Noticias del mercado

-

21:00

Dow -0.34% 17,675.88 -61.12 Nasdaq -0.53% 4,865.67 -26.13 S&P -0.62% 2,053.28 -12.85

-

20:22

American focus: the US dollar declined significantly against the Japanese yen

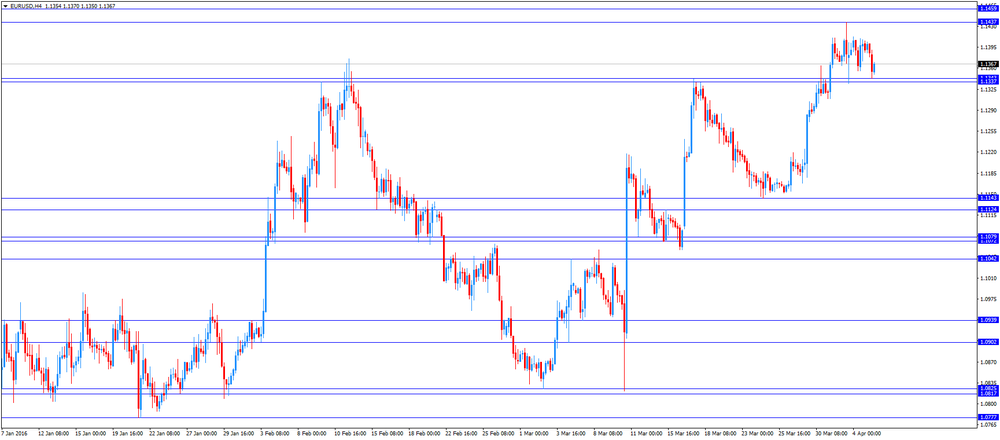

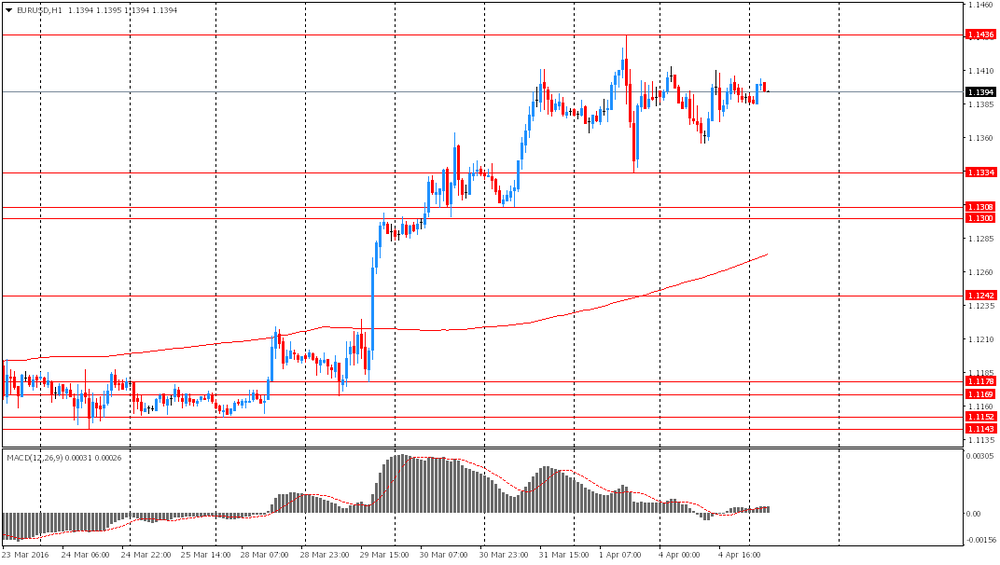

The euro has appreciated strongly against the dollar, before recovering all the lost ground. The main support for the currency have had a representative of the ECB's Nowotny comments. He noted that only one action of the ECB does not help to prevent deflation, additional public investment. In addition, Nowotny added that if the ECB did not take measures, the region has long been able to deflation. The politician also said that as soon as the situation improves, monetary and interest rate policy will be reconsidered.

A further increase in the pair made it difficult to positive US data. The Markit noted that suppliers of services in the US signaled a moderate recovery in business activity growth and sustainable employment growth in March. The seasonally adjusted final index of business activity in the US services sector rose from to 51.3 in March, up from 49.7 in February and returned back above the 50.0 threshold. However, the final reading was the second lowest level since October 2013 and indicated only a small rise in output. Meanwhile, another report showed that the index of business activity in the US service sector, which is calculated by the Institute for Supply Management rose to 54.5 in March from 53.4. According to the forecast, the rate had to increase to 54.

In the course of trading is also affected by expectations the publication of minutes of meetings of the ECB and the Fed. Minutes of the ECB is likely to help you understand why the ECB Governing Council chose the stimulus measures and whether he considered there any other options for action. Also, they may contain clues as to the reasons for the revision of economic forecasts. Meanwhile, the minutes of the last FOMC meeting may provide a better idea of when the Fed plans next rate hike. Futures on interest rates Fed indicated only 3% probability of a rate hike in April.

