Noticias del mercado

-

22:15

US stocks closed

U.S. stocks rose after data on retail sales and jobs bolstered confidence in the strength of the economy, while investors watched for progress in Greece's debt negotiations.

"It's a contest right now between the improving economy and fears about Greece," said Brad McMillan, chief investment officer of Waltham, Massachusetts-based Commonwealth Financial Network, which oversees $97 billion. "The economy really is improving and the first quarter was not the end of the world, but Greece is the big thing people are watching in the short-term."

The International Monetary Fund said its team negotiating with Greece left Brussels after failing to make progress on a debt deal. Meanwhile, European Union President Donald Tusk told Greece Prime Minister Alexis Tsipras to stop maneuvering and decide whether to accept the conditions on financial aid. The S&P 500 jumped 1.2 percent on Wednesday, the most in a month, amid optimism that progress was being made in the talks.

Greece's Tsipras has promised Germany and France that he will step up efforts to find a package of reforms and budget fixes before the country's bailout agreement expires at the end of the month.

Data earlier showed sales at retailers picked up in May, a sign households are finally willing to put the gains from continued job growth and lower fuel prices to work. Sales increases were broad-based, with auto dealers, clothing and building material stores among the best performers. A separate report showed applications for unemployment benefits remained below 300,000 for a 14th straight week, a sign of labor market strength.

The S&P 500 had tumbled 2.4 percent from its May record to a two-month low amid concern the Federal Reserve will raise benchmark rates as early as September. The equity gauge this year has traded in its tightest weekly range since the mid-'90s, signaling investor uncertainty as to whether the economic recovery is strong enough to withstand a rate increase.

"For the markets to do better we need good news about the economy," said Krishna Memani, the New York-based chief investment officer at Oppenheimer Funds Inc. "If the retail sales data was weak, we would have had a problem, but it isn't. While the data isn't knocking the cover off the ball, it's reasonable and a solid recovery."

-

21:00

S&P 500 2,111.38 +6.18 +0.29 %, NASDAQ 5,086.57 +9.88 +0.19 %, Dow 18,066.16 +65.76 +0.37 %

-

18:30

WSE: Session Results

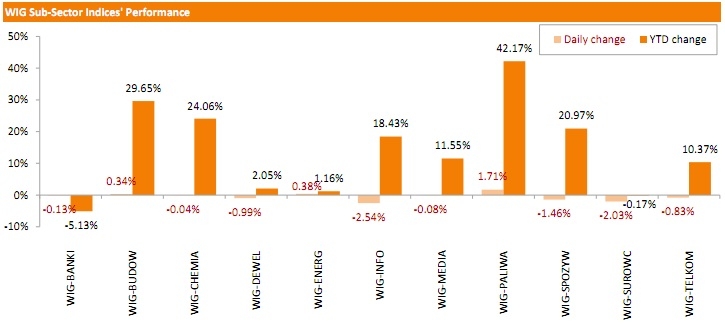

Polish equity market ended Thursday's trading session with a marginal decline. The broad market measure, the WIG Index, inched down 0.06%. Sector performance within the WIG Index was mixed. Oil&gas was the strongest sector, advancing 1.71%, while technologies lagged, losing 2.54%.

Large-cap stocks' measure, the WIG30 index, outperformed the broad market benchmark, posting a modest gain of 0.02%. Within the indicator's components, oil&gas names LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN) were the biggest gainers, advancing 3.23% and 2.10% respectively as retreating oil prices are considered to be supportive for their downstream segments. ENERGA (WSE: ENG) and LPP (WSE: LPP) also posted notable gains, climbing 1.72% and 1.14% respectively. On the country, BOGDANKA (WSE: LWB) again led the decliners with a 5.51% drop, followed by ASSECO POLAND (WSE: ACP), KERNEL (WSE: KER) and GTC (WSE: GTC), losing 3.77%, 3.01% and 2.41% respectively.

-

18:15

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday on optimism Greece would accept an aid-for-reforms deal and on strong U.S. retail sales, which lifted the U.S. dollar and bolstered expectations the Federal Reserve will raise interest rates this year. Also, U.S. retail sales rose 1.2 percent in May after an upwardly revised 0.2 percent gain in April, the Commerce Department said, as households boosted purchases of automobiles and other goods. While other U.S. data showed a slight increase in new applications for unemployment benefits, the number remained in territory associated with a tightening labor market.

