Noticias del mercado

-

21:00

S&P 500 2,083.18 +3.90 +0.19 %, NASDAQ 5,025.64 +4.01 +0.08 %, Dow 17,804.32 +37.77 +0.21 %

-

18:11

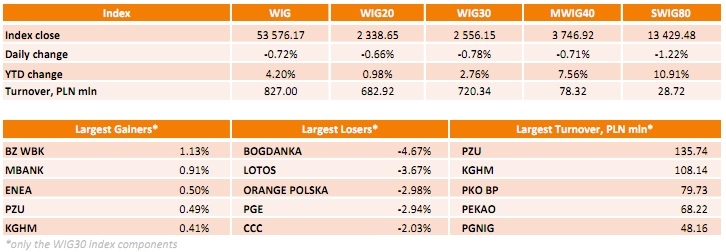

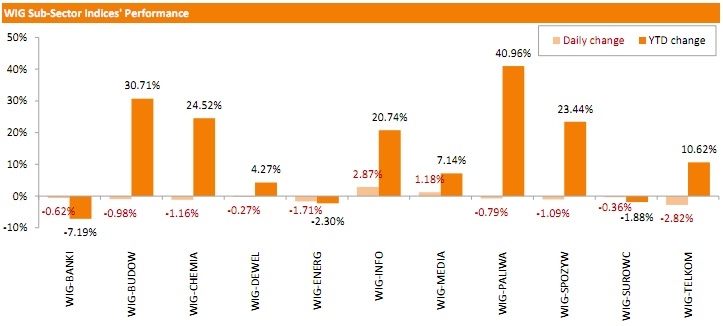

WSE: Session Results

Polish equity market continued to slide on Tuesday. The broad market measure, the WIG Index, dropped 0.72%. Only two sectors in the WIG Index rose and nine fell. Information technology stocks fared best, up 2.87%, while telecommunications names fell the most, down 2.82%.

In the large-cap stock universe, most of the names posted losses, pushing the group measure, the WIG30 Index, down 0.78%. BOGDANKA (WSE: LWB) and LOTOS (WSE: LTS) recorded the biggest declines, slumping 4.67% and 3.67% respectively. They were followed by ORANGE POLSKA (WSE: OPL) and PGE (WSE: PGE), falling nearly 3% each. On the contrary, BZ WBK (WSE: BZW) performed best, advancing 1.13%. MBANK (WSE: MBK) did well too, posting a 0.91% return.

-

18:00

European stocks closed: FTSE 100 6,753.8 -36.24 -0.53 %, CAC 40 4,850.22 -7.44 -0.15 %, DAX 11,001.29 -63.63 -0.58 %

-

18:00

European stocks close: stocks closed lower as the uncertainty over the Greek debt talks still weighed on markets

Stock indices closed lower as the uncertainty over the Greek debt talks still weighed on markets. The Greek government has provided a new budget proposal to its creditors on Tuesday. Greece hopes to reach a new agreement with its creditors to unlock €7.2 billion new loans.

Greece is running out of cash. It bundled its IMF loans repayments in June. The deadline is June 30. Athens have to repay €1.6 billion IMF loans in June.

German Finance Minister Wolfgang Schaeuble said in Berlin on Tuesday that Greece's creditors were doing everything to keep Greece in the Eurozone. He added that it is now on Greece to deliver reforms.

German Chancellor Angela Merkel said on Monday that time was running out for an agreement to be reached.

The European Central Bank (ECB) Governing Council Member Christian Noyer said on Monday that if Greece had to leave the Eurozone, it would not cause a problem for the Eurozone.

Reuters reported on Monday that Greece's creditors have suggested extending the Greek bailout programme until the end of March 2016, but disagreements over the conditions are risks to this plan.

Meanwhile, the economic data from Eurozone was positive. Eurozone's final gross domestic product (GDP) rose 0.4% in first quarter, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's final gross domestic product (GDP) increased 1.0% in first quarter, after a 0.9% rise in the fourth quarter.

Household spending gained 0.5% in the first quarter, while government expenditure was up 0.6%.

