Noticias del mercado

-

19:59

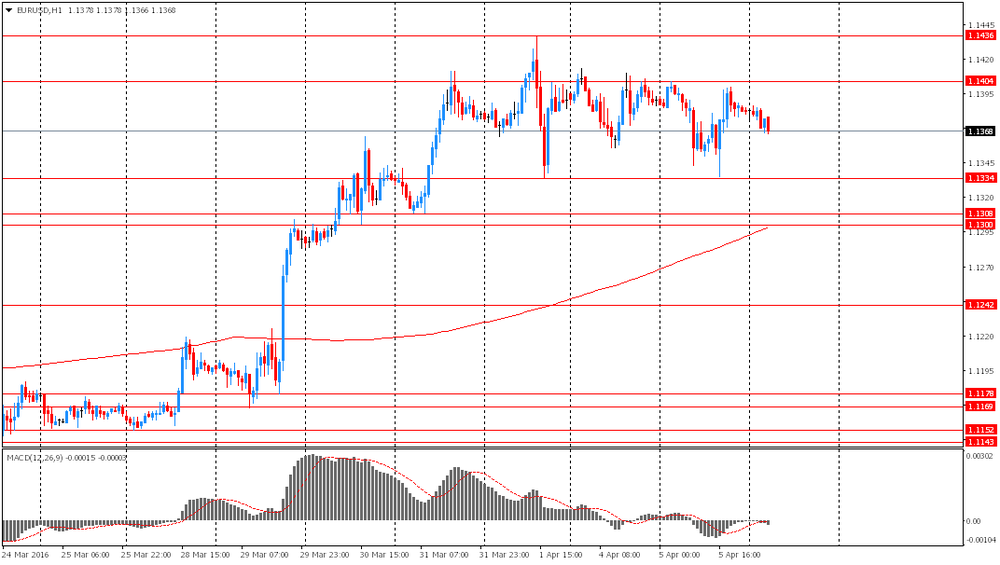

American focus: the US dollar declined significantly against major currencies

The dollar depreciated significantly against the euro, reaching a minimum of 1 April, despite the absence of a particular driver. Analysts say one reason for the recent movement may be waiting publication of the protocol of the last meeting of the Fed. Market participants hope that the protocol will contain details on the latest economic forecasts and expectations. Particular attention will be paid to the risks of growth of the national and global economy. Important will also comment on the assessments to achieve the inflation target. In addition, the protocol may allow a better understanding of the degree of influence of volatility in global markets to reduce forecasts for the pace of rate hikes this year. Currently, futures on interest rates Fed indicated only 3% probability of a rate hike in April. Meanwhile, the chances of a rate hike by December fell to 58% from 68% a month ago. However, previously the head of the Federal Reserve Bank of Boston, Rosengren said this week that the Fed rate futures are not significantly reflect the pace of rate hikes in the short term. Rosengren sees fit gradual increase in rates, but, in his opinion, it will not be so gradual, according to market participants.

After the release of the Fed's meeting minutes, market participants will switch attention to the minutes of the meeting of the European Central Bank, which will be presented tomorrow. Minutes of the ECB is likely to help you understand why the ECB Governing Council chose the stimulus measures and whether he considered there any other options for action. Also, they may contain clues as to the reasons for the revision of economic forecasts.