Most of Dow stocks in positive area (23 of 30). Top looser - Merck & Co. Inc. (MRK, -0.98%). Top gainer - The Boeing Company (BA, +0.99%).

S&P index sectors mixed. Top gainer - Utilities (+0,3%). Top looser - Conglomerates (-0.5%).

At the moment:

Dow 17971.00 +33.00 +0.18%

S&P 500 2101.75 +2.50 +0.12%

Nasdaq 100 4487.00 +4.75 +0.11%

10-year yield 2.42% -0.06

Oil 60.46 -0.97 -1.58%

Gold 1180.00 -6.60 -0.56%

-

18:05

European stocks close: stocks closed higher as hopes for a deal between Greece and its creditors supported markets

Stock indices closed higher as hopes for a deal between Greece and its creditors supported markets. Greek Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President François Hollande Wednesday agreed to intensify the debt talks.

Gains were limited due to news that the International Monetary Fund (IMF) left the debt talks between Greece and its creditors in Brussels.

Standard and Poor's Ratings Services has downgraded the long-term sovereign credit rating on Greece to 'CCC' from 'CCC+' because of the absence of a deal between Greece and its creditors. The outlook is negative.

The head of the Eurogroup Jeroen Dijsselbloem said in Helsinki on Wednesday that a deal between Greece and its creditors can still be reached. But he warned that the time was running out.

Meanwhile, the economic from the Eurozone was positive. The French statistical office Insee said its consumer price inflation for France. The French consumer price inflation rose 0.2% in May, after a 0.1% increase in April.

On a yearly basis, the consumer price index climbed 0.3% in May, after a 0.1% rise.

Fresh food prices rose 6.4% year-on-year in May, while petroleum products prices dropped by 6.3%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,846.74 +16.47 +0.24 %

DAX 11,332.78 +67.39 +0.60 %

CAC 40 4,971.37 +36.46 +0.74 %

-

18:00

European stocks closed: FTSE 100 6,846.74 +16.47 +0.24 %, CAC 40 4,971.37 +36.46 +0.74 %, DAX 11,332.78 +67.39 +0.60 %

-

17:19

Greek unemployment rate climbs to 26.6% in the first quarter

The Hellenic Statistical Authority released its labour market data for Greece on Thursday. The Greek unemployment rate climbed to 26.6% in the first quarter from 26.1% in the previous quarter.

The number of unemployed people rose by 2.1% to 1.3 million in the first quarter.

The youth unemployment rate was 51.9% in the first quarter.

-

17:15

OECD: G20 area expands at 0.7% in the first quarter

The Organization for Economic Co-operation and Development (OECD) released its economic growth figures for G20 area on Thursday. The G20 area expanded at 0.7% in the first quarter, after a 0.8% gain in the fourth quarter.

Eurozone's growth was 0.4% in first quarter. Germany's and the United Kingdom's economy climbed by 0.3% each in the first quarter, while France's economy grew by 0.6.

The United States' economy contracted 0.1% in first quarter, while Canada's economy shrank 0.1%.

Growth in China declined to 1.3% in the first quarter from 1.5% in the previous quarter, India's economy grew 2.1%.

On a yearly basis, the G20 area expanded at 3.3% in the first quarter, after a 3.2% in the fourth quarter.

-

17:03

World Bank lowered its global economic forecast for 2015

The World Bank cut its global economic growth forecast for 2015 and 2016 on Thursday, saying that developing countries will face problems from rising U.S. interest rates and lower commodity prices. The World Bank said that the Fed should wait until the next year before raising its interest rate.

The International Monetary Fund (IMF) also warned last week that the Fed should delay its interest rate hike until the first half of 2016.

The World Bank expects that the global economy would grow 2.8% in 2015, down from its January forecast of 3.0%. The global growth was left unchanged at 3.3% in 2016 and at 3.2% in 2017.

China's economy is expected to expand 7.1% in 2015 (7.4% in 2014), 7% in 2016 and 6.9% in 2017.

Growth in the U.S. is expected to accelerate to 2.7% in 2015, down from its January forecast of 3.2, to 2.8% in 2016, down from its January forecast of 3.0%, and to 2.4% in 2017. The World Bank said that a stronger U.S. dollar slowed the U.S. economy more than expected.

In the Eurozone, the economy is expected to grow 1.5% in 2015, up from its January forecast of 1.1%, 1.8% in 2016, up from its January forecast of 1.6%, and 1.6% in 2017.

