Noticias del mercado

-

21:01

Dow +0.23% 17,643.56 +40.24 Nasdaq +1.14% 4,899.26 +55.33 S&P +0.63% 2,058.03

-

19:15

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Wednesday, helped by a rise in energy and healthcare stocks, as investors awaited the release of minutes from the Federal Reserve's meeting on monetary policy in March. U.S. crude jumped more than 4%, helping prop up energy stocks, after data suggested a smaller-than-expected rise in crude inventories for last week. Investors, who have been grappling with mixed signals on interest rates from Fed officials, will parse the minutes to gain insight into the central bank's thinking on the economy.

Most of Dow stocks in positive area (21 of 30). Top looser - Verizon Communications Inc. (VZ, -1,41%). Top gainer - Pfizer Inc. (PFE, +3,97%).

Almost all S&P sectors in positive area. Top looser - Utilities (-0,4%). Top gainer - Healthcare (+2,4%).

At the moment:

Dow 17585.00 +58.00 +0.33%

S&P 500 2051.00 +12.25 +0.60%

Nasdaq 100 4509.00 +39.50 +0.88%

Oil 37.75 +1.86 +5.18%

Gold 1224.30 -5.30 -0.43%

U.S. 10yr 1.76 +0.03

-

18:00

European stocks closed: FTSE 100 6,161.63 +70.40 +1.16% CAC 40 4,284.64 +34.36 +0.81% DAX 9,624.51 +61.15 +0.64%

-

18:00

European stocks close: stocks closed higher ahead of the latest Fed’s minutes

Stock indices closed higher ahead of the release of the latest Fed's minutes later in the day. Market participants will closely analyse the minutes for hints for further interest rate hikes.

Higher oil prices supported stocks. Oil prices rose on the U.S. crude oil inventories data. According to the U.S. Energy Information Administration (EIA) on Wednesday, U.S. crude inventories declined by 4.9 million barrels to 529.9 million in the week to April 01. Analysts had expected U.S. crude oil inventories to rise by 3.5 million barrels.

Market participants also eyed the economic data from the Eurozone. Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%. The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,161.63 +70.40 +1.16 %