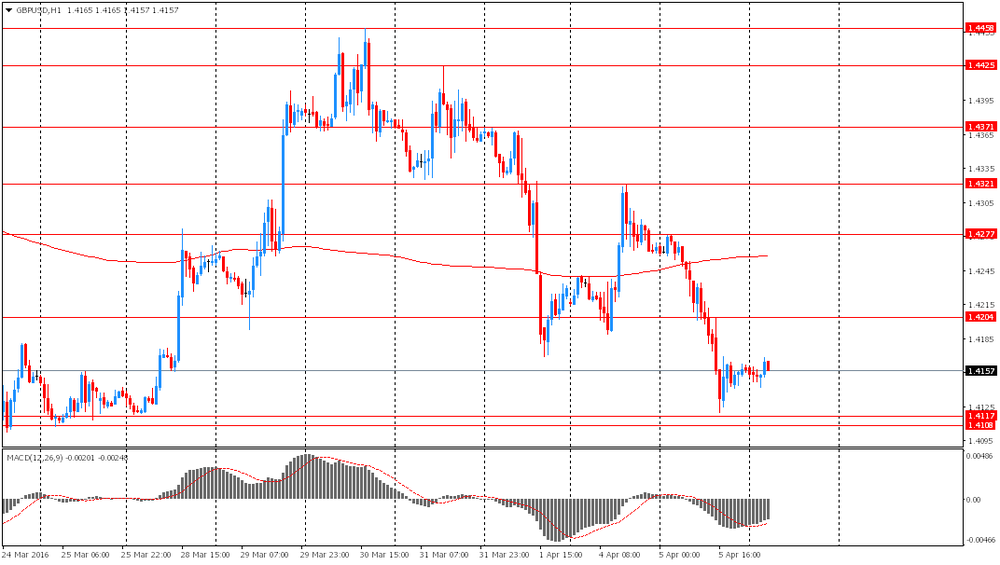

The pound rose substantially against the dollar, recouping all of the previously lost ground, which was due to the widespread weakening of the US currency on the eve of the publication of the Fed minutes. Also, market participants are waiting for release of British industrial production and trade balance data. The report on industrial production, which will be released on Friday, is likely to point to the difficulty faced by the manufacturing sector. Meanwhile, most analysts believe that the UK balance of foreign trade, which will also be presented on Friday, February remained almost unchanged.

Earlier today, investors pay attention to the statistics on the sales of cars in Britain. Society of Motor Manufacturers and Traders on Wednesday (SMMT) reported that in March car sales rose by 5.3 percent to 518,707 units, as more than half a million customers have purchased the updated models of popular cars. It is worth mentioning only the third time the market has surpassed half a million units in a single month.

Demand for cars on alternative fuels increased by 21.5 percent in March, as consumers continue to prefer vehicles with lower emissions and lower operating costs. In the 1 st quarter sales rose 5.1 percent to 771,780 units. Mike Hawes, Executive Director of the SMMT, said that consumer confidence reveals that sales remain high, but generally stable throughout the year, but can be undermined by political or economic uncertainty.

The Canadian dollar has appreciated sharply against the US dollar, updating yesterday's high. Support currency had a significant rise in oil prices against the backdrop of the US Department of Energy report. It is learned that during the week April 26 March to 1 US crude stocks fell by 4.9 million barrels to 529.9 million barrels. Analysts had expected inventories to increase by 3.5 mln. Barrels. Oil reserves in Cushing terminal rose 357,000 barrels to 66.3 million barrels. Meanwhile, gasoline stocks rose by 1.4 million barrels to 244 million barrels. Analysts had expected a decrease of 1.5 million barrels. Distillate stocks rose by 1.8 million barrels to 163 million barrels. Analysts had forecast a drop to 900,000 barrels. The utilization of refining capacity rose by 1% to 91.4%. Analysts had expected a decline of 0.1%. US domestic oil production fell to 9.008 million barrels per day, against 9.022 million. barrels the previous week. It should be emphasized, the report from the US Department of Energy has confirmed yesterday's data from the American Petroleum Institute, which showed that during the week April 26 March-1 oil inventories fell by 4.3 mln. Barrels. Analysts had forecast an increase of stocks at 3.2 million. Barrels.

-

17:37

The World Bank downgrades its economic growth forecasts for Russia

The World Bank downgraded its economic growth forecasts for Russia on Wednesday. The bank expects the Russian economy to contract 1.9% in 2016, down from its December estimate of -0.7%, and to expand 1.1% in 2017, down from its December forecast of 1.3%.

The World Bank noted that the recovery of the Russian economy would be long and difficult, due to adverse external environment.

-

16:40

Reserve Bank of Australia Assistant Governor Christopher Kent: inflation in Australia will likely remain low “over the next couple of years”

Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent said in a speech on Wednesday that inflation in Australia would likely remain low "over the next couple of years". He pointed out that the prices of imports, and spare capacity in product and labour markets globally weighed on inflation.

-

16:30

U.S.: Crude Oil Inventories, April -4.937 (forecast 3.5)

-

16:18

The People’s Bank of China injects 30 billion yuan in the financial system

The People's Bank of China (PBoC) on Wednesday injected 30 billion yuan ($5 billion) in the financial system by offering seven-day reverse repurchase agreements, increasing efforts to combat capital flight from the country's economy.

