Noticias del mercado

-

20:19

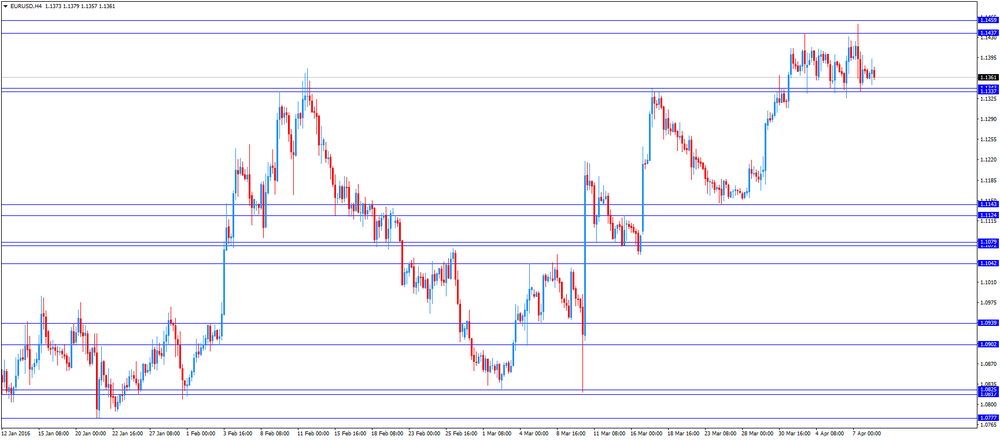

American focus: The US dollar fell against the euro

The dollar depreciated significantly against the euro, breaking the mark of $ 1.1400. Against the background almost empty calendar in Europe and the United States, market participants analyzed the recent statements by the Fed. Today the head of the Federal Reserve Bank of New York William Dudley expressed concerns about the US economic outlook, and added that he continues to support a gradual increase in interest rates FRC. "Although since the beginning of the year weakened the downside risks, I believe that the balance of risks regarding my forecasts for inflation and economic growth is slightly shifted downwards. Given the situation, it is necessary to adhere to a cautious approach to raising interest rates, "- said the politician, however, Dudley did not comment on when the Fed will raise rates again, saying that everything will depend on the data..

Moderate pressure on the dollar has had a report from the Commerce Department that showed that wholesale inventories fell at the fastest pace in nearly three years in February, pointing to a sharp slowdown in economic growth in the first quarter than previously thought. Wholesale inventories fell 0.5 percent in February, said on Friday, noting the sharpest drop since May 2013 Analysts expected a decline of 0.1 percent. The government also revised its value in January - to 0.2 percent from 0.2 percent. Inventories are a key component of the change in the gross domestic product. Component wholesale inventories, which goes into the calculation of GDP - wholesale inventories excluding cars - fell by 0.4 percent in February. Economists expect the economy grew by less than 1 per cent per annum in the first quarter, compared with growth of 1.4 percent in the last three months of 2015. Given the pace of sales in February, it would take 1.36 months to clear shelves, compared with 1.37 months in January.

