Noticias del mercado

-

20:00

U.S.: Fed Interest Rate Decision , 0.25% (forecast 0.25%)

-

19:40

American focus: the pound was up against the US dollar

The euro rose slightly against the dollar, returning the previously lost positions due to expectations of the Fed meeting, as well as news on Greece. As it became known, the ECB raised the limit on the program to provide liquidity (ELA) for Greek banks to € 1.1 billion. To € 84.1 billion. Also, stress, and tomorrow will be a meeting of the Eurogroup, with Greece obviously does not intend to make concessions on the issue of further reduction of pensions. Today, the coordinator of the team of negotiators Euclid Tsakalotos confirmed that, without reaching agreement, unlock the access to finance of Greece, in Athens no cash to pay the IMF on June 30 debt of € 1.6 billion. He also added that despite the willingness of Greece to make concessions , the issue of cutting back pensions is not discussed.

As for the Fed meeting, according to the consensus forecast of the Central Bank will refrain from raising interest rates in June, but it may toughen the wording of the statement in preparation for the normalization of monetary policy. Against the backdrop of weak data on the state of industrial production and the US housing market, economists began to reduce rates on the transition to a tightening of monetary policy in September, although it is the first month of autumn is their main goal. The market participants assess the situation differently: traders see only a 28% chance of a September rate hike, but the likelihood that this will happen in December 2015, or earlier, it is equal to 67% of them. "The most important thing for investors - comments of Fed Yellen after the meeting - said Wedbush Securities analyst Michael James. - Until her speech to investors is by and large do not care what happens in the market."

The pound rose against the dollar, updating the month high, supported by data on the labor market. The Office for National Statistics said the unemployment rate by ILO for the period from February to April was 5.5 percent, compared with 5.7 per cent recorded in the three months to January. It was also lower than the figure recorded in the same period last year at 6.6 percent. The unemployment rate was in line with economists' expectations and was the lowest since April to June 2008, when the figure was 5.4 percent. The number of unemployed fell by 43 thousand. From the previous three months to 1.81 million., The lowest level since June to August 2008. Average earnings, including bonuses, in the three months to April rose 2.7 percent year on year. Economists had forecast a 2.1 percent rise. The latest increase was the highest from June to August 2011, when the payment is increased by 2.7 per cent. Excluding bonuses, pay grew by 2.7 percent in the three months to April, the highest level since December to February 2009. The number of Britons claiming unemployment benefits in May fell by 6.5 thousand. People from the previous month to 791.8 thousand. People. Reducing the number of applications for unemployment benefits was much less than the drop of 12.3 thousand. That economists expected, and it was the smallest monthly decline since February 2013.

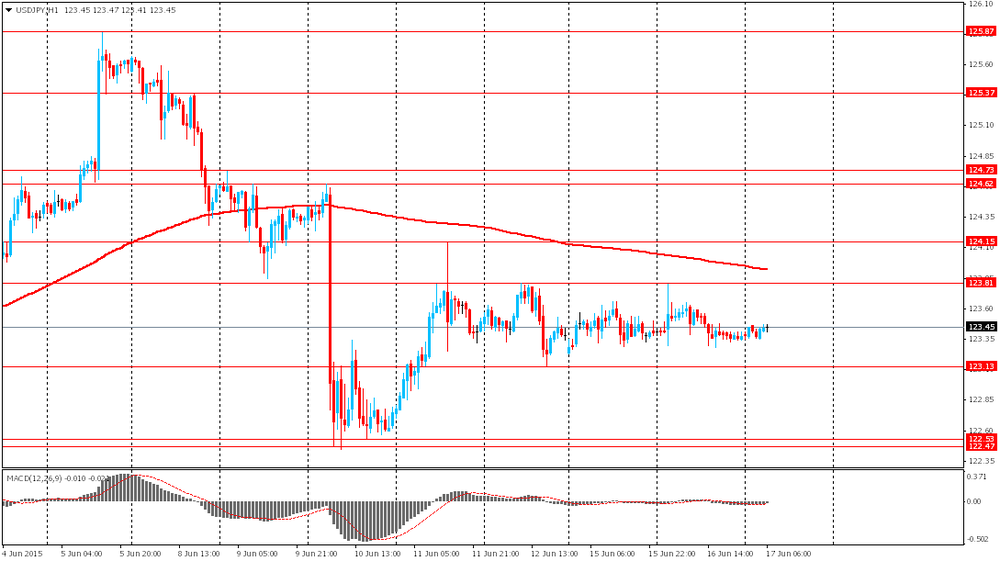

The yen fell against the US currency, updating weekly lows, which was due to a surge in demand for the dollar from investors on the eve of the meeting FOMC. Traders await the outcome of the two-day meeting of the Federal Reserve System, which can appear signals about future actions of the American regulator. If the mixed statistics do not confuse Yellen and command and rates will be increased this year, we should expect natural growth of the dollar, in this case the raw material assets temporarily come under pressure, but the effect will not be long, because in many respects the situation has calculated market.