Exports declined to 0.6% in the first quarter, while imports rose to 1.2%.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £8.56 billion in April from £10.7 billion in March. March's figure was revised down from a deficit of £10.12 billion.

The decline in the trade deficit was driven by a drop in imports. Imports dropped by 4.8% in April, while exports of goods rose 2.8%.

Sales to non-European Union countries jumped 4.7% in April.

Exports to the European Union countries increased 0.5% in April, while imports plunged 4.1%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,753.8 -36.24 -0.53 %

DAX 11,001.29 -63.63 -0.58 %

CAC 40 4,850.22 -7.44 -0.15 %

-

17:30

Wall Street. Major U.S. stock-indexes are little changed

Major U.S. stock-indexes are little changed on Tuesday, following three straight sessions of losses, on growing speculation that the Federal Reserve could raise interest rates as soon as September. Concerns about a rate hike pushed the blue-chip Dow index slipped into negative territory for 2015 on Monday, while the S&P 500 and Nasdaq touched their lowest levels in over a month. Data on Monday showed U.S. small business confidence rose to a five-month high in May, with owners expecting a solid improvement in profits, which bodes well for the economy's prospects in the months ahead.

Most of Dow stocks in positive area (20 of 30). Top looser - Apple Inc. (AAPL, -1.20%). Top gainer - Caterpillar Inc. (CAT, +1.08%).

S&P index sectors mixed. Top gainer - Basic materials (+0,4%). Top looser - Conglomerates (-0.5%).

At the moment:

Dow 17766.00 -2.00 -0.01%

S&P 500 2078.75 +0.50 +0.02%

Nasdaq 100 4417.00 -15.25 -0.34%

10-year yield 2.44% +0.05

Oil 59.90 +1.76 +3.03%

Gold 1176.10 +2.50 +0.21%

-

17:08

German Finance Minister Wolfgang Schaeuble: Greece’s creditors were doing everything to keep Greece in the Eurozone

German Finance Minister Wolfgang Schaeuble said in Berlin on Tuesday that Greece's creditors were doing everything to keep Greece in the Eurozone. He added that it is now on Greece to deliver reforms.

"In the last four or five years we have done everything in our power to keep Greece in the euro zone but this is a two-way street," Schaeuble said.

Schaeuble denied reports that there was a rift between German Chancellor Angela Merkel and himself on Greek debt talks.

-

16:44

Wholesale inventories in the U.S. rises 0.4% in April

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.4% in April, beating expectations for a 0.2% gain, after a 0.2% increase in March. March's figure was revised up from a 0.1% rise.

Inventories of durable goods increased 0.1% in April, while inventories of non-durable goods gained 0.8%.

Wholesale sales climbed by 1.6% in April, after a 0.3% decline in March.

-

16:17

Job openings jumps to 5.376 million in April, the highest reading since December 2000

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 5.376 million in April from 5.109 million in March. It was the highest reading since December 2000.

March's figure was revised up from 4.994 million.

The number of job openings increased for total private (4.887 million) and for government (489,000) in April.

The hires rate was 3.5% in April.

Total separations fell to 4.881 million in April from 5.065 million in March.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:05

U.S. President Barack Obama denied a report that he was saying the strong U.S. dollar was "a problem'' at the Group of Seven (G7) summit in Germany

-

15:34

Athens provides a new budget proposal to its creditors

The Greek government has provided a new budget proposal to its creditors on Tuesday. Greece hopes to reach a new agreement with its creditors to unlock €7.2 billion new loans.

Greece is running out of cash. It bundled its IMF loans repayments in June. The deadline is June 30. Athens have to repay €1.6 billion IMF loans in June.

-

15:33

U.S. Stocks open: Dow +0.05%, Nasdaq -0.12%, S&P +0.06%

-

15:27

Before the bell: S&P futures -0.10%, NASDAQ futures -0.30%

U.S. stock-index futures declined, indicating equities will fall for a fourth day.