DAX 9,624.51 +61.15 +0.64 %

CAC 40 4,284.64 +34.36 +0.81 %

-

17:59

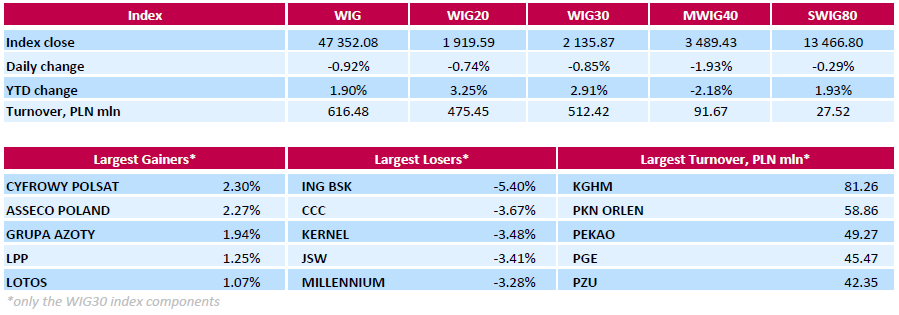

WSE: Session Results

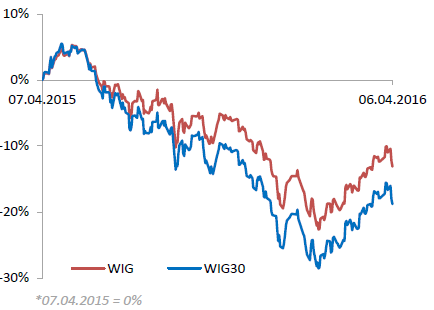

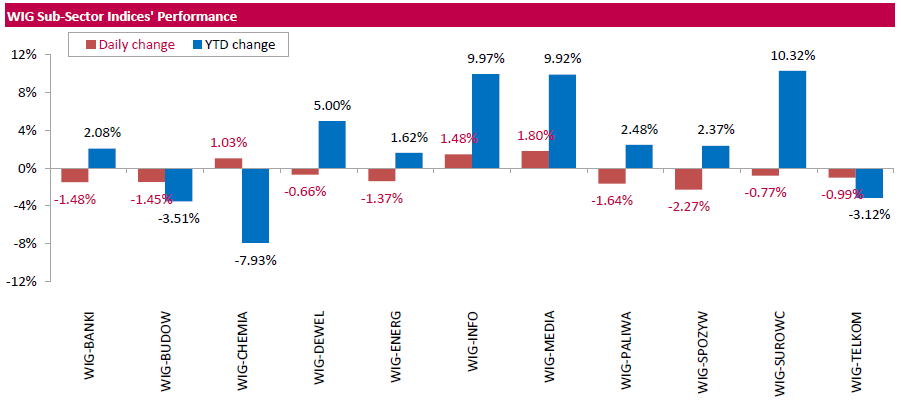

Polish equity market declined on Wednesday. The broad market measure, the WIG Index, slumped by 0.92%.The WIG sub-sector indices were mainly lower with food sector (-2.27%) underperforming.

The large-cap companies' measure, the WIG30 Index, fell by 0.85%. In the index basket, bank ING BSK (WSE: ING) led the losers with a 5.4% drop, followed by footwear retailer CCC (WSE: CCC), agricultural producer KERNEL (WSE: KER) and coking coal miner JSW (WSE: JSW), plunging by 3.67%, 3.48% and 3.41% respectively. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS) and IT-company ASSECO POLAND (WSE: ACP) were the growth leaders, adding 2.3% and 2.27% respectively.

-

16:40

Reserve Bank of Australia Assistant Governor Christopher Kent: inflation in Australia will likely remain low “over the next couple of years”

Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent said in a speech on Wednesday that inflation in Australia would likely remain low "over the next couple of years". He pointed out that the prices of imports, and spare capacity in product and labour markets globally weighed on inflation.

-

16:18

The People’s Bank of China injects 30 billion yuan in the financial system

The People's Bank of China (PBoC) on Wednesday injected 30 billion yuan ($5 billion) in the financial system by offering seven-day reverse repurchase agreements, increasing efforts to combat capital flight from the country's economy.

-

16:11

Canada’s Ivey purchasing managers’ index drops to 50.1 in March

Canada's seasonally adjusted Ivey purchasing managers' index dropped to 50.1 in March from 53.4 in February. Analysts had expected the index to rise to 55.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was down to 48.5 in March from 49.4 in February, while employment index rose to 50.7 from 50.3.

The prices index was increased to 58.5 in March from 57.8 in February, while inventories plunged to 48.6 from 49.9.

-

15:54

WSE: After start on Wall Street

U.S. Stocks open: Dow +0.06%, Nasdaq +0.20%, S&P +0.10%

Start of the day on Wall Street was in line what was suggested by earlier behavior of derivatives, so Europe had time to prepare for the opening. In fact DAX previously reacted to the decline of the contract for S&P500 with the shift into red, and went back to the area of the lower limit of the daily span. The WIG20 was also looking to rebound from the morning session decline. As a result, attention shifts to the support in the area of 1900 points. However, we must constantly emphasize that barely PLN 300 mln of turnover on the WIG20 does not indicate a serious supply activity. Declines led by such a turnover signals that the market treats the withdrawal in terms of the expected correction.

-

15:32

U.S. Stocks open: Dow +0.06%, Nasdaq +0.20%, S&P +0.10%

-

15:19

Before the bell: S&P futures +0.05%, NASDAQ futures +0.05%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 15,715.36 -17.46 -0.11%

Hang Seng 20,206.67 +29.67 +0.15%

Shanghai Composite 3,050.72 -2.34 -0.08%

FTSE 6,127.5 +36.27 +0.60%

CAC 4,261.26 +10.98 +0.26%

DAX 9,535.25 -28.11 -0.29%

Crude oil $36.64 (+2.09%)

Gold $1219.60 (-0.81%)

-

14:56

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.42

0.01(0.1063%)

16600

Amazon.com Inc., NASDAQ

AMZN

588.5

2.36(0.4026%)

8364

American Express Co

AXP

60.27

0.37(0.6177%)

482

Apple Inc.

