Noticias del mercado

-

21:01

Dow -0.21% 17,868.61 -36.97 Nasdaq +0.30% 5,074.27 +15.14 S&P -0.00% 2,095.82 -0.02

-

18:54

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes on Friday after data showed that U.S. job growth rose sharply in May and wages picked up, signs of momentum in the economy that revived expectations of an interest rate hike in September. The strong jobs data indicated that growth was gaining traction, but Wall Street took a dim view as a rate hike could increase the cost of borrowing. Traders are now betting the Fed will start raising interest rates as soon as October, and will make a second increase early next year. The Fed has kept overnight rates near zero since December 2008 and the economy's sluggishness had raised doubts the Fed would be able to raise rates this year.

Most of Dow stocks in negative area (25 of 30). Top looser - Verizon Communications Inc. (VZ, -1.56%). Top giner - JPMorgan Chase & Co. (JPM, +1.70%).

All S&P index sectors in negative area. Top looser - Utilities (-1.2%).

At the moment:

Dow 17849.00 -76.00 -0.42%

S&P 500 2091.50 -7.50 -0.36%

Nasdaq 100 4476.50 -20.00 -0.44%

10-year yield 2.39% +0.08

Oil 57.67 -0.33 -0.57%

Gold 1167.20 -8.00 -0.68%

-

18:47

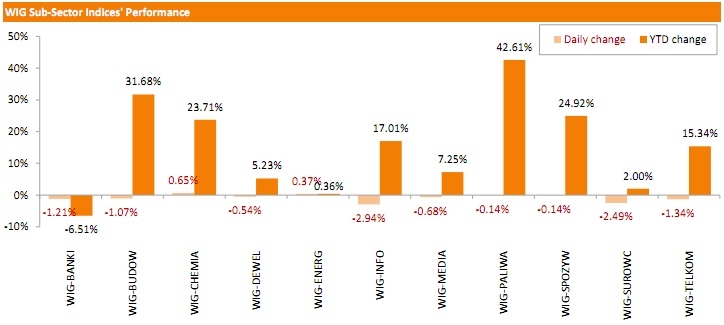

WSE: Session Results

Friday preserved a downward tendency in Polish equity market. The broad market measure - the WIG index slipped 0.86%.Chemicals and utilities were the only sectors, which posted positive results (+0.65% and +0.37% respectively). At the same time, IT (-2.94%) was the worst-performing sector, followed by basic materials (-2.49%).

Large-cap stocks benchmark - the WIG30 index underperformed the broad market, posting a 0.96% drop. ASSECO POLAND (WSE: ACP) was the sharpest decliner among the indicator's constituents with its shares' quotations being beaten down 4.34%. It was followed by MBANK (WSE: MBK), dropping 3.77%. LPP (WSE: LPP), LOTOS (WSE: LTS) and ING BSK (WSE: ING) lost nearly 3% each. On the other side of the ledger, GRUPA AZOTY (WSE: ATT) and PGNIG (WSE: PGN) were recorded as the biggest gainers, advancing 2.70% and 2.62% respectively.

-

18:04

European stocks close: stocks closed lower on the Greek debt problem

Stock indices closed lower on the Greek debt problem. According to the IMF and Greek officials, Athens plans to bundle its repayment of IMF loans. Greece have to repay of around $1.7 billion IMF loans. Greece had to repay its IMF loans on June 5, 12, 16 and 19.

German government bonds posted their worst weekly loss since 1999.

Meanwhile, the economic data from the Eurozone was better than expected. German seasonal adjusted factory orders jumped 1.4% in April, exceeding expectations for a 0.5% increase, after a 1.1% rise in March. March's figure was revised up from a 0.9% gain.

The increase was driven by a rise in foreign orders. Foreign orders climbed by 5.5% in April, while domestic orders dropped by 3.8%.

New orders from the Eurozone rose 6.8% in April, while orders from other countries increased 4.7%.

The intermediate goods declined by 0.9% in April, capital goods orders were up 2.3%, while consumer goods orders increased 4.5%.

Bundesbank upgraded its growth forecasts for 2015 and 2016 for Germany. The growth is expected to be 1.7% in 2015, up from the previous estimate of 1.0%, and 1.8% in 2016, up from the previous estimate of 1.6%.

According to the French Customs, France's trade deficit narrowed to €3.0 billion in April from €4.41 billion in March. March's figure was revised down from a deficit of €4.58 billion.

