Noticias del mercado

-

21:00

U.S.: Consumer Credit , February 17.22 (forecast 14.74)

-

20:21

American focus: the US dollar does not cease to lose ground against the Japanese currency

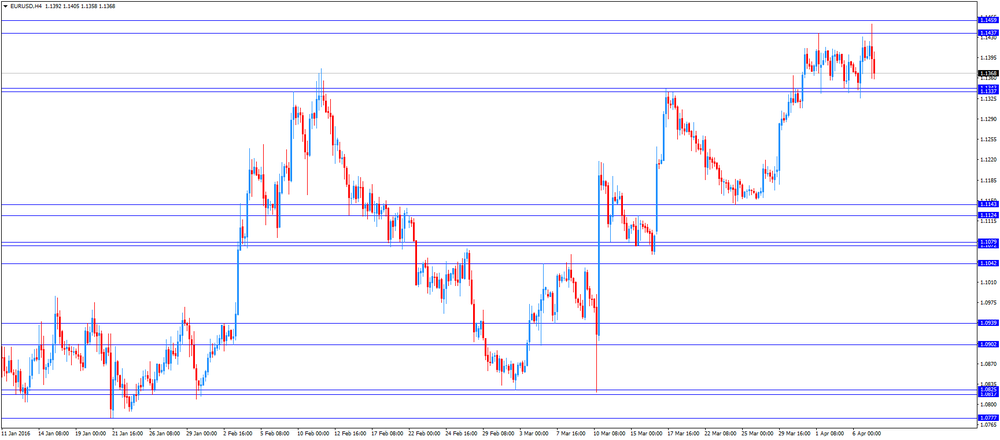

The euro rose against the dollar, recovering to the level of opening of the session. Experts note auction was held today quite volatile, which was caused by the publication of the minutes of the last meeting of the ECB and the statements of representatives of the ECB. Minutes of the March meeting of the European Central Bank showed that officials discussed the issue of more aggressive rate cuts. Also strengthen the risks of second-round effects were observed. It was unanimously recognized the need for a strong response in the circumstances, but opinions on the composition of the package varies widely. Central Bank representatives were informed that the outlook for the global economy has deteriorated again. Some expressed concern that the operations of the Central Bank may affect the independence of the bank. Fears were expressed that the further reduction of deposit rates will affect the profitability of banks.

As for today's statements by representatives of the ECB, they clearly gave to understand that the Central Bank will continue to struggle with low inflation. First, the ECB head Draghi noted that an updated package of mitigation measures presented in March, confirmed that even under the influence of external disinflation forces the ECB will not tolerate excessively low inflation. Meanwhile, the chief economist of the ECB Pret said that the ECB may adopt additional measures to stimulate the economy to offset the impact of the recent turmoil in the euro-zone economy. Meanwhile, another representative of the ECB Constancio added that the Central Bank will continue to do everything possible within its mandate to bring inflation back to the target level of 2%.

Little impact has also provided statistics on the US labor market. The Labor Department reported the number of Americans who first applied for unemployment benefits fell more than expected last week, suggesting that the labor market continued to strengthen, despite the restrained economic growth. Primary treatment decreased by 9,000 and a seasonally adjusted amounted to 267,000 for the week ending April 2nd. The data for the previous week were not revised. Economists had forecast that the initial applications will fall to 270 000. The number of applications for unemployment benefits remained below 300,000, a threshold level of health-related conditions in the labor market for 57 weeks, the longest period since 1973. Strengthening labor market attracts discouraged and new job seekers, which will continue to moderate growth of wages and allow the Fed to maintain its policy of gradually raising rates.