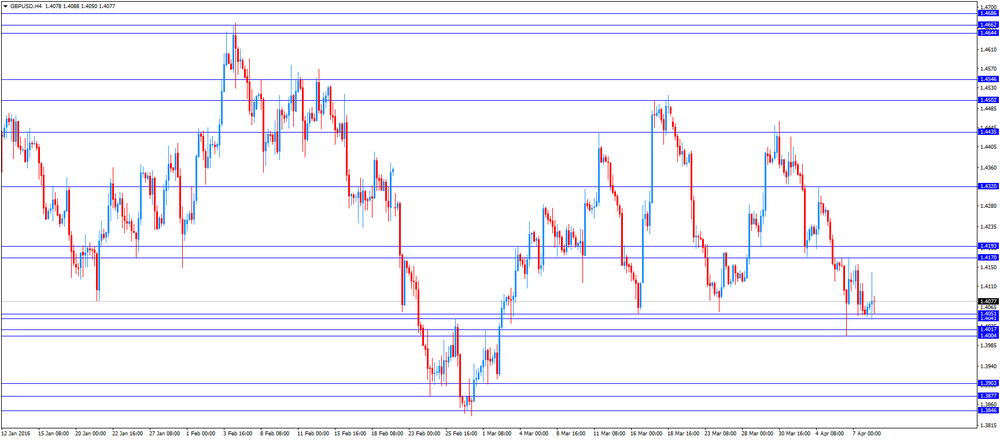

The pound rose against the dollar mildly, returning to a maximum session. Support for the pair provided statistics on Britain's GDP from NIESR, as well as the widespread weakening of the US currency. The NIESR reported that their monthly estimates of GDP suggest that the economy grew by 0.3 percent during the three months ended in March 2016, after rising 0.2 percent in the three months ended in February 2016 This assessment is the weakest rate of growth of the UK economy from the last quarter of 2012. James Warren, the NIESR researcher, said: "The moderate growth in the first quarter was mainly due to weakness in the manufacturing industries, especially in manufacturing volume of industrial production is now 10.7 percent below the pre-crisis peak in the first quarter of 2008. , while the GDP exceeded its predretsessiony peak at 7 percent. "

In addition, investors continued to analyze the previously submitted report on industrial production. Recall that in February, industrial output fell by 0.3 percent from January, when it grew by 0.2 per cent. The issue is expected to grow by 0.1 per cent. Manufacturing production fell by 1.1 percent, offset by an increase of 0.5 percent in January, and was more than 0.2 percent fall forecast

On an annual basis, industrial output fell by 0.5 percent in February, this is the largest drop since August 2013 Economists forecast that output will remain unchanged after rising 0.1 percent in January.

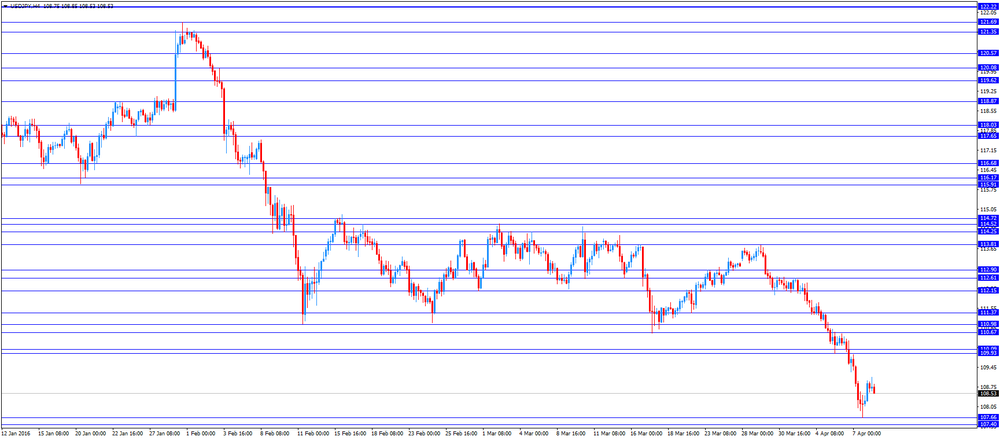

The Japanese again recovered against the dollar after a moderate decline in the first half of the session. Currently USD / JPY pair is trading near the opening level. Analysts say that many market participants strongly prefer not to risk it against the backdrop of heightened expectations of Bank of Japan intervention to stop the strengthening of the yen. Recall, today the Finance Minister of Japan Taro Aso expressed concern about the recent appreciation of the Japanese yen. "We are closely watching the currency market and take necessary measures to strengthen against the Japanese currency," - said the Minister. However, the official did not say exactly whether it will be carried out through this intervention. Recall that the last time the tool was used by the authorities of Japan in 2011 and this caused great dissatisfaction on the part of Washington and Brussels.

-

17:30

Bank of France upgrades its growth forecast for the first quarter

The Bank of France raised its growth forecast for the first quarter on Friday. The central bank expects the French economy to expand 0.4% in the first quarter, up from the previous estimate of a 0.3% growth. The upward revision was driven by a more favourable assessment of the manufacturing sector.

The manufacturing business confidence index rose to 99 in March from 98 in February.

The services business sentiment index remained unchanged at 96 in March.

The construction business sentiment index remained unchanged at 96 in March.