-

17:04

Construction production in the Eurozone rises 0.3% in April

The Eurostat released its construction production data for the Eurozone on Wednesday. Construction production in the Eurozone increased 0.3% in April, after a 0.6% rise in March. March's figure was revised down from a 0.85 gain.

Civil engineering output declined 1.8% in April, while production in the building sector climbed 0.5%.

On a yearly basis, construction output remained stable in April, after a 1.9% drop in March. March's figure was revised up from 2.7% decline.

-

16:54

Bank of Greece: failure to reach a deal with creditors could lead to the exit from the Eurozone and to crisis in Greece

The Bank of Greece said in its annual report on Wednesday that failure to reach a deal with creditors could lead to the exit from the Eurozone and to crisis in Greece.

"The conclusion of a new agreement with our partners is of the utmost importance to fend off the immediate risks to the economy, reduce uncertainty and ensure a sustainable growth outlook for Greece. Failure to reach an agreement would, on the contrary, mark the beginning of a painful course that would lead initially to a Greek default and ultimately to the country's exit from the euro area and - most likely - from the European Union," the central bank said.

The Bank of Greece urged to the Greek government to reach a deal.

-

16:35

Head of the Eurogroup Jeroen Dijsselbloem: a deal between Athens and its creditors is still possible

The head of the Eurogroup Jeroen Dijsselbloem said on Wednesday that a deal between Athens and its creditors is still possible.

"Time is running out but a deal is still possible," he noted.

Dijsselbloem also said that Greece should present alternative proposals. He added that the Eurogroup remains opposed to writing off Greek debt.

Dijsselbloem proposed to delay the election of his successor as head of the Eurogroup until July, to focus on Greece. The election is scheduled to be on Thursday.

-

16:30

U.S.: Crude Oil Inventories, June -2.676 (forecast -1.8)

-

16:07

U.K. household finance index declines to 43.8 in June

Markit Economics and financial information provider Ipsos Mori released its household finance index for the U.K. The household finance index declined to 43.8 in June from 45.5 in May.

The decline was driven by concerns over job security.

The index measuring the outlook for financial well-being over the coming twelve months increased to 50.1 in June from 49.3 in May.

The current inflation perceptions index declined to 61.5 in June from 64.7 in May.

The index measuring expected living costs over the twelve months was 78 in June.

24% expects monetary policy to tighten over the next six months. It was the lowest reading since October 2013.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E1.43bn), $1.1150(E336mn), $1.1200(E694mn)

USD/JPY: Y123.00-15($800mn)

EUR/JPY: Y140.00(E400mn)

GBP/USD: $1.5500(Gbp613mn), $1.5550(Gbp309mn)

USD/CHF: Chf0.9425($420mn)

AUD/USD: $0.7600-10(A$400mn), $0.7800(A$485mn)

AUD/JPY: Y96.00(A$333mn)

-

15:35

Ifo institute upgrades its German economic growth for 2015

The Ifo institute upgraded its German economic growth for 2015 on Wednesday. Germany's economy is expected to grow 1.9% this year, up from the previous estimate of 1.5%, and 1.8% in 2015.

The upgrade was driven by stronger private consumption.

The Ifo institute expects private consumption to remain the main driver, corporate investments to expand, while construction boom to continue.

Imports are expected to grow stronger than exports.

-

15:12

Italy’ trade surplus declines to €3.52 billion in April

The Italian statistical office Istat released its trade data for Italy. Italy' trade surplus declined to a seasonally adjusted €3.52 billion in April from €3.89 billion in March.

Exports fell 0.8% in April, while imports remained stable.

On a yearly basis, exports climbed 9.0% in April, while imports rose 9.3%.

The trade surplus with the EU was a seasonally adjusted €858 million in April, while the trade surplus with non-EU countries was €2.67 billion.