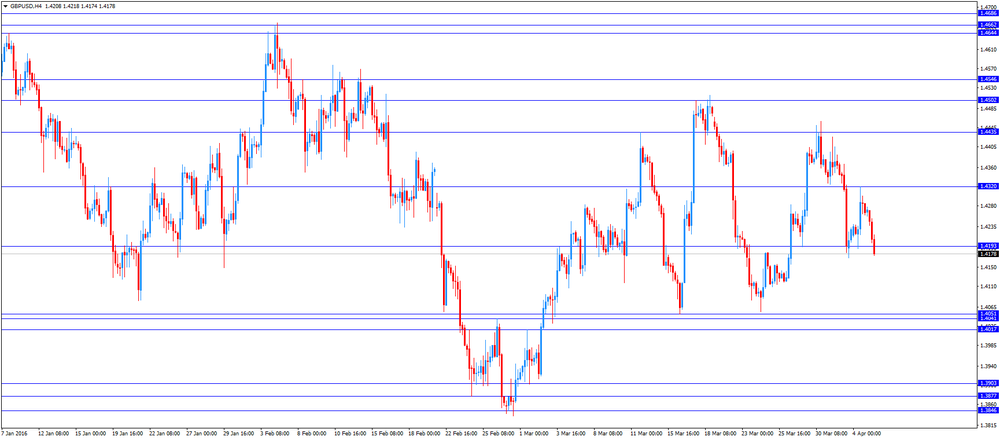

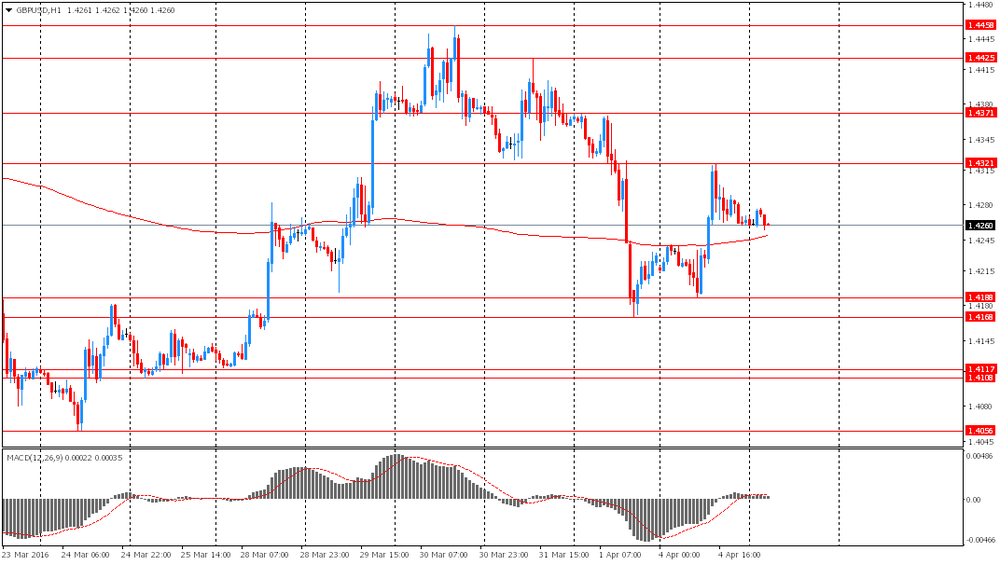

The pound dropped significantly against the dollar, reaching a low of March 28th. currency fall began after the publication of PMI data services in the UK in March. Pressure on the pound also have on oil prices, which have returned to the level of $ 35 per barrel. Recall the results of a survey by Markit Economics showed that UK service sector activity accelerated in line with expectations in March. Purchasing Managers Index services grew to 53.7 in March from 52.7 in the previous month. The result coincided with the expectations of economists. Any reading above 50 indicates expansion in the sector. Nevertheless, the index remained below its long-term average of 55.2. New orders continued to rise in March, but the growth rate was the weakest since January of 2013. Service providers continued to increase their number of employees in March, but remained weaker than the trend related to the current 39-month sequence of growth. On the price front, input price inflation accelerated to the highest level since September 2014, which was due to higher labor costs, rent and fuel prices. As a result, selling prices rose at the fastest pace in more than two years.

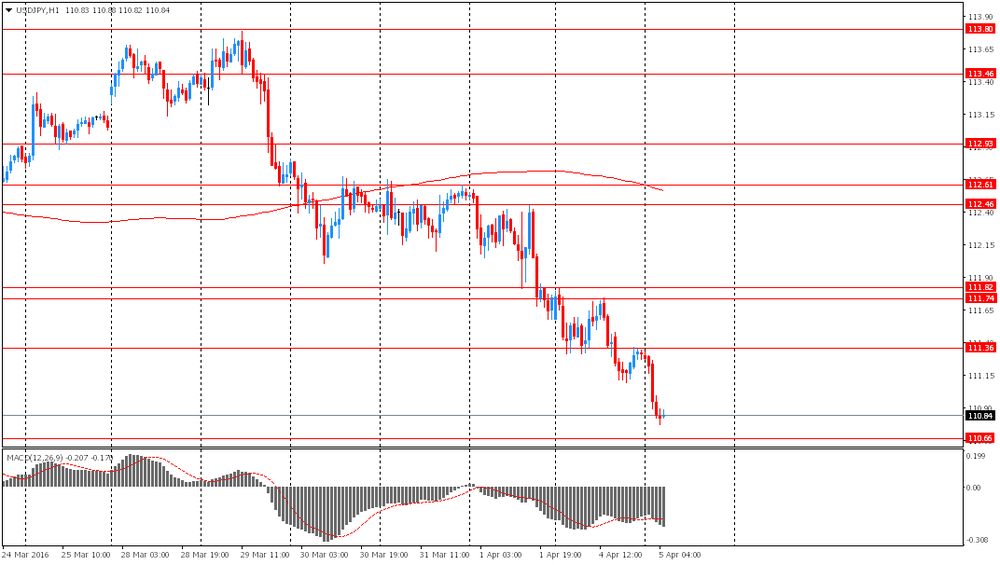

The US dollar has fallen by almost 1% against the yen, briefly dropping below the psychological mark of Y110 (for the first time since 31 October 2014), due to an increase in demand for safe-haven assets and speculation about how much further the currency will be strengthened before the officials begin act. However, today the Japanese Prime Minister Abe said that the need to refrain from unwarranted intervention in the market and avoid competitive devaluation of currencies. At the same time, Chief Cabinet Secretary of Japan Suga said about the undesirability of excessive currency fluctuations, and added that the government will be coordinated with partners and, if necessary, take appropriate action.

The dollar continues to weaken, as upbeat data on US employment and did not change the outlook for the rate hike. Despite steady employment growth rate, most market analysts do not expect the Fed will accelerate the pace of raising rates after the recent "dovish" comments Chairman of the Fed's Yellen. On Wednesday, market participants will focus on the minutes of the March meeting of the Fed's guidance in finding prospects for growth rates in the US.

-

19:28

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Tuesday as investors fretted over renewed uncertainties about the Federal Reserve's plan to raise interest rates this year. International Monetary Fund Managing Director Christine Lagarde on Tuesday warned of increasing risks to global economic growth, unless there were stronger measures by policymakers. Lagarde's comments come a week after Fed Chair Janet Yellen urged caution on rate hikes, citing a shaky global economy and low oil prices. However, some Fed officials have supported an aggressive monetary policy, sparking concerns about the timing and the number of rate hikes this year.

Most of Dow stocks in negative area (25 of 30). Top looser - The Walt Disney Company (DIS, -2,38%). Top gainer - Pfizer Inc. (PFE, +2,80%).

All S&P sectors in negative area. Top looser - Utilities (-1,5%).

At the moment:

Dow 17522.00 -120.00 -0.68%

S&P 500 2038.00 -19.50 -0.95%

Nasdaq 100 4462.50 -37.75 -0.84%

Oil 35.55 -0.15 -0.42%

Gold 1230.10 +10.80 +0.89%

U.S. 10yr 1.72 -0.05

-

18:29

Minneapolis Fed President Neel Kashkari expects the U.S. economy to grow moderately

Minneapolis Fed President Neel Kashkari said on Tuesday that he expected the U.S. economy to grow moderately. He added that he was comfortable with the currents Fed's monetary policy.

Kashkari is not a voting member of the FOMC this year.

-

18:21

Chicago Fed President Charles Evans: a slow pace of interest rate hikes would be appropriate

Chicago Fed President Charles Evans said in a speech on Tuesday that a slow pace of interest rate hikes would be appropriate as there were still the downside risks to the outlook.

"A very shallow path - such as the one envisioned by the median FOMC (Federal Open Market Committee) participant in March - is the most appropriate path for policy normalization over the next three years," he said.

Chicago Fed president expects the U.S. economy to expand 2% - 2.5% this year.

Evans is not a voting member of the FOMC this year.

-

18:10

Kuwait's OPEC governor Nawal Al-Fuzaia expects the oil market to balance in the second half of this year

Kuwait's OPEC governor Nawal Al-Fuzaia said in a speech on Tuesday that she expected the oil market to balance in the second half of this year, driven by higher oil prices.

She also said that a deal on the freeze of the oil output between OPEC and non-OPEC countries will be reached at the meeting on April 17.

-

18:01

European stocks close: stocks closed lower on the weak economic data from the Eurozone

Stock indices closed lower on the weak economic data from the Eurozone. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final services PMI declined to 53.1 in March from 53.3 in February, down from the preliminary reading of 54.0.

The downward revision was mainly driven by France and Italy.

The index was mainly driven by a softer growth in new business and output.

Eurozone's final composite output index rose to 53.1 in March from 53.0 in February, down from the preliminary reading of 54.0.

The downward revision was mainly driven by France and Italy.

"The Eurozone economy failed to show any significant gain in momentum in March. With the PMI barely rising from February's 13-month low, the region looks to have grown by just 0.3% again in the first quarter," Chief Economist at Markit Chris Williamson said.

Germany's final services PMI fell to 55.1 in March from 55.3 in February, down from the preliminary reading of 55.5. The index was mainly driven by a slower growth in new orders.

France's final services PMI increased to 49.9 in March from 49.2 in February, down from the preliminary reading of 51.2. The index was mainly driven by rises in backlogs of work and input prices.

