Noticias del mercado

-

20:20

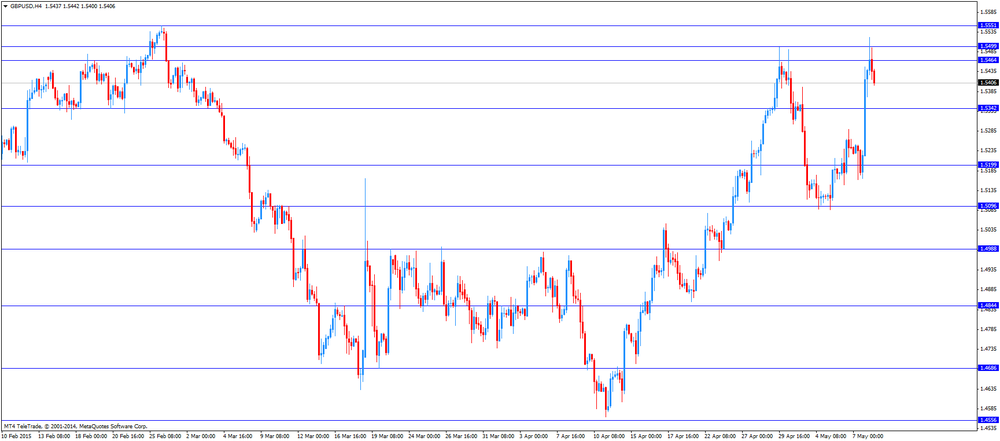

American focus: the pound rose against the dollar

The dollar stabilized against the euro after the sharp fluctuations in the background data on the US labor market. Analysts point out that the results of the employment report did not affect the position of the Federal Reserve, which expects the pressures on the US economy will weaken, and the economy will get stronger. Experts also said that employment rates were good, but not good enough to raise short-term expectations for Fed rate, which limited the potential for growth of the dollar and reduce the EUR / USD. Recall, the Ministry of Labor said the number of people employed in non-agricultural sectors of the economy increased from a seasonally adjusted 223,000 in April, rebounding from a weak March value. The report stated that the US added just 85,000 jobs in March, compared with the previously reported 126 000. In addition, the economy added 266,000 in February, slightly above the previously reported 264 000. The unemployment rate is calculated from a separate survey of households , down to 5.4% in April to 5.5% in March. The decrease reflects the positive changes: the labor force has increased, as more Americans were involved in the search for work and the number of Americans who found a job increased. The unemployment rate is close to the expected level of the Fed's "full" employment, which it is determined between 5% and 5.2%. Economists had expected growth of employment by 224 000 or 5.4% unemployment rate. Initial assessment of the April report is likely to be revised after the government gather fresh data.

The pound retreated from a session high against the dollar, but still continues to show an increase on the background of the results of parliamentary elections in the UK. Contrary to the predictions and opinion polls, an overwhelming victory in the general election in Britain, won the Conservative Party. The Tories won a majority in the new parliament - 327 seats. Conservative leader David Cameron has announced its intention to form a government without creating a coalition with other parties. The Labour Party received almost 100 mandates less than the Tories, and were worse than in the last election in 2010. Labour leader Ed Miliband announced his resignation. Even more crushing defeat suffered Liberal Democratic Party lost 47 seats. In the new parliament, the Liberal Democrats will have a total of eight seats. After winning his polling station Tory leader David Cameron promised to "unite the country." Cameron also reiterated his campaign promise to spend the next few years a referendum on Britain's membership of the European Union. However, the business is not very happily accepts the promise: experts estimate the Bertelsmann Foundation, the loss of the British economy will reach 224 billion dollars.

The Canadian dollar strengthened against the US dollar, entrenched below $ 1.21, which is associated with the publication of data on employment United States and Canada. Recall, the Canadian economy has reduced jobs in April, while the unemployment rate remained unchanged, as fewer people were looking for work and were marked by heavy losses in retail trade and construction. Canada recorded a decline of 19,700 jobs in April, said Friday Statistics Canada, noting the biggest decline in eight months. Market expectations were at a decline of 5,000 jobs. The unemployment rate in Canada remained unchanged in April and remained at 6.8%. Economists had expected the unemployment rate to rise to 6.9% .Otchet employment pointed out that 18,900 people left the labor force this month.

