Noticias del mercado

-

17:43

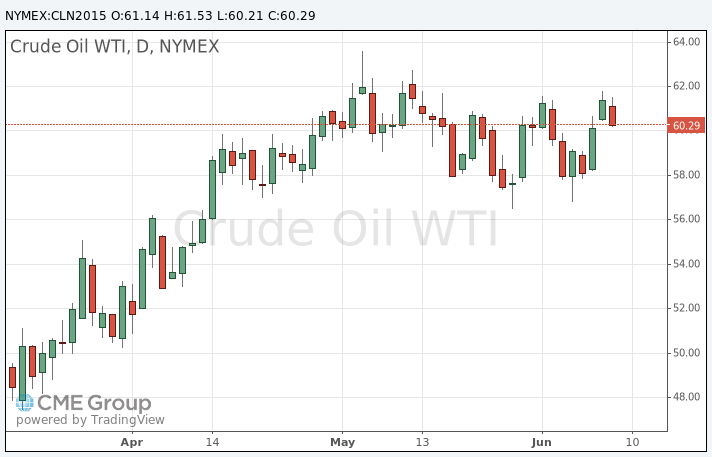

Oil prices traded lower as a stronger U.S. dollar offset higher oil demand forecasts by the International Energy Agency

Oil prices traded lower as a stronger U.S. dollar offset higher oil demand forecasts by the International Energy Agency (IEA). The IEA said on Thursday that lower oil prices and economic growth boosted global demand for energy in 2015. The agency expects oil demand to rise to 1.4 million barrels a day in 2015, up 300,000 barrels a day from its previous estimate.

Higher oil demand was driven by gasoline demand growth of 4.2% in the U.S.

The IEA said that there is a glut of oil supplies as OPEC boosted its oil production and as U.S. oil production was still growing.

The agency estimates a rise in oil production in non-OPEC countries by 195,000 barrels a day to one million barrels a day.

WTI crude oil for July delivery decreased to $60.21 a barrel on the New York Mercantile Exchange.

Brent crude oil for July fell to $65.33 a barrel on ICE Futures Europe.

-

17:28

Gold price traded lower due to a stronger U.S. dollar

Gold price traded lower due to a stronger U.S. dollar. The U.S. dollar strengthened after the better-than-expected U.S. economic data. The number of initial jobless claims in the week ending June 06 in the U.S. climbed by 2,000 to 279,000 from 277,000 in the previous week. Jobless claims remained below 300,000 the 14th straight week. This threshold is associated with the strengthening of the labour market.

The U.S. retail sales jumped 1.2% in May, exceeding expectations for a 1.1% increase, after a 0.2% gain in April. April's figure was revised up from a flat reading.

The increase was driven by higher automobiles and gasoline purchases. Automobiles sales increased 2.0% in May, while gasoline station sales climbed 3.7%.

Retail sales excluding automobiles increased 1.0% in May, beating forecasts for a 0.7% rise, after a 0.1% gain in April.

These figures indicate that U.S. economy was finding momentum after a slow start of the second quarter.

June futures for gold on the COMEX today fell to 1174.40 dollars per ounce.

-

01:02

Commodities. Daily history for Jun 10’2015:

(raw materials / closing price /% change)

Oil 61.43 +2.14%

Gold 1,185.10 -0.13%

-