Exports rose 1.4% in April, imports declined 2.1%.

The Bank of England (BoE) released its quarterly survey. Consumer inflation expectations for the coming year in the UK rose to 2.2% in May from 1.9% in February. February's reading was the lowest level since late 2001.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,804.6 -54.64 -0.80 %

DAX 11,197.15 -143.45 -1.26 %

CAC 40 4,920.74 -66.39 -1.33 %

-

18:00

European stocks closed: FTSE 100 6,804.6 -54.64 -0.80% CAC 40 4,920.74 -66.39 -1.33% DAX 11,197.15 -143.45 -1.26%

-

16:01

British Chambers of Commerce downgrades its U.K. GDP growth forecast

The British Chambers of Commerce released its U.K. GDP growth forecast on Friday. The U.K. economy is expected to grow at 2.3% in 2015, down from the previous forecast of a 2.7% rise.

According to the British Chambers of Commerce, the slowdown is temporary.

While this slowdown will serve as a warning about the strength of our economic recovery, we believe the UK will secure steady growth in the years to come," John Longworth, Director General of the British Chambers of Commerce, said.

-

15:53

Bundesbank upgrades its growth forecasts for 2015 and 2016 for Germany

Bundesbank upgraded its growth forecasts for 2015 and 2016 for Germany. The growth is expected to be 1.7% in 2015, up from the previous estimate of 1.0%, and 1.8% in 2016, up from the previous estimate of 1.6%.

German economy is expected to grow at 1.5% in 2017.

"The German economy has recovered from the lull in mid-2014 more quickly than expected and has returned to a path of growth that is supported by both internal and external demand," the Bundesbank said.

Bundesbank President Jens Weidmann said that a sharp increase in the exchange rate will be downside risks to the economy.

-

15:33

U.S. Stocks open: Dow -0.04%, Nasdaq -0.12%, S&P -0.13%

-

15:33

China’s central bank plans to remove the ceiling on bank deposit rates

According to China Business News, China's central bank plans to remove the ceiling on bank deposit rates rather than raising the cap again.

"I believe removal of the ceiling on deposit rates is not far off," Sheng Songcheng, head of the People's Bank of China's (PBOC) statistics department, said.

-

15:27

Before the bell: S&P futures -0.38%, NASDAQ futures -0.42%

U.S. stock-index futures declined, as employment data bolstered the case for raising interest rates this year.

Global markets:

Nikkei 20,460.9 -27.29 -0.13%

Hang Seng 27,260.16 -291.73 -1.06%

Shanghai Composite 5,023.1 +75.99 +1.54%

FTSE 6,799.17 -60.07 -0.88%

CAC 4,931.19 -55.94 -1.12%

DAX 11,238.6 -102.00 -0.90%

Crude oil $58.18 (+0.22%)

Gold $1167.50 (-0.67%)

-

15:13

U.S. unemployment rate rises to 5.5% in May, 280,000 jobs are added

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 280,000 jobs in May, exceeding expectations for a rise of 225,000 jobs, after a gain of 221,000 jobs in April. It was the largest increase since December.

April's figure was revised down from a rise of 223,000 jobs.

The strongest job gains showed professional and business services, leisure and hospitality and health care.

The U.S. unemployment rate rose to 5.5% in May from 5.4% in April. Analysts had expected the unemployment rate to remain unchanged at 5.4%.

The increase was driven by people entering the labour force in search of work.

Average hourly earnings increased 0.3% in May, beating forecasts of a 0.2% gain, after a 0.1% rise in April.

The labour-force participation rate was up to 62.9% in May from 62.8% in April.

These figures are signs that the labour market in the U.S. continued to strengthen. But the Fed may delay to hike its interest rate due to the weak wage growth figures and low inflation and mixed U.S. economic data in the recent months.

The U.S. economy declined 0.7% in the first quarter.

-

15:04

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

ALTRIA GROUP INC.

MO

49.90

+0.04%

3.2K

Visa

V

68.25

+0.06%

4.8K

Starbucks Corporation, NASDAQ

SBUX

51.75

+0.06%

1.6K

Apple Inc.

AAPL

129.58

+0.17%

300.3K

Chevron Corp

CVX

101.60

+0.21%

2.9K

Twitter, Inc., NYSE

TWTR

36.80

+0.25%

63.2K

Travelers Companies Inc

TRV

100.57

+0.36%

2.5K

HONEYWELL INTERNATIONAL INC.