-

14:53

Canada’s wholesale sales rise 1.9% in April

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales increased 1.9% in April, exceeding expectations for a 0.3% rise, after a 1.0% gain in March. March's figure was revised up from a 0.8% increase.

The increase was driven by higher sales in the motor vehicle and parts subsector. Sales of automobiles and parts jumped 9.3% in April.

Sales in the machinery, equipment and supplies subsector rose 1.5% in April, sales construction, forestry, mining, and industrial machinery, equipment and supplies subsector increased 4.8%, while sales in the food, beverage and tobacco subsector declined 2.0%.

Sales rose in four of the seven subsectors.

Inventories climbed by 0.5% in April.

-

14:30

Canada: Wholesale Sales, m/m, April 1.9% (forecast 0.3%)

-

14:22

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar in the release of the labour market data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May 0.0% Revised From 0.1% -0.1%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.3% Revised From 2.2% 2.5% 2.7%

08:30 United Kingdom Average Earnings, 3m/y April 2.3% Revised From 1.9% 2.1% 2.7%

08:30 United Kingdom ILO Unemployment Rate April 5.5% 5.5% 5.5%

08:30 United Kingdom Claimant count May -7.8 Revised From -12.6 -12.3 -6.5

08:30 United Kingdom Bank of England Minutes

09:00 Eurozone Harmonized CPI May 0.2% 0.2% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May 0.0% 0.3% 0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) May 0.6% 0.9% 0.9%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June -0.1 0.1

The U.S. dollar traded mixed against the most major currencies ahead of the Fed's interest rate decision. Investors are awaiting signals when the Fed starts raising its interest rate.

The euro traded lower against the U.S. dollar after the final consumer inflation data from the Eurozone. Eurozone's final consumer price index rose 0.2% in May, in line with the previous estimate.

On a yearly basis, Eurozone's final consumer price inflation climbed to 0.3% in May from 0.0% in April, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 0.9% in May from 0.6% in April, in line with the previous estimate.

Concerns over the Greek debt problem still weighed on the euro. The next round of the debt talks between Greece and its creditors is scheduled to at the finance ministers' meeting this Thursday in Luxembourg. Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

The British pound traded higher against the U.S. dollar in the release of the labour market data from the U.K. The U.K. unemployment rate remained unchanged at 5.5% in the February to April quarter, in line with expectations. It was the lowest level since 2008.

The claimant count decreased by 6,500 people in May, missing expectations for a drop by 12,300, after a decrease of 7,800 people in April.

Average weekly earnings, excluding bonuses, climbed by 2.7% in the February to April quarter, exceeding expectations for a rise by 2.5%, after a 2.3% gain in the November to January quarter. It was the highest gain since December to February 2009.

Average weekly earnings, including bonuses, rose by 2.7% in the February to April quarter, exceeding expectations for a gain of 2.1%, after a 2.3% increase in the November to January quarter. It was the highest rise since June to August 2011.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

The Bank of England's Monetary Policy Committee (MPC) released its May meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

All MPC members noted that it was appropriate to keep the monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced" between voting to hold or hike interest rate repeating comments from the last minutes.

MPC members said that the monetary policy will depend on "the prospects for inflation in the United Kingdom and would not be determined by the actions of other central banks".

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian wholesale sales data. Canadian wholesale sales are expected to climbed 0.3% in April, after a 0.8% rise in March.

The Swiss franc traded higher against the U.S. dollar due to increasing demand in the safe-haven currency. A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index rose to 0.1 points in June from -0.1 points in May.

