Noticias del mercado

-

22:09

US stocks closed

The Standard & Poor's 500 Index fell to a two-month low amid declines in airline and semiconductor shares, as investors considered the timing of an interest-rate increase and the outlook for Greece's debt talks.

Reports on consumer sentiment and retail sales are due this week, both of which are forecast to show an improving economy. Jobs data Friday showed the strongest hiring in five months and the biggest wage gains in two years, bolstering bets the Federal Reserve will raise interest rates this year.

Investors are also looking for signs of progress in negotiations between Greece and its international creditors. With talks to resume in Brussels on Monday, Prime Minister Alexis Tsipras faced a united front from Group of Seven leaders calling for movement to end the impasse and avert the risk of wider economic reverberations.

The S&P 500 posted back-to-back weekly declines for the first time since March as investors weigh equity valuations amid the potential Fed rate increase this year.

Consumer expectations for inflation rebounded in May, according to a Fed Bank of New York survey, as officials look for evidence that price pressures are firming.

In the quarter after the last 12 tightening cycles began, price-earnings ratios on the benchmark index contracted by an average of 7.2 percent. It's something else to worry about as the Fed prepares to lift rates in an economy that is still far from booming.

Should policy makers move before January, they would be doing so in a year when U.S. profits are forecast by analysts to increase 1.4 percent. That represents the weakest growth at the start of a tightening cycle since 1980.

-

21:00

S&P 500 2,081.83 -11.00 -0.53%, NASDAQ 5,034.72 -33.74 -0.67%, Dow 17,823.03 -26.43 -0.15%

-

18:38

WSE: Session Results

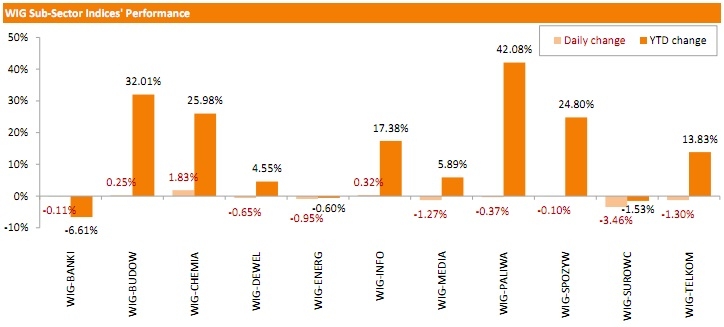

Polish equity market closed lower on Monday with the broad market measure, the WIG Index, losing 0.57 %. From a sector perspective, materials fared the worst, sliding 3.46%. The best-performing sector was chemicals, rising 1.83%.

Large-cap stocks' measure, the WIG30 Index, went down by 0.48%. Almost 2/3 of the 30 companies in the index basket retreated, and coal producers BOGDANKA (WSE: LWB) and JSW (WSE: JSW) performed particularly poorly, falling 6.86% and 6.07% respectively, dragged down by low coal prices on the local market. KGHM (WSE: KGH) was also weak, declining 2.74% on lower copper prices. It was followed by CYFROWY POLSAT (WSE: CPS) and TAURON PE (WSE: TPE), losing nearly 2% each. On the contrary, GRUPA AZOTY (WSE: ATT) and ASSECO POLAND (WSE: ACP) became the biggest advancers, adding above 2.6% each. Other strong stocks included SYNTHOS (WSE: SNS), MBANK (WSE: MBK) and PGNIG (WSE: PGN) gaining 2.09%, 1.38% and 1.05% respectively.

-

18:00

European stocks closed: FTSE 100 6,790.04 -14.56 -0.21 %, CAC 40 4,857.66 -63.08 -1.28 %, DAX 11,064.92 -132.23 -1.18 %

-

18:00

European stocks close: stocks closed lower on the uncertainty over the Greek debt crisis

Stock indices closed lower on the uncertainty over the Greek debt crisis. Greece said last week that it will bundle its IMF loans repayments.

Greek Prime Minister Alexi Tsipras said to the Greek parliament last Friday that creditors' proposal is "unrealistic".

Greek Finance Minister Yanis Varoufakis and his German Finance Minister Wolfgang Schaeuble are due to meet in Berlin later in the day.

