Noticias del mercado

-

22:11

US stocks closed

U.S. stocks rose, with technology and financial shares leading a rebound from the biggest drop in two months, amid optimism that progress is being made in Greece's debt talks.

"The Germans have officially blinked and off we go," said Michael Block, chief equity strategist at Rhino Trading Partners LLC in New York. "U.S. data has been better in general, but more people are coming around to the fact the Fed is seeing all this volatility in the bond market and is afraid to raise rates, there isn't too much tumult, oil has stabilized and so we move on."

Optimism toward a potential Greek deal with its creditors rose as people familiar with Germany's position said Chancellor Angela Merkel's government may be satisfied with Greece committing to at least one economic reform sought by creditors to open the door to bailout funds. The European Central Bank was also said to have raised the level of emergency cash available to Greek banks.

The S&P 500 fell on Monday to a two-month low before edging higher yesterday. The index had tumbled 2.4 percent from its May record amid concern the Federal Reserve will raise interest rates as early as September.

The benchmark this year has traded in its tightest weekly range since the mid-'90s, signaling investor uncertainty as to whether the economic recovery is strong enough to withstand a rate increase. Reports on retail sales and jobless claims Thursday may offer further clues.

"Incoming data will provide more evidence week by week that the world economy is not in a fragile state as some suspected in the first quarter," said William Hobbs, head of investment strategy at Barclays Plc's wealth-management unit in London. "Data seems to be pointing a bit upwards and that may be suggesting to some that revenue prospects for the U.S. corporate sector may get better than what was priced in."

-

21:00

S&P 500 2,108 +27.85 +1.34 %, NASDAQ 5,085.13 +71.26 +1.42 %, Dow 18,028.43 +264.39 +1.49 %

-

19:21

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes surged in late morning trading on Wednesday after a Bloomberg report that Germany may be satisfied with Greece committing to at least one economic reform in return for aid. All three major indexes rose more than 1 percent on the same day for the first time in a month. The German government may settle for a clear commitment by Greece to a measure up front to unlock aid, Bloomberg reported, citing two people familiar with Germany's position.

All of Dow stocks in positive area (30 of 30). Top gainer -Microsoft Corporation (MSFT, +2.39%).

S&P index sectors also in positive area. Top gainer - Financial (+1,6%).

At the moment:

Dow 18010.00 +243.00 +1.37%

S&P 500 2106.00 +26.00 +1.25%

Nasdaq 100 4492.50 +61.00 +1.38%

10-year yield 2.46% +0.04

Oil 60.64 +0.50 +0.83%

Gold 1186.90 +9.30 +0.79%

-

18:02

European stocks close: stocks closed higher on hopes for a deal between Greece and its creditors

Stock indices closed higher on hopes for a deal between Greece and its creditors. Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel and French President François Hollande later in the day.

The Greek government has submitted a new reform plan to the European Union (EU) and International Monetary Fund (IMF) on Tuesday. According to European officials, the new proposal was insufficient.

German government bonds hit the 1% barrier due to a selloff in bonds markets.

Meanwhile, the economic data from the Eurozone was mixed. The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France fell 0.9% in April, missing expectations for a 0.4% gain, after a 0.3% decline in March. It was the first decrease in five months.

The decline was driven by declines in aerospace, automobiles and textiles.

On a yearly basis, the French industrial production rose 1.1% in April, after a 1.3% gain in March.

France's current account increased to a surplus of €0.4 billion in April from a deficit of €1.4 billion in March.

The trade surplus was driven by a drop in imports of crude oil imports.

The merchandise trade deficit narrowed to €1.1 billion in April from €3.2 billion in March.

The surplus in the services trade fell to €1.3 billion from €1.5 billion. The decline was driven by higher imports of telecommunication and information technology equipment.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. dropped 0.4% in April, missing expectations for a 0.1% gain, after a 0.4% increase in March.

Manufacturing output was driven by a decline in a decline in pharmaceuticals, which dropped 6.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.2% in April, missing forecast of a 0.4% gain, after a 1.2% rise in March. March's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.4% in April, beating forecasts of a 0.1% rise, after a 0.6% gain in March. March's figure was revised up from 0.5% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 8.7% in April, the fastest pace since February 2014.

