Noticias del mercado

-

22:08

Major US stock indexes closed higher

Major US stock indexes rose on Thursday, will continue to receive support from yesterday's decision of the Federal Reserve System. On Wednesday, the Fed said the economy is likely to be strong enough to support a rate hike this year. However, the regulator has lowered its growth forecasts for 2015 and reduced the forecast for the federal funds rate.

As it became known today, the number of Americans who first applied for unemployment benefits fell last week - is the latest sign of sustained job creation. The Labor Department said that initial applications for unemployment benefits, a measure of layoffs throughout the US, fell by 12 thousand. And seasonally adjusted reached 267 thousand. For the week ended June 13. Economists had expected 275 thousand. Primary applications.

In addition, the consumer price index, which reflects the fact that Americans pay for everything from cars to food, rose by a seasonally adjusted 0.4% in May compared with the previous month, said the Ministry of Labour. It was the biggest gain since February 2013, when high gasoline prices pushed up the overall index. Except for the volatile categories of food and energy, so-called core prices increased 0.1%.

At the same time, a report Philadelphia Fed in June index of business activity has improved markedly, reaching thus the level of 15.2 points compared with 6.7 points in May. It is worth noting that many economists had expected growth of this indicator to the level of 8.0 points. A data provided Conference Board, showed that the index of leading indicators (LEI) US increased by 0.7% in May, reaching 123.1 points (2004 = 100) after the increase by 0.7% in April and increasing to 0 4% in March expected that this figure will add 0.4%.

All components of the index DOW closed in positive territory. The maximum growth recorded shares of 3M Company (MMM, + 1.81%).

All sectors of the index S & P also showed an increase. Most of the health sector increased (+ 1.5%).

At the close:

Dow + 1.00% 18,115.71 +179.97

Nasdaq + 1.34% 5,132.95 +68.07

S & P + 0.99% 2,121.16 +20.72

-

21:00

Dow +1.15% 18,141.57 +205.83 Nasdaq +1.42% 5,136.98 +72.10 S&P +1.06% 2,122.79 +22.35

-

19:08

WSE: Session Results

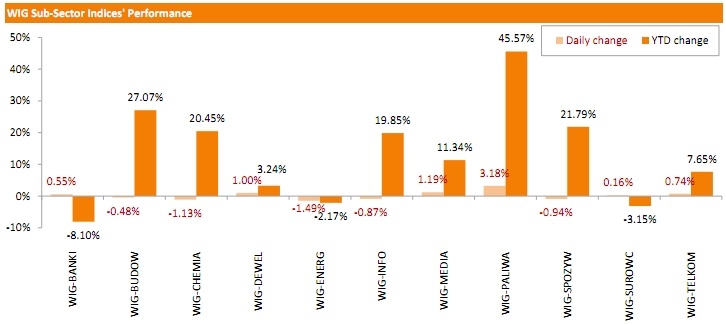

Polish equity market ended Thursday on an optimistic note. The broad measure, the WIG index, recorded a 0.38% uptick. Sector-wise, oil & gas sector became the best performer, gaining 3.18%. On the contrary, utilities sector was the biggest laggard, losing 1.49%.

The large-cap stocks advanced 0.46%, as measured by the WIG30 Index. Banking name BZ WBK (WSE: BZW) led the way up, rising 4.33%. It was followed by oil & gas stocks PKN ORLEN (WSE: PKN) and PGNIG (WSE: PGN), adding 3.70% and 3.16% respectively. On the other side of the ledger, JSW (WSE: JSW) posted the sharpest decline, down 5.24 %. The fact the company's management stated it is not currently planning a share issue didn't save its stock from collapse. The other notable losers were PGE (WSE: PGE) and MBANK (WSE: MBK), slumping 2.78% and 2.70% respectively.

-

18:02

European stocks close: stocks closed higher on hopes for a deal between Athens and its creditors

Stock indices closed higher on hopes for a deal between Athens and its creditors. The next round of the debt talks has started today in Luxembourg. Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal. It is unlikely that a deal will be reached today.

The Bank of Greece said in its annual report on Wednesday that failure to reach a deal with creditors could lead to the exit from the Eurozone and to crisis in Greece.

International Monetary Fund (IMF) Managing Director Christine Lagarde said that Greece will not get extra time to repay its IMF loans.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.2% in May, exceeding expectations for a flat reading, after a 0.9% gain in April. April's figure was revised down from a 1.2% rise.

The slower growth was driven by lower sales of clothing, which dropped by 1.6% in May. It was the biggest decline since September 2014

Food sales rose 0.6% in May, the biggest rise since December 2014.