-

16:11

Canada’s Ivey purchasing managers’ index drops to 50.1 in March

Canada's seasonally adjusted Ivey purchasing managers' index dropped to 50.1 in March from 53.4 in February. Analysts had expected the index to rise to 55.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was down to 48.5 in March from 49.4 in February, while employment index rose to 50.7 from 50.3.

The prices index was increased to 58.5 in March from 57.8 in February, while inventories plunged to 48.6 from 49.9.

-

16:00

Canada: Ivey Purchasing Managers Index, March 50.1 (forecast 55)

-

15:44

Option expiries for today's 10:00 ET NY cut

USD/JPY:110.00 (USD 400m) 111.50 (440m) 111.90 (260m) 112.85-90 (400m) 113.50 (325m) 113.70 (3.58bln)

EUR/USD: 1.1240 (EUR 224m) 1.1300 (897m) 1.1330-40 (355m) 1.1440 (583m) 1.1415 (276m) 1.1450 (290m) 1.1600 (667m)

EUR/JPY 125.00 (EUR 490m)

AUD/USD: 0.7400 (AUD 1.04bln) 0.7445 (201m) 0.7470-75 (714m) 0.7550 (539m)

NZD/USD 0.6870 (NZD 273m)

USD/CAD: 1.3030 (USD 320m) 1.3645-55 (390m)

-

14:40

Japan's leading index declines to 99.8 in February, the lowest level since December 2012

Japan's Cabinet Office released its preliminary leading index data on Wednesday. The leading index decreased to 99.8 in February from 101.4 in January, missing expectations for a decline to 99.9. It was the lowest level since December 2012.

Japan's coincident index fell to 110.3 in February from 113.8 in January. It was the lowest level since August 2013.

-

14:16

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the German industrial production data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:45 China Markit/Caixin Services PMI March 51.2 51.4 52.2

05:00 Japan Coincident Index (Preliminary) February 113.5 110.3

05:00 Japan Leading Economic Index (Preliminary) February 101.8 99.9 99.8

06:00 Germany Industrial Production s.a. (MoM) February 2.3% Revised From 3.3% -1.8% -0.5%

07:00 Australia RBA Assist Gov Kent Speaks

11:00 U.S. MBA Mortgage Applications April -1% 2.7%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the latest Fed's minutes. Market participants will closely analyse the minutes for hints for further interest rate hikes. The minutes will be released at 18:00 GMT.

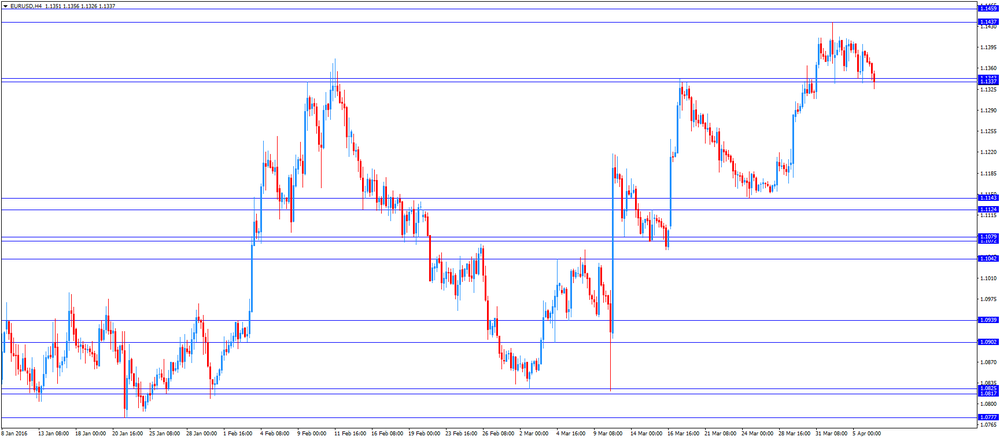

The euro traded lower against the U.S. dollar after the release of the German industrial production data. Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%. The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