Global markets:

Nikkei 20,096.3 -360.89 -1.8%

Hang Seng 26,989.52 -326.76 -1.2%

Shanghai Composite 5,113.53 -18.35 -0.4%

FTSE 6,769.71 -20.33 -0.3%

CAC 4,846.01 -11.65 -0.2%

DAX 10,973.94 -90.98 -0.8%

Crude oil $59.35 (+2.06%)

Gold $1178.20 (+0.40%)

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Walt Disney Co

DIS

109.31

+0.02%

1.7K

Johnson & Johnson

JNJ

97.99

+0.03%

1.1K

Hewlett-Packard Co.

HPQ

32.70

+0.03%

2.7K

American Express Co

AXP

78.85

+0.05%

3.3K

Pfizer Inc

PFE

34.00

+0.06%

1.0K

Verizon Communications Inc

VZ

47.47

+0.06%

0.9K

Wal-Mart Stores Inc

WMT

72.65

+0.06%

6.0K

ALCOA INC.

AA

12.26

+0.08%

22.6K

Procter & Gamble Co

PG

77.80

+0.12%

0.2K

Yandex N.V., NASDAQ

YNDX

17.26

+0.12%

16.4K

Boeing Co

BA

140.85

+0.15%

0.2K

Chevron Corp

CVX

100.60

+0.18%

6.3K

McDonald's Corp

MCD

95.50

+0.19%

27.3K

E. I. du Pont de Nemours and Co

DD

69.55

+0.20%

5.1K

Exxon Mobil Corp

XOM

85.04

+0.22%

1.1K

Barrick Gold Corporation, NYSE

ABX

11.54

+0.70%

12.3K

Home Depot Inc

HD

110.73

+0.73%

2.7K

General Motors Company, NYSE

GM

35.28

+0.83%

5.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.59

+0.98%

9.8K

Goldman Sachs

GS

209.79

0.00%

0.6K

The Coca-Cola Co

KO

40.16

-0.00%

3.0K

UnitedHealth Group Inc

UNH

116.90

-0.01%

0.2K

Visa

V

67.66

-0.03%

1.1K

Twitter, Inc., NYSE

TWTR

36.45

-0.03%

30.2K

Caterpillar Inc

CAT

86.09

-0.07%

0.1K

JPMorgan Chase and Co

JPM

66.84

-0.07%

8.7K

Ford Motor Co.

F

14.89

-0.07%

34.3K

AMERICAN INTERNATIONAL GROUP

AIG

59.48

-0.09%

3.4K

Citigroup Inc., NYSE

C

55.60

-0.09%

2.9K

International Business Machines Co...

IBM

165.18

-0.10%

1.5K

AT&T Inc

T

34.55

-0.12%

5.2K

Amazon.com Inc., NASDAQ

AMZN

423.00

-0.12%

0.4K

General Electric Co

GE

27.20

-0.15%

6.3K

Yahoo! Inc., NASDAQ

YHOO

41.94

-0.17%

2.6K

Cisco Systems Inc

CSCO

28.22

-0.19%

2.3K

Intel Corp

INTC

31.24

-0.19%

5.4K

Facebook, Inc.

FB

80.51

-0.20%

24.8K

Tesla Motors, Inc., NASDAQ

TSLA

255.74

-0.21%

19.6K

Microsoft Corp

MSFT

45.63

-0.22%

8.2K

ALTRIA GROUP INC.

MO

48.20

-0.25%

1.6K

Starbucks Corporation, NASDAQ

SBUX

51.40

-0.25%

0.6K

Apple Inc.

AAPL

126.95

-0.67%

241.3K

-

15:04

European Central Bank (ECB) Governing Council Member Christian Noyer: if Greece had to leave the Eurozone, it would not cause a problem for the Eurozone

The European Central Bank (ECB) Governing Council Member Christian Noyer said on Monday that if Greece had to leave the Eurozone, it would not cause a problem for the Eurozone.

"The problem of Greece is a problem for Greece itself," he added.

The ECB governing council member noted that Greece has only a few days to reach an agreement with its creditors.

Noyer pointed out that the exchange rate between the U.S. dollar and the euro can be explained as the difference in conditions in the U.S. and Europe.