-

16:49

Wholesale inventories in the U.S. rises 0.1% in March

The U.S. Commerce Department released wholesale inventories on Friday. Wholesale inventories in the U.S. rose 0.1% in March, beating expectations for a 0.3% gain, after a 0.2% increase in February. February's figure was revised up from a 0.3% rise.

The increase was driven by lower wholesale sales. Wholesale sales declined by 0.2% in March.

Inventories of durable goods increased 0.5% in March, while inventories of non-durable goods declined by 0.4%.

-

16:09

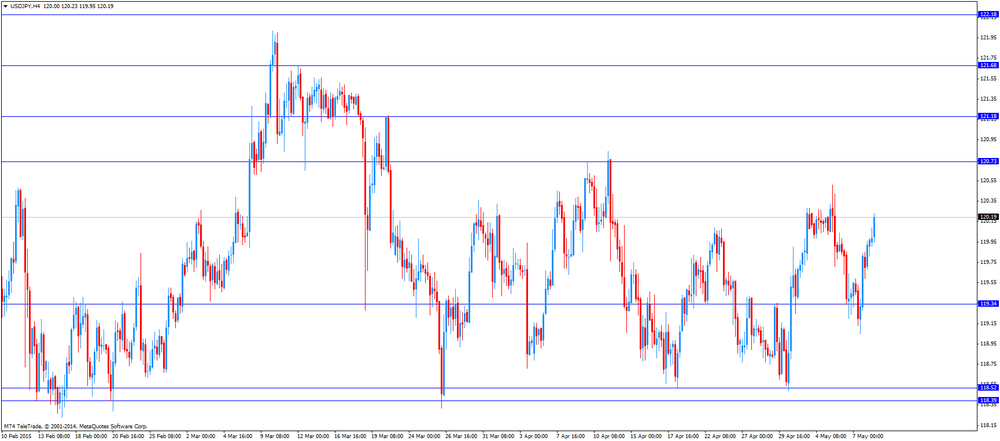

Bank of Japan’smonetary policy meeting minutes of the April 7-8: BoJ board member, Takahide Kiuchi, noted the aggressive easing measures could destabilize the bond market or could cause bubbles

The Bank of Japan (BoJ) released its monetary policy meeting minutes of the April 7-8. The central bank voted 8-1 to keep its monetary policy unchanged. The BoJ board member, Takahide Kiuchi, said the central bank should cut its asset purchases to 45 trillion yen annually. He noted that the aggressive easing measures could destabilize the bond market or could cause bubbles.

Some board members said that private consumption remained weak despite improvements in employment.

Some board members pointed out that annual consumer price inflation might turn negative in coming months depending on energy prices.

-

16:00

U.S.: Wholesale Inventories, March 0.1% (forecast 0.3%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E522mn), $1.1200(E1.5bn), $1.1295(E563mn), $1.1345-50(E680mn)

USD/JPY: Y119.00($1.3bn), Y120.00($1.1bn), Y120.50($1.0bn), Y121.25($478mn)

GBP/USD: $1.4900(Gbp359mn), $1.5000(Gbp190mn), $1.5100(Gbp285mn)

AUD/USD: $0.7800(A$592M), 0.7925(A$393mn), 0.8015(A$204mn)

AUD/NZD: NZ$1.0600 (A$312mn)

USD/CAD: C$1.2100($745mn), C$1.2300($475mn)

-

15:43

Canada’s economy shed 19,700 jobs in April, driven by a drop in part-time jobs

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 6.8% in April. Analysts had expected the unemployment rate to rise to 6.9%.

The number of employed people dropped by 19,700 jobs in April, missing expectations for a loss of 5,000 jobs, after a 28,700 rise in March.

The loss was driven by a drop in part-time jobs. Part-time employment in April plunged by 66,500 jobs, the biggest loss since March 2011, while full-time work rose by 46,900.

Retail and wholesale employment decreased by 20,500, construction employment fell by 28,400, while 18,900 people left the labour force.

The labour participation rate fell to 65.8% in April from 65.9 in March.

