Noticias del mercado

-

21:00

Dow -0.28% 17,696.57 -49.41 Nasdaq +0.09% 5,133.51 +4.72 S&P -0.12% 2,106.17 -2.46

-

19:00

European stock markets closed above the zero mark

European stocks ended today's trading with a moderate increase, while writing the fourth consecutive session gains, which was due to the publication of corporate reports. Following July index rose by 3.9 percent, registering the largest monthly increase since February.

According to FactSet, among the companies in the index Stoxx Europe 600, which have already published their financial results for the 2nd quarter, 54% better than expected earnings. For comparison, in the 1st quarter, the figure was 50%.

Meanwhile, according to Reuters, from 53% of reported companies have justified the forecasts of analysts, or exceeded them. According to analysts, the profit of European companies rose by 5.7% compared with the 2nd quarter of 2014.

A little influenced by data on inflation and unemployment in the euro area. Inflation in the euro area remained stable at 0.2 percent in July. Inflation has remained in positive territory for the third consecutive month in July and figure corresponds to economists' expectations. Meanwhile, core inflation, which excludes energy, food, alcohol and tobacco, accelerated to 1 percent from 0.8 percent. It is expected to remain at 0.8 percent.

Another report showed that the unemployment rate in the euro area remained unchanged in June, the lowest level since the beginning of 2012. The unemployment rate remained at 11.1 percent in June, unchanged from May. It was the lowest rate in the euro area in March 2012. The result coincided with the forecast of economists. The number of unemployed increased by 31,000 in May. Compared to June 2014 the number of unemployed fell by 811,000.

The focus was also on US statistics. Today it became known that at the end of the 2nd quarter of wage growth in the US slowed down as much as possible since the beginning of the study, while experts predicted that improvements in the labor market have a positive impact on the dynamics of wages. The growth in the 2nd quarter by 0.2% was the lowest since 1982. In the 1st quarter figure stood at around 0.7%. Economists had expected an increase of 0.6%. Fed monitors data on wage growth closer to raising interest rates to a level close to zero, at which they are to the end of 2008. Accelerating wage growth will signal that the labor market is finally approached the health of six years after the recession, and could push the Fed to the earlier increase in interest rates to avoid overheating the economy. However, the recent slowdown indicates that the labor market is maintained below capacity, which could cause the Fed to wait before raising interest rates.

FTSE 100 6,696.28 +27.41 + 0.41% CAC 40 5,082.61 +36.19 + 0.72% DAX 11,308.99 +51.84 + 0.46%

Sensor energy stocks recorded the largest decline among the 19 industry groups, losing 0.9%. Meanwhile, the sensor shares of mining companies fell by 0.5%. The cost of Vallourec SA fell 6.7% after the steel company expressed concern about the prospects for the remainder of the year. Shares of ArcelorMittal rose 1.4%. The net profit of the largest steel company in the world has more than tripled - to $ 179 million from $ 52 million a year earlier.

Shares of Banco Popular SA fell 2% after reports that net interest income has decreased compared to last year.

Shares of BNP Paribas SA rose by 3%, as the largest bank in France recorded the highest quarterly profit in more than three years.

Capitalization of Antofagasta Plc fell 2.2% after agreeing the purchase of 50 percent stake in Barrick Gold Corp.

At the same time, the share price of British hotel chain InterContinental Hotels Group (IHG) fell 1.4% after it denied the information to the media about the negotiations concerning the merger with the American Starwood Hotels & Resorts.

