Noticias del mercado

-

17:41

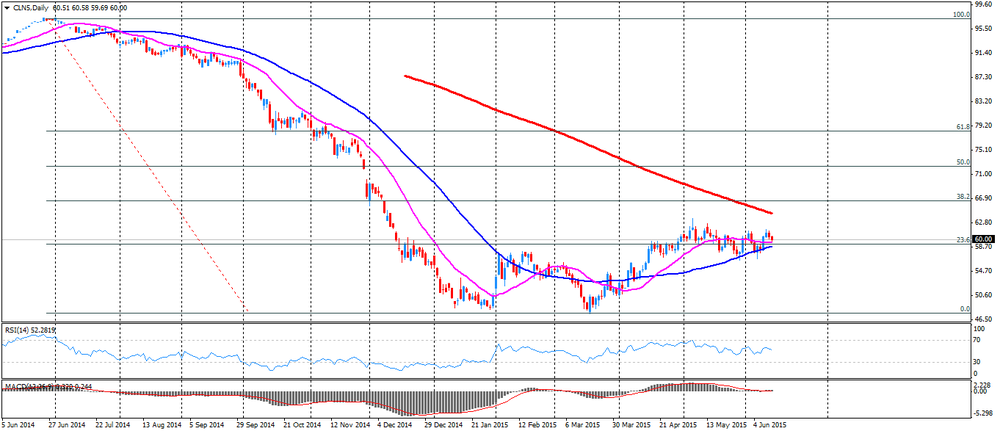

Oil prices traded lower on concerns over the global oil glut

Oil prices traded lower on concerns over the global oil glut. Market participants are concerned that U.S. oil producer could add oil rigs if oil prices stabilise above $60 a barrel.

Investors are awaiting the release of the number of the U.S. oil rigs later in the day. Oil production in the U.S. remains at high level despite the falling number of oil rigs.

The International Energy Agency (IEA) said on Thursday that lower oil prices and economic growth boosted global demand for energy in 2015. The agency expects oil demand to rise to 1.4 million barrels a day in 2015, up 300,000 barrels a day from its previous estimate.

The IEA said that there is a glut of oil supplies as OPEC boosted its oil production and as U.S. oil production was still growing.

WTI crude oil for July delivery decreased to $59.69 a barrel on the New York Mercantile Exchange.

Brent crude oil for July fell to $64.51 a barrel on ICE Futures Europe.

-

17:21

Gold price traded lower due to a stronger U.S. dollar

Gold price traded lower due to a stronger U.S. dollar. The U.S. producer price index increased 0.5% in May, exceeding expectations for a 0.4% gain, after a 0.4% drop in April. It was the largest increase since September 2012.

On a yearly basis, the producer price index decreased 1.1% in April, in line with expectations, after a 1.3% fall in April.

The rise was driven by higher food and gasoline prices. Gasoline prices jumped 17.0% in May, the largest rise since August 2009. Food prices climbed by 0.8%, driven by a shortage of eggs, and as wholesale egg prices jumped a 56.4% in May.

The producer price index excluding food and energy climbed 0.1% in May, in line with expectations, after a 0.2% decrease in April.

On a yearly basis, the producer price index excluding food and energy climbed 0.6% in May, missing forecasts of a 0.7% increase, after a 0.8% rise in April.

The figures added to speculation on that the Fed will start raising its interest rate this year.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 94.6 in June from a final reading of 90.7 in May, exceeding expectations for an increase to 91.5.

Gold price was supported by the uncertainty over the Greek debt talks. The International Monetary Fund (IMF) spokesman Gerry Rice said on Thursday that the IMF's technical team has left the debt talks in Brussels. The reason is "major differences", he noted.

News reported that Germany was preparing for a Greek default.

June futures for gold on the COMEX today fell to 1176.20 dollars per ounce.

Gold price traded lower due to a stronger U.S. dollar. The U.S. producer price index increased 0.5% in May, exceeding expectations for a 0.4% gain, after a 0.4% drop in April. It was the largest increase since September 2012.

On a yearly basis, the producer price index decreased 1.1% in April, in line with expectations, after a 1.3% fall in April.

The rise was driven by higher food and gasoline prices. Gasoline prices jumped 17.0% in May, the largest rise since August 2009. Food prices climbed by 0.8%, driven by a shortage of eggs, and as wholesale egg prices jumped a 56.4% in May.

The producer price index excluding food and energy climbed 0.1% in May, in line with expectations, after a 0.2% decrease in April.

On a yearly basis, the producer price index excluding food and energy climbed 0.6% in May, missing forecasts of a 0.7% increase, after a 0.8% rise in April.

The figures added to speculation on that the Fed will start raising its interest rate this year.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 94.6 in June from a final reading of 90.7 in May, exceeding expectations for an increase to 91.5.

Gold price was supported by the uncertainty over the Greek debt talks. The International Monetary Fund (IMF) spokesman Gerry Rice said on Thursday that the IMF's technical team has left the debt talks in Brussels. The reason is "major differences", he noted.

News reported that Germany was preparing for a Greek default.

June futures for gold on the COMEX today fell to 1176.20 dollars per ounce.

-

11:07

International Energy Agency upgrades its global oil demand forecast for 2015

The International Energy Agency (IEA) said on Thursday that lower oil prices and economic growth boosted global demand for energy in 2015. The agency expects oil demand to rise to 1.4 million barrels a day in 2015, up 300,000 barrels a day from its previous estimate.

Higher oil demand was driven by gasoline demand growth of 4.2% in the U.S.

The IEA said that there is a glut of oil supplies as OPEC boosted its oil production and as U.S. oil production was still growing.

The agency estimates a rise in oil production in non-OPEC countries by 195,000 barrels a day to one million barrels a day.

-

01:01

Commodities. Daily history for Jun 11’2015:

(raw materials / closing price /% change)

Oil 60.77 -1.07%

Gold 1,181.50 +0.09%

-