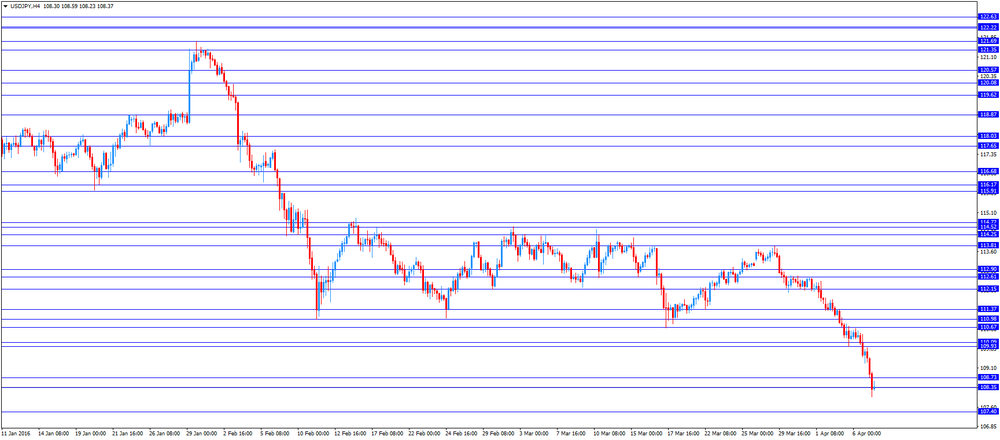

The dollar continued to decline against the yen for the first time since Oct. 29, 2014 fallen below the level of Y108. It is worth emphasizing, falling USD / JPY pair is fixed for the fifth day in a row. Since the beginning of the month the pair has lost nearly 4%. Analysts said speculation about a possible Bank of Japan intervention intensified, but so far only the motion of a pair reflect market volatility. Although the Central Bank of direct interventions are unlikely, the authorities may try to influence the market through verbal interventions. At the same time, experts say, is now technical factors have a greater impact on the market than the change in economic conditions.

Also, investors prefer to sell the pair, given the tendency to loose monetary policy of the Fed. Minutes of the Fed meeting, which was held on March 15-16, indicated that the US Fed is hardly raise interest rates until June amid widespread concerns of representatives of the regulator in connection with disabilities confront the consequences of global economic slowdown. "Most of the participants believe that the economic and financial situation in the world still pose a risk," - said in the report. Following the meeting, the representatives of the regulator made it clear that they expect two rate increases in 2016, but the exact dates are still uncertain.

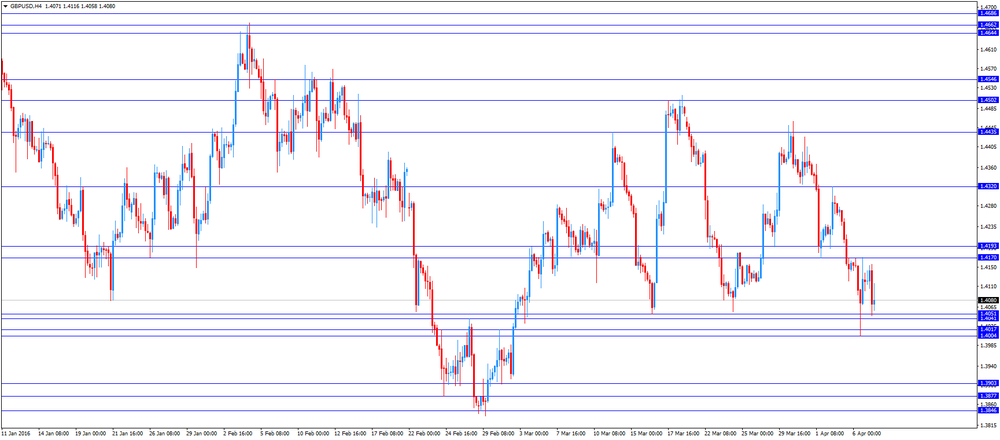

The pound depreciated moderately against the dollar, heading to yesterday's low. According to analysts, the main pressure on the currency have concerns about Britain's exit from the EU structure. Reuters survey showed that if a referendum on June 23 the majority of Britons would vote to secede from the European Union, the national currency may collapse by 7 percent. However, results of studies have also indicated that if the country is to remain within the EU, the pound could rise by 4 per cent against the dollar immediately after the referendum. "Recent trends underscore how the pound is vulnerable to any change in sentiment before the referendum a few months, and the pound is likely to continue to trade without some movement.", - Said Jane Foley, an expert the Rabobank. The median estimate of 60 analysts, one euro will cost 79 pence in the next month, to 75 pence after 6 months, and 73.5 pence in 12 months. Against the dollar, the pound will trade at $ 1.42 a month, $ 1.43 in three months and the prospects for $ 1.48 in a year. In March, the corresponding forecasts were $ 1.40, $ 1.40 and $ 1.46.

