Noticias del mercado

-

21:01

Dow +0.23% 17,643.56 +40.24 Nasdaq +1.14% 4,899.26 +55.33 S&P +0.63% 2,058.03

-

19:59

American focus: the US dollar declined significantly against major currencies

The dollar depreciated significantly against the euro, reaching a minimum of 1 April, despite the absence of a particular driver. Analysts say one reason for the recent movement may be waiting publication of the protocol of the last meeting of the Fed. Market participants hope that the protocol will contain details on the latest economic forecasts and expectations. Particular attention will be paid to the risks of growth of the national and global economy. Important will also comment on the assessments to achieve the inflation target. In addition, the protocol may allow a better understanding of the degree of influence of volatility in global markets to reduce forecasts for the pace of rate hikes this year. Currently, futures on interest rates Fed indicated only 3% probability of a rate hike in April. Meanwhile, the chances of a rate hike by December fell to 58% from 68% a month ago. However, previously the head of the Federal Reserve Bank of Boston, Rosengren said this week that the Fed rate futures are not significantly reflect the pace of rate hikes in the short term. Rosengren sees fit gradual increase in rates, but, in his opinion, it will not be so gradual, according to market participants.

After the release of the Fed's meeting minutes, market participants will switch attention to the minutes of the meeting of the European Central Bank, which will be presented tomorrow. Minutes of the ECB is likely to help you understand why the ECB Governing Council chose the stimulus measures and whether he considered there any other options for action. Also, they may contain clues as to the reasons for the revision of economic forecasts.

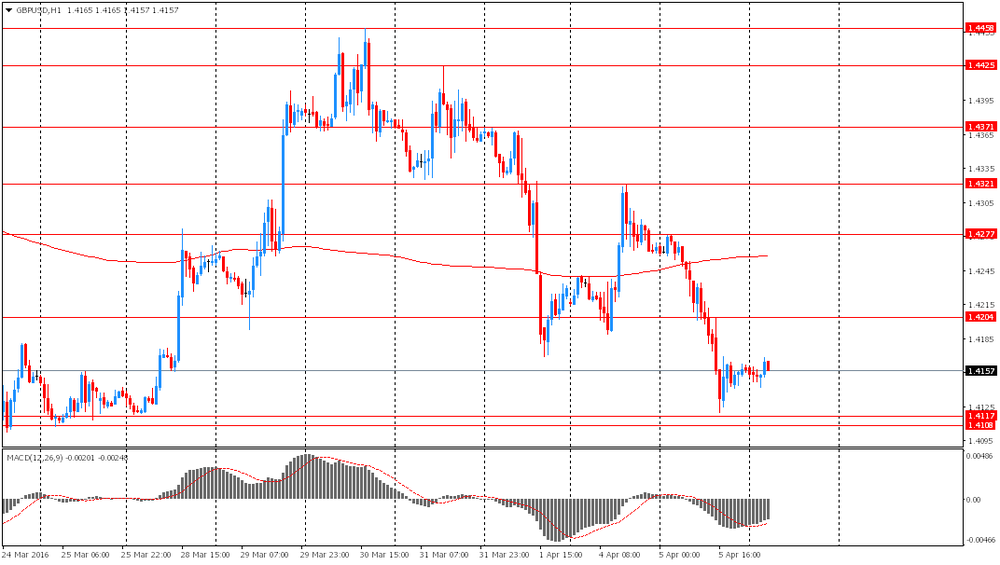

The pound rose substantially against the dollar, recouping all of the previously lost ground, which was due to the widespread weakening of the US currency on the eve of the publication of the Fed minutes. Also, market participants are waiting for release of British industrial production and trade balance data. The report on industrial production, which will be released on Friday, is likely to point to the difficulty faced by the manufacturing sector. Meanwhile, most analysts believe that the UK balance of foreign trade, which will also be presented on Friday, February remained almost unchanged.

Earlier today, investors pay attention to the statistics on the sales of cars in Britain. Society of Motor Manufacturers and Traders on Wednesday (SMMT) reported that in March car sales rose by 5.3 percent to 518,707 units, as more than half a million customers have purchased the updated models of popular cars. It is worth mentioning only the third time the market has surpassed half a million units in a single month.

Demand for cars on alternative fuels increased by 21.5 percent in March, as consumers continue to prefer vehicles with lower emissions and lower operating costs. In the 1 st quarter sales rose 5.1 percent to 771,780 units. Mike Hawes, Executive Director of the SMMT, said that consumer confidence reveals that sales remain high, but generally stable throughout the year, but can be undermined by political or economic uncertainty.

The Canadian dollar has appreciated sharply against the US dollar, updating yesterday's high. Support currency had a significant rise in oil prices against the backdrop of the US Department of Energy report. It is learned that during the week April 26 March to 1 US crude stocks fell by 4.9 million barrels to 529.9 million barrels. Analysts had expected inventories to increase by 3.5 mln. Barrels. Oil reserves in Cushing terminal rose 357,000 barrels to 66.3 million barrels. Meanwhile, gasoline stocks rose by 1.4 million barrels to 244 million barrels. Analysts had expected a decrease of 1.5 million barrels. Distillate stocks rose by 1.8 million barrels to 163 million barrels. Analysts had forecast a drop to 900,000 barrels. The utilization of refining capacity rose by 1% to 91.4%. Analysts had expected a decline of 0.1%. US domestic oil production fell to 9.008 million barrels per day, against 9.022 million. barrels the previous week. It should be emphasized, the report from the US Department of Energy has confirmed yesterday's data from the American Petroleum Institute, which showed that during the week April 26 March-1 oil inventories fell by 4.3 mln. Barrels. Analysts had forecast an increase of stocks at 3.2 million. Barrels.