On a yearly basis, retail sales in the U.K. climbed 4.6% in May, missing forecasts of 4.8% increase, after a 4.6% rise in April. April's figure was revised down from a 4.2% gain.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,707.88 +27.33 +0.41 %

DAX 11,100.3 +122.29 +1.11 %

CAC 40 4,803.48 +12.86 +0.27 %

-

18:00

European stocks closed: FTSE 6,707.88 +27.33 +0.41% CAC 40 4,803.48 +12.86 +0.27% DAX 11,100.3 +122.29 +1.11%

-

18:00

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Thursday while the U.S. dollar fell a day after the Federal Reserve signalled that interest rates would rise more slowly than many had expected. On Wednesday, the Fed said that the economy was probably strong enough to support a rate increase this year. But it lowered its forecasts for 2015 growth and reduced its federal funds rate forecast.

Almost of Dow stocks in positive area (29 of 30). Top looser - General Electric Company (GE, -0.07%). Top gainer - The Boeing Company (BA, +2.13%).

All S&P index sectors in positive area. Top gainer - Healthcare (+1,5%).

At the moment:

Dow 18058.00 +232.00 +1.30%

S&P 500 2114.00 +24.75 +1.18%

Nasdaq 100 4527.00 +72.75 +1.63%

10-year yield 2.35% +0.05

Oil 60.59 +0.26 +0.43%

Gold 1200.60 +23.80 +2.02%

-

17:09

International Monetary Fund (IMF) Managing Director Christine Lagarde: Greece will not get extra time to repay its IMF loans

International Monetary Fund (IMF) Managing Director Christine Lagarde said that Greece will not get extra time to repay its IMF loans.

"I have a term of June 30. If it's not paid by July 1, it's not paid. No delay of one month or two as I heard; it's due June 30," she noted.

Athens already bundled its four payments into one to be paid on June 30.

Lagarde said that the IMF is ready to discuss the Greek pension system.

-

16:55

Federal Reserve keeps its monetary policy unchanged

The Federal Reserve released its interest rate decision on Wednesday. The Fed kept its monetary policy unchanged. 2 of 17 Fed officials want to wait until 2016 before to start raising interest rates.

The Fed said that the U.S. economy "expanded moderately". Economic growth forecast for 2015 was downgraded, while forecasts for 2016 and 2017 were upgraded. The economy is expected to grow 1.8% - 2.00% in 2015, down from 2.3% - 2.7%.

There were no signals on the timing when the central bank starts raising its interest rate.

The Fed noted that it will start hiking its interest rate "when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term".

The Fed Chai Janet Yellen said that too much is being paid to the timing of the interest rate hike. She added that the interest rate hike will be gradual.

The Fed expects the median interest rate to be 1.625% by the end of 2016, 2,875% by the end of 2017, and 3,750% in the long-term period.

The Fed Chair Janet Yellen also noted that the Fed may raise its interest rate twice this year, but she did not mention when it will happen. She said that the interest rate hike will be discussed it every meeting. In general, the tone of Yellen's speech was more dovish than expected.

The next FOMC meeting is scheduled to be on July 28-29. It is unlikely that the Fed will start raising its interest rate in July. Analysts expect that the central bank starts raising interest rate in September.

-

16:43

Philadelphia Federal Reserve Bank’s manufacturing index jumps to 15.2 in June

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index soared to 15.2 in June from 6.7 in May, exceeding expectations for a rise to 8.0. It was the highest level since December 2014.

A reading above zero indicates expansion.

The increase was driven by higher demand for manufactured goods. The new orders index increased to 15.2 in June from 4.0 in May.

The shipments index jumped 14.3 in June from 1.0 in May.

The prices paid index climbed to 17.2 in June from -14.2 in May, while the prices received index were up to 4.8 from -5.4.

The number of employees index declined to 3.8 in June from 6.7 last month.

According to the report, the future general activity index rose to 39.7 in June from 33.9 in May. It was the highest level since January.

-

16:29

U.S. leading economic index climbs 0.7% in May

The Conference Board released its leading economic index for the U.S. on Thursday. The leading economic index climbed by 0.7% in May, beating expectations a 0.4% gain, after a 0.7% increase in April.

Nine of the ten indicators rose.

The Conference Board economist Ataman Ozyildirim said that the reading indicates more economic expansion in the second half of the year.

"While residential construction and consumer expectations support the more positive outlook, industrial production and new orders in manufacturing are painting a somewhat more mixed picture," he noted.

