Noticias del mercado

-

23:59

Schedule for today, Tuesday, Jun 9’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia ANZ Job Advertisements (MoM) May 2.3%

01:30 National Australia Bank's Business Confidence May 3

01:30 Australia Home Loans April 1.6% -2%

01:30 China PPI y/y May -4.6% -4.5%

01:30 China CPI y/y May 1.5% 1.3%

05:00 Japan Consumer Confidence May 41.5

05:45 Switzerland Unemployment Rate (non s.a.) May 3.3%

06:00 Japan Prelim Machine Tool Orders, y/y May 10.4%

07:15 Switzerland Consumer Price Index (YoY) May -1.1% -1.2%

07:15 Switzerland Consumer Price Index (MoM) May -0.2% 0.1%

08:30 United Kingdom Total Trade Balance April -2.817

09:00 Eurozone GDP (YoY) (Finally) Quarter I 0.9%

09:00 Eurozone GDP (QoQ) (Finally) Quarter I 0.3%

14:00 U.S. Wholesale Inventories April 0.1% 0.2%

14:00 U.S. JOLTs Job Openings April 4.994

20:30 U.S. API Crude Oil Inventories June 1.8

23:50 Japan Core Machinery Orders April 2.9% -2.0%

23:50 Japan Core Machinery Orders, y/y April 2.6% -1.3%

-

20:20

American focus: the dollar fell

The US dollar showed a decline against major currencies as investors continue to take profits from the recent surge of the dollar, while trade remained calm since the publication of important economic reports in the US was not in session.

On Friday, the dollar strengthened its position across the board after the US Labor Department reported that the US was established in May, 280 thousand. Jobs, more than the expected 225 thousand.

The level of hourly wages rose in May by 0.3% in April after increasing 0.2%.

The upbeat data, in particular the acceleration of wage growth, intensified speculation that the economy will show a rebound after weak growth in the first quarter, and raised expectations that the Federal Reserve may start raising interest rates already at the meeting in September.

The euro rose against the dollar, as the yield on 10-year bonds in Germany is growing, nearing a nine-month peak last week.

The yield on German bonds serves as a reference for the European financial markets and high yield raises the euro against the dollar. Yield increases as the price drops.

The recent rise in yields gave rise to signs of economic recovery in the euro area.

But investors remained cautious after earlier on Monday, German Chancellor Angela Merkel warned that "there are not a lot of time" to reach an agreement on reforms needed for Greece, most of the financial assistance.

In Athens on Friday to postpone the payment of debt to the International Monetary Fund, requesting to merge four of the June payment is one that Greece plans to pay at the end of the month.

In the focus were also the data for the euro area. The group Sentix said: June index of investor confidence fell to 17.1 points against 19.6 points in May. The last reading was the lowest since February of this year (when the figure was 12.4 points). Experts predicted that the index will fall to the level of 18.7 points. Recall, the level above zero reflects the prevalence of optimism, below - pessimism. Meanwhile, in a statement reported that the index of investor expectations will fall to 22.5 points in June, compared with 26.5 points in the previous month. It is worth emphasizing the decline of the index was recorded for the second time in a row.

The pair USD / JPY fell after rising to 13-year highs on Friday. The data showed that gross domestic product growth in Japan in the first quarter was revised on an annual basis to 3.9% compared with the original estimate of 2.4%. The revised growth of the Japanese economy in the quarterly equivalent of 1.0% instead of 0.6% preliminary assessment.

The Canadian dollar strengthened against the US currency. A report published by Statistics Canada, have shown that at the end of April, the number of building permits increased 11.6% to $ 7.8 billion. Meanwhile, the change for March was revised upward - up to 13.6% from 11 6%. On average, experts expect the growth rate to 3.4%.

Data provided by the Canada Mortgage and Housing Corporation (CMHC), have shown that at the end of May the number of bookmarks of new homes rose to 201,705 units compared to 183,329 units in April (revised from 181.8 thous.). In general, urban Share rose 10.8% to 185,235 units. Multi-city favorites have increased by 16.9% to 126,367 units, while urban single detached Bookmarks remained at 58,868 units, said the CMCH.

-

17:05

International Monetary Fund expects the Spanish economy to expand at 3.1% this year

The International Monetary Fund (IMF) released its gross domestic product (GDP) forecasts for Spain on Monday. The IMF expects the Spanish economy to expand at 3.1% this year and 2.5% in 2016.