The cost of ITV Plc rose 3.2%, as Liberty Global Plc increased its stake in the British broadcaster to 9.9%

-

18:22

WSE: Session Results

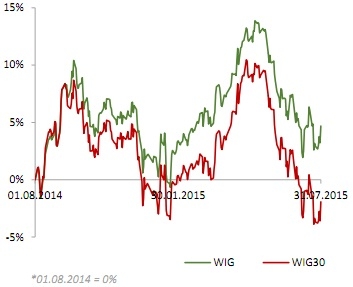

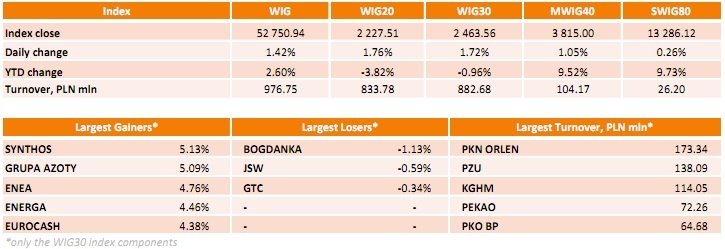

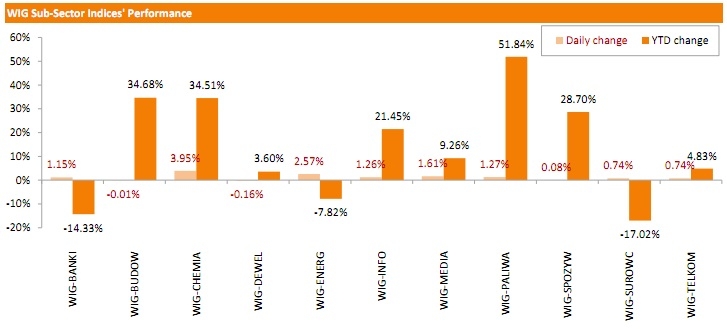

Polish equity market closed sharply higher on Friday. The broad market measure, the WIG Index, surged by 1.42%. Except for developers (-0.16%) and construction sector (-0.01%), every sector in the WIG Index gained.

The large-cap stocks' measure, the WIG30 Index, advanced 1.72%. Almost all index components generated positive returns. SYNTHOS (WSE: SNS) and GRUPA AZOTY (WSE: ATT) led the gainers, adding more than 5% each. It was followed by ENEA (WSE: ENA), ENERGA (WSE: ENG), EUROCASH (WSE: EUR) and TAURON PE (WSE: TPE), gaining 4.12%-4.76%. On the other side of the ledger, BOGDANKA (WSE: LWB), JSW (WSE: JSW) and GTC (WSE: GTC) were the only decliners, falling by 1.13%, 0.59% and 0.34% respectively.

-

18:02

Wall Street. Major U.S. stock-indexes little changed

Major Wall Street stock-indexes higher on Friday after an historically weak reading of U.S wage growth lent weight to the view that the U.S. Federal Reserve could delay a rate increase. U.S. stocks had been slightly choppy just after the opening bell as investors took cues from weak earnings from oil producers Exxon Mobil and Chevron and depressed commodity prices.

Most of Dow stocks in positive area (21 of 30). Top looser - Chevron Corporation (CVX, -3.43%). Top gainer - Pfizer Inc. (PFE, +1.95).

S&P index sectors are mixed. Top looser - Conglomerates (-0.5%). Top gainer - Utilities (+1.6%).

At the moment:

Dow 17685.00 -1.00 -0.01%

S&P 500 2106.75 +3.00 +0.14%

Nasdaq 100 4600.25 +5.00 +0.11%

10 Year yield 2,20% -0,06

Oil 47.62 -0.90 -1.85%

Gold 1094.70 +6.00 +0.55%

-

18:00

European stocks closed: FTSE 100 6,696.28 +27.41 +0.41% CAC 40 5,082.61 +36.19 +0.72% DAX 11,308.99 +51.84 +0.46%

-

15:32

U.S. Stocks open: Dow +0.08%, Nasdaq +0.26%, S&P +0.16%

-

15:25

Before the bell: S&P futures +0.11%, NASDAQ futures +0.23%

U.S. stock-index futures rose slightly as investors weighed company earnings.