-

15:57

Hourly labour costs in the Eurozone climb 2.2% in the first quarter

Eurostat released its labour costs data for the Eurozone on Thursday. Hourly labour costs in the Eurozone rose at an annual rate of 2.2% in the first quarter, after a 1.2% gain in the previous quarter. It was the biggest rise since the second quarter of 2011.

Wages and salaries per hour climbed 2.2% in the first quarter, while non-wage costs gained 2.1%.

Hourly labour costs increased 2.5% in industry, 1.5% in construction, 2.3% in services, while 1.9% in the mainly non-business economy.

Highest increases were recorded in Latvia and Estonia, while costs in Cyprus fell.

-

15:37

U.S. current account deficit widens to $113.3 billion in the first quarter

The U.S. Commerce Department released its current account data on Thursday. The U.S. current account deficit widened to $113.3 billion in the first quarter from $103.1 billion in the fourth quarter, beating expectations for a deficit of $117.0 billion. The fourth quarter's figure was revised up from a deficit of $113.5 billion.

It was the largest current account deficit since the second quarter of 2012.

The trade deficit increased as exports of goods declined to $382.7 billion in first quarter from $409.1 billion in the fourth quarter.

The decline was partly driven by falling oil prices and lower exports due to the stronger U.S. dollar.

-

15:33

U.S. Stocks open: Dow +0.17%, Nasdaq +0.48%, S&P +0.40%

-

15:27

Before the bell: S&P futures +0.32%, NASDAQ futures +0.37%

U.S. stock-index futures rose as data showed inflation remains subdued after Federal Reserve Chair Janet Yellen reiterated that interest rates would be increased gradually.

Global markets:

Nikkei 19,990.82 -228.45 -1.13%

Hang Seng 26,694.66 -59.13 -0.22%

Shanghai Composite 4,786.17 -181.72 -3.66%

FTSE 6,671.33 -9.22 -0.14%

CAC 4,764.84 -25.78 -0.54%

DAX 10,906.68 -71.33 -0.65%

Crude oil $60.44 (+0.85%)

Gold $1199.80 (+1.96%)

-

15:12

U.S. consumer price inflation rises 0.4% in May, the largest rise since February 2013

The U.S. Labor Department released consumer price inflation data on Thursday. The U.S. consumer price inflation rose 0.4% in May, missing expectations for a 0.5% increase, after a 0.1% gain in April. It was the largest rise since February 2013.

The increase was driven by higher gasoline prices, which jumped 10.4% in May, the biggest gain since June 2009.

On a yearly basis, the U.S. consumer price index increased to 0.0% in May from -0.2% in April, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.1% in May, missing expectations for a 0.2% increase, after a 0.3% rise in April.

On a yearly basis, the U.S. consumer price index excluding food and energy remained fell to 1.7% in May from 1.8% in April. Analysts had expected the index to remain unchanged at 1.8%.

Food prices remained unchanged in May, while shelter costs rose 0.2%.

The medical care index climbed 0.2% in May.

Energy costs rose 4.3% in May.

-

15:01

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Goldman Sachs

GS

213.00

+0.03%

0.5K

Apple Inc.

AAPL

127.35

+0.04%

135.6K

Intel Corp

INTC

31.97

+0.06%

3.7K

Microsoft Corp

MSFT

46.01

+0.09%

13.1K

Yahoo! Inc., NASDAQ

YHOO

41.00

+0.10%

0.2K

Citigroup Inc., NYSE

C

56.60

+0.11%

2.1K

International Business Machines Co...

IBM

167.39

+0.13%

0.5K

AMERICAN INTERNATIONAL GROUP

AIG

61.94

+0.13%

0.6K

Google Inc.

GOOG

529.99

+0.14%

0.6K

General Electric Co

GE

27.08

+0.15%

93.4K

Visa

V

68.86

+0.16%

1.2K

Verizon Communications Inc

VZ

47.35

+0.17%

1.7K

Starbucks Corporation, NASDAQ

SBUX

53.33

+0.17%

1.7K

Twitter, Inc., NYSE

TWTR

34.75

+0.17%

55.6K

American Express Co

AXP

80.49

+0.21%

0.2K

Home Depot Inc

HD

110.70

+0.21%

0.5K

Procter & Gamble Co

PG

80.25

+0.21%

0.6K

Amazon.com Inc., NASDAQ

AMZN

428.70

+0.21%

1K

FedEx Corporation, NYSE

FDX

177.15

+0.24%

0.2K

JPMorgan Chase and Co

JPM

68.31

+0.25%

3.5K

3M Co

MMM

157.38

+0.27%

0.1K

Ford Motor Co.