The Bank of Canada monitors closely the labour participation rate.

-

14:55

Reserve Bank of Australia cuts its growth and inflation forecasts

The Reserve Bank of Australia (RBA) released its quarterly Statement of Monetary Policy on Friday. The RBA revised its forecast for GDP growth for 2015 to 2.5%, compared with 2.25-3.25% in the RBA's previous estimate. The forecast for 2016 was lowered to 2.75% - 3.75 %, down the previous estimate of 3.00% - 4.00%.

The RBA revised its inflation forecast for 2015 to 2.5% from its previous estimate of 2.0% - 3.0%. The inflation forecast for 2016 was cut to 1.75% - 2.75 %, down the previous estimate of 2.00% - 3.00%.

Australia's central bank it offered no clear signal for further interest rate cut. But the RBA reiterated that further depreciation of the Australian dollar is "both likely and necessary".

The RBA cut its interest rate to a new record low of 2.00% this week, down from 2.25%. It was the second interest rate cut this year.

-

14:44

Housing starts in Canada declines to a seasonally adjusted annualized rate of 181,814 units in April

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Friday. Housing starts in Canada decreased to a seasonally adjusted annualized rate of 181,814 units in April from a revised reading of 189,546 units in March. March's figure revised down from 189,708 units.

Analysts had expected a decline to 182,000 units.

The CMHC's Chief Economist Bob Dugan said that housing starts activity declined since September 2014 to current stable levels "as builders have adjusted activity to manage inventories".

"This trend is in line with CMHC's expectations for housing starts in 2015," he added.

-

14:30

Canada: Unemployment rate, April 6.8% (forecast 6.9%)

-

14:30

U.S.: Nonfarm Payrolls, April 223 (forecast 224)

-

14:30

U.S.: Unemployment Rate, April 5.4% (forecast 5.4%)

-

14:30

Canada: Employment , April -19.7 (forecast -5)

-

14:30

U.S.: Average hourly earnings , April 0.1% (forecast 0.2%)

-

14:18

Foreign exchange market. European session: the euro traded higher against the U.S. dollar after the economic data from Germany

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:50 Japan Monetary Policy Meeting Minutes

03:00 China Trade Balance, bln April 3.08 39.45 34.13

03:30 Australia RBA Monetary Policy Statement

07:45 Switzerland Unemployment Rate (non s.a.) April 3.4% 3.3% 3.3%

08:00 France Bank holiday

08:00 Germany Current Account March 16.6 27.9

08:00 Germany Industrial Production s.a. (MoM) March 0.0% Revised From 1.4% 0.4% -0.5%

08:00 Germany Industrial Production (YoY) March -0.3% 0.1%

08:00 Germany Trade Balance March 19.2 19.7 23.0

09:00 United Kingdom Halifax house price index 3m Y/Y April 8.1% 7.8% 8.5%

09:00 United Kingdom Halifax house price index April 0.6% Revised From 0.4% 0.4% 1.6%

09:15 Switzerland Consumer Price Index (MoM) April 0.3% 0.1% -0.2%

09:15 Switzerland Consumer Price Index (YoY) April -0.9% -0.9% -1.1%

10:30 United Kingdom Total Trade Balance March -3.318 Revised From -2.859 -2.95 -2.817

10:30 United Kingdom Trade in goods March -10.8 Revised From -10.3 -10.1

14:15 Canada Housing Starts April 189.5 Revised From 189.7 182 181.8

The U.S. dollar traded higher against the most major currencies ahead of the U.S. labour market data. Analysts expect that U.S. unemployment rate is expected to decline to 5.4% in April from 5.5% in March. The U.S. economy is expected to add 224,000 jobs in April, after adding 126,000 jobs in March.

The euro traded higher against the U.S. dollar after the economic data from Germany. German industrial production dropped 0.5% in March, missing expectations for a 0.4% rise, after a flat reading in February. February's figure was revised down from a 1.4% increase.

Germany's seasonally adjusted trade surplus narrowed to €19.3 billion in March from €20.0 billion in February. February's figure was revised up from a surplus of €19.7 billion.

The Greek debt crisis still weighs on the euro.

