Noticias del mercado

-

22:08

U.S. stocks declined

U.S. stocks declined, after equities posted their best monthly gain since February, as commodities producers sank and Apple Inc. fell into a correction.

The Standard & Poor's 500 Index retreated 0.3 percent to 2,097.97 at 4 p.m. in New York, after falling as much as 0.8 percent, to close above its average price during the past 100 days.

Commodities dropped after an official gauge of Chinese manufacturing slid to a five-month low and Iran said it will be able to bolster crude production within a week of sanctions ending.

The slide in equities accelerated Monday after the S&P 500 fell below its average price for the past 100 days, a level commonly watched by market technicians. The gauge last dropped below the 100-day moving average on July 24 during its longest losing streak since January. The S&P 500 is about 1.3 percent above its 200-day average, a level that has stopped the last two declines of more than 2.8 percent.

Apple fell for the ninth time in 10 days, sliding below its average price for the past 200 days for the first time since 2013 and extending its slide from a February high past 10 percent.

Data Focus

A report earlier showed American households kept spending in June, capping a stronger quarterly performance for the biggest part of the economy. Separate data showed The Institute for Supply Management's manufacturing index slipped last month from a June reading that was the fastest since the start of the year.

Focus will turn later this week to the monthly payroll report due Friday, as the Federal Reserve looks for signs of a further pickup in the labor market before raising interest rates. Fed Chair Janet Yellen said in July she expected the central bank to raise its benchmark rate this year, while emphasizing the pace of increases will probably be gradual.

"At this point the focus is largely falling on the Fed, so the macro becomes the dominant conversation in terms of will they or won't they," said Dan Greenhaus, chief global strategist in New York at BTIG LLC. "That's really the conversation point through what is likely to be a slow month. Everyone's going to be focusing on the economic data."

The S&P 500 rose 2 percent in July, as earnings from Amazon.com Inc. and Google Inc. countered declines by commodity companies. The gauge advanced 1.2 percent last week, and is 1.9 percent below an all-time high reached in May.

More than two-thirds of companies in the equity benchmark have reported earnings results, with nearly three-quarters beating profit estimates and half exceeding sales projections. Analysts now forecast a 2.8 percent drop in second-quarter earnings, shallower than calls for a 6.4 percent fall about two weeks ago.

-

21:00

DJIA 17514.92 -174.94 -0.99%, NASDAQ 5094.72 -33.56 -0.65%, S&P 500 2088.02 -15.82 -0.75%

-

18:04

WSE: Session Results

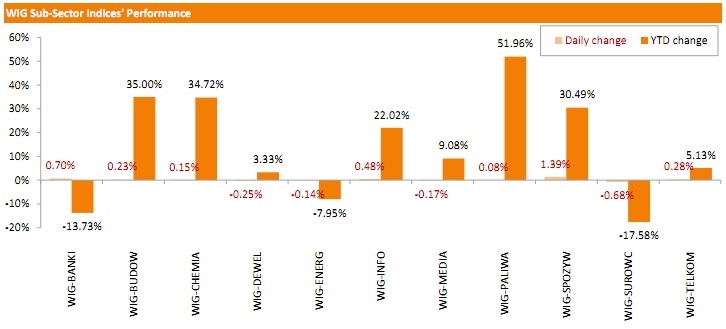

Polish equity market edged higher on Monday. The broad market measure, the WIG Index, added 0.11%. Sector-wise, food sector (+1.39%) and banks (+0.70%) fared the best, while materials (-0.68%) produced the biggest losses.

The large-cap companies' measure, the WIG30 Index, ended today's session unchanged. In the index basket, CCC (WSE: CCC) plunged by 3.37% after the company reported its monthly sales rose by11.9% y/y in July, which is lower compared to the analogical indicators for April-June (22%-27% y/y). Other major decliners included ALIOR (WSE: ALR), JSW (WSE: JSW), BOGDANKA (WSE: LWB), LOTOS (WSE: LTS) and PZU (WSE: PZU), losing 1.08%-1.94%. On the other side of the ledger, banking names PEKAO (WSE: PEO), PKO BP (WSE: PKO) and ING BSK (WSE: ING), as well as oil&gas stock PGNIG (WSE: PGN) led advancers, gaining 1.59%-1.92%.