-

19:15

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Wednesday, helped by a rise in energy and healthcare stocks, as investors awaited the release of minutes from the Federal Reserve's meeting on monetary policy in March. U.S. crude jumped more than 4%, helping prop up energy stocks, after data suggested a smaller-than-expected rise in crude inventories for last week. Investors, who have been grappling with mixed signals on interest rates from Fed officials, will parse the minutes to gain insight into the central bank's thinking on the economy.

Most of Dow stocks in positive area (21 of 30). Top looser - Verizon Communications Inc. (VZ, -1,41%). Top gainer - Pfizer Inc. (PFE, +3,97%).

Almost all S&P sectors in positive area. Top looser - Utilities (-0,4%). Top gainer - Healthcare (+2,4%).

At the moment:

Dow 17585.00 +58.00 +0.33%

S&P 500 2051.00 +12.25 +0.60%

Nasdaq 100 4509.00 +39.50 +0.88%

Oil 37.75 +1.86 +5.18%

Gold 1224.30 -5.30 -0.43%

U.S. 10yr 1.76 +0.03

-

18:00

European stocks closed: FTSE 100 6,161.63 +70.40 +1.16% CAC 40 4,284.64 +34.36 +0.81% DAX 9,624.51 +61.15 +0.64%

-

18:00

European stocks close: stocks closed higher ahead of the latest Fed’s minutes

Stock indices closed higher ahead of the release of the latest Fed's minutes later in the day. Market participants will closely analyse the minutes for hints for further interest rate hikes.

Higher oil prices supported stocks. Oil prices rose on the U.S. crude oil inventories data. According to the U.S. Energy Information Administration (EIA) on Wednesday, U.S. crude inventories declined by 4.9 million barrels to 529.9 million in the week to April 01. Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Market participants also eyed the economic data from the Eurozone. Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%. The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,161.63 +70.40 +1.16 %

DAX 9,624.51 +61.15 +0.64 %

CAC 40 4,284.64 +34.36 +0.81 %

-

17:59

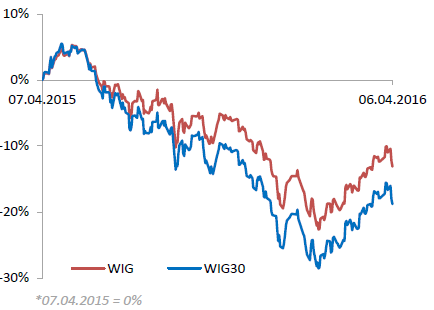

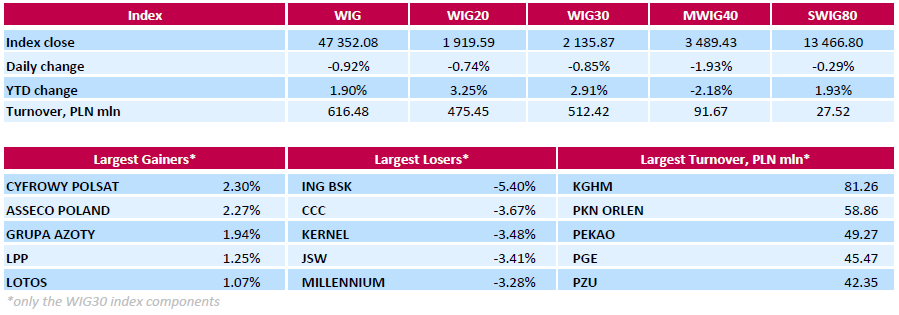

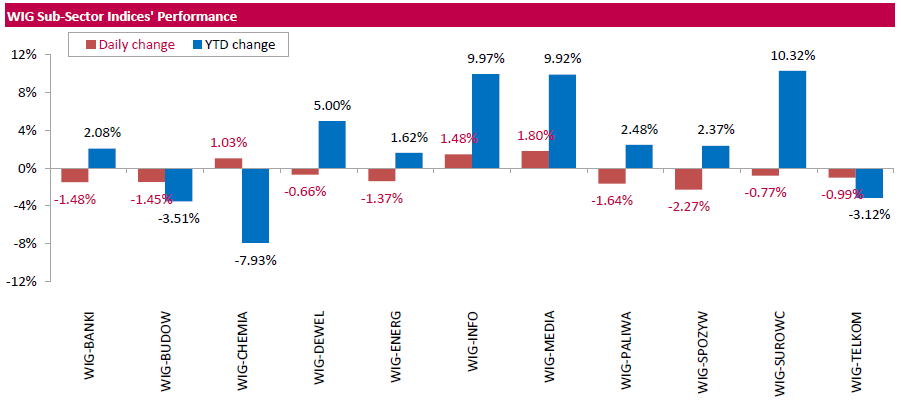

WSE: Session Results

Polish equity market declined on Wednesday. The broad market measure, the WIG Index, slumped by 0.92%.The WIG sub-sector indices were mainly lower with food sector (-2.27%) underperforming.

The large-cap companies' measure, the WIG30 Index, fell by 0.85%. In the index basket, bank ING BSK (WSE: ING) led the losers with a 5.4% drop, followed by footwear retailer CCC (WSE: CCC), agricultural producer KERNEL (WSE: KER) and coking coal miner JSW (WSE: JSW), plunging by 3.67%, 3.48% and 3.41% respectively. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS) and IT-company ASSECO POLAND (WSE: ACP) were the growth leaders, adding 2.3% and 2.27% respectively.

-

17:42

Oil going up steadily after the publication of the report on stocks

Oil futures rose more than 3 percent, supported by on US petroleum inventories report. Higher prices also contributed to the weakening of the dollar.