-

16:50

Japan’s Eco Watchers' current conditions index rises to 45.4 in March

Japan's Cabinet Office released Eco Watchers' Index figures on Friday. Japan's economy watchers' current conditions index rose to 45.4 in March from 44.6 in February, missing expectations for a gain to 46.5.

Japan's economy watchers' future conditions index decreased to 46.7 in March from 48.2 in February.

A reading above 50 indicates optimism, while a reading below 50 indicates pessimism.

-

16:35

New York Fed President William Dudley: the Fed should be cautious in raising its interest rate

New York Fed President William Dudley said in a speech on Friday that the Fed should be cautious in raising its interest rate as there were risks from abroad to the U.S. economy.

"I judge that a cautious and gradual approach to policy normalization is appropriate. Moreover, caution is also called for because of our limited ability to reduce the policy rate to respond to adverse developments," he said.

Dudley noted that there were still the downside risks to U.S. inflation and growth outlooks.

"The low levels of energy and commodity prices may signal more persistent disinflationary pressures than I currently anticipate, while renewed tightening of financial market conditions could have a greater negative impact on the U.S. economy," New York Fed president noted.

-

16:26

Wholesale inventories in the U.S. decline 0.5% in February

The U.S. Commerce Department released wholesale inventories on Friday. Wholesale inventories in the U.S. declined 0.5% in February, missing expectations for a 0.1 decline, after a 0.2% fall in January. It was the largest fall since May 2013.

January's figure was revised down from a 0.2% rise.

The decrease was mainly driven by a decline in inventories of non-durable goods. Inventories of non-durable goods decreased 1.1% in February, while inventories of durable goods fell 0.1%.

Wholesale sales slid 0.2% in February, after a 1.9% fall in January.

-

16:20

NIESR’s gross domestic product rises by 0.3% in three months to March

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Friday. The GDP estimate rose by 0.3% in three months to March, after a 0.2% growth in three months to February. The previous figure was revised down from a 0.3% growth. It was the weakest growth since the fourth quarter of 2012.

"The subdued growth in the first quarter of 2016 has been primarily driven by weakness in production industries, especially manufacturing. The volume of industrial production is currently 10.7 per cent below its pre-recession peak of the first quarter of 2008, while GDP has now surpassed its pre-recession peak by 7 per cent," James Warren, NIESR Research Fellow, said.

-

16:15

Greek industrial production decreases 4.3% in February

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Friday. Greek industrial production decreased 4.3% in February, after a 0.9% fall in January.

On a yearly basis, industrial production in Greece slid at an adjusted rate of 3.0% in February, after a 4.6% increase in January.

Production in the manufacturing sector increased at an annual rate of 0.6% in February, output in the mining and quarrying sector dropped 5.5%, while electricity production slid by 14.3%.

-

16:11

Greek consumer prices increase 1.3% in March

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Friday. Greek consumer prices increased 1.3% in March, after a 0.4% drop in February.

On a yearly basis, the Greek consumer price index declined 1.5% in March, after a 0.5 fall in February. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 4.8% in March, transport costs dropped by 4.9%, clothing and footwear prices were down 5.2%, while household equipment prices decreased 1.2%.

Prices of food and non-alcoholic beverages fell at an annual rate of 0.4% in March, while alcoholic beverages and tobacco prices increased by 1.1%.

-

16:02

United Kingdom: NIESR GDP Estimate, March 0.3%

-

16:00

U.S.: Wholesale Inventories, February -0.5% (forecast -0.1%)

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY:109.45 (USD 300m) 110.00 (USD 950m) 111.50 (440m) 111.45 (230m) 112.00 (555m) 112.40-50 (586m) 112.90-113.00 (1.49bln)

EUR/USD: 1.1195-1200 (EUR 700m) 1.1215 (445m) 1.1300 (1.18bln) 1.1315 (1.1bln)1.1325 (486m) 1.1400 (1.47bln) 1.1430 (450m) 1.1500 (596m)

EUR/GBP 0.7900 (595m) 0.8100 (387m) 0.8250 (370m)

EUR/JPY 126.00-05 (EUR 1.12bln)

AUD/USD: 0.7350 (615) 0.7400-05 (AUD 786m) 0.7550 (423m) 0.7595-605 (332m) 0.7635 (268m)

NZD/USD 0.6600 (NZD 300m)

AUD/NZD 1.1250 (AUD 290m)

-

14:45

Canada’s unemployment rate declines to 7.1% in March

Statistics Canada released the labour market data on Friday. Canada's unemployment rate declined to 7.1% in March from 7.3% in February. Analysts had expected the unemployment rate to remain unchanged at 7.3%.