-

18:02

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes lower on the first trading day in August as oil prices touched a six-month low and data showed U.S. economy lost some momentum at the end of the second quarter. In U.S. data, consumer spending recorded its smallest gain in four months, while the pace of growth in the U.S. manufacturing sector slowed in July. On Friday, wage data showed that U.S. labor costs in the second quarter rose the least in 33 years. Investors have been keeping a sharp eye on economic data for clues regarding the timing of the first rate increase in nearly a decade. The U.S. Federal Reserve has said it will hike rates only when it sees a sustained recovery in the economy.

Dow stocks are mixed (17 in positive area, 13 in negative area). Top looser - Chevron Corporation (CVX, -2.79%). Top gainer - The Walt Disney Company (DIS, +0.63).

S&P index sectors are mixed. Top looser - Basic Materials (-1.2%). Top gainer - Utilities (+0.3%).

At the moment:

Dow 17552.00 -62.00 -0.35%

S&P 500 2096.50 -2.00 -0.10%

Nasdaq 100 4590.75 +5.75 +0.13%

10 Year yield 2,17% -0,04

Oil 45.99 -1.13 -2.40%

Gold 1089.90 -5.20 -0.47%

-

18:00

European stocks closed: FTSE 6688.62 -7.66 -0.11%, DAX 11443.72 134.73 1.19%, CAC 40 5120.52 37.91 0.75%

-

18:00

European stocks close: stocks closed mixed after the mostly better-than-expected manufacturing PMIs from the Eurozone

Stock indices closed mixed after the mostly better-than-expected manufacturing PMIs from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.4 in July from 52.5 in June, up from a preliminary reading of 52.2.

The upward revision was driven by a stronger than previously recorded rise in Germany.

Markit's Chief Economist Chris Williamson said that June's PMI was "the Eurozone manufacturing economy showed encouraging resilience in the face of the Greek debt crisis in July".

Germany's final manufacturing purchasing managers' index (PMI) declined to 51.8 in July from 51.9 in June, up from a preliminary reading of 51.5.

The increase was driven by a rise in production and new orders.

"The German manufacturing sector remained stuck in a low gear at the start of the third quarter, with the PMI signalling further, albeit only modest, growth," Markit economist Oliver Kolodseike said.

France's final manufacturing purchasing managers' index (PMI) dropped to 49.6 in July from 50.7 in June, in line with the preliminary reading.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 51.9 in July from 51.4 in June, exceeding expectations for a rise to 51.6.

The increase was driven by the strong performance of the consumer goods sector.

New orders dropped to 52.2 in July, the lowest level since September 2014. The stronger pound weighed on new orders.

"Although an uptick in the headline PMI breaks the decelerating trend in UK manufacturing, growth remains near-stagnant and suggests that the sector is continuing to act as a drag on the economy. With the sterling-euro exchange rate still sapping export demand and constraining growth of total order inflows, its seems that we will again look to the service sector to sustain any semblance of reasonable economic growth in the third quarter," Markit's Senior Economist Rob Dobson said.

According to a Reuters report, the Athens stock exchange closed unofficially 16.2% lower on Monday. The Athens Stock Exchange reopened on Monday after a five-week halt.

Greek banking shares were the weakest performers.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,688.62 -7.66 -0.11 %

DAX 11,443.72 +134.73 +1.19 %

CAC 40 5,120.52 +37.91 +0.75 %

-

17:02

Greek stocks drop after reopening

According to a Reuters report, the Athens stock exchange closed unofficially 16.2% lower on Monday. The Athens Stock Exchange reopened on Monday after a five-week halt.

Greek banking shares were the weakest performers.

-

16:41

Construction spending in the U.S. is up 0.1% in June

The U.S. Commerce Department released construction spending data on Monday. Construction spending in the U.S. rose 0.1% in June, missing expectations for a 0.6% gain, after a 1.8% increase in May. May's figure was revised up from a 0.8% rise.

The decline was driven by a decrease in private construction. Private construction spending fell 0.5% in June. It was the largest decline since June 2014.

Public construction spending increased 1.6%. It was the largest increase since November 2010.

-

16:23

ISM manufacturing purchasing managers’ index falls to 52.7 in July

The Institute for Supply Management released its manufacturing purchasing managers' index for the U.S. on Monday. The index declined to 52.7 in July from 53.5 in June, missing expectations for a gain to 53.6.

A reading above 50 indicates expansion, below indicates contraction.

The decline was partly driven by a fall in employment. The employment index dropped to 52.7 in July from 55.5 in June.

The production index remained unchanged in July.

The new orders index was up to 56.5 in July from 56.0 in June.