HON

104.28

+0.54%

11.0K

Goldman Sachs

GS

210.38

+0.72%

6.3K

Citigroup Inc., NYSE

C

55.76

+0.78%

36.9K

JPMorgan Chase and Co

JPM

66.90

+0.86%

5.4K

Microsoft Corp

MSFT

46.36

0.00%

8.7K

ALCOA INC.

AA

12.50

0.00%

0.1K

Hewlett-Packard Co.

HPQ

33.30

0.00%

6.8K

Google Inc.

GOOG

536.50

-0.04%

0.2K

Procter & Gamble Co

PG

78.11

-0.05%

6.5K

Wal-Mart Stores Inc

WMT

74.11

-0.05%

1.0K

Exxon Mobil Corp

XOM

84.16

-0.07%

2.8K

Ford Motor Co.

F

15.04

-0.07%

0.6K

American Express Co

AXP

79.30

-0.08%

2.9K

International Business Machines Co...

IBM

168.25

-0.08%

0.8K

Yahoo! Inc., NASDAQ

YHOO

42.83

-0.12%

7.0K

E. I. du Pont de Nemours and Co

DD

69.60

-0.13%

3.0K

Walt Disney Co

DIS

110.16

-0.13%

10.4K

Caterpillar Inc

CAT

85.35

-0.14%

2.6K

Cisco Systems Inc

CSCO

28.57

-0.14%

13.4K

Intel Corp

INTC

32.26

-0.15%

13.5K

Johnson & Johnson

JNJ

99.08

-0.15%

6.1K

General Motors Company, NYSE

GM

35.48

-0.17%

1.8K

Amazon.com Inc., NASDAQ

AMZN

430.00

-0.18%

2.0K

Home Depot Inc

HD

111.25

-0.19%

1.1K

Pfizer Inc

PFE

34.17

-0.20%

5.3K

Verizon Communications Inc

VZ

48.00

-0.21%

13.7K

3M Co

MMM

158.00

-0.22%

0.1K

General Electric Co

GE

27.20

-0.22%

6.6K

The Coca-Cola Co

KO

40.50

-0.22%

0.2K

AT&T Inc

T

35.19

-0.23%

5.9K

Facebook, Inc.

FB

81.86

-0.23%

44.2K

Merck & Co Inc

MRK

59.33

-0.24%

0.2K

Tesla Motors, Inc., NASDAQ

TSLA

245.30

-0.25%

3.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.47

-0.26%

13.6K

Boeing Co

BA

140.75

-0.31%

0.5K

Nike

NKE

101.61

-0.33%

0.6K

United Technologies Corp

UTX

116.75

-0.33%

0.6K

UnitedHealth Group Inc

UNH

116.16

-0.42%

0.9K

McDonald's Corp

MCD

95.91

-0.42%

0.1K

Barrick Gold Corporation, NYSE

ABX

11.58

-0.94%

3.4K

Yandex N.V., NASDAQ

YNDX

17.40

-0.97%

4.4K

-

14:52

Canada’s economy adds 58,900 jobs in May

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 6.8% in May, in line with expectations.

The number of employed people rose by 58,900 jobs in May, exceeding expectations for a gain of 10,000 jobs, after a 19,700 drop in April.

The increase was driven by a rise driven in the number of private sector employees. Private companies added 56,800 workers in May, while public- sector employment declined by 19,100.

Part-time employment in May rose by 27,900 jobs, while full-time work climbed by 30,900.

Employment in the service sector was up by 48,600 in May, while the manufacturing sector adds 21,500 positions.

The labour participation rate increased to 65.9% in May from 65.8 in April.

The Bank of Canada monitors closely the labour participation rate.

-

14:25

Industrial production in Spain increases 0.1% in April

Spanish statistical office INE released its industrial production figures for Spain on Friday. Industrial production in Spain was up 0.1% in April, after a 1.2% gain in March.

On a yearly basis, industrial production in Spain climbed at adjusted 1.8% in April, after a revised 3.2% increase in March.

The increase was driven by a rise in all subindexes. Output of capital goods rose 1.2% in April, output of intermediate goods climbed 4.2%, while energy and consumer goods production was up 0.2% each.