-

14:56

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Microsoft (MSFT) initiated with a Hold at Wunderlich, target $52

Wal-Mart (WMT) initiated with a Neutral at Macquarie, target $76

-

14:42

Greek industrial production declines 3.2% in April

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Tuesday. Greek industrial production declined 3.2% in April, after a 3.1% rise in March. On a seasonally adjusted basis, industrial production dropped 2.0%.

On a yearly basis, industrial production in Greece climbed at an adjusted rate of 0.4% in April, after a 5.3% gain in March. It was the third consecutive monthly rise.

Production in the manufacturing sector jumped at an annual rate of 3.5% in April, output in the mining and quarrying sector fell 2.6%, while electricity production plunged by 11.4%.

-

14:10

Chinese consumer price index rises at annual rate of 1.2% in May

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Tuesday. The Chinese consumer price index (CPI) rose at annual rate of 1.2% in May, missing expectations for a 1.3% increase, after a 1.5% gain in April.

Food prices rose at an annual rate of 1.6% in May, while non-food prices increased 1.0%. On a monthly basis, consumer price inflation fell 0.2% in May.

The Chinese producer price index (PPI) dropped 4.6% in May, missing forecasts of a 4.5% fall, after a 4.6% decline in April.

On a monthly basis, producer price inflation decreased 0.1% in May.

-

12:05

European stock markets mid session: stocks traded lower on the uncertainty over the Greek debt talks

Stock indices traded lower on the uncertainty over the Greek debt talks. German Chancellor Angela Merkel said on Monday that time was running out for an agreement to be reached.

The European Central Bank (ECB) Governing Council Member Christian Noyer said on Monday that if Greece had to leave the Eurozone, it would not cause a problem for the Eurozone.

Reuters reported on Monday that Greece's creditors have suggested extending the Greek bailout programme until the end of March 2016, but disagreements over the conditions are risks to this plan.

Meanwhile, the economic data from Eurozone was positive. Eurozone's final gross domestic product (GDP) rose 0.4% in first quarter, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's final gross domestic product (GDP) increased 1.0% in first quarter, after a 0.9% rise in the fourth quarter.

Household spending gained 0.5% in the first quarter, while government expenditure was up 0.6%.

Exports declined to 0.6% in the first quarter, while imports rose to 1.2%.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £8.56 billion in April from £10.7 billion in March. March's figure was revised down from a deficit of £10.12 billion.

The decline in the trade deficit was driven by a drop in imports. Imports dropped by 4.8% in April, while exports of goods rose 2.8%.

Sales to non-European Union countries jumped 4.7% in April.

Exports to the European Union countries increased 0.5% in April, while imports plunged 4.1%.

Current figures:

Name Price Change Change %

FTSE 100 6,755.46 -34.58 -0.51 %

DAX 10,906.5 -158.42 -1.43 %

CAC 40 4,806.36 -51.30 -1.06 %

-

11:48

Eurozone's final GDP climbs 0.4% in first quarter

Eurozone's final gross domestic product (GDP) rose 0.4% in first quarter, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's final gross domestic product (GDP) increased 1.0% in first quarter, after a 0.9% rise in the fourth quarter.

Household spending gained 0.5% in the first quarter, while government expenditure was up 0.6%.

Exports declined to 0.6% in the first quarter, while imports rose to 1.2%.

-

11:37

U.K. trade deficit in goods narrows to £8.56 billion in April

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Tuesday. The U.K. trade deficit in goods narrowed to £8.56 billion in April from £10.7 billion in March.

March's figure was revised down from a deficit of £10.12 billion.

The decline in the trade deficit was driven by a drop in imports. Imports dropped by 4.8% in April, while exports of goods rose 2.8%.

Sales to non-European Union countries jumped 4.7% in April.

Exports to the European Union countries increased 0.5% in April, while imports plunged 4.1%.

The total trade deficit, including services, narrowed to £1.202 billion in April from £3.093 billion in March. It was the lowest total trade deficit since March 2014.

March's figure was revised down from a deficit of £2.817 billion.