Meanwhile, the economic data from the Eurozone was mixed. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 17.1 in June from 19.6 in May, missing expectations for a decline to 18.7. It was the lowest level since February.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis and a stronger euro.

German investor confidence index plunged to 26.8 in June from 28.2 in May due to a stronger euro, a slower global economic growth and higher long-term yields.

German industrial production rose 0.9% in April, exceeding expectations for a 0.5% gain, after a 0.4% decline in March. March's figure was revised up from a 0.5% drop.

The output of capital goods climbed 1.5% in April, energy output rose 1.4%, the production in the construction sector gained 1.3%, while the production of intermediate goods was up 0.7%.

The output of consumer goods declined 0.9%.

Germany's seasonally adjusted trade surplus increased to €22.3 billion in April from €19.4 billion in March. March's figure was revised up from a surplus of €19.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.9% in April, while imports declined 1.3%.

Germany's current account surplus fell to €19.6 billion in April from €27.3 billion in March. March's figure was revised down from a surplus of €27.9 billion.

The European Central Bank (ECB) Governing Council Member Christian Noyer said on Monday that quantitative easing seems to work. But he added that European governments needed to speed up their structural reforms.

The International Monetary Fund (IMF) released its gross domestic product (GDP) forecasts for Spain on Monday. The IMF expects the Spanish economy to expand at 3.1% this year and 2.5% in 2016.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,790.04 -14.56 -0.21 %

DAX 11,064.92 -132.23 -1.18 %

CAC 40 4,857.66 -63.08 -1.28 %

-

17:05

International Monetary Fund expects the Spanish economy to expand at 3.1% this year

The International Monetary Fund (IMF) released its gross domestic product (GDP) forecasts for Spain on Monday. The IMF expects the Spanish economy to expand at 3.1% this year and 2.5% in 2016.

According to the IMF, Spain should implement additional reforms to reduce the unemployment.

The IMF noted that the Spanish economy was supported by lower energy prices, a weaker euro and quantitative easing by the European Central Bank.

Spain should continue to lower private debt and budget deficits, the IMF noted.

-

16:58

European Central Bank (ECB) Governing Council Member Christian Noyer: quantitative easing seems to work

The European Central Bank (ECB) Governing Council Member Christian Noyer said on Monday that quantitative easing seems to work. But he added that European governments needed to speed up their structural reforms.

-

16:43

Pace of asset buying by the ECB rises last week

The European Central Bank (ECB) purchased €12.921 billion of assets last week. The central bank said on Monday it had settled a total of €159.600 billion of purchases of mainly government bonds as of June 5, up from €146.679 billion the previous week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB also said that it bought €2.169 billion of covered bonds last week, and €282 million of asset-backed securities. Covered bonds programmes totalled €87.277 billion, while asset-backed securities programmes totalled €7.494 billion.

-

15:55

U.K. economic growth remained unbalanced, according to Moody's Investors Service’s report

Moody's Investors Service said its report regarding the U.K. economy on Monday. Moody's expects the U.K. economy to expand at 2.7% in 2015 and 2.4% in 2016.

The Senior Credit Officer at Moody's Kathrin Muehlbronner noted that the U.K. economic growth remained unbalanced and was driven by domestic demand and the services sector.

According to the report, the UK's debt ratio is expected to be 91.5% of GDP in 2016.

The agency named to risks, which could have an impact on the UK's sovereign rating: the referendum on EU membership and the accelerated pace of decentralisation of fiscal powers to Scotland and other regions and cities.

-

15:34

U.S. Stocks open: Dow -0.16%, Nasdaq -0.11%, S&P -0.16%

-

15:34

OECD’s leading indicator remains unchanged at 100.1 in April

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator remained unchanged at 100.1 in April. It signalled stable growth in the United Kingdom, Germany, Japan and India.

There were signs of positive growth momentum in the Eurozone, especially in France and Italy.

The index for the U.S., Canada and China pointed to an easing in growth momentum.

The index for Russia showed signs of positive change in growth momentum.

-

15:25

Before the bell: S&P futures -0.14%, NASDAQ futures -0.17%

U.S. stocks were set to open modestly lower on Monday as investors digested Friday's strong jobs data, which increased expectations that the Federal Reserve could raise interest rates as soon as September.