Destatis released its factory orders data for Germany on Tuesday. German seasonal adjusted factory orders declined 1.2% in February, missing expectations for a 0.2% increase, after a 0.5% rise in January. January's figure was revised up from a 0.1% drop.

The drop was driven by a decrease in foreign orders. Foreign orders decreased by 2.7% in February, while domestic orders rose by 0.9%.

Markit's and the Chartered Institute of Purchasing & Supply's services PMI for the U.K. rose to 53.7 in March from 52.7 in February, in line with expectations. The increase was driven by a faster growth in output. Employment continued to rise in March.

"An upturn in the pace of service sector growth in March was insufficient to prevent the PMI surveys from collectively indicating a slowdown in economic growth in the first quarter. The surveys point to a 0.4% increase in GDP, down from 0.6% in the closing quarter of last year," the Chief Economist at Markit Chris Williamson said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,091.23 -73.49 -1.19 %

DAX 9,563.36 -258.72 -2.63 %

CAC 40 4,250.28 -94.94 -2.18 %

-

18:00

European stocks closed: FTSE 100 6,091.23 -73.49 -1.19% CAC 40 4,250.28 -94.94 -2.18% DAX 9,563.36 -258.72 -2.63%

-

17:57

Sources from Kuwait: a deal on the freeze of the oil output between OPEC and non-OPEC countries will be reached at the meeting on April 17

Reuters reported on Tuesday that according to two sources from Kuwait familiar with the issue, a deal on the freeze of the oil output between OPEC and non-OPEC countries will be reached at the meeting on April 17.

OPEC and non-OPEC countries plan to discuss the freeze of the oil output on April 17. Iran said last month that it was not ready to freeze its oil production until output of 4.0 million barrels a day was reached.

-

17:47

International Monetary Fund Managing Director Christine Lagarde: the global economy recovery remains too slow

International Monetary Fund (IMF) Managing Director Christine Lagarde said in a speech in Frankfurt on Tuesday that the global economy recovery remained too slow.

"The good news is that the recovery continues; we have growth; we are not in a crisis. The not-so-good news is that the recovery remains too slow, too fragile, and risks to its durability are increasing," she said.

"We are on alert, not alarm. There has been a loss of growth momentum. However, if policymakers can confront the challenges, and act together, the positive effects on global confidence-and the global economy-will be substantial," Lagerade added.

IMF managing director noted that the economic sentiment improved due to further monetary policy easing by the European Central Bank (ECB), a slower pace of interest rate hikes by the Fed, a slight rise in oil prices and lower capital outflows from China.

Lagarde pointed out that each country needed different approach, adding that the approach should contain structural, fiscal and monetary measures.

-

17:41

Oil has risen significantly in the course of today's trading

Quotes oil futures are rising gradually, but remain near month low. The pressure on prices have news about a sudden drop in gasoline demand in the US and doubts about the possibility of achieving production levels at freeze agreement.

Office of US Energy Information Administration reported that gasoline demand - one of the most important indicators that supports the consumption of oil - fell in January for the first time in 14 months. Analysts at BNP Paribas note, oil may continue to fall, as the appearance of gasoline glut could further increase the global oversupply of oil. In the 2nd quarter oil demand traditionally declines, as refinery maintenance season begins before the summer period.

Recall, the world's largest oil producers are due to meet in Doha on 17 April to discuss the production freeze, but given the increasing volume of oil production in Russia up to a maximum of 30 years, experts doubt that an agreement will be reached.

Iran, meanwhile, continues to increase the export of oil and says it will not participate in the production freeze. Today, Deputy Oil Minister Marzieh Shandala said that Iran does not plan to participate in the meeting in Doha. Meanwhile, a spokesman for Kuwait's OPEC Nawal al-Fuzaya said that oil-producing countries following the meeting in Doha may freeze oil production at the level of February. According to her, the oil producers may agree to freeze without the participation of Iran in the negotiations, because they have no other choice. Also, Nawal al-Fuzaya added that, according to its estimates, the average of Brent oil will be traded in the range $ 45- $ 60 per barrel in the second half of this year.

In the course of trade is also affected by the expectations of today's publication of data on US oil inventories from the American Petroleum Institute and tomorrow's report from the US Department of Energy. Analysts expect that the Ministry of Energy reported an increase in inventories by 3.3 million barrels last week.

WTI for delivery in May rose to $35.75 a barrel. Brent for May rose to $37.80 a barrel.

-

17:38

WSE: Session Results

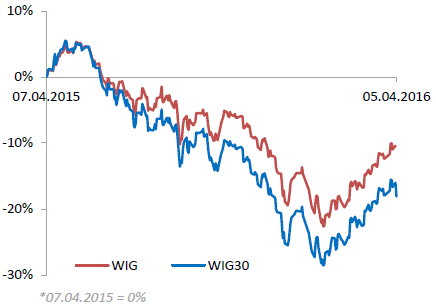

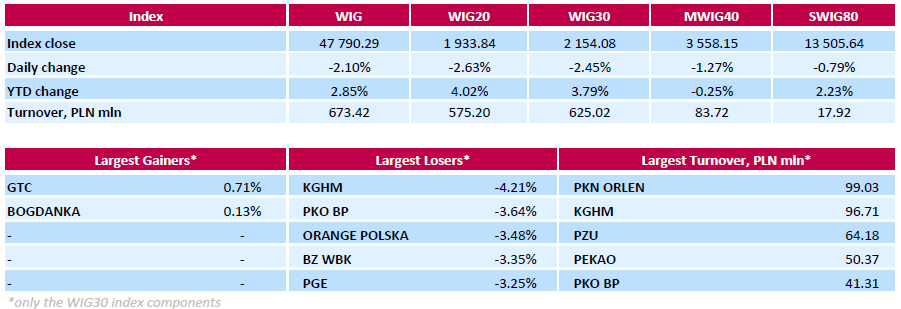

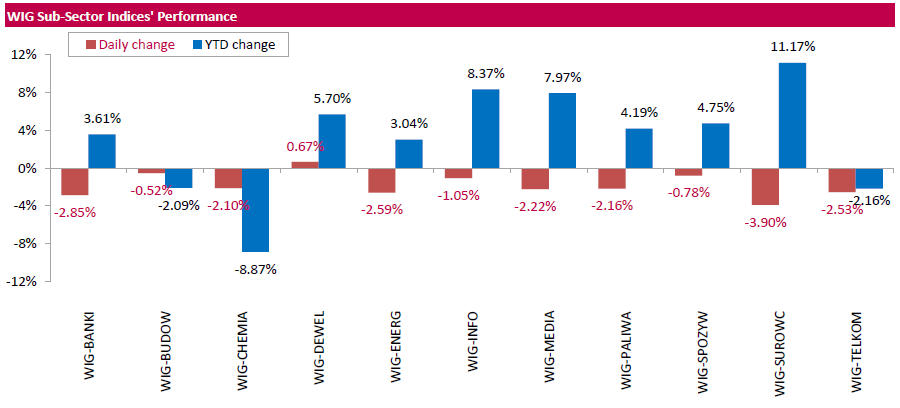

Polish equity market plunged on Tuesday. The broad market measure, the WIG Index, declined by 2.1%. Sector-wise, developing sector (+0.67%) was sole gainer within the WIG Index, while materials (-3.90%) lagged behind.

The large-cap companies' measure, the WIG30 Index, lost 2.45%. Only two index constituents managed to generate positive returns: property developer GTC (WSE: GTC) gained 0.71%, while thermal coal miner BOGDANKA (WSE: LWB) added 0.13%. At the same time, copper producer KGHM (WSE: KGH) suffered the steepest drop, plunging by 4.21%. Other major underperformers included telecommunication services provider ORANGE POLSKA (WSE: OPL), genco PGE (WSE: PGE) and two banking names PKO BP (WSE: PKO) and BZ WBK (WSE: BZW), which tumbled by 3.25%-3.64%.