In Japan, the economy is expected to expand at 1.1% in 2015, down from its January forecast of 1.2%, at 1.7% in 2016 and at 1.2% in 2017.

Developing countries are expected to grow by 4.4% in 2015, by 5.2% in 2016, and by 5.4% in 2017.

-

16:44

Australia's unemployment rate declines to 6.0% in May

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate declined to 6.0% in May from 6.1% in April, beating expectations for a rise to 6.2%. April's figure was revised down from 6.2%.

The number of employed people in Australia climbed by 42,000 in May, exceeding expectations for an increase by 11,000, after a decline by 13,700 in April. April's figure was revised down from a decrease by 2,900.

The increase in employment was driven by a rise in part-time employment for females, which gained by 29,800, and full-time employment for males, which increased by 15,900.

Full-time employment rose by 14,700, while part-time employment increased by 27,300.

The participation rate was 64.7%.

-

16:29

U.S. business inventories rise 0.4% in April

The U.S. Commerce Department released the business inventories data on Thursday. The U.S. business inventories rose 0.4% in April, beating expectations for a 0.2% increase, after a 0.1% gain in March.

The increase was driven by a rise in retail inventories. Retail inventories climbed 0.8% in April.

Business sales climbed 0.6% in April.

The business inventories/sales ratio remained unchanged at 1.36 months in April. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

15:55

Canada’s new housing price index climbs 0.1% in April

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in April, in line with expectations, after a flat reading in March.

The increase was driven by gains in Toronto, Oshawa, Ontario and Vancouver.

On a yearly basis, new housing price index in Canada climbed 1.1% in April. It was the slowest pace since February 2010.

-

15:32

U.S. Stocks open: Dow +0.21%, Nasdaq +0.24%, S&P +0.32%

-

15:28

Before the bell: S&P futures +0.11%, NASDAQ futures +0.19%

U.S. stock-index futures rose slightly as investors assessed data on jobs and retail sales for clues on the timing of higher interest rates.

Global markets:

Nikkei 20,382.97 +336.61 +1.68%

Hang Seng 26,907.85 +220.21 +0.83%

Shanghai Composite 5,122.15 +16.12 +0.32%

FTSE 6,865.99 +35.72 +0.5%

CAC 4,995.06 +60.15 +1.2%

DAX 11,427.02 +161.63 +1.4%

Crude oil $60.97 (-0.73%)

Gold $1186.70 (+0.77%)

-

15:27

U.S. import price index jumps 1.3% in May

The U.S. Labor Department released its import and export prices data on Thursday. The U.S. import price index climbed by 1.3% in May, exceeding expectations for a 0.8% increase, after a 0.2% decline in April. It was the first rise since June 2014.

April's figure was revised up from a 0.3% decrease.

The rise was driven by higher fuel import prices, which climbed 12.7% in May.

Prices for automobiles, natural gas, nonfuel industrial supplies and capital goods declined in May.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices increased by 0.6% in May, after a 0.7% drop in April. It was the biggest gain since March 2014.

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Chevron Corp

CVX

101.87

+0.04%

1.2K

Exxon Mobil Corp

XOM

85.30

+0.11%

3.2K

Merck & Co Inc

MRK

59.25

+0.15%

0.2K

General Motors Company, NYSE

GM

35.65

+0.17%

1.5K

Yahoo! Inc., NASDAQ

YHOO

42.13

+0.17%

2.0K

Microsoft Corp

MSFT

46.70

+0.19%

18.8K

Google Inc.

GOOG

537.69

+0.19%

0.2K

Home Depot Inc

HD

111.20

+0.20%

0.6K

Caterpillar Inc

CAT

88.67

+0.21%

1.7K

AT&T Inc

T

34.80

+0.23%

5.8K

Pfizer Inc

PFE

34.39

+0.23%

0.8K

Walt Disney Co

DIS

110.25

+0.23%

7.9K

The Coca-Cola Co

KO

40.10

+0.25%

0.2K

Verizon Communications Inc

VZ

47.60

+0.27%

0.8K

Intel Corp

INTC

31.91

+0.28%

7.6K

Twitter, Inc., NYSE

TWTR

35.95

+0.28%

23.7K

Apple Inc.

AAPL

129.25

+0.29%

104.0K

Facebook, Inc.