Global markets:

Nikkei 20,457.19 -3.71 -0.02%

Hang Seng 27,316.28 +56.12 +0.21%

Shanghai Composite 5,131.88 +108.79 +2.17%

FTSE 6,811.8 +7.20 +0.11%

CAC 4,888.5 -32.24 -0.66%

DAX 11,121.28 -75.87 -0.68%

Crude oil $58.90 (-0.41%)

Gold $1171.50 (+0.29%)

-

15:06

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Goldman Sachs

GS

210.48

+0.01%

30.8K

Home Depot Inc

HD

110.40

+0.03%

3.7K

General Electric Co

GE

27.30

+0.04%

6.3K

Microsoft Corp

MSFT

46.16

+0.04%

10.6K

Citigroup Inc., NYSE

C

56.26

+0.04%

7.9K

Cisco Systems Inc

CSCO

28.60

+0.07%

3.3K

ALCOA INC.

AA

12.43

+0.08%

3.6K

JPMorgan Chase and Co

JPM

67.50

+0.12%

0.6K

Merck & Co Inc

MRK

59.06

+0.12%

4.4K

The Coca-Cola Co

KO

40.15

+0.12%

0.1K

General Motors Company, NYSE

GM

34.80

+0.12%

0.8K

AMERICAN INTERNATIONAL GROUP

AIG

60.60

+0.17%

0.3K

Google Inc.

GOOG

534.21

+0.17%

0.3K

Apple Inc.

AAPL

128.89

+0.19%

144.7K

Hewlett-Packard Co.

HPQ

32.82

+0.23%

0.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.70

+0.25%

5.3K

Ford Motor Co.

F

14.83

+0.34%

11.6K

Barrick Gold Corporation, NYSE

ABX

11.51

+0.35%

4.6K

Wal-Mart Stores Inc

WMT

73.40

+0.47%

33.1K

Procter & Gamble Co

PG

77.80

+0.48%

385.2K

AT&T Inc

T

34.74

+0.49%

4.8K

McDonald's Corp

MCD

96.11

+0.60%

3.5K

Tesla Motors, Inc., NASDAQ

TSLA

250.85

+0.69%

16.9K

Yandex N.V., NASDAQ

YNDX

17.74

+1.03%

1.1K

E. I. du Pont de Nemours and Co

DD

69.07

0.00%

2.0K

Exxon Mobil Corp

XOM

84.28

0.00%

2.0K

Verizon Communications Inc

VZ

47.23

0.00%

1K

Amazon.com Inc., NASDAQ

AMZN

426.95

0.00%

0.3K

Twitter, Inc., NYSE

TWTR

37.00

0.00%

47.2K

Johnson & Johnson

JNJ

98.58

-0.01%

0.3K

FedEx Corporation, NYSE

FDX

182.18

-0.03%

0.6K

Walt Disney Co

DIS

110.25

-0.05%

2.6K

Chevron Corp

CVX

101.53

-0.06%

11.6K

Intel Corp

INTC

31.82

-0.06%

15.4K

Starbucks Corporation, NASDAQ

SBUX

52.16

-0.06%

4.4K

ALTRIA GROUP INC.

MO

48.17

-0.08%

4.7K

American Express Co

AXP

79.30

-0.11%

0.7K

Facebook, Inc.

FB

82.05

-0.11%

29.5K

Caterpillar Inc

CAT

85.94

-0.13%

0.1K

International Business Machines Co...

IBM

167.00

-0.24%

0.4K

Yahoo! Inc., NASDAQ

YHOO

42.70

-0.26%

0.1K

Visa

V

68.15

-0.32%

0.5K

-

15:01

Building permits in Canada jump 11.6% in April

Statistics Canada released housing market data on Monday. Building permits in Canada rose 11.6% in April, after a 13.6% gain in March.

March's figure was revised up from a 11.6% rise.

The increase was partly driven by a rise in construction permits in the residential and non-residential sectors in Ontario.

Building permits for non-residential construction jumped 30.2% in April, while permits in the residential sector rose 1.2%.