-

13:58

Markit’s Emerging Markets Index declines to 50.7 in May

Markit Economics and HSBC Bank released its index the emerging markets on Thursday. The Emerging Markets Index fell to 50.7 in May from 51.3 in March. It was the lowest level since May 2014.

A reading above 50 indicates an expansion of the activity.

The fall was driven by a decline in services and manufacturing sectors.

"Growth of emerging markets ground almost to a halt in May, according to the latest PMI surveys, highlighting the deepening malaise facing many parts of the global economy," Markit's Chief Economist Chris Williamson noted.

-

12:00

European stock markets mid session: stocks traded lower as German government bonds declined

Stock indices traded lower as German government bonds declined. Yields of German government bonds rose. Rising yields of government bonds indicate their sales, the cause of which may be the fears of a possible Greek default.

According to the IMF and Greek officials, Athens plans to bundle its repayment of IMF loans. Greece have to repay of around $1.7 billion IMF loans. Greece had to repay its IMF loans on June 5, 12, 16 and 19.

Meanwhile, the economic data from the Eurozone was better than expected. German seasonal adjusted factory orders jumped 1.4% in April, exceeding expectations for a 0.5% increase, after a 1.1% rise in March. March's figure was revised up from a 0.9% gain.

The increase was driven by a rise in foreign orders. Foreign orders climbed by 5.5% in April, while domestic orders dropped by 3.8%.

New orders from the Eurozone rose 6.8% in April, while orders from other countries increased 4.7%.

The intermediate goods declined by 0.9% in April, capital goods orders were up 2.3%, while consumer goods orders increased 4.5%.

Bundesbank upgraded its growth forecasts for 2015 and 2016 for Germany. The growth is expected to be 1.7% in 2015, up from the previous estimate of 1.0%, and 1.8% in 2016, up from the previous estimate of 1.6%.

According to the French Customs, France's trade deficit narrowed to €3.0 billion in April from €4.41 billion in March. March's figure was revised down from a deficit of €4.58 billion.

Exports rose 1.4% in April, imports declined 2.1%.

The Bank of England (BoE) released its quarterly survey. Consumer inflation expectations for the coming year in the UK rose to 2.2% in May from 1.9% in February. February's reading was the lowest level since late 2001.

Current figures:

Name Price Change Change %

FTSE 100 6,813.35 -45.89 -0.67 %

DAX 11,233.36 -107.24 -0.95 %

CAC 40 4,935.57 -51.56 -1.03 %

-

11:44

France's trade deficit narrows to €3.0 billion in April

According to the French Customs, France's trade deficit narrowed to €3.0 billion in April from €4.41 billion in March. March's figure was revised down from a deficit of €4.58 billion.

Exports rose 1.4% in April, imports declined 2.1%.

On a yearly basis, exports increased 4.4% in April, while imports climbed by 2.1%.

-

11:38

German seasonal adjusted factory orders jumps 1.4% in April

Destatis released its factory orders data for Germany on Friday. German seasonal adjusted factory orders jumped 1.4% in April, exceeding expectations for a 0.5% increase, after a 1.1% rise in March. March's figure was revised up from a 0.9% gain.

The increase was driven by a rise in foreign orders. Foreign orders climbed by 5.5% in April, while domestic orders dropped by 3.8%.

New orders from the Eurozone rose 6.8% in April, while orders from other countries increased 4.7%.

The intermediate goods declined by 0.9% in April, capital goods orders were up 2.3%, while consumer goods orders increased 4.5%.

-

11:27

Consumer inflation expectations for the coming year in the UK rise to 2.2% in May

The Bank of England (BoE) released its quarterly survey. Consumer inflation expectations for the coming year in the UK rose to 2.2% in May from 1.9% in February. February's reading was the lowest level since late 2001.

Inflation expectations for coming two years in the U.K. climbed to 2.3% in May from 2.1% in February.

Consumer price inflation declined 0.1% in April.

-

11:15

Canada’s Ivey purchasing managers’ index climbs to 62.3 in May

Canada's seasonally adjusted Ivey purchasing managers' index rose to 62.3 in May from 58.2 in April. Analysts had expected the index to decline to 55.5.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The increase was driven by a rise in employment and inventory levels. The employment index was up to 51.8 in May from 50.3 in April, while inventories index rose to 59.5 from 53.2.