US Department of Energy announced that in the week 1 April-26 March crude oil inventories fell by 4.9 million barrels to 529.9 million barrels. Analysts had expected inventories to increase by 3.5 mln. Barrels. Oil reserves in Cushing terminal rose 357,000 barrels to 66.3 million barrels. Meanwhile, gasoline stocks rose by 1.4 million barrels to 244 million barrels. Analysts had expected a decrease of 1.5 million barrels. Distillate stocks rose by 1.8 million barrels to 163 million barrels. Analysts had forecast a drop to 900,000 barrels. The utilization of refining capacity rose by 1% to 91.4%. Analysts had expected a decline of 0.1%. US domestic oil production fell to 9.008 million barrels per day, against 9.022 million. barrels the previous week. We remind investors are closely watching the mark of 9.0 million. Barrels. Recent data may mean that next week's production will fall below this level, it will be a positive factor for the market. It should be emphasized, the report from the US Department of Energy has confirmed yesterday's data from the American Petroleum Institute, which showed that during the week April 26 March-1 oil inventories fell by 4.3 mln. Barrels. Analysts had forecast an increase of stocks at 3.2 million. Barrels.

Positive impact on prices also have hopes of reaching an agreement between major oil producers to freeze production. Yesterday, the official representative of Kuwait at OPEC Nawal al-Fuzaya said that oil-producing countries following the meeting in Doha may freeze oil production at the level of February. According to her, the oil producers may agree to freeze without the participation of Iran in the negotiations. "Oil futures gained some momentum after a comment representative of Kuwait, - analysts said ANZ bank -. However, investors will be cautious in the run-up to the meeting on April 17".

In focus were also data on business activity in the sector of services in China, which surpassed expectations. As it became known, the PMI index of Caixin / Markit in March rose to 52.2 from 51.2 in February. The growth index indicates a recovery of activity outside the manufacturing sector in China. China's official non-manufacturing PMI also showed accelerated growth activity in May. The company said that new orders in March rose moderately, and that service companies cautious approach to personnel matters, despite a slight increase in activity. However, the employment indicator fell below the neutral level of 50 for the first time since August of 2013.

WTI for delivery in May rose to $37.57 a barrel. Brent for May rose to $39.63 a barrel.

-

17:37

The World Bank downgrades its economic growth forecasts for Russia

The World Bank downgraded its economic growth forecasts for Russia on Wednesday. The bank expects the Russian economy to contract 1.9% in 2016, down from its December estimate of -0.7%, and to expand 1.1% in 2017, down from its December forecast of 1.3%.

The World Bank noted that the recovery of the Russian economy would be long and difficult, due to adverse external environment.

-

17:20

Gold prices dropped significantly

Gold prices fell nearly 1 percent, returning to yesterday's low as the stock recovery has prompted some investors to lock in profits. In the course of trading is also affected by expectations of publishing minutes of the last Fed meeting.

"The precious metal fell today as investors once again turned their attention to the stock markets - said principal analyst Ava Trade Naeem Aslam -. However, the situation may change after the release of the Fed minutes of the meeting."

Recall, the Fed's minutes of the meeting will be presented today at 18:00 GMT. Market participants hope that the protocol will contain clues regarding US monetary policy outlook, as well as the reasons that forced politicians to leave rates unchanged at the March meeting. Recall, higher interest rates have a downward pressure on the price of gold, which brings its holders to interest income and that is difficult to compete with the assets, bringing that income against the background of increasing interest rates. Late last month, Fed Chairman Yellen provoked gold rally after allegations that the central bank should remain cautious on further rate increase. However, the head of the Federal Reserve Bank of Boston President Eric Rosengren and Chicago Fed Charles Evans indicated this week that the market's opinion on the prospects of raising rates too pessimistic. Futures on interest rates Fed point to 3% probability of a rate hike in April and 22% probability in June.

Some analysts point out that the price of gold near $ 1230 per troy ounce reasonable and should be stable in the short term.

In addition, it became known that the gold reserves in the largest investment fund SPDR Gold Trust yesterday fell 0.28 tons to 815.44 tons. Recall, the fund reported on this year's first weekly outflow of inventories last week.

April futures price of gold on COMEX fell today to $ 1221.9 an ounce.

-

17:17

The World Bank does not see a significant rise in oil prices even if a deal on the freeze of the oil output is reached this month

The World Bank's Lead Economist for the Russian Federation in the Europe and Central Asia Region, Birgit Hansl, said on Wednesday that the World Bank did not see a significant rise in oil prices even if a deal on the freeze of the oil output would be reached at the meeting in Doha on April 17.

-

17:08

Iran’s Oil Minister Bijan Zanganeh: Iran’s oil production will reach 4 million barrels a day by March 2017

Iran's Oil Minister Bijan Zanganeh said on Wednesday that the country's oil production would reach 4 million barrels a day by March 2017. He added that Iran planned to export 2.25 million barrels a day of this output.

-

16:46

U.S. crude inventories decline by 4.9 million barrels to 529.9 million in the week to April 01

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 4.9 million barrels to 529.9 million in the week to April 01.

Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Gasoline inventories increased by 1.4 million barrels, according to the EIA.

Crude stocks at the Cushing, Oklahoma, increased by 357,000 barrels.

U.S. crude oil imports fell by 446,000 barrels per day.

Refineries in the U.S. were running at 91.4% of capacity, up from 90.4% the previous week.

-

16:40

Reserve Bank of Australia Assistant Governor Christopher Kent: inflation in Australia will likely remain low “over the next couple of years”

Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent said in a speech on Wednesday that inflation in Australia would likely remain low "over the next couple of years". He pointed out that the prices of imports, and spare capacity in product and labour markets globally weighed on inflation.

-

16:30

U.S.: Crude Oil Inventories, April -4.937 (forecast 3.5)

-

16:18

The People’s Bank of China injects 30 billion yuan in the financial system

The People's Bank of China (PBoC) on Wednesday injected 30 billion yuan ($5 billion) in the financial system by offering seven-day reverse repurchase agreements, increasing efforts to combat capital flight from the country's economy.