AAPL

110.44

0.63(0.5737%)

110382

AT&T Inc

T

38.84

0.13(0.3358%)

28826

Barrick Gold Corporation, NYSE

ABX

13.78

-0.23(-1.6417%)

30559

Caterpillar Inc

CAT

75.32

0.08(0.1063%)

1607

Chevron Corp

CVX

93.05

0.38(0.4101%)

3607

Cisco Systems Inc

CSCO

27.88

0.30(1.0877%)

20560

Citigroup Inc., NYSE

C

41.65

0.14(0.3373%)

4240

Deere & Company, NYSE

DE

76.07

-0.00(-0.00%)

200

Exxon Mobil Corp

XOM

82.45

0.24(0.2919%)

15600

Facebook, Inc.

FB

112.46

0.24(0.2139%)

79237

Ford Motor Co.

F

12.82

0.05(0.3915%)

34642

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.48

0.14(1.4989%)

144583

General Electric Co

GE

31.06

0.08(0.2582%)

13447

Goldman Sachs

GS

155.36

0.01(0.0064%)

2000

Google Inc.

GOOG

739.65

1.85(0.2507%)

991

Intel Corp

INTC

32

0.10(0.3135%)

430

Johnson & Johnson

JNJ

108.99

0.04(0.0367%)

2195

JPMorgan Chase and Co

JPM

58.4

0.04(0.0685%)

7090

Merck & Co Inc

MRK

54.24

0.00(0.00%)

2602

Nike

NKE

60

0.33(0.553%)

800

Pfizer Inc

PFE

31.66

0.30(0.9566%)

1317808

Starbucks Corporation, NASDAQ

SBUX

60

-0.04(-0.0666%)

467

Tesla Motors, Inc., NASDAQ

TSLA

254.7

-0.77(-0.3014%)

46520

The Coca-Cola Co

KO

46.6

0.07(0.1504%)

2403

Twitter, Inc., NYSE

TWTR

17.2

0.15(0.8798%)

75825

United Technologies Corp

UTX

99.95

0.09(0.0901%)

1000

Verizon Communications Inc

VZ

53.65

0.125(0.2335%)

5985

Walt Disney Co

DIS

97.02

0.02(0.0206%)

1222

Yahoo! Inc., NASDAQ

YHOO

36.5

0.09(0.2472%)

5982

-

14:44

Upgrades and downgrades before the market open

Upgrades:

Cisco Systems (CSCO) upgraded to Neutral from Underweight at JP Morgan; target raised to $27.50 from $17

Downgrades:

Other:

Apple (AAPL) initiated with a Strong Buy at Needham; target $150

Alphabet (GOOG) target raised to $880 from $875 at UBS; maintain Buy

-

14:40

Japan's leading index declines to 99.8 in February, the lowest level since December 2012

Japan's Cabinet Office released its preliminary leading index data on Wednesday. The leading index decreased to 99.8 in February from 101.4 in January, missing expectations for a decline to 99.9. It was the lowest level since December 2012.

Japan's coincident index fell to 110.3 in February from 113.8 in January. It was the lowest level since August 2013.

-

13:34

WSE: Mid session comment

During today's session, investors are cautious due to the low turnover on the market. More than half of the session the market needed to generate turnover in the WIG20 index at the level of PLN 200 mln. At the halfway point of the session there is another signal that yesterday's sell-off is unlikely to be subject to reversal today.

In the United States, markets are about to open, most likely on a quiet note. We do not see indications for either enthusiastic buying or selling. The S&P contract recorded a merely cosmetic change.

We expect that, unless opening of the Wall Street generates an impulse to change sentiment in Europe, the second half of the session should not differ from the first one.

-

12:00

European stock markets mid session: stocks traded mixed, supported by higher oil prices and the better-than-expected Chinese economic data

Stock indices traded mixed, supported by higher oil prices and the better-than-expected Chinese economic data. The Caixin/Markit Services Purchasing Managers' Index (PMI) for China rose to 52.2 in March from 51.2 in February, exceeding expectations for a rise to 51.4.