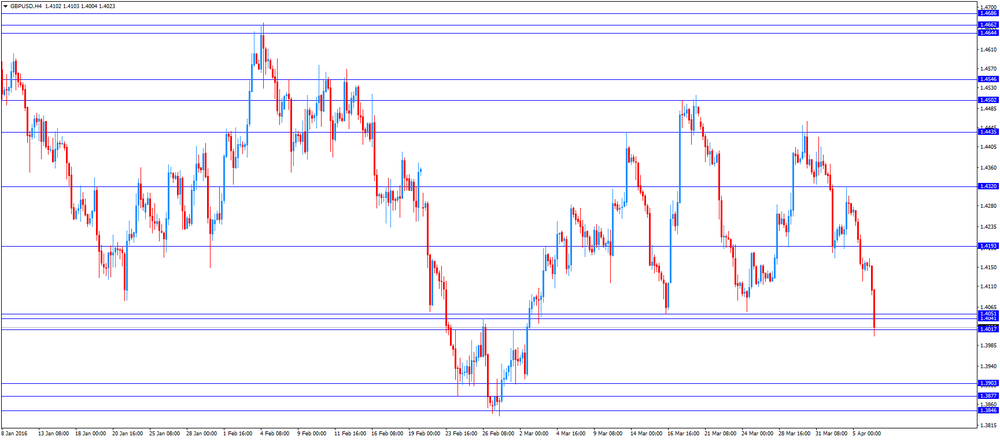

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian trade data. Canada's seasonally adjusted Ivey purchasing managers' index is expected to rise to 55.0 in March from 53.4 in February.

EUR/USD: the currency pair declined to $1.1326

GBP/USD: the currency pair decreased to $1.4004

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 Canada Ivey Purchasing Managers Index March 53.4 55

14:30 U.S. Crude Oil Inventories April 2.299 3.5

16:20 U.S. FOMC Member Mester Speaks

18:00 U.S. FOMC meeting minutes

23:30 Australia AiG Performance of Construction Index March 46.1

-

13:50

Orders

EUR/USD

Offers: 1.1370 1.1385 1.1400 1.1420 1.1435 1.1450 1.1480 1.1500

Bids: 1.1330-35 1.1310 1.1300 1.1275-80 1.1250 1.1230 1.1200

GBP/USD

Offers: 1.4150 1.4180-85 1.4200 1.4230 1.4250 1.4280 1.4300 1.4320-25 1.4350

Bids: 1.4100 1.4085 1.4065 1.4050 1.4030 1.4000 1.3980-85 1.3965 1.3950

EUR/JPY

Offers: 125.80 126.00 126.20 126.50 126.80 127.00 127.50

Bids: 125.20 125.00 124.75-80 124.50 124.25 124.00

EUR/GBP

Offers: 0.8050 0.8060-65 0.8085 0.8100 0.8130 0.8150

Bids: 0.8020 0.8000 0.7970-75 0.7950 0.7930 0.7900 0.7880-85 0.7865 0.7850

USD/JPY

Offers: 110.60-65 110.80 111.00 111.25-30 111.60 111.80 112.00 112.20 112.50 112.65 112.80 113.00

Bids: 110.20 110.00 109.85 109.65 109.50 109.30 109.00

AUD/USD

Offers: 0.7585 0.7600 0.7625-30 0.7650 0.7700 0.7720 0.7735-40 0.7750

Bids: 0.7550 0.7520 0.7500 0.7485 0.7465 0.7450 0.7430 0.7400

-

13:00

U.S.: MBA Mortgage Applications, April 2.7%

-

11:47

BRC: U.K. shop prices are down 1.7% year-on-year in March

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.7% year-on-year in March, after a 2.0% decline in February.

The decline was mainly driven by a drop in non-food prices, which plunged 2.6% year-on-year in March.

Food prices declined at an annual rate of 0.4% in March, driven mainly by reductions in fresh food.

"March was the 36th month in which consumers have benefited from falling prices. March also marked the 35th month of falling overall prices," BRC Chief Executive, Helen Dickinson, said.

"Despite consumer confidence remaining at zero, a relatively benign economic environment (inflation remains very low and oil is trading at just under $40 per barrel) and a fiercely competitive market will see retailers continue to respond to their customers with prices and promotions to maintain market share as the Spring season kicks off," she added.

-

11:36

German industrial production falls 0.5% in February

Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%.

The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

-

11:19

Germany's construction PMI decreases to 55.8 in March

Markit Economics released construction purchasing managers' index (PMI) for Germany on Wednesday. Germany's construction PMI decreased to 55.8 in March from 59.6 in February.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by a softer growth in new orders and purchasing activity.

"Despite falling to a three-month low in March, the Germany Construction PMI signalled a sharp rise in building activity, thereby adding to hopes that the sector will contribute positively to economic growth in the opening quarter of the year," an economist at Markit, Oliver Kolodseike, said.