-

16:11

Canada’s Ivey purchasing managers’ index drops to 50.1 in March

Canada's seasonally adjusted Ivey purchasing managers' index dropped to 50.1 in March from 53.4 in February. Analysts had expected the index to rise to 55.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was down to 48.5 in March from 49.4 in February, while employment index rose to 50.7 from 50.3.

The prices index was increased to 58.5 in March from 57.8 in February, while inventories plunged to 48.6 from 49.9.

-

16:00

Canada: Ivey Purchasing Managers Index, March 50.1 (forecast 55)

-

15:54

WSE: After start on Wall Street

U.S. Stocks open: Dow +0.06%, Nasdaq +0.20%, S&P +0.10%

Start of the day on Wall Street was in line what was suggested by earlier behavior of derivatives, so Europe had time to prepare for the opening. In fact DAX previously reacted to the decline of the contract for S&P500 with the shift into red, and went back to the area of the lower limit of the daily span. The WIG20 was also looking to rebound from the morning session decline. As a result, attention shifts to the support in the area of 1900 points. However, we must constantly emphasize that barely PLN 300 mln of turnover on the WIG20 does not indicate a serious supply activity. Declines led by such a turnover signals that the market treats the withdrawal in terms of the expected correction.

-

15:44

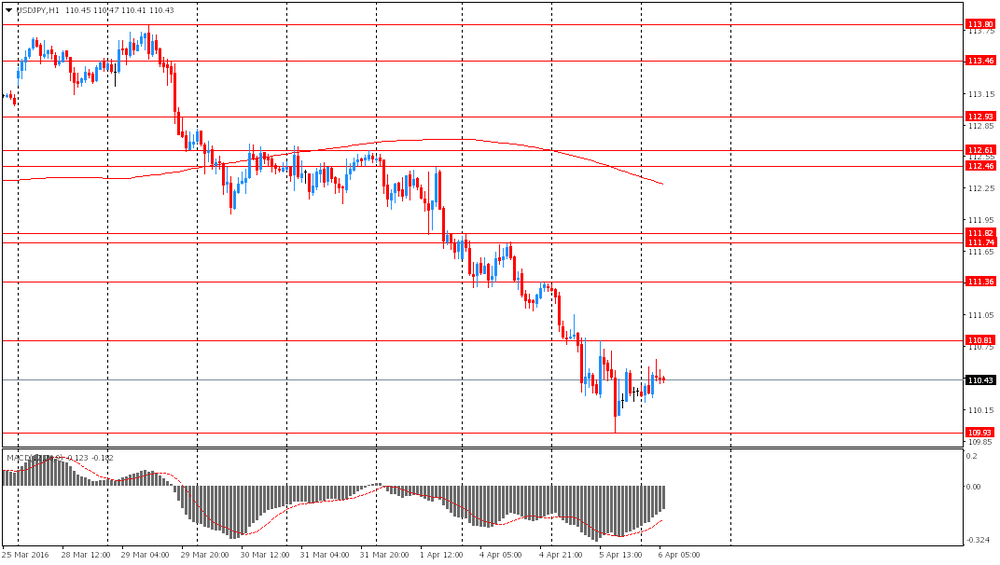

Option expiries for today's 10:00 ET NY cut

USD/JPY:110.00 (USD 400m) 111.50 (440m) 111.90 (260m) 112.85-90 (400m) 113.50 (325m) 113.70 (3.58bln)

EUR/USD: 1.1240 (EUR 224m) 1.1300 (897m) 1.1330-40 (355m) 1.1440 (583m) 1.1415 (276m) 1.1450 (290m) 1.1600 (667m)

EUR/JPY 125.00 (EUR 490m)

AUD/USD: 0.7400 (AUD 1.04bln) 0.7445 (201m) 0.7470-75 (714m) 0.7550 (539m)

NZD/USD 0.6870 (NZD 273m)

USD/CAD: 1.3030 (USD 320m) 1.3645-55 (390m)

-

15:41

Reuters: Russia expects an oil price at $45-$50 per barrel would allow to balance the oil market

Reuters reported on Wednesday that according to Russian sources familiar with the matter, Russia believes that an oil price at $45-$50 per barrel would allow to balance the oil market. Russia's Energy Ministry confirmed this information.

Sources also said that 17 countries could participate in the meeting in Doha on April 17. OPEC and non-OPEC countries plan to discuss the freeze of the oil output. Iran said last month that it was not ready to freeze its oil production until output of 4.0 million barrels a day was reached.

-

15:32

U.S. Stocks open: Dow +0.06%, Nasdaq +0.20%, S&P +0.10%

-

15:19

Before the bell: S&P futures +0.05%, NASDAQ futures +0.05%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 15,715.36 -17.46 -0.11%

Hang Seng 20,206.67 +29.67 +0.15%

Shanghai Composite 3,050.72 -2.34 -0.08%

FTSE 6,127.5 +36.27 +0.60%

CAC 4,261.26 +10.98 +0.26%

DAX 9,535.25 -28.11 -0.29%

Crude oil $36.64 (+2.09%)

Gold $1219.60 (-0.81%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.42

0.01(0.1063%)

16600

Amazon.com Inc., NASDAQ

AMZN

588.5

2.36(0.4026%)

8364

American Express Co

AXP

60.27

0.37(0.6177%)

482

Apple Inc.