-

17:21

Gold prices rose significantly

Gold prices rose significantly today, fixing the maximum increase for the week and peaking 31 March. Support for precious metals has increased demand for safe-haven assets due to the fall in world stock markets.

"If I look at the markets, I would say that there is some demand for safe-haven assets, - said an analyst at ABN Amro Georgette Boele -. Gold is now no reason to fall in price, people are looking for reasons for buying it, and now it is becoming cheaper stock" .

Since the beginning of the year gold has risen in price by almost 16 percent against the backdrop of the Fed's commitment to a gradual increase in the cost of borrowing. Fed Chairman Yellen said last week that caution is justified in terms of tightening policy. Recall, tomorrow the Fed will publish the minutes of its last meeting, which took place on 15-16 March. Analysts say that the protocol may provide a more complete picture of how the Fed plans to the next rate hike. The chances of a rate hike by December fell to 58 percent from 68 percent a month ago. However, yesterday the head of the Federal Reserve Bank of Boston Eric Rosengren said that the Fed's rate futures are not significantly reflect the pace of rate hikes in the short term. Rosengren sees fit gradual increase in rates, but, in his opinion, it will not be so gradual, according to market participants. "While the recent turmoil in financial markets are constraining factor for the Fed at higher rates, strong labor market and rising core inflation is likely to force the Fed to increase the rate at 0.25% until the end of the year", - stated in the Societe Generale.

The rise in gold prices also contributed to the statement of the head of the IMF Lagarde. She noted that skeptical about the pace of global economic growth, and considers necessary a more decisive action to implement structural reforms. "Recovery is too slow, remains too fragile, and the risks are growing", - explained Lagarde. According to her, over the past 6 months, the prospects for global growth have deteriorated, which was caused, including the weakening of the growth of China's economy and the fall in commodity prices.

Little influenced by the US statistics. The Markit noted that suppliers of services in the US signaled a moderate recovery in business activity growth and sustainable employment growth in March. The seasonally adjusted final index of business activity in the US services sector rose from to 51.3 in March, up from 49.7 in February and returned back above the 50.0 threshold. However, the final reading was the second lowest level since October 2013 and indicated only a small rise in output. Meanwhile, another report showed that the index of business activity in the US service sector, which is calculated by the Institute for Supply Management rose to 54.5 in March from 53.4 in the previous month. According to the forecast, the rate had to increase to 54.

April futures price of gold on COMEX today rose to $ 1228.1 per ounce.

-

17:09

European Central Bank Governing Council member Ewald Nowotny: core inflation in the Eurozone is expected to be 1.1% in 2016

European Central Bank (ECB) Governing Council member Ewald Nowotny said in an interview on Tuesday that core inflation in the Eurozone was expected to be 1.1% this year. He added that the ECB should fight risks of deflation.

Nowotny pointed out that helicopter money was out of the question for the central bank.

-

16:48

Labour cash earnings in Japan rise 0.9% year-on-year in February

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Tuesday. Labour cash earnings in Japan rose 0.9% year-on-year in February, after a flat reading in January. January's figure was revised down from a 0.4% gain.

Contractual earnings rose 0.6% year-on-year in February, while special cash earnings gained 25.7%.

Total real wages climbed 0.4% in February, after a flat reading in January.

-

16:33

Australian Industry Group’s services purchasing managers’ index for Australia falls to 49.5 in March

The Australian Industry Group (AiG) released its services purchasing managers' index (PMI) for Australia on the late Monday evening. The index fell to 49.5 in March from 51.8 in February.

A reading above 50 indicates expansion in the sector, while a reading below 50 indicates contraction in the sector.

Four of the five activity sub-indexes were below 50 points in March.

Main contributor to the decline was sales sub-index.

-

16:16

ISM non-manufacturing purchasing managers’ index rises to 54.5 in March

The Institute for Supply Management released its non-manufacturing purchasing managers' index for the U.S. on Tuesday. The index rose to 54.5 in March from 53.4 in February, beating expectations for an increase to 54.0.

A reading above 50 indicates a growth in the service sector.

The ISM's new orders index increased to 56.7 in March from 55.5 in February.

The business activity/production index increased to 59.8 in March from 57.8 in February.

The ISM's employment index was up to 50.3 in March from 49.7 in February.

The prices index jumped to 49.1 in March from 45.5 in February.

-

16:08

Job openings decline to 5.445 million in February

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings declined to 5.445 million in February from 5.604 million in January, missing expectations for a fall to 5.500. January's figure was revised up from 5.541 million.

The number of job openings declined for total private (4.960 million) in February from January, while the number of job openings rose for government (486,000).

The hires rate was 3.8% in February.

Total separations increased to 5.050 million in February from 4.977 million in January.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:01

U.S.: JOLTs Job Openings, February 5.445 (forecast 5.5)

-

16:00

U.S.: ISM Non-Manufacturing, March 54.5 (forecast 54)

-

15:58

Final U.S. services PMI rises to 51.3 in March

Markit Economics released final services purchasing managers' index (PMI) for the U.S. on Tuesday. Final U.S. services purchasing managers' index (PMI) rose to 51.3 in March from 49.7 in February, up from the preliminary reading of 51.0.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction of activity.

The index was driven by a rise in output. The growth in new business was the slowest increase since October 2009.

"The welcome news of sustained robust hiring in March, as indicated by both the PMI surveys and non-farm payroll numbers, masks a more worrying picture of a further slowing in economic growth so far this year," Chief Economist at Markit Chris Williamson said.

-

15:45

WSE: After start on Wall Street

Future contracts on the S&P 500 lost before the opening of Wall Street 0.7 percent.

Thus, the Wall Street session started in a manner analogous to the morning declines in Asia and later in Europe. This is a consequence of the weakening growth momentum as the approach of the market to the strong resistance zone.

U.S. Stocks open: Dow -0.55%, Nasdaq -0.75%, S&P -0.59%

From the point of view of Europe's, trade in the United States has so far neutral tone, as it is in line with previous signals sent by the futures market.

-

15:45

U.S.: Services PMI, March 51.3 (forecast 51)

-

15:44

Australia's trade deficit widens to A$3.41 billion in February

The Australian Bureau of Statistics released its trade data on Tuesday. Australia's trade deficit widened to A$3.41 billion in February from A$3.16 billion in January, missing expectations for a decline to a deficit of A$2.6 billion. January's figure was revised down from a deficit of A$2.94 billion.

Exports decreased by 1.0% in February, while imports were flat.

-

15:33

U.S. Stocks open: Dow -0.55%, Nasdaq -0.75%, S&P -0.59%

-

15:30

Option expiries for today's 10:00 ET NY cut

USD/JPY:111.10 (USD 600m) 112.30 ( 390m) 112.50 (230m) 113.00 (230m) 113.10 (200m) 113.45-50 (590m) 113.70-75 (480m)

EUR/USD: 1.1280 (EUR 319m) 1.1295-1.1300 (805m) 1.1350 (608m) 1.1440 (250m)

EUR/GBP: 0.7935 (EUR 385m)

USD/CHF 0.9445 (USD 202m)

EUR/JPY 124.00 (EUR 300m) 127.75 (230m)

AUD/USD: 0.7400 (AUD 527m) 0.7600 (310m) 0.7625 (219m) 0.7750 (427m)

NZD/USD 0.6800-05 (NZD 251m) 0.6900 (401m)

USD/CAD: 1.3100 (USD 270m) 1.3400 (311m)

-

15:24

Before the bell: S&P futures -0.85%, NASDAQ futures -0.76%

U.S. stock-index futures fell.