The labour participation rate remained unchanged at 65.9% in March.

The Bank of Canada monitors closely the labour participation rate.

The number of employed people rose by 40,600 jobs in March, exceeding expectations for a rise of 10,000 jobs, after a 2,300 decrease in February.

The increase was mainly driven by a rise in full-time work. Full-time employment climbed by 35,300 in March, while part-time employment increased by 5,300 jobs.

Employment rose in health care and social assistance, accommodation and food services, professional, scientific and technical services, and 'other services'.

-

14:30

Canada: Unemployment rate, March 7.1% (forecast 7.3%)

-

14:30

Canada: Employment , March 40.6 (forecast 10)

-

14:26

Housing starts in Canada fall to a seasonally adjusted annualized rate of 204,251 units in March

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Friday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 204,251 units in March from 219,077 units in February. February's figure was revised up from 212,594 units.

Housing starts were mainly driven by a drop in the multi-unit segment.

"Overall, starts were trending lower in March due to a slowdown in multi-unit construction. This was the case across the country, except in British Columbia where declining inventories of new and unsold units as well as low levels of new listings in the resale market spurred builders to start new projects," the CMHC's Chief Economist Bob Dugan said.

-

14:15

Foreign exchange market. European session: the British pound traded mixed against the U.S. dollar after the release of the weaker-than-expected industrial production data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan Consumer Confidence March 40.1 40.5 41.7

05:45 Switzerland Unemployment Rate (non s.a.) March 3.7% 3.6% 3.6%

06:00 Germany Current Account February 14.3 Revised From 13.2 20.0

06:00 Germany Trade Balance (non s.a.), bln February 13.4 Revised From 13.6 20.3

06:00 Japan Eco Watchers Survey: Current March 44.6 46.5 45.4

06:00 Japan Eco Watchers Survey: Outlook March 48.2 46.7

06:45 France Industrial Production, m/m February 1.0% Revised From 1.3% -0.4% -1.0%

06:45 France Industrial Production, y/y February 1.9% 0.6%

07:15 Switzerland Consumer Price Index (MoM) March 0.2% 0.3% 0.3%

07:15 Switzerland Consumer Price Index (YoY) March -0.8% -0.9% -0.9%

08:30 United Kingdom Total Trade Balance February -5.23 Revised From -3.46 -4.84

08:30 United Kingdom Industrial Production (MoM) February 0.2% Revised From 0.3% 0.1% -0.3%

08:30 United Kingdom Industrial Production (YoY) February 0.1% Revised From 0.2% 0% -0.5%

08:30 United Kingdom Manufacturing Production (MoM) February 0.5% Revised From 0.7% -0.2% -1.1%

08:30 United Kingdom Manufacturing Production (YoY) February -0.3% Revised From -0.1% -0.7% -1.8%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. wholesale sales data. Wholesale inventories in the U.S. are expected to decline 0.1% in February, after a 0.2% increase in January.

The greenback was supported by yesterday's comments by the Fed Chairwoman Janet Yellen. She said in a speech in New York that the U.S. economy continued to progress and the U.S. labour market continued to strengthen. Yellen pointed out that the Fed remained on track for further interest rate hikes, saying that the decision to raise the interest rate in December was the right decision.

The euro traded mixed against the U.S. dollar after the release of the positive trade data from Germany. Destatis released its trade data for Germany on Friday. Germany's trade surplus increased to a seasonally adjusted €19.7 billion in February from 18.7 in January.

Exports climbed 1.3% in February, while imports were up 0.4%.

On a yearly basis, German exports increased 4.1% in February, while imports rose by 4.0%.

Germany's current account surplus was €20.0 billion in February, up from €14.3 billion in January. January's figure was revised up from a surplus of €13.2 billion.