The prices paid index declined to 44.0 in July from 49.5 in June.

-

15:54

U.S. final manufacturing purchasing managers' index (PMI) rises to 53.8 in July

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. final manufacturing purchasing managers' index (PMI) increased to 53.8 in July from 53.6 in June, in line with the previous estimate.

A reading above 50 indicates expansion in economic activity.

The increase was driven by driven by the rise in overall new business volumes.

The Markit Chief Economist Chris Williamson said that companies reported that the strong U.S. dollar hurt export competiveness.

"The data suggest the manufacturing sector is struggling rather than collapsing against the various headwinds. Relief has also come in the form of lower commodity prices, and low oil prices in particular," he added.

-

15:39

Italy’s final manufacturing PMI climbs to 55.3 in July

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Italy on Monday. Italy's manufacturing purchasing managers' index (PMI) climbed to 55.3 in July from 54.1 in June.

The output and new orders rose in June, while the employment was up.

"Momentum continues to build in the Italian manufacturing sector, with the PMI now having risen in six of the past seven months to its highest since April 2011. Production is expanding on all fronts, though particularly sharply in the capital goods sector, in a sign of increasing investment among businesses," Markit economist Phil Smith said.

-

15:33

U.S. Stocks open: Dow +0.05%, Nasdaq +0.18%, S&P +0.06%

-

15:28

Before the bell: S&P futures -0.04%, NASDAQ futures +0.02%

U.S. stock-index futures fluctuated as investors awaited data on manufacturing.

Global Stocks:

Nikkei 20,548.11 -37.13 -0.18%

Hang Seng 24,411.42 -224.86 -0.91%

Shanghai Composite 3,622.99 -40.74 -1.11%

FTSE 6,700.83 +4.55 +0.07%

CAC 5,118.55 +35.94 +0.71%

DAX 11,440.51 +131.52 +1.16%

Crude oil $46.02 (-2.33%)

Gold $1090.40 (-0.40%)

-

15:17

Spain’s final manufacturing PMI falls to 53.6 in July

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Spain on Monday. Spain's manufacturing purchasing managers' index (PMI) declined to 53.6 in July from 54.5 in June. It was the lowest level since October 2014.

The decline was driven by a slower increase in output and new businesses.

"On the one hand, growth of output and new orders continued to slow from the sharp rates seen in May. On the other, firms raised employment and stocks of purchases at rates not seen since before the economic crisis, suggesting that manufacturers aren't expecting a prolonged slowdown," a senior economist at Markit Andrew Harker said.

-

15:02

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

99.89

+0.03%

0.8K

Johnson & Johnson

JNJ

100.25

+0.04%

1.3K

JPMorgan Chase and Co

JPM

68.60

+0.10%

0.1K

Starbucks Corporation, NASDAQ

SBUX

57.99

+0.10%

1.9K

Visa

V

75.43

+0.12%

2.3K

Apple Inc.

AAPL

121.47

+0.14%

171.2K

Boeing Co

BA

144.43

+0.18%

5.1K

ALTRIA GROUP INC.

MO

54.49

+0.20%

1.1K

Microsoft Corp

MSFT

46.80

+0.21%

4.5K

AMERICAN INTERNATIONAL GROUP

AIG

64.30

+0.28%

0.9K

Amazon.com Inc., NASDAQ

AMZN

537.90

+0.33%

3.1K

Tesla Motors, Inc., NASDAQ

TSLA

267.10

+0.36%

1.2K

General Motors Company, NYSE

GM

31.63

+0.38%

0.7K

Walt Disney Co

DIS

120.55

+0.46%

0.7K

Goldman Sachs

GS

205.07

0.00%

0.3K

General Electric Co

GE

26.10

0.00%

1.3K

UnitedHealth Group Inc

UNH

121.40

0.00%

0.3K

Deere & Company, NYSE

DE

94.57

0.00%

3.9K

American Express Co

AXP

76.05

-0.01%

0.2K

Merck & Co Inc

MRK

58.95

-0.02%

0.7K

AT&T Inc

T

34.73

-0.03%

2.5K

Google Inc.

GOOG

625.31

-0.05%

1.4K

Ford Motor Co.

F

14.82

-0.07%

4.9K

Yahoo! Inc., NASDAQ

YHOO

36.64

-0.08%

49.4K

United Technologies Corp

UTX

100.21

-0.10%

2.7K

Hewlett-Packard Co.