Global Stocks:

Nikkei 15,732.82 -390.45 -2.42%

Hang Seng 20,177 -321.92 -1.57%

Shanghai Composite 3,053.38 +43.85 +1.46%

FTSE 6,078.41 -86.31 -1.40%

CAC 4,245.28 -99.94 -2.30%

DAX 9,581.38 -240.70 -2.45%

Crude oil $35.40 (-0.84%)

Gold $1234.70 (+1.26%)

-

15:14

Spain’s services PMI climbs to 55.3 in March

Markit Economics released services purchasing managers' index (PMI) for Spain on Tuesday. Spain's services purchasing managers' index (PMI) climbed to 55.3 in March from 54.1 in February.

The decline was driven by a rise in new orders, employment and output prices.

"The pick-up in service sector growth in March is something of a relief following a slowdown in previous months, and suggests that the Spanish economy was able to maintain forward momentum during the first quarter of the year," Senior Economist at Markit Andrew Harker said.

-

14:55

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

9.26

-0.14(-1.4894%)

25226

ALTRIA GROUP INC.

MO

63.02

-0.21(-0.3321%)

1551

Amazon.com Inc., NASDAQ

AMZN

588.5

-4.69(-0.7906%)

4523

American Express Co

AXP

60.07

-0.55(-0.9073%)

1216

Apple Inc.

AAPL

109.69

-1.43(-1.2869%)

319257

AT&T Inc

T

39.22

-0.14(-0.3557%)

13325

Barrick Gold Corporation, NYSE

ABX

13.88

0.38(2.8148%)

138290

Boeing Co

BA

125.12

-1.22(-0.9656%)

2157

Chevron Corp

CVX

92.4

-1.03(-1.1024%)

13168

Cisco Systems Inc

CSCO

27.49

-0.65(-2.3099%)

77217

Citigroup Inc., NYSE

C

41.46

-0.60(-1.4265%)

16170

Deere & Company, NYSE

DE

75.02

-0.88(-1.1594%)

484

Exxon Mobil Corp

XOM

82.3

-0.86(-1.0341%)

9070

Facebook, Inc.

FB

111.69

-0.86(-0.7641%)

92517

FedEx Corporation, NYSE

FDX

163

-0.80(-0.4884%)

230

Ford Motor Co.

F

12.71

-0.09(-0.7031%)

66395

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.27

-0.15(-1.5924%)

199537

General Electric Co

GE

31

-0.23(-0.7365%)

57901

General Motors Company, NYSE

GM

29.59

-0.31(-1.0368%)

2532

Goldman Sachs

GS

156

-1.77(-1.1219%)

4773

Google Inc.

GOOG

739

-6.29(-0.844%)

1748

Home Depot Inc

HD

134.25

-0.60(-0.4449%)

814

Intel Corp

INTC

31.76

-0.24(-0.75%)

15959

International Business Machines Co...

IBM

150.71

-1.36(-0.8943%)

3106

International Paper Company

IP

40.41

-0.15(-0.3698%)

690

Johnson & Johnson

JNJ

108

-0.59(-0.5433%)

2220

JPMorgan Chase and Co

JPM

58.59

-0.61(-1.0304%)

16864

McDonald's Corp

MCD

126.9

-0.67(-0.5252%)

3411

Merck & Co Inc

MRK

53.51

-0.89(-1.636%)

120

Microsoft Corp

MSFT

55

-0.43(-0.7758%)

4023

Nike

NKE

59.26

-0.71(-1.1839%)

8166

Pfizer Inc

PFE

31.36

0.64(2.0833%)

41475412

Starbucks Corporation, NASDAQ

SBUX

59.82

-0.43(-0.7137%)

6340

Tesla Motors, Inc., NASDAQ

TSLA

238.2

-8.79(-3.5588%)

68723

The Coca-Cola Co

KO

46.65

-0.24(-0.5118%)

15614

Twitter, Inc., NYSE

TWTR

17.55

0.46(2.6916%)

1045419

UnitedHealth Group Inc

UNH

127.98

-1.51(-1.1661%)

375

Verizon Communications Inc

VZ

54.25

-0.17(-0.3124%)

2693

Visa

V

77

-0.83(-1.0664%)

9196

Wal-Mart Stores Inc

WMT

68.65

-0.45(-0.6512%)

1247

Walt Disney Co

DIS

96.6

-2.08(-2.1078%)

64153

Yahoo! Inc., NASDAQ

YHOO

36.7

-0.32(-0.8644%)

10798

Yandex N.V., NASDAQ

YNDX

14.88

-0.18(-1.1952%)

7200

-

14:54

Italy’s services PMI drops 51.2 in March from 53.8 in February, the lowest level since March 2015

Markit/ADACI's services purchasing managers' index (PMI) for Italy dropped to 51.2 in March from 53.8 in February. It was the lowest level since March 2015.

A reading above 50 indicates expansion in the sector.

The index was mainly driven by a softer growth in new business.

"The drop in the services PMI signals a loss of growth momentum at the end of the first quarter," an economist at Markit Phil Smith said.

-

14:48

U.S. trade deficit widens to $47.06 billion in February

The U.S. Commerce Department released the trade data on Tuesday. The U.S. trade deficit widened to $47.06 billion in February from a deficit of $45.88 billion in January. January's figure was revised down from a deficit of $45.68 billion.

Analysts had expected a trade deficit of $46.2 billion.

The rise of a deficit was driven by a rise in imports. Exports increased by 1.0% in February, while imports rose by 1.3%.

-

14:42

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Cisco Systems (CSCO) downgraded to Neutral from Buy at BofA/Merrill; target raised to $30 from $27

Other:

Verizon (VZ) initiated with Neutral ratings at Macquarie

AT&T (T) initiated with an Outperform at Macquarie

McDonald's (MCD) initiated with a Hold at Evercore ISI

Starbucks (SBUX) initiated with a Buy at Evercore ISI

Tesla Motors (TSLA) target raised to $280 from $240 at Credit Suisse

-

14:39

Canada's trade deficit widens to C$1.91 billion in February

Statistics Canada released the trade data on Tuesday. Canada's trade deficit widened to C$1.91 billion in February from a deficit of C$0.63 billion in January. January's figure was revised up from a deficit of C$0.66 billion.

Analysts had expected a trade deficit of C$0.9 billion.

The rise in deficit was driven by a drop in exports. Exports slid 5.4% in February.

Exports of consumer goods plunged 14.3% in February, exports of energy products dropped by 14.4%, while exports of motor vehicles and parts were down 4.4%.

Imports fell 2.6% in February.

Imports of energy products slid by 29.7% in February, imports of motor vehicles and parts decreased by 2.7%, while imports of metal and non-metallic mineral products fell 4.8%.

-

14:30

U.S.: International Trade, bln, February -47.06 (forecast -46.2)

-

14:30

Canada: Trade balance, billions, February -1.91 (forecast -0.9)

-

14:17

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the services PMI data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Japan Labor Cash Earnings, YoY February 0.0% Revised From 0.4% 0.9%

01:30 Australia Trade Balance February -3.16 Revised From -2.94 -2.6 -3.41

04:30 Australia Announcement of the RBA decision on the discount rate 2% 2% 2%

04:30 Australia RBA Rate Statement

06:00 Germany Factory Orders s.a. (MoM) February 0.5% Revised From -0.1% 0.2% -1.2%

07:50 France Services PMI (Finally) March 49.2 51.2 49.9

07:55 Germany Services PMI (Finally) March 55.3 55.5 55.1

08:00 Eurozone Services PMI (Finally) March 53.3 54 53.1

08:30 United Kingdom Purchasing Manager Index Services March 52.7 53.7 53.7

09:00 Eurozone Retail Sales (MoM) February 0.3% Revised From 0.4% 0% 0.2%

09:00 Eurozone Retail Sales (YoY) February 2.0% 1.9% 2.4%

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. trade deficit is expected to widen to $46.2 billion in February from $45.68 billion in January.