-

11:07

IMF: the Fed should delay its first interest rate hike until the first half of 2016

The International Monetary Fund (IMF) released its growth forecasts for the U.S. The IMF downgraded its growth forecast to 2.5% in 2015 from the previous forecast of 3.1%, and to 3.0% in 2016 from the previous forecast of 3.1%.

Inflation is expected to be 0.7% in 2015 and 1.5% in 2016, the unemployment is expected to be 5.3% in 2015 and 5.2% in 2016, while the budget deficit is expected to be 2.7% of the GDP in 2015 and 2.9% of the GDP in 2016.

The IMF noted that the slowdown in the U.S. economy was driven by harsh weather, a sharp contraction in oil sector investment, the West Coast port strike, and the stronger U.S. dollar. According to the IMF, these effects were temporary.

The IMF said that the Fed should delay its first interest rate hike until the first half of 2016.

-

10:58

European Central Bank (ECB) Governing Council Member Erkki Liikanen: the central bank will continue its asset buying programme until the annual rate of inflation close to but below 2%

European Central Bank (ECB) Governing Council Member and the President of the Bank of Finland Erkki Liikanen said on Thursday that the central bank will continue its asset buying programme until the annual rate of inflation close to but below 2%.

The ECB's asset buying programme is set to run until September 2016.

Liikanen noted that quantitative easing has already had a positive impact.

"This policy set-up that is giving strong support to the economy is bound to continue for an extended period of time," he said.

-

10:47

Bank of France expects the French economy to expand at an average 1.2% in 2015

The Bank of France released its growth forecasts on Thursday. France's central bank expects the French economy to expand at an average 1.2% in 2015, 1.8% in 2016 and 1.9% in 2017.

Low oil prices, a weaker euro and quantitative easing by the European Central Bank (ECB) is expected to support the economic growth.

The ILO employment rate is expected to increase to 10.3% in 2015 and to 10.1% in 2016.

The Bank of France forecasts the budget deficit to decline to 1.6% of GDP in 2015 and 2016 as a result of declining energy bill.

Increase in oil prices, a stronger euro and geopolitical tensions are downside risks to forecasts.

-

10:34

German Chancellor Angela Merkel is confident conditions can be created to keep the U.K. in the EU

German Chancellor Angela Merkel said in a BBC interview that she was confident conditions can be created to keep the U.K. in the EU.

"I'm optimistic that if we all want it, we'll find a good solution. It's not about losing sleep over this, but about doing our work and creating the necessary preconditions for Britain to remain in the EU," Merkel noted.

-

10:18

Athens plans to bundle its repayment of IMF loans

According to the IMF and Greek officials, Athens plans to bundle its repayment of IMF loans. Greece have to repay of around $1.7 billion IMF loans.

"The Greek authorities have informed the Fund today that they plan to bundle the country's four June payments into one, which is now due on June 30," IMF spokesman Gerry Rice said on Thursday.

Greece had to repay its IMF loans on June 5, 12, 16 and 19.

-

10:07

International Monetary Fund Managing Director Christine Lagarde: debt relief would be a necessary component of any new bailout package for Greece

International Monetary Fund Managing Director Christine Lagarde said on Thursday that debt relief would be a necessary component of any new bailout package for Greece.

She pointed out that financing would be very important in case of any slippages from the last bailout program. Greece has failed to meet many of its bailout conditions.

"And financing is a factor of the level of the debt, which itself is a factor of the maturity and interest rates at which debt has been accumulated. Everything has to add up at the end of the day," Lagarde noted.

-

04:01

Nikkei 225 20,379.58 -108.61 -0.53%, Hang Seng 27,482.6 -69.29 -0.25%, Shanghai Composite 5,016.09 +68.99 +1.39%

-

00:29

Stocks. Daily history for Jun 4’2015:

(index / closing price / change items /% change)

Nikkei 225 20,488.19 +14.68 +0.07%

Hang Seng 27,551.89 -105.58 -0.38%

S&P/ASX 200 5,504.3 -79.28 -1.42%

Shanghai Composite 4,947.1 +37.12 +0.76%

FTSE 100 6,859.24 -91.22 -1.31%

CAC 40 4,987.13 -47.04 -0.93%

Xetra DAX 11,340.6 -79.02 -0.69%

S&P 500 2,095.84 -18.23 -0.86%

NASDAQ Composite 5,059.13 -40.11 -0.79%

Dow Jones 17,905.58 -170.69 -0.94%

-