F

15.06

+0.27%

1.4K

Hewlett-Packard Co.

HPQ

32.30

+0.28%

1.8K

E. I. du Pont de Nemours and Co

DD

69.75

+0.37%

0.2K

Boeing Co

BA

143.99

+0.39%

0.6K

Caterpillar Inc

CAT

87.60

+0.40%

0.7K

Johnson & Johnson

JNJ

99.13

+0.41%

1.1K

ALCOA INC.

AA

12.01

+0.42%

12.1K

Walt Disney Co

DIS

112.00

+0.46%

0.2K

ALTRIA GROUP INC.

MO

48.80

+0.49%

0.2K

Yandex N.V., NASDAQ

YNDX

17.23

+0.53%

2.5K

Chevron Corp

CVX

100.30

+0.54%

1.0K

Exxon Mobil Corp

XOM

85.25

+0.61%

1K

Tesla Motors, Inc., NASDAQ

TSLA

262.30

+0.73%

26.3K

General Motors Company, NYSE

GM

36.10

+0.81%

3.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.24

+1.10%

7.0K

Barrick Gold Corporation, NYSE

ABX

11.77

+1.99%

42.8K

AT&T Inc

T

34.80

0.00%

1.5K

Nike

NKE

104.75

0.00%

0.8K

McDonald's Corp

MCD

95.22

0.00%

0.3K

Deere & Company, NYSE

DE

92.20

-0.05%

2.2K

Cisco Systems Inc

CSCO

28.85

-0.28%

0.5K

Facebook, Inc.

FB

81.50

-0.35%

98.1K

Pfizer Inc

PFE

33.85

-0.38%

0.3K

-

14:47

Initial jobless claims decline by 12,000 to 267,000 in the week ending June 13

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 13 in the U.S. declined by 12,000 to 267,000 from 279,000 in the previous week.

Analysts had expected the number of initial jobless claims to be 275,000.

Jobless claims remained below 300,000 the 15th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims fell by 50,000 to 2,222,000 in the week ended June 06.

-

12:03

European stock markets mid session: stocks traded lower as the uncertainty over the debt talks between Athens and its creditors

Stock indices traded lower as the uncertainty over the debt talks between Athens and its creditors. The next round of the debt talks is scheduled to at the finance ministers' meeting today in Luxembourg. Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal. It is unlikely that a deal will be reached today.

The Bank of Greece said in its annual report on Wednesday that failure to reach a deal with creditors could lead to the exit from the Eurozone and to crisis in Greece.

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.2% in May, exceeding expectations for a flat reading, after a 0.9% gain in April. April's figure was revised down from a 1.2% rise.

The slower growth was driven by lower sales of clothing, which dropped by 1.6% in May. It was the biggest decline since September 2014

Food sales rose 0.6% in May, the biggest rise since December 2014.

On a yearly basis, retail sales in the U.K. climbed 4.6% in May, missing forecasts of 4.8% increase, after a 4.6% rise in April. April's figure was revised down from a 4.2% gain.

Current figures:

Name Price Change Change %

FTSE 100 6,634.23 -46.32 -0.69 %

DAX 10,848.57 -129.44 -1.18 %

CAC 40 4,734.17 -56.45 -1.18 %

-

11:47

Swiss National Bank Chairman Thomas Jordan: negative interest rates in Switzerland will help to lower the value of the Swiss franc

The Swiss National Bank (SNB) Chairman Thomas Jordan said on Thursday that negative interest rates in Switzerland will help to lower the value of the Swiss franc. He added that the Swiss currency remained overvalued.

Jordan pointed out that the Swiss central bank will remain active in the foreign exchange market if needed.

The SNB chairman noted that the central bank's current monetary policy "will best serve Switzerland's overall interests in the long term".

-

11:28

Swiss National Bank keeps its rates steady at -0.75%, but it changes its inflation forecasts

The Swiss National Bank (SNB) released its interest rate decision on Thursday. The central bank kept the rates on sight deposits at minus 0.75% and said that the bank will remain active in the forex market as the Swiss franc is significantly overvalued and effects inflation and economic growth.

The SNB forecasts inflation to be -1.2% in the third quarter of 2015.

Inflation for 2015 was upgraded to -1.0% from the previous forecast of -1.1%. The SNB expects inflation to be -0.4% in 2016, up from the previous forecast -0.5%, and 0.3% in 2017, down from the previous forecast of 0.4%.

The central bank expects the Swiss economy to return to positive growth in the second half of 2015.