According to the IMF, Spain should implement additional reforms to reduce the unemployment.

The IMF noted that the Spanish economy was supported by lower energy prices, a weaker euro and quantitative easing by the European Central Bank.

Spain should continue to lower private debt and budget deficits, the IMF noted.

-

16:58

European Central Bank (ECB) Governing Council Member Christian Noyer: quantitative easing seems to work

The European Central Bank (ECB) Governing Council Member Christian Noyer said on Monday that quantitative easing seems to work. But he added that European governments needed to speed up their structural reforms.

-

16:43

Pace of asset buying by the ECB rises last week

The European Central Bank (ECB) purchased €12.921 billion of assets last week. The central bank said on Monday it had settled a total of €159.600 billion of purchases of mainly government bonds as of June 5, up from €146.679 billion the previous week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB also said that it bought €2.169 billion of covered bonds last week, and €282 million of asset-backed securities. Covered bonds programmes totalled €87.277 billion, while asset-backed securities programmes totalled €7.494 billion.

-

16:01

U.S.: Labor Market Conditions Index, May 1.3

-

15:55

U.K. economic growth remained unbalanced, according to Moody's Investors Service’s report

Moody's Investors Service said its report regarding the U.K. economy on Monday. Moody's expects the U.K. economy to expand at 2.7% in 2015 and 2.4% in 2016.

The Senior Credit Officer at Moody's Kathrin Muehlbronner noted that the U.K. economic growth remained unbalanced and was driven by domestic demand and the services sector.

According to the report, the UK's debt ratio is expected to be 91.5% of GDP in 2016.

The agency named to risks, which could have an impact on the UK's sovereign rating: the referendum on EU membership and the accelerated pace of decentralisation of fiscal powers to Scotland and other regions and cities.

-

15:44

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0995-1.1000(E904mn), $1.1100(E1.2bn), $1.1200(E2.3bn)

USD/JPY: Y124.00($900mn), Y125.00($1.16bn), Y125.25($1.1bn), Y125.35($330mn), Y126.75($540mn)

GBP/USD: $1.4900(Gbp1.2bn), $1.5150(Gbp275mn), $1.5415(Gbp1.0bn)

USD/CHF: Chf0.9475($650mn)

AUD/USD: $0.7500(A$400mn), $0.7700-05(A$280mn)

USD/CAD: C$1.2550-55($700mn), C$1.2575($525mn)

-

15:34

OECD’s leading indicator remains unchanged at 100.1 in April

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator remained unchanged at 100.1 in April. It signalled stable growth in the United Kingdom, Germany, Japan and India.

There were signs of positive growth momentum in the Eurozone, especially in France and Italy.

The index for the U.S., Canada and China pointed to an easing in growth momentum.

The index for Russia showed signs of positive change in growth momentum.

-

15:01

Building permits in Canada jump 11.6% in April

Statistics Canada released housing market data on Monday. Building permits in Canada rose 11.6% in April, after a 13.6% gain in March.

March's figure was revised up from a 11.6% rise.

The increase was partly driven by a rise in construction permits in the residential and non-residential sectors in Ontario.

Building permits for non-residential construction jumped 30.2% in April, while permits in the residential sector rose 1.2%.

-

14:45

Housing starts in Canada declines to a seasonally adjusted annualized rate of 201,705 units in May

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 201,705 units in May from a revised reading of 183,329 units in April. April's figure revised up from 181,814 units.

The increase was driven by higher multiple starts in Ontario, the Atlantic region, and Québec.

"CMHC also forecasts slight moderation in housing starts in 2015 and 2016, reflecting a slowdown in housing market activity in oil-producing provinces that will partly be offset by increased activity in provinces that are seeing the positive impacts of low oil prices," the CMHC's Chief Economist Bob Dugan said.

-

14:39

Bank of France expects the country’s economy to expand at 0.3% in the second quarter

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.3% in the second quarter due to a rise in industrial production and services activity.

The manufacturing business confidence index climbed to 99 in May from 98 in April due to an increase in agri-food, automobile, and pharmaceutical sectors.

The services business sentiment index remained unchanged at 95.

The construction business sentiment index was up to 93 in May from 92 in April.