-

17:58

European Central Bank Governing Council member Benoit Coeure defends the central bank’s latest stimulus measures

The European Central Bank (ECB) Governing Council member Benoit Coeure on Thursday defended the central bank's latest stimulus measures, saying that the central bank had to act to boost inflation and growth in the Eurozone.

He said that he was confident the stimulus measures would be effective.

-

17:52

The World Trade Organization downgrades its world trade forecasts for this year

The World Trade Organization (WTO) said on Thursday that the world trade expected to climb 2.8% in 2016, down from its previous estimate of a 3.9% growth, and 3.6% in 2017. The WTO pointed out that uncertainties weigh on global demand.

According to the WTO, downside risks to the forecast are a faster than expected slowdown in the Chinese economy, higher financial market volatility, and exposure of countries with large foreign debts to sharp exchange rate movements, while upside potential is a faster growth in the Eurozone if the European Central Bank's monetary policy is effective.

"Trade is still registering positive growth, albeit at a disappointing rate," WTO Director-General Roberto Azevêdo said.

The WTO expects the world economy to expand 2.4% in 2016 and 2.7% in 2017.

-

17:41

Fitch affirms Japan’s sovereign debt rating at 'A'

Rating agency Fitch Ratings on Thursday affirmed Japan's sovereign debt rating at 'A'. The outlook is 'stable'.

"The key factor constraining the rating is high and rising government debt," Fitch said.

The agency expects Japan's gross general government debt to reach 245% of GDP by end-2016.

Japan's general government budget deficit is forecasted to be 4.8% of GDP in 2016.

"The Stable Outlooks reflect Fitch's assessment that upside and downside risks to the ratings are currently broadly balanced," the agency said.

-

17:34

Labour productivity in the U.K. falls by 1.2% in the fourth quarter

The U.K. Office for National Statistics (ONS) released its labour productivity data on Thursday. Labour productivity in the U.K. measured by output per hour declined by 1.2% in the fourth quarter of 2015, after a 0.6% rise in the third quarter.

Output per worker and output per job were broadly unchanged in the fourth quarter.

Output per hour in services decreased by 0.7% in the fourth quarter, while output per hour in manufacturing dropped by 2.0%.

On a yearly basis, labour productivity increased by 0.4% in the fourth quarter, after a 1.5% in the third quarter.

-

17:25

Dallas Fed President Robert Kaplan: the Fed should be patient and cautious in hiking its interest rate

Dallas Fed President Robert Kaplan said on Wednesday that the Fed should be patient and cautious in hiking its interest rate, noting that gradual interest rate hikes would appropriate. He added that he would vote for an interest rate hike if the U.S. economic data remained strong.

He expects the U.S. economy to expand 1.9% this year.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:13

Chicago Fed President Charles Evans: the Fed should be cautious in raising its interest rate further

Chicago Fed President Charles Evans said on Thursday that the Fed should be cautious in raising its interest rate further.

"It's best to be proactive and keep inflation closer to target," he noted.

Evans pointed out the Fed will discuss Britain's vote on the membership in the European Union at its monetary meeting.

Evans is not a voting member of the Federal Open Market Committee (FOMC) this year.

-

17:02

Ai Group/HIA Australian Performance of Construction Index is down to 45.2 in March

The Australian Industry Group (AiG) released its construction data for Australia on late Wednesday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 45.2 in March from 46.1 in February, reaching the 13-month low.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The decline was mainly driven by a drop in house building and apartment building activity, and employment.