AAPL

110.44

0.63(0.5737%)

110382

AT&T Inc

T

38.84

0.13(0.3358%)

28826

Barrick Gold Corporation, NYSE

ABX

13.78

-0.23(-1.6417%)

30559

Caterpillar Inc

CAT

75.32

0.08(0.1063%)

1607

Chevron Corp

CVX

93.05

0.38(0.4101%)

3607

Cisco Systems Inc

CSCO

27.88

0.30(1.0877%)

20560

Citigroup Inc., NYSE

C

41.65

0.14(0.3373%)

4240

Deere & Company, NYSE

DE

76.07

-0.00(-0.00%)

200

Exxon Mobil Corp

XOM

82.45

0.24(0.2919%)

15600

Facebook, Inc.

FB

112.46

0.24(0.2139%)

79237

Ford Motor Co.

F

12.82

0.05(0.3915%)

34642

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.48

0.14(1.4989%)

144583

General Electric Co

GE

31.06

0.08(0.2582%)

13447

Goldman Sachs

GS

155.36

0.01(0.0064%)

2000

Google Inc.

GOOG

739.65

1.85(0.2507%)

991

Intel Corp

INTC

32

0.10(0.3135%)

430

Johnson & Johnson

JNJ

108.99

0.04(0.0367%)

2195

JPMorgan Chase and Co

JPM

58.4

0.04(0.0685%)

7090

Merck & Co Inc

MRK

54.24

0.00(0.00%)

2602

Nike

NKE

60

0.33(0.553%)

800

Pfizer Inc

PFE

31.66

0.30(0.9566%)

1317808

Starbucks Corporation, NASDAQ

SBUX

60

-0.04(-0.0666%)

467

Tesla Motors, Inc., NASDAQ

TSLA

254.7

-0.77(-0.3014%)

46520

The Coca-Cola Co

KO

46.6

0.07(0.1504%)

2403

Twitter, Inc., NYSE

TWTR

17.2

0.15(0.8798%)

75825

United Technologies Corp

UTX

99.95

0.09(0.0901%)

1000

Verizon Communications Inc

VZ

53.65

0.125(0.2335%)

5985

Walt Disney Co

DIS

97.02

0.02(0.0206%)

1222

Yahoo! Inc., NASDAQ

YHOO

36.5

0.09(0.2472%)

5982

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Cisco Systems (CSCO) upgraded to Neutral from Underweight at JP Morgan; target raised to $27.50 from $17

Downgrades:

Other:

Apple (AAPL) initiated with a Strong Buy at Needham; target $150

Alphabet (GOOG) target raised to $880 from $875 at UBS; maintain Buy

-

14:40

Japan's leading index declines to 99.8 in February, the lowest level since December 2012

Japan's Cabinet Office released its preliminary leading index data on Wednesday. The leading index decreased to 99.8 in February from 101.4 in January, missing expectations for a decline to 99.9. It was the lowest level since December 2012.

Japan's coincident index fell to 110.3 in February from 113.8 in January. It was the lowest level since August 2013.

-

14:16

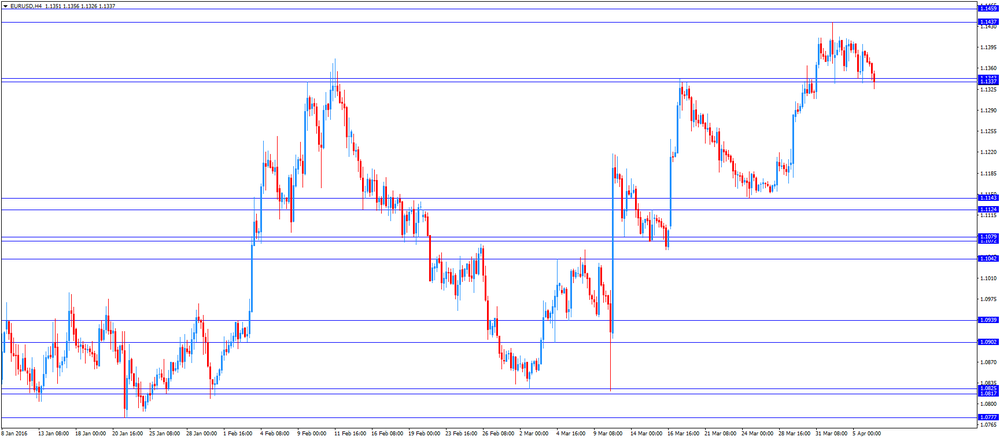

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the German industrial production data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:45 China Markit/Caixin Services PMI March 51.2 51.4 52.2

05:00 Japan Coincident Index (Preliminary) February 113.5 110.3

05:00 Japan Leading Economic Index (Preliminary) February 101.8 99.9 99.8

06:00 Germany Industrial Production s.a. (MoM) February 2.3% Revised From 3.3% -1.8% -0.5%

07:00 Australia RBA Assist Gov Kent Speaks

11:00 U.S. MBA Mortgage Applications April -1% 2.7%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the release of the latest Fed's minutes. Market participants will closely analyse the minutes for hints for further interest rate hikes. The minutes will be released at 18:00 GMT.

The euro traded lower against the U.S. dollar after the release of the German industrial production data. Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%. The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

The British pound traded lower against the U.S. dollar in the absence of any major economic data from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian trade data. Canada's seasonally adjusted Ivey purchasing managers' index is expected to rise to 55.0 in March from 53.4 in February.