The British pound traded lower against the U.S. dollar despite the better-than-expected economic data from the U.K. The U.K. trade deficit in goods narrowed to £10.1 billion in March from £10.8 billion in February. February's figure was revised down from a deficit of £10.3 billion.

The trade deficit fell as exports rose, while imports declined. Exports of goods climbed by 1.4% in March, while imports declined by 1.0%.

The U.K. Halifax house price index climbed 1.6% in April, exceeding expectations for a 0.4% gain, after a 0.6% rise in March. March's figure was revised up from a 0.4% increase.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in Canada is expected to rise to 6.9% in April from 6.8% in March.

Canada's economy is expected to shed 5,000 jobs in April.

The Swiss dollar traded lower against the U.S. dollar after the weaker-than-expected consumer price inflation from Switzerland. Switzerland's consumer price index fell 0.2% in April, missing expectations for a 0.1% rise, after a 0.3% increase in March.

The rise was driven by a stronger Swiss franc.

On a yearly basis, Switzerland's consumer price index declined to -1.1% in April from -0.9% in March.

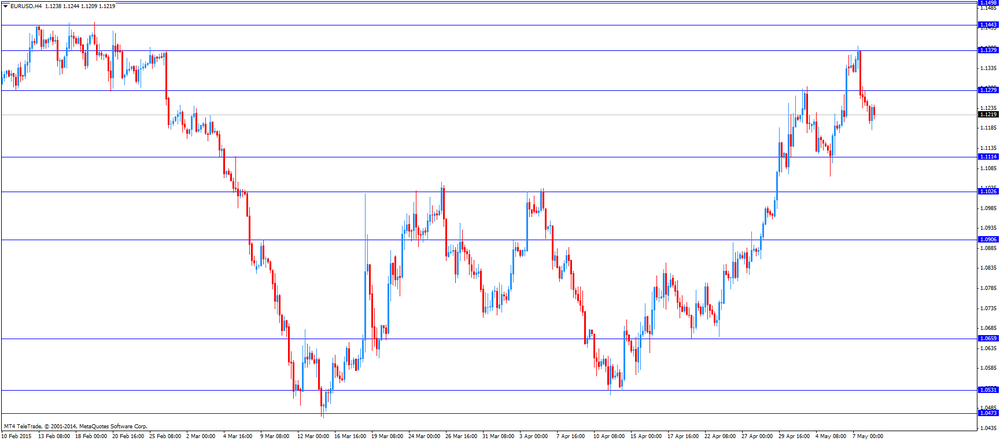

EUR/USD: the currency pair increased to $1.1245

GBP/USD: the currency pair fell to $1.5400

USD/JPY: the currency pair rose to Y120.23

The most important news that are expected (GMT0):

14:30 Canada Employment April 28.7 -5

14:30 Canada Unemployment rate April 6.8% 6.9%

14:30 U.S. Average hourly earnings April 0.3% 0.2%

14:30 U.S. Nonfarm Payrolls April 126 224

14:30 U.S. Unemployment Rate April 5.5% 5.4%

-

14:16

Canada: Housing Starts, April 181.8 (forecast 182)

-

14:00

Orders

EUR/USD

Offers 1.1230 1.1250 1.1280 1.1300 1.1330 1.1360-65 1.1385 1.1400

Bids 1.1180 1.1160 1.1140 1.1120 1.1100 1.1085 1.1050-60

GBP/USD

Offers 1.5500 1.5525 1.5545-50 1.5570 1.5585 1.5600 1.5630 1.5650

Bids 1.5440 1.5420-25 1.5400 1.5380 1.5365 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7280 0.7300 0.7320-25 0.7350 0.7380 0.7400 0.7420

Bids 0.7220-25 0.7200 0.7185 0.7165 0.7150

EUR/JPY

Offers 135.00 135.30 135.50 135.85 136.00 136.50 136.80 137.00

Bids 134.40 134.00 133.70 133.50 133.00

USD/JPY

Offers 120.25-30 120.50 120.80 121.00

Bids 119.85 119.60-65 119.25-30 119.00 118.85 118.65 118.50

AUD/USD

Offers 0.7920 0.7940 0.7960 0.7980 0.8000 0.8025 0.8050-60 0.8085 0.8100

Bids 0.7900 0.7880 0.7850-55 0.7820-25 0.7800

-

12:18

U.K. trade deficit in goods narrows to £10.1 billion in March

The U.K. Office for National Statistics (ONS) released trade data on Friday. The U.K. trade deficit in goods narrowed to £10.1 billion in March from £10.8 billion in February.