German industrial production data weighed on stocks. Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%. The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

Current figures:

Name Price Change Change %

FTSE 100 6,124.16 +32.93 +0.54 %

DAX 9,562.7 -0.66 -0.01 %

CAC 40 4,271.43 +21.15 +0.50 %

-

11:47

BRC: U.K. shop prices are down 1.7% year-on-year in March

According to the British Retail Consortium (BRC), the U.K. shop prices declined by 1.7% year-on-year in March, after a 2.0% decline in February.

The decline was mainly driven by a drop in non-food prices, which plunged 2.6% year-on-year in March.

Food prices declined at an annual rate of 0.4% in March, driven mainly by reductions in fresh food.

"March was the 36th month in which consumers have benefited from falling prices. March also marked the 35th month of falling overall prices," BRC Chief Executive, Helen Dickinson, said.

"Despite consumer confidence remaining at zero, a relatively benign economic environment (inflation remains very low and oil is trading at just under $40 per barrel) and a fiercely competitive market will see retailers continue to respond to their customers with prices and promotions to maintain market share as the Spring season kicks off," she added.

-

11:36

German industrial production falls 0.5% in February

Destatis released its industrial production data for Germany on Wednesday. German industrial production fell 0.5% in February, beating expectations for a 1.8% drop, after a 2.3% rise in January. January's figure was revised down from a 3.3% increase.

The output of capital goods decreased 1.0% in February, energy output declined 1.8%, and the production in the construction sector was up 1.3%, while the production of intermediate goods climbed 0.1%.

The output of consumer goods declined 1.0% in February.

German industrial production excluding energy and construction fell by 0.5% in February.

-

11:19

Germany's construction PMI decreases to 55.8 in March

Markit Economics released construction purchasing managers' index (PMI) for Germany on Wednesday. Germany's construction PMI decreased to 55.8 in March from 59.6 in February.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by a softer growth in new orders and purchasing activity.

"Despite falling to a three-month low in March, the Germany Construction PMI signalled a sharp rise in building activity, thereby adding to hopes that the sector will contribute positively to economic growth in the opening quarter of the year," an economist at Markit, Oliver Kolodseike, said.

-

11:04

Germany's retail PMI climbs to 54.1 in March

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Wednesday. Germany's retail PMI climbed to 54.1 in March from 52.5 in February. It was the highest level since August 2015.

The increase was driven by rises in buying activity, inventories and employment.

"German retailers reported further growth of sales during March, thereby signalling that household demand continued to strengthen at the end of the first quarter," an economist at Markit, Oliver Kolodseike, said.

-

10:54

Eurozone's retail PMI declines to 49.2 in March

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Wednesday. Eurozone's construction purchasing managers' index (PMI) declined to 49.2 in March from 50.1 in February.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Sales in France and Italy declined in March, while sales in Germany rose.

"The modest decrease in sales shown by the headline index masked some strikingly opposing trends at the country level," an economist at Markit, Phil Smith, said.

-

10:43

Japan’s Prime Minister Shinzo Abe: countries should avoid competitive devaluation of their currencies

Japan's Prime Minister Shinzo Abe said in an interview with The Wall Street Journal on Tuesday that countries should avoid competitive devaluation of their currencies.

"Whatever the circumstances, we must definitely avoid competitive devaluation, and I think we should refrain from arbitrary intervention in currency markets," he said.

Abe added that stability was an important factor for the economy.

-

10:24

Chinese Markit/Caixin services PMI rises to 52.2 in March

The Caixin/Markit Services Purchasing Managers' Index (PMI) for China rose to 52.2 in March from 51.2 in February, exceeding expectations for a rise to 51.4.

The index was mainly driven by a rise in new orders.

"Overall, the services sector developed well, but the economy is riding choppy waves, indicating the lack of a solid foundation for a recovery. The government needs to push forward with "supply-side reform" to encourage the development of emerging industries," Dr. He Fan, Chief Economist at Caixin Insight Group, said.