EUR/USD: the currency pair declined to $1.1326

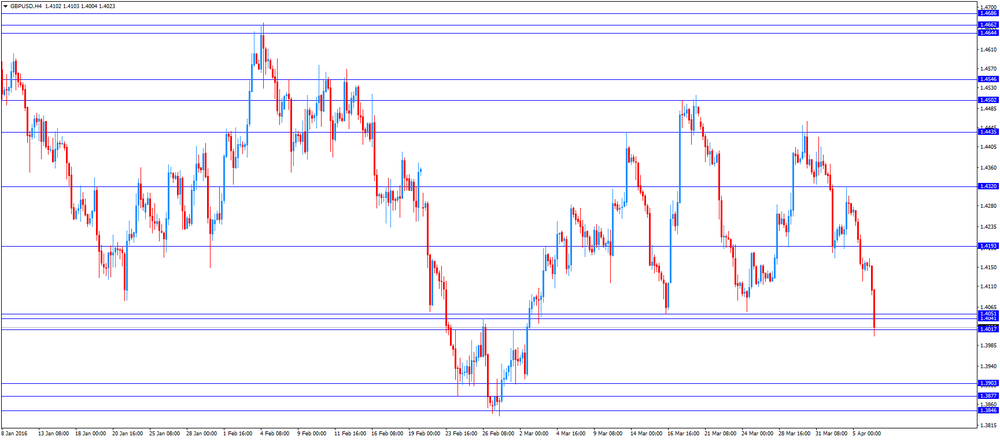

GBP/USD: the currency pair decreased to $1.4004

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:00 Canada Ivey Purchasing Managers Index March 53.4 55

14:30 U.S. Crude Oil Inventories April 2.299 3.5

16:20 U.S. FOMC Member Mester Speaks

18:00 U.S. FOMC meeting minutes

23:30 Australia AiG Performance of Construction Index March 46.1

-

13:50

Orders

EUR/USD

Offers: 1.1370 1.1385 1.1400 1.1420 1.1435 1.1450 1.1480 1.1500

Bids: 1.1330-35 1.1310 1.1300 1.1275-80 1.1250 1.1230 1.1200

GBP/USD

Offers: 1.4150 1.4180-85 1.4200 1.4230 1.4250 1.4280 1.4300 1.4320-25 1.4350

Bids: 1.4100 1.4085 1.4065 1.4050 1.4030 1.4000 1.3980-85 1.3965 1.3950

EUR/JPY

Offers: 125.80 126.00 126.20 126.50 126.80 127.00 127.50

Bids: 125.20 125.00 124.75-80 124.50 124.25 124.00

EUR/GBP

Offers: 0.8050 0.8060-65 0.8085 0.8100 0.8130 0.8150

Bids: 0.8020 0.8000 0.7970-75 0.7950 0.7930 0.7900 0.7880-85 0.7865 0.7850

USD/JPY

Offers: 110.60-65 110.80 111.00 111.25-30 111.60 111.80 112.00 112.20 112.50 112.65 112.80 113.00

Bids: 110.20 110.00 109.85 109.65 109.50 109.30 109.00

AUD/USD

Offers: 0.7585 0.7600 0.7625-30 0.7650 0.7700 0.7720 0.7735-40 0.7750

Bids: 0.7550 0.7520 0.7500 0.7485 0.7465 0.7450 0.7430 0.7400

-

13:34

WSE: Mid session comment

During today's session, investors are cautious due to the low turnover on the market. More than half of the session the market needed to generate turnover in the WIG20 index at the level of PLN 200 mln. At the halfway point of the session there is another signal that yesterday's sell-off is unlikely to be subject to reversal today.

In the United States, markets are about to open, most likely on a quiet note. We do not see indications for either enthusiastic buying or selling. The S&P contract recorded a merely cosmetic change.

We expect that, unless opening of the Wall Street generates an impulse to change sentiment in Europe, the second half of the session should not differ from the first one.

-

13:00

U.S.: MBA Mortgage Applications, April 2.7%

-

12:00

European stock markets mid session: stocks traded mixed, supported by higher oil prices and the better-than-expected Chinese economic data

Stock indices traded mixed, supported by higher oil prices and the better-than-expected Chinese economic data. The Caixin/Markit Services Purchasing Managers' Index (PMI) for China rose to 52.2 in March from 51.2 in February, exceeding expectations for a rise to 51.4.

German industrial production data weighed on stocks. Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%. The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

Current figures:

Name Price Change Change %

FTSE 100 6,124.16 +32.93 +0.54 %

DAX 9,562.7 -0.66 -0.01 %

CAC 40 4,271.43 +21.15 +0.50 %

-

11:47

BRC: U.K. shop prices are down 1.7% year-on-year in March

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.7% year-on-year in March, after a 2.0% decline in February.

The decline was mainly driven by a drop in non-food prices, which plunged 2.6% year-on-year in March.

Food prices declined at an annual rate of 0.4% in March, driven mainly by reductions in fresh food.

"March was the 36th month in which consumers have benefited from falling prices. March also marked the 35th month of falling overall prices," BRC Chief Executive, Helen Dickinson, said.

"Despite consumer confidence remaining at zero, a relatively benign economic environment (inflation remains very low and oil is trading at just under $40 per barrel) and a fiercely competitive market will see retailers continue to respond to their customers with prices and promotions to maintain market share as the Spring season kicks off," she added.

-

11:36

German industrial production falls 0.5% in February

Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%.

The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

-

11:19

Germany's construction PMI decreases to 55.8 in March

Markit Economics released construction purchasing managers' index (PMI) for Germany on Wednesday. Germany's construction PMI decreased to 55.8 in March from 59.6 in February.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by a softer growth in new orders and purchasing activity.

"Despite falling to a three-month low in March, the Germany Construction PMI signalled a sharp rise in building activity, thereby adding to hopes that the sector will contribute positively to economic growth in the opening quarter of the year," an economist at Markit, Oliver Kolodseike, said.

-

11:04

Germany's retail PMI climbs to 54.1 in March

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Wednesday. Germany's retail PMI climbed to 54.1 in March from 52.5 in February. It was the highest level since August 2015.

The increase was driven by rises in buying activity, inventories and employment.

"German retailers reported further growth of sales during March, thereby signalling that household demand continued to strengthen at the end of the first quarter," an economist at Markit, Oliver Kolodseike, said.