The British pound traded mixed against the U.S. dollar after the release of the weaker-than-expected industrial production data from the U.K. The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Friday. Industrial production in the U.K. fell 0.3% in February, missing forecasts of a 0.1% increase, after a 0.2% rise in January.

The decrease was mainly driven by a decline in the manufacturing output.

On a yearly basis, industrial production in the U.K. decreased 0.5% in February, missing expectations for a flat reading, after a 0.1% increase in January. It was the largest decline since August 2013.

The decline was driven by a drop in the manufacture of machinery & equipment, which slid 10.6% year-on-year in February.

Manufacturing production in the U.K. dropped 1.1% in February, missing expectations for a 0.2% fall, after a 0.5% gain in January.

The decline was driven by a fall in in the manufacture of transport equipment, which decreased 2.9% in February.

Manufacturing output was mainly driven by a rise in other manufacturing and repair, which climbed by 4.8% in January.

On a yearly basis, manufacturing production in the U.K. decreased 1.8% in February, missing forecast of a 0.7% fall, after a 0.3% drop in January. It was the largest decrease since July 2013.

According to another report from the ONS, the U.K. trade deficit in goods narrowed to £11.96 billion in February from £12.16 billion in January. January's figure was revised down from a deficit of £10.29 billion. The decline in deficit was driven by a rise in exports.

The total trade deficit, including services, narrowed to £4.84 billion in February from £5.23 billion in January. January's figure was revised down from a deficit of £3.46 billion.

The Canadian dollar traded higher against the U.S. dollar ahead of the release of the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 7.3% in March.

Canada's economy is expected to add 10,000 jobs in March.

Housing starts in Canada are expected to decline to 190,000 in March from 212,600 in February.

The Swiss franc traded mixed against the U.S. dollar. The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index rose 0.3% in March, in line with expectations, after a 0.2% increase in February.

The increase was mainly driven by higher prices for petroleum products and airfares.

On a yearly basis, Switzerland's consumer price index decreased to -0.9% in March from -0.8% in February, in line with forecasts.

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Friday. The Swiss unemployment rate increased to a seasonally adjusted 3.5% in March from 3.4% in February.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair fell to Y108.53

The most important news that are expected (GMT0):

12:15 Canada Housing Starts March 212.6 190

12:30 Canada Employment March -2.3 10

12:30 Canada Unemployment rate March 7.3% 7.3%

12:30 U.S. FOMC Member Dudley Speak

14:00 United Kingdom NIESR GDP Estimate March 0.3%

14:00 U.S. Wholesale Inventories February 0.2% -0.1%

-

14:14

Canada: Housing Starts, March 204.3 (forecast 190)

-

12:17

French industrial production slides 1.0% in February

The French statistical office Insee its industrial production figures on Friday. Industrial production in France slid 1.0% in February, missing expectations for a 0.4% decrease, after a 1.0% rise in January. January's figure was revised down from a 1.3% increase.

Manufacturing output dropped 0.9% in February, while construction output plunged 6.0%.

Output in mining and quarrying, energy, water supply and waste management fell 1.6% in February.

On a yearly basis, the French industrial production climbed 0.6% in February, after a 1.9% gain in January.

-

12:11

Germany's trade surplus increases to €19.7 billion in February

Destatis released its trade data for Germany on Friday. Germany's trade surplus increased to a seasonally adjusted €19.7 billion in February from 18.7 in January.

Exports climbed 1.3% in February, while imports were up 0.4%.

On a yearly basis, German exports increased 4.1% in February, while imports rose by 4.0%.

Germany's current account surplus was €20.0 billion in February, up from €14.3 billion in January. January's figure was revised up from a surplus of €13.2 billion.

-

12:03

Switzerland’s consumer price inflation rises 0.3% in March

The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index rose 0.3% in March, in line with expectations, after a 0.2% increase in February.

The increase was mainly driven by higher prices for petroleum products and airfares.

On a yearly basis, Switzerland's consumer price index decreased to -0.9% in March from -0.8% in February, in line with forecasts.

-

11:58

Swiss unemployment rate rises to a seasonally adjusted 3.5% in March

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Friday. The Swiss unemployment rate increased to a seasonally adjusted 3.5% in March from 3.4% in February.