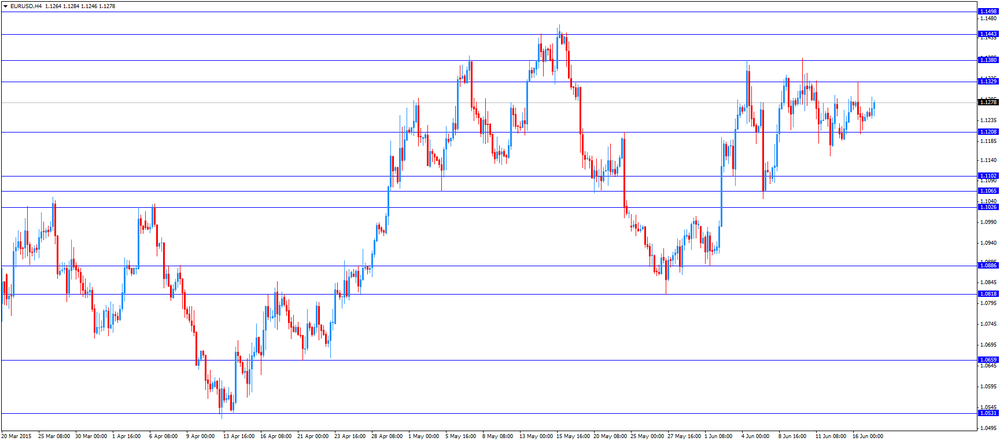

EUR/USD: the currency pair increased to $1.1292

GBP/USD: the currency pair rose to $1.5754

USD/JPY: the currency pair was up to Y123.97

The most important news that are expected (GMT0):

12:30 Canada Wholesale Sales, m/m April 0.8% 0.3%

14:30 U.S. Crude Oil Inventories June -6.812 -1.8

17:45 United Kingdom BOE Gov Mark Carney Speaks

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP y/y Quarter I 3.5% 3.1%

22:45 New Zealand GDP q/q Quarter I 0.8% 0.6%

-

14:04

Japan's trade deficit widens to ¥216 billion in May

The Ministry of Finance released its trade data for japan on Wednesday. Japan's trade deficit widened to ¥216 billion in May from a deficit of ¥55.8 billion in April. April's figure was revised down from a deficit of ¥53.4 billion.

Analysts had expected a deficit of ¥226 billion.

The adjusted trade deficit was ¥182.5 billion in May.

Exports rose 2.4% year-on-year, while imports dropped 8.7%.

Exports to Asia climbed by 3.3% year-on-year, exports to the United States increased by 7.4%, while exports to the European Union were up 0.4%.

Imports from Asia fell 3.0% year-on-year, imports from the United States jumped 11.5%, while imports from the European Union rose 1.1%.

-

13:50

Orders

EUR/USD

Offers 1.1285 1.1300 1.1330 1.1345-50 1.1365 1.1380 1.1400 1.1430 1.1450

Bids 1.1240 1.1220 1.1200 1.1185 1.1150 1.1130 1.1100 1.1080 1.1050

GBP/USD

Offers 1.5650-55 1.5670 1.5685 1.5700 1.5725 1.5745 1.5780 1.5800

Bids 1.5620 1.5600 1.5585 1.5565 1.5540 1.5520-25 1.5500 1.5480-85 1.5460 1.5445

EUR/GBP

Offers 0.7220-25 0.7245-50 0.7270 0.7285 0.7300 0.7320-25 0.7350

Bids 0.7185 0.7160 0.7130 0.7100 0.7080

EUR/JPY

Offers 139.60 139.80 140.00 140.20 140.50 140.80 141.00

Bids 139.00 138.80 138.50 138.30 138.00 137.50 137.00

USD/JPY

Offers 123.80 124.00 124.25 124.40 124.75-80 125.00

Bids 123.30 123.00 122.80 122.60 122.30 122.00

AUD/USD

Offers 0.7730 0.7745-50 0.7770 0.7785 0.7800-05 0.7830 0.7850

Bids 0.7700 0.7680 0.7650 0.7625-30 0.7600 0.7585 0.7550

-

11:44

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to 0.1 points in June

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index rose to 0.1 points in June from -0.1 points in May.

The current conditions index dropped to -23.0 points in June from 0.0 points in May, driven by a downgrade of the Swiss gross domestic product (GDP) estimate for Q1 2015. The State Secretariat for Economic Affairs (SECO) forecasts Switzerland's real GDP to decline by 0.2%.

71.8% of the financial analysts noted that the present state of Switzerland's economy is "normal".

-

11:35

Eurozone's final consumer price index increases 0.2% in May

Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's final consumer price index rose 0.2% in May, in line with the previous estimate.

On a yearly basis, Eurozone's final consumer price inflation climbed to 0.3% in May from 0.0% in April, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco climbed to an annual rate of 0.9% in May from 0.6% in April, in line with the previous estimate.

-

11:24

Bank of England's Monetary Policy Committee minutes: it was appropriate to keep the monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its May meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

All MPC members noted that it was appropriate to keep the monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced" between voting to hold or hike interest rate repeating comments from the last minutes.

MPC members said that the monetary policy will depend on "the prospects for inflation in the United Kingdom and would not be determined by the actions of other central banks".