FB

82.40

+0.29%

45.3K

Visa

V

69.84

+0.30%

1.0K

ALTRIA GROUP INC.

MO

48.85

+0.31%

0.8K

Boeing Co

BA

142.08

+0.32%

0.3K

Citigroup Inc., NYSE

C

57.20

+0.32%

2.0K

Ford Motor Co.

F

15.08

+0.33%

6.7K

International Business Machines Co...

IBM

169.50

+0.34%

6.3K

JPMorgan Chase and Co

JPM

68.49

+0.34%

54.2K

Procter & Gamble Co

PG

79.82

+0.35%

0.5K

Starbucks Corporation, NASDAQ

SBUX

52.88

+0.36%

2.3K

Goldman Sachs

GS

214.00

+0.41%

6.2K

Wal-Mart Stores Inc

WMT

73.25

+0.44%

2.8K

Tesla Motors, Inc., NASDAQ

TSLA

251.95

+0.50%

18.8K

Cisco Systems Inc

CSCO

28.83

+0.59%

6.7K

FedEx Corporation, NYSE

FDX

184.20

+1.03%

2.8K

Nike

NKE

104.72

+1.34%

18.5K

ALCOA INC.

AA

12.17

0.00%

20.8K

Barrick Gold Corporation, NYSE

ABX

11.63

0.00%

5.9K

HONEYWELL INTERNATIONAL INC.

HON

104.73

-0.04%

0.1K

Travelers Companies Inc

TRV

99.08

-0.10%

6.4K

General Electric Co

GE

27.60

-0.11%

78.6K

American Express Co

AXP

80.05

-0.17%

2.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.46

-0.49%

4.3K

Yandex N.V., NASDAQ

YNDX

17.30

-0.57%

2.1K

-

15:12

U.S. retail sales soar 1.2% in May

The U.S. Commerce Department released the retail sales data on Thursday. The U.S. retail sales jumped 1.2% in May, exceeding expectations for a 1.1% increase, after a 0.2% gain in April. April's figure was revised up from a flat reading.

The increase was driven by higher automobiles and gasoline purchases. Automobiles sales increased 2.0% in May, while gasoline station sales climbed 3.7%.

Retail sales excluding automobiles increased 1.0% in May, beating forecasts for a 0.7% rise, after a 0.1% gain in April.

Sales at clothing retailers climbed 1.5%. Sales at building material and garden equipment stores were up 2.1% and sales at restaurants and bars increased 0.1%.

Sales at electronics and appliance outlets were up 0.1% in May, whiles sales at online stores gained 1.4%.

These figures indicate that U.S. economy was finding momentum after a slow start of the second quarter.

-

15:08

Upgrades and downgrades before the market open

Upgrades:

Newmont Mining (NEM) upgraded from Sector Perform to Outperform at RBC Capital Mkts, target raised from $27 to $30

Downgrades:

Other:

FedEx (FDX) reiterated at Sector Perform at RBC Capital Mkts, target raised from $180 to $195

FedEx (FDX) reiterated at Outperform at Credit Suisse, target raised from $198 to $206

-

14:45

Initial jobless claims rise by 2,000 to 279,000 in the week ending June 06

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 06 in the U.S. climbed by 2,000 to 279,000 from 277,000 in the previous week. The previous week's reading was revised down from 276,000.

Analysts had expected the number of initial jobless claims to be 277,000.

Jobless claims remained below 300,000 the 14th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 61,000 to 2,265,000 in the week ended May 30.

-

12:00

European stock markets mid session: stocks traded higher on hopes for a deal between Greece and its creditors

Stock indices traded higher on hopes for a deal between Greece and its creditors. Greek Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President François Hollande Wednesday agreed to intensify the debt talks.

The head of the Eurogroup Jeroen Dijsselbloem said in Helsinki on Wednesday that a deal between Greece and its creditors can still be reached. But he warned that the time was running out.

Yields of German government bonds continued to rise on Thursday.

Meanwhile, the economic from the Eurozone was positive. The French statistical office Insee said its consumer price inflation for France. The French consumer price inflation rose 0.2% in May, after a 0.1% increase in April.

On a yearly basis, the consumer price index climbed 0.3% in May, after a 0.1% rise.

Fresh food prices rose 6.4% year-on-year in May, while petroleum products prices dropped by 6.3%.