Global Stocks:

Nikkei 20,585.24 +62.41 +0.30%

Hang Seng 24,636.28 +138.30 +0.56%

Shanghai Composite 3,664.01 -41.76 -1.13%

FTSE 6,680.32 +11.45 +0.17%

CAC 5,064.28 +17.86 +0.35%

DAX 11,259.58 +2.43 +0.02%

Сентябрьские нефтяные фьючерсы Nymex WTI в данный момент котируются по $47.89 за баррель (-1.32%)

Золото торгуется по $1089.70 за унцию (+0.12%).

Crude oil $47.89 (-1.32%)

Gold $1095.10 (+0.65%)

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Home Depot Inc

HD

116.50

+0.03%

0.4K

Apple Inc.

AAPL

122.41

+0.03%

95.2K

Johnson & Johnson

JNJ

99.90

+0.06%

0.1K

Wal-Mart Stores Inc

WMT

72.21

+0.07%

1.2K

Starbucks Corporation, NASDAQ

SBUX

58.10

+0.07%

2.4K

Tesla Motors, Inc., NASDAQ

TSLA

267.00

+0.08%

5.2K

Walt Disney Co

DIS

120.16

+0.11%

0.5K

Yahoo! Inc., NASDAQ

YHOO

37.46

+0.11%

1.0K

Amazon.com Inc., NASDAQ

AMZN

537.40

+0.12%

3.0K

Boeing Co

BA

143.22

+0.15%

0.4K

Pfizer Inc

PFE

35.79

+0.17%

1.9K

ALCOA INC.

AA

10.00

+0.20%

0.4K

Nike

NKE

115.25

+0.21%

0.2K

General Motors Company, NYSE

GM

31.98

+0.22%

4.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.87

+0.25%

12.0K

American Express Co

AXP

76.35

+0.30%

0.6K

Procter & Gamble Co

PG

77.79

+0.52%

0.3K

The Coca-Cola Co

KO

40.97

+1.01%

0.3K

Merck & Co Inc

MRK

59.35

+1.42%

1.5K

Barrick Gold Corporation, NYSE

ABX

07.24

+2.70%

20.9K

Cisco Systems Inc

CSCO

28.30

0.00%

4.3K

Travelers Companies Inc

TRV

106.50

0.00%

0.7K

United Technologies Corp

UTX

100.73

0.00%

0.6K

Ford Motor Co.

F

15.окт

0.00%

2.8K

Citigroup Inc., NYSE

C

58.87

-0.02%

1.0K

Intel Corp

INTC

28.90

-0.03%

213.6K

General Electric Co

GE

26.11

-0.04%

11.4K

Microsoft Corp

MSFT

46.86

-0.04%

1K

Verizon Communications Inc

VZ

46.65

-0.04%

0.4K

Goldman Sachs

GS

207.07

-0.06%

4.2K

AT&T Inc

T

34.78

-0.06%

2.5K

Caterpillar Inc

CAT

78.30

-0.06%

91.2K

JPMorgan Chase and Co

JPM

69.00

-0.06%

5.9K

Hewlett-Packard Co.

HPQ

30.60

-0.07%

6.6K

International Business Machines Co...

IBM

160.75

-0.13%

4.3K

Visa

V

76.25

-0.17%

9.8K

Facebook, Inc.

FB

95.00

-0.22%

56.0K

Twitter, Inc., NYSE

TWTR

31.40

-0.22%

21.6K

McDonald's Corp

MCD

98.90

-0.27%

0.3K

ALTRIA GROUP INC.

MO

53.85

-0.65%

0.1K

Chevron Corp

CVX

91.26

-1.90%

3.4K

Exxon Mobil Corp

XOM

81.20

-2.18%

57.4K

-

14:57

-

14:46

-

12:30

Europe reverses gains as earnings, China eyed

European equities reversed earlier gains to trade down by mid-morning on Friday as investors eyed mixed earnings and data from the U.S., ongoing volatility in Chinese equities and slipping commodity prices.