-

11:04

Germany's retail PMI climbs to 54.1 in March

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Wednesday. Germany's retail PMI climbed to 54.1 in March from 52.5 in February. It was the highest level since August 2015.

The increase was driven by rises in buying activity, inventories and employment.

"German retailers reported further growth of sales during March, thereby signalling that household demand continued to strengthen at the end of the first quarter," an economist at Markit, Oliver Kolodseike, said.

-

10:54

Eurozone's retail PMI declines to 49.2 in March

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Wednesday. Eurozone's construction purchasing managers' index (PMI) declined to 49.2 in March from 50.1 in February.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in France and Italy declined in March, while sales in Germany rose.

"The modest decrease in sales shown by the headline index masked some strikingly opposing trends at the country level," an economist at Markit, Phil Smith, said.

-

10:43

Japan’s Prime Minister Shinzo Abe: countries should avoid competitive devaluation of their currencies

Japan's Prime Minister Shinzo Abe said in an interview with The Wall Street Journal on Tuesday that countries should avoid competitive devaluation of their currencies.

"Whatever the circumstances, we must definitely avoid competitive devaluation, and I think we should refrain from arbitrary intervention in currency markets," he said.

Abe added that stability was an important factor for the economy.

-

10:24

Chinese Markit/Caixin services PMI rises to 52.2 in March

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China rose to 52.2 in March from 51.2 in February, exceeding expectations for a rise to 51.4.

The index was mainly driven by a rise in new orders.

"Overall, the services sector developed well, but the economy is riding choppy waves, indicating the lack of a solid foundation for a recovery. The government needs to push forward with "supply-side reform" to encourage the development of emerging industries," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:09

OECD: consumer price inflation in the OECD area falls to 1.0% year-on-year in February

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area fell to 1.0% year-on-year in February from 1.2% in January. The decline was driven by a drop in energy prices.

Energy prices slid at an annual rate of 8.8% in February, down from a 5.4% fall in January, while food prices increased to 0.9% from 0.7%.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.9% in February.

February's CPI was 0.0% in Germany, 0.3% in Japan, -0.3% in Italy, 1.0% in the U.S, 1.4% in Canada, and 0.3% in the U.K.

The consumer price inflation in Eurozone was -0.2% in February, while the inflation in China was 2.3%.

-

09:26

Option expiries for today's 10:00 ET NY cut

USD/JPY:110.00 (USD 400m) 111.50 (440m) 111.90 (260m) 112.85-90 (400m) 113.50 (325m) 113.70 (3.58bln)

EUR/USD: 1.1240 (EUR 224m) 1.1300 (897m) 1.1330-40 (355m) 1.1440 (583m) 1.1415 (276m) 1.1450 (290m) 1.1600 (667m)

EUR/JPY 125.00 (EUR 490m)

AUD/USD: 0.7400 (AUD 1.04bln) 0.7445 (201m) 0.7470-75 (714m) 0.7550 (539m)

NZD/USD 0.6870 (NZD 273m)

USD/CAD: 1.3030 (USD 320m) 1.3645-55 (390m)

-

08:26

Options levels on wednesday, April 6, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1512 (4066)

$1.1474 (2752)

$1.1409 (3132)

Price at time of writing this review: $1.1356

Support levels (open interest**, contracts):

$1.1293 (3218)

$1.1247 (1069)

$1.1199 (1788)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 48097 contracts, with the maximum number of contracts with strike price $1,1500 (4066);

- Overall open interest on the PUT options with the expiration date April, 8 is 75769 contracts, with the maximum number of contracts with strike price $1,0900 (6429);

- The ratio of PUT/CALL was 1.58 versus 1.55 from the previous trading day according to data from April, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.4400 (1993)

$1.4301 (940)

$1.4204 (633)

Price at time of writing this review: $1.4138

Support levels (open interest**, contracts):

$1.4097 (1209)

$1.3999 (2983)

$1.3900 (1082)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 22495 contracts, with the maximum number of contracts with strike price $1,4400 (1993);

- Overall open interest on the PUT options with the expiration date April, 8 is 23532 contracts, with the maximum number of contracts with strike price $1,4000 (2983);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from April, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:22