-

10:54

Eurozone's retail PMI declines to 49.2 in March

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Wednesday. Eurozone's construction purchasing managers' index (PMI) declined to 49.2 in March from 50.1 in February.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in France and Italy declined in March, while sales in Germany rose.

"The modest decrease in sales shown by the headline index masked some strikingly opposing trends at the country level," an economist at Markit, Phil Smith, said.

-

10:43

Japan’s Prime Minister Shinzo Abe: countries should avoid competitive devaluation of their currencies

Japan's Prime Minister Shinzo Abe said in an interview with The Wall Street Journal on Tuesday that countries should avoid competitive devaluation of their currencies.

"Whatever the circumstances, we must definitely avoid competitive devaluation, and I think we should refrain from arbitrary intervention in currency markets," he said.

Abe added that stability was an important factor for the economy.

-

10:24

Chinese Markit/Caixin services PMI rises to 52.2 in March

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China rose to 52.2 in March from 51.2 in February, exceeding expectations for a rise to 51.4.

The index was mainly driven by a rise in new orders.

"Overall, the services sector developed well, but the economy is riding choppy waves, indicating the lack of a solid foundation for a recovery. The government needs to push forward with "supply-side reform" to encourage the development of emerging industries," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:09

OECD: consumer price inflation in the OECD area falls to 1.0% year-on-year in February

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area fell to 1.0% year-on-year in February from 1.2% in January. The decline was driven by a drop in energy prices.

Energy prices slid at an annual rate of 8.8% in February, down from a 5.4% fall in January, while food prices increased to 0.9% from 0.7%.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.9% in February.

February's CPI was 0.0% in Germany, 0.3% in Japan, -0.3% in Italy, 1.0% in the U.S, 1.4% in Canada, and 0.3% in the U.K.

The consumer price inflation in Eurozone was -0.2% in February, while the inflation in China was 2.3%.

-

09:26

Option expiries for today's 10:00 ET NY cut

USD/JPY:110.00 (USD 400m) 111.50 (440m) 111.90 (260m) 112.85-90 (400m) 113.50 (325m) 113.70 (3.58bln)

EUR/USD: 1.1240 (EUR 224m) 1.1300 (897m) 1.1330-40 (355m) 1.1440 (583m) 1.1415 (276m) 1.1450 (290m) 1.1600 (667m)

EUR/JPY 125.00 (EUR 490m)

AUD/USD: 0.7400 (AUD 1.04bln) 0.7445 (201m) 0.7470-75 (714m) 0.7550 (539m)

NZD/USD 0.6870 (NZD 273m)

USD/CAD: 1.3030 (USD 320m) 1.3645-55 (390m)

-

09:19

WSE: After opening

After yesterday's session, investors have mixed feelings, with cautious stance being dominant. The morning rebound in the markets resulted in small gains of ca. 0.3%, but we should remember about few points that the market leaned on the bears side at yesterday's fixing. Thus, current upward movement has only offset the last downward motion of yesterday.

After the first trades the WIG20 was in the area of 1,944 pts., but weaker opening of the DAX prompted correction of the WIG20, and now growth of the index barely exceeds 0.3 percent. Generally, opening in Europe does not point to a possibility of a rebound from yesterday's decline, but rather appears to suggest stabilization of the previous growth. Similar pattern is probably going to be followed by the Polish market.

WIG20 index opened at 1939.74 points (+0.31% to previous close)

WIG 47941.00 0.32%

WIG30 2162.62 0.40%

mWIG40 3562.86 0.13%

-

08:29

WSE: Before opening

Yesterday's bears activity did not spare Wall Street where the major indices moved down. For the decline of the DAX index (by 2.6 percent), Wall Street responded with drop in the S&P500 by 1 percent and the course of trading was virtually identical.

During the night, market attitude to S&P500 contract has improved, and now it has grown by 0.3 percent, while the Nikkei index is currently losing about 0.1 percent, which corresponds to the weakening of yen.

Today, no macro data of significant importance is expected to be released. Wednesday therefore is likely to start as a day of transition, in which markets can rebound from yesterday's correction.

From the technical analysis point of view, reversion of the WIG20 from 2000 points line and breaking the support at 1,970 points would hint towards a reversal of the several weeks upward trend and suggest the possibility of correction to the area of 1900 points.

-

08:26

Options levels on wednesday, April 6, 2016:

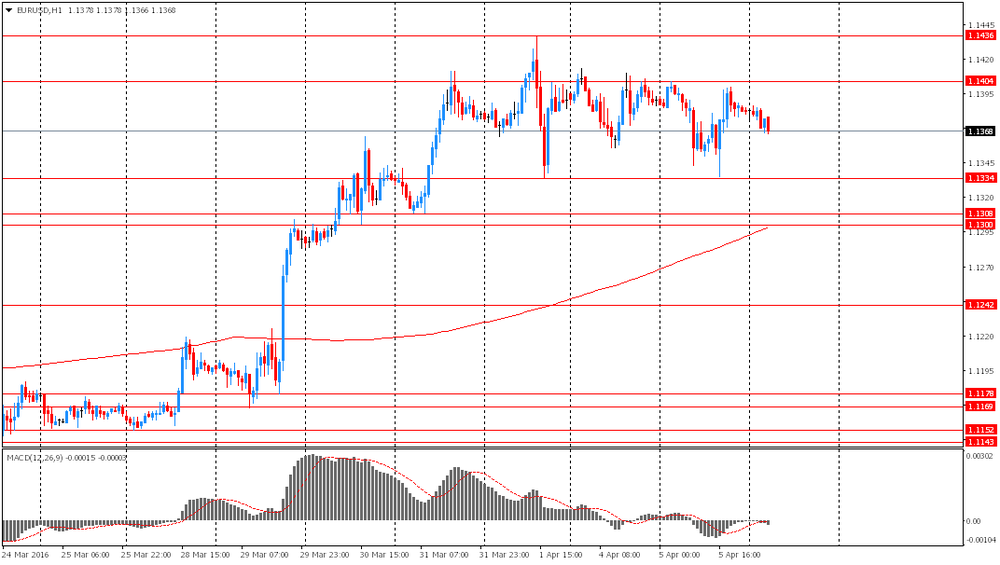

EUR / USD

Resistance levels (open interest**, contracts)