-

14:30

Canada: Building Permits (MoM) , April 11.6%

-

14:21

The Confederation of British Industry downgrades its U.K. GDP forecasts

The Confederation of British Industry (CBI) downgraded its U.K. gross domestic product (GDP) growth estimates on Monday. The U.K. economy is expected to expand at 2.4% in 2015 and at 2.5% in 2016, down from its February estimate of 2.7% and 2.6% respectively.

"The recovery has built up a good head of steam and we expect to see solid, steady and sustainable growth carrying through into next year. Risks remain in the form of economic instability in Greece and a sluggish Eurozone, and clearly the EU referendum is a hot topic in Britain's boardrooms. Businesses now have certainty that the referendum is happening, but not the outcome," the CBI Director-General John Cridland said.

-

14:14

Canada: Housing Starts, May 201.7

-

14:13

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Trade Balance, bln May 34.13 44.95 59.49

05:00 Japan Eco Watchers Survey: Current May 53.6 53.3

05:00 Japan Eco Watchers Survey: Outlook May 54.2 54.5

06:00 Germany Current Account April 27.3 Revised From 27.9 19.6

06:00 Germany Industrial Production s.a. (MoM) April -0.4% Revised From -0.5% 0.5% 0.9%

06:00 Germany Trade Balance April 23.1 Revised From 19.4 22.1

06:00 Germany Industrial Production (YoY) April 0.2% Revised From 0.0% 1.4%

08:30 Eurozone Sentix Investor Confidence June 19.6 18.7 17.1

09:00 G7 G7 Meetings

The U.S. dollar traded mixed against the most major currencies. There will be released no major economic reports today.

The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 280,000 jobs in May, exceeding expectations for a rise of 2225,000 jobs, after a gain of 221,000 jobs in April. It was the largest increase since December.

The U.S. unemployment rate rose to 5.5% in May from 5.4% in April. Analysts had expected the unemployment rate to remain unchanged at 5.4%.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 17.1 in June from 19.6 in May, missing expectations for a decline to 18.7. It was the lowest level since February.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis and a stronger euro.

German investor confidence index plunged to 26.8 in June from 28.2 in May due to a stronger euro, a slower global economic growth and higher long-term yields.

German industrial production rose 0.9% in April, exceeding expectations for a 0.5% gain, after a 0.4% decline in March. March's figure was revised up from a 0.5% drop.

The output of capital goods climbed 1.5% in April, energy output rose 1.4%, the production in the construction sector gained 1.3%, while the production of intermediate goods was up 0.7%.

The output of consumer goods declined 0.9%.

Germany's seasonally adjusted trade surplus increased to €22.3 billion in April from €19.4 billion in March. March's figure was revised up from a surplus of €19.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.9% in April, while imports declined 1.3%.

Germany's current account surplus fell to €19.6 billion in April from €27.3 billion in March. March's figure was revised down from a surplus of €27.9 billion.

The uncertainty over the Greek debt crisis continues to weigh on the euro. Greece said last week that it will bundle its IMF loans repayments.

Greek Finance Minister Yanis Varoufakis and his German Finance Minister Wolfgang Schaeuble are due to meet in Berlin later in the day.

The British pound traded slightly higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of Canadian housing market data.