-

11:25

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.3% in May

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in May. On a seasonally unadjusted basis, the unemployment rate in Switzerland declined to 3.2 percent in May from 3.3% in April. Analysts had expected the unemployment rate to remain unchanged at 3.3%.

The number of unemployed people in Switzerland decreased by 4,782 in May, after a 6,039 rise in April.

The youth unemployment rate was down to 2.9% in May from 3.1% in April.

-

11:04

Switzerland’s consumer price inflation rises 0.2% in May

The Swiss Federal Statistics Office released its consumer inflation data on Tuesday. Switzerland's consumer price index rose 0.2% in May, exceeding expectations for a 0.1% increase, after a 0.2% drop in April.

On a yearly basis, Switzerland's consumer price index declined to -1.2% in May from -1.1% in April, in line with expectations. It was the seventh consecutive decline.

Food and beverages prices dropped at an annual rate of 1.2% in May, alcoholic beverages prices were up 0.1%, and clothing and footwear prices fell 0.6%, while housing and energy prices declined 0.3%.

-

10:50

President of the Supervisory Council at the European Central Bank Danièle Nouy: the central bank’s Supervisory Board plans to carry out stress tests of Eurozone’s big banks next year

The President of the Supervisory Council at the European Central Bank (ECB), Danièle Nouy, said on Monday that the central bank's Supervisory Board plans to carry out stress tests of Eurozone's big banks next year.

"There will be a public and general stress test next year. It could only concern a part of the 123 banks that we supervise directly," Nouy noted.

-

10:42

International Monetary Fund's deputy managing director, Mitsuhiro Furusawa: the Federal Reserve could reduce the risk of disorderly capital outflows

The International Monetary Fund's (IMF) deputy managing director, Mitsuhiro Furusawa, said on Monday that the Federal Reserve could reduce the risk of disorderly capital outflows. He warned about the risk of disorderly capital outflows once the Fed started hiking interest rates.

Furusawa pointed out that emerging countries should implement structural reforms to promote strong, sustainable and balanced growth. The IMF deputy managing director added that IMF expects merging market economies to rebound next year.

-

10:33

European Central Bank Executive Board Member Yves Mersch: the recent increase in government bond yields in Europe reflects desirable outcomes

The European Central Bank (ECB) Executive Board Member Yves Mersch said in Frankfurt on Monday that the recent increase in government bond yields in Europe reflects desirable outcomes such as an increase in inflation expectations and increased optimism about economic growth.

"Rising rates either mean that inflation expectations rise or that growth expectations rise. We like both," Mersch noted.

The ECB executive board member added that the central bank cannot set prices in financial markets.

"When markets have gotten on the wrong track we're not in charge of stopping them. When the markets correct, it's a correction. In that case you can't tell the central bank that it should have prevented it," Mersch said.

-

10:17

European Central Bank (ECB) Governing Council Member Ewald Nowotny: the central bank’s asset buying programme was working and it will continue until September 2016

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Monday that the central bank's asset buying programme was working and it will continue until September 2016.

"The economic downturn is over, the risk of deflation has been overcome, and the emergency measures of the ECB appear successful," Nowotny noted.

He also said that lower oil prices were also supporting the economy in the Eurozone.

-

04:03

Nikkei 225 20,292.94 -164.25 -0.80%, Hang Seng 27,100.69 -215.59 -0.79%, Shanghai Composite 5,131.92 +0.04 0.00%

-

00:33

Stocks. Daily history for Jun 8’2015:

(index / closing price / change items /% change)

Nikkei 225 20,457.19 -3.71 -0.02%

Hang Seng 27,316.28 +56.12 +0.21%

Shanghai Composite 5,131.88 +108.79 +2.17%

FTSE 100 6,790.04 -14.56 -0.21%

CAC 40 4,857.66 -63.08 -1.28%

Xetra DAX 11,064.92 -132.23 -1.18%

S&P 500 2,079.28 -13.55 -0.65%

NASDAQ Composite 5,021.63 -46.83 -0.92%

Dow Jones 17,766.55 -82.91 -0.46%

-