-

16:56

European Central Bank President Mario Draghi: the Eurozone’s economy recovers moderately

The European Central Bank (ECB) President Mario Draghi said in a speech in Portugal on Thursday that the Eurozone's economy recovered moderately, supported by the central bank's monetary policy and low energy prices. He noted that investment remained weak.

Draghi pointed out that the ECB was ready to act to preserve price stability, noted that there was "no shortage of tools available".

The ECB president also said that structural and fiscal policies were needed for a sustainable growth.

Draghi noted that the central bank's monetary policy easing was effective and the recent stimulus measures would take time to start working.

-

16:18

European Central Bank Governing Council member Ignazio Visco: the ECB’s credibility is at stake if the ECB fails to reach its inflation target

The European Central Bank (ECB) Governing Council member Ignazio Visco said on Thursday that the central bank's credibility was at stake if the central bank failed to reach its inflation target. He pointed out that helicopter money was risky from a legal and practical point of view, adding that the ECB did not discussed the introduction of helicopter money.

-

16:04

European Central Bank President Mario Draghi: 2016 will a challenging year for the ECB

The European Central Bank (ECB) President Mario Draghi wrote in the foreword to the central bank's annual report that 2016 would a challenging year for the central bank.

"We face uncertainty about the outlook for the global economy. We face continued disinflationary forces. And we face questions about the direction of Europe and its resilience to new shocks. In that environment, our commitment to our mandate will continue to be an anchor of confidence for the people of Europe," he wrote.

Draghi noted that the ECB was ready to act to boost inflation in the Eurozone.

"Even when faced with global disinflationary forces, the ECB does not surrender to excessively low inflation," the ECB president said.

-

15:50

Option expiries for today's 10:00 ET NY cut

USD/JPY:109.45 (USD 300m) 110.00 (USD 950m) 111.50 (440m) 111.45 (230m) 112.00 (555m) 112.40-50 (586m) 112.90-113.00 (1.49bln)

EUR/USD: 1.1195-1200 (EUR 700m) 1.1215 (445m) 1.1300 (1.18bln) 1.1315 (1.1bln)1.1325 (486m) 1.1400 (1.47bln) 1.1430 (450m) 1.1500 (596m)

EUR/GBP 0.7900 (595m) 0.8100 (387m) 0.8250 (370m)

EUR/JPY 126.00-05 (EUR 1.12bln)

AUD/USD: 0.7350 (615) 0.7400-05 (AUD 786m) 0.7550 (423m) 0.7595-605 (332m) 0.7635 (268m)

NZD/USD 0.6600 (NZD 300m)

AUD/NZD 1.1250 (AUD 290m)

-

15:44

China’s foreign-exchange reserves increase in March

According to data released by the People's Bank of China (PBoC) on Thursday, China's foreign-exchange reserves increased by $10.26 billion to $3.21 trillion in March, after a drop by $28.57 billion in February. It was the first rise in five months.

-

15:38

ECB March Monetary Policy Meeting Account: most members of the Governing Council supported the monetary policy easing

The European Central Bank's (ECB) its minutes of March meeting on Thursday. The minutes showed that most members of the Governing Council supported the monetary policy easing.

"A large majority of voting members supported the proposed policy package," the ECB said in its minutes.

The central bank cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion).

The ECB considered a sharper cut in deposit rate.

"On the one hand, a sharper rate cut could be considered, together with indications that the effective lower bound would have been reached for all practical purposes. On the other hand, the proposed limited rate cut could be judged as appropriate for now, given the current assessment, while it would also not rule out the possibility and prospect of further cuts if warranted by the outlook for price stability," the minutes said.

According to the minutes, the downside risks to inflation in the Eurozone and the risks of second-round effects increased.

-

14:48

Initial jobless claims decline to 267,000 in the week ending April 02

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 02 in the U.S. decreased by 9,000 to 267,000 from 276,000 in the previous week. Analysts had expected jobless claims to decline to 270,000.

Jobless claims remained below 300,000 the 57th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 19,000 to 2,191,000 in the week ended March 26.