On a yearly basis, industrial production in the U.K. gained 1.2% in April, exceeding expectations for a 0.6% rise, after a 1.1% increase in March. March's figure was revised up a 0.7% rise.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.6% in three months to May, after a 0.5% growth in three months to April. The previous three months' figure was revised up from a 0.4% rise.

The NIESR said that the current estimate is consistent with a rebound of the economic growth in the U.K. in the second quarter, and it expects the U.K. economy to expand at 2.5% this year, and 2.4% next year.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,830.27 +76.47 +1.13 %

DAX 11,265.39 +264.10 +2.40 %

CAC 40 4,934.91 +84.69 +1.75 %

-

18:00

European stocks closed: FTSE 100 6,830.27 +76.47 +1.13 %, CAC 40 4,934.91 +84.69 +1.75 %, DAX 11,265.39 +264.10 +2.40 %

-

17:57

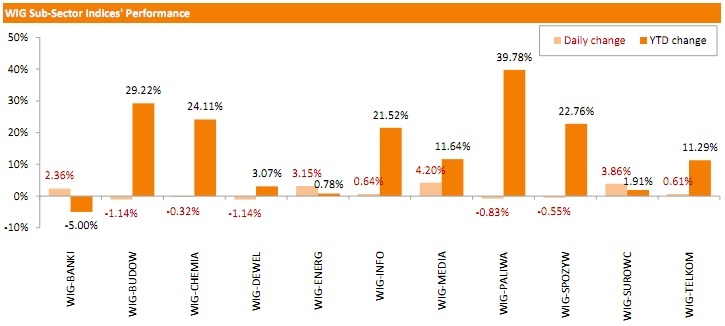

WSE: Session Results

Polish equity market bounced back on Wednesday after five days of losses. The broad market measure, the WIG Index, surged 1.52%. 6 out of 11 sectors in the WIG Index rose, led by media stocks, which climbed 4.20%. On the contrary, construction companies and developers were the sharpest decliners, losing 1.14%.

Large-cap stocks were mostly positive. As measured by the WIG30 Index, this group of companies rose by 1.86%. TVN (WSE: TVN) led advances, soaring 8.4 % on news the company's new owner, U.S. media group Scripps Networks Interactive, intends to make a tender offer for all shares of its Polish broadcaster. KGHM (WSE: KGH) and PGE (WSE: PGE) also demonstrated notable increases, gaining almost 5% each, supported by rising prices for raw materials. On the other side of the ledger, GTC (WSE: GTC) was the biggest laggard, dropping 2.52%. It was followed by BOGDANKA (WSE: LWB), which slumped 2.31% on lowered 2015 output forecast and the management's request to put a dividend pay-out on hold.

-

16:29

NIESR’s gross domestic product rises by 0.6% in three months to May

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.6% in three months to May, after a 0.5% growth in three months to April. The previous three months' figure was revised up from a 0.4% rise.

The NIESR said that the current estimate is consistent with a rebound of the economic growth in the U.K. in the second quarter, and it expects the U.K. economy to expand at 2.5% this year, and 2.4% next year.

-

15:53

Core machinery orders in Japan jumps 3.8% in April

Japan's Cabinet Office released its core machinery orders data for Japan on Wednesday. Core machinery orders in Japan jumped 3.8% in April, beating expectations for a 2.0% drop, after a 2.9% gain in March.

On a yearly basis, Japan's core machinery orders gained 3.0% in April, beating forecasts of a 1.3% decline, after a 2.6% rise in March.

These figures are signs that Japanese companies may be expanding their capital expenditure.

The Cabinet Office upgraded its assessment of machinery orders saying they were picking up, compared with the previous view that machinery orders were "showing a gradual pickup."

-

15:33

U.S. Stocks open: Dow +0.25%, Nasdaq +0.28%, S&P +0.48%

-

15:29

Before the bell: S&P futures +0.28%, NASDAQ futures +0.17%

U.S. stock futures gained as rising oil prices buoyed shares of energy companies in premarket trade.