HPQ

30.47

-0.16%

0.8K

The Coca-Cola Co

KO

41.01

-0.17%

7.6K

Twitter, Inc., NYSE

TWTR

30.95

-0.19%

12.6K

Facebook, Inc.

FB

93.80

-0.22%

81.7K

Pfizer Inc

PFE

35.97

-0.25%

8.9K

ALCOA INC.

AA

09.83

-0.41%

6.7K

Exxon Mobil Corp

XOM

78.82

-0.49%

5.8K

Caterpillar Inc

CAT

78.21

-0.53%

0.1K

Chevron Corp

CVX

87.89

-0.67%

2.0K

Barrick Gold Corporation, NYSE

ABX

07.01

-0.71%

15.2K

Yandex N.V., NASDAQ

YNDX

13.71

-1.44%

3.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.54

-1.79%

20.7K

-

14:57

U.S. personal spending climbs 0.2% in June

The U.S. Commerce Department released personal spending and income figures on Monday. Personal spending rose 0.2% in June, in line with expectations, after a 0.7% increase in May. May's figure was revised down from a 0.9% increase.

Consumer spending makes more than two-thirds of U.S. economic activity.

Personal spending was driven by lower demand for automobiles. Spending on auto mobiles dropped 1.3% in June.

The saving rate rose to 4.8% in June from 4.6% in May.

Personal income increased 0.4% in June, in line with expectations, after a 0.4% gain in May. May's figure was revised down from a 0.5% rise.

The personal consumption expenditures (PCE) price index excluding food and energy rose 0.1% in June, in line with forecasts, after a 0.1% gain in May.

On a yearly basis, the PCE price index excluding food and index increased 1.3% in June, after a 1.3% gain in May. May's figure was revised up from a 1.2% rise.

The PCE index is below the Fed's 2% inflation target. The PCE index is the Fed's preferred measure of inflation.

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) reiterated at Buy at Stifel, target raised from $120 to $130

Walt Disney (DIS) reiterated at Outperform at RBC Capital Mkts, target raised from $120 to $130

-

14:41

Greece’s final manufacturing PMI drops to 30.2 in July

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Greece on Monday. Greece's manufacturing purchasing managers' index (PMI) dropped to 30.2 in July from 46.9 in June.

The decline was driven by falls in the capital goods sector and in the production of intermediate and consumer goods.

"Manufacturing output collapsed in July as the debt crisis came to a head. Factories faced a record drop in new orders and were often unable to acquire the inputs they needed, particularly from abroad, as bank closures and capital restrictions badly hampered normal business activity," Markit economist Phil Smith said.

-

12:01

European stock markets mid session: stocks traded mixed after the mostly better-than-expected manufacturing PMIs from the Eurozone

Stock indices traded mixed after the mostly better-than-expected manufacturing PMIs from the Eurozone. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.4 in July from 52.5 in June, up from a preliminary reading of 52.2.

The upward revision was driven by a stronger than previously recorded rise in Germany.

Markit's Chief Economist Chris Williamson said that June's PMI was "the Eurozone manufacturing economy showed encouraging resilience in the face of the Greek debt crisis in July".

Germany's final manufacturing purchasing managers' index (PMI) declined to 51.8 in July from 51.9 in June, up from a preliminary reading of 51.5.

The increase was driven by a rise in production and new orders.

"The German manufacturing sector remained stuck in a low gear at the start of the third quarter, with the PMI signalling further, albeit only modest, growth," Markit economist Oliver Kolodseike said.

France's final manufacturing purchasing managers' index (PMI) dropped to 49.6 in July from 50.7 in June, in line with the preliminary reading.

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 51.9 in July from 51.4 in June, exceeding expectations for a rise to 51.6.

The increase was driven by the strong performance of the consumer goods sector.

New orders dropped to 52.2 in July, the lowest level since September 2014. The stronger pound weighed on new orders.

"Although an uptick in the headline PMI breaks the decelerating trend in UK manufacturing, growth remains near-stagnant and suggests that the sector is continuing to act as a drag on the economy. With the sterling-euro exchange rate still sapping export demand and constraining growth of total order inflows, its seems that we will again look to the service sector to sustain any semblance of reasonable economic growth in the third quarter," Markit's Senior Economist Rob Dobson said.

The Athens Stock Exchange reopened on Monday after a five-week halt.