On a seasonally unadjusted basis, the unemployment rate in Switzerland decreased to 3.6% in March from 3.7% in February, in line with expectations.

The number of unemployed people in Switzerland fell by 6,093 to 155,324 in March from the previous month.

The youth unemployment rate was down to 3.4% in March from 3.6% in February.

-

11:52

Japan’s consumer confidence index rises to 41.7 in March

Japan's Cabinet Office released its consumer confidence index on Friday. The consumer confidence index increased to 41.7 in March from 40.1 in February, exceeding expectations for a rise to 40.5. It was the lowest level since January 2015.

The increase was driven by rises in all sub-indexes. The overall livelihood sub-index increased to 40.5 in March from 38.5 in February, the income growth sub-index was up to 40.6 from 39.8, the employment sub-index climbed to 43.9 from 42.2, while the willingness to buy durable goods sub-index rose to 41.7 from 40.0.

-

11:46

U.K. trade deficit in goods narrows to £11.96 billion in February

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £11.96 billion in February from £12.16 billion in January. January's figure was revised down from a deficit of £10.29 billion.

The decline in deficit was driven by a rise in exports.

The total trade deficit, including services, narrowed to £4.84 billion in February from £5.23 billion in January. January's figure was revised down from a deficit of £3.46 billion.

-

11:35

U.K. industrial production declines 0.3% in February

The Office for National Statistics (ONS) released its manufacturing and industrial production figures for the U.K. on Friday. Industrial production in the U.K. fell 0.3% in February, missing forecasts of a 0.1% increase, after a 0.2% rise in January. January's figure was revised down from a 0.3% gain.

The decrease was mainly driven by a decline in the manufacturing output.

On a yearly basis, industrial production in the U.K. decreased 0.5% in February, missing expectations for a flat reading, after a 0.1% increase in January. It was the largest decline since August 2013.

January's figure was revised down from a 0.2% rise.

The decline was driven by a drop in the manufacture of machinery & equipment, which slid 10.6% year-on-year in February.

Manufacturing production in the U.K. dropped 1.1% in February, missing expectations for a 0.2% fall, after a 0.5% gain in January. January's figure was revised down from a 0.7% increase.

The decline was driven by a fall in in the manufacture of transport equipment, which decreased 2.9% in February.

Manufacturing output was mainly driven by a rise in other manufacturing and repair, which climbed by 4.8% in January.

On a yearly basis, manufacturing production in the U.K. decreased 1.8% in February, missing forecast of a 0.7% fall, after a 0.3% drop in January. It was the largest decrease since July 2013.

January's figure was revised down from a 0.1% decline.

-

11:19

Japan’s Finance Minister Taro Aso: a rapid move in the yen is undesirable

Japan's Finance Minister Taro Aso said on Friday that a rapid move in the yen was undesirable, adding that the government would act if needed. Aso declined to comment if the government would intervene.

-

11:14

Japan’s current account surplus climbs to ¥2,434.9 billion in February

Japan's Ministry of Finance released its current account data for Japan late Thursday evening. Japan's current account surplus climbed to ¥2,434.9 billion in February from ¥520.8 billion in January, exceeding expectations for a surplus of ¥2,006.0 billion.

The goods trade deficit turned into a surplus of ¥425.2 billion in February, up from a deficit of ¥411.0 billion in January.

Exports dropped at an annual rate of 5.5% in February, while imports plunged 14.6%.

-

11:04

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 42.6 in in the week ended April 04

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy decreased to 42.6 in in the week ended April 04 from 42.8 the prior week.

The decrease was driven by a decline in the personal finances sub-index. The measure of views of the economy remained unchanged at 32.6, the buying climate index remained unchanged at 38.3, while the personal finances index fell to 56.9 from 57.6.

-

10:52

Kansas City Fed President Esther George: the Fed should continue to hike its interest rate gradually

Kansas City Fed President Esther George said on Thursday that the Fed should continue to hike its interest rate gradually as the U.S. labour market continued to strengthen and inflation showed some signs of the acceleration.