-

14:59

Upgrades and downgrades before the market open

Upgrades:

Tesla (TSLA) target raised to $335 from $275 at Robert W. Baird

Downgrades:

Other:

Wal-Mart (WMT) upgraded to Strong Buy from Outperform at Raymond James

-

14:45

Housing starts in Canada declines to a seasonally adjusted annualized rate of 201,705 units in May

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 201,705 units in May from a revised reading of 183,329 units in April. April's figure revised up from 181,814 units.

The increase was driven by higher multiple starts in Ontario, the Atlantic region, and Québec.

"CMHC also forecasts slight moderation in housing starts in 2015 and 2016, reflecting a slowdown in housing market activity in oil-producing provinces that will partly be offset by increased activity in provinces that are seeing the positive impacts of low oil prices," the CMHC's Chief Economist Bob Dugan said.

-

14:39

Bank of France expects the country’s economy to expand at 0.3% in the second quarter

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.3% in the second quarter due to a rise in industrial production and services activity.

The manufacturing business confidence index climbed to 99 in May from 98 in April due to an increase in agri-food, automobile, and pharmaceutical sectors.

The services business sentiment index remained unchanged at 95.

The construction business sentiment index was up to 93 in May from 92 in April.

-

14:21

The Confederation of British Industry downgrades its U.K. GDP forecasts

The Confederation of British Industry (CBI) downgraded its U.K. gross domestic product (GDP) growth estimates on Monday. The U.K. economy is expected to expand at 2.4% in 2015 and at 2.5% in 2016, down from its February estimate of 2.7% and 2.6% respectively.

"The recovery has built up a good head of steam and we expect to see solid, steady and sustainable growth carrying through into next year. Risks remain in the form of economic instability in Greece and a sluggish Eurozone, and clearly the EU referendum is a hot topic in Britain's boardrooms. Businesses now have certainty that the referendum is happening, but not the outcome," the CBI Director-General John Cridland said.

-

12:02

European stock markets mid session: most stocks traded lower on the uncertainty over the Greek debt crisis

Most stock indices traded lower on the uncertainty over the Greek debt crisis. Greece said last week that it will bundle its IMF loans repayments.

Greek Finance Minister Yanis Varoufakis and his German Finance Minister Wolfgang Schaeuble are due to meet in Berlin later in the day.

Meanwhile, the economic data from the Eurozone was mixed. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 17.1 in June from 19.6 in May, missing expectations for a decline to 18.7. It was the lowest level since February.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis and a stronger euro.

German investor confidence index plunged to 26.8 in June from 28.2 in May due to a stronger euro, a slower global economic growth and higher long-term yields.

German industrial production rose 0.9% in April, exceeding expectations for a 0.5% gain, after a 0.4% decline in March. March's figure was revised up from a 0.5% drop.

The output of capital goods climbed 1.5% in April, energy output rose 1.4%, the production in the construction sector gained 1.3%, while the production of intermediate goods was up 0.7%.

The output of consumer goods declined 0.9%.

Germany's seasonally adjusted trade surplus increased to €22.3 billion in April from €19.4 billion in March. March's figure was revised up from a surplus of €19.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.9% in April, while imports declined 1.3%.

Germany's current account surplus fell to €19.6 billion in April from €27.3 billion in March. March's figure was revised down from a surplus of €27.9 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,805.03 +0.43 +0.01 %

DAX 11,145.38 -51.77 -0.46 %

CAC 40 4,896.27 -24.47 -0.50 %

-

11:44

Germany's seasonally adjusted trade surplus increases to €22.3 billion in April

Destatis released its trade data for Germany on Monday. Germany's seasonally adjusted trade surplus increased to €22.3 billion in April from €19.4 billion in March. March's figure was revised up from a surplus of €19.3 billion.

Exports climbed at a seasonally and calendar-adjusted 1.9% in April, while imports declined 1.3%.

On an annual basis, exports were up 7.5% in April.

Germany's current account surplus fell to €19.6 billion in April from €27.3 billion in March. March's figure was revised down from a surplus of €27.9 billion.

-

11:33

German industrial production climbs 0.9% in April

Destatis released its industrial production data for Germany on Monday. German industrial production rose 0.9% in April, exceeding expectations for a 0.5% gain, after a 0.4% decline in March. March's figure was revised up from a 0.5% drop.

The output of capital goods climbed 1.5% in April, energy output rose 1.4%, the production in the construction sector gained 1.3%, while the production of intermediate goods was up 0.7%.