-

14:38

Building permits in Canada jump 15.5% in February

Statistics Canada released housing market data on Thursday. Building permits in Canada jumped 15.5% in February, exceeding expectations for a 4.8% rise, after a 9.5% drop in January. January's figure was revised up from a 9.8% decrease.

The increase was driven by a rise in building permits for commercial buildings in Alberta, single-family dwellings in Ontario and institutional structures in Quebec.

Building permits for non-residential construction were up 33.1% in February, while permits in the residential sector climbed 5.0%.

-

14:30

U.S.: Initial Jobless Claims, April 267 (forecast 270)

-

14:30

Canada: Building Permits (MoM) , February 15.5% (forecast 4.8%)

-

14:30

U.S.: Continuing Jobless Claims, March 2191 (forecast 2173)

-

14:23

Greek unemployment rate rises to 24.4% in January

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece rose to 24.4% in January from 24.3% in December. December's figure was revised up from 24.0%.

The number of unemployed increased by 3,570 persons compared with December 2015.

The youth unemployment rate was up to 51.9% in January from 50.5% compared with January 2015.

-

14:14

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the European Central Bank's March minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:45 France Trade Balance, bln February -3.91 Revised From -3.70 -3.8 -5.18

07:00 Switzerland Foreign Currency Reserves March 571 576

07:30 United Kingdom Halifax house price index March -1.5% Revised From -1.4% 0.7% 2.6%

07:30 United Kingdom Halifax house price index 3m Y/Y March 9.7% 9.5% 10.1%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. initial jobless claims data. The number of initial jobless claims in the U.S. is expected to decline by 6,000 to 270,000 last week.

The Fed Chairwoman Janet Yellen will speak at 21:30 GMT.

The euro traded lower against the U.S. dollar after the release of the European Central Bank's (ECB) March minutes. The minutes showed that most members of the Governing Council supported the monetary policy easing. The central bank cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion).

ECB Vice President Vitor Constancio said before the Committee on Economic and Monetary Affairs of the European Parliament on Thursday that the central bank was doing and would continue to do everything to fulfil its mandate.

ECB Executive Board member Peter Praet said in a speech on Thursday that the central bank's monetary policy adopted since June 2014 was effective.

He pointed out that the ECB could add further stimulus measures if the downside risks increase.

"If further adverse shocks were to materialise, our measures could be recalibrated once more commensurate with the strength of the headwind, also taking into account possible side-effects," Praet said.

He noted that the central bank did not discussed helicopter money.

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. climbed 2.6% in March, after a 1.5% decline in February. February's figure was revised down from a 1.4% fall.

On a yearly basis, house prices jumped 10.1% in the three months to March, after a 9.7% increase in the three months to February.

"Worsening sentiment regarding the prospects for the UK economy and uncertainty ahead of the European referendum in June could result in some softening in the housing market over the next couple of months," Halifax's housing economist Martin Ellis said.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian housing market data. The Canadian building permits are expected to rise 4.8% in February, after a 9.8% drop in January.

EUR/USD: the currency pair declined to $1.1358

GBP/USD: the currency pair decreased to $1.4047

USD/JPY: the currency pair dropped to Y108.00

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) February -9.8% 4.8%

12:30 U.S. Continuing Jobless Claims March 2173 2173

12:30 U.S. Initial Jobless Claims April 276 270

14:00 Eurozone ECB President Mario Draghi Speaks

19:00 U.S. Consumer Credit February 10.54 14.74

21:30 U.S. Fed Chairman Janet Yellen Speaks

23:50 Japan Current Account, bln February 521 2006

-

13:51

Orders

EUR/USD

Offers: 1.1450 1.1460-70 1.1480 1.1500 1.1530 1.1550

Bids: 1.1400 1.1380-85 1.1350 1.1330-35 1.1310 1.1300 1.1275-80 1.1250 1.1230 1.1200