$1.1512 (4066)

$1.1474 (2752)

$1.1409 (3132)

Price at time of writing this review: $1.1356

Support levels (open interest**, contracts):

$1.1293 (3218)

$1.1247 (1069)

$1.1199 (1788)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 48097 contracts, with the maximum number of contracts with strike price $1,1500 (4066);

- Overall open interest on the PUT options with the expiration date April, 8 is 75769 contracts, with the maximum number of contracts with strike price $1,0900 (6429);

- The ratio of PUT/CALL was 1.58 versus 1.55 from the previous trading day according to data from April, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.4400 (1993)

$1.4301 (940)

$1.4204 (633)

Price at time of writing this review: $1.4138

Support levels (open interest**, contracts):

$1.4097 (1209)

$1.3999 (2983)

$1.3900 (1082)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 22495 contracts, with the maximum number of contracts with strike price $1,4400 (1993);

- Overall open interest on the PUT options with the expiration date April, 8 is 23532 contracts, with the maximum number of contracts with strike price $1,4000 (2983);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from April, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:22

Asian session: The dollar hovered near a 17-month low against the yen

The dollar hovered near a 17-month low against the yen on Wednesday after taking a fresh knock overnight on comments by Japan's prime minister which suggested that authorities were cautious towards arresting the yen's appreciation. Japanese Prime Minister Shinzo Abe told the Wall Street Journal that countries should avoid seeking to weaken their currencies with "arbitrary intervention."

Amid earlier turmoil in the global markets, the yen has advanced steadily this year due to its safe-haven status and more recently on expectations that the Federal Reserve would not hike interest rates as aggressively this year as initially anticipated.

The dollar has lost more than one percent against the yen so far this week, and appears on track to post its third weekly loss in four.

EUR/USD: during the Asian session the pair traded in the range of $1.1385-00

GBP/USD: during the Asian session the pair traded in the range of $1.4250-75

USD/JPY: during the Asian session the pair fell to Y110.75

Based on Reuters materials

-

08:00

Germany: Industrial Production s.a. (MoM), February -0.5% (forecast -1.8%)

-

07:02

Japan: Coincident Index, February 110.3

-

07:01

Japan: Leading Economic Index , February 99.8 (forecast 99.9)

-

06:17

Global Stocks: stocks swung between gains and losses

European stock markets suffered broad-based losses on Tuesday as an unexpected plunge in German manufacturing orders and worries about global growth hurt sentiment.

U.S. stocks tumbled Tuesday, logging a second day of losses as fears about global economic health dogged the market and fueled selling in traditionally riskier assets.

Asian stocks swung between gains and losses, after the regional benchmark index dropped to a one-month low, as energy companies surged with a rebound in oil while utilities slid. U.S. crude solidified its rebound, climbing a second day as concern eased over a prospective deal among producers to freeze output. Contracts for May delivery climbed as much as 2.5 percent on Wednesday.

Based on MarketWatch materials

-

04:01

Nikkei 225 15,766.69 +33.87 +0.22 %, Hang Seng 20,196.54 +19.54 +0.10 %, Shanghai Composite 3,042.48 -10.59 -0.35 %

-

03:45

China: Markit/Caixin Services PMI, March 52.2 (forecast 51.4)

-

00:30

Commodities. Daily history for Apr 05’2016:

(raw materials / closing price /% change)

Oil 36.56 +1.87%

Gold 1,232.90 +0.27%

-

00:30

Stocks. Daily history for Sep Apr 05’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,924.39 -70.93 -1.42%

TOPIX 1,268.37 -34.34 -2.64%

SHANGHAI COMP 3,053.38 +43.85 +1.46%

HANG SENG 20,177 -321.92 -1.57%

FTSE 100 6,091.23 -73.49 -1.19 %

CAC 40 4,250.28 -94.94 -2.18 %

Xetra DAX 9,563.36 -258.72 -2.63 %

S&P 500 2,045.17 -20.96 -1.01 %

NASDAQ Composite 4,843.93 -47.86 -0.98 %

Dow Jones 17,603.32 -133.68 -0.75 %

-

00:29

Currencies. Daily history for Apr 05’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1382 -0,07%

GBP/USD $1,4158 -0,76%

USD/CHF Chf0,9558 -0,30%

USD/JPY Y110,33 -0,89%

EUR/JPY Y125,58 -0,96%

GBP/JPY Y156,18 -1,66%

AUD/USD $0,7541 -0,82%

NZD/USD $0,6804 -0,35%

USD/CAD C$1,3135 +0,43%

-

00:00

Schedule for today, Wednesday, Apr 06’2016:

(time / country / index / period / previous value / forecast)

01:45 China Markit/Caixin Services PMI March 51.2 51.4

05:00 Japan Coincident Index (Preliminary) February 113.5

05:00 Japan Leading Economic Index (Preliminary) February 101.8 99.9

06:00 Germany Industrial Production s.a. (MoM) February 3.3% -1.8%

07:00 Australia RBA Assist Gov Kent Speaks

11:00 U.S. MBA Mortgage Applications April -1%

14:00 Canada Ivey Purchasing Managers Index March 53.4 55

14:30 U.S. Crude Oil Inventories April 2.299

16:20 U.S. FOMC Member Mester Speaks

18:00 U.S. FOMC meeting minutes

23:30 Australia AiG Performance of Construction Index March 46.1

-