The pan-European STOXX 600 opened in mildly positive territory, up around 0.2 percent, but pared earlier gains to trade 0.3 percent lower.

Britain's FTSE 100 opened in positive territory but was trading down around 0.2 percent, while the German DAX was hovering around the flatline. The French CAC was around 0.2 percent higher.

Earnings continued in full swing on Friday as a number of big companies reported results.

Shares in Airbus jumped to the top of the CAC, up around 3.6 percent, after it reported a rise in first half core operating profit and revenue driven by strong uptake of helicopters and passenger jets.

However, the plane maker also reported a further charge because of development delays in its new A400M, caused by a fatal crash in May.

BNP Paribas, traded around 2.5 percent higher by mid-morning. The lender reported better-than-expected profit on Friday, as the strong dollar gave its earnings a boost.

Shares in French retailer Carrefour saw a 0.3 percent pop after it said its recurring operating profit rose 2.6 percent to 726 million euros in the first half of 2015, beating market expectations.

Outside of France, Lloyds Banking Group shares fell to near the bottom of the FTSE 100, down just over 1.2 percent.

The part-state-owned bank said that underlying profit for the first half of 2015 rose 15 percent year-on-year to £4.4 billion. However, it set aside a further £1.4 billion ($2.2 billion) to compensate customers for its mis-selling of loan insurance.

ArcelorMittal, the world's largest producer of steel, swung to $200 million in net profit for the second quarter after recording a $728 million loss in the previous quarter. The company also warned that steel imports from Russia and China could threaten its business. Shares traded around 0.6 percent higher.

-

08:46

Global Stocks: U.S. indices little changed

Major U.S. stock indices were driven by earnings reports and GDP data.

The U.S. Commerce Department reported on Thursday that the country's GDP posted a modest 2.3% gain in the second quarter of this year compared with expectations for a 2.6% increase. In the first quarter the economy rose by 0.6% (revised from -0.2%). Market participants were waiting for this data to assess strength of the U.S economy and adjust their expectations for a rate hike. Some analysts believe that a significant revision of the Q1 GDP growth suggests that the Fed may raise rates in September.

The Dow Jones Industrial Average slid 5.41 points, or 0.03%, to 17745.98. The S&P 500 added 0.06 point to 2108.63. The Nasdaq Composite Index rose 17.05 points, or 0.3%, to 5128.78.

Facebook Inc. shares fell 1.8% after the company reported a 39% increase in quarterly revenue but noted expenses grew faster than profits.

In Asia this morning Hong Kong Hang Seng rose 0.29%, or 69.95.31 points, to 24,567.93. China Shanghai Composite Index fell 0.93%, or 34.41 points, to 3,671.36. The Nikkei gained 0.13%, or 26.25 points, to 20,549.08.

Japanese stock indices advanced amid inflation data. Japan core consumer price index except fresh food rose by 0.1% vs expectations for a flat reading. Nevertheless the index was well below the 2% inflation target of the Bank of Japan.

-

04:03

Nikkei 225 20,525.29 +2.46 +0.01%, Hang Seng 24,572.69 +74.71 +0.30%, Shanghai Composite 3,676.29 -29.48 -0.80%

-

00:31

Stocks. Daily history for Jul 30’2015:

(index / closing price / change items /% change)

Nikkei 225 20,522.83 +219.92 +1.08%

Hang Seng 24,497.98 -121.47 -0.49%

S&P/ASX 200 5,669.52 +45.37 +0.81%

Shanghai Composite 3,705.73 -83.44 -2.20%

FTSE 100 6,668.87 +37.87 +0.57%

CAC 40 5,046.42 +28.98 +0.58%

Xetra DAX 11,257.15 +45.30 +0.40%

S&P 500 2,108.63 +0.06 0.00%

NASDAQ Composite 5,128.79 +17.05 +0.33%

Dow Jones 17,745.98 -5.41 -0.03%

-