Noticias del mercado

-

17:42

Oil prices traded mixed on concerns over the global oil glut

Oil prices traded mixed on concerns over the global oil glut. Oil production in the U.S. remains at high level despite the falling number of oil rigs.

The debt talks between Greece and its creditors also weighed on oil prices. the weekend's debt talks between Greece and its creditors were unsuccessful. An EU Commission official said that there are still big differences between the Greek reform plan and the demand of the creditors.

European Commission President Jean-Claude Juncker noted that a new debt deal could be reached until the end of the month.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

European Central Bank (ECB) President Mario Draghi said on Monday before the European Parliament's Economic and Monetary Affair's Committee that the ball lies in Athens' court to act. He noted that a "strong and comprehensive agreement" between Greece and its creditors was needed as soon as possible.

Investors are awaiting the Fed's interest rate decision on Wednesday. It is unlikely that the Fed start raising its interest rate in June as U.S. industrial production dropped in May. The U.S. industrial production dropped 0.2% in May, missing expectations for a 0.3% increase, after a 0.5% decline in April.

The decline was driven by lower mining output. Mining output dropped by 0.3% in May as oil and gas well drilling plunged 7.9%.

Capacity utilisation rate fell to 78.1% in May from 78.3% in April. April's figure was revised up 78.2%. Analysts had expected a capacity utilisation rate of 78.3%.

WTI crude oil for July delivery decreased to $59.46 a barrel on the New York Mercantile Exchange.

Brent crude oil for July rose to $64.08 a barrel on ICE Futures Europe.

-

17:25

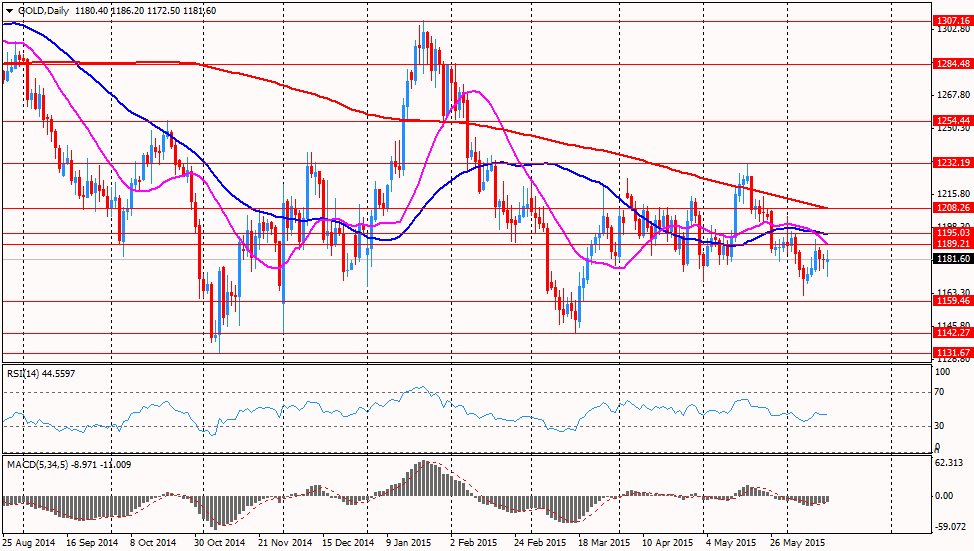

Gold price traded higher as the weekend's debt talks between Greece and its creditors were unsuccessful

Gold price traded higher as the weekend's debt talks between Greece and its creditors were unsuccessful. An EU Commission official said that there are still big differences between the Greek reform plan and the demand of the creditors.

European Commission President Jean-Claude Juncker noted that a new debt deal could be reached until the end of the month.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

European Central Bank (ECB) President Mario Draghi said on Monday before the European Parliament's Economic and Monetary Affair's Committee that the ball lies in Athens' court to act. He noted that a "strong and comprehensive agreement" between Greece and its creditors was needed as soon as possible.

Speculation on that the Fed start raising its interest rate this year weighed on gold price.

Lower physical demand in Asia also weighed on gold price.

June futures for gold on the COMEX today rose to 1180.40 dollars per ounce.

-

15:29

-

10:08

U.S. oil and gas rigs decline by 9 to 859

The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 7 rigs to 635 last week, the lowest weekly level since August 2010. It was the 27th consecutive weekly fall.

Combined oil and gas rigs fell by 9 to 859.

The U.S. Energy Information Administration forecasts that U.S. crude-oil production would begin to fall from June until February 2016.

-

00:38

Commodities. Daily history for Jun 12’2015:

(raw materials / closing price /% change)

Oil 59.96 -1.33%

Gold 1,179.20 -0.10%

-