The ISM non-manufacturing purchasing managers' index is expected to rise to 54.0 in March from 53.4 in February.

Job openings are expected to decline to 5.500 million in February from 5.541 million in January.

The euro traded lower against the U.S. dollar on the weak economic data from the Eurozone. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final services PMI declined to 53.1 in March from 53.3 in February, down from the preliminary reading of 54.0.

The downward revision was mainly driven by France and Italy.

The index was mainly driven by a softer growth in new business and output.

Eurozone's final composite output index rose to 53.1 in March from 53.0 in February, down from the preliminary reading of 54.0.

The downward revision was mainly driven by France and Italy.

"The Eurozone economy failed to show any significant gain in momentum in March. With the PMI barely rising from February's 13-month low, the region looks to have grown by just 0.3% again in the first quarter," Chief Economist at Markit Chris Williamson said.

Germany's final services PMI fell to 55.1 in March from 55.3 in February, down from the preliminary reading of 55.5. The index was mainly driven by a slower growth in new orders.

France's final services PMI increased to 49.9 in March from 49.2 in February, down from the preliminary reading of 51.2. The index was mainly driven by rises in backlogs of work and input prices.

Destatis released its factory orders data for Germany on Tuesday. German seasonal adjusted factory orders declined 1.2% in February, missing expectations for a 0.2% increase, after a 0.5% rise in January. January's figure was revised up from a 0.1% drop.

The drop was driven by a decrease in foreign orders. Foreign orders decreased by 2.7% in February, while domestic orders rose by 0.9%.

The British pound traded lower against the U.S. dollar after the release of the services PMI data from the U.K. Markit's and the Chartered Institute of Purchasing & Supply's services PMI for the U.K. rose to 53.7 in March from 52.7 in February, in line with expectations. The increase was driven by a faster growth in output. Employment continued to rise in March.

"An upturn in the pace of service sector growth in March was insufficient to prevent the PMI surveys from collectively indicating a slowdown in economic growth in the first quarter. The surveys point to a 0.4% increase in GDP, down from 0.6% in the closing quarter of last year," the Chief Economist at Markit Chris Williamson said.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the Canadian trade data. The Canadian trade deficit is expected to widen to C$0.9 billion in February from C$0.66 billion in January.

EUR/USD: the currency pair declined to $1.1343

GBP/USD: the currency pair decreased to $1.4174

USD/JPY: the currency pair rose to Y110.80

The most important news that are expected (GMT0):

12:30 Canada Trade balance, billions February -0.66 -0.9

12:30 U.S. International Trade, bln February -45.68 -46.2

13:45 U.S. Services PMI (Finally) March 49.7 51

14:00 U.S. ISM Non-Manufacturing March 53.4 54

14:00 U.S. JOLTs Job Openings February 5.541 5.5

20:00 Canada Gov Council Member Wilkins Speaks

-

13:58

Orders

EUR/USD

Offers: 1.1400 1.1420 1.1435 1.1450 1.1480 1.1500 1.1530 1.1550

Bids: 1.1370 1.1350 1.1330-35 1.1310 1.1300 1.1275-80 1.1250

GBP/USD

Offers: 1.4235 1.4250 1.4275-80 1.4300 1.4325-30 1.4350 1.4380 1.4400

Bids: 1.4200 1.4175-80 1.4150 1.4130 1.4100 1.4085 1.4065 1.4050

EUR/JPY

Offers: 125.80 126.00 126.20 126.50 126.80 127.00 127.50

Bids: 125.30 125.00 124.75-80 124.50 124.25 124.00

EUR/GBP

Offers: 0.8000 0.8020 0.8030 0.8060-65 0.8085 0.8100

Bids: 0.7970-75 0.7950 0.7930 0.7900 0.7880-85 0.7865 0.7850

USD/JPY

Offers: 110.65 110.80 111.00 111.25-30 111.60 111.80 112.00 112.20 112.50 112.65 112.80 113.00

Bids: 110.30 110.00 109.85 109.65 109.50 109.30 109.00

AUD/USD

Offers: 0.7585 0.7600 0.7625-30 0.7650 0.7700 0.7720 0.7735-40 0.7750

Bids: 0.7550 0.7520 0.7500 0.7485 0.7465 0.7450 0.7430 0.7400

-

13:02

WSE: Mid session comment

This morning we met readings of PMI indicators for the sector of services in the euro zone. Positively surprising only Spain and Ireland. Clearly negative readings come from Italy, where the PMI index went down from 53.8 to 51.2 pts.

Generally morning publications do not look optimistic, and it is difficult to see the acceleration of growth on the horizon.

European markets show exceptional weakness today. The future contract on the DAX index is the lowest in almost a month.

On the Warsaw Stock Exchange we also see deeper declines and it looks like the session is ruled by bears today. The WIG20 index in the mid-session is traded at the level of 1948 pts. (-1,90%).

-

12:03

European stock markets mid session: stocks traded lower on the weak economic data from the Eurozone

Stock indices traded lower on the weak economic data from the Eurozone. Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final services PMI declined to 53.1 in March from 53.3 in February, down from the preliminary reading of 54.0.

The downward revision was mainly driven by France and Italy.

The index was mainly driven by a softer growth in new business and output.

Eurozone's final composite output index rose to 53.1 in March from 53.0 in February, down from the preliminary reading of 54.0.

The downward revision was mainly driven by France and Italy.

"The Eurozone economy failed to show any significant gain in momentum in March. With the PMI barely rising from February's 13-month low, the region looks to have grown by just 0.3% again in the first quarter," Chief Economist at Markit Chris Williamson said.

Germany's final services PMI fell to 55.1 in March from 55.3 in February, down from the preliminary reading of 55.5. The index was mainly driven by a slower growth in new orders.

France's final services PMI increased to 49.9 in March from 49.2 in February, down from the preliminary reading of 51.2. The index was mainly driven by rises in backlogs of work and input prices.

Destatis released its factory orders data for Germany on Tuesday. German seasonal adjusted factory orders declined 1.2% in February, missing expectations for a 0.2% increase, after a 0.5% rise in January. January's figure was revised up from a 0.1% drop.

The drop was driven by a decrease in foreign orders. Foreign orders decreased by 2.7% in February, while domestic orders rose by 0.9%.

Markit's and the Chartered Institute of Purchasing & Supply's services PMI for the U.K. rose to 53.7 in March from 52.7 in February, in line with expectations. The increase was driven by a faster growth in output. Employment continued to rise in March.

"An upturn in the pace of service sector growth in March was insufficient to prevent the PMI surveys from collectively indicating a slowdown in economic growth in the first quarter. The surveys point to a 0.4% increase in GDP, down from 0.6% in the closing quarter of last year," the Chief Economist at Markit Chris Williamson said.

Current figures:

Name Price Change Change %

FTSE 100 6,068.69 -96.03 -1.56 %

DAX 9,560.76 -261.32 -2.66 %

CAC 40 4,248.1 -97.12 -2.24 %

-

11:59

Markit/Nikkei services purchasing managers' index for Japan decreases to 50.0 in March

The Markit/Nikkei services Purchasing Managers' Index (PMI) for Japan decreased to 50.0 in March from 51.2 in February.

A reading below 50 indicates contraction of activity, while a reading above 50 indicates expansion.

The decrease was driven by a decline in employment.