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E1.43bn), $1.1150(E336mn), $1.1200(E694mn)

USD/JPY: Y123.00-15($800mn)

EUR/JPY: Y140.00(E400mn)

GBP/USD: $1.5500(Gbp613mn), $1.5550(Gbp309mn)

USD/CHF: Chf0.9425($420mn)

AUD/USD: $0.7600-10(A$400mn), $0.7800(A$485mn)

AUD/JPY: Y96.00(A$333mn)

-

11:12

U.K. unemployment rate remains unchanged at 5.5% in the February to April quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.5% in the February to April quarter, in line with expectations. It was the lowest level since 2008.

The claimant count decreased by 6,500 people in May, missing expectations for a drop by 12,300, after a decrease of 7,800 people in April. April's figure was revised down from a decline of 12,600.

Average weekly earnings, excluding bonuses, climbed by 2.7% in the February to April quarter, exceeding expectations for a rise by 2.5%, after a 2.3% gain in the November to January quarter. It was the highest gain since December to February 2009.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 2.7% in the February to April quarter, exceeding expectations for a gain of 2.1%, after a 2.3% increase in the November to January quarter. It was the highest rise since June to August 2011.

The previous three months' figure was revised up from a 1.9% rise.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:01

Eurozone: Harmonized CPI, May 0.2% (forecast 0.2%)

-

11:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, May 0.9% (forecast 0.9%)

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), June 0.1

-

11:00

Eurozone: Harmonized CPI, Y/Y, May 0.3% (forecast 0.3%)

-

10:51

European Court of Justice: the European Central Bank has the right to purchase government securities from EU members

The Luxembourg-based European Court of Justice (ECJ) said on Tuesday that the European Central Bank (ECB) has the right to purchase government securities from EU members undergoing a financial crisis. The ECJ noted that government securities purchases were fully in line with the European system of central banks' existing competences.

-

10:35

Former European Central Bank President Jean-Claude Trichet: Greece should stay in the Eurozone because the exit from the Eurozone would hurt the Greek public most

Former European Central Bank President (ECB) Jean-Claude Trichet said on Tuesday that Greece should stay in the Eurozone because the exit from the Eurozone would hurt the Greek public most.

"I think the will of the Greek government, the overwhelming will of the Greek people -- according to the information I have -- and of course the option of the European friends is that staying in the euro area is by far the best solution," Trichet said.

Trichet was the ECB president in 2010 when Eurozone's finance ministers provided Athens with initial financial aid.

-

10:30

United Kingdom: ILO Unemployment Rate, April 5.5% (forecast 5.5%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, April 2.7% (forecast 2.5%)

-

10:30

United Kingdom: Claimant count , May -6.5 (forecast -12.3)

-

10:30

United Kingdom: Average Earnings, 3m/y , April 2.7% (forecast 2.1%)

-

10:15

European Central Bank Executive Board Member Yves Mersch: membership of the Eurozone is irreversible and the exit from the Eurozone is not foreseen in the European Union's treaty

European Central Bank (ECB) Executive Board Member Yves Mersch said that membership of the Eurozone is irreversible and the exit from the Eurozone is not foreseen in the European Union's treaty.

"We consider participation in the euro area to be irreversible and it is on this assumption that the regulations and the treaty have been written," he said.

Mersch noted that that the European approach to a problem was a cooperative one.

-

08:18

Foreign exchange market. Asian session: U.S. dollar muted ahead of Fed benchmark rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Leading Index May 0.1% -0.1%

The U.S. dollar has had a flat start today with most major currencies as investors await the result of the Federal Open Market Committee meeting. The liftoff is not expected to take place today so traders will listen carefully to comments made after the meeting. Fed Chair Janet Yellen will speak after the announcement of the rate decision. Particular attention will be paid to the median forecast for the funds rate over the current year.

The euro has slightly fallen amid ongoing uncertainty about Greece. Market participants are waiting for news on Greece when the euro zone finance ministers meet on Thursday. Today traders will pay attention to Eurozone inflation data 09:00 GMT and Fed interest rate decision 18:00 GMT.

The pound has given up a little bit of its gains. However today news background is strong and lack of motion in the morning might mean that the currency is waiting for a storm. Yesterday data showed that the Harmonized index of consumer prices confirmed expectations and rose by 0.2% m/m and 0.1% y/y in May.

The Australian dollar fell to 0.7720. Westpac Leading Index for May came in at -0.12%. Westpac said that the country is likely to see even lower rates.

The New Zealand dollar slightly shifted down to 0.6968.