Global markets:

Nikkei 20,046.36 -49.94 -0.25%

Hang Seng 26,687.64 -301.88 -1.12%

Shanghai Composite 5,106.04 -7.50 -0.15%

FTSE 6,778.98 +25.18 +0.37%

CAC 4,879.6 +29.38 +0.61%

DAX 11,117.71 +116.42 +1.06%

Crude oil $61.52 (+2.28%)

Gold $1190.000 (+1.05%)

-

15:28

Industrial production in Italy falls 0.3% in April

The Italian statistical office Istat released its industrial production data on Wednesday. Industrial production in Italy declined at a seasonally-adjusted rate of 0.3% in April, after a 0.5% gain in March. It was the first fall in three months.

Output in the energy sector dropped 1.3% in April, while production in the consumer goods sector declined 1.2%.

On a yearly basis, industrial production in Italy rose at a seasonally-adjusted rate of 0.1% in April, after a 1.4% increase in March.

During the first quarter of the year, Italian industrial production fell 0.1%.

-

15:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Pfizer Inc

PFE

34.02

+0.03%

0.1K

Verizon Communications Inc

VZ

47.39

+0.11%

14.5K

General Motors Company, NYSE

GM

35.30

+0.11%

2.4K

The Coca-Cola Co

KO

40.26

+0.15%

2.0K

General Electric Co

GE

27.38

+0.18%

22.0K

Walt Disney Co

DIS

108.74

+0.20%

3.1K

International Business Machines Co...

IBM

166.05

+0.22%

5.0K

McDonald's Corp

MCD

94.95

+0.23%

0.1K

Merck & Co Inc

MRK

58.98

+0.24%

0.4K

Johnson & Johnson

JNJ

98.48

+0.27%

0.4K

Amazon.com Inc., NASDAQ

AMZN

426.74

+0.30%

0.2K

3M Co

MMM

157.50

+0.33%

0.1K

Facebook, Inc.

FB

80.94

+0.33%

26.5K

Apple Inc.

AAPL

127.87

+0.35%

176.1K

Visa

V

68.20

+0.37%

0.8K

Twitter, Inc., NYSE

TWTR

36.02

+0.39%

14.8K

JPMorgan Chase and Co

JPM

67.45

+0.40%

2.6K

Intel Corp

INTC

31.38

+0.42%

3.2K

Yahoo! Inc., NASDAQ

YHOO

41.82

+0.46%

4.7K

Citigroup Inc., NYSE

C

56.29

+0.52%

14.0K

Google Inc.

GOOG

529.45

+0.52%

0.6K

Cisco Systems Inc

CSCO

28.39

+0.53%

3.7K

Goldman Sachs

GS

210.18

+0.55%

0.1K

AT&T Inc

T

34.70

+0.55%

1.3K

Microsoft Corp

MSFT

45.97

+0.70%

5.3K

Procter & Gamble Co

PG

79.48

+0.74%

0.1K

Caterpillar Inc

CAT

87.50

+0.89%

0.8K

ALCOA INC.

AA

12.31

+0.98%

53.6K

Ford Motor Co.

F

15.03

+1.01%

60.5K

Exxon Mobil Corp

XOM

85.50

+1.09%

23.4K

Chevron Corp

CVX

101.71

+1.28%

3.2K

Yandex N.V., NASDAQ

YNDX

17.60

+1.38%

0.3K

Barrick Gold Corporation, NYSE

ABX

11.73

+1.73%

30.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.55

+2.65%

3.7K

American Express Co

AXP

79.00

-0.21%

1.4K

Home Depot Inc

HD

109.00

-0.48%

0.9K

Tesla Motors, Inc., NASDAQ

TSLA

251.74

-1.66%

28.4K

-

15:07

Greek consumer prices decline 0.8% in May

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Wednesday. Greek consumer prices fell 0.8% in May, after the 0.5% increase in April. It was the first decline in three months.

On a yearly basis, the Greek consumer price index declined 2.1% in May, after a 2.1 drop in April. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 6.9% in May, transport costs dropped by 2.9%, clothing and footwear prices declined 5.5%, while household equipment prices were down 2.1%.

