decline in the industrial output was driven by a drop in oil and gas output. Oil and gas production plunged 5.8% in June, the biggest fall since January 2014.

On a yearly basis, industrial production in the U.K. gained 1.5% in June, missing expectations for a 2.2% rise, after a 1.9% increase in May. May's figure was revised down from 2.1% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,722.68 -29.73 -0.44 %

DAX 11,635.07 -1.23 -0.01 %

CAC 40 5,192.85 -3.88 -0.07 %

-

11:41

SECO consumer climate index for Switzerland plunges to -19 in July

The State Secretariat for Economic Affairs (SECO) released its consumer climate index for Switzerland on Thursday. The SECO consumer climate index plunged to -19 in July from -6 in April.

The future economic expectations subindex dropped to -25 in July from -8 in April.

The unemployment trends subindex jumped to 65 in July from 51 in April.

The assessment of previous economic trends subindex fell to -36 in July from -22 in April.

The price trends over the last twelve months was down to -5 in July from -3 in April, while the future price trends subindex rose to +18 from +6.

-

11:18

House prices in the U.K. fall 0.6% in July

Halifax released its house prices data for the U.K. on Wednesday. House prices in the U.K. decreased 0.6% in July, after a 1.6% rise in June. June's figure was revised down from a 1.7% gain.

On a yearly basis, house prices climbed 7.9% in three months to July, after a 9.6% increase in three months to June. It was the slowest pace since December 2014.

"The underlying pace of house price growth remains robust notwithstanding the easing in July," Halifax's managing director for retail customer products, Stephen Noakes, said.

-

11:04

U.K. manufacturing production rises 0.2% in June, but industrial production declines 0.4%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Thursday. Manufacturing production in the U.K. rose 0.2% in June, in line with expectations, after a 0.6% decrease in May.

Manufacturing output was driven by a rise in the manufacture of weapons and ammunition, which jumped 31.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.5% in June, beating forecast of a 0.4% gain, after a 1.0% rise in May.

Industrial production in the U.K. dropped 0.4% in June, missing forecasts of a 0.1% rise, after a 0.3% gain in May. May's figure was revised down from 0.4% increase.

The decline in the industrial output was driven by a drop in oil and gas output. Oil and gas production plunged 5.8% in June, the biggest fall since January 2014.

On a yearly basis, industrial production in the U.K. gained 1.5% in June, missing expectations for a 2.2% rise, after a 1.9% increase in May. May's figure was revised down from 2.1% gain.

-

10:53

German seasonal adjusted factory orders climb 2.0% in June

Destatis released its factory orders data for Germany on Thursday. German seasonal adjusted factory orders climbed 2.0% in June, beating expectations for a 0.2% gain, after a 0.3% decline in May. May's figure was revised down from a 0.2% fall.

The increase was driven by rises in new orders from the Eurozone and from other countries. New orders from the Eurozone rose 2.3% in June, while orders from other countries increased 6.3%.

Foreign orders climbed by 4.8% in June, while domestic orders decreased by 2.0%.

Orders of the intermediate goods fell by 0.2% in June, capital goods orders were up 3.7%, while consumer goods orders decreased 0.6%.

-

10:43

Australia's unemployment rate is up to 6.3% in July

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate rose to 6.3% in July from 6.1% in June, missing expectations for a decline to 6.0%. June's figure was revised up from 6.0%.

The number of employed people in Australia climbed by 38,500 in July, beating forecast of a rise by 10,000, after a gain by 7,000 in June. June's figure was revised down from a rise by 7,300.

Full-time employment rose by 12,400, while part-time employment climbed by 26,100.

The participation rate was 65.1%.

-

10:34

Portugal’s unemployment rate declines to 11.9% in the second quarter

Statistics Portugal released its labour market data on Wednesday. The unemployment rate declined to 11.9% in the second quarter from 13.7% in the first quarter, the lowest level since the fourth quarter of 2010.

The number of unemployed persons fell to 620,400 in the second quarter from 712,900 in the first quarter.

The youth jobless rate decreased to 29.8% in the second quarter from 34.4% in the previous quarter.

The number of persons employed rose to 4.58 million from 4.48 million. The participation rate was up to 58.6% from 58.5%.

-

10:25

NIESR expects Britain’s economy to expand 2.5% in 2015

The National Institute of Economic and Social Research (NIESR) said on Wednesday that it expect Britain's economy to expand 2.5% in 2015, driven by consumption and business investment.

The think tank also expects the inflation to remain around zero throughout the rest of this year, while the unemployment rate is expected to run in the range between 5.0% and 5.5%. A stronger pound and low oil prices weigh on the inflation.

The inflation is expected to increase toward the BoE's 2.0% target by 2017.

The NIESR said that the BoE will start raising its interest rate in the first quarter of 2016 and will reach 2% per annum by 2019.

An absolute budget surplus is expected to be reached in 2019-2020.

-

10:11

European Central Bank decided not to raise the amount of emergency funding (ELA)

The European Central Bank (ECB) decided not to raise the amount of emergency funding (ELA) on Wednesday. The amount the Greek central bank can lend its banks totals around €91.0 billion.

Sources familiar with the situation said that Greek banks have built up a liquidity buffer of around €5 billion.

The ECB will review ELA in two weeks.

The Greek government is negotiating with its creditors the third bailout programme.

-

09:43

Global Stocks: U.S. indices traded mixed

U.S. stock indices posted mixed results amid mixed earnings reports as investors awaited payrolls data to assess timing of the Fed rate increase. Data by Automatic Data Processing (ADP) showed on Wednesday that private sector of the U.S. economy added 185,000 jobs vs 215,000 jobs expected.

The Dow Jones Industrial Average fell 10.22 points, or 0.1%, to 17540.47. The S&P 500 rose 6.52 points, or 0.3%, to 2099.84. The Nasdaq Composite gained 34.40 points, or 0.7%, to 5139.94.

This morning in Asia Hong Kong Hang Seng declined 0.50%, or 121.74 points, to 24,392.42. China Shanghai Composite Index climbed 0.04%, or 1.43 points, to 3,696.01. The Nikkei gained 0.58%, or 119.60 points, to 20,733.66.

Asian stocks mostly declined amid low oil prices and bets for the Federal Reserve to raise rates in September.

Japanese stocks fell at the beginning of today's session, but managed to grow later due to a weaker yen, which is favorable for exporters. Investors are also waiting for U.S. employment data due Friday.

-

04:02

Nikkei 225 20,735.85 +121.79 +0.59 %, Hang Seng 24,382.71 -131.45 -0.54 %, Shanghai Composite 3,625.5 -69.07 -1.87 %

-

00:35

Stocks. Daily history for Aug 5’2015:

(index / closing price / change items /% change)

Nikkei 225 20,614.06 +93.70 +0.46 %

Hang Seng 24,514.16 +108.04 +0.44 %

S&P/ASX 200 5,673.98 -23.92 -0.42 %

Shanghai Composite 3,695.76 -60.78 -1.62 %

FTSE 100 6,752.41 +65.84 +0.98 %

CAC 40 5,196.73 +84.59 +1.65 %

Xetra DAX 11,636.3 +180.23 +1.57 %

S&P 500 2,099.84 +6.52 +0.31 %

NASDAQ Composite 5,139.95 +34.40 +0.67 %

Dow Jones 17,540.47 -10.22 -0.06 %

-