GBP/USD

Offers: 1.4150 1.4180-85 1.4200 1.4230 1.4250 1.4280 1.4300 1.4320-25 1.4350

Bids: 1.4100 1.4085 1.4065 1.4050 1.4030 1.4000 1.3980-85 1.3965 1.3950

EUR/JPY

Offers: 124.50 124.80 125.00 125.25-30 125.50 125.80 126.00 126.20 126.50

Bids: 124.00 123.70 123.50 123.30 123.00 122.80 122.50

EUR/GBP

Offers: 0.8120 0.8130 0.8150 0.8180 0.8200

Bids: 0.8100 0.8075-80 0.8060 0.8025-30 0.8000 0.7970-75 0.7950

USD/JPY

Offers: 109.00 109.20 109.50 109.80 110.00 110.30 110.50 110.80 111.00

Bids: 108.50 108.30 108.00 107.80-85 107.50 107.30 107.00

AUD/USD

Offers: 0.7600 0.7625-30 0.7650 0.7700 0.7720 0.7735-40 0.7750

Bids: 0.7550 0.7520 0.7500 0.7485 0.7465 0.7450 0.7430 0.7400

-

12:04

European Central Bank Vice President Benoit Coeure: the central bank is doing and will continue to do everything to fulfil its mandate

European Central Bank (ECB) Vice President Vitor Constancio said before the Committee on Economic and Monetary Affairs of the European Parliament on Thursday that the central bank was doing and would continue to do everything to fulfil its mandate.

He defended the recent monetary policy easing by the ECB.

"In discussing our recent monetary policy measures, it is essential to consider the global environment in which they were taken. This environment was characterised by subdued growth, historically weak trade developments and low inflationary pressures reflecting sharp falls in energy prices," the ECB vice president said.

-

11:57

European Central Bank Executive Board member Peter Praet: the ECB’s monetary policy adopted since June 2014 is effective

European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Thursday that the central bank's monetary policy adopted since June 2014 was effective.

"It has led to a substantial easing of financial conditions, and this has in turn led to an improvement in both output and inflation relative to counterfactual scenarios," he noted, adding that higher structural growth and employment could not depend on monetary policy.

Praet pointed out that the ECB could add further stimulus measures if the downside risks increase.

"If further adverse shocks were to materialise, our measures could be recalibrated once more commensurate with the strength of the headwind, also taking into account possible side-effects," he said.

Praet noted that the central bank did not discussed helicopter money.

-

11:53

Germany’s manufacturing turnover declines by 0.5% in February

Destatis released its manufacturing turnover data for Germany on Thursday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 0.5% in February, after a revised 0.8% rise in January.

Domestic turnover decreased by 0.8% in February, while the business with foreign customers dropped 0.3%.

Sales to euro area countries declined 0.6% in February, while sales to other countries were down 0.1%.

On a yearly basis, real manufacturing turnover in Germany rose on seasonally adjusted and on adjusted for working days basis by 1.3% in February.

-

11:40

Halifax: House prices in the U.K. climb 2.6% in March

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. climbed 2.6% in March, after a 1.5% decline in February. February's figure was revised down from a 1.4% fall.

On a yearly basis, house prices jumped 10.1% in the three months to March, after a 9.7% increase in the three months to February.

"Worsening sentiment regarding the prospects for the UK economy and uncertainty ahead of the European referendum in June could result in some softening in the housing market over the next couple of months," Halifax's housing economist Martin Ellis said.

-

11:31

France’s current account deficit rises to €3.90 billion in February

The Bank of France released its current account data on Thursday. France's current account deficit was €3.90 billion in February, down from a deficit of €2.20 billion in January. January's figure was revised down from a deficit of €1.40 billion.

The trade goods deficit widened to €3.9 billion in February from €2.4 billion in January, while the surplus on services rose to €0.3 billion from €0.1 billion.

-

11:27

France's trade deficit widens to €5.18 billion in February

According to the French Customs, France's trade deficit widened to €5.18 billion in February from €3.91 billion in January, missing expectations for a decline to a deficit of €3.8 billion. January's figure was revised down from a deficit of €3.70 billion.

The increase in deficit was driven by lower imports and higher imports. Exports decreased 0.2% in February, while imports were up 2.8%.