Current figures:

Name Price Change Change %

FTSE 100 6,860.9 +30.63 +0.45 %

DAX 11,368.86 +103.47 +0.92 %

CAC 40 4,979.66 +44.75 +0.91 %

-

11:41

Reserve Bank of New Zealand cuts its interest rate to 3.25% from 3.50%

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision on Wednesday. The central bank cut its interest rate to 3.25% from 3.50%. It was the first cut since 2011.

The RBNZ Governor Graeme Wheeler said that the interest rate cut was "appropriate given low inflationary pressures and the expected weakening in demand, and to ensure that medium term inflation converges towards the middle of the target range".

He pointed out that the further interest rate cut is possible, but it will depend on the incoming economic data.

-

11:27

French consumer price inflation rises 0.2% in May

The French statistical office Insee said its consumer price inflation for France. The French consumer price inflation rose 0.2% in May, after a 0.1% increase in April.

On a yearly basis, the consumer price index climbed 0.3% in May, after a 0.1% rise.

Fresh food prices rose 6.4% year-on-year in May, while petroleum products prices dropped by 6.3%.

-

11:08

Standard & Poor's downgrades the long-term sovereign credit rating on Greece to ‘CCC’

Standard and Poor's Ratings Services has downgraded the long-term sovereign credit rating on Greece to 'CCC' from 'CCC+' because of the absence of a deal between Greece and its creditors. The outlook is negative.

The agency noted that Athens will likely default on its commercial debt within the next 12 months.

"As its liquidity position continues to deteriorate, Greece appears to be prioritizing other spending items over debt servicing. In our view, without a turnaround in the trajectory of nominal GDP and deep public-sector reform, Greece's debt is unsustainable. The downgrade reflects our view that in the absence of an agreement with its official creditors, Greece will likely default on its commercial debt within the next 12 months," S&P said in its statement.

-

10:54

Standard & Poor's affirms the U.S.’s AA+ credit rating with a stable outlook

Standard & Poor's Ratings Services affirmed the U.S.'s AA+ credit rating with a stable outlook. According to S&P analysts, the U.S. credit rating was underpinned by the resiliency and diversity of the U.S. economy, and the U.S. role as the issuer of the world's reserve currency.

-

10:35

U.S. federal budget declines to $82.4 billion in May

The U.S. Treasury Department released its federal budget data on Wednesday. The budget deficit declined to $82.4 billion in May, down from a deficit of $130 billion in May 2014. Analysts had expect a decline to $98 billion.

The budget deficit declined as revenue was higher than expenses.

Receipts in May rose 6% from the same period last year, while outlays declined 11% from the same period last year.

-

10:18

Head of the Eurogroup Jeroen Dijsselbloem: a deal between Greece and its creditors can still be reached

The head of the Eurogroup Jeroen Dijsselbloem said in Helsinki on Wednesday that a deal between Greece and its creditors can still be reached. But he warned that the time was running out.

"We are still open to serious alternatives, but the alternatives of the last couple of days have not been of a high enough standard," Dijsselbloem said.

-

10:08

European Central Bank raises the amount the Greek central bank can lend its banks by €2.3 billion to €83.0 billion

The European Central Bank (ECB) on Wednesday raised the amount the Greek central bank can lend its banks by €2.3 billion to €83.0 billion from €80.7 billion, according to people familiar with the decision. It was the biggest weekly rise since February 18.

The ECB declined to comment.

The total level of available ELA has increased by more than €23 billion since February.

-

04:01

Nikkei 225 20,329.76 +283.40 +1.41 %, Hang Seng 26,929.33 +241.69 +0.91 %, Shanghai Composite 5,086.49 -19.55 -0.38 %

-

01:01

Stocks. Daily history for Jun 10’2015:

(index / closing price / change items /% change)

Nikkei 225 20,046.36 -49.94 -0.25 %

Hang Seng 26,687.64 -301.88 -1.12 %

S&P/ASX 200 5,478.63 +7.32 +0.13 %

Shanghai Composite 5,106.04 -7.50 -0.15 %

FTSE 100 6,830.27 +76.47 +1.13 %

CAC 40 4,934.91 +84.69 +1.75 %

Xetra DAX 11,265.39 +264.10 +2.40 %

S&P 500 2,105.2 +25.05 +1.20 %

NASDAQ Composite 5,076.69 +62.82 +1.25 %

Dow Jones 18,000.4 +236.36 +1.33 %

-