The Japanese yen has declined slightly against the U.S. dollar. The Finance Ministry reported Wednesday that the deficit in May was 216 billion yen ($1.7 billion), compared with 917.2 billion yen a year earlier. At the same time, it expanded compared to the 55.8 billion yen deficit recorded in April.

EUR/USD: the dollar is muted ahead of Fed interest rate decision

USD/JPY: the U.S. dollar slightly gained against the yen.

GBP/USD: the pound is steady waiting for news.

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.2% 2.5%

08:30 United Kingdom Average Earnings, 3m/y April 1.9% 2.1%

08:30 United Kingdom ILO Unemployment Rate April 5.5% 5.5%

08:30 United Kingdom Claimant count May -12.6 -12.3

08:30 United Kingdom Bank of England Minutes

09:00 Eurozone Harmonized CPI May 0.2% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y May 0.0% 0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y May 0.6% 0.9%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June -0.1

12:30 Canada Wholesale Sales, m/m April 0.8% 0.3%

14:30 U.S. Crude Oil Inventories June -6.812 -1.8

17:45 United Kingdom BOE Gov Mark Carney Speaks

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP y/y Quarter I 3.5% 3.1%

22:45 New Zealand GDP q/q Quarter I 0.8% 0.6%

23:05 United Kingdom BOE Quarterly Bulletin

-

08:10

Options levels on wednesday, June 17, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1394 (2155)

$1.1352 (1299)

$1.1308 (1696)

Price at time of writing this review: $1.1245

Support levels (open interest**, contracts):

$1.1205 (1426)

$1.1176 (532)

$1.1135 (1403)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 51773 contracts, with the maximum number of contracts with strike price $1,1600 (3736);

- Overall open interest on the PUT options with the expiration date July, 2 is 79204 contracts, with the maximum number of contracts with strike price $1,0500 (8324);

- The ratio of PUT/CALL was 1.53 versus 1.52 from the previous trading day according to data from June, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (784)

$1.5806 (2073)

$1.5710 (607)

Price at time of writing this review: $1.5642

Support levels (open interest**, contracts):

$1.5589 (408)

$1.5493 (358)

$1.5395 (1647)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22273 contracts, with the maximum number of contracts with strike price $1,5500 (2549);

- Overall open interest on the PUT options with the expiration date July, 2 is 23208 contracts, with the maximum number of contracts with strike price $1,5250 (2134);

- The ratio of PUT/CALL was 1.04 versus 1.02 from the previous trading day according to data from June, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:31

Australia: Leading Index, May -0.1%

-

01:52

Japan: Trade Balance Total, bln, May -216 (forecast -226)

-

00:46

New Zealand: Current Account , Quarter I 660 (forecast 235)

-

00:28

Currencies. Daily history for Jun 16’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1244 -0,33%

GBP/USD $1,5647 +0,33%

USD/CHF Chf0,9321 +0,25%

USD/JPY Y123,37 -0,02%

EUR/JPY Y138,73 -0,35%

GBP/JPY Y193,03 +0,31%

AUD/USD $0,7748 -0,15%

NZD/USD $0,6982 -0,20%

USD/CAD C$1,2292 -0,21%

-

00:01

Schedule for today, Wednesday, Jun 17’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Leading Index May 0.1%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y April 2.2% 2.5%

08:30 United Kingdom Average Earnings, 3m/y April 1.9% 2.1%

08:30 United Kingdom ILO Unemployment Rate April 5.5% 5.5%

08:30 United Kingdom Claimant count May -12.6 -12.3

08:30 United Kingdom Bank of England Minutes

09:00 Eurozone Harmonized CPI May 0.2% 0.2%

09:00 Eurozone Harmonized CPI, Y/Y (Finally) May 0.0% 0.3%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) May 0.6% 0.9%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) June -0.1

12:30 Canada Wholesale Sales, m/m April 0.8% 0.3%

14:30 U.S. Crude Oil Inventories June -6.812

17:45 United Kingdom BOE Gov Mark Carney Speaks

18:00 U.S. Fed Interest Rate Decision 0.25% 0.25%

18:00 U.S. FOMC Statement

18:00 U.S. FOMC Economic Projections

18:30 U.S. Federal Reserve Press Conference

22:45 New Zealand GDP y/y Quarter I 3.5% 3.0%

22:45 New Zealand GDP q/q Quarter I 0.8% 0.6%

23:05 United Kingdom BOE Quarterly Bulletin

-