Prices of food and non-alcoholic beverages increased 0.5% in May, while alcoholic beverages and tobacco prices climbed by 2%.

-

14:47

Reserve Bank of Australia Governor Glenn Stevens: the central bank remains “open to the possibility of further policy easing”

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in Brisbane on Wednesday that the central bank remains "open to the possibility of further policy easing" if it is needed for sustainable growth.

"The bigger point is that monetary policy alone can't deliver everything we need and expecting too much from it can lead, in time, to much bigger problems," the RBA governor added.

Stevens pointed out that there are a lot of countries that would prefer a lower exchange rate to boost exports.

He also said that he was concerned about housing property boom.

-

12:05

European stock markets mid session: stocks traded higher despite the uncertainty over the Greek debt talks

Stock indices traded higher despite the uncertainty over the Greek debt talks. Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel and French President François Hollande later in the day.

The Greek government has submitted a new reform plan to the European Union (EU) and International Monetary Fund (IMF) on Tuesday. According to European officials, the new proposal was insufficient.

German government bonds hit the 1% barrier due to a selloff in bonds markets.

Meanwhile, the economic data from the Eurozone was mixed. The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France fell 0.9% in April, missing expectations for a 0.4% gain, after a 0.3% decline in March. It was the first decrease in five months.

The decline was driven by declines in aerospace, automobiles and textiles.

On a yearly basis, the French industrial production rose 1.1% in April, after a 1.3% gain in March.

France's current account increased to a surplus of €0.4 billion in April from a deficit of €1.4 billion in March.

The trade surplus was driven by a drop in imports of crude oil imports.

The merchandise trade deficit narrowed to €1.1 billion in April from €3.2 billion in March.

The surplus in the services trade fell to €1.3 billion from €1.5 billion. The decline was driven by higher imports of telecommunication and information technology equipment.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. dropped 0.4% in April, missing expectations for a 0.1% gain, after a 0.4% increase in March.

Manufacturing output was driven by a decline in a decline in pharmaceuticals, which dropped 6.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.2% in April, missing forecast of a 0.4% gain, after a 1.2% rise in March. March's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.4% in April, beating forecasts of a 0.1% rise, after a 0.6% gain in March. March's figure was revised up from 0.5% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 8.7% in April, the fastest pace since February 2014.

On a yearly basis, industrial production in the U.K. gained 1.2% in April, exceeding expectations for a 0.6% rise, after a 1.1% increase in March. March's figure was revised up a 0.7% rise.

Current figures:

Name Price Change Change %

FTSE 100 6,778.05 +24.25 +0.36 %

DAX 11,062.15 +60.86 +0.55 %

CAC 40 4,874.05 +23.83 +0.49 %

-

11:39

France’s current account increases to a surplus of €0.4 billion in April

The Bank of France released its current account data on Wednesday. France's current account increased to a surplus of €0.4 billion in April from a deficit of €1.4 billion in March.

The trade surplus was driven by a drop in imports of crude oil imports.

The merchandise trade deficit narrowed to €1.1 billion in April from €3.2 billion in March.

The surplus in the services trade fell to €1.3 billion from €1.5 billion. The decline was driven by higher imports of telecommunication and information technology equipment.

-

11:21

French industrial production declines 0.9% in April

The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France fell 0.9% in April, missing expectations for a 0.4% gain, after a 0.3% decline in March. It was the first decrease in five months.

The decline was driven by declines in aerospace, automobiles and textiles.

Output in the transport equipment sector plunged 3.3% in April due to a 5.0% drop in transport equipment and a 1.4% decline in the automobile sector.

On a yearly basis, the French industrial production rose 1.1% in April, after a 1.3% gain in March.

Construction output declined 0.8% in April, after a 0.5% increase in March.

-

11:05

U.K. manufacturing production drops 0.4% in April

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. dropped 0.4% in April, missing expectations for a 0.1% gain, after a 0.4% increase in March.

