Noticias del mercado

-

17:42

Oil prices traded lower after the release of U.S. oil inventories data

Oil prices traded lower after the release of U.S. oil inventories data. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 2.68 million barrels to 467.9 million in the week to June 12. It was the seventh consecutive weekly decline.

Analysts had expected a decline of 1.8 million barrels.

Gasoline inventories were up by 460,000 barrels to 217.8 million barrels last week, according to the EIA.

U.S. oil production fell 21,000 barrels a day to 9.59 million barrels a day.

Crude stocks at the Cushing, Oklahoma, increased by 112,000 barrels. It was the first rise since mid-April.

U.S. crude oil imports rose by 114,000 barrels per day to 7.1 million barrels per day.

Refineries in the U.S. were running at 93.1% of capacity, down from 94.6% the previous week.

Investors are awaiting the results of the Fed's monetary policy meeting later in the day. The Fed will also release its economic forecasts. The Fed Chair Janet Yellen is scheduled to speak after the release of the results.

Investors are also awaiting signals when the Fed starts raising its interest rate.

WTI crude oil for July delivery decreased to $59.97 a barrel on the New York Mercantile Exchange.

Brent crude oil for July fell to $63.53 a barrel on ICE Futures Europe.

-

17:27

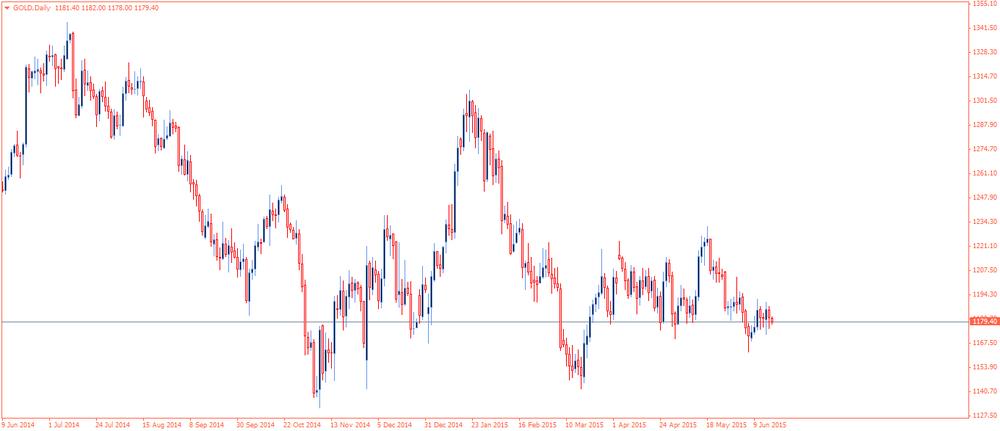

Gold price traded lower due to a stronger U.S. dollar

Gold price traded lower due to a stronger U.S. dollar. The U.S. dollar traded higher against the other currencies ahead of the release of the Fed's interest rate decision. The results of the Fed's monetary policy meeting are scheduled to be released at 18:00 GMT. The Fed will also release its economic forecasts. The Fed Chair Janet Yellen is scheduled to speak after the release of the results.

Investors are awaiting signals when the Fed starts raising its interest rate.

The debt talks between Greece and its creditors remained in focus. Greek Prime Minister Alexis Tsipras said on Wednesday that he was ready to assume responsibility for the consequences of rejecting a deal with creditors.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

June futures for gold on the COMEX today fell to 1177.40 dollars per ounce.

-

17:15

U.S. crude inventories decline by 2.68 million barrels in the week to June 12

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 2.68 million barrels to 467.9 million in the week to June 12. It was the seventh consecutive weekly decline.

Analysts had expected a decline of 1.8 million barrels.

Gasoline inventories were up by 460,000 barrels to 217.8 million barrels last week, according to the EIA.

U.S. oil production fell 21,000 barrels a day to 9.59 million barrels a day.

Crude stocks at the Cushing, Oklahoma, increased by 112,000 barrels. It was the first rise since mid-April.

U.S. crude oil imports rose by 114,000 barrels per day to 7.1 million barrels per day.

Refineries in the U.S. were running at 93.1% of capacity, down from 94.6% the previous week.

-

14:37

International Energy Agency (IEA) data: global oil supply has exceeded demand for the past five quarters

According to International Energy Agency (IEA) data, global oil supply has exceeded demand for the past five quarters, the most enduring oil glut since the 1997 Asian economic crisis. If Saudi Arabia will keep its oil production at current level, it would become the longest surplus since 1985.

OPEC produced 31.3 million barrels a day in May, according to an IEA June report.

-

08:58

Oil: prices gained amid declines in US crude inventories

West Texas Intermediate crude prices for July delivery rose by 0.23% to $60.11, while Brent crude for August rose by 22% to $63.84 a barrel. The rise in U.S. crude prices was partly caused by a tropical storm in the oil-producing state of Texas. However, globally excessive supplies limited gains and pressured Brent.

API data showed yesterday that U.S. crude inventories fell by 2.9 million barrels in the week ended June the 12th, crude stocks at Cushing rose by 329,000 barrels, while Gasoline stocks fell by 2.9 million barrels.

-

08:43

Gold weakened ahead of the FOMC rate decision

Gold declined to $1,179.10 an ounce as traders await the Federal Open Market Committee benchmark rate decision as the two-day policy meeting ends.

Strength of the U.S. currency would hurt the dollar-denominated precious metal, making it more expensive for holders of other currencies. At the same time it would limit demand for safe-haven.

The ongoing uncertainty regarding future of Greece's debt and EU membership does not provide much support.

-

00:33

Commodities. Daily history for Jun 16’2015:

(raw materials / closing price /% change)

Oil 60.02 +0.08%

Gold 1,181.10 +0.02%

-