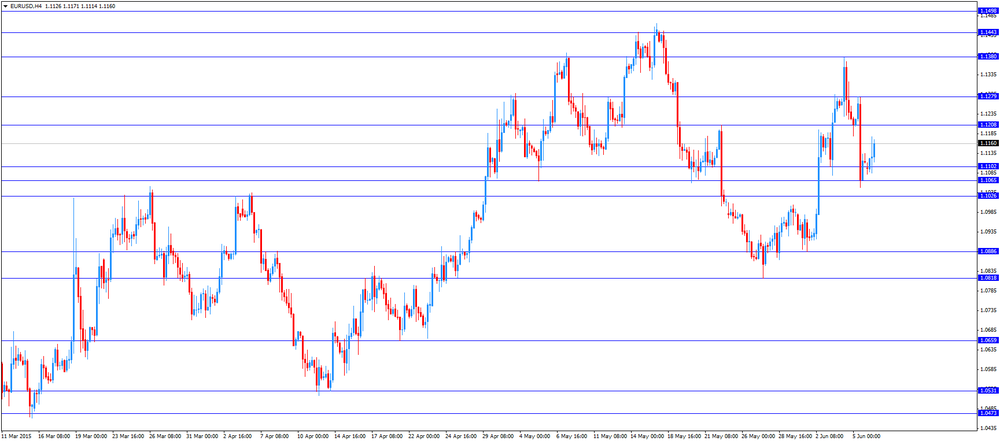

EUR/USD: the currency pair traded mixed

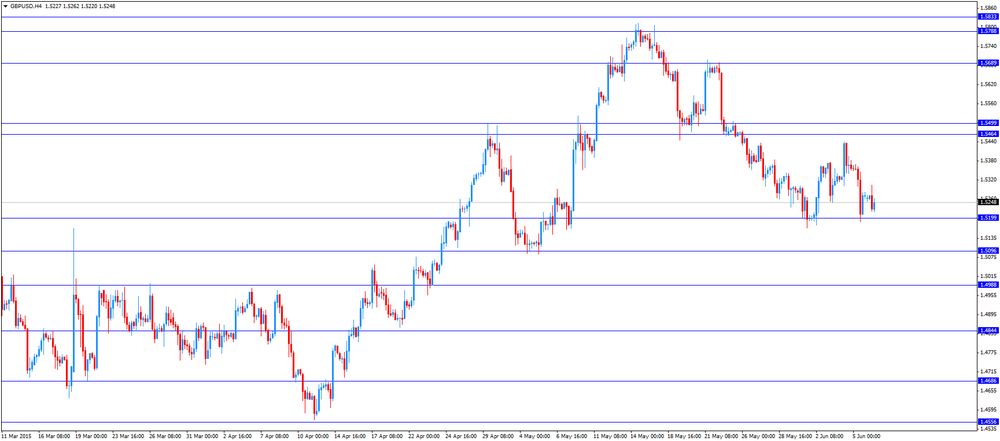

GBP/USD: the currency pair decreased to $1.5220

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

12:15 Canada Housing Starts May 181.8

12:30 Canada Building Permits (MoM) April 11.6%

20:30 Canada Gov Council Member Wilkins Speaks

-

13:45

Orders

EUR/USD

Offers 1.1185 1.1200 1.1220 1.1250 1.1285 1.1300 1.1320 1.1350 1.1380 1.1400

Bids 1.1100 1.1080 1.1050 1.1035 1.1020 1.1000 1.0985 1.0965 1.0950

GBP/USD

Offers 1.5320-25 1.5350 1.5370 1.5385 1.5400 1.5420 1.5450 1.5480 1.5500

Bids 1.5280 1.5265 1.5240 1.5225 1.5200 1.5185 1.5165 1.5150

EUR/GBP

Offers 0.7320 0.7330 0.7350 0.7365 0.7380 0.7400 0.7425-30 0.7450

Bids 0.7285 0.7265 0.7250 (stops if 0.7240 breached) 0.7225-30 0.7200

EUR/JPY

Offers 140.60 140.80 141.00 141.30 141.50 142.00

Bids 139.00 138.60 138.20 138.00

USD/JPY

Offers 125.40 125.60 125.75- 80 126.00 126.25 126.50

Bids 125.00 124.80-85 124.50 124.30 124.00 123.80 123.50

AUD/USD

Offers 0.7650 0.7680 0.7700 0.7720 0.7745 0.7775 0.7800

Bids 0.7620 0.7600 0.7585 0.7550 0.7530 0.7500

-

11:44

Germany's seasonally adjusted trade surplus increases to €22.3 billion in April

Destatis released its trade data for Germany on Monday. Germany's seasonally adjusted trade surplus increased to €22.3 billion in April from €19.4 billion in March. March's figure was revised up from a surplus of €19.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.9% in April, while imports declined 1.3%.

On an annual basis, exports were up 7.5% in April.

Germany's current account surplus fell to €19.6 billion in April from €27.3 billion in March. March's figure was revised down from a surplus of €27.9 billion.

-

11:33

German industrial production climbs 0.9% in April

Destatis released its industrial production data for Germany on Monday. German industrial production rose 0.9% in April, exceeding expectations for a 0.5% gain, after a 0.4% decline in March. March's figure was revised up from a 0.5% drop.