Manufacturing output was driven by a decline in a decline in pharmaceuticals, which dropped 6.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.2% in April, missing forecast of a 0.4% gain, after a 1.2% rise in March. March's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.4% in April, beating forecasts of a 0.1% rise, after a 0.6% gain in March. March's figure was revised up from 0.5% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 8.7% in April, the fastest pace since February 2014.

On a yearly basis, industrial production in the U.K. gained 1.2% in April, exceeding expectations for a 0.6% rise, after a 1.1% increase in March. March's figure was revised up a 0.7% rise.

-

10:44

Bank of Japan (BoJ) Governor Haruhiko Kuroda said: it is unlikely that yen will decline further as it is already "very weak"

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Wednesday that it is unlikely that yen will decline further as it is already "very weak". He added that even if the Fed starts to raise its interest rate, the yen does not have to increase as traders may have already priced into the market this possibility.

"If you look at the real effective exchange rate, it shows that the yen is already very weak. Even further declines on a real effective exchange rate basis are not likely to happen," Kuroda noted.

-

10:29

European Central Bank Governing Council Member Jozef Makuch: the central bank’s quantitative easing has led to an increase in inflation, to a higher economic growth and to a weaker euro against the U.S. dollar

The European Central Bank (ECB) Governing Council Member Jozef Makuch said on Tuesday that the central bank's quantitative easing has led to an increase in inflation, to a higher economic growth and to a weaker euro against the U.S. dollar.

"We can say it has been a successful operation, it was the correct move which is being shown in the rise of inflation, which was the main motive, and also (there is) the indirect effect of higher GDP growth and the wholly indirect, though visible effect in the form of a low exchange rate of the euro to other currencies, mainly to the US dollar," Makuch noted.

He also said that the ECB governing council wants to keep Greece in the Eurozone if it meets its commitments.

-

10:18

Small business owners in the U.S. are more confident about their economic situation

The National Federation of Independent Business (NFIB) its small-business optimism data for the U.S. on Tuesday. The small-business optimism index rose to 98.3 in May from 96.9 in April. Small business owners in the U.S. are more confident about their economic situation. Higher sales were pushing small firms to add workers and raise selling prices.

The earnings trend index rose 9 percentage points to -7%.

7% of businesses were reporting higher nominal sales during the three months ended in May, up 11 percentage points. The business conditions expectations climbed 3 points to -3%.

The index covering hiring plans was up 1 point to 12% in May.

In the three months ended in May, 6% of owners raised selling prices, up 4 percentage points.

-

10:07

Targets in Greece’s new proposal are still lower than Greece’s creditors have proposed

The Greek government has submitted a new reform plan to the European Union (EU) and International Monetary Fund (IMF) on Tuesday. According to European officials, Athens has proposed following targets for primary surplus: 0.75% of gross domestic product (GDP) in 2015, 1.75% in 2016, and 2.5% in 2017. These targets are lower than Greece's creditors have proposed, but higher than in Athens previous proposal.

Greece's proposal contains higher revenue from value-added tax (VAT). Greece estimated revenue from the tax at €1.36 billion in 2016, but Greece's creditors proposed to implement measures that would generate €1.8 billion, or about 1% of GDP.

Greece's proposal does not contain any details about reforms of the Greek labour market.

-

04:02

Nikkei 225 20,183.29 +86.99 +0.43 %, Hang Seng 27,036.59 +47.07 +0.17 %, Shanghai Composite 5,073.19 -40.35 -0.79 %

-

00:31

Stocks. Daily history for Jun 9’2015:

(index / closing price / change items /% change)

Nikkei 225 20,096.3 -360.89 -1.76 %

Hang Seng 26,989.52 -326.76 -1.20 %

S&P/ASX 200 5,471.31 -27.15 -0.49 %

Shanghai Composite 5,113.53 -18.35 -0.36 %

FTSE 100 6,753.8 -36.24 -0.53 %

CAC 40 4,850.22 -7.44 -0.15 %

Xetra DAX 11,001.29 -63.63 -0.58 %

S&P 500 2,080.15 +0.87 +0.04 %

NASDAQ Composite 5,013.87 -7.76 -0.15 %

Dow Jones 17,764.04 -2.51 -0.01 %

-