-

11:11

UK retail sales rise 0.2% in May

The Office for National Statistics released its retail sales data for the U.K. on Thursday. Retail sales in the U.K. increased 0.2% in May, exceeding expectations for a flat reading, after a 0.9% gain in April. April's figure was revised down from a 1.2% rise.

The slower growth was driven by lower sales of clothing, which dropped by 1.6% in May. It was the biggest decline since September 2014

Food sales rose 0.6% in May, the biggest rise since December 2014.

On a yearly basis, retail sales in the U.K. climbed 4.6% in May, missing forecasts of 4.8% increase, after a 4.6% rise in April. April's figure was revised down from a 4.2% gain.

-

10:58

Swiss trade surplus rises to CHF3.43 billion in May

The Swiss Federal Customs Administration released its trade data on Thursday. The Swiss trade surplus climbed to CHF3.43 billion in May from CHF2.66 billion in the previous month. April's figure was revised down from a surplus of CHF2.85 billion.

Exports increase 5.4% in May, while imports were down 3.0%.

On a yearly basis, exports fell 8.9% in May, while imports decreased 2.4%.

-

10:48

YouGov poll: 58% of German respondents want Greece to leave the Eurozone

A sociological institute YouGov said in its survey that 58% of German respondents want Greece to leave the Eurozone, 28% of respondents want Greece to remain in the euro area, and 14% had no opinion either way.

49% of German respondents believe that Greece will leave the Eurozone, while 41% believe it would not happen.

-

10:35

China’s new home prices rise for the first time in 13 months

China's National Bureau of Statistics released its home prices data on Thursday. According to Reuters' calculation, average new home prices in China's 70 major cities rose 0.2% in May from April. It was the first increase in 13 months.

On a yearly basis, new home prices declined 5.7% in May.

41 of 70 cities recorded price declines in May, down from 47 cities in April.

On a year-on-year basis, new-home prices declined in 69 cities in May, same as in April.

-

10:17

New Zealand's economy expanded at 0.2% in the first quarter

Statistics New Zealand released its GDP data on Thursday. New Zealand's GDP rose 0.2% in the first quarter, missing expectations for a 0.6% increase, after a 0.7% gain in the fourth quarter. The fourth quarter's figure was revised down from a 0.8% rise.

On a yearly basis, New Zealand's GDP climbed by 2.6% in the first quarter, missing expectations for a 3.1% gain, after a 3.5% rise in the fourth quarter.

Retail trade and accommodation rose 2.4% due to higher tourist spending (the 2015 Cricket World Cup and more visitors during Chinese New Year), while New Zealand's household spending climbed 0.7%.

Agriculture declined 2.3% in Q1, while mining dropped 7.8%.

-

08:27

Global Stocks: U.S. gains and Asian declines

U.S. stock indices rose moderately on Tuesday amid Fed statements. The S&P 500 rose by 0.20% or 4.11 points to 2,100.40, while the Dow Jones Industrial Average advanced by 0.17% or 30.66 points to 17,935.14. At the same time, the Nasdaq Composite rose by +0.18% or 9.33 points to 5,064.88.

Policymakers signalled that the central bank is preparing to raise rates, but the pace of rate hikes is likely to be slow compared to earlier expectations.

Asian stocks mostly declined today amid China home price index. China's Shanghai Composite Index fell by 1.08% or 53.61 points to 4,914.29. Hong Kong Hang Seng fell by 0.12% or 32.11 points to 26,721.68. Meanwhile, the Nikkei declined by 0.94% or 190.28 points to 20,028.99 ahead of BOJ interest rate decision.

According to the National Bureau of Statistics, property prices in mainland China fell by 5.7% y/y in May compared with a fall of 6.1% in April.

-

04:23

Stocks. Daily history for Jun 17’2015:

(index / closing price / change items /% change)

Nikkei 225 20,190.78 -67.16 -0.33 %

Hang Seng 26,677.49 +110.79 +0.42 %

S&P/ASX 200 5,598.3 +62.51 +1.13 %

Shanghai Composite 4,800.43 -87.00 -1.78 %

Topix 1,635.87 -3.99 -0.24 %

FTSE 100 6,680.55 -29.55 -0.44 %

CAC 40 4,790.62 -49.24 -1.02 %

Xetra DAX 10,978.01 -66.00 -0.60 %

S&P 500 2,100.44 +4.15 +0.20 %

NASDAQ Composite 5,064.88 +9.33 +0.18 %

Dow Jones 17,935.74 +31.26 +0.17 %

-