The output of capital goods climbed 1.5% in April, energy output rose 1.4%, the production in the construction sector gained 1.3%, while the production of intermediate goods was up 0.7%.

The output of consumer goods declined 0.9%.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0995-1.1000(E904mn), $1.1100(E1.2bn), $1.1200(E2.3bn)

USD/JPY: Y124.00($900mn), Y125.00($1.16bn), Y125.25($1.1bn), Y125.35($330mn), Y126.75($540mn)

GBP/USD: $1.4900(Gbp1.2bn), $1.5150(Gbp275mn), $1.5415(Gbp1.0bn)

USD/CHF: Chf0.9475($650mn)

AUD/USD: $0.7500(A$400mn), $0.7700-05(A$280mn)

USD/CAD: C$1.2550-55($700mn), C$1.2575($525mn)

-

11:18

Sentix investor confidence index for the Eurozone is down to 17.1 in June

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 17.1 in June from 19.6 in May, missing expectations for a decline to 18.7.

It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis and a stronger euro.

The current conditions index declined to 11.8 in June from 13 in May.

The expectations index remained dropped to 22.5 in June from 26.5 in May.

German investor confidence index plunged to 26.8 in June from 28.2 in May due to a stronger euro, a slower global economic growth and higher long-term yields.

-

11:10

Japan’s current account surplus declines to 1,326 billion yen in April

Japan's Ministry of Finance released its current account data for Japan late Sunday. Japan's current account surplus fell to 1,326 billion yen in April from 2,795 billion yen in March, missing expectations for a surplus of 1,696 billion.

The current account surplus was driven by lower oil prices.

Japan's trade balance deficit was 146.2 billion yen in April, after a surplus of 671.4 billion yen in the previous month.

Exports climbed 4.1% in April, while imports dropped 5.9%.

-

10:50

Japan’s final GDP rises 1.0% in the first quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Sunday. Japan's GDP increased by 1.0% in the first quarter, exceeding expectations for a 0.7% gain, after a 0.3% rise in the fourth quarter. The preliminary estimate was a 0.6% increase.

The upward revision was driven by a rise in business investment, which gained 2.7%, compared with the previous estimate of a 0.4% increase.

Household spending rose at 0.4% in the first quarter.

Exports gained 2.4%, while imports climbed 2.9%.

On a yearly basis, Japan's economy expanded at 3.9% in the first quarter, beating forecasts of 2.7% rise, after a 1.1% increase in the fourth quarter.

-

10:33

Fitch Ratings: Greece’s decision to bundle its IMF loans repayments do not have on Greece's 'CCC' sovereign rating

Fitch Ratings said on Friday that Greece's decision to bundle its IMF loans repayments do not have on Greece's 'CCC' sovereign rating. But this decision was showing an extreme pressure on government funding, Fitch Rating noted.

"Fitch's ratings reflect the risk of default to private rather than official sector creditors, so delaying repayment to the IMF is not in and of itself a ratings default. Nevertheless, bundling this month's repayments illustrates the pressure that a lack of market or official funding and tight liquidity conditions for Greek banks are putting on Greece's sovereign liquidity. Our 'CCC' sovereign rating, affirmed last month, indicates that default on privately held bonds is a real possibility. The risk that Greece misses its larger IMF payment at end-June cannot be discounted. The prospect of fiscal disbursements from Greece's official creditors is highly uncertain", Fitch Ratings said.

-

10:30

Eurozone: Sentix Investor Confidence, June 17.1 (forecast 18.7)

-

10:15

New York Federal Reserve President William Dudley: the interest rate by the Fed later this year is appropriate

The New York Federal Reserve President William Dudley said on Friday that the interest rate by the Fed later this year is appropriate despite the slow economic growth in the second quarter.

He expects the U.S. economy to pick up and the inflation in the U.S. to move back to the Fed's 2% target.

The New York Federal Reserve president pointed out that the timing of the interest rate hike will depend on the economic data.

Dudley is a voting member of the Federal Open Market Committee this year.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 China Trade Balance, bln May 34.13 44.95 59.49

05:00 Japan Eco Watchers Survey: Current May 53.6 53.3

05:00 Japan Eco Watchers Survey: Outlook May 54.2 54.5

Japan's gross domestic product growth was revised sharply higher in the first quarter, data on Monday showed, adding to hopes that its economic recovery is gaining traction. GDP rose an annualized 3.9 percent in the first quarter, higher than the preliminary reading of a 2.4 percent increase.