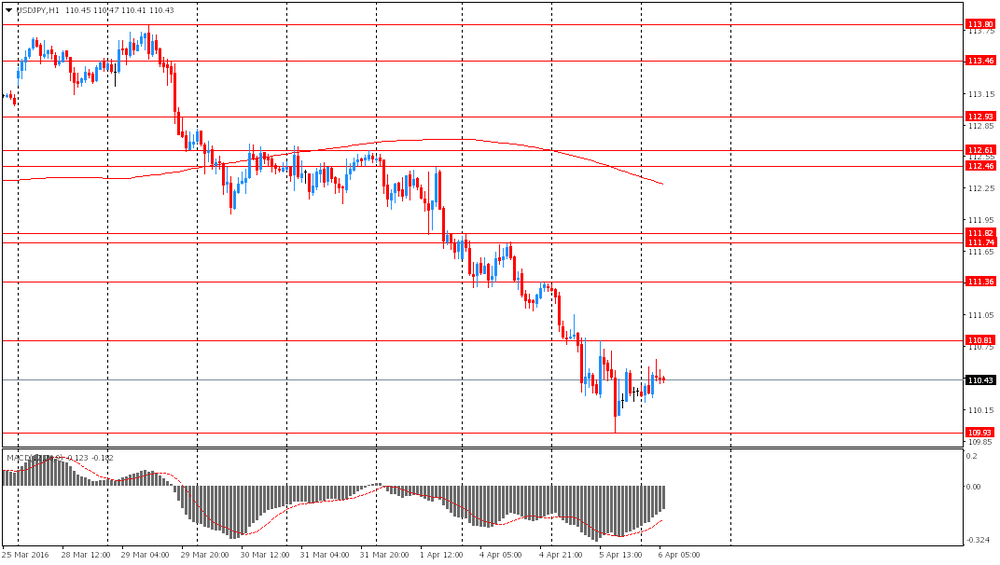

Asian session: The dollar hovered near a 17-month low against the yen

The dollar hovered near a 17-month low against the yen on Wednesday after taking a fresh knock overnight on comments by Japan's prime minister which suggested that authorities were cautious towards arresting the yen's appreciation. Japanese Prime Minister Shinzo Abe told the Wall Street Journal that countries should avoid seeking to weaken their currencies with "arbitrary intervention."

Amid earlier turmoil in the global markets, the yen has advanced steadily this year due to its safe-haven status and more recently on expectations that the Federal Reserve would not hike interest rates as aggressively this year as initially anticipated.

The dollar has lost more than one percent against the yen so far this week, and appears on track to post its third weekly loss in four.

EUR/USD: during the Asian session the pair traded in the range of $1.1385-00

GBP/USD: during the Asian session the pair traded in the range of $1.4250-75

USD/JPY: during the Asian session the pair fell to Y110.75

Based on Reuters materials

-

08:00

Germany: Industrial Production s.a. (MoM), February -0.5% (forecast -1.8%)

-

07:02

Japan: Coincident Index, February 110.3

-

07:01

Japan: Leading Economic Index , February 99.8 (forecast 99.9)

-

03:45

China: Markit/Caixin Services PMI, March 52.2 (forecast 51.4)

-

00:29

Currencies. Daily history for Apr 05’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1382 -0,07%

GBP/USD $1,4158 -0,76%

USD/CHF Chf0,9558 -0,30%

USD/JPY Y110,33 -0,89%

EUR/JPY Y125,58 -0,96%

GBP/JPY Y156,18 -1,66%

AUD/USD $0,7541 -0,82%

NZD/USD $0,6804 -0,35%

USD/CAD C$1,3135 +0,43%

-

00:00

Schedule for today, Wednesday, Apr 06’2016:

(time / country / index / period / previous value / forecast)

01:45 China Markit/Caixin Services PMI March 51.2 51.4

05:00 Japan Coincident Index (Preliminary) February 113.5

05:00 Japan Leading Economic Index (Preliminary) February 101.8 99.9

06:00 Germany Industrial Production s.a. (MoM) February 3.3% -1.8%

07:00 Australia RBA Assist Gov Kent Speaks

11:00 U.S. MBA Mortgage Applications April -1%

14:00 Canada Ivey Purchasing Managers Index March 53.4 55

14:30 U.S. Crude Oil Inventories April 2.299

16:20 U.S. FOMC Member Mester Speaks

18:00 U.S. FOMC meeting minutes

23:30 Australia AiG Performance of Construction Index March 46.1

-