February's figure was revised down from a deficit of £10.3 billion.

The trade deficit fell as exports rose, while imports declined. Exports of goods climbed by 1.4% in March, while imports declined by 1.0%.

The deficit in trade in goods in the first quarter period rose to £29.9 billion from 29.1 billion pounds in the fourth quarter of 2014.

In the first quarter, exports dropped 3.6%, while imports declined 1.9%.

The total trade deficit, including services, narrowed to £2.82 billion in March from £3.32 billion in February. February's figure was revised down from a deficit of £2.86 billion.

-

11:28

Switzerland’s consumer price inflation declines 0.2% in April

The Swiss Federal Statistics Office released its consumer inflation data on Friday. Switzerland's consumer price index fell 0.2% in April, missing expectations for a 0.1% rise, after a 0.3% increase in March.

The rise was driven by a stronger Swiss franc.

On a yearly basis, Switzerland's consumer price index declined to -1.1% in April from -0.9% in March.

Analysts had expected the consumer price index to remain unchanged at -0.9%.

-

11:02

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E522mn), $1.1200(E1.5bn), $1.1295(E563mn), $1.1345-50(E680mn)

USD/JPY: Y119.00($1.3bn), Y120.00($1.1bn), Y120.50($1.0bn), Y121.25($478mn)

GBP/USD: $1.4900(Gbp359mn), $1.5000(Gbp190mn), $1.5100(Gbp285mn)

AUD/USD: $0.7800(A$592M), 0.7925(A$393mn), 0.8015(A$204mn)

AUD/NZD: NZ$1.0600 (A$312mn)

USD/CAD: C$1.2100($745mn), C$1.2300($475mn)

-

11:01

Chicago Federal Reserve President Charles Evans: the Fed should wait until 2016 to hike its interest rate

Chicago Federal Reserve President Charles Evans said on Thursday that the Fed should wait until 2016 to hike its interest rate. But he added that the Fed could raise its interest rate at every monetary policy meeting.

Evans expects that the economy will improve in the second quarter and it will grow 2.5% to 3% this year.

Evans is a voting member of the Federal Open Market Committee this year.

-

10:42

Consumer credit in the U.S. climbs by $20.5 billion in March

The Fed released its consumer credits figures on Thursday. Consumer credit in the U.S. rose by $20.5 billion in March, exceeding expectations for a $16.0 billion increase, after a $14.8 billion gain February.

February's figure was revised down from a $15.52 billion rise.

The increase was driven by a gain in non-revolving credit. Revolving credit climbed by $4.3 billion in March, while non-revolving credit jumped by $16.2 billion.

-

10:31

United Kingdom: Trade in goods , March -10.1

-

10:30

United Kingdom: Total Trade Balance, March -2.817 (forecast -2.95)

-

10:24

China’s trade surplus rises to $34.13 billion in April

The Chinese Customs Office released its trade data on Friday. China's trade surplus rose to $34.13 billion in April from $3.08 billion in March, missing expectations for an increase to a surplus of $39.45 billion.

Exports dropped 6.4% in April on a weak demand, while imports slid 16.2%.

-

09:15

Switzerland: Consumer Price Index (YoY), April -1.1% (forecast -0.9%)

-

09:15

Switzerland: Consumer Price Index (MoM) , April -0.2% (forecast 0.1%)

-

08:25

Options levels on friday, May 8, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1350 (2925)

$1.1307 (6502)

$1.1278 (4568)

Price at time of writing this review: $1.1196

Support levels (open interest**, contracts):

$1.1129 (1741)

$1.1088 (5184)

$1.1043 (2915)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 64034 contracts, with the maximum number of contracts with strike price $1,1200 (6502);

