Noticias del mercado

-

17:42

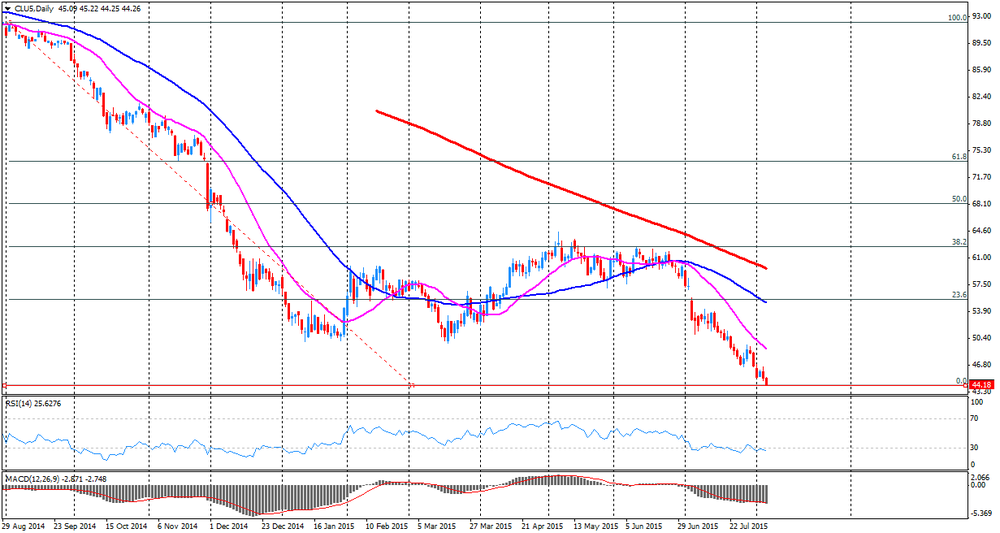

Oil prices plunge on concerns over the global oil glut

Oil prices plunged on concerns over the global oil glut. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories fell by 4.407 million barrels to 455.3 million in the week to July 31. But oil production in the U.S. rose to 9.47 million barrels in last week from 9.41 million in the previous week.

Concerns over the global oil glut grew due to a global economic slowdown and a nuclear deal with Iran.

Market participants are awaiting the release of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.3% in July. The U.S. economy is expected to add 218,000 jobs in July, after adding 223,000 jobs in June.

A stronger U.S. dollar due to the better-than-expected U.S. labour market data could put oil prices under more pressure.

Market participants are also awaiting the release of the number of active U.S. rigs.

WTI crude oil for September delivery dropped to $44.29 a barrel on the New York Mercantile Exchange.

Brent crude oil for September fell to $49.33 a barrel on ICE Futures Europe.

-

17:23

Gold traded higher after the release of the U.S. initial jobless claims

Gold traded higher after the release of the U.S. initial jobless claims. The number of initial jobless claims in the week ending August 01 in the U.S. rose by 3,000 to 270,000 from 267,000 in the previous week.

Analysts had expected the number of initial jobless claims to be 273,000.

Jobless claims remained below 300,000 the 22th straight week. This threshold is associated with the strengthening of the labour market.

Gold price is under pressure due to speculation that the Fed may start raising its interest rate soon.

Market participants are awaiting the release of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 5.3% in July. The U.S. economy is expected to add 218,000 jobs in July, after adding 223,000 jobs in June.

October futures for gold on the COMEX today declined to 1090.00 dollars per ounce.

-

09:50

Oil prices are under pressure amid a mixed report

West Texas Intermediate futures for September delivery slid to $45.14 (-0.02%), while Brent crude climbed to $49.71 (+0.24%). Investors remained focused on oversupply concerns after the Energy Information Administration published its report on Wednesday. On one hand, U.S. crude stockpiles fell 4.4 million barrels in the week through July 31, pointing to strong demand. On the other hand, U.S. production rose by 52,000 barrels per day to 9.5 million barrels per day.

A stronger greenback makes this dollar-denominated commodity more expensive for importers.

-

09:49

Gold remains under pressure amid U.S. data

Gold slid to $1,083.80 (-0.17%). The Institute for Supply Management reported on Wednesday that the index of economic activity in U.S. non-manufacturing sector exceeded expectations and rose to 60.3 in July. New orders and backlog orders climbed to 63.8 and 54.0 respectively. This report argues for an upcoming rate hike in the U.S.

Investors are anticipating U.S. employment data as Fed officials closely watch developments in the labor market.

-

00:36

Commodities. Daily history for Aug 5’2015:

(raw materials / closing price /% change)

Oil 45.11 -0.09%

Gold 1,084.00 -0.15%

-