Noticias del mercado

-

17:43

Oil prices traded higher on a weaker U.S. dollar

Oil prices traded higher on a weaker U.S. dollar. The U.S. dollar declined against the other currencies on the results of the Fed's monetary policy meeting. The Fed kept its monetary policy unchanged. Investors were disappointed that there were no signals on the timing when the central bank starts raising its interest rate.

The Greek debt problem remained in focus. International Monetary Fund (IMF) Managing Director Christine Lagarde said that Greece will not get extra time to repay its IMF loans.

Investors still weigh yesterday's U.S. crude oil inventories data. According to the U.S. Energy Information Administration (EIA), U.S. crude inventories declined by 2.68 million barrels to 467.9 million in the week to June 12. It was the seventh consecutive weekly decline.

Analysts had expected a decline of 1.8 million barrels.

U.S. oil production fell 21,000 barrels a day to 9.59 million barrels a day.

Crude stocks at the Cushing, Oklahoma, increased by 112,000 barrels. It was the first rise since mid-April.

U.S. crude oil imports rose by 114,000 barrels per day to 7.1 million barrels per day.

Refineries in the U.S. were running at 93.1% of capacity, down from 94.6% the previous week.

WTI crude oil for July delivery increased to $60.33 a barrel on the New York Mercantile Exchange.

Brent crude oil for July rose to $64.25 a barrel on ICE Futures Europe.

-

17:25

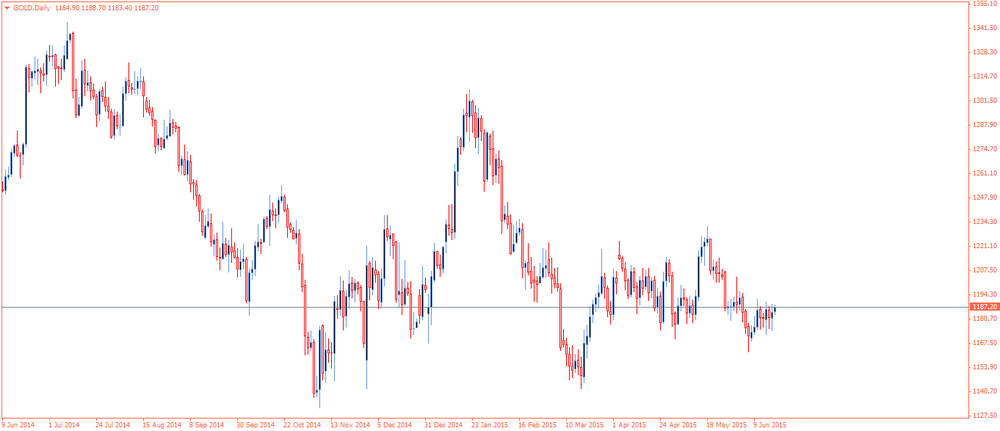

Gold price traded higher due to a weaker U.S. dollar

Gold price traded higher due to a weaker U.S. dollar. The U.S. dollar declined against the other currencies on the results of the Fed's monetary policy meeting. The Fed kept its monetary policy unchanged. 2 of 17 Fed officials want to wait until 2016 before to start raising interest rates.

Economic growth forecast for 2015 was downgraded, while forecasts for 2016 and 2017 were upgraded. The economy is expected to grow 1.8% - 2.00% in 2015, down from 2.3% - 2.7%.

There were no signals on the timing when the central bank starts raising its interest rate.

The Fed noted that it will start hiking its interest rate "when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term".

U.S. consumer price inflation data also supported gold price. The U.S. consumer price inflation rose 0.4% in May, missing expectations for a 0.5% increase, after a 0.1% gain in April. It was the largest rise since February 2013.

The increase was driven by higher gasoline prices, which jumped 10.4% in May, the biggest gain since June 2009.

On a yearly basis, the U.S. consumer price index increased to 0.0% in May from -0.2% in April, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.1% in May, missing expectations for a 0.2% increase, after a 0.3% rise in April.

On a yearly basis, the U.S. consumer price index excluding food and energy remained fell to 1.7% in May from 1.8% in April. Analysts had expected the index to remain unchanged at 1.8%.

Gains were limited by the number of initial jobless claims. The number of initial jobless claims in the week ending June 13 in the U.S. declined by 12,000 to 267,000 from 279,000 in the previous week. Analysts had expected the number of initial jobless claims to be 275,000.

June futures for gold on the COMEX today rose to 1201.10 dollars per ounce.

-

08:58

Oil: prices gained amid declines in US crude inventories

West Texas Intermediate crude prices for July delivery fell by 0.65% to $59.94, while Brent crude for August declined by 33% to $63.65 a barrel.

Data from the U.S. Energy Information Administration showed that crude inventories fell more than expected in the week ending June the 12th, while gasoline stocks rose by 460,000 barrels, exceeding expectations for a 314,000-barrel drop.

US oil production declined by 21,000 barrels per day to 9.59 million bpd from last week's record high.

-

08:40

Gold gained after the FOMC rate decision

Gold rose by 90% to $1,186.80 an ounce amid a weaker dollar after the Federal Open Market Committee left the key interest rate unchanged at 0.25% and hinted that the liftoff might happen later than investors and analysts had expected. The Fed said that further improvements in employment and inflation are needed in order to justify a rate hike.

A weaker dollar pushes gold up and low rates give extra support to the non-interest-paying metal.

-

04:25

Commodities. Daily history for Jun 17’2015:

(raw materials / closing price /% change)

Oil 59.60 -0.53%

Gold 1,186.90 +0.86%

-