-

11:23

Industrial production in Spain declines 0.2% in February

Spanish statistical office INE released its industrial production figures for Spain on Thursday. Industrial production in Spain declined 0.2% in February, after a 0.1% drop in January.

On a yearly basis, industrial production in Spain climbed at adjusted 2.2% in February, after a 3.4% increase in January. January's figure was revised down from a 3.5% gain.

Output of capital goods jumped at seasonally adjusted 6.1% year-on-year in February, output of intermediate goods climbed 3.6%, energy production was down 8.0%, while consumer goods output rose 4.1%.

-

11:02

Bank of Japan Governor Haruhiko Kuroda: the BoJ is ready to add further stimulus measures if needed

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Thursday that the central bank was ready to add further stimulus measures if needed to boost inflation toward 2% target. He also said that the Japanese economy continued to recover moderately, adding that there was a weakness in exports and output.

-

10:48

International Monetary Fund: capital outflows from emerging economies contribute to the slowdown in those economies

The International Monetary Fund (IMF) said on Wednesday that capital outflows from emerging economies contributed to the slowdown in those economies.

"Both weaker inflows and stronger outflows have contributed to the slowdown. Much of the decline in inflows can be explained by the narrowing differential in growth prospects between emerging market and advanced economies," the IMF said in its World Economic Outlook (WEO).

-

10:38

St. Louis Fed President James Bullard: a long-term economic plan in the U.S. is needed to boost the growth

St. Louis Fed President James Bullard said in a speech on Wednesday that a long-term economic plan in the U.S. was needed to boost the growth.

"The U.S. needs a medium-term growth strategy that is less oriented towards stabilization policy, stimulus, and is more oriented to what kinds of things would improve the long term and medium term growth prospects," he said.

-

10:23

Cleveland Fed President Loretta Mester: the Fed should continue to hike its interest rate gradually this year

Cleveland Fed President Loretta Mester said in a speech on Wednesday that the Fed should continue to hike its interest rate gradually this year.

"In my view, it will be appropriate for monetary policymakers to continue to gradually reduce the level of accommodation this year," she said.

Mester pointed out that she expected more gradual policy path than in December as she downgraded her growth forecasts.

Mester is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:12

Fed’s March monetary policy meeting minutes: Fed officials noted the Fed should be cautious in rising its interest rate further

The Fed released its March monetary policy meeting minutes on Wednesday. The Fed kept its interest rate unchanged in March. Fed officials noted the Fed should be cautious in rising its interest rate further.

"Several members expressed the view that a cautious approach to raising rates would be prudent or noted their concern that raising the target range as soon as April would signal a sense of urgency they did not think appropriate," the minutes said.

According to the minutes, global economic and financial developments posed risks to the U.S. economy.

"A number of participants judged that the headwinds restraining growth and holding down the neutral rate of interest were likely to subside only slowly," the minutes said.

Two Fed officials wanted to hike interest rate in March. The Fed did not identify one official. The other official was Kansas City Fed President Esther George. She wanted a 25 basis point increase.

-

09:31

United Kingdom: Halifax house price index, March 2.6% (forecast 0.7%)

-

09:31

United Kingdom: Halifax house price index 3m Y/Y, March 10.1% (forecast 9.5%)

-

09:21

Option expiries for today's 10:00 ET NY cut

USD/JPY:109.45 (USD 300m) 110.00 (USD 950m) 111.50 (440m) 111.45 (230m) 112.00 (555m) 112.40-50 (586m) 112.90-113.00 (1.49bln)

EUR/USD: 1.1195-1200 (EUR 700m) 1.1215 (445m) 1.1300 (1.18bln) 1.1315 (1.1bln)1.1325 (486m) 1.1400 (1.47bln) 1.1430 (450m) 1.1500 (596m)

EUR/GBP 0.7900 (595m) 0.8100 (387m) 0.8250 (370m)

EUR/JPY 126.00-05 (EUR 1.12bln)

AUD/USD: 0.7350 (615) 0.7400-05 (AUD 786m) 0.7550 (423m) 0.7595-605 (332m) 0.7635 (268m)