"While I view the gradual approach as appropriate, postponing the removal of accommodation when the economy is near full employment and inflation is rising toward the 2 percent target could promote alternative risks that would decrease the likelihood of achieving our longer-run objectives," she said.

Esther voted for an interest rate hike at the Fed's monetary policy meeting in March.

-

10:40

Consumer credit in the U.S. increases by $17.22 billion in February

The Fed released its consumer credits figures on Thursday. Consumer credit in the U.S. rose by $17.22 billion in February, exceeding expectations for a $14.74 billion increase, after a $14.9 billion gain in January. January's figure was revised up from a $10.54 billion rise.

The increase was mainly driven by gains in non-revolving credit. Revolving credit rose by $3.0 billion in February, while non-revolving credit jumped by $14.3 billion.

-

10:30

United Kingdom: Industrial Production (YoY), February -0.5% (forecast 0%)

-

10:30

United Kingdom: Manufacturing Production (YoY), February -1.8% (forecast -0.7%)

-

10:30

United Kingdom: Total Trade Balance, February -4.84

-

10:30

United Kingdom: Industrial Production (MoM), February -0.3% (forecast 0.1%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , February -1.1% (forecast -0.2%)

-

10:23

Fed Chairwoman Janet Yellen: the U.S. economy continued to progress and the U.S. labour market continued to strengthen

The Fed Chairwoman Janet Yellen said in a speech in New York on Thursday that the U.S. economy continued to progress and the U.S. labour market continued to strengthen. She also said that there were signs of the accelerating in inflation, adding that low inflation, which was driven by the strong U.S. dollar and low oil prices, was temporary.

The Fed chairwoman noted that the global growth remained weak.

Yellen pointed out that the Fed remained on track for further interest rate hikes, saying that the decision to raise the interest rate in December was the right decision.

"We remain on a reasonable path and I don't think December was a mistake," the Fed chairwoman said. She added that further interest rate hikes should be gradual.

Yellen noted that the U.S. economy was not a bubble economy.

-

10:03

Option expiries for today's 10:00 ET NY cut

USD/JPY:109.45 (USD 300m) 110.00 (USD 950m) 111.50 (440m) 111.45 (230m) 112.00 (555m) 112.40-50 (586m) 112.90-113.00 (1.49bln)

EUR/USD: 1.1195-1200 (EUR 700m) 1.1215 (445m) 1.1300 (1.18bln) 1.1315 (1.1bln)1.1325 (486m) 1.1400 (1.47bln) 1.1430 (450m) 1.1500 (596m)

EUR/GBP 0.7900 (595m) 0.8100 (387m) 0.8250 (370m)

EUR/JPY 126.00-05 (EUR 1.12bln)

AUD/USD: 0.7350 (615) 0.7400-05 (AUD 786m) 0.7550 (423m) 0.7595-605 (332m) 0.7635 (268m)

NZD/USD 0.6600 (NZD 300m)

AUD/NZD 1.1250 (AUD 290m)

-

09:15

Switzerland: Consumer Price Index (YoY), March -0.9% (forecast -0.9%)

-

09:15

Switzerland: Consumer Price Index (MoM) , March 0.3% (forecast 0.3%)

-

08:46

Japan: Eco Watchers Survey: Outlook, March 46.7

-

08:46

France: Industrial Production, y/y, February 0.6%

-

08:45

France: Industrial Production, m/m, February -1.0% (forecast -0.4%)

-

08:36

Options levels on friday, April 8, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1503 (4187)

$1.1458 (2628)

$1.1425 (3151)

Price at time of writing this review: $1.1372

Support levels (open interest**, contracts):

$1.1342 (2131)

$1.1297 (3461)

$1.1249 (1175)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 48837 contracts, with the maximum number of contracts with strike price $1,1500 (4187);

- Overall open interest on the PUT options with the expiration date April, 8 is 75697 contracts, with the maximum number of contracts with strike price $1,0900 (6429);

- The ratio of PUT/CALL was 1.55 versus 1.57 from the previous trading day according to data from April, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.4300 (898)

$1.4200 (703)

$1.4102 (720)

Price at time of writing this review: $1.4073

Support levels (open interest**, contracts):

$1.3999 (2804)

$1.3900 (1003)