"General business conditions in the Japanese service sector broadly stabilised in March. Both activity and new orders were unchanged from February, when only modest increases were seen. As a result, services firms were less optimistic towards their hiring policies, with job numbers decreasing for the first time since last November," economist at Markit, Amy Brownbill, said.

-

11:35

German seasonal adjusted factory orders decline 1.2% in February

Destatis released its factory orders data for Germany on Tuesday. German seasonal adjusted factory orders declined 1.2% in February, missing expectations for a 0.2% increase, after a 0.5% rise in January. January's figure was revised up from a 0.1% drop.

The drop was driven by a decrease in foreign orders. Foreign orders decreased by 2.7% in February, while domestic orders rose by 0.9%.

New orders from the Eurozone slid 3.7% in February, while orders from other countries declined 2.1%.

Orders of the intermediate goods climbed by 1.7% in February, capital goods orders were down 2.1%, while consumer goods orders plunged 7.3%.

-

11:25

France's final services PMI increases to 49.9 in March

Markit Economics released final services purchasing managers' index (PMI) for France on Tuesday. France's final services purchasing managers' index (PMI) increased to 49.9 in March from 49.2 in February, down from the preliminary reading of 51.2.

The index was mainly driven by rises in backlogs of work and input prices.

"March PMI data round off a broadly flat performance of the French service sector on average over the first quarter. There remains little sign of the stagnancy lifting - although business expectations rose to the highest since last August they remain subdued in historical terms," Senior Economist at Markit Jack Kennedy said.

-

11:20

Germany's final services PMI falls to 55.1 in March

Markit Economics released final services purchasing managers' index (PMI) for Germany on Tuesday. Germany's final services purchasing managers' index (PMI) fell to 55.1 in March from 55.3 in February, down from the preliminary reading of 55.5.

The index was mainly driven by a slower growth in new orders.

"The German service sector continued to expand at a solid pace at the end of the first quarter, although activity and new order inflows both increased at weaker rates. Moreover, a closer look at the sub-indices highlights some concerns that growth may slow further in coming months," an economist at Markit, Oliver Kolodseike, said.

-

11:17

Eurozone's final services PMI declines to 53.1 in March

Markit Economics released final services purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's final services purchasing managers' index (PMI) declined to 53.1 in March from 53.3 in February, down from the preliminary reading of 54.0.

The downward revision was mainly driven by France and Italy.

The index was mainly driven by a softer growth in new business and output.

Eurozone's final composite output index rose to 53.1 in March from 53.0 in February, down from the preliminary reading of 54.0.

The downward revision was mainly driven by France and Italy.

"The Eurozone economy failed to show any significant gain in momentum in March. With the PMI barely rising from February's 13-month low, the region looks to have grown by just 0.3% again in the first quarter," Chief Economist at Markit Chris Williamson said.

-

11:14

WSE: ORBIS SA

Orbis SA (WSE: ORB) will recommend to pay a dividend in the amount of PLN 69.11 mln, or PLN 1.50 per share from 2015 profit.

The proposed DPS puts the dividend yield as calculated against PLN 65.95 share price to 2.3%.

The rights will be established on July 18 and the payout will be made on August 3.

Orbis also paid a PLN 1.5 DPS from 2014 and 2013 profits.

Orbis Hotel Group is the leader of the hotel market in Poland. Orbis Group hotels operate under well-known global brands belonging to Accor Group: Sofitel, Novotel, Mercure, ibis, ibis Styles, ibis budget, as well as under the brand Orbis Hotels.

-

11:08

Eurozone’s retail sales increase 0.2% in February

Eurostat released its retail sales data for the Eurozone on Tuesday. Retail sales in the Eurozone increased 0.2% in February, beating expectations for a flat reading, after a 0.3% gain in January. January's figure was revised down from a 0.4% increase.

Non-food sales decreased 0.2% in February, food, drinks and tobacco sales rose 0.5%, while automotive fuel sales were down 0.2%.

On a yearly basis, retail sales in the Eurozone climbed 2.4% in February, beating forecasts of a 1.9% gain, after a 2.0% increase in January.

Non-food sales gained 1.7% year-on-year in February, gasoline sales declined 0.5%, while food, drinks and tobacco sales rose 2.9%.

-

11:02

UK’s services PMI rises to 53.7 in March

Markit's and the Chartered Institute of Purchasing & Supply's services purchasing managers' index (PMI) for the U.K. rose to 53.7 in March from 52.7 in February, in line with expectations.

A reading above 50 indicates expansion in the sector.

The increase was driven by a faster growth in output. Employment continued to rise in March.

"An upturn in the pace of service sector growth in March was insufficient to prevent the PMI surveys from collectively indicating a slowdown in economic growth in the first quarter. The surveys point to a 0.4% increase in GDP, down from 0.6% in the closing quarter of last year," the Chief Economist at Markit Chris Williamson said.

-

11:00

Eurozone: Retail Sales (YoY), February 2.4% (forecast 1.9%)

-

11:00

Eurozone: Retail Sales (MoM), February 0.2% (forecast 0%)

-

10:36

Bank of Japan Governor Haruhiko Kuroda: the BoJ is ready to add further stimulus measures

Bank of Japan (BoJ) Governor Haruhiko Kuroda said before the parliament on Tuesday that the central bank was ready to add further stimulus measures if the downside risks to inflation increase. He added that there was no need for further easing at the moment as the effect of negative interest rates was very strong.

Kuroda noted that the BoJ's next move will depend on the economic and price developments.

He pointed out that the central bank would not predetermine its moves.

-

10:30

United Kingdom: Purchasing Manager Index Services, March 53.7 (forecast 53.7)

-

10:10

Reserve Bank of Australia keeps its interest rate unchanged at 2.00% in April

The Reserve Bank of Australia (RBA) kept its interest rate unchanged at 2.00% on Tuesday. This decision was expected by analysts.

The RBA Governor Glenn Stevens said that the board's decision was reasonable "for continued growth in the economy, with inflation close to target".

He pointed out that further interest rate cut is possible.

"Continued low inflation would provide scope for easier policy, should that be appropriate to lend support to demand," the RBA governor said.

But Stevens noted that the next central bank's decision would depend on the incoming economic data.

The RBA governor said that the Australian economy continued to rebalance after the mining investment boom.

Stevens also said that the lending to business picked up.

The RBA governor also said that consumer price inflation remained "quite low", adding that inflation in Australia was likely to remain low over the next year or two.

He pointed out that the monetary policy should be accommodative.

Stevens noted that the Australian dollar appreciated recently due to higher commodity prices and the monetary policy moves in the world, which could "complicate the adjustment under way in the economy" in Australia.

-

10:00

Eurozone: Services PMI, March 53.1 (forecast 54)

-

09:55

Germany: Services PMI, March 55.1 (forecast 55.5)

-

09:50

France: Services PMI, March 49.9 (forecast 51.2)

-

09:15

WSE: After opening

The WIG20 futures contracts (WSE: FW20M16) began trading 10 points below yesterday's close, which means a decrease of 0.5 percent. It was the announcement of the red at the beginning of the sessions both on the Warsaw Stock Exchange as well as on other European markets. The atmosphere is reminiscent of what we had on Friday. After considerable devaluated Asian markets there is also nervously in Euroland, where the weakness of the indexes for a good few sessions is growing. The mood spoils further drop in oil prices.

Cash market opens with a discount of 0.5%. The turnover all the time is modest and the current environment is not improving. In Frankfurt the DAX lost 1.7%.