The Dollar Index, a gauge of the currency versus 10 major peers, was little changed after jumping 0.8 percent on Friday. Employers in the U.S. added 280,000 workers to nonfarm payrolls in May, following April's 221,000 increase.

The euro fell a third day, losing 0.1 percent to $1.1101. U.S. President Barack Obama put concerns over the Greek deadlock onto the agenda of the G-7 summit in southern Germany on Sunday. Greece deferred a payment to the IMF on Friday and needs to crack a deal or get another extension before a euro-area bailout package expires June 30.

EUR / USD: during the Asian session the pair fell to $ 1.1080

GBP / USD: during the Asian session, the pair was trading in the range $1.5250-70

USD / JPY: during the Asian session the pair fell to Y125.30

-

08:16

Germany: Current Account , April 19.6

-

08:16

Germany: Industrial Production (YoY), April 1.4%

-

08:01

Options levels on monday, June 8, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1334 (2488)

$1.1262 (765)

$1.1212 (910)

Price at time of writing this review: $1.1113

Support levels (open interest**, contracts):

$1.1040 (804)

$1.1000 (3101)

$1.0951 (2922)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 41034 contracts, with the maximum number of contracts with strike price $1,1300 (4000);

- Overall open interest on the PUT options with the expiration date July, 2 is 64203 contracts, with the maximum number of contracts with strike price $1,0500 (7652);

- The ratio of PUT/CALL was 1.56 versus 1.15 from the previous trading day according to data from June, 5

GBP/USD

Resistance levels (open interest**, contracts)

$1.5505 (1006)

$1.5408 (537)

$1.5312 (264)

Price at time of writing this review: $1.5271

Support levels (open interest**, contracts):

$1.5189 (689)

$1.5092 (1155)

$1.4995 (902)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 13291 contracts, with the maximum number of contracts with strike price $1,5800 (1315);

- Overall open interest on the PUT options with the expiration date July, 2 is 16295 contracts, with the maximum number of contracts with strike price $1,5250 (1268);

- The ratio of PUT/CALL was 1.23 versus 1.47 from the previous trading day according to data from June, 5

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Industrial Production s.a. (MoM), April 0.9 (forecast 0.5%)

-

08:01

Germany: Trade Balance, April 22.1

-

07:01

Japan: Eco Watchers Survey: Outlook, May 54.5

-

07:00

Japan: Eco Watchers Survey: Current , May 53.3

-

04:12

China: Trade Balance, bln, May 59.49 (forecast 44.95)

-

01:53

Japan: Current Account, bln, April 1376.4 (forecast 1696)

-

01:53

Japan: GDP, y/y, Quarter I 3.9% (forecast 2.7%)

-

01:52

Japan: GDP, q/q, Quarter I 1.0% (forecast 0.7%)

-

00:31

Currencies. Daily history for Jun 5’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1113 -0,99%

GBP/USD $1,5270 -0,56%

USD/CHF Chf0,9394 +0,59%

USD/JPY Y125,61 +0,92%

EUR/JPY Y139,59 -0,06%

GBP/JPY Y191,82 +0,37%

AUD/USD $0,7624 -0,67%

NZD/USD $0,7044 -1,01%

USD/CAD C$1,2439 + 0,28%

-

00:00

Schedule for today, Monday, Jun 8’2015:

(time / country / index / period / previous value / forecast)

01:00 China Trade Balance, bln May 34.13 44.95

05:00 Japan Eco Watchers Survey: Current May 53.6

05:00 Japan Eco Watchers Survey: Outlook May 54.2

06:00 Germany Current Account April 27.9

06:00 Germany Industrial Production s.a. (MoM) April -0.5% 0.5%

06:00 Germany Trade Balance April 23.0

06:00 Germany Industrial Production (YoY) April -0.1%

08:30 Eurozone Sentix Investor Confidence June 19.6 18.7

09:00 G7 G7 Meetings

12:15 Canada Housing Starts May 181.8

12:30 Canada Building Permits (MoM) April 11.6%

14:00 U.S. Labor Market Conditions Index May -1.9

20:30 Canada Gov Council Member Wilkins Speaks

-