$1.3800 (1008)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 24033 contracts, with the maximum number of contracts with strike price $1,4450 (2203);

- Overall open interest on the PUT options with the expiration date April, 8 is 23398 contracts, with the maximum number of contracts with strike price $1,4000 (2804);

- The ratio of PUT/CALL was 0.97 versus 0.97 from the previous trading day according to data from April, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:31

Japan: Eco Watchers Survey: Current , March 45.4 (forecast 46.5)

-

08:19

Asian session: The dollar firmed a little but languished close to 17-month lows against the yen

The dollar firmed a little but languished close to 17-month lows against the yen on Friday, with the Japanese currency poised for weekly gains against its major counterparts despite verbal warnings from Japanese officials.

Underpinning the greenback, a less cautious tone from Federal Reserve Chair Janet Yellen reminded investors that U.S. interest rate hikes are likely still in the cards this year, and Japanese Finance Minister Taro Aso let them know direct intervention is also possible.

Speaking at a panel with former chiefs of the U.S. central bank, Yellen said late on Thursday that the labour market was "close" to full strength and that inflation was currently held back by temporary factors. She said the economy is on a solid course and still on track to warrant further interest rate hikes.

While the odds of direct yen-selling foreign exchange intervention have "slightly risen," strategists at ING said they remain some distance away from any material action ahead of a G7 summit that Japan is hosting in May, unless the dollar were to sharply drop into the 100-105 area.

Japanese Finance Minister Taro Aso said early on Friday that rapid foreign exchange moves were "undesirable," that the current yen moves were "one-sided," and that Japan would takes steps as needed.

EUR/USD: during the Asian session the pair traded in the range of $1.1355-75

GBP/USD: during the Asian session the pair traded in the range of $1.4045-75

USD/JPY: during the Asian session the pair rose to Y109.00

Based on Reuters materials

-

08:01

Germany: Trade Balance (non s.a.), bln, February 20.3

-

08:00

Germany: Current Account , February 20.0

-

07:45

Switzerland: Unemployment Rate (non s.a.), March 3.6% (forecast 3.6%)

-

07:01

Japan: Consumer Confidence, March 41.7 (forecast 40.5)

-

01:55

Japan: Current Account, bln, February 2434.9 (forecast 2006)

-

00:29

Currencies. Daily history for Apr 07’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1372 -0,20%

GBP/USD $1,4052 -0,48%

USD/CHF Chf0,9561 +0,05%

USD/JPY Y108,26 -1,36%

EUR/JPY Y123,11 -1,58%

GBP/JPY Y152,11 -1,85%

AUD/USD $0,7504 -1,25%

NZD/USD $0,6776 -0,65%

USD/CAD C$1,315 +0,43%

-

00:01

Schedule for today, Friday, Apr 08’2016:

(time / country / index / period / previous value / forecast)

05:45 Switzerland Unemployment Rate (non s.a.) March 3.7% 3.6%

06:00 Germany Current Account February 13.2

06:00 Germany Trade Balance (non s.a.), bln February 13.6

06:00 Japan Eco Watchers Survey: Current March 44.6 46.5

06:00 Japan Eco Watchers Survey: Outlook March 48.2

06:45 France Industrial Production, m/m February 1.3% -0.4%

06:45 France Industrial Production, y/y February 1.9%

07:15 Switzerland Consumer Price Index (MoM) March 0.2% 0.3%

07:15 Switzerland Consumer Price Index (YoY) March -0.8% -0.9%

08:30 United Kingdom Total Trade Balance February -3.46

08:30 United Kingdom Industrial Production (MoM) February 0.3% 0.1%

08:30 United Kingdom Industrial Production (YoY) February 0.2% 0%

08:30 United Kingdom Manufacturing Production (MoM) February 0.7% -0.2%

08:30 United Kingdom Manufacturing Production (YoY) February -0.1% -0.7%

12:15 Canada Housing Starts March 212.6 190

12:30 Canada Employment March -2.3 10

12:30 Canada Unemployment rate March 7.3% 7.3%

14:00 United Kingdom NIESR GDP Estimate March 0.3%

14:00 U.S. Wholesale Inventories February 0.2% -0.1%

-