NZD/USD 0.6600 (NZD 300m)

AUD/NZD 1.1250 (AUD 290m)

-

09:01

Switzerland: Foreign Currency Reserves, March 576

-

08:45

France: Trade Balance, bln, February -5.18 (forecast -3.8)

-

08:25

Options levels on thursday, April 7, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1557 (2229)

$1.1514 (3943)

$1.1477 (2620)

Price at time of writing this review: $1.1422

Support levels (open interest**, contracts):

$1.1343 (1708)

$1.1297 (3021)

$1.1249 (1195)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 48367 contracts, with the maximum number of contracts with strike price $1,1500 (3943);

- Overall open interest on the PUT options with the expiration date April, 8 is 75720 contracts, with the maximum number of contracts with strike price $1,0900 (6429);

- The ratio of PUT/CALL was 1.57 versus 1.58 from the previous trading day according to data from April, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.4400 (2074)

$1.4301 (888)

$1.4202 (706)

Price at time of writing this review: $1.4137

Support levels (open interest**, contracts):

$1.4096 (1170)

$1.3999 (2905)

$1.3900 (1011)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 23968 contracts, with the maximum number of contracts with strike price $1,4450 (2203);

- Overall open interest on the PUT options with the expiration date April, 8 is 23361 contracts, with the maximum number of contracts with strike price $1,4000 (2905);

- The ratio of PUT/CALL was 0.97 versus 1.05 from the previous trading day according to data from April, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:21

Asian session: The dollar hovered near a 17-month low against the yen

The yen's lunge higher led a senior Japanese finance ministry official to warn the move had been one-sided and that the ministry would take steps in the market as needed. Bank of Japan Governor Haruhiko Kuroda also repeated that the central bank would ease policy further if needed, but the market seems to doubt he can do much more. Traders said being short of yen had been a very heavily favored trade early in the year and the currency's surge was squeezing many investors out of those positions.

The dollar was also soft on its own account as minutes from the latest Federal Reserve meeting showed many participants wanted to move cautiously on rate hikes. The drop in the dollar added to gains in oil which jumped 5 percent overnight as U.S. inventories unexpectedly fell and investors gauged the possibility of an output freeze.

Aiding risk sentiment were the Fed minutes which showed many members reluctant to hike further in the face of global uncertainty, a point underlined by Dallas Fed President Robert Kaplan in a speech late on Wednesday.

EUR/USD: during the Asian session the pair traded in the range of $1.1395-15

GBP/USD: during the Asian session the pair traded in the range of $1.4105-40

USD/JPY: during the Asian session the pair dropped to Y109.00

Based on Reuters materials

-

01:30

Australia: AiG Performance of Construction Index, March 45.2

-

00:32

Currencies. Daily history for Apr 06’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1395 +0,11%

GBP/USD $1,4119 -0,28%

USD/CHF Chf0,9556 -0,02%

USD/JPY Y109,73 -0,55%

EUR/JPY Y125,05 -0,42%

GBP/JPY Y154,93 -0,81%

AUD/USD $0,7598 +0,75%

NZD/USD $0,6820 +0,23%

USD/CAD C$1,3094 -0,31%

-

00:02

Schedule for today, Thursday, Apr 07’2016:

(time / country / index / period / previous value / forecast)

06:45 France Trade Balance, bln February -3.70 -3.8

07:00 Switzerland Foreign Currency Reserves March 571

07:30 United Kingdom Halifax house price index March -1.4% 0.7%

07:30 United Kingdom Halifax house price index 3m Y/Y March 9.7% 9.5%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada Building Permits (MoM) February -9.8% 4.8%

12:30 U.S. Continuing Jobless Claims March 2173 2173

12:30 U.S. Initial Jobless Claims April 276 270

14:00 Eurozone ECB President Mario Draghi Speaks

19:00 U.S. Consumer Credit February 10.54 14.74

21:30 U.S. Fed Chairman Janet Yellen Speaks

23:50 Japan Current Account, bln February 521 2006

-