Noticias del mercado

-

17:43

Oil prices traded higher on speculation on the higher oil demand as a tropical storm Bill headed towards the oil-producing state of Texas

Oil prices traded higher on speculation on the higher oil demand as a tropical storm Bill headed towards the oil-producing state of Texas. More than 45% of U.S. oil refining capacity is located along the Gulf Coast.

Investors are awaiting the release of the U.S. oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data today, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

The debt talks between Greece and its creditors remained in focus. Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

German newspaper Süddeutsche Zeitung reported that capital controls could be imposed this week. Athens denied this report.

Investors are also awaiting the release of the Fed's monetary policy meeting results. The results are scheduled to be released tomorrow. Analysts expect that the central bank will keep unchanged its monetary policy.

WTI crude oil for July delivery increased to $59.88 a barrel on the New York Mercantile Exchange.

Brent crude oil for July rose to $63.97 a barrel on ICE Futures Europe.

-

17:25

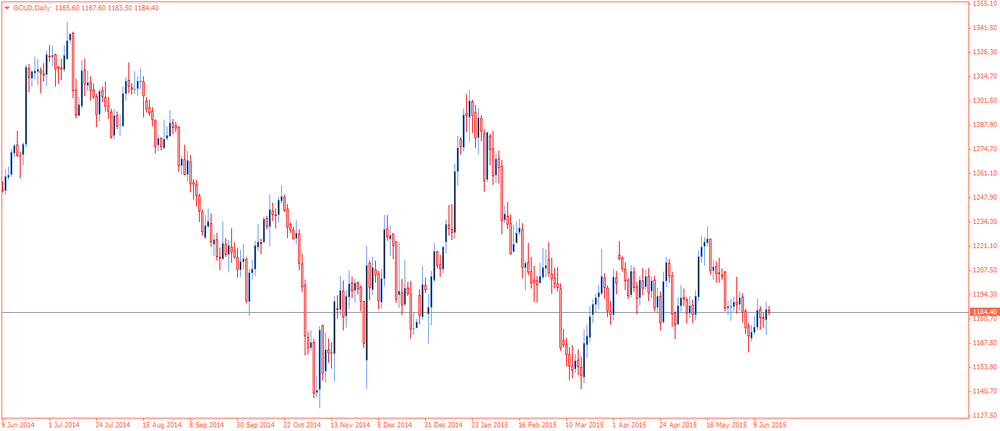

Gold price traded lower on a stronger U.S. dollar

Gold price traded lower on a stronger U.S. dollar. The U.S. dollar rose other currencies ahead of the release of the Fed's monetary policy meeting results. The results are scheduled to be released tomorrow. Analysts expect that the central bank will keep unchanged its monetary policy. Market participants will monitor closely a speech by the Fed Chair Janet Yellen for signs when the central bank starts raising its interest rate.

The debt talks between Greece and its creditors remained in focus. Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

German newspaper Süddeutsche Zeitung reported that capital controls could be imposed this week. Athens denied this report.

Assets at SPDR Gold Trust declined 0.3% to 701.9 tonnes on Monday, the lowest level since 2008.

Speculation on that the Fed start raising its interest rate this year weighed on gold price.

Lower physical demand in Asia also weighed on gold price.

June futures for gold on the COMEX today fell to 1177.00 dollars per ounce.

-

09:48

Oil: prices rebounded amid signs of declines in US crude inventories

West Texas Intermediate crude prices for July delivery advanced 60 cents to $60.12 while Brent crude for August rose by 32 cents to $64.27 a barrel this morning. The rise in crude oil futures corresponds with the generally better trade data from Asia, which might be partly driven by a softer dollar despite worries over supply issues and the struggling Greece's debt negotiations.

API Crude Oil Inventories data will be published today 20:30 GMT. Analysts surveyed by Bloomberg believe that crude inventories might have declined for the seventh week in a row.

-

09:34

Gold limited gains ahead of the FOMC meeting

The precious metal traded in a narrow range ahead of the Federal Reserve policy meeting that may provide clues on the timing of the data-dependent first rate hike. U.S. economic data on Monday showed weakness in industrial production despite recent strong data on retail sales, employment, consumer and small business confidence.

Recently prices were upbeat amid uncertainty about Greece debt talks.

Spot gold was up 0.5% at $1,186.60 an ounce, while US gold futures for August delivery gained $6.60 an ounce at $1,185.80.

-

00:33

Commodities. Daily history for Jun 15’2015:

(raw materials / closing price /% change)

Oil 59.61 +0.15%

Gold 1,185.70 -0.01%

-