Current figures:

Name Price Change Change %

FTSE 100 6,688.39 -7.89 -0.12 %

DAX 11,356.09 +47.10 +0.42 %

CAC 40 5,097.45 +14.84 +0.29 %

-

11:49

Swiss manufacturing PMI drops to 48.7 in July

Credit Suisse released its manufacturing purchasing managers' index (PMI) for Switzerland on Monday. The manufacturing purchasing managers' index in Switzerland was down to 48.7 in July from 50.0 in June, missing expectations for an increase to 50.7.

The decline was driven by a drop in purchase prices and backlog of orders. Purchase prices decreased three points to 40.2 points in July, while the backlog of orders sub-index declined by 2.6 points to 48.5.

Production rose 0.7 points to 55.5 in July, while the employment sub-index remained unchanged 41.6.

-

11:38

Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. climbs to 51.9 in July

Markit Economics released its manufacturing purchasing managers' index (PMI) for the U.K. on Monday. The Markit/Chartered Institute of Procurement & Supply manufacturing PMI for the U.K. increased to 51.9 in July from 51.4 in June, exceeding expectations for a rise to 51.6.

A reading above 50 indicates expansion.

The increase was driven by the strong performance of the consumer goods sector.

New orders dropped to 52.2 in July, the lowest level since September 2014. The stronger pound weighed on new orders.

"Although an uptick in the headline PMI breaks the decelerating trend in UK manufacturing, growth remains near-stagnant and suggests that the sector is continuing to act as a drag on the economy. With the sterling-euro exchange rate still sapping export demand and constraining growth of total order inflows, its seems that we will again look to the service sector to sustain any semblance of reasonable economic growth in the third quarter," Markit's Senior Economist Rob Dobson said.

-

11:29

France’s final manufacturing PMI drops to 49.6 in July

Markit Economics released its final manufacturing purchasing managers' index (PMI) for France on Monday. France's final manufacturing purchasing managers' index (PMI) dropped to 49.6 in July from 50.7 in June, in line with the preliminary reading.

"The French manufacturing sector slipped back into contraction during July, failing to build on the previous month's marginal improvement in operating conditions. Key variables such as output, new orders, employment and stock levels all showed declines, as weak demand continued to hold back the performance of the industry and thwart any sort of upturn taking hold," Markit Senior Economist Jack Kennedy said.

-

11:17

Germany’s final manufacturing PMI declines to 51.8 in July

Markit Economics released its final manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's final manufacturing purchasing managers' index (PMI) declined to 51.8 in July from 51.9 in June, up from a preliminary reading of 51.5.

The increase was driven by a rise in production and new orders.

"The German manufacturing sector remained stuck in a low gear at the start of the third quarter, with the PMI signalling further, albeit only modest, growth," Markit economist Oliver Kolodseike said.

-

11:12

Eurozone’s final manufacturing PMI falls to 52.4 in July

Markit Economics released its final manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's final manufacturing purchasing managers' index (PMI) fell to 52.4 in July from 52.5 in June, up from a preliminary reading of 52.2.

The upward revision was driven by a stronger than previously recorded rise in Germany.

Markit's Chief Economist Chris Williamson said that June's PMI was "the Eurozone manufacturing economy showed encouraging resilience in the face of the Greek debt crisis in July".

-

11:02

Chinese manufacturing PMI declines to 50.0 in July

The Chinese manufacturing PMI declined to 50.0 in July from 50.2 in June. Analysts had expected the index to remain unchanged.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The index reflected the weakness in new orders and new export orders, employment and prices for materials.

"Both domestic and external manufacturing remain weak," Zhao Qinghe, an economist at the National Bureau of Statistics, said.

The final Chinese Markit/Caixin manufacturing PMI declined to 47.8 in July from 49.4 in June, missing expectations for a fall to 48.2.

-

10:57

Chicago purchasing managers' index rises to 54.7 in July

The Institute for Supply Management released its Chicago purchasing managers' index on Friday. The index climbed to 54.7 in July from 49.4 in June, exceeding expectations for an increase to 50.5.

A reading above the 50 mark indicates expansion, a reading below 50 indicates contraction.

The rise was partly driven by increases in the production and new orders. The production index rose by 12.0 points to 61.8 in July, while new orders index also increased.

The employment index remained below 50.

-

10:53

Thomson Reuters/University of Michigan final consumer sentiment index decreases to 93.1 in July

The Thomson Reuters/University of Michigan final consumer sentiment index decreased to 93.1 in July from 96.1 in June, missing the preliminary estimate of 94.0.