-

10:09

OECD: consumer price inflation in the OECD area falls to 1.0% year-on-year in February

OECD released its consumer price inflation (CPI) data on Tuesday. Consumer price inflation in the OECD area fell to 1.0% year-on-year in February from 1.2% in January. The decline was driven by a drop in energy prices.

Energy prices slid at an annual rate of 8.8% in February, down from a 5.4% fall in January, while food prices increased to 0.9% from 0.7%.

CPI excluding food and energy in the OECD area remained unchanged an annual rate to 1.9% in February.

February's CPI was 0.0% in Germany, 0.3% in Japan, -0.3% in Italy, 1.0% in the U.S, 1.4% in Canada, and 0.3% in the U.K.

The consumer price inflation in Eurozone was -0.2% in February, while the inflation in China was 2.3%.

-

09:19

WSE: After opening

After yesterday's session, investors have mixed feelings, with cautious stance being dominant. The morning rebound in the markets resulted in small gains of ca. 0.3%, but we should remember about few points that the market leaned on the bears side at yesterday's fixing. Thus, current upward movement has only offset the last downward motion of yesterday.

After the first trades the WIG20 was in the area of 1,944 pts., but weaker opening of the DAX prompted correction of the WIG20, and now growth of the index barely exceeds 0.3 percent. Generally, opening in Europe does not point to a possibility of a rebound from yesterday's decline, but rather appears to suggest stabilization of the previous growth. Similar pattern is probably going to be followed by the Polish market.

WIG20 index opened at 1939.74 points (+0.31% to previous close)

WIG 47941.00 0.32%

WIG30 2162.62 0.40%

mWIG40 3562.86 0.13%

-

08:29

WSE: Before opening

Yesterday's bears activity did not spare Wall Street where the major indices moved down. For the decline of the DAX index (by 2.6 percent), Wall Street responded with drop in the S&P500 by 1 percent and the course of trading was virtually identical.

During the night, market attitude to S&P500 contract has improved, and now it has grown by 0.3 percent, while the Nikkei index is currently losing about 0.1 percent, which corresponds to the weakening of yen.

Today, no macro data of significant importance is expected to be released. Wednesday therefore is likely to start as a day of transition, in which markets can rebound from yesterday's correction.

From the technical analysis point of view, reversion of the WIG20 from 2000 points line and breaking the support at 1,970 points would hint towards a reversal of the several weeks upward trend and suggest the possibility of correction to the area of 1900 points.

-

06:17

Global Stocks: stocks swung between gains and losses

European stock markets suffered broad-based losses on Tuesday as an unexpected plunge in German manufacturing orders and worries about global growth hurt sentiment.

U.S. stocks tumbled Tuesday, logging a second day of losses as fears about global economic health dogged the market and fueled selling in traditionally riskier assets.

Asian stocks swung between gains and losses, after the regional benchmark index dropped to a one-month low, as energy companies surged with a rebound in oil while utilities slid. U.S. crude solidified its rebound, climbing a second day as concern eased over a prospective deal among producers to freeze output. Contracts for May delivery climbed as much as 2.5 percent on Wednesday.

Based on MarketWatch materials

-

04:01

Nikkei 225 15,766.69 +33.87 +0.22 %, Hang Seng 20,196.54 +19.54 +0.10 %, Shanghai Composite 3,042.48 -10.59 -0.35 %

-

00:30

Stocks. Daily history for Sep Apr 05’2016:

(index / closing price / change items /% change)

S&P/ASX 200 4,924.39 -70.93 -1.42%

TOPIX 1,268.37 -34.34 -2.64%

SHANGHAI COMP 3,053.38 +43.85 +1.46%

HANG SENG 20,177 -321.92 -1.57%

FTSE 100 6,091.23 -73.49 -1.19 %

CAC 40 4,250.28 -94.94 -2.18 %

Xetra DAX 9,563.36 -258.72 -2.63 %

S&P 500 2,045.17 -20.96 -1.01 %

NASDAQ Composite 4,843.93 -47.86 -0.98 %

Dow Jones 17,603.32 -133.68 -0.75 %

-