WIG20 index opened at 1976.23 points (-0.50%)*

WIG 48569.08 -0.51%

WIG30 2193.10 -0.69%

mWIG40 3600.84 -0.09%

*/ - change to previous close

-

09:04

Option expiries for today's 10:00 ET NY cut

USD/JPY:111.10 (USD 600m) 112.30 ( 390m) 112.50 (230m) 113.00 (230m) 113.10 (200m) 113.45-50 (590m) 113.70-75 (480m)

EUR/USD: 1.1280 (EUR 319m) 1.1295-1.1300 (805m) 1.1350 (608m) 1.1440 (250m)

EUR/GBP: 0.7935 (EUR 385m)

USD/CHF 0.9445 (USD 202m)

EUR/JPY 124.00 (EUR 300m) 127.75 (230m)

AUD/USD: 0.7400 (AUD 527m) 0.7600 (310m) 0.7625 (219m) 0.7750 (427m)

NZD/USD 0.6800-05 (NZD 251m) 0.6900 (401m)

USD/CAD: 1.3100 (USD 270m) 1.3400 (311m)

-

08:27

WSE: Before opening

The market sentiment has deteriorated since yesterday's close on the Warsaw Stock Exchange. Yesterday's session in the US ended with a decline of 0.3%, and the morning futures on US indices lose by the same amount.

The mood in Asia are bearish, it does not apply to returning after a break investors in China. The price of oil from yesterday afternoon was under the pressure of new supply and finally fell on Monday by nearly 3%. A bit better looks the situation with copper. There are signs that the terms of trading today may be harder than yesterday, and after a short break can return sentiments favoring implementation of inconsiderable gains from recent weeks.

In today's macro calendar we expect to see the PMI indicators for the services sector. Traditionally most attention will be given to the US index published by the ISM.

-

08:25

Asian session

The dollar nursed losses against the yen and euro on Tuesday, but was firmer versus the Canadian and New Zealand currencies, which succumbed to weakness in commodity prices.

The greenback has been on the defensive as views that the U.S. central bank is in no hurry to tighten monetary policy have held sway ever since Federal Reserve Chair Janet Yellen last week expressed caution toward hiking interest rates.

The dollar came under further pressure against the safe-haven yen as equities and crude oil prices fell.

Perceptions that the Bank of Japan would not immediately ease monetary policy, which in theory would curb yen strength, further favored the Japanese currency.

The Australian dollar nudged up 0.3 percent to $0.7623 from an intraday low of $0.7568 after the Reserve Bank of Australia left its cash rate unchanged at a record low 2 percent as widely expected. The Aussie drew a bit of relief as the RBA resisted talking down the currency's recent strength as some had feared. Yet Boston Fed President Eric Rosengren on Monday warned that the interest rate futures market could be "too pessimistic", noting external risks to the U.S. economy seemed to be abating.

EUR/USD: during the Asian session the pair traded in the range of $1.1385-00

GBP/USD: during the Asian session the pair traded in the range of $1.4250-75

USD/JPY: during the Asian session the pair fell to Y110.75

Based on Reuters materials

-

08:20

Options levels on tuesday, April 5, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1517 (4110)

$1.1481 (2733)

$1.1436 (2932)

Price at time of writing this review: $1.1378

Support levels (open interest**, contracts):

$1.1333 (1461)

$1.1293 (3257)

$1.1247 (1077)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 48568 contracts, with the maximum number of contracts with strike price $1,1500 (4110);

- Overall open interest on the PUT options with the expiration date April, 8 is 75413 contracts, with the maximum number of contracts with strike price $1,0900 (6429);

- The ratio of PUT/CALL was 1.55 versus 1.53 from the previous trading day according to data from April, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.4501 (1955)

$1.4402 (2053)

$1.4305 (993)

Price at time of writing this review: $1.4251

Support levels (open interest**, contracts):

$1.4197 (992)

$1.4099 (915)

$1.4000 (2990)

Comments:

- Overall open interest on the CALL options with the expiration date April, 8 is 22428 contracts, with the maximum number of contracts with strike price $1,4400 (2053);

- Overall open interest on the PUT options with the expiration date April, 8 is 23511 contracts, with the maximum number of contracts with strike price $1,4000 (2990);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from April, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Factory Orders s.a. (MoM), February -1.2% (forecast 0.2%)

-

06:30

Australia: Announcement of the RBA decision on the discount rate, 2% (forecast 2%)

-

05:51

Global Stocks: investor confidence after last week’s comments from Federal Reserve Chairwoman Janet Yellen

European stocks finished modestly higher Monday, but the French telecom sector was hit hard as merger talks between Orange SA and Bouygues SA fell apart.

U.S. stocks slumped on Monday as losses for industrials and materials offset sharp gains in health-care shares. Meanwhile, a fresh drop in oil prices weighed on risk appetite, eroding investor confidence after last week's comments from Federal Reserve Chairwoman Janet Yellen helped support stock advances.

Asian stocks slumped to a four-week low and emerging-market currencies weakened as investors reassessed last month's rally in riskier assets. Oil declined for a third day, while the yen and Treasuries gained.

Based on MarketWatch materials

-

04:01

Nikkei 225 15,820.84 -302.43 -1.88 %, Hang Seng 20,218.51 -280.41 -1.37 %, Shanghai Composite 2,996.22 -13.31 -0.44 %

-

03:30

Australia: Trade Balance , February -3.41 (forecast -2.6)

-

02:02

Japan: Labor Cash Earnings, YoY, February 0.9%

-

01:31

Australia: AIG Services Index, March 49.5

-

00:32

Commodities. Daily history for Apr 04’2016:

(raw materials / closing price /% change)

Oil 35.46 -0.67%

Gold 1,217.00 -0.19%

-

00:31

Stocks. Daily history for Sep Apr 04’2016:

(index / closing price / change items /% change)

Nikkei 225 16,123.27 -40.89 -0.25 %

S&P/ASX 200 4,995.32 -4.07 -0.08 %

Topix 1,302.71 +1.31 +0.10 %

FTSE 100 6,164.72 +18.67 +0.30 %

CAC 40 4,345.22 +22.98 +0.53 %

Xetra DAX 9,822.08 +27.44 +0.28 %

S&P 500 2,066.13 -6.65 -0.32 %

NASDAQ Composite 4,891.8 -22.75 -0.46 %

Dow Jones 17,737 -55.75 -0.31 %

-

00:30

Currencies. Daily history for Apr 04’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1390 0,00%

GBP/USD $1,4265 +0,25%

USD/CHF Chf0,9587 +0,11%

USD/JPY Y111,31 -0,39%

EUR/JPY Y126,78 -0,39%

GBP/JPY Y158,78 -0,06%

AUD/USD $0,7603 -0,97%

NZD/USD $0,6828 -1,11%

USD/CAD C$1,3078 +0,50%

-

00:01

Schedule for today, Tuesday, Apr 05’2016:

(time / country / index / period / previous value / forecast)

01:00 Japan Labor Cash Earnings, YoY February 0.4%

01:30 Australia Trade Balance February -2.94 -2.6

04:30 Australia Announcement of the RBA decision on the discount rate 2% 2%

04:30 Australia RBA Rate Statement

06:00 Germany Factory Orders s.a. (MoM) February -0.1% 0.2%

07:50 France Services PMI (Finally) March 49.2 51.2

07:55 Germany Services PMI (Finally) March 55.3 55.5

08:00 Eurozone Services PMI (Finally) March 53.3 54

08:30 United Kingdom Purchasing Manager Index Services March 52.7 54

09:00 Eurozone Retail Sales (MoM) February 0.4% 0%

09:00 Eurozone Retail Sales (YoY) February 2.0% 1.9%

12:30 Canada Trade balance, billions February -0.66 -1

12:30 U.S. International Trade, bln February -45.68 -46.2

13:45 U.S. Services PMI (Finally) March 49.7 51

14:00 U.S. ISM Non-Manufacturing March 53.4 54

14:00 U.S. JOLTs Job Openings February 5.541

-