"A disappointing pace of economic growth was the main reason for the small decline in consumer confidence," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin.

He adds that there is "no indication of a break in the prevailing positive trend".

The current economic conditions index declined to 107.2 in July from 108.9 in June.

The index of consumer expectations fell to 84.1 from 87.8.

-

10:42

Swiss National Bank reports losses of CHF20 billion in the second quarter

The Swiss National Bank (SNB) reported losses of CHF20 billion in the second quarter. The SNB's losses for the first half of the year 2015 totalled CHF50.1 billion, equivalent to 7.5% of Switzerland's GDP.

The losses were mainly driven by removing of the euro exchange rate cap in January, set at 1.20 francs per euro in September 2011. The depreciation of the euro against the Swiss franc led to significant currency losses.

-

10:34

CBI: Britain’s economy expands by 0.7% in the second quarter

The Confederation of British Industry (CBI) data showed that UK's economic growth strengthened in the second quarter. Britain's economy expanded by 0.7% in the second quarter after a 0.4% increase in the first quarter.

"A healthy pace of growth puts the economy on a firm footing going into the third quarter and it looks set to stay that way through the rest of this year, as low oil prices and inflation help support spending," head of economic analysis at the CBI, Anna Leach, said.

Britain's exporters faces problems due to the stronger pound, Leach added.

-

10:25

St. Louis Federal Reserve President James Bullard: the Fed may start raising interest rates in September due to the latest U.S. economic growth data

St. Louis Federal Reserve President James Bullard said on Friday that the Fed may start raising interest rates in September due to the latest U.S. economic growth data.

The U.S. GDP rose at an annual rate of 2.3% in the second quarter, while the first quarter's GDP was revised up to a 0.6% rise from a 0.2% fall.

Bullard noted that "the outlook remains fairly good for the economy". He was not concerned over the slow growth in employer costs.

-

10:11

Athens Stock Exchange reopens today

The Athens Stock Exchange will reopen today. The stock exchange was closed since June 29. But local investors will face restrictions to stop capital flight from the country. Local investors could purchase shares with existing cash holdings, but not to withdraw money from their Greek bank accounts to purchase shares. There will be no restrictions on foreign investors.

-

08:52

Global Stocks: U.S. indices fell and drag Asian stocks down

Major U.S. stock indices fell on Friday amid declines in energy companies.

The Dow Jones Industrial Average slid 55.32 points, or 0.3%, to 17,690.66, but ended July with a 0.4% gain. The S&P 500 fell 4.71 points, or 0.2%, to 2,103.90; its energy sector fell 2.6% and is now 28% below levels seen 12 months ago. Nevertheless the S&P gained 2% over July. The Nasdaq Composite Index declined less than a point to 5,218.28, but booked a 2.9% gain over the month.

The U.S. Labor Department reported on Friday that wages rose a record-low 0.2% in the second quarter after the 0.7% gain in the first quarter.

Today Asian stocks followed declines in U.S. equities. Hong Kong Hang Seng fell 1.02%, or 252.19 points, to 24,384.09. China Shanghai Composite Index fell 2.35%, or 86.28 points, to 3,577.45. The Nikkei lost 0.18%, or 37.13 points, to 20,548.11.

Data by Markit Economics added to investors' concerns. China Manufacturing PMI came in at 47.8 in July; this is below preliminary reading of 48.2 and June final reading 49.4.

Beijing infrastructure companies advanced after it was known that Chinese capital will host Olympic Games in 2022.

-

03:59

Nikkei 225 20,485.56 -99.68 -0.48 %, Hang Seng 24,439.72 -196.56 -0.80 %, Shanghai Composite 3,632.13 -31.60 -0.86 %

-

00:30

Stocks. Daily history for Jul 31’2015:

(index / closing price / change items /% change)

Nikkei 225 20,585.24 +62.41 +0.30 %

Hang Seng 24,636.28 +138.30 +0.56 %

S&P/ASX 200 5,699.16 +29.64 +0.52 %

Shanghai Composite 3,664.01 -41.76 -1.13 %

FTSE 100 6,696.28 +27.41 +0.41 %

CAC 40 5,082.61 +36.19 +0.72 %

Xetra DAX 11,308.99 +51.84 +0.46 %

S&P 500 2,103.84 -4.79 -0.23 %

NASDAQ Composite 5,128.28 -0.50 -0.01 %

Dow Jones 17,689.86 -56.12 -0.32 %

-