- Overall open interest on the PUT options with the expiration date May, 8 is 97755 contracts, with the maximum number of contracts with strike price $1,0000 (9280);

- The ratio of PUT/CALL was 1.53 versus 1.46 from the previous trading day according to data from May, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.5700 (731)

$1.5601 (967)

$1.5502 (2199)

Price at time of writing this review: $1.5435

Support levels (open interest**, contracts):

$1.5382 (331)

$1.5288 (1452)

$1.5193 (1775)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 27592 contracts, with the maximum number of contracts with strike price $1,5000 (2844);

- Overall open interest on the PUT options with the expiration date May, 8 is 37844 contracts, with the maximum number of contracts with strike price $1,5000 (2764);

- The ratio of PUT/CALL was 1.37 versus 1.36 from the previous trading day according to data from May, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Trade Balance, bln April 3.08 39.45 34.13

01:30 Australia RBA Monetary Policy Statement

The pound jumped the most since 2009 as the U.K. Conservative Party was on course to retain power after a general election. The Conservatives were on course to be the largest party in Parliament, just short of a majority, an exit poll and early results showed. The exit poll predicted the Conservatives would win 316 of Parliament's 650 seats, more than in the last election in 2010, with the Labour Party trailing on 239 seats. As the first results were declared in the early hours of Friday, Labour failed to gain key target seats in central England.

U.S. employers probably added 228,000 workers to nonfarm payrolls in April, after a 126,000 increase in March, according to economists surveyed by Bloomberg. Federal Reserve policy makers are monitoring labor data to determine the timing of higher borrowing costs after growth slowed in the first quarter.

EUR / USD: during the Asian session the pair fell to $ 1.1200

GBP / USD: during the Asian session the pair rose to $ 1.5495

USD / JPY: during the Asian session the pair rose to Y119.95

-

08:16

Germany: Current Account , March 27.9

-

08:02

Germany: Trade Balance, March 23.0 (forecast 19.7)

-

08:00

Germany: Industrial Production s.a. (MoM), March 1.2% (forecast 0.4%)

-

07:45

Switzerland: Unemployment Rate (non s.a.), April 3.3% (forecast 3.3%)

-

04:26

China: Trade Balance, bln, April 34.13 (forecast 39.45)

-

00:30

Currencies. Daily history for May 7’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1251 -0,81%

GBP/USD $1,5415 +1,12%

USD/CHF Chf0,9221 +0,67%

USD/JPY Y119,69 +0,21%

EUR/JPY Y134,67 -0,59%

GBP/JPY Y184,51 +1,33%

AUD/USD $0,7910 -0,73%

NZD/USD $0,7449 -0,64%

USD/CAD C$1,2110 +0,57%

-

00:00

Schedule for today, Friday, May 8’2015:

(time / country / index / period / previous value / forecast)

01:00 China Trade Balance, bln April 3.08 39.45

01:30 Australia RBA Monetary Policy Statement

05:45 Switzerland Unemployment Rate (non s.a.) April 3.4% 3.3%

06:00 France Bank holiday

06:00 Germany Current Account March 16.6

06:00 Germany Industrial Production s.a. (MoM) March 0.2% 0.4%

06:00 Germany Industrial Production (YoY) March -0.3%

06:00 Germany Trade Balance March 19.2 19.7

07:00 United Kingdom Halifax house price index 3m Y/Y April 8.1% 7.8%

07:00 United Kingdom Halifax house price index April 0.4% 0.4%

07:15 Switzerland Consumer Price Index (MoM) April 0.3% 0.1%

07:15 Switzerland Consumer Price Index (YoY) April -0.9% -0.9%

08:30 United Kingdom Total Trade Balance March -2.859 -2.95

08:30 United Kingdom Trade in goods March -10.3

12:15 Canada Housing Starts April 189.7 182

12:30 Canada Employment April 28.7 -5

12:30 Canada Unemployment rate April 6.8% 6.9%

12:30 U.S. Average hourly earnings April 0.3% 0.2%

12:30 U.S. Nonfarm Payrolls April 126 224

12:30 U.S. Unemployment Rate April 5.5% 5.4%

14:00 U.S. Wholesale Inventories March 0.3% 0.3%

-