The output of consumer goods declined 0.9%.

-

11:18

Sentix investor confidence index for the Eurozone is down to 17.1 in June

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 17.1 in June from 19.6 in May, missing expectations for a decline to 18.7.

It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

The Eurozone's recovery was offset by the uncertainty over the Greek debt crisis and a stronger euro.

The current conditions index declined to 11.8 in June from 13 in May.

The expectations index remained dropped to 22.5 in June from 26.5 in May.

German investor confidence index plunged to 26.8 in June from 28.2 in May due to a stronger euro, a slower global economic growth and higher long-term yields.

-

11:10

Japan’s current account surplus declines to 1,326 billion yen in April

Japan's Ministry of Finance released its current account data for Japan late Sunday. Japan's current account surplus fell to 1,326 billion yen in April from 2,795 billion yen in March, missing expectations for a surplus of 1,696 billion.

The current account surplus was driven by lower oil prices.

Japan's trade balance deficit was 146.2 billion yen in April, after a surplus of 671.4 billion yen in the previous month.

Exports climbed 4.1% in April, while imports dropped 5.9%.

-

10:50

Japan’s final GDP rises 1.0% in the first quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Sunday. Japan's GDP increased by 1.0% in the first quarter, exceeding expectations for a 0.7% gain, after a 0.3% rise in the fourth quarter. The preliminary estimate was a 0.6% increase.

The upward revision was driven by a rise in business investment, which gained 2.7%, compared with the previous estimate of a 0.4% increase.

Household spending rose at 0.4% in the first quarter.

Exports gained 2.4%, while imports climbed 2.9%.

On a yearly basis, Japan's economy expanded at 3.9% in the first quarter, beating forecasts of 2.7% rise, after a 1.1% increase in the fourth quarter.

-

10:33

Fitch Ratings: Greece’s decision to bundle its IMF loans repayments do not have on Greece's 'CCC' sovereign rating

Fitch Ratings said on Friday that Greece's decision to bundle its IMF loans repayments do not have on Greece's 'CCC' sovereign rating. But this decision was showing an extreme pressure on government funding, Fitch Rating noted.

"Fitch's ratings reflect the risk of default to private rather than official sector creditors, so delaying repayment to the IMF is not in and of itself a ratings default. Nevertheless, bundling this month's repayments illustrates the pressure that a lack of market or official funding and tight liquidity conditions for Greek banks are putting on Greece's sovereign liquidity. Our 'CCC' sovereign rating, affirmed last month, indicates that default on privately held bonds is a real possibility. The risk that Greece misses its larger IMF payment at end-June cannot be discounted. The prospect of fiscal disbursements from Greece's official creditors is highly uncertain", Fitch Ratings said.

-

10:15

New York Federal Reserve President William Dudley: the interest rate by the Fed later this year is appropriate

The New York Federal Reserve President William Dudley said on Friday that the interest rate by the Fed later this year is appropriate despite the slow economic growth in the second quarter.

He expects the U.S. economy to pick up and the inflation in the U.S. to move back to the Fed's 2% target.

The New York Federal Reserve president pointed out that the timing of the interest rate hike will depend on the economic data.

Dudley is a voting member of the Federal Open Market Committee this year.

-

04:02

Nikkei 225 20,387.74 -73.16 -0.36 %,Hang Seng 27,199.02 -61.14 -0.22 %, Shanghai Composite 5,038.88 +15.79 +0.31 %

-

00:33

Stocks. Daily history for Jun 5’2015:

(index / closing price / change items /% change)

Nikkei 225 20,460.9 -27.29 -0.13 %

Hang Seng 27,260.16 -291.73 -1.06 %

S&P/ASX 200 5,498.46 -5.84 -0.11 %

Shanghai Composite 5,023.1 +75.99 +1.54 %

FTSE 100 6,804.6 -54.64 -0.80 %

CAC 40 4,920.74 -66.39 -1.33 %

Xetra DAX 11,197.15 -143.45 -1.26 %

S&P 500 2,092.83 -3.01 -0.14 %

NASDAQ Composite 5,068.46 +9.33 +0.18 %

Dow Jones 17,849.46 -56.12 -0.31 %

-